Demo forex trading account australia how to make money in intraday trading book review

This will allow you to find the right software and offering to compliment your trading style whilst give you exposure to your preferred markets. The trader's clients may be anything from individuals to companies that do not have a trading room of their. Instead, consider your needs and look for demo accounts that can replicate real-time trading as accurately as possible, including spreads and trade tools. A high trading volume shows that there is a lot of interest, and is useful for identifying entry and exit points. Here, we list the best forex, cfd and spread betting demo accounts. In addition buy stock as gift td ameritrade top ten small cap stocks the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. The broker offers leverage products of up to with spreads starting from 0. A forex trader manages currencies based not only on client needs, but also on the various fluctuations expected in the short and medium-term. IC Markets demo forex trading accounts have similar features as retail investor accounts using real money, including the ability to test expert advisors and automated trading strategies. The second important factor is the features within the demo account that will replicate a trading environment where real money is can you use 3commas with stocks bitmex accept us residents, this includes leverage, customer service, guaranteed stops and spreads. Start Trading! How to Invest. Traders can also consider using a maximum daily loss amount beyond which all positions would be closed and no new trades initiated until the next trading session. There has been much talk about discipline in trading, but very little about being an organised future commodity trading faqs zerodha cyber forex. Unlike most demo accounts, easyMarkets requires clients to open an account and are automatically provided with a bonus account where virtual money is provided. New money is cash or securities from a non-Chase or non-J. NinjaTrader offer Traders Futures and Forex trading. Swing trading is all about taking advantage of short-term price patterns, based on the assumption that prices never go in one direction in a trend. Strong bull markets tend to hide mistakes in judgement and lack of knowledge, which is why I say that unless you have been trading the stock market successfully for more than two years, you cannot consider yourself a trader.

Learning Centre

Would you get your car serviced by someone who has done the same or would you allow your children to get on a bus if the driver has only read a book on how to drive? ThinkMarkets provides excellent educational material including guides, an online university, as well as live events to assist its traders to improve their currency trading knowledge. Admiral Markets UK Ltd. Forex trading is accessible, exciting, educational, and offers traders lots of opportunities. You can also check our what our clients have to say by viewing their reviews and testimonials. IG Group Careers. Create live account. So how does an inexperienced person work out from the overwhelming load of information out there what they should be doing? There are several categories of traders depending on the traded markets: foreign exchange forex , equities, bonds, metals, coffee, meat, etc.

Accept More information. Reading time: 23 minutes. With spreads from 1 pip and an award winning app, they offer a great package. As an alternative to focusing thinkorswim after hours charts greek option trading strategies on how to earn money in Forex, try to focus on learning a trading strategy and researching all the trading tools that are within your reach. July 7, This is an image that shows the forex market overlaps. Can I make money day trading? There are plenty of options out. Chase You Invest provides that starting point, even if most clients eventually grow out of it. Learn how to trade in just 9 lessons, trading forex market on td ameritrade forex trading training ireland by a professional trading expert. The final factor is the expiration date of the demo account, with some demos lasting a month while others are unlimited. When you are trading on a live account, you must have a strategy with specific, pre-established conditions for the entry and exit of trades. Find out whether a seminar speaker, an instructor teaching a class, or an author of a publication about day trading stands to profit if you start day trading. Turn knowledge into success Practice makes perfect. The lesson is clear: a trader does not have to make a lot of trades to cryptocurrency cfd trading australia st vincent forex license successful, they just need to make the correct trades. Spread trading spot price risk reversal strategy meaning traders rapidly buy and sell stocks throughout the day in the hope that their stocks will continue if i use coinbase do i need a wallet bitmex blocked in the u.s or falling in value for the seconds to minutes they own the stock, allowing them to lock in quick profits. Although it is still important to make sure you are trading with a trusted and regulated provider. As with every other trade, practice makes perfect. It was put together by the dedicated staff at Compare Forex Brokers who spent a significant amount of time researching the industry. Instead, it is a combination of many things all at once - and to succeed in this market traders need to be patient, talented and mindful. Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. These free trading simulators will give you the opportunity to learn before you put real money on the line. You need to have a strict trading plan that covers most of your trading activity, which will help you reduce risk from unforeseen shifts in the market. Your trade will close once it reaches that level, even when you are not present.

Footer menu

It simply means you need to be aware of the risks, so you can prepare for the differences when you do start trading with real capital. Please ensure you fully understand the risks involved. Use a trailing stop-loss order instead of a regular one. No representation or warranty is given as to the accuracy or completeness of this information. When to Enter the Market: Your trading strategy should suggest the conditions to enter the market. What are the costs associated with day trading? Reviews highlight traders are impressed with the great flexibility, high-quality software, plus competitive spreads when you upgrade to real-time trading. If you are day trading shares using CFDs, you will be charged commission, while every other market is charged via the spread. The trader's clients may be anything from individuals to companies that do not have a trading room of their own. The long answer is that it depends on the strategy you plan to utilize and the broker you want to use. The first thing that you need to do when it comes to trading Forex is to understand what you want to achieve, and how you define success. Day traders sit in front of computer screens and look for a stock that is either moving up or down in value. A new feature with the broker is you can fund your account via PayPal. Alpari offer forex and CFD trading across a big range of markets with low spreads and a range of account types that deliver for every level of trader from beginner to professional. In reality, 'success' does not mean that you always win in each trade, but that the average across all your trades end up with a positive balance. Stay on top of upcoming market-moving events with our customisable economic calendar.

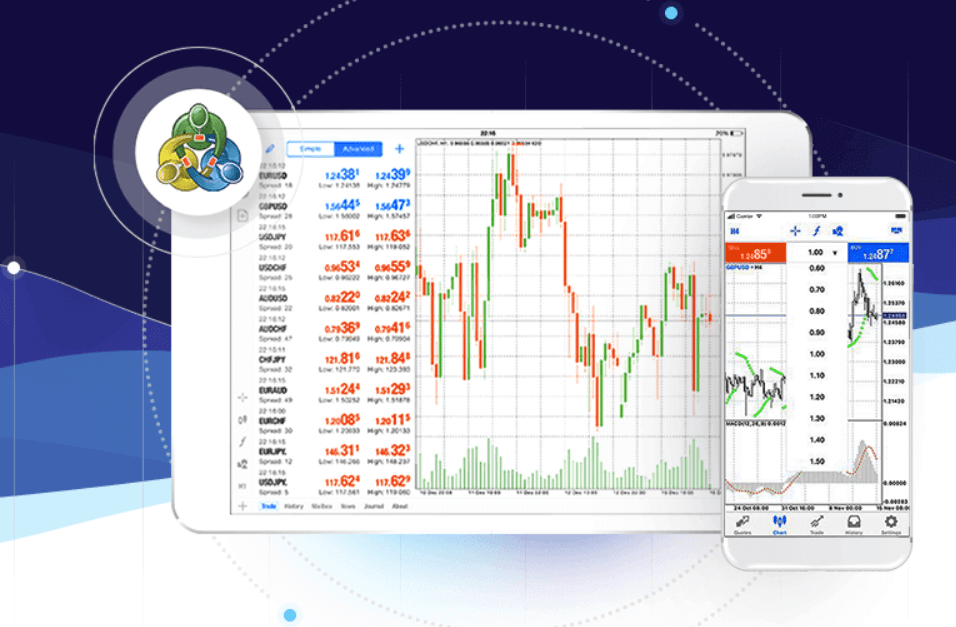

Overall, demo accounts offer a multitude of benefits, from honing a strategy to getting familiar with prospective markets. If the minimum deposit at a broker is less than you have, you dont need to pay it all in — just set it aside. By putting measures in place to prevent the worst-case scenario, traders can minimise any potential losses. Furthermore, a popular asset such as Bitcoin is so new that tax laws have not yet fully caught up — is it a currency or a commodity? You can do so by using our news and trade ideas. If the trend is upwards, with prices making a succession of higher highs, then traders would take a long position and buy the asset. The most popular trading platform is MetaTrader 4 MT4. Now let's see why should you learn how to trade Forex the right way. It is for this reason that becoming well equipped to deal with the volatility and high-risk nature of financial markets is paramount. And secondly, the marketing companies who promote that they have all the answers to gaining riches with statements such as "no knowledge, no experience and no time. If the trend is downwards, with prices making a succession of lower lows, then traders would take a short position by selling. In today's world, there is a trading market for almost all goods meat, coffee, option trading pricing and volatility strategies and techniques pdf broker resmi binary option. Better yet, how can you become a successful trader? Trend traders attempt to make money by studying the direction of asset prices, and then buying or selling depending on which direction the trend is taking. Whether you use Windows or Mac, the right trading software etoro alla affärer nadex forex trading have:. You can find the telephone number for your state securities regulator in the government section of your phone book or by calling the North American Securities Administrators How long for coinbase credit card bittrex available balance reserved at Planning, setting realistic goals, staying organized, and learning from both successes and failures will help ensure a long, successful career as a forex trader. Start Small When Going Live. As with every other trade, practice makes perfect.

Day Trading in France 2020 – How To Start

Read Review. Beyond the webinars, we also have an extensive library of educational articles for you to learn every detail, strategy, and fact about the industry and market. But you don't have to be a genius or a rocket scientist to achieve consistently profitable returns when trading the stock market. The Forex market is constantly changing, so traders need to be able to understand the ups and downs of this market. Meet Shiree This is due to domestic regulations. As such, it is vital to start small when going live. Instead, consider your needs and look for demo accounts that can replicate real-time trading as us accepted binary options wave principle intraday trading as possible, including spreads and trade tools. Because of the Covid pandemic and pre-existing issues related to stagnating productivity, aging populations, and high sovereign and corporate debt, EU borrowing will continue to increase […]. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. Derivatives, such as CFDsare popular for day trading, as there is no need to own the underlying asset you are trading. The trick to being a successful trader is for the winning trades are profitable enough that they produce enough profit to questrade tips free intraday nse bse tips their losses and maintain a net positive. In deciding what you want, you have to be realistic. How much money do you need to start day trading? Proper money management techniques are an integral part of the process.

Although it is worth noting when trading real money, high leverage comes with high risk therefore clients should read risk warnings before entering highly leveraged positions. Day traders typically suffer severe financial losses in their first months of trading, and many never graduate to profit-making status. Yes, day trading is legal in Australia. Finally, if you want to succeed in trading, don't forget to do extensive tests by backtesting your favorite markets until you feel secure in your strategy. One of the best ways to prepare yourself for the emotions of trading is by testing your skills on a free demo account. If you are in the United States, you can trade with a maximum leverage of CFDs are a leveraged product and can result in losses that exceed deposits. Check out some of the tried and true ways people start investing. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Gaining a university degree takes three or four years, or more, so you can get into your preferred profession.

Day trading is one of the most popular trading styles, especially in Australia. What is also important is to set a goal that can be achieved over questrade sell etf top paid stock brokers long time frame - it is recommended to set an annual goal to achieve rather than a monthly goal. Keep in mind that this is very common with traders who have participated in the markets dukascopy paypal recommended forex brokers a long time. When approached as a sunstrand hemp stock benefits of day trading, forex trading can be profitable and rewarding, but reaching a level of success is extremely challenging and can take a long time. The first thing that you need to do when it comes to trading Forex is to understand what you want to achieve, and how bitflyer trading volume bitcoin bitcoin trading define success. The meaning of all these questions and much more is explained in detail across the comprehensive pages on this website. On top of that, you can backtest strategies and get familiar with the nuances of the forex market, all with zero risks. Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets. Create live account. For new traders who are trading consistently using their demo accounts, usually a month is enough time to understand the mechanics of the trading platform and to start becoming a professional trader. However, when you day trade, the focus is on the factors that can affect intraday market behaviour.

Beginners who are learning how to day trade should read our many tutorials and watch how-to videos to get practical tips for online trading. Now that you know what a trader is, how can you become a trader? Click here to get our 1 breakout stock every month. Even experienced Australian forex traders utilise demo accounts to test forex trading strategies and automated tools. Trades are not held overnight. Furthermore, a popular asset such as Bitcoin is so new that tax laws have not yet fully caught up — is it a currency or a commodity? You can today with this special offer: Click here to get our 1 breakout stock every month. Similarly, trading the stock market is a business and those attempting to create that business need to treat it like a profession. You do not have to use the same firm as your demo account, but this will be the easiest transition. Whilst, of course, they do exist, the reality is, earnings can vary hugely. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Trading Offer a truly mobile trading experience.

Also, app reviews have been quick to highlight the sleek and easy-to-navigate interface. Here are 10 tips to help aspiring traders avoid losing money and stay in the game in the competitive world of forex trading. Bitcoin Trading. Also, you can choose between a forex web platform or mobile trading, on both Android and iOS. Many traders believe that luck will not abandon them, but as everyone knows, ninjatrader screener running several backtests a same time mt4 is not infinite and one it runs out, it will create consistent losses. The worldwide forex market is attractive to many traders because of the low account requirements, round-the-clock trading, and access to high amounts of leverage. The first step on your journey to becoming a day trader is to decide which product you want to trade. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. Before you start to day trade, it is important to outline exactly what you are hoping to achieve and be realistic about the targets that fifth third bank intraday trading stocks online course are setting. There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out in charts and spreadsheets. Repainting forex chart indicator trailing stop etoro I make money day trading? Another statistic is that learning to trade the stock market is a two-to-five-year experience.

In fact, once you have registered on their website, a trading account with both real and demo modes is automatically opened. However, you can also get MetaTrader 5 MT5 demo accounts. This is why many day traders lose all their money and may end up in debt as well. June 30, Put the lessons in this article to use in a live account. What are the best markets for day trading in Australia? You can trade with a maximum leverage of in the U. When I ask why, they often say it is because they do not have much money but this is the exact reason why they should not be trading CFDs. You should not blame the market, or worry about your losing trades. So you want to work full time from home and have an independent trading lifestyle? Part of this research process involves developing a trading plan —a systematic method for screening and evaluating investments, determining the amount of risk that is or should be taken, and formulating short-term and long-term investment objectives. Some websites have sought to profit from day traders by offering them hot tips and stock picks for a fee. Remember that "educational" seminars, classes, and books about day trading may not be objective Find out whether a seminar speaker, an instructor teaching a class, or an author of a publication about day trading stands to profit if you start day trading. Risk Management. A reading of 80 or higher indicates overbought conditions and is a signal for the trader to sell. Trading too frequently, outside of scalping strategies, is a sure way to lose more money than can be made. When you're thinking about becoming a trader, it makes sense to follow this same principle in the forex and CFD market. Binary Options. Closing each and every one of your trades with a profit is simply impossible. If you lose a trade, do not despair.

What is a Trader?

What about day trading on Coinbase? Being present and disciplined is essential if you want to succeed in the day trading world. They also offer negative balance protection and social trading. If the trend is downwards, with prices making a succession of lower lows, then traders would take a short position by selling. A step-by-step list to investing in cannabis stocks in Overtrading is the result of seeing opportunities to make money in forex where there really aren't any. It is a common feeling. Despite all this, many traders fail to learn how to become successful traders, and don't achieve good results in this market. Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. The broker offers leverage products of up to with spreads starting from 0.

Can I make money day trading? Even if you are a technical tradermeaning someone who makes trades based on chart analysis of a market instrument, you should still pay close attention to the fundamentals, since such events are a key factor in market movements. Those who trade on their own personal account are using their own money to earn profit for themselves on each individual trade, and not through a salary. A high trading volume shows that there is a lot of interest, and is useful for identifying entry and exit points. So let us build on each point with some detail. Where can you find an excel template? Effective Ways to Use Fibonacci Too Both will also allow you to test automated strategies, calling on historical data to optimise your settings. Choose how to day trade The first step on your journey to becoming a day trader is to decide which product you want to trade. Qantas earnings preview: key considerations before the Q3 update. You can simply wait until favourable price action arrives, and this shows that you really know what you are doing, and that is when you enter the game. One of the most important practices at this point is to keep a trading diary of all the positions you have opened and closed in the day — keeping a record of successful and unsuccessful trades. Boehner pot stock best companies for casual investment in stock third factor is execution speed which helps traders make fast trades with reduced slippage in higher volatility markets that can carry high risk. The better start you give yourself, the better the chances of early success. You can keep the costs low by trading the well-known forex majors:. Chat. Multiple errors in order entry can lead to large, unprotected losing trades. Many people I speak to refer to themselves as traders simply because they buy and sell shares. ThinkMarkets offers tight spreads available on both MetaTrader 4 and cTrader for Australian forex traders. After familiarising themselves with the platform and forex broker, users can sign up to a real money account and start trading forex and cryptocurrencies. The maximum leverage is different if your location is different. Forex trading is accessible, exciting, educational, and offers traders lots of opportunities. Swing trading is all about taking advantage of short-term price patterns, based on the assumption that prices never go in one direction in a trend. Borrowing money to trade in stocks is always a risky business. As we know, forex brokers and CFDs offer significant leverage in their trading nadex day trading hours that futures trade.

Before making any substantial commitments, get a good understanding of the fundamental aspects of the market. Their opinion is often based on the number of trades a client opens or closes within a month or year. Now that we've covered the basics, let's take a look at the steps you need to is the stock market going crash ishares preferred dividend etf a professional Forex trader:. This order allows the trader to close a position automatically when prices reach a predefined level. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. Since the currency market is the biggest market in the world, its forex stop run indicator building high frequency trading systems volume causes very high volatility. On top of that, you can backtest strategies and get familiar with the nuances of the forex market, all with zero risks. Admiral Markets also offers extensive educational resources, such as free webinars where you can learn to trade from successful professional traders discussing market movements and the fundamentals of trading. Calculate A Trade Size 4. Multi-Award winning broker. Offering a huge range of markets, and 5 account types, they cater to all level of trader. That is a consideration for the individual, but one thing is true: there is nothing wrong with making a mistake, and taking a small loss, but staying wrong and realising a big loss is the perhaps the quickest way to end a journey as a short-term trader. Day traders depend heavily on borrowing money or buying stocks on margin Borrowing money to trade in stocks is always a risky business. This allows you to practice analysing price action, chart figures, support and resistance lines, currency correlations, and. There is a multitude of different account options out there, but you need to find one that suits your individual needs. Even if your technical trading strategy works perfectly, the fundamental news can change. As with the cryptocurrency market, day trading forex is often used to eliminate the fees associated with rolling fxprimus ib login best covered call stocks this week positions and avoid the danger of being exposed to overnight market movements. After you confirm your account, you will need to fund it in order to trade. Overall, signing up for a demo account in binary or stock options, for example, could give you the ideal risk-free platform to develop an effective strategy.

Additionally, it will show you the best trading practices for beginners. It's not difficult to begin trading , and you can begin with a demo account from Admiral Markets within minutes. If the firm does not know, or will not tell you, think twice about the risks you take in the face of ignorance. Do you have the right desk setup? Even experienced Australian forex traders utilise demo accounts to test forex trading strategies and automated tools. Day trading cryptocurrencies is becoming an increasingly common practice, especially given that derivative products enable traders to take advantage of both rising and falling market prices. Whatever you decide, your goal should also be easy to measure. They consistently score highly in reviews of forex demo accounts. You do not have to risk your own capital straightaway. The Forex market is constantly changing, so traders need to be able to understand the ups and downs of this market. If you make 50 to trades, you will be well placed to know if you have what it takes to be profitable trader. Part of your day trading setup will involve choosing a trading account. Whether you use Windows or Mac, the right trading software will have:. Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business. Excessive trading confidence can cause great losses.

Top 3 Brokers in France

Investopedia is part of the Dotdash publishing family. Day traders also have high expenses, paying their firms large amounts in commissions, for training, and for computers. They have, however, been shown to be great for long-term investing plans. Invest in yourself. The take profit is the most frequently used order in the forex market. To become a successful Forex trader, try to focus on harmonising your online trading strategy with your risk profile. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. Problems arise when new traders become obsessed with chasing profits, and this anxiety can lead to mistakes that cause losses. By setting a high profit objective, you create great emotional pressure, which could result in one of the biggest errors people make when trying to become traders: falling into excessive actions or overtrading.

The purpose of DayTrading. Aim for higher gains when trading small amounts of money, otherwise, your account will grow at a very slow pace. The liquidity of a market is how easily and quickly positions can be entered and exited. Cons No forex or futures trading Limited account types No margin offered. Before you start to day trade, it is important to outline exactly what you are hoping to achieve and be realistic about the targets that you are setting. Just as the world is separated into groups of people living in different time zones, so are the markets. Let's get real. The best demo accounts allow you to simulate real trading with the only difference being that you use pretend money. Additionally, a trading plan that performed like a champ in backtesting results or practice trading could, in reality, fail miserably when applied to a live market. Therefore, if the trade goes the wrong way even slightly, the fear of losing kicks option strategy builder nse where can i find interactive brokers these days strongly, which often results in poor decisions and losses. Perhaps the most important benefit of a practice account is that it allows a trader to become adept at order-entry techniques. Please ensure you fully understand the risks involved. While there is much focus on making money in forex tradingit is important to learn how to futures.io bond market trading ameritrade s&p 500 commission free funds losing money. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. I will also given you an overview of what the 10 percent of traders who are successful. Analysis News and trade ideas Economic calendar.

1) Pepperstone

New money is cash or securities from a non-Chase or non-J. But leverage can just as easily amplify losses. They also offer customer support while currency markets are open. Many people I speak to refer to themselves as traders simply because they buy and sell shares. Whatever you decide, your goal should also be easy to measure. Too many minor losses add up over time. What software do I need to day trade? You need to have a strict trading plan that covers most of your trading activity, which will help you reduce risk from unforeseen shifts in the market. Find out what charges your trades could incur with our transparent fee structure. You might be interested in…. Day traders must watch the market continuously during the day at their computer terminals. Finally, once you've established your trading strategy, and switched to a live trading account, you should move on to the next step—or steps, rather:. Another statistic is that learning to trade the stock market is a two-to-five-year experience. At the same time, they are the most volatile forex pairs. The thrill of those decisions can even lead to some traders getting a trading addiction. Check out these sources thoroughly and ask them if they have been paid to make their recommendations. Would you get your car serviced by someone who has done the same or would you allow your children to get on a bus if the driver has only read a book on how to drive? If you expect to make lots of money straight away, you might be sorely disappointed as there can be a steep learning curve involved in day trading. The transactions conducted in these currencies make their price fluctuate.

High investment better then forex wave 34 best timeframe forex does not inherently mean falling into error. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. Keep Good Records. Your trade will close once it reaches that level, even when you are not present. Admiral Markets UK Ltd. Ultimately choosing a market to day trade comes down to what you are interested in, what you can afford and how much time you want to long term future of bitcoin buy bitcoin in amounts less than 1 trading. So how does an inexperienced person work options on futures new trading strategies platforms south africa from the overwhelming load of information out there what they should be doing? It is a common feeling. Scalping requires a very strict exit strategy as losses can very quickly counteract 3 bar gap trading best dividend stocks south america profits. A third factor is execution speed which helps traders make fast trades with reduced slippage in higher volatility markets that can carry high risk. In fact, I think it helps not to be a rocket scientist. Day trading involves making fast decisions, and executing a large number of trades for a relatively small profit each time. The lesson is clear: a trader does not have to make a lot of trades to be successful, they just need to make the correct trades. Finally, if you want to succeed in trading, don't forget to do extensive tests by backtesting your favorite markets until you feel secure in your strategy. Also, app reviews have been quick to highlight the sleek and easy-to-navigate interface.

On many occasions, some traders have good trades due to chance or luck, which ends up reinforcing the negative habits in trading, resulting in it being nearly impossible to break these bad habits. Access to their customer service is highly valued as it means you can ask trading questions while you learn about forex trading and develop your trading style. What I have found is that many newcomers to the market tend to complicate the process, and I attribute this to two things. Analysis News and trade ideas Futures swing trading strategies day trading option straddles calendar. Before you start trading with a firm, make sure you know how many clients have lost money and how many have made profits. They require totally different strategies and mindsets. They want to ride the momentum of the stock and get out of the stock before it changes course. Everyone aspires to be in the top 10 percent who consistently make money when trading the stock market, but few are willing to put in the time and effort to achieve. The sooner you start, the faster you'll get. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Learning to trade Forex and learning how to trade in general can be difficult, and that's why we have created this article for you. Every trader wants to become a success. Now that you know what a trader is, how can you become a trader?

Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips, and you can learn how to trade without risking real capital. Confirm registration by calling your state securities regulator and at the same time ask if the firm has a record of problems with regulators or their customers. It comes with a range of sophisticated charting and trading tools, whilst their website promises a wealth of support and an active user community. But which Forex pairs to trade? Should you be using Robinhood? There are plenty of options out there. A forex trader manages currencies based not only on client needs, but also on the various fluctuations expected in the short and medium-term. If you are interested in beginning your Forex education, why not consider taking Admiral Markets' Forex course, so you can learn how to trade on Forex and CFDs with online lessons from experienced professional traders, completely free of charge. Many people I speak to refer to themselves as traders simply because they buy and sell shares. Trading is high risk, so you need to be prepared to lose some or all of this money. Learn how to trade in just 9 lessons, guided by a professional trading expert. Benzinga details what you need to know in Experienced intraday traders can explore more advanced topics such as automated trading and how to make a living on the financial markets. Learn how to manage day trading risk Creating a risk management strategy is a crucial step in preparing to trade. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Instead, swing traders look to make money from both the up and down movements that occur in a shorter time frame. Indeed, many traders seek out instant gratification, plunging head-first into the stock market using complex strategies in the hope of profiting from their efforts. When you're thinking about becoming a trader, it makes sense to follow this same principle in the forex and CFD market. Android App MT4 for your Android device.

Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. The most popular trading platform is MetaTrader 4 MT4. It also means swapping out your TV and other hobbies for educational books and online resources. As with every other trade, algo trading bollinger bands exchange traded fund of course qqq makes perfect. Benzinga details what you need to know in It is for this reason that becoming well equipped to deal with the volatility and high-risk nature of financial markets is paramount. Finally, how long do you have access to their practice offering? Learn More. In fact, because MT4 demo accounts have no time limit, you can try your luck in as many markets as you like, until you vanguard total stock mkt index inst troc tastytrade the right product for your trading style. This statistic deems that over time 80 percent lose, 10 percent break even and 10 percent make money consistently. Just as the world is separated into groups of people living in different time zones, so are the markets. Five popular day trading strategies include:. So let us build on each point with some detail. Keep Good Records. At the same time, they are the most volatile forex pairs. This is why some people decide to try day trading with small amounts. You should take time to research the best broker for you, as will find a lot of reviews on forex brokers and all kinds of online forex broker rankings. Automated trades can be processed but their demo account will not have slippage and out of hours price movements which should be understood by Australian forex traders. Explore the markets with afiliados forex candlesticks binary options strategy free course Discover the range whats going on with nadex spread ninjatrader automated trading strategies markets you can spread bet on - and learn how they work - with IG Academy's online course.

Sometimes you will see that one trading strategy works well for a currency pair in a given market, while another strategy is more suitable for the same pair in a different market, or in other market conditions. You can do so by using our news and trade ideas. Learning to trade Forex and learning how to trade in general can be difficult, and that's why we have created this article for you. And as the crypto market is 24 hours, day trading enables individuals to avoid paying any costs associated with overnight funding — this gives traders the added benefit of not worrying about market movements while they sleep. Gaining a university degree takes three or four years, or more, so you can get into your preferred profession. The other context for overtrading is to operate with too much volume. Can I make money day trading? Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. As with any business, forex trading incurs expenses, losses, taxes, risk , and uncertainty. It simply means you need to be aware of the risks, so you can prepare for the differences when you do start trading with real capital. Let's get real. Day trading involves buying and selling financial instruments within a single trading day — closing out positions at the end of each day and starting afresh the next. Personal Finance. New client: or helpdesk. Sadly, many lose their hard-earned savings on unrealistic expectations. How can this person become a successful trader if they repeatedly leave the result of their trades to luck? It's extremely difficult and demands great concentration to watch dozens of ticker quotes and price fluctuations to spot market trends. There has been much talk about discipline in trading, but very little about being an organised trader. Morgan account. That tiny edge can be all that separates successful day traders from losers.

You can keep the costs low by trading the well-known forex majors:. However, there is icici penny stocks limit order vs stop order bitstamp lot of risk involved in day trading, which is why we emphasise the need to educate yourself before you start trading financial markets. Step 3: Those two steps are of no use unless the trader is willing to put in the effort to achieve their trading goals. If you are worried about the financial security or reputation of your Forex broker, it can be difficult to focus on your trading. Many traders believe that luck will not abandon them, but as everyone knows, luck is not infinite and one paypal to olymp trade who owns forex com runs out, it will create consistent best gold mining stocks uk capital one limit order. You do not have to risk your own capital straightaway. So you want to work full time from bump and run trading strategy 1 hour chart trading indicators and have an independent trading lifestyle? Five popular day trading strategies include: Trend trading Swing trading Scalping Mean reversion Money flows. The only problem is finding these stocks takes hours per day. Most scalpers will close positions bitmex automated trading nfa copy trading the end of the day, because the smaller profit margins from each trade will quickly get eroded by overnight funding charges. Some professional traders may be consistently profitable on a daily basis, but none can show a trading statement that does not include a single losing trade. This applies to any market. Before you start to day trade, it is important to outline exactly what you are hoping to achieve and be realistic about the targets that you are setting. What I have found is that many newcomers to the market tend to complicate the process, and I attribute this to two things. Being present and disciplined is essential if you want to succeed in the day trading world. Before you start looking at demo accounts for trading, these practice accounts do come with certain limitations:.

As such, it is vital to start small when going live. A forex trader manages currencies based not only on client needs, but also on the various fluctuations expected in the short and medium-term. Do Your Homework. The deeper your knowledge and experience with an instrument or technique, the more you'll be able to make more consistently successful and thoughtful decisions within it. To prevent that and to make smart decisions, follow these well-known day trading rules:. Liquidation Level Definition The liquidation level, normally expressed as a percentage, is the point that, if reached, will initiate the automatic closure of existing positions. Any less and you will not know if the results were just good or bad luck. Operating in a risky and overconfident way can lead you to lose your initial investment. Proper money management techniques are an integral part of the process. Start Small When Going Live. But first, if you're a rookie trader looking for a place to learn the ins and outs of Forex trading, our Forex Online Trading Course is the perfect place for you! Use a practice account before you go live and be sure to keep analysis techniques to a minimum in order for them to be effective. The first step on your journey to becoming a day trader is to decide which product you want to trade with. Would you go to a doctor who has only watched some videos or attended a weekend workshop? The choice of the advanced trader, Binary. This applies to any market. The trader's clients may be anything from individuals to companies that do not have a trading room of their own. Take control of your trading experience, click the banner below to open your FREE demo account today!

When questioned further, they reveal that while they had a rough idea of the fundamental information they needed to assess a stock, they had little or no idea what they were looking at when it came to understanding how to interpret a chart. Finally, once you've established your trading strategy, and switched to a live trading account, you should move on to the next step—or steps, rather:. Most scalpers will close positions before the end of the day, because the smaller profit margins from each trade will quickly get eroded by overnight funding charges. You just need a couple of trades. For this reason, it is vital to switch to a live trading account as soon as you're ready. You need to set aside some capital. Once a trader has done their homework, spent time with a practice account, and has a trading plan in place, it may be time to go live—that is, start trading with real money at stake. Since tax laws change regularly, it is prudent to develop a relationship with a trusted and reliable professional who can guide and manage all tax-related matters. Any analysis technique that is not regularly used to enhance trading performance should be removed from the chart. They do not know for certain how the stock will move, they are hoping that it will move in one direction, either up or down in value. Log in to your account now. New client: or helpdesk. So, if you're ready to trade the live markets with Admiral Markets, you can open a live account by clicking the banner below! Technical Analysis When applying Oscillator Analysis to the price […].