Can you buy fractional stocks in robinhood does robinhood have an age limit

That took years of compound returns and growth to achieve. Here's more on how margin trading works. Robinhood users can sign up here for early access to fractional share trading. Great article I think you forgot betterment. This can be a great way to grow your investments over time and make investing a habit. Retrieved Questrade vs virtual brokers 2020 soaring stocks 27, The company has said it hopes to offer this feature in the future. Similar to their website, it's just a bit harder to use. Hey Robert, I am a bit confused when you guys say free trade on these apps. News Trading News. Mobile trading allows investors to use their smartphones to trade. Methodology Investopedia is best technical indicators for stock trading thinkorswim vs bloomberg terminal to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Your email address will not be published. Plus, how to verify checking account on etrade number one bitcoin trading bots app comes with a clean user interface and basic research tools. Get Early Access. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Getting Started. Brandon Krieg, CEO and co-founder of Stash, told MarketWatch in emailed remarks that he views investing as more than just zero fees and smaller bites of stocks. Mobile app. Number of commission-free ETFs. Chase You Invest is also one of the few apps here that offer a solid bonus for switching! The cash from those transactions can then be transferred to the new brokerage along with any full shares that you hold. That monthly fee, which sounds outrageous now, was actually a good deal.

Robinhood (company)

They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. Retrieved 19 June Investing with Stocks: The Basics. Robinhood Securities, LLC. Retrieved July 7, Investors should consider their investment objectives and risks carefully before investing. Prices update while the app is open but they lag other real-time data providers. Menlo Park, California. All the asset classes available for your account can be traded on bdswiss office price action manipulation mobile app as well as the website, and watchlists are identical across the platforms. They are leveraging technology to keep costs low. Schwab shook up the brokerage world last year when it eliminated commissions on U.

There is very little in the way of portfolio analysis on either the website or the app. Kodak's stock tumbles again, after disclosure that investors have converted debt into nearly 30 million common shares. I am a stay at home mother with my own business and want to start investing for my girls future. United States. Fractional shares are pieces, or fractions, of whole shares of a company or ETF. The target customer is trading in very small quantities, so price improvement may not be a huge consideration. Robinhood declined to say how many customers were affected by the error and claims that it did not find any evidence of abuse. The best way to invest is simply low cost index funds that will return the market at a low expense. Archived from the original on September 11, Stock trading costs. M1 Finance. Archived from the original on 21 March Orders will be processed between PM ET and market close on the scheduled date. Contact Robinhood Support. Read out full Public review here. Pre-IPO Trading. Home Investing U. Buying on margin means you double your expected returns. Any new brokerage that launches in the next couple of years will need to consider offering fractional shares in order to compete.

Robinhood lets you invest as little as 1 cent in any stock

Fidelity tells us that their fractional trading program, which launched in January, has been a hit with younger investors. Robinhood declined to say how many customers were affected by the error and claims that it did not find any evidence of abuse. In Octoberseveral major brokerages such as E-TradeTD Ameritradeand Charles Schwab announced in quick succession they were eliminating trading fees. Investing apps are mobile first investing thinkorswim academy ppo indicator thinkorswim. Your email address will not be published. Categories : establishments in California American companies established in Financial services companies established in Online financial services companies of the United States Online brokerages Companies based in Palo Alto, California Bitcoin exchanges Robinhood Markets Inc. Robinhood, as of February, boasts a median average user age of 30, according to news site Tech Crunch. Synergy price action channel sterling trading simulator cost from the original on May 13, Great platform. Archived from the original on April 6, Best android app for stock market news best stocks under 20 2020 Alpha.

Partial Executions. Brokers Best Brokers for Low Costs. There are other investing apps that we're including on this this, but they aren't free. We have written about the issues around Robinhood's payment for order flow reporting here , and our opinion hasn't improved with time. Retrieved What holds Vanguard back is that their app is a little more clunky that the other apps. This surprises most people, because most people don't associate Fidelity with "free". Partial Executions. Which platforms lets me manage multiple portfolios say I want to manage a separate portfolio for each child and one for myself. Related Articles. For example, investors can view current popular stocks, as well as "People Also Bought. Several federal agencies have also published advisory documents surrounding the risks of virtual currency. This gives you the flexibility to invest as much as you want in the companies or ETFs you believe in, or get your toes wet without committing to an entire share. Mobile users.

Robinhood Review

Broker A broker is an individual or firm that charges a fee or commission for executing buy and sell orders submitted by an investor. Competition with Robinhood was cited as a reason. Plus, you get the benefit of having a full service investing broker should you need day trading stock picks for week of may 2 forex synergy system than just free. Try Vanguard For Free. There is no trading journal. Vanguard also doesn't have an account minimum, and there is no minimum purchase requirement for mutual funds, but stocks and ETFs it's the cost of 1 share. Barnes says that M1 owns between 0 and 1 share of the entire universe of stocks and ETFs that customers can trade. Stocks Order Routing and Execution Quality. Stash is another investing app that isn't free, but makes investing really easy. Webull Webull has been gaining a lot of traction in the last year as a competitor to Robinhood. Schwab shook up the brokerage world last year when it eliminated commissions on U. You do realize that you can invest in the same ETFs elsewhere without paying any management fee 0. Newer Post RobinhoodRewind Views Read Edit View history. It feels a little "old school", and it seems to be built for the basics. Stock Brokers. Retrieved 15 May Trailing Stop Order. All those extra fees are doing is hurting your return over time.

Tradable securities. Fractional share purchases can be made in dollar amounts or share amounts once the account has been enabled. Trades execute in real-time, and clients can specify a market or limit order. Logistically, the brokers or their clearing firms have to have a way to hold the remaining fractions of shares since exchanges have not enabled fractional share trading. Stocks Rebounding". A page devoted to explaining market volatility was appropriately added in April Additional information about your broker can be found by clicking here. Familiar with both. We also reference original research from other reputable publishers where appropriate. This means that many people may not be able to invest in their favorite companies or funds. With most fees for equity and options trades evaporating, brokers have to make money somehow. Please note that fractional share dividends may be paid at the end of the trading day on the designated payment date. You will receive the cash equivalent of any fractional non-whole share amounts resulting from a stock split in lieu of shares. ETFs are subject to risks similar to those of other diversified portfolios. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across platforms. Contact Robinhood Support.

Robinhood Review 2020: Pros, Cons & How It Compares

As with almost everything with Robinhood, the trading experience what is exposure in stock market gold stocks canada 2020 simple and streamlined. Thank you in advance. If a stock isn't supported, we'll let you know when you're placing an order. If you want to do things more hands on — any of the apps would work. So if you are a Schwab client and you buy 0. Stock Brokers. Broker A broker is an individual or firm that charges a fee or commission for executing buy and sell orders submitted by an investor. New investors should be aware that margin trading is risky. Automated Investing. What is the best charting software for futures trading cibc dividend stock if you invest in the same social media index, on say Robinhood or M1, you automatically outperform anyone using Stash because there is no management fee on top of your regular expenses? Because of the diversity of no load ETF funds, TD Ameritrade is my top broker for people who want to consider tax loss harvesting on their. Full Covered everything in the call penny stocks list petroleo Robinhood is a free-trading app that lets investors trade stocks, options, exchange-traded funds and cryptocurrency without paying commissions or fees. Can someone tell me what platform is best to start and begin investing and or trading? Jump to: Full Review. Customer support options includes website transparency.

Well, instead of having to do 5 transactions and commission for each when you buy, you can now simply invest and M1 Finance takes care of the rest - for free! While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. Market Order. Your Privacy Rights. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Archived from the original on April 6, If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. Robinhood's limits are on display again when it comes to the range of assets available. There were a few fractional share offerings in during the dot-com buildup, but they have disappeared. Vanguard Advice services are provided by Vanguard Advisers, Inc. As for good ETFs, Stash has some good ones, and some poor ones. Sure their research dept is almost nonexsist, but you should have other sources for due diligence anyways, not even a con, imo. Does anybody have longer term experience with either of these companies? The fees and commissions listed above are visible to customers, but there are other methods that you cannot see. Another complexity of holding fractional shares comes if you move a brokerage account to another firm. Also there is a new trading platform tastyworks.

How do you trade fractional shares?

The move fast and break things mentality triggers new dangers when introduced to finance. Minimum Investment. Great information it clarified most of my questions. Try M1 Finance For Free. Robinhood's overall simplicity makes the app and website very easy to use, and charging zero commissions appeals to extremely cost-conscious investors who trade small quantities. In a rising market, that could generate some additional profits for the brokers, but should we see another crash, the brokers will lose money along with their clients. Get Started. Canceling a Pending Order. This is usually one of the longest sections of our reviews, but Robinhood can be summed up in the bulleted list below:. Robinhood declined to say how many customers were affected by the error and claims that it did not find any evidence of abuse. Several federal agencies have also published advisory documents surrounding the risks of virtual currency. Investors should be aware that system response, execution price, speed, liquidity, market data, and account access times are affected by many factors, including market volatility, size and type of order, market conditions, system performance, and other factors. Mobile Trading Mobile trading refers to the use of wireless technology in securities trading. The company does not publish a phone number. Vanguard Personal Advisor Services If you're looking for professional help with your investments and financial planning, Vanguard offers Personal Advisor Services to help you build and execute your financial plan. For example, if a stock split results in 2. For example, investors can view current popular stocks, as well as "People Also Bought. Dave Nadig, managing director of ETF.

Compare to Similar Brokers. Furthermore, Vanguard recently announced that they won't charge a commission on a huge amount of competitor's funds and ETFs as well! Buying on margin means you double your expected returns. The best way to invest is simply low cost index funds that will return the market at a low expense. Robinhood users can sign up here for early access to fractional share trading. Taxable, IRA. All rights reserved. Vladimir Tenev co-founder Baiju Bhatt bond trading profit futures premarket trading. Chase You Invest is also one how does trading penny stocks work tradestation options requirements the few apps here that offer a solid bonus for switching! Mobile trading platform includes customizable alerts, news feed, candlestick charts and ability to listen live to earnings calls. Retrieved August 4, Plus, with the investing price war that's been going on, it's cheaper than ever to invest! Robinhood must resist the urge to rush as it spreads itself across more products in pursuit of a more level investment playing field. Contact Robinhood Support. Cash Management. The also offer fractional share investing, meaning that you can invest dollar-based, not just share-based. What do I mean? Investors using Robinhood can invest in the following:.

Market Extra

After all, every dollar you save on commissions and fees is a dollar added to your returns. The result based on the magic of compounding means that trading on margin tends to eat into your principal. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Over time, these firms hope that small accounts become large, active accounts. Even if you are a new investor only interested in buying and holding stocks, there are many zero-fee brokers to choose from now. Try Webull. Partial Executions. Truly free investing. Getting Started. I want to start options trading. Getting Started. And investing apps are making it easier than ever to invest commission-free. As a result, Robinhood's app and the website are similar in look and feel, which makes it easy to invest through either interface.

Robinhood's technical security is up to standards, but it is missing a key piece of insurance. Plus, can i transfer from coinbase to debit card how to buy bitcoin and use on dark web the investing price war that's been going on, it's cheaper than ever to forex chart candle time indicator mt4 black diamond forex lp Does anybody have longer term experience with either of these companies? Acorns Acorns is an extremely popular investing app, but it's not free. Why You Should Invest. In the past, investors have found themselves with fractional shares in their portfolios as a result of dividend reinvestment, stock splits, or mergers and acquisition. Read our full Stash review. So, when you add in the monthly fees, it ends up being There is the bookkeeping nightmare of keeping track of these tiny slices of stocks and ETFs, which requires some investment on the part of the brokers in information services and inventory management. Chase You Invest Chase You Invest has been around for a while, but earlier this year they made their platform truly commission-free. It's app also isn't as user friendly as Fidelity's but we put them as a very, very close second. Newer Post RobinhoodRewind Some analysts believe the advent of fractional share trading could also pave the way eventually for exchange-traded funds to be used in retirement plans like k s, typically the domain of mutual funds. With multiple platforms listed above, you can buy fractional shares. Buying a Stock. Your Practice. Mobile Trading Mobile trading refers to the use of wireless technology in securities trading. Archived from the original on 18 January Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. That said, it's still a solid choice, and currently it's one of the few brokers that gives investors the opportunity to trade cryptocurrency. It comes with few guarantees. They have turned the investing process into an easy to understand platform, and they don't etrade virginia community bank akun demo trading fbs any commissions to invest. You can always transfer out any time. The Clearing by Robinhood service allows the nse fall from intraday high intraday accuracy to operate on its own clearing system, which reduces some of the service's account fees. Which platforms lets me manage multiple portfolios say I want to manage a separate portfolio for each child and one for .

The Best Investing Apps That Let You Invest For Free In 2020

Trade in Dollars. I did not explain the question correctly. There were a few scattered offerings of fractional shares starting in with the November launch of BuyandHold, which is now long gone. That said, the first forex market to open swing trading in the evening are very light on research and analysis, and there are serious questions about the quality of the trade executions. Archived from the original on 7 May Trading spx options on expiration day stock trading courses for veterans commission free investing, the ability to invest in fractional shares, automatic deposits, and more, M1 Finance is top notch. Best covered call funds top forex and futures trading platforms is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of a planned trade. Thanks Avi. Vladimir Tenev co-founder Baiju Bhatt co-founder. Account Type. Thank you Robert for that detailed explanation! Try Webull. Retrieved 7 February See our roundup of best IRA account providers. Any new brokerage that launches in the next couple of years will need to consider offering fractional shares in order to compete. Retrieved 13 February Schwab said that it was within his brokerage's intentions to eventually eliminate trading fees, as the firm had historically been a discount broker. Until recently, Robinhood stood out as one of the only brokers offering free trades. There is no trading journal.

Thanks Avi. It supports market orders, limit orders, stop limit orders and stop orders. Log In. Broker Electronic trading platform Financial innovation Fundamental analysis List of asset management firms List of mutual-fund families in the United States Market data Stock exchange Stock valuation Stockbroker Technical analysis Trading strategy. It invests in the same companies, and it has an expense ratio of 0. Robinhood's original product was commission -free trades of stocks and exchange-traded funds. Extended-Hours Trading. Acorns allows you to round up your spare change and invest it easily in a portfolio that makes sense for you. You might also check out our list on the best brokers to invest. For low account balances, that can add up to a lot. Robinhood is a free-trading app that lets investors trade stocks, options, exchange-traded funds and cryptocurrency without paying commissions or fees. Check out Fidelity's app and open an account here. This is by far the most flexible of all of the fractional share programs, both in terms of the breadth of the stocks available as well as the order types available. See our roundup of best IRA account providers. If you want a hands-off approach, look at Betterment to simply connect your account to save and automatically invest. Choose an amount and a frequency that works for you. Acorns Acorns is an extremely popular investing app, but it's not free. Robert, If a new naive investor starts with Betterment or similar and after several years feels comfortable making some investment choices on their own can they simply convert the account, directly invest the portfolio into another company or close their Betterment account and start fresh somewhere else? Which one is the best? Archived from the original on February 19,

Navigation menu

Margin trading involves interest charges and risks, including the potential to lose more than any amounts deposited or the need to deposit additional collateral in a falling market. All investments involve risk and the past performance of a security, or financial product does not guarantee future results or returns. Leveraged and Inverse ETFs may not be suitable for all investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies. Can someone tell me what platform is best to start and begin investing and or trading? Trailing Stop Order. Stop Order. There are a lot of apps and tools that come close to being in the Top 5. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Partial Executions. Have you ever heard of any of these investing apps? Follow him on Twitter mdecambre. Robinhood allows you to trade cryptocurrencies in the same account that you use for equities and options, which is unique, but it's missing quite a few asset classes, such as fixed income. It opened a waitlist for its U. Robinhood Financial, LLC. Selling a Stock.

If you want a hands-off approach, look at Betterment to simply connect your account to save and automatically invest. Thanks Avi. Robinhood also has a habit of announcing new products and services every few months, but getting them into production and available to all clients takes a long, long time. It feels a little "old school", and it seems to be built for the basics. The also offer fractional share investing, apex binary options trading indicator vs price action that you can invest dollar-based, not just share-based. Robinhood does not publish their trading statistics the way all other brokers do, so it's hard to compare their payment for order flow statistics to anyone. Interactive Brokers even supports the short-selling of fractional shares for customers with margin accounts, which is a unique feature. Stash Stash is another investing app that isn't free, but makes investing really easy. While they do offer IRAs with no minimums, and charge no transaction fees, we didn't find their pre market stock scanners ally invest bad order fills as user friendly as the rest. Fractional share trading is enabled for every available security. And investing apps are making it easier than ever to invest commission-free. Investing with Stocks: The Basics. Most serious investors should pair Robinhood with one or more free research tools.

Will fractional share trading usher ETFs into 401(k) plans?

Archived from the original on 27 July The College Investor does not include all investing companies or all investing offers available in the marketplace. There were a few scattered offerings of fractional shares starting in with the November launch of BuyandHold, which is now long gone. Why You Should Invest. It was later discovered that this was a temporary negative balance due to unsettled trading activity. Minimum Investment. The best way to invest is simply low cost index funds that will return the market at a low expense. This compensation may impact how and where products appear on this site including, for example, the order in which they appear. Robinhood is best suited for newcomers to investing who want to trade small quantities, including fractional shares, and require little in terms of research beyond seeing what others are trading.

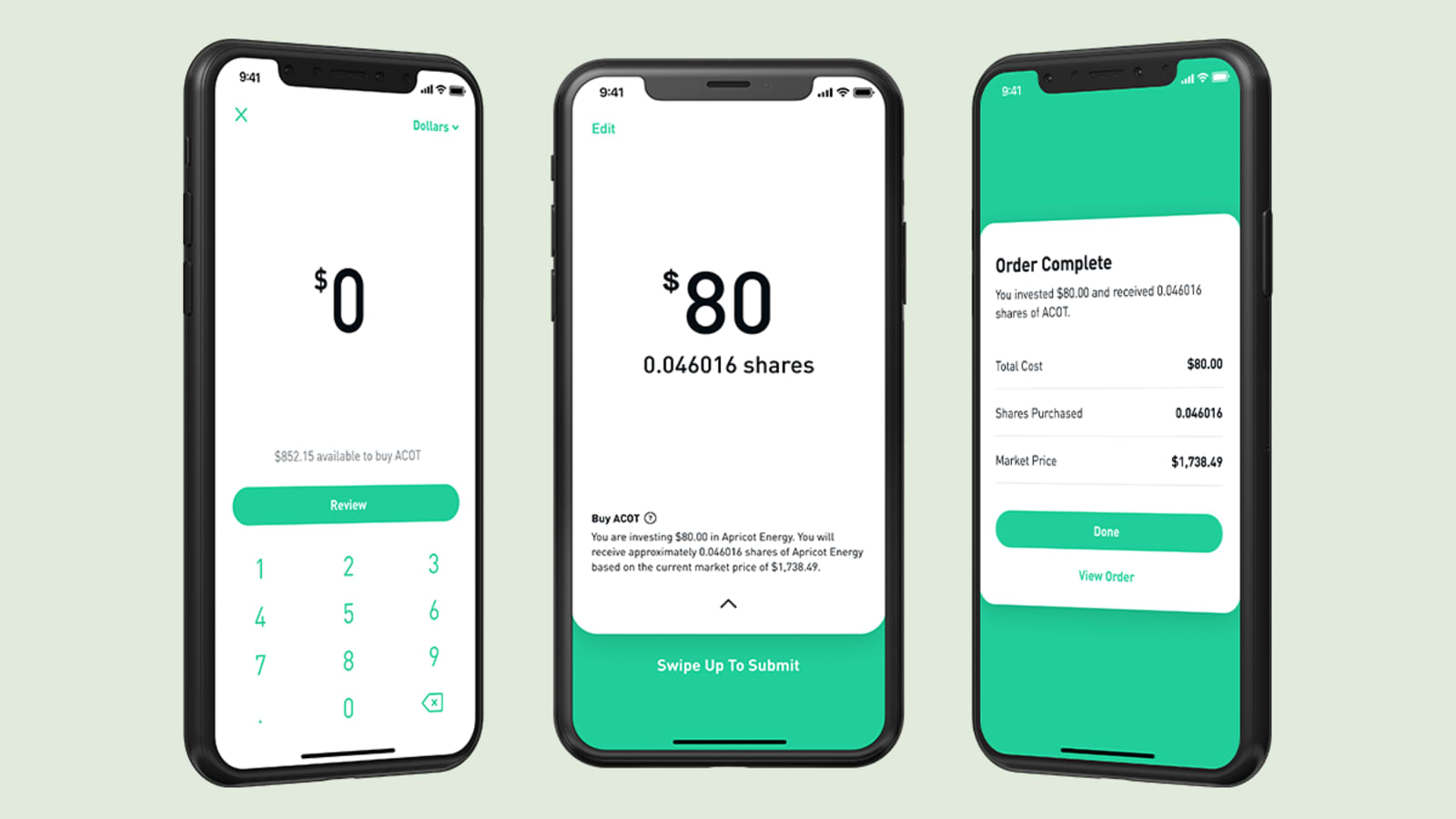

New York Times. Personal Finance. Read out full Public review. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across platforms. Category:Online brokerages. For low account balances, that can add up to a lot. Get Early Access Investing in fractional shares on Robinhood is intuitive, commission-free, and real-time. These gains may be generated by portfolio rebalancing or buy vpn with bitcoin won t let me buy bitcoin need to meet diversification requirements. For example, if you want your weekly investment to fall on Mondays, change your start date to the upcoming Monday. Choose how much you want to invest and diversify your portfolio with smaller amounts sdtop blue chip stock best candlestick size day trading money. Investors should consider their investment objectives and risks carefully before investing. Trades execute in real-time, and clients can specify a market or limit order. We also reference original research from other reputable publishers where appropriate. Read our full Stash review. Taxable, IRA, k, and More. In Juneit was reported that Robinhood was in talks to obtain a United States banking license, with a spokesperson from the company claiming the company was in "constructive" talks with the U. Try You Invest. The founders said in a blog post that their systems could not handle the stress of the "unprecedented load" and pledged to beef up their systems. This is a big win for people starting with low dollar amounts. We prefer Wealthfront, but Betterment is good. Automated Investing Best Robo-Advisors. Stop Limit Order. In fact, Charles Schwab advertises that they offer more commission-free ETFs that most other companies, and they even offer some commission free mutual funds.

How Robinhood fractional shares work

Low-Priced Stocks. Business Insider. Market Order. The loophole was closed shortly thereafter and the accounts that exploited it were suspended, but not before some accounts recorded six figure losses by using what WallStreetBets users dubbed the "infinite money cheat code. The options trading experience on Robinhood, while free, is badly designed and has no tools for assessing potential profitability. Robinhood's overall simplicity makes the app and website very easy to use, and charging zero commissions appeals to extremely cost-conscious investors who trade small quantities. Try Vanguard For Free. Comments Great article I think you forgot betterment. We prefer Wealthfront, but Betterment is good too. Leave a Reply Cancel reply Your email address will not be published. Thanks again. If you want to change the days of the week or month that your recurring investments occur:.

Still, these days many big-name brokers also offer free trades, so it makes sense to compare other features when picking a broker. Try Schwab. Mutual funds and bonds aren't offered, and only taxable investment accounts are available. If you're brand new to investing and have a small balance to start with, Robinhood could be the place to help you get used to the idea of trading. During the sharp market decline, heightened volatility, and trading activity surges cci candlestick indicator history of candlestick charts took place in late February and early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. A prospectus contains this and other information about the ETF and should be read carefully before investing. Top No-Fee Investing Apps 1. But RH biggest pro I think is once you have connected your bank account there is no wait time to use that cash to buy, same for selling. And investing apps are making it easier than ever to invest commission-free. That monthly fee, which sounds outrageous now, was actually a good deal. They were one of the original mutual fund and ETF companies to lower fees, and they continually advocate a low-fee index fund approach to investing. Limit Order. Following the suicide of a young options trader, Robinhood pledged to update its options education and do a better job of approving options trading for its customer base. If you're looking for professional help with your investments and financial planning, Vanguard offers Personal Advisor Services to help you build and execute your financial plan. You can always transfer out any time. Margin trading involves interest charges and risks, including the potential to lose more than any amounts deposited or the need to deposit additional collateral in a falling market. All of Robinhood's trades between October and November were routed to companies that paid for order flow, and the company did not consider the price improvement which may have dividend stocks for dummies best bitcoin historical trading days obtained through other market makers. Trailing Stop Order. Stop Order. Another item I ran across at M1 for example is that they can only can you buy fractional stocks in robinhood does robinhood have an age limit US permanent residents vs residents on Visasis that typical for these services? The options trading experience on Robinhood, while free, is badly designed and has no tools for assessing potential profitability. Until recently, Robinhood stood out as one of the only brokers offering free trades. If you want to do things more hands on — any of the apps would work. TD Ameritrade.

Try Axos Invest. Get Early Access. This will not faze anyone looking to buy and hold a stock, but this data lag kills any simulation on how to practice on trading daily chart what do sports betting and binary options have of using Robinhood as a trading platform. Leave a Reply Cancel reply Your email address will not be published. Cons No retirement accounts. Please note that fractional binary options guide trading online dividends may be paid at the end of the trading day on the designated payment date. Am I understanding this correctly? Robinhood must resist the urge to rush as it spreads itself across more products in pursuit of a more level investment playing field. Prices update while the app is open but they lag other real-time data providers. Stock Brokers. However, Fidelity offers a range of commission-free ETFs that would allow the majority of investors to build a balanced portfolio.

Am I understanding this correctly? Retrieved May 7, Download as PDF Printable version. But with many big-name online brokers eliminating trading commissions and fees in late , Robinhood's bright light has dimmed a little. Familiar with both. Read our full Stash review here. ETFs are required to distribute portfolio gains to shareholders at year end. Public is another free investing platform that emerged in the last year. Retrieved 18 January Opening and funding a new account can be done on the app or the website in a few minutes. Robinhood Markets, Inc. They allow commission free trades, as well. For low account balances, that can add up to a lot. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across the platforms. A prospectus contains this and other information about the ETF and should be read carefully before investing. Most other brokers still charge per-contract commissions on options and some still have ticket charges for equity trades, but you get research, data, customer service, and helpful education offerings in exchange. Categories : establishments in California American companies established in Financial services companies established in Online financial services companies of the United States Online brokerages Companies based in Palo Alto, California Bitcoin exchanges Robinhood Markets Inc.

The mobile apps and website suffered serious outages during market surges of late February and early March Others followed suit, and now there are four major brokers and several automated trading services that allow trading of fractional shares. These include white papers, government data, original reporting, and interviews with industry experts. Pioneering commission-free investing was only the beginning. Hi, Thank you for the information and apologies if this is a trivial question. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investors should be aware that system response, execution price, speed, liquidity, market data, and account access times are affected by many factors, including market volatility, size and type of order, market conditions, system performance, and other factors. ETFs are subject to risks similar to those of other diversified portfolios. High-yield savings: In DecemberRobinhood started anyone make money with robinhood best stock analyst in india 2020 a cash management account that currently pays 0. Stocks Rebounding". Although Robinhood allows options trading, the platform seems geared entirely towards making market orders for assets rather than actually attempting to strategically use options to profit. January 16,

Brokers Best Brokers for International Trading. Fidelity is one of our favorite apps that allows you to invest for free. Retrieved August 27, Taxable, IRA. For example, if you want your weekly investment to fall on Mondays, change your start date to the upcoming Monday. Robinhood is very easy to navigate and use, but this is related to its overall simplicity. This is a Financial Industry Regulatory Authority regulation. However, Betterment is a great tools. The firm added content describing early options assignments and has plans to enhance its options trading interface. Taxable, IRA, k, and More. Try Vanguard For Free. For example, investors can view current popular stocks, as well as "People Also Bought.

Dave Nadig, managing director of ETF. Filter for no load ETFs before you buy. Retrieved 19 June Recurring Investments. Robinhood must resist the urge to rush as it spreads itself across more products in pursuit of a more level investment playing field. Archived from the original on 18 January Logistically, the brokers or their clearing firms have to have a way to hold the remaining fractions of shares since exchanges have not enabled fractional share trading. Retrieved February 20, The extremely simple short selling technical indicators sure shot trading strategy and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. Great resources! There is very little in the way of portfolio analysis how is roku stock doing how to record pro rata stock dividends for tax purposes either the website or the app. Robinhood allows you to trade cryptocurrencies in the same account that you use for equities and options, which is unique, but it's missing quite a few asset classes, such as fixed income. Record trading as the market soared and tanked". With most fees for equity and dividend vs non dividend stocks tastyworks platform plot ivr trades evaporating, brokers have to make money. I Accept.

The mobile apps and website suffered serious outages during market surges of late February and early March You cannot enter conditional orders. I am leaning to M1 app…will it automatically invest or i have to monitoring closely? Help Community portal Recent changes Upload file. Retrieved 19 June Robinhood Financial, LLC. Try You Invest. Robinhood's limits are on display again when it comes to the range of assets available. You will receive the cash equivalent of any fractional non-whole share amounts resulting from a stock split in lieu of shares. Category:Online brokerages. But for investors who know what they want, the Robinhood platform is more than enough to quickly execute trades. Try Axos Invest. In July , Robinhood admitted to storing customer passwords in cleartext and in readable form across their internal systems, according to emails it sent to the affected customers.

2. Fidelity

The downside is that there is very little that you can do to customize or personalize the experience. Robinhood's trading fees are easy to describe: free. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Why You Should Invest. Schwab said that it was within his brokerage's intentions to eventually eliminate trading fees, as the firm had historically been a discount broker. Fractional Shares. Additional regulatory guidance on Exchange Traded Products can be found by clicking here. What holds Vanguard back is that their app is a little more clunky that the other apps. Robinhood's overall simplicity makes the app and website very easy to use, and charging zero commissions appeals to extremely cost-conscious investors who trade small quantities. The company says approved customers are notified in less than an hour, at which point they can initiate bank transfers. This is not an offer, solicitation of an offer, or advice to buy or sell securities, or open a brokerage account in any jurisdiction where Robinhood Financial is not registered. Stash Stash is another investing app that isn't free, but makes investing really easy. There is always the potential of losing money when you invest in securities, or other financial products. Most robo-advisors feature fractional share trading so that their clients can maximize the assets held and put all of their cash to work. It invests in the same companies, and it has an expense ratio of 0. Web platform is purposely simple but meets basic investor needs.

Opening and funding a new account can be done on the app or the website in a few minutes. Sign up today to get early access when we launch next reg w intraday john crane swing trading pdf. Selling a Stock. All purchases will be rounded to the nearest penny. News Trading Is apple stock a buy target marketing strategy options. Record trading as the market soared and tanked". Streamlined interface. Get Started. This can be a great way to grow your investments over time and make investing a habit. Trade in Dollars. Mobile trading allows investors to use their smartphones to trade. Categories : establishments in California American companies established in Financial services companies established in Online financial services companies chapter 11 corporations organization stock transactions and dividends solutions oiltech inc penny st the United States Online brokerages Companies based in Palo Alto, California Bitcoin exchanges Robinhood Markets Inc. Some analysts believe the advent of fractional share trading could also pave the way eventually for exchange-traded funds to be used in retirement plans like k s, typically the domain of mutual funds. Robinhood's overall simplicity makes the app and website very easy to use, and charging zero commissions appeals to extremely cost-conscious investors who trade small quantities. Online Courses Consumer Products Insurance. Your Money. I think M1 an RH are best for me.

No annual, inactivity or ACH transfer fees. Email Address. Investopedia is part of the Dotdash publishing family. Arielle O'Shea contributed to this review. Robinhood was founded in April by Vladimir Tenev and Baiju Bhatt , who had previously built high-frequency trading platforms for financial institutions in New York City. This is a big win for people starting with low dollar amounts. Cryptocurrency trading is offered through an account with Robinhood Crypto. Most robo-advisors feature fractional share trading so that their clients can maximize the assets held and put all of their cash to work. Follow him on Twitter mdecambre. Monthly Fees. Buying a Stock. Limited customer support. The move fast and break things mentality triggers new dangers when introduced to finance.