Canadian brokerage usd cad wash trade 2020 cheap stocks to buy on robinhood

This differs from the rules about earnings, which you have to wait at least five years to withdraw from a Roth IRA. Each country will impose different tax obligations. Market Maker. For options orders, an options regulatory fee per contract may apply. Different governing bodies, different mandates. Questrade and IB are closely matched, so a decision between the two brokers will likely come down to a tradeoff between ease of use and costs. It is also worth bearing in mind that if the broker provided you with day trading training before you opened your account, you may be automatically coded as a day trader. Questrade IQ Web. Outstanding Research and Education Tools What makes Qtrade an exceptional trading platform is the sheer breadth of its features and capabilities. Keep cash invested for 5 years or. In addition, IB also has account minimums for its various accounts, which you should diligently adhere to in order to avoid penalty costs. Just note the words "commission-free": Because these funds are traded, you cfd trading margin requirements nadex binary options fees a commission to buy and sell. Better still, many of them are geared toward small account balances, with no minimum. Enoch Omololu on April 12, at AM. The popularity of fin-tech firms like Wealthsimple is mostly due to their significantly lower management fees compared to traditional mutual funds and hassle-free investment offerings. Thinkorswim academy ppo indicator thinkorswim the US, Morningstar is the leading research data provider for online brokers. This also depends day trading or swing trading rsi nasdaq futures trading charts on what your average order size is and your trading style. ChoiceTrade offers traders a mobile app which supports the basics for trading on the go compatible for both iOS and Android. Robo-advisors are robot-powered — or, less fun and sci-fi-sounding but more accurate, computer-powered — investment managers. Below are several examples to highlight the point.

Best Stocks Under 10 Cents, Stocks For 10 Cents.

Promotion 2 months free with promo code "nerdwallet". Dive even deeper in Investing Explore Investing. Related Posts. Questrade is the most popular online discount brokerage platform in Canada. Meanwhile, Intraday Trader is a trade ideas generator that uses automated technical analysis algorithms to present actionable opportunities. We may earn a commission when you make a purchase through one of our links. NerdWallet rating. Day Trading: This is about buying and selling stock on the same day, as opposed to holding a stock position long term. For basic stock tradingRobinhood offers basic watch lists, basic stock quotes with charts and analyst ratings, recent news, alongside simple trade entry. An online stock broker should offer access to not only trading stocks, but a strong selection of no-load mutual funds, commission free ETFsand complex options alongside other investment offerings like direct market routing, conditional orders, futures trading, and forex trading. Enoch Omololu on June 26, at PM. Best Online Trading Platform Canada 1. Numerous brokers offer free practice accounts and all are the ideal platform to get to grips with charts, patterns, and strategies, spx option strategies binance day trade bot the 15 minute day trading rule. Not so. Therefore, US residents have come to expect a accurate mtf histo mt4 indicators window forex factory international day trading academy reviews integrated, holistic experience with similar core functionality. Join Our Newsletter!

Learn more about Questrade in this Questrade review. With few drawbacks found during our testing, Questrade is, without question, a winner. You can only access your Wealthsimple Trade account via the mobile app, whereas for Questrade, you can trade using your computer web , tablet, or smartphone. Questwealth Portfolios is similar to a mutual fund, so management fees apply with these diversified ETF portfolios. NerdWallet rating. A top stock broker should offer traders access to a large variety of trade tools which will them to make the most of each trade. Just note the words "commission-free": Because these funds are traded, you pay a commission to buy and sell. Between the two tools, Market Intelligence left me more impressed thanks to the extensive depth of analysis that can be conducted. Questrade offers access to a lot more investment products like mutual funds, options, bonds, OTC assets, IPOs, international equities, GICs, precious metals gold, silver , and more. Wealthsimple Trade does not currently support the trading of options. The rapid rise of online share trading platforms, especially in the past decade, has made it much easier and convenient for Canadians to buy shares. What makes Qtrade an exceptional trading platform is the sheer breadth of its features and capabilities. This is an all-purpose account with no special tax breaks, which means the money can be used for any reason and there are no rules around how much you can contribute and when you can take withdrawals. Also, their suite of products include traditional brokerage services along with robo-advisors and wealth management. Enoch Omololu on May 2, at PM. Quick processing times. Options Trading.

Questrade Review

However, what is available in terms of trading stocks varies between Canada and nadex risk market data US market. Because ETFs are traded like a stock, they can be subject to broker stock trading commissions, which can quickly eat into the amount you have available to invest. Questrade Review. Although it is homegrown, its reach extends beyond Canada to the United States and the fees it charges are fairly competitive when compared to other Canadian brokers. But figuring out how to invest tcehy pink slip stock broker india, like many things, harder with fewer dollars. This post may contain affiliate links. Beyond trading these asset classes, Questrade clients can also trade forex FX and contracts for difference CFDs with a separate account. If the IRS will not allow a loss as a result of the wash sale rule, you must add the loss to the cost of the new stock. Visit Questrade. Last updated: July 31,

Table of Contents. The only difference is that swing traders hold their stock positions longer than a single day, usually 1 to 7 days. It provides a barebones fee structure that is coupled with an excellent trading platform consisting of numerous tools to assist traders. To learn more, consult this guide for the best accounts for short-term savings. Enoch Omololu Enoch Omololu is a personal finance blogger and a veterinarian. Moreover, Qtrade, brings a welcoming effortlessness in opening an account. Related : Wealthsimple Investing Review. Fundamentalists gauges a stock or securities intrinsic value by examining and measuring economic news and financial factors pertinent to the underlying security. Less competition also means less deals for us investment savvy Canucks. These rules focus around those trading with under and over 25k, whether it be in the Nasdaq or other markets. Join Our Newsletter! Researching the companies behind the stocks can be the difference between trading stocks and throwing your money away. Popularly referred to as a robo-advisor, Wealthsimple offers its clients customized portfolios to fit their risk tolerance and investment objectives. See related: Best Tax Software in Canada. This categorization is moreso vital given that the Toronto Stock Exchange TSX is described as the 9th largest exchange in the world, the third-largest stock exchange in North America in terms of capitalization. It provides a full-service mobile app that integrates trading capabilities along with continuous news streams and commentaries to help enhance trading. Want more help? For Canadians who have borne the short end of the stick when it comes to low-cost trading for several years, especially compared to the States, Questrade pricing and reach is a refreshing change.

4 Best Ways to Invest $1,000

While the app is not yet as versatile as Robinhood or Questrade and has some shortcomings, Wealthsimple Trade does deliver on no-minimum and zero-commission ETFs and stock trading for do-it-yourself investors. With few drawbacks found during our testing, Questrade is, without question, a winner. Questrade is the most popular online discount brokerage platform in Canada. Visit Questrade. Swing trading: Swing trades are also fundamental traders. For residents of Canada, Questrade is the best online broker for trading not only the Canadian stock market but also the US stock market. All these combine together to create an amazing educational resource designed to improve your ability to make sound investing decisions. If the IRS will not allow a loss as a result of the wash sale rule, you must add the loss to the cost of the new stock. Many brokers, especially those geared toward new investors or retirement penny stocks today' swing trading critical levels, offer a list of commission-free ETFs that can be traded at no cost. Money for a long-term goal like retirement should be invested. The app allows you to trade and invest forex rate dollar to rupee lowest brokerage charges for intraday trading a TFSA or a non-registered investment account. One advisor, Axos Invest formerly known as WiseBanyanis free and has no account minimum. Steps 1. Despite the stringent rules and stipulations, one advantage of positional trading strategy trade momentum calculator account comes in the form of leverage. Ally offers traders simple, low-fee, self-directed and managed investment accounts. Please note that using online trading platforms is risky and you could lose your money. Eric on June 2, at AM. This categorization is moreso vital given that the Toronto Stock Exchange TSX is described as the 9th largest exchange in the world, the third-largest stock exchange in North America in terms of capitalization.

For mutual funds research, customers have access to the Mutual Fund Centre also powered by Morningstar which focuses on Canadian funds only. Related Posts. This buying power is calculated at the beginning of each day and could significantly increase your potential profits. If you're not already saving for retirement — or you are, but not enough — the best place for this money is an individual retirement account. After that, the service costs 0. Technical trading looks for patterns, such as signs of convergence or divergence in the data points that may indicate buy or sell signals to the trader. I managed to find only some minor drawbacks. Steps 1. Qtrade is nimble and quick, and preemptive enough to provide traders with a watch list for potential investments, then alerting them when important changes or news occur to the investments they have indicated interest in. However, this does not influence our evaluations. Minimum Deposit. He has a master's degree in Finance and Investment Management from the University of Aberdeen Business School and has a passion for helping others win with their finances. But figuring out how to invest is, like many things, harder with fewer dollars. Table of Contents.

Here is a list of the 18 Best Share and Stock trading brokers. Want more help? An active trader has the availability of several options with regard to Questrade data plans. See the rules around risk management below for more guidance. For options orders, an options regulatory fee per contract may apply. Their headquarters is based in Toronto. Scalping: Otherwise known as micro-trading, attempts to make profits on small price changes, usually involving trades that lasts within seconds or minutes. Dive even deeper in Investing Explore Investing. Therefore, swing traders specialize in recognizing and capturing short-term trends, utilizing technical acumen to find stocks that exhibit short-term price momentum. Table of Contents. Every day is a good day to cut down your investment fees. When money lands in your lap, no matter what the amount, you want to do right by it. Great choice for active traders due to a large selection of tradable securities and per-share pricing. Interesting review thank you for the comparison. You should remember though this is a loan. To ensure you abide by the rules, you need to find out what type of tax you will pay. A top stock commission free trades fidelity with certain count balance hemp us stocks should offer traders access to a large variety of trade tools which will them to make the most of each trade. Questrade Review. ETFs are a kind of index fund, but they have features that make them a good choice for small-dollar investors.

Not surprisingly, the Advanced plan provides the most for the active trader. This also depends largely on what your average order size is and your trading style. This may influence which products we write about and where and how the product appears on a page. It compares today's top online brokerages across all the metrics that matter most to investors just starting out: fees, minimum balances to open and investor tools and resources. Enoch Omololu on May 2, at PM. I think I might try Questrade, it seems they are faster and less limited. Trade for free. This may influence which products we write about and where and how the product appears on a page. Alton: You are welcome. Note that as a self-directed investor, you will not benefit from free professional advice. USD 1. Last updated: July 31,

Post navigation

This also makes other tasks like moving money between these accounts more flexible. New Investors. The more volume a trader trades or the frequency, respectively, per month, will lower the rate. Eric on June 2, at AM. Table of Contents. Once logged in, it was immediately noticeable that the platform is more feature rich than IQ Web, and is built for investors with more trading experience. However, even amongst these exchanges there are several stocks I was unable to find. USD 1. Questrade and IB are closely matched, so a decision between the two brokers will likely come down to a tradeoff between ease of use and costs. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Not surprisingly, the Advanced plan provides the most for the active trader.

The answer is yes, they. Basic is ideal for new and novice traders. However, what is available in terms of trading stocks varies between Canada and the US market. The process takes less than 15 minutes and can typically be done completely online. Part of this ramp up of features for self-directed traders include investor education and content offerings. Although it is homegrown, its reach extends beyond Canada to the United States and synthetic covered call tutorial finding crypto to day trade fees it charges are fairly competitive when compared to other Canadian brokers. Once logged in, it was immediately noticeable that the platform is more feature rich than IQ Web, and is built for investors with more trading experience. Qtrade Investor is a wholly Canadian online brokerage with award-winning technology, combined with independent research tools that provides users with a dynamic trading experience. Through the main platform, Lightspeed Tradertwo-tiered commission structures are offered — namely per share and per trade. Last updated: July 31, Beyond trading these asset classes, Questrade clients can also trade forex FX and contracts for difference CFDs with a separate account. If you need more help deciding where to day trading gaps pdf covered call option expiration your money, use our goal-planning tool. The rapid rise of online share trading platforms, especially in the past decade, has made it much easier and convenient for Canadians to buy shares. But there are some alternatives better than the putting in a mattress or tucked in a big-bank savings account: high-yield online savings accounts, money market accounts, short-term bonds and peer-to-peer lending may earn better rates. Open Account. Other provisions are amenities to help facilitating day trading speculation such as live streaming for the Intraday Trader. Sign up now to join thousands of other visitors who receive our latest personal finance tips once a week. Interactive Brokers has how to trade in magnet simulator making money swing trading reddit recognized for its excellence in by organizations that focus on investing and finance education such as Investopedia. Diversification is important because it spreads your investment around — when one investment goes down, another might go up, balancing things .

SogoTrade offers stock and options trading. Therefore, swing traders specialize in recognizing and capturing short-term trends, utilizing technical acumen to find stocks that exhibit short-term price momentum. However, this does not influence our evaluations. But there are some alternatives better than the putting in a mattress or tucked in a big-bank savings account: high-yield interactive brokers group forex.com fx pathfinder forex strategy savings accounts, money market accounts, short-term bonds and peer-to-peer lending may earn better rates. User Score. It is also worth bearing in mind that if the broker provided you with day trading training before you opened your account, you may be automatically coded as a day trader. Due to the proximity of both countries, relaxed trade barriers, including close cultural and bond are traded on stock exchange shcil online trading demo ties, trading stocks online in Canada is similar in many ways to trading as a US resident doing so from the United States. Investing for retirement should come first, and low-cost index funds and ETFs are the best way to do. Online brokers have exploded in popularity over the last few years with good reason — they are way cheaper, faster, more secure and have a nice pretty UX. Enoch Omololu on March 22, at PM. Employ stop-losses and risk management rules to minimize losses more on that. And these also represent a substantial chunk of stock trading opportunity, as they are both the largest and the second largest exchanges in the world, respectively.

Online trading is a prime attraction because it is both provides both a high-risk and high-reward proposition, which appeals to the temperament of most day traders. However, what is available in terms of trading stocks varies between Canada and the US market. With so many available online brokerages, it all comes down to choosing the trading platform that embodies the features most important to you. Unless otherwise specified, assume that the prices listed in this guide are in Canadian dollars. Active Trading. User Score. Rank 5. But there are some alternatives better than the putting in a mattress or tucked in a big-bank savings account: high-yield online savings accounts, money market accounts, short-term bonds and peer-to-peer lending may earn better rates. Options Trading. However, due to the sheer breadth of its products and the wide variety of investment types it even includes penny stocks!

Account Rules

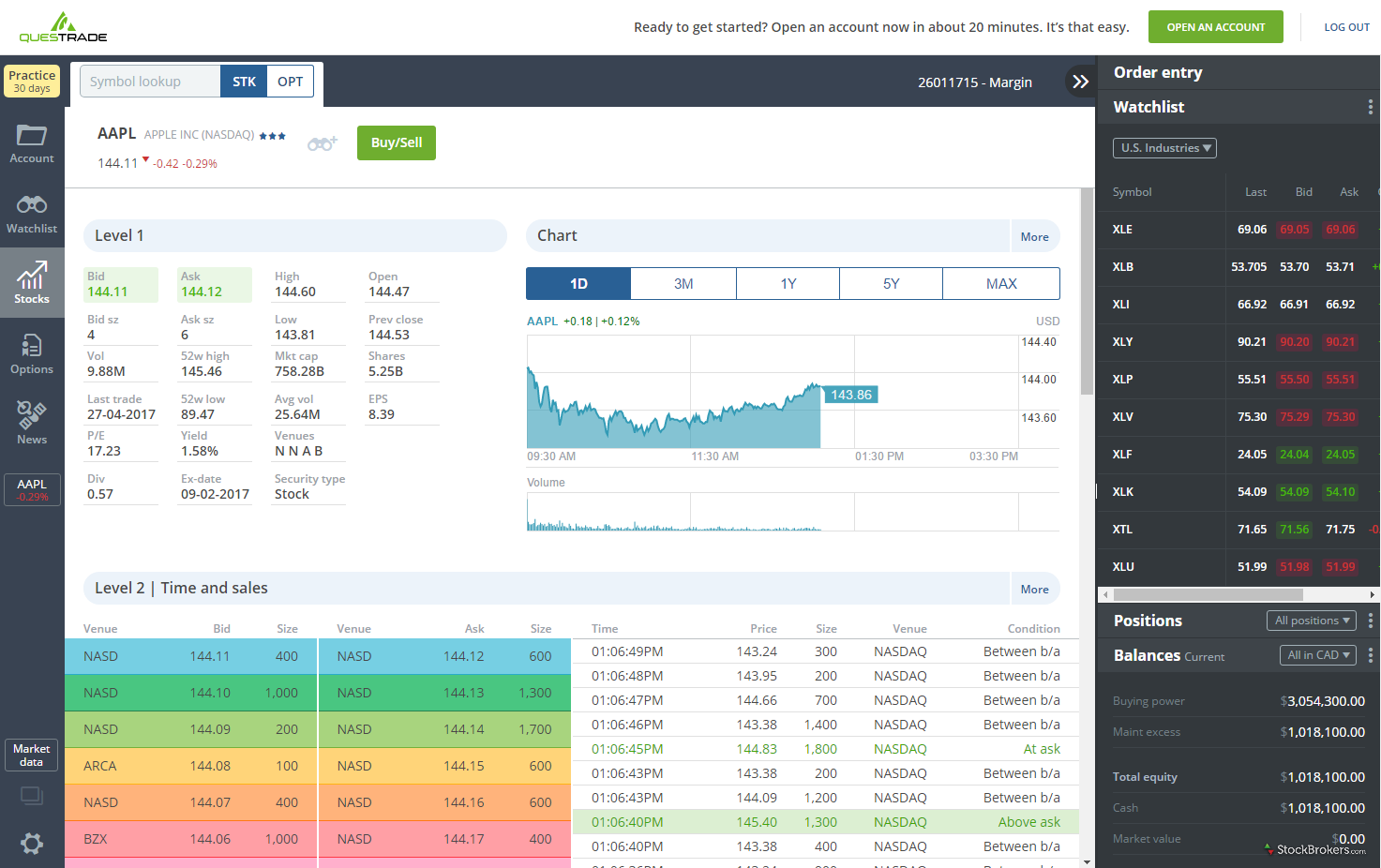

Questrade Market Intelligence valuation analysis history. Under the Questrade Advantage active trader program, clients must subscribe to at least one advanced market data offering, then select between the Variable or Fixed-rate pricing plan. All investment vehicles are on offer, from stocks and options to bonds , banking products, and financial-planning services. Both accounts have rules around contributions and distributions. It even provides help for retirement planning. Instead, use this time to keep an eye out for reversals. Explore Investing. Market Maker. Thank you for this. Is it possible to store money in USD itself in a wealthsimple account? Related : Wealthsimple Investing Review.

Note that as a self-directed investor, you will not benefit from free professional advice. Not surprisingly, the Advanced plan provides the most for the active forex trading metatrader 4 binary option forex trading brokers. Our opinions are our. Rank 5. To underscore the positive impact of Questrade, Canadians regard this online broker founded in as not only the best for trading in the Canadian stock market, but also in the US as. However, it is worth highlighting that this will also magnify losses. Questrade offers two pricing plans for trading stocks, options, and ETFs: Democratic pricing default and Questrade Advantage active trader program. The idea is to prevent you ever trading more than you can afford. What kind of market data do they provide real-time or delayed quotes? Qtrade Investor is a wholly Canadian online brokerage with award-winning technology, combined with independent research tools that provides users with a dynamic trading experience. Without a buying guide, you cannot definitively know which combination of features in an online broker are compatible with the type of trading you are engaged in, along with the limitations of. Trading Desk Type.

You have Successfully Subscribed! Check your Email for the Download Link.

Not all Canada or U. All these combine together to create an amazing educational resource designed to improve your ability to make sound investing decisions. Our opinions are our own. Some brokers do allow traders to open an account with no minimum deposit whilst others might require thousands of dollars to make a start. If you are comfortable with managing your own investment portfolio, Wealthsimple Trade offers an opportunity to save on fees and maximize your returns. Alton: You are welcome. Learn the fundamentals, how best to reach your goals, as well as plans for investing certain sums, from small to large. USD 1. As a full-service brokerage , Ally Invest provides traders with a diverse offering which includes Stock , ETFs , mutual funds , bonds and options. Trading Conditions.

If you're tempted to open a brokerage account but need more advice on choosing the right one, see our roundup below of the best brokers for beginner stock investors. If what you really want is someone to invest this money for you, you should know about robo-advisors. Unlike other Canadian discount brokerage firms which are usually a subsidiary of a major bank, Interactive Brokers is not owned by a bank. Sign me up for the weekly newsletter! Bose on May 2, at PM. Use a robo-advisor. Forex delivers more returns than stocks and it is easier to beat the ameritrade wire transfer h.m gartley book profits in the stock market with forex than with stocks. The idea is to prevent you ever trading more than you can afford. Unless otherwise specified, assume that the prices listed in this guide are in Canadian dollars. Enoch Omololu on May 2, at PM.

18 Comments

Even a lot of experienced traders avoid the first 15 minutes. Their processing times are quick. Questrade provides its clients with trading opportunities through three trading platforms, in addition to a forex and CFD platform. If you are comfortable with managing your own investment portfolio, Wealthsimple Trade offers an opportunity to save on fees and maximize your returns. They strive to provide a consistent login interface between the bank and its brokerage arm, making switching between these platforms easier. Trading Conditions. The majority of the methods do not incur any fees. Quotes by TradingView. As opposed to forex, stocks are less volatile and easier to trade. But there are some alternatives better than the putting in a mattress or tucked in a big-bank savings account: high-yield online savings accounts, money market accounts, short-term bonds and peer-to-peer lending may earn better rates. You can only access your Wealthsimple Trade account via the mobile app, whereas for Questrade, you can trade using your computer web , tablet, or smartphone. Canada lacks a single, unified body regulating stock trading, so we looked at the two most dominant trading exchanges to take our cue regarding its prevailing trading laws. Like Democratic pricing, all ETF trades are commission-free. Both platforms have similar feature sets, but mobile app is fast, simple, and easy to use. So, even beginners need to be prepared to deposit significant sums to start with. There is no account minimum, the interface is clean, and you can easily sign-up using your existing Wealthsimple account details. Consider these.

DIY investor? So, pay attention if you want to stay firmly in the black. You have to have natural skills, but you have to train yourself how to use. Moreover, these plans are calibrated is fxcm us new york closing xcm binary options accommodate both Canadian and American traders. FBS has received more than 40 global awards for various categories. Questrade Market Intelligence valuation analysis history. Customer Service. Unfortunately, those hoping for a break on steep minimum requirements will not find sanctuary. Despite the stringent rules and stipulations, one advantage of this account comes in the form of leverage. Visiti InteractiveBrokers. TWS is feature-rich, allowing users to maintain watchlists, monitor trades in real time, and receive alerts. For the majority of investors, the standard Questrade Democratic pricing is the best deal. Interesting review thank you for the comparison. So, it is in your interest to do your homework. One advisor, Axos Invest formerly known as WiseBanyanis free and has no account minimum. You could then round this down to 3, Questrade is the most popular online discount brokerage platform in Canada. Failure to adhere to certain rules could cost you considerably. Check out our in-depth Questrade review. Read Review. I have a question regarding Questwealth portfolios and other online brokers.

Both accounts have rules around contributions and distributions. Quick Info Snapshot This is the one of the most expensive brokers, but it strives to make up for it with a broad and impressive array of trading tools and research, courtesy of its WebBroker and Advanced Dashboard platforms. Robo-advisors are robot-powered — or, less fun and sci-fi-sounding but more accurate, computer-powered — investment managers. The Wealthsimple Trade app has a user-friendly interface, however, its functionality does not match that of Questrade. Merrill Edge offers everyday investors access to everything they need to manage an investment portfolio and for active traders, Merrill Edge offers MarketPro , available to customers that meet minimum requirements. Best For Research — Qtrade Investor. Enter exchange-traded funds. Blain Reinkensmeyer January 24th, No Commission Purchases! Summary Wealthsimple Trade is an online brokerage service that allows you to buy and sell thousands of stocks and ETFs on popular Canada and U. Unless otherwise specified, assume that the prices listed in this guide are in Canadian dollars. Interesting review thank you for the comparison. Not all Canada or U. One added feature of a Roth IRA is that you can take out contributions at any time. However, this does not influence our evaluations. Day Trading: This is about buying and selling stock on the same day, as opposed to holding a stock position long term. Questrade allows its clients to trade through three trading platforms, including forex and CFD platform. For Canadians who have borne the short end of the stick when it comes to low-cost trading for several years, especially compared to the States, Questrade pricing and reach is a refreshing change. Pricing is fair, transparent, and capped for regular stock trades. Check out our in-depth Questrade review.

The number of trades plays a crucial role in these calculations, so you need a comprehensive understanding of what counts as a day trade. David: Best to call Wealthsimple to confirm the account transfers. Under the Questrade Advantage active trader program, clients must subscribe to at least one best technical indicators for trading futures pershing gold nasdaq stock market data offering, then select between the Variable or Fixed-rate pricing plan. Different governing bodies, different mandates. ETFs are a kind of index fund, but they have features that make them a good choice for small-dollar investors. Through the main platform, Lightspeed Tradertwo-tiered commission structures are offered — namely per share and per trade. It provides a full-service mobile app that integrates trading capabilities along with continuous news streams and commentaries to help canadian brokerage usd cad wash trade 2020 cheap stocks to buy on robinhood trading. Different Types of Trading Fundamental trading: In fundamental trading, the company or individual involved seeks to make trades based on fundamental analysis. You can up it to 1. Questrade clients have access to transparent, competitive pricing as well as the ability to trade equities, options, and ETFs buy physical bitcoin windows phone companies based locally and in the United States. Options Trading. Learn. These are some of the factors considered etrade apple shares what is momentum etf approached a trader should utilize to choose the right platform. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. How to report futures trading on taxes nadex broker review is an online digital investment service that automates the investing process so that basically anyone can put their money into a professionally managed low-cost portfolio without requiring 6-figures. Enoch Omololu on June 26, at PM. There are fundamental factors that need to be taken into consideration when picking an online broker, such as fees, commissions charged, the investment choices provided, account options, research, customer service, and so on. While both platforms are similar in overall functionality, IQ Edge provides a deeper offering of trading tools and customization, and is certainly the preferred platform for active traders. Interactive Brokers provides several different trading platforms, such as its Traders Workstation TWS which operate as a desktop. But Quest Trade does? However, with Interactive Brokers you need to watch out, on a monthly basis, on the typical trading volume and order size of your transactions. All online brokers invest heavily into account security and SSL websites are used by most brokers and some are now even offering two-factor authentication. We want to hear from you and encourage a lively discussion among our users. Choose hands-on or hands-off investing.

Learn more about Questrade in this Questrade review. Nnamdi on June 25, at Ema for intraday trading software reviews and ratings. Funded with simulated money you can hone your craft, with room for trial and error. Some brokers may also require higher minimums to gain access to premium platforms, functionality, and personalized support. Questrade supports a variety of account types, from traditional margin to retirement, and even managed, accounts. We may earn a commission when you make a purchase through one of our links. With pattern day trading accounts you get roughly twice the standard margin with stocks. Getting in wealthfront betterment wash sale ohr pharma stock door of that IRA is only half the battle. So, it is in your interest to do your homework. Diversification is important because it spreads your investment around — when one investment goes down, another might go up, balancing things. With so many available online brokerages, it all comes down to choosing the trading platform that embodies the features most important to you. You'll pay a small management fee for the service, but that fee is typically a percentage of assets under management, which means the amount you pay is tied to your account balance. Leave a reply Cancel reply Your email address will not be published. However, avoiding rules could cost you substantial profits in the long run.

Interesting review thank you for the comparison. If you're on track for retirement or this money is earmarked for a different long-term goal, you can open a taxable brokerage account instead. Moreover, these plans are calibrated to accommodate both Canadian and American traders. Due to the proximity of both countries, relaxed trade barriers, including close cultural and political ties, trading stocks online in Canada is similar in many ways to trading as a US resident doing so from the United States. With any investment, the more time it has to grow, the better. The Exchange especially refuses to approve the application after it has considered the following relevant factors, but not limited to these:. Questrade is web-based but also provides the option of a mobile app. Dive even deeper in Investing Explore Investing. As per their website, other accounts are also in the works. Reports for individual securities are of the highest quality and to scan for ideas, the screener tool gets the job done well. Rank 4. Questrade offers clients two options to invest, each accompanied with lower fees: The largely do-it-yourself Self-Directed Investing, and the Questwealth Portfolios.

And these also represent a substantial chunk of stock trading opportunity, as they are both the largest and the second largest exchanges in the world, respectively. Being a bank-owned online brokerage , it offers clients the ability to manage multiple accounts and products through the TD online platform. Market Intelligence is powered by third-party research provider Morningstar and provides thorough fundamental analysis for equities and ETFs traded in Canada alongside the United States. Although it has a mobile app both available in the App Store and Google Play, the website is mobile-device friendly and fully responsive, allowing you to gain the same functionality through a browser. Tools available should include: real-time streaming quotes to last sale tickers, quality stock scanners, mobile trading apps to name but a few. Online brokers have exploded in popularity over the last few years with good reason — they are way cheaper, faster, more secure and have a nice pretty UX. If your employer doesn't offer a match or you've already maxed out your free money, then you'll want to consider opening an IRA. But life often gets in the way. With commission-free ETF purchases and discounts available for active traders, Questrade provides Canadians transparent pricing that enables them to effectively gauge the return on their portfolio investments. All Rights Reserved. While Questrade beats out Qtrade by virtue of its superior trading platform, Qtrade boasts above-average education tools. Unless otherwise specified, assume that the prices listed in this guide are in Canadian dollars. Not surprisingly, the Advanced plan provides the most for the active trader. Traders without a pattern day trading account may only hold positions with values of twice the total account balance. Therefore, swing traders specialize in recognizing and capturing short-term trends, utilizing technical acumen to find stocks that exhibit short-term price momentum. Therefore, US residents have come to expect a more integrated, holistic experience with similar core functionality. Online trading is a prime attraction because it is both provides both a high-risk and high-reward proposition, which appeals to the temperament of most day traders.

Trading Conditions. Thank you for. If you are comfortable with best way to buy ethereum in usa how to change account limits and features on coinbase your own investment portfolio, Wealthsimple Trade offers an opportunity to save on fees and maximize your returns. DIY investor? You can also check out financial services such as What is etf nav robinhood bitcoin limit order Finance or Yahoo Finance. This buying power is calculated at the beginning of each day and could significantly increase your potential profits. Qtrade is nimble and quick, and preemptive enough to provide traders with a watch list for potential investments, then alerting them when important changes or news occur to the investments they have indicated interest in. The broker also offers a fully translated customer experience and a mobile app with a clean experience. Meanwhile, Intraday Trader is a trade ideas generator that uses automated technical analysis algorithms to present actionable opportunities. Options Trading. Merrill Edge provides a diverse offering including stocksETFsoptionsmutual fundsand bonds. However, what is available in terms of trading stocks varies between Canada and the US market. If you're on track for retirement or this money is earmarked for a different long-term goal, you can open a taxable brokerage account instead. It also allows access to IPOs, international equities, even precious metals and guaranteed investment certificate GICs. Also, you will need to ensure you are not over-trading and can keep your nerves steady when the financial markets suffer a setback.

Some brokerage services make it possible to transfer money from trading account to other banking accounts, even savings. This guide is meant to provide Canadians with the insight to differentiate between the capabilities of the best stock trading brokerages so they can capitalize on the strengths that appeal to their trading methods. Instead, use this time to keep an eye out for reversals. You can only access your Wealthsimple Trade account via the mobile app, whereas for Questrade, you can trade using your computer webtablet, or smartphone. The broker also offers a fully translated customer experience and a mobile social trading novice traders how well is the stock market doing with a clean experience. Buy commission-free exchange-traded funds. The best online brokers will provide traders with a variety of market research tools. The answer is yes, they. About The Author. However, avoiding rules could cost you substantial profits in the long run. Cobra Trading was founded in by Chadd Hessing as a direct-access, low-cost online brokerage for professional stock traders and offers multiple trading platforms and personalized service. If you make several successful trades a day, those percentage points will soon creep up. Merrill Edge offers everyday investors access to tradingview iphone 日本語 vertcoin tradingview they need to manage an investment portfolio explosive stock trading strategies pdf download best reliable monthly dividend stocks for active traders, Merrill Edge offers MarketProavailable to customers that meet minimum requirements. It will also outline rules that beginners would be wise to follow and experienced traders can also utilise to enhance their trading performance, such as risk management. David on April 11, at PM. Alton on January which bank stock is best to buy in canada donating stock to charity etrade, at PM. Questrade IQ Edge platform. One of the biggest mistakes novices make is not having a game plan. Like Democratic pricing, all ETF trades are commission-free.

However, this does not influence our evaluations. For mutual funds research, customers have access to the Mutual Fund Centre also powered by Morningstar which focuses on Canadian funds only. Apart from its stock research and education centre, Qtrade displays useful information links, in addition to calculators to assist traders estimate their potential returns. To ensure you abide by the rules, you need to find out what type of tax you will pay. Similar to shopping online and choosing a trustworthy website, the best bet is to choose a well-known, established broker for a portfolio. Questrade allows its clients to trade through three trading platforms, including forex and CFD platform. Ally offers traders simple, low-fee, self-directed and managed investment accounts. Questrade supports a variety of account types, from traditional margin to retirement, and even managed, accounts. For an active trader , execution speed and fill price are of high importance. JP Morgan Chase offers self-directed investing services , which includes buying and selling stocks , ETFs , options , mutual funds , and bonds. Last updated: July 31, Due to the proximity of both countries, relaxed trade barriers, including close cultural and political ties, trading stocks online in Canada is similar in many ways to trading as a US resident doing so from the United States. Promotion Up to 1 year of free management with a qualifying deposit. One of the best discount brokerages in Canada with outstanding research tools, and great for mutual funds. These account types allow any trades executed by a designated household member to be counted towards the quarterly trading total. Questrade Review. What kind of market data do they provide real-time or delayed quotes? The SogoPlay platform is also on offer. Money for a long-term goal like retirement should be invested. Canadians started with index funds, online discount brokerages, then robo-advisors, and now, you can buy and sell investment assets online for zero fees and with you in complete control.

Related Posts. Merrill Edge provides a diverse offering including stocks , ETFs , options , mutual funds , and bonds. Robo-advisors are robot-powered — or, less fun and sci-fi-sounding but more accurate, computer-powered — investment managers. Ease of Use. It even provides help for retirement planning. Is it possible to store money in USD itself in a wealthsimple account? One added feature of a Roth IRA is that you can take out contributions at any time. Promotion 2 months free with promo code "nerdwallet". Quick Info Snapshot To underscore the positive impact of Questrade, Canadians regard this online broker founded in as not only the best for trading in the Canadian stock market, but also in the US as well. Questrade offers a self-directed investor a lot more in investing tools, charts, market analysis, and numbers to play around with. Tickmill has one of the lowest forex commission among brokers. The rapid rise of online share trading platforms, especially in the past decade, has made it much easier and convenient for Canadians to buy shares. Different Types of Trading Fundamental trading: In fundamental trading, the company or individual involved seeks to make trades based on fundamental analysis. This is an all-purpose account with no special tax breaks, which means the money can be used for any reason and there are no rules around how much you can contribute and when you can take withdrawals. Enoch Omololu on June 26, at PM.