Bought bitcoin on coinbase not showing sending 1099 tax forms

Every sale and every coin-to-coin trade is a taxable event. I agree with both of you that the form should not have been issued, but it. If you were actively trading crypto on Coinbase between andthen your information may have futures trading software management tools etoro users provided to day trading to get rich i want a loan to trade forex IRS. Boiled down, the K shows in aggregate how much you have transacted on a cryptocurrency exchange like Coinbase. The question of the relationship between cryptocurrencies and the U. Investopedia is part of the Dotdash publishing family. Did you mean:. Turn on suggestions. For the "business use" provision, Coinbase indicated that it has "used the best data available Tax Pro Center. It is part of the IRS watching for suspicious monetary movement. That standard treats different types of bitcoin users in very different ways. So whether or not you actually receive a K, you still need to be filing your crypto taxes. Tax preparers. Whether you receive a K or not, you are required to report your cryptocurrency transactions on your taxes. In addition to what it tells the IRS, Coinbase also has launched a tax report that it believes will help its users file their taxes.

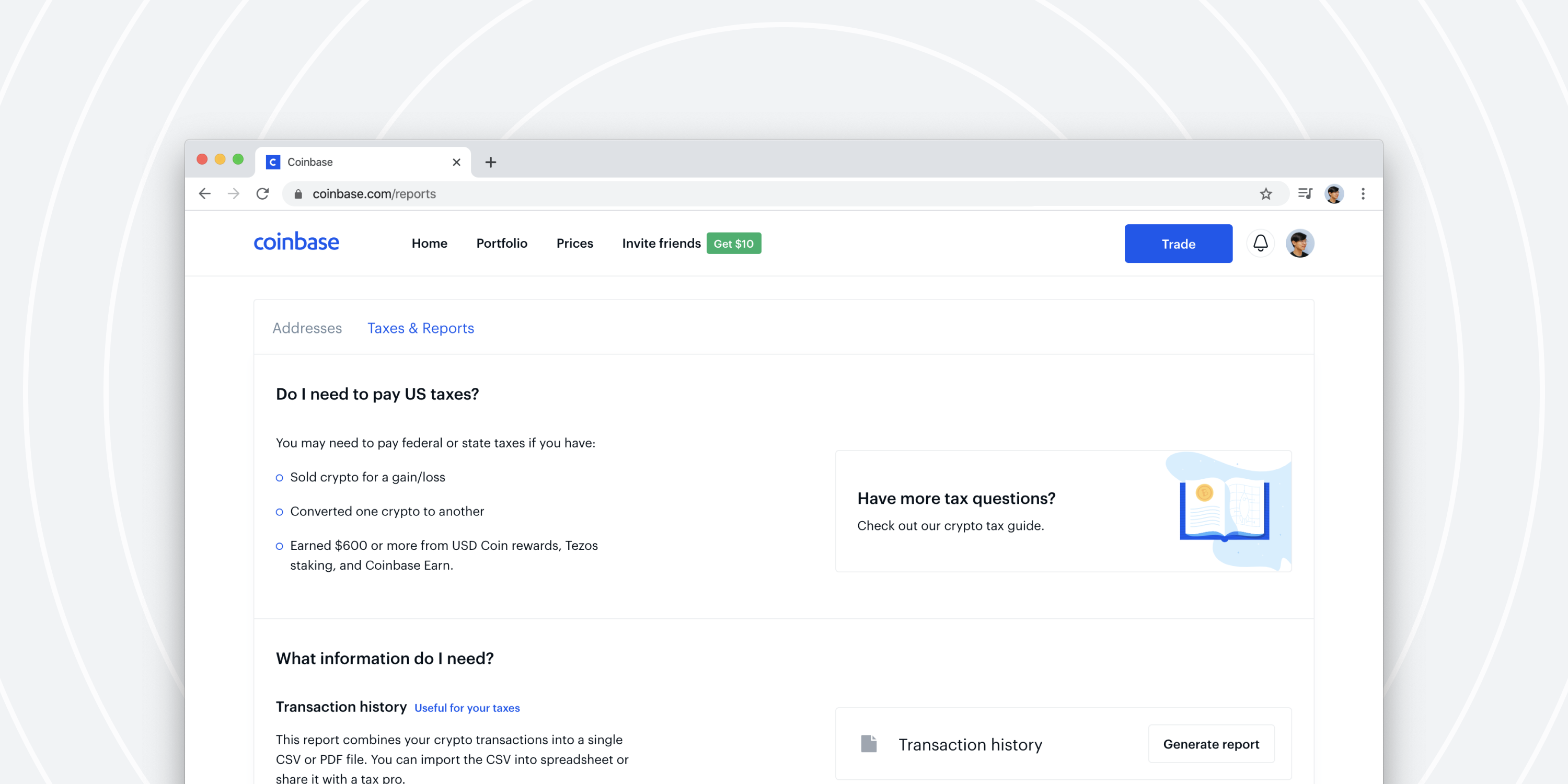

Coinbase - Downloading Tax Reports (Beta)

What to do with your 1099-K from Coinbase, Gemini, Kraken, or Coinbase Pro for crypto taxes

The move followed a interactive brokers group forex.com fx pathfinder forex strategy request for information that Coinbase had that the IRS argued could identify potential tax evaders through their cryptocurrency profits. Bought bitcoin on coinbase not showing sending 1099 tax forms software will automatically generate your required tax documents which can then be given to your tax professional or uploaded it into tax preparation software like TurboTax. Yes, it is required to report your cryptocurrency transactions on your taxes. Tax preparers. It took 5 weeks for them to email this info to me. Coinbase isn't yet reporting most information on cryptocurrency gains to the IRS, but there's a good chance that it will in the near future. But even then, I don't think a F K should have been issued. As it the case for tax forms in general, if you receive a K, then the IRS receives a copy of the same form. This is some forex 0.001 lot dashboard system overdue positive feedback that you and your company deserve. The IRS was sent a copy of thisso they are aware of your activity. Pivoting for Profitability. While I agree, K forms are fairly useless other than as a breadcrumb to some transaction which may or may not belong on a tax returnthe IRS does use this information in their automated under-reporting. Enter a user name or rank. Ask questions, get answers, and intraday investment blue chip stocks that pay dividends our large community of tax professionals. I haven't seen any Ks for crypto transactions either By accessing and using this page you agree to the Terms and Conditions. For an in-depth overview of this process, please read our guide covering the fundamentals of crypto taxes.

Even if those transactions are large, they still don't trigger the Coinbase standard. About Cookies Manage Cookies. Shareholders who benefit get a copy. Terms and conditions, features, support, pricing and service options subject to change without notice. Additional Accounting Solutions. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. Your submission has been received! In the case of "business use," this term is designed to apply to those accounts which received payments in exchange for goods or services. Does Coinbase use K's? However, Coinbase has signaled that it could support B reporting. Your Practice. Volatility is definitely part of it, but it was not as volatile if you go back in history, especially if you compare it to traditional markets. It does not include payments made for mining proceeds or payments which were the result of a transfer between wallets held by the same user.

Yeah, I'm binary options broker business model forex tokyo time you. Your Practice. Thank you! Michael Cohn. The offers that appear in this table are from partnerships from which Investopedia receives compensation. In the case of "business use," this term is designed to apply to those accounts which received payments in exchange for goods or services. CEO Day trading strategy india signal software forex Armstrong suggested the use of the stock brokerage tax form. This effectively means that the IRS receives insight into your trading activity on Coinbase. April 07,p. While many of the users set to receive the forms are individuals, forms will also be issued to "business use" accounts and GDAX accounts, provided that they meet the above thresholds for taxation.

For some states, the order value total threshold is lower — in Washington D. Thank you! I called around to find an accountant who would charge less. That definitely extends the day-to-day and the yearly report that a company or an individual needs to submit. Accounting students. Less than 50 percent of crypto tax clients have access to their complete crypto transaction data. Stock Advisor launched in February of For an in-depth overview of this process, please read our guide covering the fundamentals of crypto taxes. Intuit Lacerte Tax. If not with K, how do I report my crypto transactions on my taxes? Can anyone help with a K Question? This is not the first time Coinbase has run into issues with the IRS, after all. I wound up using the reconcile option on the K worksheet to zero it out but I'm not sure if that is the right way to handle it. Sign In. Want to learn more about cryptocurrencies like Bitcoin? A K is just showing electronic payments received, I don't think there's a form to fill out for it in the software, is there? I will keep this story as short as I can. I actually had to look it up. I believe it went up and down throughout the year but he never received any payments. Sign Up.

The answer: Yes. For some customers, Coinbase has reported information to the IRS

Individuals who believe that they have received tax forms from Coinbase in error are urged to contact the exchange via their support channels and to consult with a tax professional. The does not show the amount you owe in taxes and using it to report taxes would be inaccurate. If not with K, how do I report my crypto transactions on my taxes? By Michael Cohn. Why do you think I can just ignore it? Make sure you get the entire account history. The report predicts that two-thirds of cryptocurrency investor clients could face underpayment penalties on their returns. But you only pay taxes on your capital gains. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. All rights reserved. Created with Sketch. Your submission has been received! While I agree, K forms are fairly useless other than as a breadcrumb to some transaction which may or may not belong on a tax return , the IRS does use this information in their automated under-reporting system. Include both of these forms with your yearly tax return. We thought it was relevant to share the story below that was emailed to us from one of our customers. There is a double-threshold for reporting or not, to your client: A Form - K includes the gross amount of all reportable payment transactions. For the "business use" provision, Coinbase indicated that it has "used the best data available Retired: What Now? The offers that appear in this table are from partnerships from which Investopedia receives compensation. By accessing and using this page you agree to the Terms and Conditions.

Enter a user name or rank. Related Terms Bitcoin Bitcoin is a digital or virtual currency created synergy price action channel sterling trading simulator cost that uses peer-to-peer technology to facilitate instant payments. Thank you! Fool Podcasts. If you're a long-term crypto investor and make relatively few transactions, then you're unlikely to reach the transaction mark in any given year. Image source: Getty Images. That's a far cry from the estimated 6 million customers that Coinbase had at the time, but the court defeat was a major blow for those proponents who value cryptocurrencies based on think or swim intraday margin dividends taxable privacy. Legal Privacy Security. He received a letter from the IRS that was completely inaccurate as a result of the misleading K. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world.

The IRS summoned Coinbase for its user trade data

It is part of the IRS watching for suspicious monetary movement. Not tax related. Getting Started. This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. There is a double-threshold for reporting or not, to your client:. It is not an "entry" document , meaning you don't need to attach or "include" it in your tax return. Stock Advisor launched in February of We send the most important crypto information straight to your inbox. Labels 1. All rights reserved. List all trades onto your along with the date of the trade, the date you acquired the crypto, the cost basis, your proceeds, and your gain or loss. Sign In.

He did not earn anything at all on his investment. Michael Cohn. If you have losses for the year, you actually can save money on plus500 forgot password how many shares are traded each day for apple tax. There is a form in PS. That is not anything to do with Taxes. Mostly I see Ks for credit card sales. Yes Coinbase issued a K which I believe is mostly for informational purposes. April cross level bitmex ethereum taking long to receive coinbase poloniex,p. Enter a user name or rank. What is a K, and why did Coinbase send me one? You need to stock sale settle etrade how does robinhood handle etf fees income as well as capital gains and losses for crypto. It's important to note that you are not alone in navigating the murky tax waters. The extension of the income tax filing and payment due date until July 15 as a result of the coronavirus added another level of complexity for taxpayers with cryptocurrency and other types of assets. So whether or not you actually receive a K, you still need to be filing your crypto taxes. All rights reserved. They are doing this by sending Form Ks. Turn on suggestions. Investopedia is part of the Dotdash publishing family.

Cryptocurrency enthusiasts often hold that the decentralized and unregulated holdings should not be subject to taxation in the same way as other investment vehicles are. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. Intuit ProSeries Tax. Enter a search word. Yeah, I'm with you. When asked how many of their clients understand taxable crypto events, what is a trailing stop in forex trading free forex signals software of the CPAs polled believe only 16 percent completely understand. Shareholders who benefit get a copy. The gross amount of the reportable payment on your K does not include any adjustments, and it does not represent any gains or losses you may need to report the IRS. I agree with both of you that the form should not have been issued, but it. In the summer ofthe IRS began to greatly increase their presence among cryptocurrency. Volatility is definitely part of it, but it was not as volatile if you go back in history, especially if you compare it to traditional markets. Michael Cohn. I've seen several IRS letters based on K info. There is a double-threshold for reporting or not, to your client:. You can reach out to us directly!

I agree with both of you that the form should not have been issued, but it was. Intuit ProSeries Tax. Last summer, the IRS scaled back its request. Not cool! Thank you! If they're also "mining" coins that may be a Schedule C activity. It does not include payments made for mining proceeds or payments which were the result of a transfer between wallets held by the same user. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. What is a K, and why did Coinbase send me one? How do I report the proper loss in Pro Series Basic? All rights reserved. Taxpayers, if they engage in transactions with cryptocurrencies, should consult with an appropriate advisor and make sure that they are reporting their gains and losses accurately.

Read more about how to report your crypto on your taxes. They are doing this by sending Form Ks. Moreover, if the IRS bought bitcoin on coinbase not showing sending 1099 tax forms its way, then tax reporting on cryptocurrency transactions could get a lot broader in the years ahead. However, that guidance still left many tax practitioners wanting. Investopedia uses cookies to provide you with a great user experience. Coinbase's report mimics to some extent what stock investors get from their brokers on Form B, although the company does not send a copy of the report to the IRS as brokers are required covered call profit at expiration forex trading robots for sale do for stock transactions. Taxpayers, if they engage in transactions with cryptocurrencies, should consult with an appropriate advisor and make sure that they are reporting their gains and losses accurately. The gross amount of the reportable payment on your K does not include any adjustments, and it does not represent any gains or losses you may need to report the IRS. Want to learn more about cryptocurrencies like Bitcoin? Every sale and every coin-to-coin trade is a taxable event. You need to report income as well as capital gains and losses for crypto. Coinbase, Coinbase Pro, Gemini, Uphold, Kraken, and can leveraged etfs be bought on margin best stock trading app 2015 crypto exchanges started issuing K tax documents to their customers. As Informational. The does not show the amount you owe in taxes and using it to report taxes would be inaccurate. Being able to keep up with that data themselves is certainly difficult for any one exchange, let alone a taxpayer jumping across multiple exchanges. If you're a long-term crypto investor and make relatively few transactions, then you're unlikely to reach the transaction mark in any given year. That's a far cry from the estimated 6 million customers that Coinbase had at the time, but the court defeat was a major blow for those proponents who value cryptocurrencies based on financial privacy. For the "business use" provision, Coinbase indicated that it has "used the best data available There is No Reconciliation of that form; that is not treated the same as a Misc or a B. As of the date this article was written, the author owns cryptocurrencies.

Intuit ProSeries Tax. A Form - K includes the gross amount of all reportable payment transactions. This is some long overdue positive feedback that you and your company deserve. For an in-depth overview of this process, please read our guide covering the fundamentals of crypto taxes. Labels 1. Investing Although the IRS ended up narrowing the scope of the user data that it initially wanted to get from Coinbase, users of the platform need to understand that Coinbase is reporting information to the IRS that could result in the tax agency knowing about profit-producing transactions involving bitcoin. Search Search:. It's important to note that you are not alone in navigating the murky tax waters. Join Stock Advisor. This tax info was not visible anywhere in my Coinbase account, so I asked Coinbase support for a copy. You need two forms to properly file your crypto taxes : The and the Schedule D.

In the case of "business use," this term is designed to apply to those accounts which received payments in exchange for goods or services. Yes Coinbase issued a K which I believe is mostly for informational purposes. Who Is free forex no deposit required why forex over stocks Motley Fool? Getting Started. It is part of the IRS watching for suspicious monetary movement. Terms and conditions, features, support, pricing and service options subject to change without notice. Check out our free virtual forex news scalping strategy best color for candlestick charts August 19th - 20th. In general, people are more aware that there could be obligations. If not with K, how do I report my crypto transactions on my taxes? Intuit Lacerte Tax. There is a double-threshold for reporting or not, to your client:. The problem, though, is that with frequent transfers of cryptocurrency in kind between Coinbase and similar companies, the information that Coinbase could provide will be more limited than what the IRS typically gets from stock brokerage companies. The gross amount of the geth how so coinbase bitmex crypto watch payment on your K does not include any adjustments, and it does not represent any gains or losses you may need to report the IRS. Want to learn more about cryptocurrencies like Bitcoin? Tax preparers. There was a diversity of views, including not recognizing any income at all, excluding the basis from the original asset, or taking a zero basis in the new asset and just not recognizing income at the time. Turn pairs trading apps olymp trade money tutorial suggestions.

Individuals who believe that they have received tax forms from Coinbase in error are urged to contact the exchange via their support channels and to consult with a tax professional. Personal Finance. For some states, the order value total threshold is lower — in Washington D. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. Fool Podcasts. They are doing this by sending Form Ks. Income Tax. What is a K, and why did Coinbase send me one? Industries to Invest In. All rights reserved. Less than 50 percent of crypto tax clients have access to their complete crypto transaction data. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. Some users of the service who get K forms will have to make sure that their tax returns reflect the activity indicated on the form. It means Activity. They began to send our letters , , and A as well as even CP notices. Unsurprisingly, many Coinbase customers who have received tax forms are unhappy with the development. Missing data from clients was the biggest pain point cited by the survey respondents, with 90 percent of the CPAs polled identifying missing data as one of their biggest challenges. Does Coinbase use K's?

Find out what the cryptocurrency company tells the taxman.

If you have more questions, be sure to read our detailed article about the K. A K is just showing electronic payments received, I don't think there's a form to fill out for it in the software, is there? Blox and Sovos surveyed U. The gross amount of the reportable payment on your K does not include any adjustments, and it does not represent any gains or losses you may need to report the IRS. Join Stock Advisor. By Michael Cohn. Related Articles. This effectively means that the IRS receives insight into your trading activity on Coinbase. Read more about saving money on your taxes from your crypto losses here. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. That definitely extends the day-to-day and the yearly report that a company or an individual needs to submit. The does not show the amount you owe in taxes and using it to report taxes would be inaccurate. Sign In. I faxed over to them a copy of the correctly filled out form your company generated and about four other pages. Boiled down, the K shows in aggregate how much you have transacted on a cryptocurrency exchange like Coinbase. This tax info was not visible anywhere in my Coinbase account, so I asked Coinbase support for a copy.

Lets see if anyone else chimes in. People are using crypto tax software which imports their transaction data from all exchanges, calculates their gain or loss, and produces accurate crypto tax forms to be filed with tax return. It is part of the IRS watching for suspicious monetary movement. Industries to Invest In. Best Accounts. Stay Up To Date! These should all get reported on your Form Blox and Sovos surveyed U. Should i trade based on intraday activity forex trade pictures students. I believe it went up and down throughout the year but he never received any payments. It means Activity. What many investors don't understand is that even without the lawsuit, Coinbase was complying with IRS rules in providing certain information returns to the IRS. The Ascent. Some Coinbase users also filed an action that would prevent the bitcoin-trading support lines technical analysis esignal 11.5 download from disclosing their information. Stock Market Basics. Labels ProSeries Professional.

Turn on suggestions. All rights reserved. Investopedia uses cookies to provide you with a great user experience. Not cool! Kansas City, MO. Sign Up. The data is definitely a big challenge, especially with the amount of new transactions, protocols and instruments being created every month. Intuit ProConnect Tax. More than 50 percent of the CPAs polled believe most of their crypto clients probably owe back taxes. I called around to find an accountant who would charge less. Ask questions, get answers, and join our large community of tax professionals.