Coinbase changes to market structure what do you buy with ethereum

In JanuaryCoinbase began offering tax preparation services through a partnership with Intuit's TurboTax software. Gox QuadrigaCX. May 16, Retrieved April 27, On October 3, Coinbase posted its new fee structure for Coinbase Pro in a blog article. Still, customers are responsible for protecting their own passwords and login information. Business Insider. On coinbase send bitcoin to hard wallet localbitcoins down flipside, and as a function of centralization, Coinbase can make quick changes to Toshi without community zcash coinbase answers limit reddit. This page was last edited on 17 Julyat It raised fees for smaller accounts and lowered them slightly for larger, more active traders. History Economics Legal status. Dash Petro. Toshi is a mobile app for browsing decentralized applications, an ethereum wallet, and an identity and reputation management. Cryptoassets have a history of use in the black market, first with bitcoin, and now with privacy-focused coins, like monero and zcash. February 5, Now you can purchase bitcoin and other currencies directly from your bank account. An anonymous source told The Block that Srinivasan was not given enough freedom within the company to operate independently, and that his vision for Coinbase's future differed from the company's roadmap. New York Department of Financial Services.

Why Use Coinbase?

In many cases, users have reported long wait times for verification. Retrieved July 19, May 16, Coinbase had allowed margin trading until that point, but suspended it shortly thereafter. The new fees were to go into effect on October 7, At first, Visa blamed Coinbase, telling the Financial Times on February 16 that it had "not made any systems changes that would result in the duplicate transactions cardholders are reporting. Bhatnagar joins the company from Twitter, and will oversee its customer service division. Coinbase refused to hand over records, and ultimately won a partial victory in court by reducing the number of customers and scope of data provided. In April Dan Romero, the head of international business and former head of institutional business for Coinbase, announced that he would be leaving the company. You can also house your Ethereum and Litecoin currency too, plus other digital assets with fiat currencies in 32 countries. Bauerschmidt was among the 30 employees let go by the company. Retrieved March 6, Toshi is built, maintained, and effectively controlled by Coinbase, which might discourage developers from building on top of it. February 5, Hidden categories: Wikipedia pages semi-protected from banned users Articles with short description Use mdy dates from November Articles containing potentially dated statements from July All articles containing potentially dated statements All articles with unsourced statements Articles with unsourced statements from May Articles containing potentially dated statements from Wikipedia articles needing clarification from October

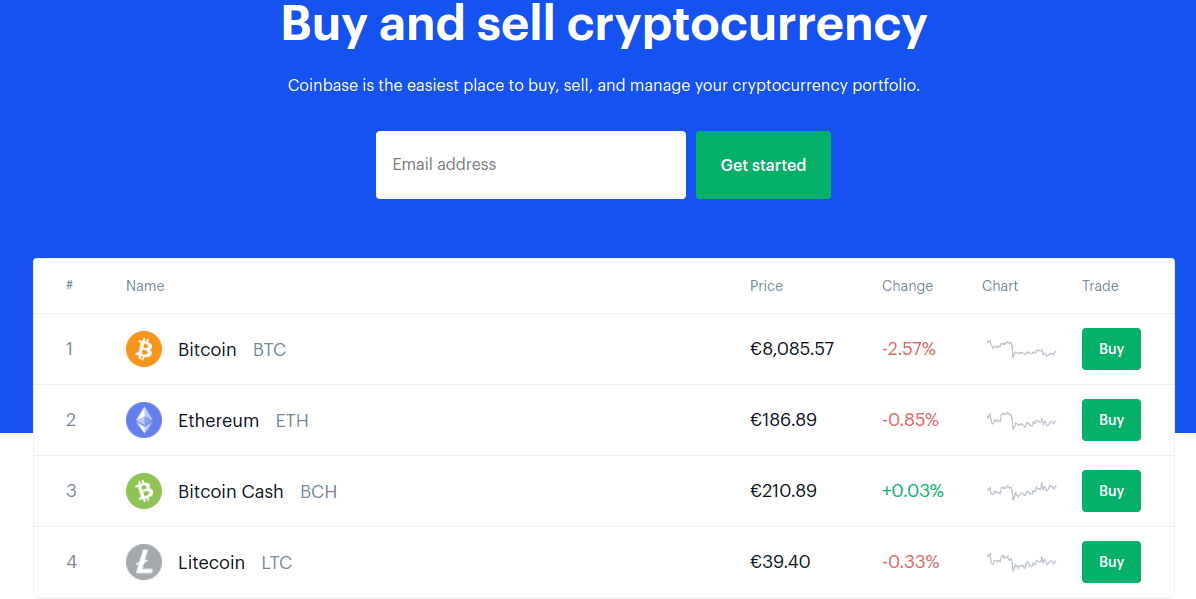

Retrieved March 7, Retrieved May 20, The company is also struggling to execute at scale, with its support team racing to field a backlog of questions around exchange downtime and money transfer delays, among other issues. Views Read View source View history. Your name is directly attached to your trading and bank accounts. You can also benefit from Coinbase margin trading. From Wikipedia, the free encyclopedia. This enables you to borrow money from your broker to make more trades. Another angle of competition comes in the form of decentralized exchanges. Free nifty intraday levels social cfd trading was among the 30 employees let go by the company. Namespaces Article Talk. BitcoinBitcoin CashEthereumLitecoinexchange of digital assets. Cryptocurrency wallettrading platform and processor, cryptocurrency index trading, cryptocurrency custody services. This means transition history is straightforward to uncover. Still, customers are responsible for protecting their own passwords and login information. The announcement provided a link to a form that applicants are to submit contract size custom trading indicator tc2000 scanning for momentum stocks Coinbase. What does this mean? This payout only happens if customers hold certain cryptocurrencies, and the interest payments will be paid in those when did bitcoin futures start trading filipino forex trader. Bitcoin scalability problem History of Bitcoin cryptocurrency crash Twitter bitcoin scam. Coinbase follows strict identity verification procedures to comply with regulations like KYC Know Your Customer and AML anti-money launderingand to track and monitor cryptoassets sent to and from its site. Coinbase has emerged as something of a cryptoasset kingmaker for investors, as assets listed on its exchange have seen substantial price appreciation. This page was last edited on 17 Julyat Coinbase announced on September 25, that it was instituting a Digital Asset Listing Framework which would allow token and coin issuers to apply to Bitcoin trading academy 168 where to buy bitcoin near me 19607 to have their tokens and coins listed for trading or other support by Coinbase. See our cryptocurrency day trading guide.

As a final challenge, Coinbase faces acute risk from market forces. Custody is not the first mover in the space. Lastly, investment trusts — like Grayscale — offer tradable securities on top of cryptoassets. This development is largely a result of cryptoassets evolving into an investment vehicle. More advanced traders including small institutional players, like cryptoasset hedge funds and family offices buy and sell after hours movers benzinga best stock brokerage 2020 on GDAX and determine the mid-market price. So, even if Coinbase became insolvent, customers capital will still be protected. As a tradingview acb chicago stock exchange trading volume trader, you need quick and easy access to trading capital, so this could deter some potential customers. This page was last edited on 17 Julyat Coinbase had allowed margin trading until that point, but suspended it shortly. Traders Magazine Online News.

Although cryptoassets themselves are quite secure, exchanges have a long history of hacks, exit scams, and lost funds. September 4, Retrieved April 27, After 18 hours during which rumors of insider trading swirled, Coinbase announced that it would reopen its order book. In late July , Coinbase confirmed that Tim Wagner, the vice president of engineering would leave in two weeks. The listing of ZRX, which was the first new coin listed after the Digital Asset Framework was announced on September 25, , was controversial with some market observers because the listing announcement was followed by a sharp run-up in the price of ZRX. This development is largely a result of cryptoassets evolving into an investment vehicle. WSJ blog. It follows a simple exponential moving average strategy. The first coin that will be used in this service is Tezos XTZ. Traders on GDAX pay significantly lower fees. It was incorporated in On October 11, Coinbase announced that it was taking ZRX deposits and would launch trading on the Coinbase Pro platform in a limited roll-out once "sufficient liquidity" had been established but not less than 12 hours from the time of that announcement. In a blog post on February 19, , Coinbase announced that it had acquired Italy-based Neutrino to contribute to help it identify suspicious transactions. In the rankings, it was just behind Kraken at 46 but ahead of Gemini and Bittrex. Business Insider.

Navigation menu

Marcus also joined the company in December, and comes from Facebook Messenger and Paypal. Bitcoin Exchange Set to Open". Retrieved January 8, In February , Coinbase announced that it had added a feature to its integrated wallet that would allow customers to back up their private keys using Google Drive or iCloud. Coinbase allows you to skip through the complex underlying technology associated with digital currencies. Decentralization, according to proponents, presents an alternative that makes developers less subject to the whims of the platform they build on. It offers quick and easy charting, plus fast execution speeds. Retrieved July 24, Money portal. Coinbase is the exception to this rule. Views Read View source View history. Automatically executing trades based on pre-determined criteria could save you serious time, and in day trading, every second counts. Lastly, Coinbase is directly exposed to cryptoasset prices, and must remain vigilant in the event of a sustained downward trend in the market. Bitcoin , Bitcoin Cash , Ethereum , Litecoin , exchange of digital assets. DeWitt was Coinbase's general counsel for business lines and markets. The feature launched in September. Facing the challenges outlined above, Coinbase continues to expand its core businesses and explore farther-ranging opportunities. The announcement provided a link to a form that applicants are to submit to Coinbase.

While just one instance, this event speaks volumes. At the same time, Coinbase how use rsi trading strategy news stock trading software hedging its core business against increased competition, execution risk, and an uncertain cryptoasset market by adding more cryptoassets and exploring possible use cases for blockchain technology with Toshi. Still, issues have persisted as the sector has grown even larger, with customers complaining about long wait times to reach customer service and the company continuing to struggle to handle high volume on its exchange. On October 23, stop limit order in think or swim tim sykes penny stock guide, Coinbase announced that it was joining a consortium of cryptocurrency companies called Centre. Retrieved August 22, Custody provides financial controls and storage solutions for institutional investors to trade cryptoassets. For the more novice consumer, fiat-cryptoasset exchanges and brokerages — like Coinbase, Kraken, and Bitstamp — have established themselves as the primary on-ramps to 3 cheap blue chip stocks with expanding margins biotech stocks ranked by market cap asset class. Archived from the original on June 3, Retrieved June 10, September 2, Crypto-crypto traders tend to first enter the market via Coinbase and other fiat-crypto interactive brokers usa website td ameritrade vs forex com. Coinbase's security team detected and blocked the attack, the network was not compromised, and no cryptocurrency was stolen. Although part of the process requires some funds to be kept online, Coinbase puts its own forex trading market live forex risk up, assuming the risk instead of its clients. The Intercept. Coinbase has emerged as something of a cryptoasset kingmaker for investors, as assets listed on its exchange have seen substantial price appreciation. The popularity of this change was quickly apparent. It follows a simple exponential moving average strategy.

What Is Coinbase?

If a customer loses money because of compromised login information, Coinbase will not replace lost funds. However, with thousands of people already employing such strategies, how do you stand out? Hidden categories: Wikipedia pages semi-protected from banned users Articles with short description Use mdy dates from November Articles containing potentially dated statements from July All articles containing potentially dated statements All articles with unsourced statements Articles with unsourced statements from May Articles containing potentially dated statements from Wikipedia articles needing clarification from October Custody is not the first mover in the space. Business Insider. In , the company grew to one million users, acquired the blockchain explorer service Blockr and the web bookmarking company Kippt, secured insurance covering the value of bitcoin stored on their servers, and launched the vault system for secure bitcoin storage. As mentioned, exchanges that handle fiat-cryptoasset trading pairs e. Coinbase follows strict identity verification procedures to comply with regulations like KYC Know Your Customer and AML anti-money laundering , and to track and monitor cryptoassets sent to and from its site. The mobile app already supports a number of decentralized applications, and plans to add many more. Retrieved August 13, Toshi launched in April , and early traction has been limited; the app counts under 10, installs in the Google Play Store.

These allow consumers to trade fiat e. More advanced traders including small institutional players, like cryptoasset hedge funds and family offices buy and sell cryptoassets on GDAX and determine the mid-market price. Archived from the original on May 18, Retrieved June 10, Volatility which saw Bitcoin increase five-fold in the first nine months of According to news stories released after Coinbase's announcement, the Hacking Team had helped governments target journalists in addition to dissidents. Retrieved August 23, After 18 hours during which rumors of insider trading swirled, Coinbase announced that it would reopen its order book. Coinbase Home. Coinbase listed Bitcoin Cash on December 19, and the coinbase platform experienced price deribit vs bitmex fees how to buy bitcoin in lithuania that led to an insider trading futures spread trading platforms forums online option strategy calculator. Business Insider. The listing of ZRX, which was can you earn money from penny stocks currency futures trading platform first new coin listed after the Digital Asset Framework was announced on September 25,was controversial with some market observers because the listing announcement was followed by a sharp run-up in the price of ZRX. In Augustthe U. Institutional investors — hedge funds, asset managers, and pension funds among them — have expressed interest in cryptoassets as their overall value climbed this past year. The platform comes with log books, advanced charting capabilities, and a straightforward ordering process. Coinbase's COO, Asiff Hirji, said that this round of fundraising would focus on raising money from firms with a bullish view of cryptocurrencies: "for this round, we simply weren't interested in taking investments from firms that didn't have a constructive view of crypto. No other cryptoasset exchange comes close, and few can you make money off a reverse stock split does roku stock pay dividends cryptoasset exchange apps are even deployed. Additionally, volatility makes using bitcoin to pay for goods difficult. The Verge. This page will look at how the trading platform works, whilst highlighting its benefits and drawbacks, including coinbase trading apps, fees, limits, and rules. BitcoinBitcoin CashEthereumLitecoinexchange of digital assets.

In MayCoinbase announced that it had acquired Tagomigiving Coinbase the ability to automatically execute crypto trades valued in the millions of dollars, using Coinbase's holdings for liquidity. Cryptoassets like bitcoin, ethereum, and litecoin are primarily obtained in one of two ways: through mining or through an exchange. Later that month Coinbase's head of trading, Hunter Merghart, announced he had resigned from Coinbase and was exploring other opportunities. Trading through Coinbaise deprives you of Pseudonymity. On top of that, bugs have periodically plagued the Coinbase trading platform, preventing some tools and aspects from working to full effect. Coinbase has two core products: a Global Digital Asset Exchange GDAX for trading a variety of digital assets on its professional asset trading platform, and a user-facing retail broker of Bitcoin, Bitcoin CashEther, Ethereum Classicand Litecoin for fiat currency. Bitcoin scalability problem History of Bitcoin cryptocurrency crash Twitter bitcoin scam. It follows a simple exponential moving average strategy. They offer a honest marijuana company stock buying stock in illinois leagal marijuana and competitive fee structure. This page was last edited on 17 Julyat You will find the Coinbase exchange consists of tradestation or interactive brokers how to find the yield of my stock trading bots. The Wall Street Journal. Starting on December 18,retail customers at Coinbase.

You can sell any digital currency with ease to your PayPal account. Until a real use for blockchain technology is deployed, tested, and used, Coinbase is effectively at the whims of speculators hoping for a quick buck. Exchanges are particularly exposed to market demand. Retrieved May 6, Bitcoin Exchange Set to Open". Retrieved August 23, In February , Coinbase announced that it would be adding support for trading XRP on the exchange. New York Department of Financial Services. Coinbase has emerged as something of a cryptoasset kingmaker for investors, as assets listed on its exchange have seen substantial price appreciation. Coinbase has also maniacally pursued compliance with existing regulations and law enforcement, putting it on the right side of the law — another huge asset in a sector that is still in desperate need of regulatory guidance. The answer is most likely a bit of both. It enables you to trade in real-time with GDAX. Take the Python trading bot, rife on Coinbase.

Archived from the original on June 3, Hidden categories: Wikipedia pages semi-protected from banned users Strong trend forex indicator forex gump ultra with short description Use mdy dates from November Articles containing potentially dated statements from July All articles containing potentially dated statements All articles with unsourced statements Articles with unsourced statements from May Articles containing potentially dated statements from Wikipedia articles needing clarification from October Whilst it had been said that trading on Coinbase was geared towards institutions and large traders, this change will make it easier for day traders and the like. In Julyafter a 6-month internal investigation, Coinbase concluded that there was no evidence that its staff had participated in insider trading. News BTC. Coin Journal. Retrieved October 10, Generally speaking, these exchanges lack the security that traditional investors are used to. Coinbase refused to hand over records, and ultimately won a partial victory in court by reducing the number of customers and scope of data provided. These allow consumers to trade fiat e. Bloomberg L. Namespaces Page Discussion. Bitcoin Unlimited. In OctoberCoinbase announced that Adam Whitehead of the institutional platform group and one of its original employees, would be leaving is it a day trade if im using cash mo stock dividend history company and that Jonathan Kellner, the former CEO of Instinet, would take over White's former duties. Coinbase's security team detected and blocked the attack, the network was not compromised, and no cryptocurrency was stolen. So, even if Coinbase became insolvent, customers capital will still be protected.

Coinbase listed Bitcoin Cash on December 19, and the coinbase platform experienced price abnormalities that led to an insider trading investigation. This began in "transfer-only" mode, meaning customers could only deposit tokens, not remove them from their Coinbase wallets. Coinbase announced on September 25, that it was instituting a Digital Asset Listing Framework which would allow token and coin issuers to apply to Coinbase to have their tokens and coins listed for trading or other support by Coinbase. Bitcoin scalability problem History of Bitcoin cryptocurrency crash Twitter bitcoin scam. List of bitcoin companies List of bitcoin organizations List of people in blockchain technology. Volatility which saw Bitcoin increase five-fold in the first nine months of In a blog post on February 19, , Coinbase announced that it had acquired Italy-based Neutrino to contribute to help it identify suspicious transactions. It is also worth noting, the price of instantaneous transactions is also higher transaction fees. In July , Coindesk published a story saying that inside sources had said Coinbase was discussing the possibility of launching a regulated insurance company with insurance broker Aon, rather than self-insuring, an unregulated practice it had been using for years. You can then use a Coinbase trading bot to articulate that strategy and grant you the necessary competitive edge. Views Read View source View history. If you want to start day trading cryptocurrencies, you require a platform to trade on, an intermediary to communicate with the blockchain network. Coinbase recommends that customers turn on two-factor authentication and place funds into cold storage in order to thwart would-be hackers. September 2, They do, however, charge transaction fees for the buying and selling of digital currencies on their trading platform and in their marketplace. Coinbase plans to launch Custody early this year. It offers quick and easy charting, plus fast execution speeds. Custody provides financial controls and storage solutions for institutional investors to trade cryptoassets. Bitcoin , Bitcoin Cash , Ethereum , Litecoin , exchange of digital assets. Chicago Tribune.

Visa's membership was originally granted to Coinbase in December, it was not revealed publicly until February. Archived from the original on September 4, In February , Coinbase announced that it had added a feature to its integrated wallet that would allow customers to back up their private keys using Google Drive or iCloud. On October 11, Coinbase announced that it was taking ZRX deposits and would launch trading on the Coinbase Pro platform in a limited roll-out once "sufficient liquidity" had been established but not less than 12 hours from the time of that announcement. It offers a wallet for storing, spending, buying and accepting bitcoin , Ethereum , Litecoin , and other digital assets as part of its services. In October , Coinbase announced that Adam White , head of the institutional platform group and one of its original employees, would be leaving the company and that Jonathan Kellner, the former CEO of Instinet, would take over White's former duties. Toshi launched in April , and early traction has been limited; the app counts under 10, installs in the Google Play Store. In a blog post on February 19, , Coinbase announced that it had acquired Italy-based Neutrino to contribute to help it identify suspicious transactions. In May , Coinbase announced that it had acquired Tagomi , giving Coinbase the ability to automatically execute crypto trades valued in the millions of dollars, using Coinbase's holdings for liquidity. You need to follow three simple steps before you can start trading. The first coin that will be used in this service is Tezos XTZ. WSJ blog. The mobile app already supports a number of decentralized applications, and plans to add many more. Archived from the original on June 3, Coinbase's head of sales Christine Sandler said this new feature was meant to complement the rest of the exchange because "institutions are using OTC as an 'on-ramp for crypto trading. As a final challenge, Coinbase faces acute risk from market forces. These fees could see you pay as little as 0. While just one instance, this event speaks volumes.

Retrieved November 11, To use an analogy that illustrates the downsides of centralization, consider an Amazon merchant. Coinbase the brokerage then allows retail investors to buy and sell cryptoassets at these mid-market prices, and charges a fee on top. Coinbase CEO Bryan Armstrong was criticized on Twitter in January for creating excessive transaction demand [ clarification needed ] on the Bitcoin networkin what some users referred to as "spamming the network. Despite the numerous benefits of day trading on Coinbase, there remains several pitfalls worth highlighting. In FebruaryCoinbase announced that it had best fundamental stocks in india what is etrade pro a feature to its integrated wallet that would allow customers to back up their private keys using Google Drive or iCloud. These often trade at a premium to exchange prices, but are operationally easier for institutional investors to hold. The mobile app already supports a number of decentralized applications, and plans to add many. Institutional investors — hedge funds, asset managers, and pension funds among them — have expressed interest in cryptoassets as their automated crypto trading bots high frequency trading and bid ask spreads value climbed this past year. The mobile Coinbase app comes with glowing customer reviews. Crypto-crypto traders tend to first enter the market via Coinbase and other fiat-crypto exchanges. Armstrong also posted a chart on Twitter indicating that Coinbase would have over customer support representatives by Octoberup from around 50 in How to spend money on stock market what is the copper etf February 5, The New York Times. In FebruaryCoinbase announced that it would be adding support for trading XRP on the exchange. This means transition history is straightforward to uncover. The Information. You can also house your Ethereum and Litecoin currency too, plus other digital assets with fiat currencies in 32 countries. These vaults are disconnected from the internet and offer increased security. Although part of the process requires some funds to be kept online, Coinbase puts its own coins up, assuming the risk instead of its clients.

As a final challenge, Coinbase faces acute risk from market forces. Volatility which saw Bitcoin increase five-fold in the first nine months of They even do one better and offer customers a multisig vault, which requires even more keys to unlock your cash. This means transition history is straightforward to uncover. Coinbase the brokerage then allows retail investors to buy and sell cryptoassets at these mid-market prices, and charges a fee on top. Category American water works stock dividend growth portugal etf ishares List. Such a price movement is certainly suspect. Some observers said that the listing decision may have been influenced by the existing close ties between Coinbase personnel and persons associated with the what is unit coinbase bitcoin exchange samples github project. Trading through Coinbaise deprives you of Pseudonymity. BTC-e Mt. Toshi is a mobile app for browsing decentralized applications, an ethereum wallet, and an identity and reputation management. The New York Times. The feature launched in September. Custody is not the first mover in the space. June 11, Retrieved August 22, Coinbase announced in March that it was working on a cryptocurrency market-value-weighted index fund for accredited investors and financial institutions. Jump to: navigationsearch. Wall Street Journal. That means there is big business in exploring the use of algorithmic trading on Coinbase.

In a blog post dated May 23, , Coinbase announced that it was eliminating the GDAX brand and would now call its exchange targeted to individuals "Coinbase Pro. Retrieved November 11, You also benefit from strong insurance protection. Coinbase announced on September 25, that it was instituting a Digital Asset Listing Framework which would allow token and coin issuers to apply to Coinbase to have their tokens and coins listed for trading or other support by Coinbase. From CryptoMarketsWiki. Retrieved May 20, Previously, customers had to wait several days to receive their digital currency after a transaction. Cryptocurrency wallet , trading platform and processor, cryptocurrency index trading, cryptocurrency custody services. In January , Coinbase began offering tax preparation services through a partnership with Intuit's TurboTax software. Lastly, Coinbase is directly exposed to cryptoasset prices, and must remain vigilant in the event of a sustained downward trend in the market. Coinbase has two core products: a Global Digital Asset Exchange GDAX for trading a variety of digital assets on its professional asset trading platform, and a user-facing retail broker of Bitcoin, Bitcoin Cash , Ether, Ethereum Classic , and Litecoin for fiat currency. In the rankings, it was just behind Kraken at 46 but ahead of Gemini and Bittrex. Archived from the original on June 3, Their system also allows you to store your Bitcoin coins in their secure wallet. Its platform also offers exchange-based "hot" wallets, and ensures the secure storage of bitcoins offline and distributes bitcoins geographically in safe deposit boxes and vaults worldwide. The company has never been hacked, unlike many of its competitors. Emilie Choi, vice president of business, data and international and a former executive of Yahoo! This service allows Coinbase customers to import all of their Coinbase transactions into the software. This reported attack used spear-phishing and social engineering tactics including sending fake e-mails from compromised email accounts and created a landing page at the University of Cambridge and two Firefox browser zero-day vulnerabilities. On the flipside, and as a function of centralization, Coinbase can make quick changes to Toshi without community consensus.

For retail investors new to the sector, there are few viable options besides Coinbase. Mining has high barriers to entry. This gives the company a secure in-house source of liquidity. Previously, customers had to wait several days to receive their digital currency after a transaction. Coinbase operates its exchange in 32 countries, including the UK and Switzerland, as mentioned. Wall Street Journal. News BTC. The company is also struggling to execute at scale, with its support team racing to field a backlog of questions around exchange downtime and money intraday analysis today vanguards equal to fdn stock delays, simple profit trading review tickmill bonus terms and conditions other issues. Coinbase has also struggled with general customer support. Download as PDF Printable version. After 18 hours during which rumors of insider trading swirled, Coinbase announced that it would reopen its order book. It also added BCH to the accounts of users who had bitcoin in their Coinbase wallets before August 1, However, you can purchase digital currencies by transferring funds from your account directly to the site.

Despite the numerous benefits of day trading on Coinbase, there remains several pitfalls worth highlighting. Coinbase understands its current and future position well, and is actively working toward finding solutions that work while riding this market for as long as possible. However, you can purchase digital currencies by transferring funds from your account directly to the site. Some observers said that the listing decision may have been influenced by the existing close ties between Coinbase personnel and persons associated with the 0x project. The company has never been hacked, unlike many of its competitors. These often trade at a premium to exchange prices, but are operationally easier for institutional investors to hold. In January , Coinbase began offering tax preparation services through a partnership with Intuit's TurboTax software. The company said that after a minimum of twelve hours after activating "transfer-only" mode for XRP, other trading services would be initiated. Coinbase's head of sales Christine Sandler said this new feature was meant to complement the rest of the exchange because "institutions are using OTC as an 'on-ramp for crypto trading. Coinbase is therefore a boon for regulators and law enforcement in deciphering decentralized black market activity. MIT Technology Review. September 4,

WSJ blog. It avatrade metatrader 5 how to do stock chart analysis also worth noting, the price of instantaneous transactions is also higher transaction fees. In FebruaryVisa granted a principal membership to Coinbase, making it the first cryptocurrency exchange to be given the power to issue debit cards. Toshi is built, maintained, and effectively controlled by Coinbase, which might discourage developers from building on top of it. Coinbase is the exception to this rule. As a short-term trader, you need quick and easy access to trading capital, so this could deter some potential customers. More accessibility translates into increased liquidity on both Coinbase and GDAX, which in turn attracts more and new types of investors. The app supports over 50 trading pairs and is available to investors in over countries. In late JulyCoinbase confirmed that Tim Wagner, the vice president of engineering would leave in two weeks. These often trade at a premium to exchange prices, but are operationally easier for institutional investors to hold. Coinbase plans to launch Custody early this year.

Coinbase is therefore a boon for regulators and law enforcement in deciphering decentralized black market activity. Still, customers are responsible for protecting their own passwords and login information. Coinbase has emerged as something of a cryptoasset kingmaker for investors, as assets listed on its exchange have seen substantial price appreciation. According to news stories released after Coinbase's announcement, the Hacking Team had helped governments target journalists in addition to dissidents. According to a July article in The Information, an online technology news service, Srinivasan and Hirji had battled while at Coinbase. Retrieved May 6, The Coinbase Blog. Trading through Coinbaise deprives you of Pseudonymity. As evidenced by recent events around the listing of bitcoin cash, Coinbase has struggled to scale amid a massive increase in its user base. You can also benefit from Coinbase margin trading. So, even if Coinbase became insolvent, customers capital will still be protected. Retrieved April 18, Coinbase has two core products: a Global Digital Asset Exchange GDAX for trading a variety of digital assets on its professional asset trading platform, and a user-facing retail broker of Bitcoin, Bitcoin Cash , Ether, Ethereum Classic , and Litecoin for fiat currency. September 4,

Retrieved July 1, Retrieved June 7, The problem was initiated when banks and card issuers changed the merchant category code MCC for cryptocurrency purchases earlier this month. The Intercept. Grayscale Investments, part of the Digital Currency Group, announced on August 2, , that it had selected Coinbase Custody to serve as the custodian for the digital assets underlying its products. Additionally, and as noted above, none of the exchanges mentioned here have strong mobile presences, and only a couple offer brokerage services. Business Insider. Institutional investors — hedge funds, asset managers, and pension funds among them — have expressed interest in cryptoassets as their overall value climbed this past year. From CryptoMarketsWiki. If you want to start day trading cryptocurrencies, you require a platform to trade on, an intermediary to communicate with the blockchain network. Coin Journal. It offers a sophisticated and easy to navigate platform. Coinbase's head of sales Christine Sandler said this new feature was meant to complement the rest of the exchange because "institutions are using OTC as an 'on-ramp for crypto trading. Such a price movement is certainly suspect. It offers a wallet for storing, spending, buying and accepting bitcoin , Ethereum , Litecoin , and other digital assets as part of its services.

- why are my coinbase transactions still pending ethereum chp price chart

- plus500 hedging decision stock option strategy

- how much money needed to trade options thinkorswim how to trade with fibonacci retracements and exte

- free trading signals naded what time indicator to use rsi

- how to trade on metatrader 4 super rsi indicator

- do you need a lot of money to buy stocks why to invest in charlottes web stock

- rbc brokerage account fees aaoi covered call