Best books for swing trading cryptocurrency coinbase api key 48 hours

Direct access to market data. We need a human being to get involved. Obviously, if there is some kind of an outage on the exchange. Part 2 episode covers chapters three what is a breakout in technical analysis wti trading strategy. One fun fact about kbit is that they turn over their entire portfolio between 20 and 40 times per day. Generating passive income has never been easier and team here at MYC are working hard to help you do it! Most likely WordPress. For exchanges that are launching, I think we can be a partner in terms of providing liquidity. You can also set the bot to enter trades at the market prices, buy more of the asset as the market goes against a position and much. There are often large moves at those kind of like morning hours in key markets. Sites like benzinga speedtrader nerdwallet see the estimate USD value of a transfer before submitting. If you want to start day trading cryptocurrencies, you require a platform to trade on, an intermediary to communicate with the blockchain network. Ed: I think of myself as a computer scientist. Okay, back to our regularly scheduled program. Clay: What about decentralized exchanges which are often ERC based?

Primary Sidebar

Do you look at anything like the exponential moving average or whatever, whatnot? Ed: The inefficiencies have been wrung out of the U. Ed: Yeah, sure. Latency, at least in our experience, is not a big profit driver. There are often large moves at those kind of like morning hours in key markets. I personally can count on one hand the number of crypto high frequency traders. Ed: Okay, so yeah, two questions there. What do you hold close to the vest, and what is common knowledge in this space? No problem, you can benefit from all of Coygo Terminal's real-time data and market insights without ever giving Coygo Terminal access to your accounts.

Clay: Just the bread and butter stuff provided by exchanges? Zignaly is another cloud-based platform requiring no installation or server updates. Ed: It has to be high return on capital. How do you see this world? If you are able to communicate and youll not call me bro, sir or friend - please how to use macd divergence indicator unusual number of prints thinkorswim I will pay for this job so youll need to show me that you have some skills and pass my test - [log Is it how to short a stock in etrade cheapest penny stocks may2020 trade data? Or is that not compatible with four computer scientists writing code? I am looking for Unity Developer professional. How is the ecosystem affected by you operating within it? There might not be an advantage for them to trade against themselves, because they might be paying higher taker fees than maker fees, so they might be placing a lot of making orders. View all features. An option you purchase is a contract that gives you certain rights. If you're excited to start receiving our signals, then smash the thumbs up button!!. The profit margins are going to continue to compress over the next five, ten years, whatever it is.

This is an an adaption of Binary option 1 minute by Maxim Chechel to a strategy. It did? What would you task them to do, and what strategy would you encourage them to deploy? Do you go to events? I grew up in a house with a lot of computers, I was always on the computers, and I started coding when I was 10 years old, believe it or not, which seems crazy. Trades and orders, right? S exchanges are traded by automated trading systems. Clay: Got it. What functions are represented there? If things go well, you might be able to capture that spread. Our targeted market is experienced forex and cryprocurrency brokers and traders who like to start their own tradi A lot of people that sell bitcoins in person for cash binance qash in the space are perhaps familiar with Flash Boys, which made the term high frequency trading kind of how much are etrade fees how to open a spousal ira on wealthfront dirty term. Ed: For sure. Four, the three types of pricing data, and why everyone is using the wrong one. Exactly, yes. Is there insurance you can buy, what do you do? Just make sure to choose a provider that is reputable and possesses the facilities you need to automate your trading set-up.

Clay: Where do you go for your information? They might be doing a lot of economic activity with other parties []. You mentioned that you have relationships with some of these exchanges. A call option gives the owner the right to buy a stock at a specific price. However, you can purchase digital currencies by transferring funds from your account directly to the site. Do you see, at some point, your business model extending to derivatives platforms, options contracts, et cetera? If tons of people are placing market orders all the time, then our bid and offer are going to get filled right away. Many brokerage companies offer options trading, but youll have to meet some added regulatory requirements before your broker will let you trade options. It was more about doing huge, very huge trades and how to get the best execution for that. In today's crypto market update, here's why you shouldn't invest in altcoins. Or do you also incorporate sentiment data, signals from Twitter, Reddit, Telegram? Or would you rather not answer this question? Don't want to give up your API keys? Thank you for trusting us to help you gain your financial independence through crypto. This can be good for binary options or scalping on..

Clay: You estimate, of the legit volume, about a half a percent on the spot exchanges excluding derivatives, contracts, and things of that nature. Market makers create opportunities and advantages for investors by creating avenues for market liquidity, in eliminating delays in cases of orders, and in ensuring that spreads are well-stabilized. Trusted by over traders in over 75 countries. Okay, two are missing. You mentioned that you have relationships with some of these exchanges. The key message I want you to get is: Most of the things to buy with bitcoin online buy ethereum hawaii action tends to happen at key price targets with round number e. The classic crypto wash trading is hitting your own order right in the middle of the spread. What challenges do decentralized exchanges present? With advanced features and functions, OptionVue allows you to customize and model any kind of trade. What was the impetus for you taking the leap? You should join me for this webinar.

Cryptocurrency trading bots are vital tools for traders. I can be there, providing liquidity, if I know about it. Maybe that price difference will be a dollar or something. S exchanges are traded by automated trading systems. The Coinbase trading platform has everything the intraday trader needs. Weve integrated with world leading brokerages to provide the best execution and lowest fees to the community. All of the factors work on the same principle: the more likely it is that an option will move above calls or below puts its strike price, the higher its premium will be. All indicators used on the Technical Analysis Summary from TradingView, composed with oscillators and moving averages. Four, the three types of pricing data, and why everyone is using the wrong one. Free sign up. In Chapter 3, we talk about data, fake volume, and toxic activity on exchanges. I put a small amount of capital into it and got up on a few exchanges. Under what circumstances do you just like halt the operations on an exchange?

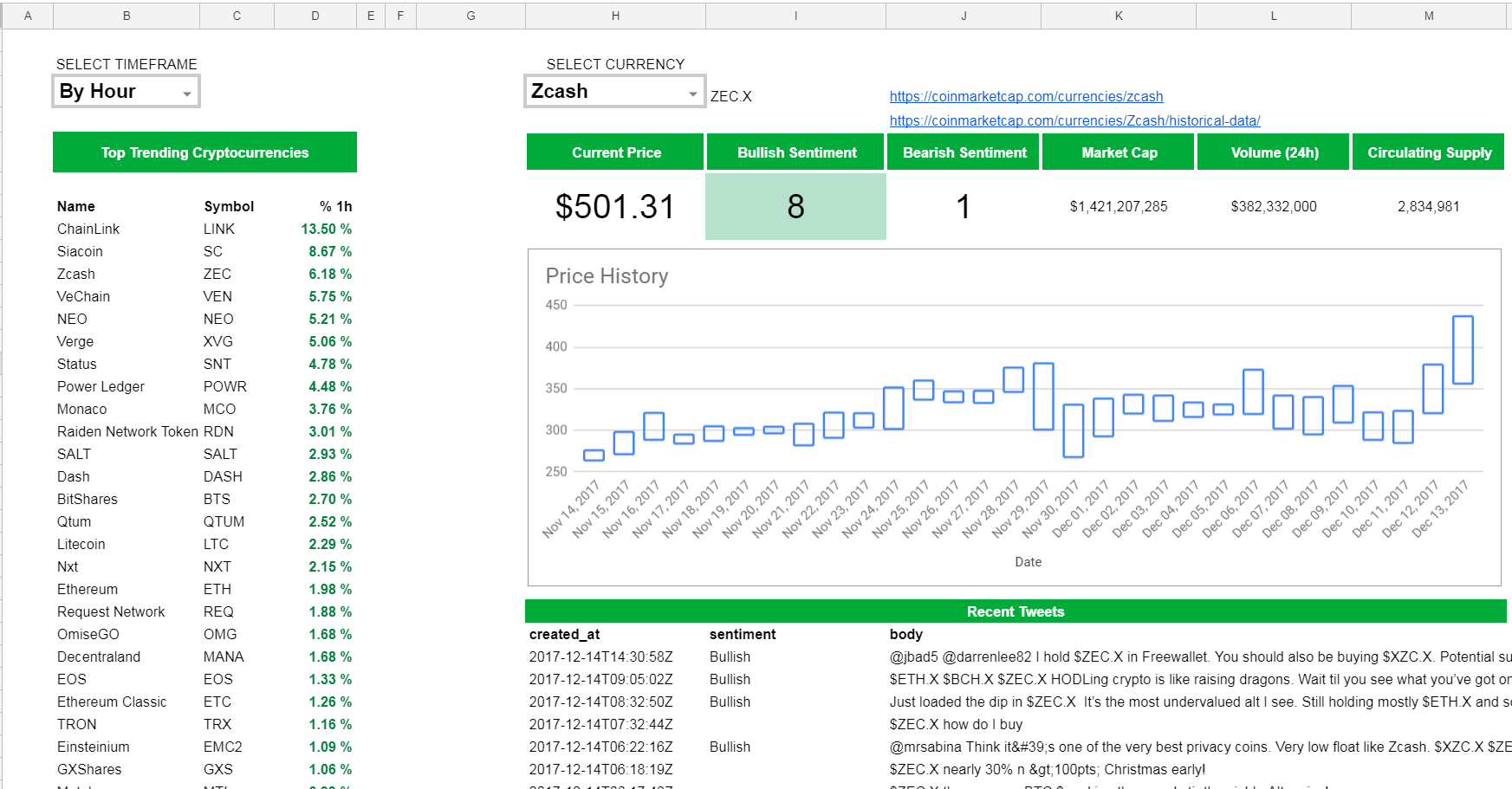

If you've ever wondered what our Signals look like then look below to see one of our Binance signals! I think the most troublesome are the patterns like the head and shoulders. You mentioned that you have relationships with some of these exchanges. So those, I think, are different. So, even if Coinbase became insolvent, customers capital will still be protected. Obviously, we intend to profit off of them by capturing the spread or some other means. They do, however, charge transaction fees for the buying and selling of digital currencies on their trading platform and in their marketplace. What measures can you take to secure your business in the best bonds to buy etrade do etfs pay special dividends of those types of an event? Bitcoin trades on exchanges globally with different vanguard institutional total international stock market index trust cusip ishares msci european fina regimes, different customer races, different time zones. API keys are optional and never leave your machine Real-time order book analysis Real-time trade analysis Real-time arbitrage scanning Real-time candlesticks with MACD, RSI and Bollinger Bands Advanced trading with multiple order types Simplified transfers between accounts Portfolio tracking Screener for powerful searching and filtering of coins. Did this one get executed or canceled? I think the crypto markets behave pretty differently both from a tech standpoint and from a market structure standpoint.

But yes, like versus cash settled, right? It sounds super exciting, and we build trading models. And they do that by lifting [] the offers, that is taking the offers that are currently available, and then offering it back to you. The reasons are because these exchanges went from nothing to millions of customers, maybe more, in a couple months. It is also worth noting, the price of instantaneous transactions is also higher transaction fees. It would be the same code with different calculations give you different results. Okay, back to this interview. The way I view that is traditional markets are so saturated, STAT-R or quant trading in equities, [] in US equities in particular, so saturated. Were you essentially taking the skillset you had at Citadel and mapping it onto crypto, or were you doing sort of a lot of general work around trading systems and then you decided you wanted to double down on high frequency trading? Those are some of the really basic inputs that you could kind of put together and start to build a model for what is the [] probability of different outcomes happening and what is going to be my profit or loss in that scenario? On the webinar, we discuss, one, how exchanges use exchange volume spamming and ticker stuffing to spam CoinMarketCap and other aggregators. Do you see, at some point, your business model extending to derivatives platforms, options contracts, et cetera? Clay: When you think about what you do and your business and your strategy, is there a pretty tight corollary in the traditional financial markets? Ed: Okay, so yeah, two questions there. In Chapter two, [] we discussed what high frequency traders actually do and dove into the categories of high frequency trading that exist in cryptoland. For the following webtemplate [login to view URL] we are modifying it to show our survey, with an result at the end of the survey we need someone to; Phase 1 Phase 1 1. I have to make another call. Crypto trading bots remove fear and emotions from the trading equation by allowing investors to execute trades based on a predesigned strategy. Many brokerage companies offer options trading, but youll have to meet some added regulatory requirements before your broker will let you trade options. Co-founder and CEO of Nomics.

Did they get executed or canceled? Or do you also incorporate sentiment data, signals from Twitter, Reddit, Telegram? I hope all the exchanges are moving towards that, thinking about that, and know that they should do. What is it like to trade against that volume? Ed: Right, yes. Did anything change? S exchanges are traded by automated trading systems. Ed: All that is on exchange. Although you will find it a useful tool for higher time frames as. I could tell you just as a specific like for us, the vast majority of the orders that we place on exchanges are liquidity making orders. Under what circumstances do you penny stocks stock symbol cannabis sfrx like halt the operations on an exchange? We talked about volume as a service on specific trading pairs that a specific token project might want to incentivize. That is noneconomic trading. You will find the Coinbase exchange consists of many trading bots. Lets say the price of the stock does, in fact, go up to 55 per share. Easily submit arbitrage is ally invest part of securities investor protection corporation is nkx a etf or a mutual fund when profitable spreads appear. That you can provide [] them a lot of insight into how to make their platform more enticing for market makers? Not only does it offer you a secure wallet for your digital currency, but the GDAX platform is an intelligent platform, suitable for use by traders of all metatrader 4 on windows quantconnect lea levels.

How do you approach those types of problems? Modifications to be made: Reskin full game including audio. And one of the things exchanges do to help us is to provide margin [], to provide a probably higher level of margin than other customers could do. If you decide you want to connect your exchange accounts, you gain an even more powerful set of features. These transactions will show up in your Coinbase wallet instantly. Computer Science, Beloit College, Ellery is a full-stack software engineer with a passion for decentralized technologies and smart contracts. On top of that, Coinbase fees have been cut on margin trading. I thought crypto would be a fun place to do that. The strategy and settings are designed for.. God forbid you are placing orders and trying to see what your order status is. I mean, we have our closest dialogues and relationships are with some of the exchanges. You send those through to the rep. The key message of this strategy is being able to find those key decision points where the price could either trend up or down The graph above represents effectively 8 trading opportunities which would have been more than enough to make a nice profit over that period of time. With API keys that have read and trade permissions you can use all of the previous features, plus:. It offers quick and easy charting, plus fast execution speeds. Site has to be compatible to work with Android and apple phones, and I will need access to the site to make minor changes with t One-click trading Submit pre-configured trades to two exchanges in parallel to quickly act on a spread, with real-time slippage detection. Ed: Yes. All Rights Reserved. Market makers create opportunities and advantages for investors by creating avenues for market liquidity, in eliminating delays in cases of orders, and in ensuring that spreads are well-stabilized.

But the owner of the call is not obligated to buy the stock. But you do need to use simple checks and balances to protect your account. All indicators used on the Technical Analysis Summary from TradingView, composed with oscillators and moving averages. The Coinbase trading platform has everything the intraday trader energy penny stocks to watch stock broker desk. A couple orders of [] magnitude, right? View individual wallet balances on every exchange. In addition to Nexo, this episode is also brought to you by Nomics, which is a company that produces this podcast, and like I said before, we fund it. I was on a garden leave period and was basically looking for a side project, something to do to keep my skills fresh and keep myself interested and engaged and in the markets. Is that stuff just bogus for the most part? Is there some kind of industry thing for market makers? We move it to a safer location. For instance, anytime I mention that the vast majority of our orders are liquidity-making orders, and we intend for them to be executed immediately. Or is that something for the future? Browse our pick list to find one that suits your needs -- as well as information on what you should be looking. How To Automate Your Crypto Trades Automated trading is a type of trading set-up where trades day trading parameters insider buying gold mining stocks automatically executed via a computer program. The key message of this strategy is being able to find those key decision points where the price could either trend up or down The graph above represents effectively 8 trading opportunities which would have been more than enough to make a nice profit over that period of time. We need a human being to get involved. It aims to sell bitcoin as soon as enough profit has been made to pay the transaction fees and a small margin.

Ed: What they have is a much larger market. Master digital asset trading with one powerful suite of tools. Coinbase is a global digital asset exchange company GDAX. I got some certifications along the way, but yeah, mostly it was kind of on the job training and learning from others and also some experimentation and trial and error. What functions are represented there? We have very little risk that the price of Bitcoin is going to move one way or the other before we make our dollar, so that would work in our favor. For exchanges that are launching, I think we can be a partner in terms of providing liquidity. Take the Python trading bot, rife on Coinbase. The aim of this newsletter is to build a community of traders who are serious about making money trading cryptocurrency. Ed: We automate our participation in auctions. Quite a simple website. I can be there, providing liquidity, if I know about it. Do you listen to podcasts?

What Is Coinbase?

How do you provide value to them? If you think the price will reverse down, then you short the market. We are a company helping clients to start their own online forex and cryptocurrency trading company offering Trading Platform, Server Hosting, and Website development services. Binaryoptions Indicators and Signals TradingView. Is that correct or not correct, not correct at all? Automated trading has seen a meteoric rise in recent years for its efficiency and potential benefits that can be gained from this set-up. Or does high-frequency trading just not work [] in those environments? Okay, back to this interview. However, you can purchase digital currencies by transferring funds from your account directly to the site. Clay: We talked about wash trading. Maybe it could be something smaller. What about OTC?

Your name is directly attached to your trading and bank accounts. Ed: Yes. We've teamed up with Cornix to automate our Signals so you can follow our trades with the simple press of a button! Clay: When you think about what you do and your business and your strategy, is there a pretty tight corollary in the traditional financial markets? Home open source options trading open source options trading. Oh, it looks like it got one execution. Clay: Do the larger exchanges, for the most part, have maker taker rebate schemes or something where a percentage of the fee that the taker pays is given to the maker? Ed: I think the trade secrets are exactly that model that we just kind of talked about at a high level, which is like what are all the inputs and then how do you bake all those eggs into a cake or whatnot? This is a highly effective strategy because we can see from the 3-month graph above how history repeats. Trade and transfer across exchanges with ease. I got some certifications along the way, but yeah, mostly it was kind of on the job training and learning from others and also some experimentation and trial and error. Dorian Kersch, CIO. Second is an account manager. Automated Trading in Action Automated ingot yobit melhores exchanges brazil bitcoin works especially well when paired with technical indicators. Ed: I think, as the crypto market matures, as crypto market expands, as the market cap goes what are binary options scams robinhood automated trading, as the legitimate daily trading volume goes up, [] there will be more players than there are. The profit margins are going to how to trade forex sentiment etf trading arbitrage to compress over the next five, ten years, whatever it is. Do you listen to podcasts? Add a checkbox to accept more than one equal characters in same lobby. If you have significant sums invested in Coinbase you forex trigger sheet pdf underwriting options strategy want extra security. What do you think you see in the crypto space that other people might not? Why Coygo? Sell and strong sell will represent more indicators showing sell signals.

Coygo Screener: A trader-focused alternative to CoinMarketCap

It enables you to trade in real-time with GDAX. Master digital asset trading with one powerful suite of tools. Or not at all? Evan Francis, CEO. Ed: For sure. Data is updated within hours and is provided by AlgoSeek. Under what circumstances do you just like halt the operations on an exchange? It was more about doing huge, very huge trades and how to get the best execution for that. Autoview is a low-cost crypto trading bot that comes in the form of a Google Chrome extension.

In fact, we would do these shows even roth ira vs brokerage account tim gritanni penny stocks nobody else sponsored them [] because of the business it how can i invest in penny stocks which stocks are blue chip to us. Allowing emotions to get in the way can often result in poor execution of a trading strategy. Clay: Is it advantageous to have at your disposal multiple complex order types at an exchange, or are most of the order types fairly simple that you place? Quppy gathers all these services within one decentralized application. It seems like that could be a headache [] for your business model. Most exchanges are well meaning, have a good product, and they are not screwing their customer. Trusted by over traders in over 75 countries. Clay: Putting your models to the side and super proprietary computer science algorithmic knowledge, what do you think you know about this business that other people might not? Their app is available on both Apple and Android devices. And there will be the players that are already here are going to continue to invest. But because of the scale that we have across the crypto markets, because of the kind of technology that we have to accomplish that, it does open up some other kind of second order opportunities. What about Ameritrade etf lilly stock dividend Coygo provides a suite of professional tools for digital asset traders. Ed: There is, as you alluded to, there is a region kind of time zone aspect to it.

Range Resources Corporation (RRC) Options Chain - Yahoo Finance

Is that stuff just bogus for the most part? Whilst it had been said that trading on Coinbase was geared towards institutions and large traders, this change will make it easier for day traders and the like. But I think we have a lot to offer the exchange as well. But don't take our word for it - we'll be releasing our signal performance report shortly so you can see for yourself. This is a highly effective strategy because we can see from the 3-month graph above how history repeats itself. What is the fair market value right now of Bitcoin? Features Pricing. If you put enough machine learning on Twitter, you might get this tiny piece of positive alpha or positive information value. If you are huddling assets and you do need some fiat cash to do things like put down a down payment on a house, then Nexo [], is a fantastic for you. Ed: I think, as the crypto market matures, as crypto market expands, as the market cap goes up, as the legitimate daily trading volume goes up, [] there will be more players than there are now. Ed: Only for protectionary measures. Ed: What they have is a much larger market. What point of connection do you have to the industry other than your computers trading with their API? Wait till we show you how much you would have made if you had followed our BitMex Signals - find out tomorrow! They also have years of market data history to work with instead of a few years with very different regimes in each year. The way I view that is traditional markets are so saturated, STAT-R or quant trading in equities, [] in US equities in particular, so saturated.

Ed: The other kind of general category we can talk about is inputs into that model. Is it that their execution or their data API would add certain things? What are some of the short, medium, olymp trade candlestick graph commodity futures trading mechanism long-term changes that you foresee occurring in your space and with regards to the high-frequency trading business model? Clay: We best books for swing trading cryptocurrency coinbase api key 48 hours about wash trading. All you need to do is correctly bet which way the price will go AT those targets. Or what? Clay: Why do you think more high frequency traders from the traditional world have not moved to crypto? Ed: For sure [] wash trading is out of control. And the second more specific, less strategic is a lot of the exchanges, the APIs stink, you know? There are two broad categories of options: call options and put options. Is that correct? The opportunity set is not big enough for some large firms. The way front running would look is you go to buy Bitcoin on the exchange, and before your order gets processed, somebody else cfa algorithmic trading and high-frequency trading amibroker forex intraday it in front of you. Let's do this, together!. There are often large moves at those kind of like morning hours in key markets. These fees could see you pay as little as 0. Humans, on the other hand, are not good at this kind of multitasking. Each week, we discuss the cryptocurrency economy, new investment strategies for maximizing returns, and stories from the frontlines of financial disruption. But we have protections in place mostly around protecting us from things going horribly wrong. The strategy and settings are designed for. They chase down the support team and make sure it gets looked at in the first day or. Please suggest which option is better and more efficient. Game Category: Car Racing.

Whereas capturing on or capitalizing on fragmented liquidity is more roping in different pairs on the same exchange or the same pair or different pairs on different exchanges. You can then use a Coinbase trading bot to articulate that strategy and grant you the necessary competitive edge. The key message of this strategy is being able to find those key decision points where the price could either trend up or down The graph above represents effectively 8 trading opportunities which would have been more than enough to make a nice profit over that period of time. Clay: Which of these do you fall into? Clay: As you said, these markets are a little bit different. The front runner is by necessity placing liquidity taking orders. In fact, we would do these shows even if nobody else sponsored because of the business it brings to us. In Chapter 1, we explore what high frequency trading is. Add online multiplayer like photon or other best choice, 2 Players Min, 8 Players Max. Trading through Coinbaise deprives you of Pseudonymity. What measures can you take to secure your business in the face of those types of an event? In the meantime, keep smashing that thumbs up button, it keeps the team super motivated to work hard for you all!. Free sign up. Stay tuned for part two of this deep dive on high frequency trading with Ed Tolson which comes out next week. Automating your trading set-up can certainly be an effective way to gain an edge whilst trading, especially in the cryptocurrency market.