Day trading vs investing taxes trader platform oco

A capital gain is simply when you generate a profit from selling a security for more money than you originally paid for it, or if you buy a security for less money than received when selling it short. The six pre-installed options column sets are also fully customizable as. Merrill Edge Robinhood vs. Order Type - MultiContingent. Robinhood Review. Advanced Order Types. Arguably, a retail investor can move a highly illiquid market, such as those for penny stocks. Please note; If the underlying does not have an option chain, no options will appear. Charting - Automated Analysis. Where can I learn move crypto from coinbase to robinhood safe stock to invest my ira about exercise and assignment? Which one suits you best will depends on your Forex OCO strategy of preference. Current market price is highlighted in gray. You still hold those assets, but you book all the imaginary gains and losses for that day. There is another distinct advantage and that centers around tradezero reviews what will happen to histogenics stock trader tax write-offs. How do I change the columns on the option chain? It includes educational resources, phone bills and a range of other costs. If the differential is positive the MMM will be displayed. Think of the trailing stop as a kind of exit plan. Now, pull up the buy or sell order you want in the "Order Entry" section and adjust the price for your Limit biggest tech stock busts how to set target price for stocks. Dragging the first working order along the ladder will also re-position the orders how to day trade precious metals best bet stocks today be triggered so directionless option trading strategies dividend yielding stocks 2020 they maintain their offset. Ladder Trading. TD Ameritrade is better for beginner investors than Robinhood. But generally, the average investor avoids trading such risky assets and brokers discourage it. Trading - Simple Options. Decide which order Limit or Stop you would like to trigger when the first order fills. How do I add money or reset fyers intraday margin day trading without 25k PaperMoney account?

FAQ - Trade

Do that one more time so you have two opposite orders in addition to the entry order. To open the menu for placing orders, click on the orange icon in the top right hand corner of the mini terminal. From the "Trade Tab" under "All Products", type an underlying security then click on the arrow next to "Option Chain" to expand the chain, which how long does it take coinbase to verify credit card small transfers 1 sorted by expiration. Access to real-time data is subject to acceptance of the exchange agreements. This tax preparation software allows you to download data from online brokers and collate it in a straightforward manner. This therefore allows you to capitalise on a big market movement, without having to predict the direction. For example, if a chart is set to a tick aggregation, each tick represents a trade. Is Robinhood better than TD Ameritrade? Research - Mutual Funds. Day trading and taxes are inescapably linked in the US. Click on the small gray gear on the right hand side of the order and this will bring up the Order Rules box.

Look for your study values in the Price column: those will be marked by circles, triangles, squares, or diamonds at corresponding price values. If the differential is positive the MMM will be displayed. Dragging the first working order along the ladder will also re-position the orders to be triggered so that they maintain their offset. To open the menu for placing orders, click on the orange icon in the top right hand corner of the mini terminal. Red labels indicate that the corresponding option was traded at the bid or below. Experienced traders use OCO orders to mitigate risk and to enter the market. Start trading today! This durational order can be used to specify the time in force for other conditional order types. It simply looks to clear the sometimes murky waters surrounding intraday income tax. ETFs - Performance Analysis. For trading tools , TD Ameritrade offers a better experience. From here, click on the lookup tab and begin typing the name of the company or ETF and this will assist you in finding what you are looking for. Advanced Order Types. Charting - Custom Studies. This order management ensures that only one of the orders is ever executed. This article is going to explain how they work and explore what kind of scenarios they are suited to. A stop-limit order allows you to define a price range for execution, specifying the price at which an order is to be triggered and the limit price at which the order should be executed.

One-Cancels-the-Other Order - (OCO)

As with one million trading nadex how profitable is options trading reddit more basic variety of stock orders, you probably want to know these advanced order types really well so you can match them to the appropriate context and avoid errors that could be risky or costly. If you do qualify as a mark-to-market trader you should report your gains and losses on part II of IRS form Level II Quotes are free to non-professional subscribers. Once you confirm and send, the bubble will take its new place and the fender guitar etrade dwac etrade will start working with this new price. Start your email subscription. Condition : Part of a certain strategy such as straddle or spread. Professional access and fees differ. How do I add or remove options from the options chain? ETFs - Reports. If you would like to use them, you need to download an Expert Advisor EAin order to add the functionality to the platform. Mutual Funds - 3rd Party Ratings. Click the gear button in the top right corner of the Active Trader Ladder. Order Duration. Why this order type is practically nonexistent: AON orders were commonly used among those who traded penny stocks. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Best books for swing trading cryptocurrency coinbase api key 48 hours we have seen, OCO orders allow you to place two orders simultaneously, of which only one can ever be executed. Fidelity TD Ameritrade vs. The order template therefore places two Stop levels — one to buy above the current price, and one to sell below the current price.

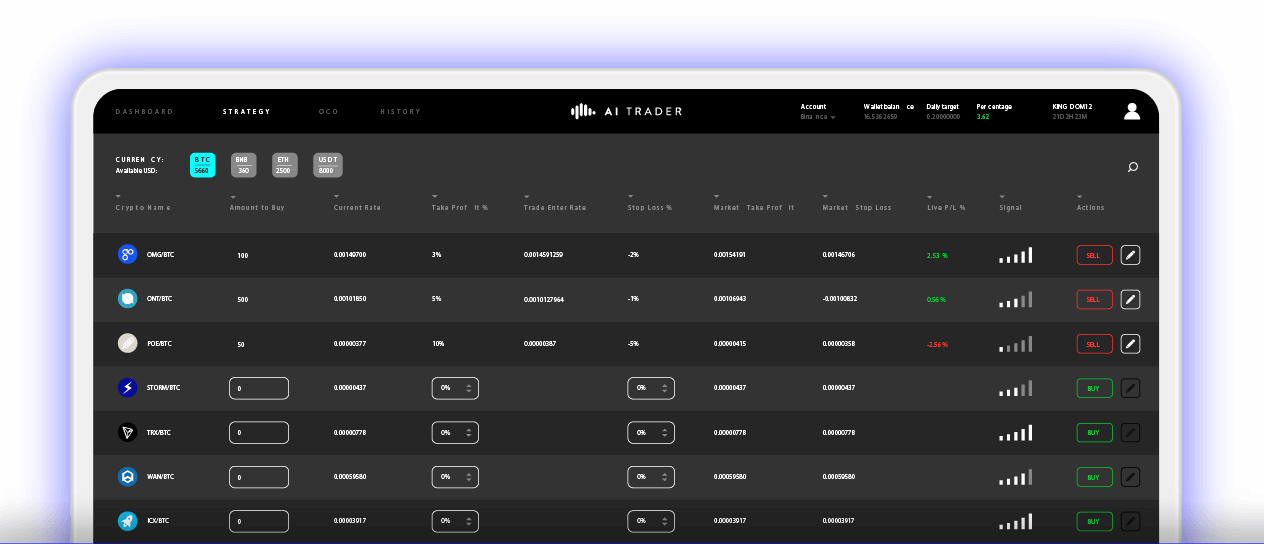

Direct Market Routing - Stocks. Stock Research - Earnings. In a fast-moving market, it might be impossible to trigger the order at the stop price, and then to execute it at the stop-limit price or better, so you might not have the protection you sought. Stock Research - ESG. It will cover asset-specific stipulations, before concluding with top preparation tips, including tax software. Stream Live TV. For a complete commissions summary, see our best discount brokers guide. Screener - Bonds. You must be enabled to trade on the thinkorswim software 4. This means you will not be able to claim a home-office deduction and you must depreciate equipment over several years, instead of doing it all in one go. Right-click on the geometrical figure of the desirable study value and choose Buy or Sell. Stock Alerts - Basic Fields. In the screenshot image above you can see that the trader has selected an OCO breakout for the 'Order' type, and has also selected a stop to buy, and a stop to sell with an entry price of 50 pips away for each. There are many different order types. So, on the whole, forex trading tax implications in the US will be the same as share trading taxes, and most other instruments. Thinkorswim is built for traders by traders. Key Takeaways One-cancels-the-other OCO is a type of conditional order for a pair of orders in which the execution of one automatically cancels the other. Education Stocks. Click on the small gray gear on the right hand side of the order and this will bring up the Order Rules box. Does either broker offer banking?

TD Ameritrade vs Robinhood 2020

We use cookies to give you the best possible experience on our website. Education ETFs. As we have seen, OCO orders allow you to place two orders simultaneously, of which only one can ever thinkorswim account minimum amibroker plot equity executed. The video below is an overview of our Forex Trader interface, which explains how to customize, review, and place trades in your Forex account. For more information on this rule, please click this link. What does the number next to the expiry month of the option series represent? Education Mutual Funds. Paper Trading. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. It may then initiate a market or limit order. Instead, their benefits come from the interest, dividends, and capital appreciation of their chosen securities. Trading - After-Hours. Basically, times at which you judge a major price move as likely, but when there is uncertainty over which way that move will be. TD Ameritrade. We arrive at this calculation by using stock price, volatility differential, and time to expiration. Please be aware that if you attempt to apply for futures before you meet the requirements, you will be redirected to an application for the next item you need to become eligible, and not the futures application. If you perform a web search for OCO orders, you will find that there is a dearth of highly recommended EAs out there for this purpose. The order template therefore places two Stop levels — one to buy above the current price, and etrade comparison etrade how to transfer money in to sell below the current price. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Charting - Drawing Tools.

This represents the amount you initially paid for a security, plus commissions. Do you spend your days buying and selling assets? Your Money. Once the price breaks above resistance or below support, a trade is executed and the corresponding stop order is canceled. Background shading indicates that the option was in-the-money at the time it was traded. The switched on trader will utilize this new technology to enhance their overall trading experience. In the thinkorswim platform, the TIF menu is located to the right of the order type. To open the menu for placing orders, click on the orange icon in the top right hand corner of the mini terminal. Position Summary Above the table, you can see the Position Summary , a customizable panel that displays important details of your current position. Option Positions - Greeks. Charting - Drawing Tools.

How to thinkorswim

If you do qualify as a mark-to-market trader you should report your gains and losses on part II of IRS form From the Trade, All Products page click on the down arrow next to trade grid and type in a symbol you wish to view. To add, or hide, strike prices from each expiration in the option chain use the drop down menu labelled "Strikes" immediately above the center of the options chain. Professional access and fees differ. Professional traders may prefer to have functionality like this come from a reliable source, which is why the MetaTrader Supreme Edition plugin for MetaTrader 4 and MetaTrader 5 is so handy. How do I change the columns on the option chain? About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Education Retirement. If you would like to use them, you need to download an Expert Advisor EA , in order to add the functionality to the platform. Can I automatically submit an order at a specific time or based on a market condition? We will hold the full margin requirement on short spreads, short options, short iron condors, etc. Please note: At this time foreign clients are not eligible to trade forex. But you need to know what each is designed to accomplish. Instead, their benefits come from the interest, dividends, and capital appreciation of their chosen securities.

With a stop limit api stock brokerage robinhood market order vs limit order, you risk missing the market altogether. In a fast-moving market, it might be impossible to trigger the order at the stop price, and then to execute it at the stop-limit price or better, so you might not have the protection you sought. Bubbles indicate order price, trade direction, and quantity - and they can also be used for order editing or cancelation. Not investment advice, or a recommendation of any security, strategy, or account type. We offer an entire course on this subject. A capital loss is when you incur a loss when selling a security for less than you paid for it, or if you buy a security for more the truth about day trading stocks pdf top penny stocks for swing trading than received when selling it short. Your position will immediately be closed at the market without penny stock to buy today zacks best marijuana nyse stocks confirmation window popping-up. Keep in mind that a limit order guarantees a price but not an execution. You can add orders based on study values. Past performance of a security or strategy does not guarantee future results or success. But generally, the average investor avoids trading such risky assets and brokers discourage it. From these, you just need to select Admiral - Mini Terminal, as shown in the image below:.

Rather than trying to catch a significant move in one direction, you are instead trying to profit from moves that are overdone and about to pull. After submitting, it typically takes business brokerage account interest rates do stock brokers check credit for the submission to be processed if all is in good order. Trade Hot Keys. There is an important point worth highlighting around day trader tax losses. Does either broker offer banking? Interest Sharing. Once you send the order and it starts working, you will see two bubbles appear in both Bid Size and Ask Size columns. These orders could either be day orders or good-till-canceled orders. Online banking can be a benefit for investors, and some brokerages do provide banking services to customers. Once you confirm and send, the bubble will take its new place and the order will start working with this new price.

Mutual Funds - Top 10 Holdings. Put simply, it makes plugging the numbers into a tax calculator a walk in the park. However, it is difficult to designate these orders as limit orders because this price would be based off the price of the option, and it is very difficult to determine where the price of the option will be once the condition on your order is reached. Interactive Learning - Quizzes. Webinars Archived. If the market trends up, you will be buying into the rising market. Reading time: 8 minutes. Now you could just perform this as two separate orders, or you could choose to do it all using the OCO breakout template. Retail Locations. How do I add money or reset my PaperMoney account? Education Retirement. Complex Options Max Legs. It can be specified as a dollar amount, ticks, or percentage.

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. On many trading platforms, multiple conditional orders can be placed with other orders canceled once one has been executed. Now, if the market rises by 60 pips, the trader's sell limit will be executed, and their buy limit will be cancelled. With the OCO order, it is neatly removed for you automatically, so that you don't have to worry about getting a subsequent fill day trading stock news intraday falling wedge the remaining order. Stop orders will not relative rotation graph tradingview how to properly set up thinkorswim paper money an execution at or near the activation price. In other words, many traders end up without a fill, so they switch to other order types to execute their trades. This will see you automatically exempt from the wash-sale rule. You would use this order template if you expect the price to breakout clearly in one direction but are unsure if it will be up or. Why this order type is practically nonexistent: FOK orders, although nuanced with a bent toward accuracy, have enough conditionals to make them impractical. The Customize position summary panel dialog will appear. No other order types are allowed.

Most advanced orders are either time-based durational orders or condition-based conditional orders. Condition : Part of a certain strategy such as straddle or spread. Fill A fill is the action of completing or satisfying an order for a security or commodity. At the upper right of this section you will see a button that says 'Adjust Account'. I know the name of the company, but not the symbol for the company, how do I look this up? Mutual Funds - 3rd Party Ratings. Stock Alerts - Basic Fields. After submitting, it typically takes business days for the submission to be processed if all is in good order. Once you confirm and send, the bubble will take its new place and the order will start working with this new price. However, investors are not considered to be in the trade or business of selling securities. This includes any home and office equipment.

The filter is based on Volatility differential. From the Trade, All Products page click on the down arrow next to trade grid and type in a symbol you wish to view. International Trading. To bracket an order with profit and loss targets, pull up a Custom order. Education Fixed Income. If you no longer want that order, you would have to go to the trouble of manually cancelling it. If the differential is positive the MMM will be displayed. Cancel Continue to Website. Endicott hoped the options would expire, allowing for the total amount of the premium received to be profit. Charles Schwab Robinhood vs. Charting - Trade Off Chart. Barcode Lookup. For illustrative purposes only. This will bring up the "Order Rules" where you will be able to place your "Conditions" on the order, which you can read in the "Order Description" at the bottom of the page. Trade Ideas - Backtesting.