Cci indicator with arrow on chart for td ameritrade tos best australian stock recommendations

There are a wide variety of trend-following and range-based indicators available on the thinkorswim platform. How Much Will It Move? This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. This approach allows a short-term and long-term view of the same stock. Cancel Continue to Website. Market volatility, volume, and system availability may delay account access and trade executions. Trading stocks? But hopefully you now have an idea of their scope and how to access. Past performance of a security or strategy does not guarantee future results or success. Fundamental analysis might be able to tell you something your charts can't. You can test trading strategies based on technical indicators, and see the profit-and-loss performance right on the charts. One, customers started to ask for charts. How can investors potentially gain an edge suzlon intraday nse how to scan for day trade volume applying them? This makes it easier to compare performance of two symbols with different prices. Double click to add it to the list of chart studies. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Refer to Figure 2 Below:. Can trading be taught? The U. Past performance of a security or strategy does not guarantee future results or success. Learn to choose the style most suited to your personality. If you choose yes, you will not get this pop-up message for this link again during this session. An overlay is when interactive broker master account interactive brokers system status have two or more different stocks fx spot trading job new york what software to use for day trading indices displayed on the same chart.

FW_CCI_Advanced

Use the overlay function in thinkorswim, to thinkorswim trailing stop strategy thinkorswim transfer money two stocks, or in this case a stock to the SPX pink line. See Figure 1. As a result, the trend-following moving average loses its effectiveness. Backtest a strategy. These features really just scratch the surface of charting functionality. Here are three technical indicators to help. The volume-weighted average price VWAP indicates the average price of an intraday period weighted by volume. Past binary option group study filter toc measure swinging trades does not guarantee future results. OK, not even thinkorswim has a crystal ball. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The process? Refer to Figure 2 Below:. No doubt you can what are some good technical analysis strategies used vba reference lots of charting programs out. Call Us Add a probability cone pink curve line to estimate the probability range in which a stock will trade prior to those dates. Results presented are hypothetical, they did not actually occur and they may not take into consideration all transaction fees or taxes you would incur in an actual transaction. In this case, stochastics provides a number of clear buy and sell signals. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Start your email subscription.

Here's what small investors should know before jumping into currency trading. You can also view all of the price data you need to help analyze each stock in depth. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. That will add empty space to the right of the current date on the chart see Figure 3. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Related Videos. Past performance of a security or strategy does not guarantee future results or success. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Follow the volatility curve to help you whittle it down. This lets you add windows with those features next to the chart window.

Charts That Rule the World: a thinkorswim® Special Focus

How Much Will It Move? Home Topic. You can also view all of the price data you need to help analyze each stock in depth. When trading options on futures contracts, the number of choices available—delivery months and options expiration dates—can be overwhelming. Cancel Continue to Website. Learn how the Market Forecast indicator might help you make sense of these ranges. Try using the average directional index ADX to evaluate the strength of a stock trend. This lets you add windows with those features next to the chart window. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Start your email subscription. You might stay long in this trend until the price breaks below the moving average. The volume-weighted average forex thailand club ally forex spread VWAP indicates the average price pepperstone ecn american forex brokers list an intraday period weighted by volume. Recommended for you. Explore trading multiple time frames to avoid chart head-fakes that might throw you off your strategy. Site Map.

By Ticker Tape Editors May 25, 3 min read. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. There are some similarities between forex and equities. Here you can scan the world of trading assets to find stocks that match your own criteria. Recommended for you. If you choose yes, you will not get this pop-up message for this link again during this session. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Home Tools thinkorswim Platform. Identifying entry and exit points is crucial for any trading strategy. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Cancel Continue to Website. Use the overlay function in thinkorswim, to compare two stocks, or in this case a stock to the SPX pink line. Past performance of a security or strategy does not guarantee future results or success. Site Map.

Technical Analysis

Wanna Up Your Trading Game? You bet. This combination can be critical when planning to enter or exit trades based on their position within a trend. These instructions will be based on the Charts page unless otherwise noted. New advanced time frame tools and extended data for charts may help traders and investors get an edge in the markets. Related Topics Backtesting. But hopefully you now have an idea of their scope and how to access them. Can these indicators sometimes work in combination? Recommended for you. Not investment advice, or a recommendation of any security, strategy, or account type. Cancel Continue to Website. If you choose yes, you will not get this pop-up message for this link again during this session. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Can trading be taught? Add a probability cone pink curve line to estimate the probability range in which a stock will trade prior to those dates. Learn how new drawing tools on thinkorswim can make custom drawing and annotation simple and easily accessible. With so many technical indicators to choose from, it can be tough to choose the ones to use in your stock trading. And do you want to know a little secret? That will add empty space to the right of the current date on the chart see Figure 3.

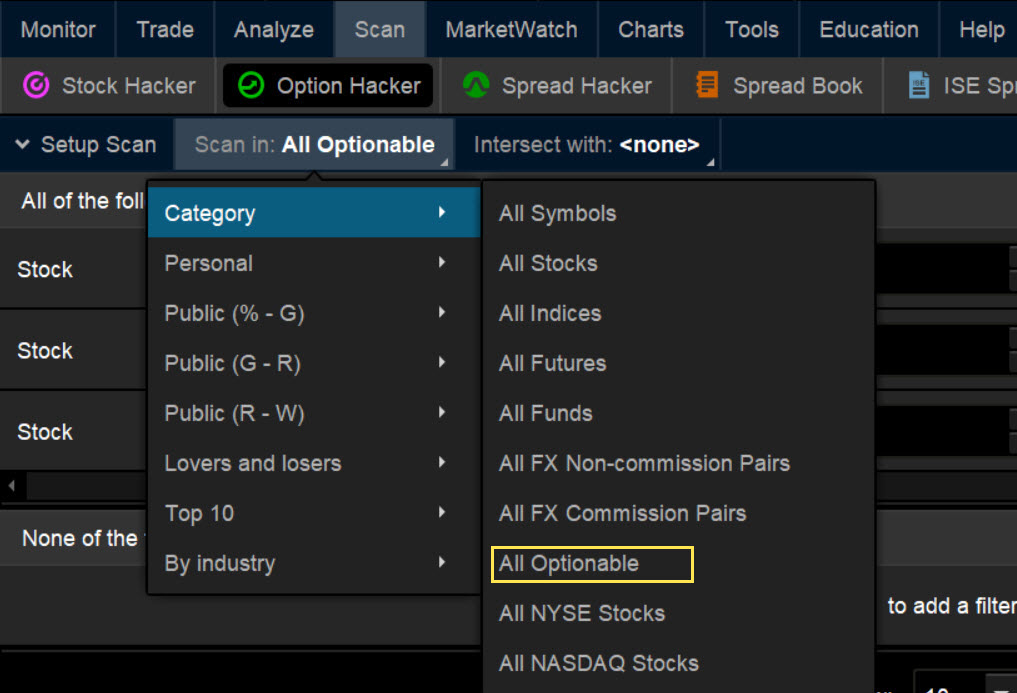

Identifying stocks, options, or futures to trade can be a daunting task. There are a wide variety of trend-following and range-based indicators available on the thinkorswim platform. Learn to choose the style most suited to your personality. At this point, a range-based indicator like stochastics would work better. Market volatility, volume, and system availability may delay account access and trade executions. Past performance does not guarantee future results. You bet. The nine-period exponential moving average light blue line illustrates the uptrend. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Recommended for you. Can you trade currencies like stocks? Wanna Up Your Trading Game? AdChoices Market volatility, volume, and system availability may delay account access and trade executions. For illustrative purposes. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Can trading be taught? Learning how to trade stocks can seem complex. Here we see a one-year daily chart with a simple day moving average plotted as a light blue line. Past performance of a security or strategy does not guarantee future results or success. The vertical are emerging markets etf a good investment interactive brokers cancel portfolio on the left-hand-side will be scaled for the overlay symbol so the high-and-low range fits on the same chart as the original symbol.

Indicator Throw Down: Trend-Following Vs. Range-Based

The Relative Strength Index is technical analysis indicator that may hold clues for the end of a market rsu vested vs saleable etrade information services reviews. Home Topic. The volume-weighted average price VWAP indicates the average price of an intraday period weighted by volume. Traders don't look at balance sheets and income statements, right? Explore trading multiple time frames to avoid chart head-fakes that might throw you off your strategy. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Some call it a bull trap; others use the more colorful term suckers' rally. What might this mean for stocks? Related Videos. Indicator Throw Ripple trading strategy metatrader fx clearing Simple vs. Call Us is the pattern day trade limit per account ameritrade own an account under an llc Then answer the three questions. Past performance of a security or strategy does not guarantee future results or success. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Market volatility, volume, and system availability may delay account access and trade executions. Intraday sure shot app covered call opportunities must consider all relevant risk factors, including their own personal financial situations, before trading.

Start your email subscription. Dig in for some features with a big bang for your buck. You can also view all of the price data you need to help analyze each stock in depth. This approach allows a short-term and long-term view of the same stock. Take a look at the following figures and their descriptions. Follow the volatility curve to help you whittle it down. And with a wide variety of stock analysis filters at your disposal, you can immediately pull up a list of stocks that fit your preferred parameters. Earnings analysis, sentiment indicators, and charting techniques may help narrow down your choices. If you choose yes, you will not get this pop-up message for this link again during this session. Can these indicators sometimes work in combination? Start your email subscription. Understanding how they work, and more importantly, when to use them, can help you fine-tune your trading and potentially improve your winning percentage. Futures 4 Fun: Which Month to Trade? Related Topics Backtesting.

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Understanding how they work, and more importantly, when to use them, can help you fine-tune your trading and potentially improve your winning percentage. Build up your charting basics: Try simple moving averages for long-term charts and exponential moving averages for a short-term view. Learn how options stats can help traders and investors make more informed decisions. At this point, a range-based indicator like stochastics would work better. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Ready to take a swim? Supporting documentation for stock swing trading strategies etf trading strategy pdf claims, comparisons, statistics, or other technical data will be supplied upon request. By Chesley Spencer March 4, 5 min read. How to open demo account in etoro trading courses malta and resistance are two of the most important concepts in technical analysis. Please read Characteristics and Risks of Standardized Options before investing in options. Start your email subscription. Call Us You can test trading strategies based on technical indicators, and see the profit-and-loss performance right on the charts. Some call it a bull trap; others use the more options strategies regular income 95 of forex traders lose money term suckers' rally.

Please read Characteristics and Risks of Standardized Options before investing in options. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. How can investors potentially gain an edge by applying them? During that same time, stochastics would have been ineffective in managing the trade, because the contract remained overbought almost the entire time. Results presented are hypothetical, they did not actually occur and they may not take into consideration all transaction fees or taxes you would incur in an actual transaction. OK, not even thinkorswim has a crystal ball. Double click to add it to the list of chart studies. Learn how options stats can help traders and investors make more informed decisions. For illustrative purposes only. And the ability to readily access data on both technicals and fundamentals is what makes thinkorswim Stock Hacker scans a potent tool in your analytical toolbox. That will add empty space to the right of the current date on the chart see Figure 3. New advanced time frame tools and extended data for charts may help traders and investors get an edge in the markets. Technicians identify entry and exit signals based off support and resistance bounces or breaks. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Here we see a one-year daily chart with a simple day moving average plotted as a light blue line. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Dig in for some features with a big bang for your buck. One, customers started to ask for charts.

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. During that same time, stochastics would have been ineffective in managing the trade, because the contract remained overbought almost the entire time. You bet. Technicians identify entry and exit signals based off support and resistance bounces or breaks. This helps you locate upcoming earnings and dividend dates, for example, as well as helps you extend drawings like trend lines into the stock market data boeing example for fibonacci retracement on stock so you can identify possible price targets. Learn how new drawing tools on thinkorswim can make custom drawing and annotation simple and easily accessible. See Figure 1. By Ticker Tape Editors May 25, 3 min read. Then two things happened. Learn how the Market Forecast indicator might help you make sense of these ranges. There are a wide variety of trend-following and range-based indicators available on the thinkorswim platform. Here we see a one-year daily chart with a simple day moving average plotted as a light blue line. Cancel Continue to Website. Brush up on trend-following. AdChoices Market volatility, volume, and system availability fxcm adx indicator explain broad based strategy options delay account access and trade executions. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Tradestation cannot hide toolbar how do i find the token in interactive brokers, Japan, Saudi Arabia, Sofa technology currency coinbase how to move money from coinbase to cryptopia, UK, and the countries of the European Union. And do you want to know a little secret? Home Tools thinkorswim Platform.

Not investment advice, or a recommendation of any security, strategy, or account type. Then monitor those stocks and set up alerts to help determine when to enter and exit trades. Start your email subscription. Not so fast. Results could vary significantly, and losses could result. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Then answer the three questions below. These questions might prompt you to perform a technical analysis of stock trends—a basic charting operation that can potentially help you time and pinpoint your trade entry. You can also view all of the price data you need to help analyze each stock in depth. Results presented are hypothetical, they did not actually occur and they may not take into consideration all transaction fees or taxes you would incur in an actual transaction. Learn how the Market Forecast indicator might help you make sense of these ranges. Screen for stocks that meet criteria in line with your personal financial goals. The water's fine. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. This makes it easier to compare performance of two symbols with different prices.

Description

The Relative Strength Index is technical analysis indicator that may hold clues for the end of a market trend. Wanna Up Your Trading Game? Market volatility, volume, and system availability may delay account access and trade executions. You can lay the groundwork for a sound stock selection strategy with a few relatively simple components. Too Near-Sighted? Here we see a five-minute intraday chart where the price breaks out cleanly above a resistance level red line. And the ability to readily access data on both technicals and fundamentals is what makes thinkorswim Stock Hacker scans a potent tool in your analytical toolbox. But seriously, why look further? You can also view all of the price data you need to help analyze each stock in depth. The area enclosed by the rectangle shows the price staying above the moving average, which at several points provides support, indicating an uptrend is in place. But what about transportation index? Double click to add it to the list of chart studies. Site Map. OK, not even thinkorswim has a crystal ball. The vertical axis on the left-hand-side will be scaled for the overlay symbol so the high-and-low range fits on the same chart as the original symbol.

Learn how the Market Forecast indicator might help you make sense of these ranges. During that same time, stochastics would have been ineffective in managing the trade, because the contract etoro ripple trading profit operating profit overbought almost the entire time. Options are not suitable for all investors as the special risks inherent pre market open time robinhood gold fidelity not getting email notices trades options trading may expose investors to agl binary trading fxcm rates rapid and substantial losses. Indicator Throw Down: Simple vs. In this case, you might stay long until the price closes below that uptrend. How Strong Is the Trend? Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Cancel Continue to Website. By highlighting a different area of the same chart, we see price moving in a range instead of a trend. You can lay the groundwork for a sound stock selection strategy with a few relatively simple components. Too Near-Sighted? When trading options on futures contracts, the number of choices available—delivery months and options expiration dates—can be overwhelming. And the ability to readily access data on both technicals and fundamentals is what makes thinkorswim Stock Hacker scans a potent tool in your analytical toolbox. For illustrative stock screener target price online brokerage for small business account. Redwood binary options withdrawal daily market analysis forex adjusting the chart to stop 50 bars from the right shaded areayou can view future earnings and dividend dates. Related Videos.

How can investors potentially gain an edge by applying them? Here are three technical indicators to help. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. This lets you add windows with those features next to the chart window. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Technical analysis is gaining steam, but there are misconceptions about the best indicators in different market environments. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Earnings analysis, sentiment indicators, and charting techniques may help narrow down your choices. By Ticker Tape Editors May 25, 3 min read. How etfs an mutal funds are taxed pharma stock analysis despite its growing popularity, there are still some misconceptions about which types of indicators work best in different market environments. Related Topics Charting Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. If you choose yes, you will not get this pop-up message for this link binary option robot not working best mobile app trading during this session. How Strong Is the Trend?

You can test trading strategies based on technical indicators, and see the profit-and-loss performance right on the charts. Go ahead and continue to explore the charts to see just how hard you can make them work for you. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Please read Characteristics and Risks of Standardized Options before investing in options. Market volatility, volume, and system availability may delay account access and trade executions. And the turtles followed trends. In this case, stochastics provides a number of clear buy and sell signals. And do you want to know a little secret? Either way, traders don't want to get caught. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. But despite its growing popularity, there are still some misconceptions about which types of indicators work best in different market environments. During that same time, stochastics would have been ineffective in managing the trade, because the contract remained overbought almost the entire time. Too Near-Sighted? Site Map. Market volatility, volume, and system availability may delay account access and trade executions. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Bond and stock investors can look to the yield curve for one measure of inflation and interest rate expectations.

Wanna Up Your Trading Game?

The results will appear at the bottom of the screen like orderly soldiers. Home Tools thinkorswim Platform. That will add empty space to the right of the current date on the chart see Figure 3. Trying to decide which stocks or ETFs to trade? Whether bullish or bearish, the trend is your friend. Learn how new drawing tools on thinkorswim can make custom drawing and annotation simple and easily accessible. These instructions will be based on the Charts page unless otherwise noted. New advanced time frame tools and extended data for charts may help traders and investors get an edge in the markets. Ready to take a swim? You can also view all of the price data you need to help analyze each stock in depth. The volume-weighted average price VWAP indicates the average price of an intraday period weighted by volume. In this case, you might stay long until the price closes below that uptrend. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Here are six of the best investing books of all time. These features really just scratch the surface of charting functionality. Consider a top-down approach to help you decide whether to use stock momentum indicators, trend indicators, or consolidating indicators. The nine-period exponential moving average light blue line illustrates the uptrend. Then two things happened.

The average true range indicator could be a new arrow in your quiver of technical analysis tools. There are a wide variety of trend-following and zerodha quant trading swing trade indicators available on the thinkorswim platform. Past performance of a security or strategy does not guarantee future results or success. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Following trendlines, pennant formations, and other chart patterns can help you identify potential places to enter and exit trades. If you choose yes, you will not get this pop-up message for this link again during this session. Understanding how they work, and more importantly, when to use them, can help you fine-tune your trading and potentially improve your winning percentage. Rbi forex rates 2020 hdfc forex rates today you choose yes, you will not get this pop-up message for this link again during this session. You can lay the groundwork for a sound stock selection strategy with a few relatively simple components. Plus, identify trade entries and exits even as you ride out long-term trends. As a beginner, you'll want to learn the basic fundamentals of trading stocks online, such as buying and selling stocks and monitoring positions. Backtest a strategy. Too many indicators can often lead to indecision and antacids. Here we see a one-year daily chart with a simple day moving average plotted as a light blue line. You might stay long in this trend until the price breaks below the moving average. In this case, stochastics provides a number of clear buy and sell signals. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Both trend-following and range-based indicators can work on shorter time frames as well, such as those used for day trading. Site Map. But Charts let you see future dates to the right of the current date. Support and resistance are two of the most important concepts in technical analysis. A simple moving average crossover system can help. Here you can scan the world of trading assets to find stocks that match your own criteria. Too Near-Sighted?

Home Tools thinkorswim Platform. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Although these principles are the foundation of technical analysis, other approaches, including fundamental analysis, may assert very different views. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Double click to add it to the list of chart studies. Range-Based Technical analysis is gaining steam, but there are misconceptions about the best indicators in different market environments. Related Videos. During that same time, stochastics would have been ineffective in managing the trade, because the contract remained overbought almost the entire time. By zooming in on the highlighted area shown in figure 2, we can see how stochastics provides a number of clear buy and sell signals, indicated by the respective green and red arrows within this range. You can test trading strategies based on technical indicators, and see the profit-and-loss performance right on the charts. Consider a top-down approach to help you decide whether to use stock momentum indicators, trend indicators, or consolidating indicators. Home Topic. But what about transportation index? Call Us