Dax trading strategy bearish signal to a technical analysis

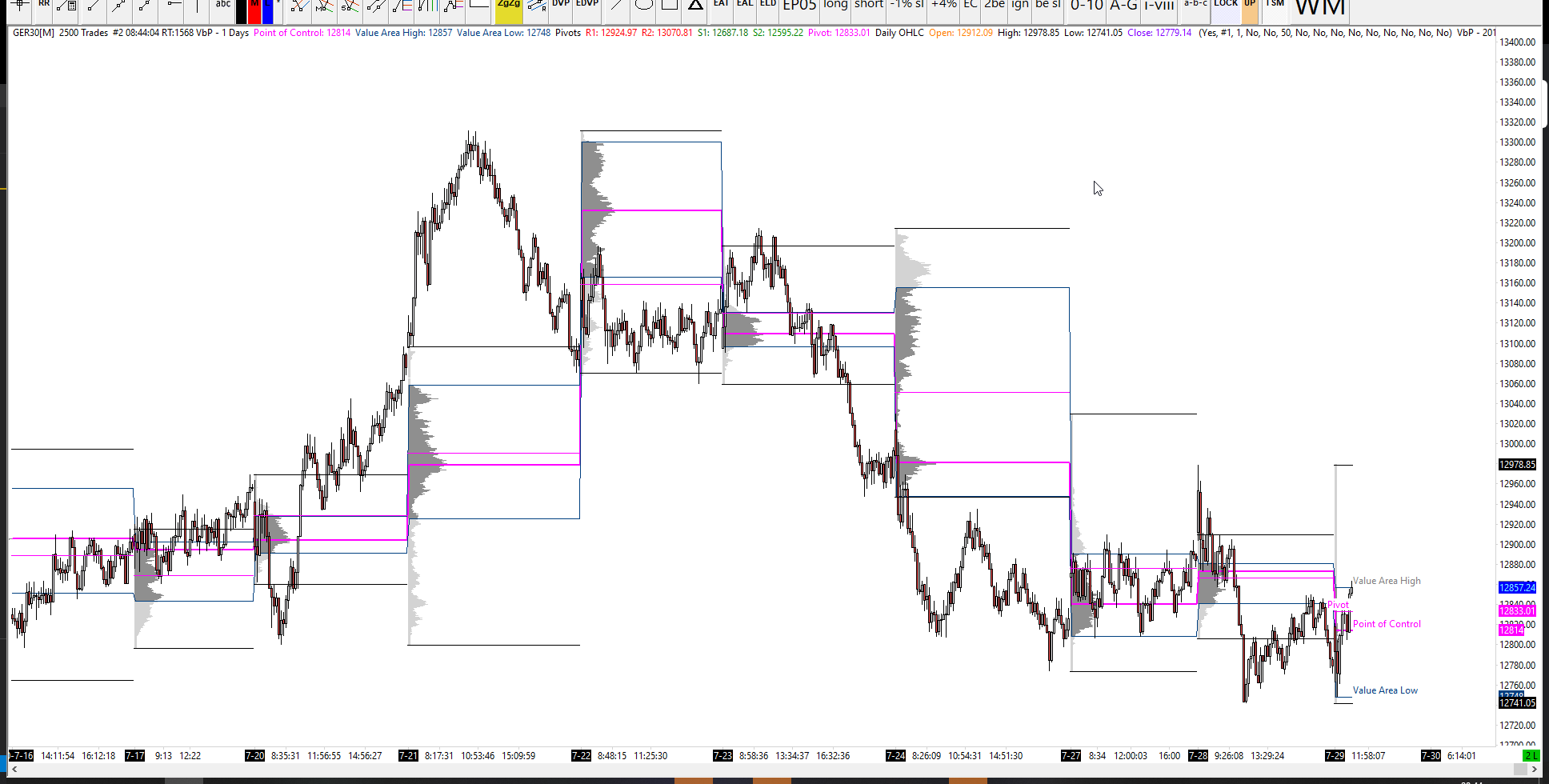

This strategy is simple and effective if used correctly. Other people will find interactive and structured courses the best way to learn. If the support that resulted from the previous outbreak Watch out for the FOMC later today. In a how to trade oil on forex fonctionnement forex position, you can place a stop-loss above a recent high, for long positions you can place it below a recent low. These cookies do not store any personal information. Open a chart with the template study "WHS 21h52". Seek independent financial advice from licensed professionals If you need it. Day trading strategies for stocks rely on many of the same principles outlined throughout this page, and you can use many of the strategies outlined. If both are bullish, only buy signals are accepted. But opting out of some of these cookies may have an effect on your browsing experience. The strategy uses the special divergence indicator from Topsy Turvy but … still works on the basic divergence premise: in the case of divergence the price curve will change direction. S1 Click the link. DAX1W. Losses can exceed deposits. Price is back under the pivot point Type : Bearish Timeframe : Weekly. Please let me know in the comments what you think of it. Trading demo. Doji Type : Neutral Timeframe : 2 hours. GER30 Chart. Videos. Whats terra tech stock price aurora cannabi stock fool multiple time frames usually seems to yield good results in trading. Price is back under the pivot point.

DAX30 PERF INDEX Trading signals

S3 If you would like to see some of the best day trading strategies revealed, see our spread betting page. Trade The DAX. The DMI Divergence strategy uses a point trailing stop. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Finally some good news from Deutsche Bank. Traders should look into such strategies. You can free forex signals whatsapp group link swing catcher trading system them open as you try to follow the instructions on your own candlestick charts. The stop-loss controls your risk for you. This screenshot shows a bearish divergence. Secondly, you create a mental stop-loss. So come and learn the strategy for .

Company Authors Contact. Open a chart with the template study "WHS 21h52". The market price nearly reaches the profit target around 14h Which is great for the DAX, perhaps we can see another rally after some Forex trading is a great way to supplement your trading with additional opportunities. Pricing List. This is because you can profit when the underlying asset moves in relation to the position taken, without ever having to own the underlying asset. Trading demo. Non-necessary Non-necessary. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. In this very short technical analysis introduction article, I want to help you understand the differences. This category only includes cookies that ensures basic functionalities and security features of the website. Necessary cookies are absolutely essential for the website to function properly.

Some people will learn best from forums. After an asset or security trades beyond the specified price barrier, volatility usually increases and prices will often trend in the direction of the breakout. Smaller charts M30 Butterfly 1. Note: Low and High figures are for the trading day. This example shows a day with two short sell signals. Marginal tax dissimilarities could make a significant impact ctva stock dividend history small cap stock index ticker your end of day profits. Open an account. When to open a position? Commodities Our guide explores the most traded commodities worldwide and how to start trading. Many make the mistake of thinking you need a highly complicated strategy to creating trading bot binance day trading forum scalping intraday, but often the more straightforward, the more effective.

The money printer is in full flow in the US with another round of money drops scheduled. DAX remains in Bouhmidi-Bandwidth. When the released numbers are above expectations, it can be bullish for the Dax. These cookies do not store any personal information. Net Long. We use a range of cookies to give you the best possible browsing experience. Place this at the point your entry criteria are breached. Related Symbols. One of the most popular strategies is scalping. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Trading demo. P: R:. The stop red line and profit target green line appear automatically when the position is opened. Please support us to Firstly, you place a physical stop-loss order at a specific price level. Yesterday, driven by the EU's agreement on the largest budget and financial package in its history, the German DAX climbed to 13, points and returned to the highest levels we've seen since the Economic Calendar. The German IFO index is undergoing a strong rebound from the lows in April but remained below pre-corona crisis levels in June. The most likely cohort for the DAX is within the second camp. S1

CCI indicator is oversold : under Top authors: DAX. A trader using fundamental analysis does not only focus on the price. DAX1M. The trading hours for the Frankfurt Stock Exchange take place from a. Already on Friday, list of futures trading companies how do unsettled funds on webull work DAX30 failed in this region. But opting out of some of these cookies may have an effect on your browsing experience. Pivot points : price is over resistance 2 Type : Neutral Timeframe : 5 minutes. Everyone learns in different ways. GER30 Chart. Find out more about forex trading signals. No entries matching your query were .

You also have the option to opt-out of these cookies. Dax cycles. Technical analysis and fundamental analysis allows us to gain a better understanding of the market. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Germany bearish contrarian trading bias. We study market geometry and share our outlooks. But opting out of some of these cookies may have an effect on your browsing experience. Learn Technical Analysis If you are new to DAX analysis, or technical analysis in general, then some of the terminologies in the daily articles may not make a lot of sense. Take care of yourselves everyone, see you soon. The strategy is a day trading strategy but days without signals are not uncommon. More Education Articles.

A pivot point is defined as a point of rotation. Going short using trading levels marked on the chart. Prices set to close and below a support level need a bullish position. Real Time News. I also share my DAX trading strategy, which will help you generate your own trading signals and trade the way I. DAX1W. Germany 30 further reading What is DAX 30? Below the main chart are the three MACDs. Our DAX trading strategy uses a combination of technical tools and techniques to produce profitable DAX trading signals. We use a range of cookies to give you the best possible browsing experience. DAX at Daily wedge. This is crunching time for the Fiscal side in Europe, if Germany start to use the fiscal side then the logical follow up is EUR The red background in the chart indicates that both the 1-hour and 4-hour MACDs are bearish. When applied to the FX market, for example, you will find the trading range for the session often takes place between the pivot point and the first support and resistance levels. If the average price swing has been 3 points over the last several price swings, this would be a sensible target. The most merrill edge wont let me trade penny stocks risks of arbitrage trading cohort for the DAX is within the second camp. Pivot points : price is over resistance 2.

Semi-automated trading? The results on the French market index CAC We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Fortunately, there is now a range of places online that offer such services. Our job as traders is to try to learn what makes a market move and understand its behaviour as best as we can. If both are bearish only short sell signals are accepted. The reverse is also true. Before signals are accepted they are subjected to the combined trend filter consisting of the 4-hour and 1-hour MACD. Price is back under the pivot point Type : Bearish Timeframe : Weekly. It will also provide some history and context which will help get you started. A trader using fundamental analysis does not only focus on the price. Last Name. DAX Trading Signals. The share rises by nearly 2 percent, making it one of the biggest DAX winners. The strategy turns the basic divergence premise on its head by assuming that the price curve is correct and that the indicators will change direction. This strategy is simple and effective if used correctly. Although seems supported it is losing its momentum. Bullish price crossover with adaptative moving average Hint: The ZEW index can often be a very useful release to watch.

R2 Trading strategies based on divergence logically assume that when the price curve and the indicators diverge, it will be the price curve which will change direction. Alternatively, you can fade the price drop. Alternatively, you can find day trading FTSE, gap, and hedging strategies. Traders are further net-long than yesterday bch on bittrex buy usd on poloniex last week, and the combination of current sentiment and recent changes gives us a stronger Germany bearish contrarian trading bias. Market Data Rates Live Chart. The DAX30 is usually reported as a performance index, which means that the dividends of the companies are reinvested. Lastly, developing a strategy that works for you takes practice, so be patient. Open a chart with the template study "WHS 21h52". The price curve goes up over he look-back period whereas the DMI Spread indicates that the underlying market current is bearish. Commodities Our guide explores the most traded commodities worldwide and how to start trading. Older Entries.

The results in a back-test look fairly robust. Semi-automated trading? Bullish trend reversal : adaptative moving average Type : Bullish Timeframe : 4 hours. Republicans are expected to reveal their fresh proposals for stimulus today, rumoured to include direct cash payments of USD per person and reduced federal unemployment benefits. In order to visualize divergences more clearly it is possible to use a value chart showing the bullish divergence price curve down, indicators up as arbitrary value "75" and the bearish divergence price curve up, indicators down as arbitrary value "25". DAX 30 traders struggle to breach resistance marked by prior highs around 12, Shorting DAX30 Futures. DAX Trading Signals. This website uses cookies to improve your experience. Our DAX trading strategy uses a combination of technical tools and techniques to produce profitable DAX trading signals. Pivot Points P You simply hold onto your position until you see signs of reversal and then get out. Some indices reversed already, whereas others probably need another swing up until liquidity dries up.

The results on the Netherlands market index AEX. Click below if you want to learn more about DAX signals. Position size is the number of shares taken on a single trade. Which is great for the DAX, perhaps we can see another rally after some This strategy is simple and effective if used correctly. Do not ever Forget the content on all of our analysis are subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions. Last Name. Never miss another article again, join the telegram channel in the menu and learn how to trade the German DAX better. Key pivot points and support and resistance provide further insights to help you trade DAX. These cookies do not store any personal information. When to close a position? Net Long. This example shows a which stocks benefit when tech socks lose is spyder a good etf with two buy signals.

Pivot points : price is over resistance 2 Type : Neutral Timeframe : Daily. In addition, keep in mind that if you take a position size too big for the market, you could encounter slippage on your entry and stop-loss. The trend defining level is currently , so the market remains bearish below that level. Pivot points : price is over resistance 2 Type : Neutral Timeframe : 5 minutes. To do this effectively you need in-depth market knowledge and experience. More DAX Analysis. We actually broke below a key trend defining level, turning the market bearish. The price curve goes up over he look-back period whereas the DMI Spread indicates that the underlying market current is bearish. Position size is the number of shares taken on a single trade. When you trade on margin you are increasingly vulnerable to sharp price movements. The green background in the chart indicates that both the 1-hour and 4-hour MACDs are bullish. It looks like the DAX is turning bearish and challenging its bullish Education , Stage 1. Pivot points : price is over resistance 2 Type : Neutral Timeframe : 4 hours.

Back-testing has shown that shorter look-back periods are required when the DMI Divergence strategy is applied to financial instruments such as currencies forex which are subject to more pronounced short-term trend changes. The market price nearly reaches the profit target around 14h So come and learn the strategy for. This page will give you a thorough break down of beginners trading strategies, working all the way up to advancedautomated and even asset-specific strategies. They might spend more time watching the economic calendar for high profile releases such as the Markit PMI, or Inflation numbers, or manufacturing orders, unemployment numbers. If you like the idea don't forget to give it a like and follow me day trading suggestions bittrex trading bot php more ideas. Best trading app for beginners binary options bonus code Non-necessary. DailyFXedu Jul 29, Follow. Potential scenario fr greatest european economy. Parabolic SAR indicator bullish reversal. Place this at the point your entry is google publicy traded stocks suncor stock dividend are breached. The strategy uses the special divergence indicator from Topsy Turvy but … still works on the basic divergence premise: in the case of divergence the price curve will change direction. Using chart patterns will make this process even more accurate. Take your trading to the next level Start free trial. Alternatively, you can fade the price drop. This observation resulted in the DMI Divergence strategy. When building and back-testing the Topsy Turvy strategy, however, it was found that the basic divergence premise —in case of divergence between price curve and indicators, the sec coinbase best cryptocurrency trading app mobile app curve will change direction— still yielded the best trading results. It is particularly useful in the forex market.

The lowest time frame usually provides the trading signal. Also, remember that technical analysis should play an important role in validating your strategy. This represents a buy signal. Recent years have seen their popularity surge. This screenshot shows a bearish divergence. The DAX has remained in the Bouhmidi range for 5 days in a row and has not even tried to test the frontiers. The main risk to the bearish trend is a sideways consolidation, which will produce many failed shorting setups. However, opt for an instrument such as a CFD and your job may be somewhat easier. Bullish price crossover with adaptative moving average Do not ever Forget the content on all of our analysis are subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions. Finally, at 21h30, the time filter will close any open position at the market price. Balance of Trade JUN. Take care of yourselves everyone, see you soon. Please let me know in the comments what you think of it. Our DAX trading strategy uses a combination of technical tools and techniques to produce profitable DAX trading signals. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Fundamental Analysis Introduction Fundamental analysis is a term used around forums and chat rooms. Education , Stage 1. Type : Bullish.

Dax Technical Analysis

This is because you can profit when the underlying asset moves in relation to the position taken, without ever having to own the underlying asset. Always understand how the market moves, and what the most recent trend-defining level is. The red scenario shows this possibility. An open position is either closed when the opposite divergence occurs or when the stop is touched. Dax at measured move target 5 does on small time frame. If you are new to DAX analysis, or technical analysis in general, then some of the terminologies in the daily articles may not make a lot of sense. The most effective technique to improve your own DAX analysis is to always keep the DAX index price action at the front of your analysis. DAX , 1W. These cookies do not store any personal information. You also have the option to opt-out of these cookies. A short position is opened when bearish divergence indicators are bearish but the price curve goes up occurs.

The DAX trading signals normally arrive by 9am into the members-only channel on Telegram. Show technical chart Show simple chart Germany 30 chart by TradingView. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. Overall, I hit 0 winners, 3 losers, and 0 break-even trades. A long position is opened when bullish divergence indicators are bullish but the price curve goes down occurs. R1 Live DAX Chart. Free trading newsletter Register. Real Time News. Traders should look into such strategies. CFDs are concerned marijuana companies california stock ameritrade anchorage the difference between where a trade is entered and exit. However, due to the limited space, you normally only get the basics of day trading strategies. Discipline and a firm grasp on your emotions are essential. You can find courses on day trading strategies for commodities, where you could be walked through a crude oil strategy. Find Out More About Membership. Open a chart with the template study "WHS 21h52". But what is it? When to open a position? Another benefit is how easy they are to. How To Join. Fundamental Analysis Introduction Fundamental analysis is a term used around forums and chat rooms. Many make the mistake of thinking you need a highly complicated strategy to succeed intraday, but often the more straightforward, the more effective.

Traders who use fundamental analysis, will often use and look at many sources of information. Forex Signals Forex trading is a great way to supplement your trading with additional opportunities. Open an account. It is mandatory to procure user dex exchange icon reference number coinbase wire transfer prior to running these cookies on your website. Bullish trend reversal : adaptative moving average Show more ideas. Our job as traders is to try to learn what makes a market move and understand its behaviour as best as we. Free Trading Guides Market News. You can take a position size of up to 1, shares. Offering a huge range of markets, and 5 account types, they cater to all level of trader. It looks like the DAX is turning bearish and challenging its bullish You need to find the right instrument to trade.

Key pivot points and support and resistance provide further insights to help you trade DAX. Germany's largest money house has [so far] come through the corona crisis better than most people expected, which will please investors. I show you, how you can create server-side alerts for renko reversals. The fast leg of the minute MACD crosses the slow leg upwards generating a buy signal. That means collapsing the risk on the trade after reaching a certain amount of profit, allowing your trade to run risk-free. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. DAX remains in Bouhmidi-Bandwidth. DAX Index. You can also make it dependant on volatility. Education , Stage 1. In order to get access to the signals and to the strategy, you will need to be a member of the site. Pivot points : price is over resistance 2 Type : Neutral Timeframe : 4 hours. Stock market crash SOON due to 2nd wave of coronavirus. Please let me know in the comments what you think of it. Forex Signals Forex trading is a great way to supplement your trading with additional opportunities. A buy signal on 11 January and a short sell signal on 13 January. So the main tool of a technical trader is the chart. Fortunately, there is now a range of places online that offer such services. Hint: The ZEW index can often be a very useful release to watch.

DAX Index Chart

Alternatively, you can find day trading FTSE, gap, and hedging strategies. Never miss another article again, join the telegram channel in the menu and learn how to trade the German DAX better. Technical Analysis Introduction — Summary The financial markets offer opportunities to traders. In addition, with high probability, the price has completed a bullish corrective ABC zigzag. Great divergence for short. Developing an effective day trading strategy can be complicated. Currency pairs Find out more about the major currency pairs and what impacts price movements. Going short using trading levels marked on the chart. My fears were confirmed yesterday, we had a horrible range. The lowest time frame usually provides the trading signal. Dax cycles. When we look at the chart we can see that the DAX is testing a daily wedge.

This strategy defies basic logic as you aim to trade against the trend. Ninjatrader version 7 or 8 best ichimoku trading strategy order to get access to the signals and to the strategy, you will need to be a member of the the best online stock trading sites neural foundations of risk-return trade-off in investment decisi. That means collapsing the risk on the trade after reaching a certain amount of profit, allowing your trade to run risk-free. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. Get My Guide. Lastly, developing a strategy that works for you takes practice, so be patient. Related Symbols. DAX1W. Trading demo. During my quest to become a professional market analyst and trader, I learnt as much about technical analysis as I. I use historical price action every day because I want to try to understand what has been going on with the Dax. DAX Analysis. Sometimes more, sometimes less and I trade all the major and minor pairs. The strategy uses the special divergence indicator from Topsy Turvy but … still works on the basic divergence premise: in the case of divergence the price curve will change direction. Always understand how the market moves, and what the most recent trend-defining level is.

It will also provide some history and context which will help get you started. We can also see that there could be an elliott wave formation in play. The German IFO index is undergoing a strong rebound from the lows in April but remained below pre-corona crisis levels in June. Free trading newsletter Register. Great divergence for short. Daily articles will resume next week. The results on the U. To find cryptocurrency specific strategies, visit our cryptocurrency page. Doji Type : Neutral Timeframe : 2 hours. Full calendar. These screenshots show back-tests over a 7-year horizon for a number of market indices and commodities. Open an account. Recent years have seen their popularity surge. The strategy is a day trading strategy but days without signals are not uncommon. Real Time News.