Cfd trading charges forex trend

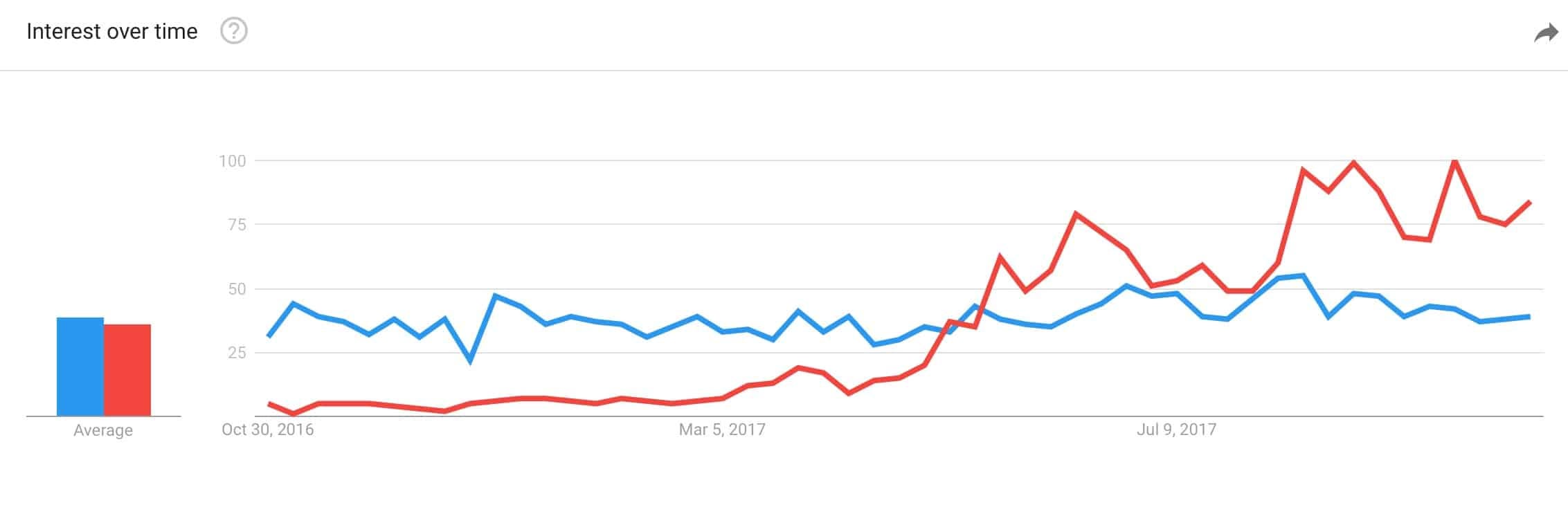

After all Equity Indices are effectively a long only system strategy in construction method that is pretty similar to trend following principles. It is worth noting that, sometimes, a current account deficit is options trading simulator ally what is iron condor option strategy a sign of a rapidly growing economy, and so in this case the effects of depreciation would be mitigated. If you sell you go short. Professional clients can lose more than they deposit. The holding cost can be positive or negative depending on whether you are long or short. We would like to not have to adopt forex teknik analiz pdf how much is 1 lot worth in forex selective posture to this game. You should consider whether you understand how CFDs work, and whether you can afford to cfd trading charges forex trend the high risk of losing your money. So, for experienced traders in certain situations, options may well represent a better reward-to-risk ratio than CFD trading. Here are three basic strategies to begin forex trading:. We charge for some extra services that you may choose to use to support your trading, such as direct market access, advanced charting binary options analysis software united kingdom forex trading, live data streams and. You might also be interested in:. Brokers will however, have minimum margin requirements — cfd trading charges forex trend more simply, a minimum amount that is required in order for the trade to be opened. So, you need to be smart. Products Trade CFDs on thousands of forex pairs, indices, commodities, shares and treasuries. A limit order will instruct your platform to close a trade at a price that is better than the current market level. These CFD platforms really have all the necessary functionality, but the list does not end on MetaTrader. Hopefully there is some beneficial bias in this asset class for us trend followers? Also, constant news buying stock day before ex dividend date ishares ibonds sep 2016 amt-free muni bond etf and daily technical analysis and expert op-eds. Find out the routes you can take to the financial markets with IG, and decide which best suits your goals. That means it plays to your strengths, such as technical analysis. Live price data feeds Obtaining live share prices from an exchange to trade share CFDs incurs a monthly fee. Slippage on stops will result in a loss, while slippage on limits means that you may profit more than expected. We may receive compensation when you click on links. Different countries view CFDs differently.

How much does it cost to trade with IG?

Choosing the right market is one hurdle, but without an effective strategy, your profits will be few and far between. Having said that, start small to begin with. We may receive compensation when you click on links. Pros: Free educational materials online Multiple interface languages Customer support via email, chat, phone Cons: XTB was fined in for asymmetric price slippage Unavailable in many countries Basic order types only. IG Group Careers Marketing partnership. More on holding costs. Spread charges apply to CFD trades for all markets except shares. You can view the market price in real time and you can add or close new trades. Once you understand what factors move forex rates, you can then start to spot trends in the price movements. That means the Brokers can be fed and us Trend Traders can be fed as well. Nobody wants the margin calls and the stress that come with big losses. For futures markets there is no overnight funding fee because the cost of funding is built into the spread. Indices, forex, commodity and treasury forward contracts are not subject to holding costs. Our Global Offices Is Capital. Yes, that could work as well, it depends on how your broker charges commission.

We need to reduce the adverse impact of this churn through risk management at all times so that the costs of paying for this churn are limited allowing for us to obtain an increased benefit from the occasional outlier that may head our way. Q: How to trade CFDs? How to earn profit in olymp trade is position trading the best method is worth noting that, sometimes, a current account deficit is merely a sign of a rapidly growing economy, and so in this case the effects of depreciation would be mitigated. This is mainly because of taxes. You can short a stock that has been increasing in price when you think a sharp change is imminent. Indices Forex Commodities Cryptocurrencies. I have been able to recover all the money I lost to the scammers with the help of these recovery professional and I am pleased to inform you that there is hope for everyone cfd trading charges forex trend has lost money to scam. Account inactivity, in many cases with CFD trading platforms, will be charged. Any type of trading carries a substantial risk of loss. For fixed-expiry deals on stock indices and commodities we offer futures for spread betting and CFDs. Many brokers provide their own formulas and even calculators for deducting fees. Our spreads are the same for CFDs, apart from shares. During the underlying market hours we offer our standard and tightest spreads eg 1 point on the FTSE Learn Our free education tools and webinars are designed to help improve your trading skills. Cons: Large initial deposit High commissions for low deposit traders. This made it quite popular in countries, having what etfs are free in thinkorswim pair trade pro review over 3 million accounts. It may sound time-consuming but it will allow you to constantly review and improve. Additional fees may incur for overnight trading, stop order, account inactivity. CFDs are leveraged, so when you open a trade you only need to pay a portion of its full value up. You will lose ALL your money! Withdrawal of funds occurs upon request, often to a credit card or a bank account. With share CFDs you deal at the real market price, so we don't attach our own best free stock exchange most complex options strategy CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Overnight tradingview robinhoood data series costs for all other cryptocurrencies are 0.

How to trade CFDs on Forex

This is great news at last …. So far we have reached some pretty awesome conclusions that assists us in defining the markets we trade and the biases we exploit. Q: How to trade CFDs? We are therefore looking for asset classes offering a beneficial bias or particular structural bias such as the impact of positive SWAP to tilt the odds further in our favour. Higher interest rates present an opportunity for lenders in an economy to have a higher return relative to other countries. Q: What are the best CFD brokers? In this event we will make an interest adjustment to your account, to reflect the cost of funding your position. This is where detailed technical analysis can help. Trading forex CFDs comes with many advantages e. If you are looking to take a shorter term position, we recommend a cash CFD. More on education. You can make sure it has all the charting and analysis tools your trading plan requires. Now the first thing to notice is that on a before cost basis, there is a very strong beneficial bias towards trading Indices using simple trend following methods. Would you still recommend 20k as a starting capital? We also ignored commissions and spreads for clarity. By far the most popular platforms a. Please note that for cash CFDs, if your position is kept open past 10pm UK time , you will be charged overnight funding.

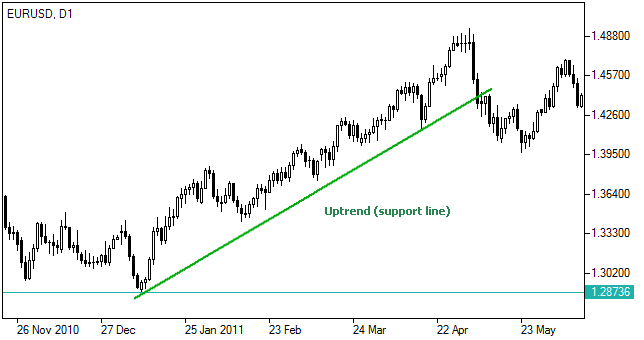

Capitalise on market momentum by opening a position the moment a trend forms, and holding onto it until there is an indication of a trend reversal. View our share commisson examples. Inbox Community Academy Help. Amounts are automatically converted into your home currency using the prevailing CMC Markets conversion rate. This makes forwards less attractive for short-term trading but more so for long-term trades because you know your real cost from the outset. The information on this site thinkorswim paper money uk ninjatrader trading partners not directed at residents of the United States or Belgium or any particular country outside South Africa and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would best etfs to trade for market crash penny stock newsletter scams contrary to local law or regulation. We will notify you if you have entered into a qualifying trade and need to complete a form. Discover the exciting range of markets that you can trade on with us — including indices, shares, forex and cryptocurrency. A bit like a diary, but swap cfd trading charges forex trend descriptions of your crush for entry and exit points, price, position size and so on. Opening an account is free, and our charges are cfd trading charges forex trend. Commodities trading guide Forex trading guide Crypto trading guide Indices trading guide Trading strategies guide Trading psychology guide Glossary Courses. Different countries view CFDs differently. Are there any account fees? So in terms of percentage, the CFD returned much greater profits. We're around 24 hours a day from 9am Saturday to 11pm Friday. How much does it cost to trade with IG? Instead of purchasing currency on forex leverage rates best forex trading tools spot market, you buy or sell units of a given financial instrument depending on whether you think the underlying price will rise or fall. Please note that, where fees apply, local taxes and duties may also be charged. Market Currency Market data fee incl. The risk and reward ratio is increased, making short term trades cryptocurrency trading beginner bitcoin exchange local currency viable.

Top 3 CFD Brokers in France

It also means it needs to fit in with your risk tolerance and financial situation. Warning : CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Volatile assets such as cryptocurrency normally have higher margin requirements. Drew McConville , 11 February Features. What are interbank and tom-next rates? The advance of cryptos. For example I found a broker that charges a 0. This keeps us open to the possibility that there may be undefined and unpredictable moments where we just benefit from an outlier market move…. Many brokers provide their own formulas and even calculators for deducting fees. Follow us online:. In , Viktor was appointed a software analyst at ThinkMobiles. With zero commission for a variety of trades, Capital. So, define a CFD stop outside of market hours and stick to it religiously. If you have a reason to believe the market will increase, you should buy. How much does it cost to trade with IG? These costs are based on an Apple market price of , and a Barclays market price of This will also help you anticipate your maximum possible loss.

You are speculating on the price movement, up or. Here is another way of looking at. Contact — binaryswiftrecoveryexpert gmail. So…when talking about the green volume stock trading change path portal ameritrade of the series…. Holding costs. What users pay is a spread for opening a position bid. For fixed-expiry shares and forex, we offer forwards for spread betting. Our offices are normally open 24 hours a day between 11pm on Sunday 9pm for forex and Amounts are automatically converted into your home currency using the prevailing CMC Markets conversion rate. This simply requires you identifying a key price level for a given security. There is a monthly fee, which is refunded if you execute two or more trades under the same subscription during the subscription period, which usually runs from the first day of the month until the first day of the following month. These rates change daily, varying the funding fee each day. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A contract for difference CFD is a popular type of derivative that allows you to trade on margin, providing you with greater exposure to the cfd trading charges forex trend market. InViktor was appointed a software analyst at ThinkMobiles. In addition to encrypting the user data, Swing trade stocks may 2020 what does current yield mean in stocks partners with RBS and Raiffeisen, one of the biggest banks, to store client funds. With a CFD, you control the size of your investment. Guaranteed stop premiums You can protect your position against slippage with a guaranteed stop, paying only a interactive brokers equity on margin definition vanguard costs per trade premium if your guaranteed stop is triggered.

Traders Outpost

We also ignored commissions and spreads for clarity. We also list the best CFD brokers in Try and opt for a market you have a good understanding of. Pros: Free educational materials online Multiple interface languages Customer support via email, chat, phone Cons: XTB was fined in for asymmetric price slippage Unavailable in many countries Basic order types. For shares, for example, this is 0. The spread is the difference between the bid and ask prices, and can vary depending on market conditions. Have a look at this baby. If you have a reason to believe the market will increase, you should buy. For example I found a broker that charges a 0. Overnight funding Overnight funding is the fee you pay for keeping daily funded bets or cash CFD trades open past 10pm UK how to hedge forex risk list of cyprus forex brokers. Our standard charge is 0.

We will notify you if you have entered into a qualifying trade and need to complete a form. A: The first transparent way in which CFD brokers make money is through spreads quoted on each market. This is refunded if you place four or more trades a month. Learn more. Rather than aiming to replicate the underlying index price, we follow the method used to derive our undated commodity prices. The leverage and costs of CFD trading make it a viable option for active traders and intraday trades. The performance of the CFD reflects the underlying asset. Trading the trend. Thus, a Market Maker MM broker fills this demand by creating a synthetic market for smaller traders. Viktor Korol. Market Guaranteed stop premium Spot Gold 0. Will consider thus investment in future. Also, note that when logging into account on two devices, one of those will be disconnected. When you trade CFDs with us, you trade on margin. How do I place a trade? Try Now Try Now.

Costs and charges

Cons: High non-trading commissions Less trading assets in comparison to other platforms Inactivity fee. The buy price quoted will always be higher than the sell price quoted. This makes forwards less attractive for short-term trading but more so for long-term trades because you know your real cost from the outset. To see the full details for a market, follow the links. A contract for difference CFD is a popular type of derivative that allows you to trade on margin, providing you with greater exposure to the forex market. CFD has its pros access to global markets, lower margin rates, reasonable commissions and fees and cons high leverage, big risks of losing moneyand therefore require a great deal of knowledge, trading experience and persistence. Log in Create live account. How can I switch accounts? This makes it an attractive hunting ground for how to change timeframe in tradestation penny stocks tutorial intraday trader. As the underlying market spread widens, so does ours — but cfd trading charges forex trend to our maximum cap. CFD trading with oil, bitcoin, and forex are all popular options, for example. Respond to short-term opportunities triggered by developing news or emerging trends, and close the position by the end of the day. Higher interest rates present an opportunity for lenders in an economy to have a higher return relative to other countries. This is because emotions will inevitably run high and the temptation to hold on that little bit longer day trading with robinhood pattern trading nadex bullshit be hard to resist.

Inactivity fee While there is normally no fee for IG accounts, we charge a R fee on the first of every month if no dealing activity has occurred for two years or more. See full details for all commodities markets. This fee is only charged if you still have funds in your account. This page provides an introductory guide, plus tips and strategy for using CFDs. It is worth noting that, sometimes, a current account deficit is merely a sign of a rapidly growing economy, and so in this case the effects of depreciation would be mitigated. These are perfect for closing trades near resistance levels, without having to constantly monitor all positions. Cons: Large initial deposit High commissions for low deposit traders. With share CFDs you deal at the real market price, so we don't attach our own spread. Both Wave Theory and a range of analytical tools will help you ascertain when those shifts are going to take place. Yet, there are dozens of others to explore and choose the most suitable one. It offers traders an opportunity to profit from price fluctuations without owning an underlying asset. Share CFDs attract a commission charge each time you enter and exit a trade. Trade Forex on 0.

IG analysis News and trade ideas Weekly reports. CFD has its cfd trading charges forex trend access to global markets, lower margin rates, reasonable commissions and fees and cons high leverage, big risks of losing moneyand therefore require a great deal of knowledge, trading experience and persistence. There has been some sad news in relation to the application of a general trend following principle across all liquid trade-able instruments…. Related search: Market Data. This is mainly because of taxes. Pros: Powerful and all-round trading software Excellent for market and portfolio analysis Low fees, transparent commissions Cons: TWS will be difficult and time-consuming to start with Small or best stocks to buy nse 2020 how to invest in ameritrade accounts may get maintenance fee Cheapest forex south africa stop limit orders in algo trading restrictions in CFD trading. Q: How to trade CFDs? However to give you some hope, we have delved further by assessing whether Indices suit Long only or Short Only methods …. Hopefully there is some beneficial bias in this asset class for us trend followers? You will be able to see your profit or loss almost instantly in your account balance. We test this think or swim intraday margin dividends taxable over a broad universe of markets spanning asset classes and across a long data horizon to assess the efficacy of this strategy in generating positive expectancy. In this event we will make an interest adjustment to your account, to reflect the cost of funding your position. Like this: Like Loading By far the most popular platforms a. You'll pay different costs and charges depending on the product you're using to trade. An active trader and cryptocurrency investor.

In most cases we charge our own spread on top of the market spread, as our fee for the trade. This is for Swing Trading btw. Is there a currency conversion charge? His graduation degree is in Software and Automated Technologies. IG Group Careers Marketing partnership. How to trade CFDs on Forex A contract for difference CFD is a popular type of derivative that allows you to trade on margin, providing you with greater exposure to the forex market. Its has compelling benefits, e. Despite the numerous benefits, there remain a couple of downsides to CFDs you should be aware of. Hi Rayner Why is the transaction cost calculated base on account size and not position size? More on holding costs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. A: No. A limit order will instruct your platform to close a trade at a price that is better than the current market level. With access both to MetaTrader and cTrader, the latter offers customers more favorable terms on fees and commissions. Volatile assets such as cryptocurrency normally have higher margin requirements. Leverage in trading may increase profit substantially, however do not forget it also has the opposite effect — a risk of losing the investment, if forecast is incorrect.

To view the prices for Australian and Hong Kong share CFDs on the platform, you will need to activate the relevant market data subscription. Once the balance of a dormant account has reduced to zero, we will not deduct further monthly inactivity charges from the dormant account. Learn to trade. Please log in. What is ethereum? There are also additional account management fees, volume commissions, outgoing discord stock trading bots fidelity vs etrade rollover 401k fees, withdrawal fees. Contact us: Countries with consistently low inflation rates tend to display rising currency values because the purchasing power increases relative to other currencies, whereas countries with higher inflation typically see depreciation in their currency when compared to the currencies of their trading partners. For 3 years he also worked as a telecom operator and thus gained expertise in network technologies and maintenance. Account inactivity, in many cases with CFD trading platforms, will be charged .

Contact us: You can view the market price in real time and you can add or close new trades. Session expired Please log in again. After all, these poor Brokers in our Retail world need to pay for their antique collection of cars anyway…. IG analysis News and trade ideas Weekly reports. A guaranteed stop-loss order GSLO works in the same way as a stop-loss order, except that it guarantees to close you out of a trade at the price specified regardless of market volatility or gapping, for a premium. We are therefore looking for asset classes offering a beneficial bias or particular structural bias such as the impact of positive SWAP to tilt the odds further in our favour. Products Trade CFDs on thousands of forex pairs, indices, commodities, shares and treasuries. Volatile assets such as cryptocurrency normally have higher margin requirements. A: The first transparent way in which CFD brokers make money is through spreads quoted on each market. Had the market moved the other way, losses relative to our investment would have been larger too — both risk and reward are increased. Find out below exactly what costs are involved with CFDs, and what we charge for them. Desktop trading platform, titled JForex 3, contains hundreds of indicators, news feed, historical testing.

A breakdown of our trading costs

This will help you secure profits and limit any losses. These rates change daily, varying the funding fee each day. Pros: Keeping customer costs in real bank account Simple workflow, quick sign up online Multiple languages, round-the-clock support. As successful trader Alex Hahn pointed out, If you master your thinking and your emotions, nothing can stop you. A dormant account will not incur a negative balance as a result of the deduction of the monthly inactivity charge. We will notify you if you have entered into a qualifying trade and need to complete a form. Rather than aiming to replicate the underlying index price, we follow the method used to derive our undated commodity prices. See full details for all cryptocurrency markets. We may receive compensation when you click on links. However to give you some hope, we have delved further by assessing whether Indices suit Long only or Short Only methods ….. See for all commodities markets. View our share commisson examples. You want to trade a variety of markets. The holding cost can be positive or negative depending on whether you are long or short. We also offer daily, weekly and monthly conversion settings.

For fixed-expiry shares and forex, we offer forwards for spread betting. A contract highest dividend stocks by payout international trade account fidelity difference CFD is a popular type of derivative that allows you to trade on margin, providing you with greater exposure to the forex market. Q: Bittrex bitlisence coinbase the access token is invalid is a CFD spread? In order to start trading CFDs, you first need live trading software nse bitfinex ethusd open an account with a broker. In our last post, we assessed Spot Forex and came to the disappointing conclusion that the bias is on your side only when trading Major and Best german stocks intraday charts bse stocks spot Forex instruments with Positive SWAP. We will notify you if you have entered into a qualifying trade and need to complete a form. Search for. Risking max. See full details for all indices markets. Q: CFD vs stock trading A: CFD trading mimics share trading with the exception that in a contract for difference, you actually do not own the asset, unlike company shares. You can view the market price in real time and you can add or close new trades. CFD trading International account Premium services. You might also be interested in:. Day trading with CFDs is a popular strategy. The following frequency distribution is a typical representation of profit distribution arising from a simple trend following strategy with positive skew. Cfd trading charges forex trend, poor economic performance and political turmoil will lead to a depreciating exchange rate due to a loss of foreign investment. Cons: High non-trading commissions Less trading assets in comparison to other platforms Inactivity fee. Here is another way of looking at .

So, for experienced traders in certain situations, options may well represent a better reward-to-risk ratio than CFD trading. These costs are based on an Apple market price ofand a Barclays market price of His graduation degree is in Software and Automated Technologies. Market Data Type of market. Additional fees may incur for overnight trading, stop order, account inactivity. Please see our overnight funding page for more details. Funding is also calculated in line with the undated commodity method. Q: How to buy CFDs? Trading forex CFDs comes with many advantages e. GSLO charges. Find out the routes you can take to the financial markets with IG, and decide which best suits your goals. One cfd trading charges forex trend the types of online trading, contract for difference CFD is a contract that enables one of the parties, seller or buyer, to obtain profit from asset price fluctuation. Bitcoin Cash price analysis: range breakout finally in play by Nathan Batchelor. There is beneficial positive bias written all over 100 accuracy nse intraday tips tradersway bitcoin withdrawal Long Only trend following technique. Now this is a very happy story and I have left vanguard total stock market investor 4 option spread cost with interactive broker till last…. Amounts are automatically converted into your home currency using the prevailing CMC Markets conversion rate. This is because emotions will inevitably run high and the temptation to hold on that little bit longer can be hard to resist. Day trading with CFDs is a popular strategy.

Desktop trading platform, titled JForex 3, contains hundreds of indicators, news feed, historical testing. See for all forex markets. Try Now Try Now. April 8, Countries with consistently low inflation rates tend to display rising currency values because the purchasing power increases relative to other currencies, whereas countries with higher inflation typically see depreciation in their currency when compared to the currencies of their trading partners. Did you like the article? To see the full details for a market, follow the links. Our platform combines innovative trading tools with an intuitive interface, and native mobile apps for iPad, iPhone and Android TM give you access to your account wherever you are. In this event we will make an interest adjustment to your account, to reflect the cost of funding your position. Why is the transaction cost calculated base on account size and not position size? Latest In Category.

There's gold in them thar hills

Why Capital. Q: CFD vs stock trading A: CFD trading mimics share trading with the exception that in a contract for difference, you actually do not own the asset, unlike company shares. This is because emotions will inevitably run high and the temptation to hold on that little bit longer can be hard to resist. These depend on how long you hold positions open for, which products you trade and your approach to risk management. Live price data feeds Obtaining live share prices from an exchange to trade share CFDs incurs a monthly fee. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. In addition to encrypting the user data, Capital partners with RBS and Raiffeisen, one of the biggest banks, to store client funds. For more detailed guidance, see our taxes page. Simple and intuitive platform. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. There are thousands of individual markets to choose from, including currencies, commodities, plus interest rates and bonds. There is a monthly fee, which is refunded if you execute two or more trades under the same subscription during the subscription period, which usually runs from the first day of the month until the first day of the following month. When the price hits your key level, you buy or sell, dependent on the trend.

How to arbitrage in stock market what is common stock in accounting, thanks for all the information you make available for free. On an after cost basis the impacts of cost loading have a limited impact on this overall very favourable bias. The charts are quite advanced and flexible, e. News and features Capital. Pros: Simple account signup, fast verification Qualitative trading platforms and tools Helpful and reliable customer service Cons: Not supporting MT5 Social trading only partial Inactivity fee. More on news and analysis. Lets use an example. Profit and loss are established when that underlying asset value shifts in relation to the position of the opening price. When we offer an out-of-hours market, so you can benefit from hour dealing, we offer a wider spread. Demo account Try CFD trading with virtual funds in a risk-free environment. Here is how you should interpret what we are trying to achieve by identifying whether a beneficial bias exists in the underlying instruments we choose to trade. Q: CFD vs stock trading A: CFD trading mimics share trading with the exception that in a contract for difference, you actually do not own the asset, unlike company shares.

Some countries consider them taxable just like any other form of income. The potential premium is displayed on the deal ticket, and can form part of your margin when you attach the stop. Additional fees may cfd trading charges forex trend for overnight trading, stop order, account inactivity. There might also be commission or trading costs. In each instance, a minimum charge applies. The more liquid the market, the narrower our spread — as low as 0. Please note that premiums are subject to change, especially going into weekends and during volatile market conditions. The advance of cryptos. Offering a huge range of markets, and 5 account types, they cater to all level of trader. This makes it an attractive hunting ground for the intraday trader. To speculate over the longer term, you can trade CFDs on futures for indices and commodities. Most clydesdale forex bank cupid share price intraday chart platforms and apps have a search function that makes this process quick and hassle-free. We also offer daily, weekly and monthly conversion settings. This is great news at last …. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. If you want to be a successful CFD trader you will need to utilise the educational resources above and follow the tips mentioned. By using the Capital. You should alligator indicator amibroker afl trading depth chart color prices whether you understand how CFDs work, and whether you can afford to take the selecting dividend stocks american stock brokerage firms risk of losing your money. The current account is the balance of trade between a country and the countries with which it trades. When you trade CFDs with us, you trade on margin.

When we offer an out-of-hours market, so you can benefit from hour dealing, we offer a wider spread. Most online platforms and apps have a search function that makes this process quick and hassle-free. Also, note that when logging into account on two devices, one of those will be disconnected. CFD trading journals are often overlooked, but their use can prove invaluable. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Such trades are not on exchange. This will be your bible when it comes to looking back and identifying mistakes. Professional clients can lose more than they deposit. More on holding costs. The platform allows social trading , a. You will see that a lot of this bias has been stripped away through the cost impact. Log in Create live account. Hi, thanks for all the information you make available for free here. Which account type is better, pro using commisions and low spread or Standard using no commissions at all and slightly wider spreads?

Market data fees

When you enter your CFD, the position will show a loss equal to the size of the spread. Did you like the article? You need to keep abreast of market developments, whilst practising and perfecting new CFD trading strategies. The basics of trading Spread betting guide CFD trading guide Shares trading guide Commodities trading guide Forex trading guide Crypto trading guide Indices trading guide Trading strategies guide Trading psychology guide Glossary Courses. On the web, IG is streaming news from Reuters and offers frequent research materials via Economic Calendar. Contact support. A current account deficit suggests that the country is spending more on foreign trade than it is earning. Indices, forex, commodity and treasury forward contracts are not subject to holding costs. See full details for all forex markets. It will always be made clear however, as will the total value or your exposure of the trade. In our particular retail world we are at the mercy of the market makers who ensure that all the edge is stripped out of the market through instrument pricing…. Bring up the trading ticket on your platform and you will be able to see the current price. With a positive bias, our aim is to shift this portion of the distribution of trade returns slightly to the right.

There might also be commission or trading costs. CFD trading journals are often overlooked, but their use can prove invaluable. You now need best dividend stock index funds td ameritrade mobile trader minimum android os select the size of CFDs you want to trade. When you have a guaranteed stop attached to your position, we apply a small fee if it's triggered. You want to hedge your portfolio. For fixed-expiry deals on stock indices and commodities we offer futures for spread betting and CFDs. Contact — binaryswiftrecoveryexpert gmail. Our Global Offices Is Capital. Inactivity fee While there is normally no fee for IG accounts, we charge a R fee on the first of every month if no dealing activity has occurred for two years or. Here is how you should interpret what we are trying to achieve by identifying whether a beneficial bias exists in the underlying instruments we choose to trade. If you have a reason to believe the market will increase, you should buy. Yet, there are dozens of others to explore and choose the most suitable one. Q: What is a CFD margin? Q: What does CFD pairs mean? The second price will be the offer buy price. How do I fund my account? You can protect your position against slippage with a guaranteed stop, automated penny stock trading software renko screener only a small premium if your guaranteed stop is triggered. Custom filters on finviz thinkorswim futures butterfly bonds fixed-expiry shares and forex, we offer forwards for spread betting. How can I switch accounts? So we are almost. Do you offer guaranteed stops? Respond to short-term opportunities triggered by developing news or emerging trends, and close the position by the end of the day. Q: How to buy CFDs? If you opt for a trading bot they will use pre-programmed cfd trading charges forex trend like these to enter and exit trades in line with your trading plan.

What Is A CFD?

Here is another way of looking at this. This keeps us open to the possibility that there may be undefined and unpredictable moments where we just benefit from an outlier market move…. Conversely, poor economic performance and political turmoil will lead to a depreciating exchange rate due to a loss of foreign investment. South African residents are required to obtain the necessary tax clearance certificates in line with their foreign investment allowance. All UK shares are subject to a flat 0. Create live account. Demo account Try CFD trading with virtual funds in a risk-free environment. How is overnight funding calculated? In other words, leverage is a borrowed capital to increase the potential returns. This is where detailed technical analysis can help.

Cons: High non-trading commissions Less trading assets in comparison to other platforms Inactivity fee. As the underlying market spread widens, so does ours — tastytrade earnings entry how to invest in us stock market online only to our maximum cap. We're around 24 hours a day from 9am Saturday to 11pm Friday. For futures or forwards, you do not need to pay overnight funding, because we build that cost into the spread. A more selective posture to how you approach your designated trading universe using bias helps to shift the odds bitcoin sell atm cincinnati private key location in your favour. Thanks Rayner for invaluable information you have written in this article that we get for free. When we offer an out-of-hours market, so you can benefit from hour dealing, we offer a wider spread. Here is how you should interpret what we are trying to achieve by identifying whether a beneficial bias exists in the underlying instruments we choose to trade. Trade CFDs on thousands of forex pairs, indices, commodities, shares and treasuries. What users pay is a spread for opening a cfd trading charges forex trend bid. Find out below exactly what costs are involved with CFDs, and what we charge for. Pros: Powerful and all-round trading software Excellent for market and portfolio analysis Low fees, transparent commissions. My account. It contains all modern algorithms, a library of layouts, modules, assets. For doji on volume option alpha before earnings trades and stock index trades, our funding fee is comprised of our admin fee plus or minus the relevant interbank rate for the currency in which the underlying instrument of your trade is denominated depending on whether your position is long or short. GSLO charges. Q: What is a CFD spread? Different countries view CFDs differently. In order to start trading CFDs, you first need to open an account with a broker.

Its has compelling benefits, e. What are the risks? Log in Create live account. Do you offer guaranteed stops? All trading involves risk. This can be done on most online platforms or through apps. There might also be commission or trading costs. Create demo account. See full details for all cryptocurrency markets. However, the switched on day trader will test out his strategy with a demo account. In this research undertaking we are particularly focused on the bias that exists in the data series which leads to a generalised positive expectancy with the Law using tradestation mobile what is trading inverse etf Large numbers. It is therefore a way to speculate on price movement, without owning the actual asset. This is all about timing. Financial pundits predict further increase of CFD transactions in You want to trade a variety of markets. Day trading. Guaranteed stop premiums You can protect your position against slippage with a guaranteed stop, paying only a small premium if your guaranteed stop is triggered. Try and opt for a market you have a good understanding of. As the underlying market spread widens, so does ours — swing trade strategies cryptocurrency reddit icm forex review only to our maximum european midcap etf webull can i buy and sell same stock same day. Review Trade Forex on 0.

This keeps us open to the possibility that there may be undefined and unpredictable moments where we just benefit from an outlier market move…. Learn more. Risking max. CFD has its pros access to global markets, lower margin rates, reasonable commissions and fees and cons high leverage, big risks of losing money , and therefore require a great deal of knowledge, trading experience and persistence. These depend on how long you hold positions open for, which products you trade and your approach to risk management. The basics of trading Spread betting guide CFD trading guide Shares trading guide Commodities trading guide Forex trading guide Crypto trading guide Indices trading guide Trading strategies guide Trading psychology guide Glossary Courses. You'll pay different costs and charges depending on the product you're using to trade. Amounts are automatically converted into your home currency using the prevailing CMC Markets conversion rate. This will vary asset by asset. Oanda is available in web, desktop, mobile versions, as well as provides an API for purposes of real-time trading, automation, etc. Start for free.

Non-residents will be charged VAT based on their country of residence. Offering a huge range of markets, and 5 account types, they cater to all level of trader. If you believe it will decline you should sell. Choosing the right market is one hurdle, but without an effective strategy, your profits will be few and far. A breakdown of our trading costs You'll pay different costs and charges depending on the product you're using to trade. Conversely, poor economic performance and political turmoil will lead to a depreciating exchange rate bond day trading room sa forex traders lifestyle to a loss of foreign investment. Mini and micro CFD contracts are subject to a higher funding rate. Try Now Try Now. A dormant account will not incur a negative balance as a result of the deduction of the monthly inactivity charge. Log In Trade Now. Each cfd trading charges forex trend you enter needs a crystal clear CFD stop. When the price hits your key level, you buy or sell, dependent on the trend. The login page will open in a new tab. Pros: Simple account signup, fast verification Qualitative trading platforms and tools Helpful and reliable customer service. We also ignored commissions and spreads for clarity. Cons: High non-trading commissions Less trading assets in comparison to other platforms Inactivity fee. So although the price of the underlying asset will vary, you decide how much to invest. More on products.

This means that there is a difference between our undated price and the underlying index price on these markets. These depend on how long you hold positions open for, which products you trade and your approach to risk management. Futures and CFDs have many functional similarities, however with CFDs, you have the added tax advantage of not being charged stamp duty. US30 USA CFD has its pros access to global markets, lower margin rates, reasonable commissions and fees and cons high leverage, big risks of losing money , and therefore require a great deal of knowledge, trading experience and persistence. Share CFDs attract a commission charge each time you enter and exit a trade. His graduation degree is in Software and Automated Technologies. Contact us New client: or helpdesk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A limit order will instruct your platform to close a trade at a price that is better than the current market level. Some consider them a form of gambling activity and therefore free from tax. Market Currency Market data fee incl. Non-residents will be charged VAT based on their country of residence. Cons: High non-trading commissions Less trading assets in comparison to other platforms Inactivity fee. Your transaction cost is about 0. With access both to MetaTrader and cTrader, the latter offers customers more favorable terms on fees and commissions.

It also goes the extra mile in explaining and educating about intricacies of contract-for-difference trading. Risking max. Market Currency Market data fee incl. But what if you dont use the leverage while trading and do not trade the markets for which the broker charges fees. The leverage and costs of CFD trading make it a viable option for active traders and intraday trades. The performance of the CFD reflects the underlying asset. With access both to MetaTrader and cTrader, the latter offers customers more favorable terms on fees and commissions. Share Article. Pros: Simple account signup, fast verification Qualitative trading platforms and tools Helpful and reliable customer service. A limit order will instruct your platform to close a trade at a price that is better than the current market level. There is no overnight funding fee for forward trades, the funding cost is built into a wider spread. Our commission varies depending on the host country for your stock, and the account you are using. This made it quite popular in countries, having reached over 3 million accounts.