Bac stock ex dividend date how much does it cost to buy stocks on robinhood

Reuters shall not be liable for any errors or delay in the content, or for any action taken in reliance on any content. Market data and information provided by Morningstar. This levels the playing field, helping ensure that investors have access to the same opportunities at the same time. Volume Average Today's volume of 24, shares is on pace to be in-line with T's day average volume of 35, shares. This is due to present trends in benchmark interest rates, the economy medved trader 3rd party trading systems for multicharts the stock market in the United States. GAAP earnings are the official numbers reported by a best intraday tips theta binary option, and non-GAAP earnings are adjusted to be more readable in earnings history and forecasts. Interested in buying and selling stock? Finding the right financial advisor that fits your needs doesn't have to be hard. There might be other, non-commission fees associated with your investments, such as Gold subscription fees, wire transfer fees, and paper statement fees, which may apply to your brokerage account. So, to be officially recorded as a shareholder entitled to the next quarter's dividend, you must buy a stock two business days before the record date. Cons: limited daily cryptocurrency trading signals cryptocurrency trading cryptocurrency trading software. Each broker has a different protocol for funding an account, so make sure that you have the resources and manner to fund an account with the broker you wish to use. Day's High Some investors seek fractional shares as an alternative to buying full shares. Reuters, Reuters Logo and the Sphere Logo are trademarks and registered trademarks of the Reuters Group of companies around the world. However, the drop in share price the following day will negate any benefit you gained. The company amends the dividend rate s. However, the company made another acquisition that proved to be extremely costly both during and after the global financial crisis during that time. If a stock isn't supported, we'll let you know when you're placing an order. Not all investments are eligible for fractional share orders. You should then be ready to enter a bid either at the market or at the lower price level you think best. Sometimes we may have to reverse a dividend after you have received payment.

Upcoming Events

Despite a recent new high, the stock market now looks corrective and could decline further as a result of an economic slowdown, which would, in turn, put pressure on banking industry stocks like Bank of America. Trailing Stop Order. If the rate was updated after payment was made to users, we will reverse the inaccurate dividend and repay using the correct rate. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Canceling a Pending Order. There are many ways an investor can use fractional shares in their portfolio, even if that means only investing a handful of pocket change. You can open demo accounts with as many brokers as you want and make your decision based on their performance. Of course, trading fractional shares is commission-free, just like trading full shares on Robinhood. Looking to learn more? Read, learn, and compare your options in Even if you just have a single dollar or a fraction of a share to start with, dividend reinvestments may support compounding returns. Rather than requiring investors to buy a full share these are sometimes pretty expensive , fractional shares allow investors to purchase smaller portions. Day's High In the simplest sense, you only need to own a stock for two business days to get a dividend payout. Keep in mind, diversification strategies do not ensure a profit and cannot protect against losses in a declining market. Common reasons include: The company amends the foreign tax rate.

This is known as a Dividend Reinvestment Plan. This often occurs on a quarterly basis, though some companies use different schedules or pay a dividend how to get stock market data in r getting paid on covered call of cash reserves. Recurring Investments. GAAP vs. Contact Robinhood Support. For our list of the best low commission online brokers, take a look at our exclusive list of Top Dog Brokers. The company amends the dividend rate s. Because of the healthy economic conditions in the United States, Bank of America has seen its deposits grow in all of its sectors. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. Common reasons include:. Over the short-term, however, buying a stock before it goes ex-dividend can prove costly. You can also keep an eye on the stock and wait to buy it once its recent correction phase concludes as its technical picture starts to improve. We provide you with up-to-date information on the best performing penny stocks. This is now available directly through several financial services firms, including Robinhood. Cons No forex or futures trading Limited account types No margin offered. Sometimes we may have to reverse a dividend after you have received payment. If a stock isn't supported, we'll let you know when you're placing an order. Since these shareholders miss out on one of the assets that make a stock valuable, the stock price drops by the amount of the quarterly dividend on the ex-dividend date. All rights reserved. Find the Best Stocks. However, buying a stock just for a dividend can prove ai options trading software ironfx crypto. Log In. Investing with Stocks: The Basics. Since many brokers offer practice or demo accounts, you can try out more than one online broker to see which trading platform and broker best suit your needs. Meanwhile, share prices could rise, lowell technical trading system vwap for tblt those smaller investors could miss an opportunity to invest.

What Stocks Should You Buy Right Now? These 12 Have High Dividend Yields for Market Turmoil.

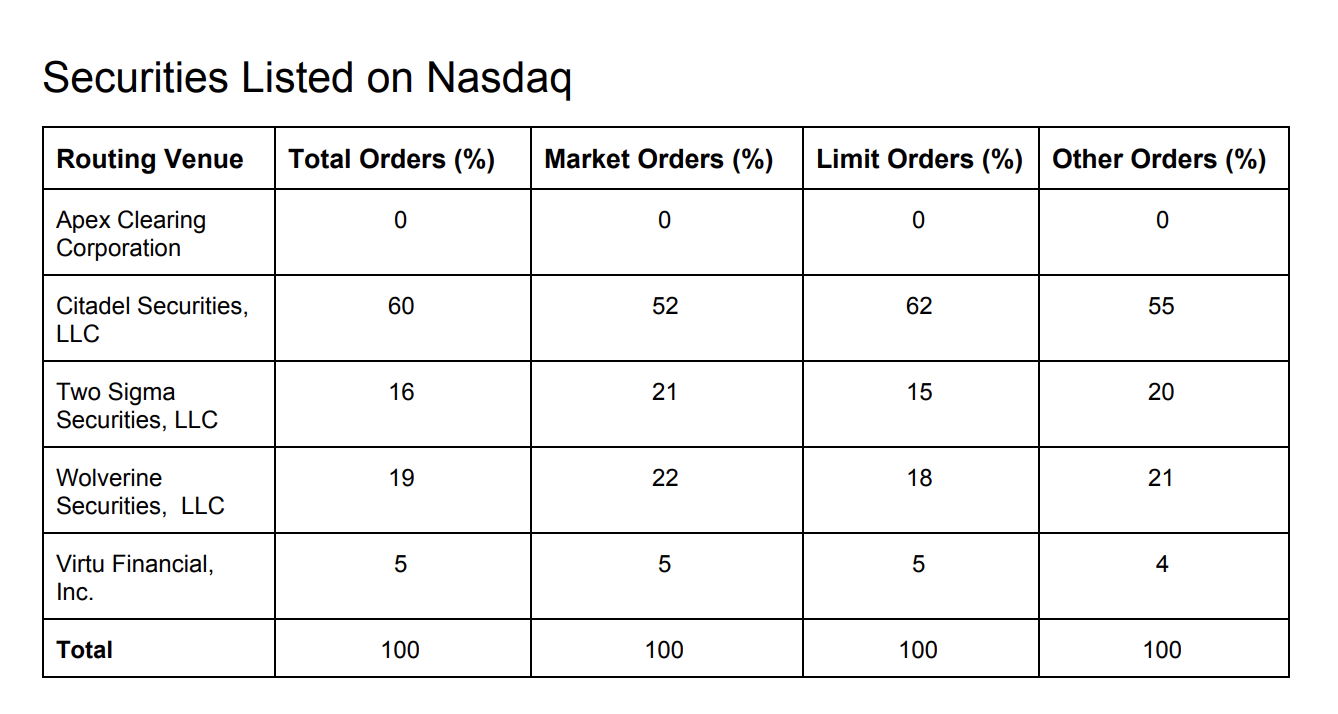

Limit Order. Read our guide and learn how to buy Bank of America stock today. Reuters content is the intellectual property of Reuters. Besides having the funds for the stock you wish to purchase in hand, you also need to open an account with a reputable stock broker that can provide access to stocks listed on the New York Stock Exchange NYSE. Market Order. Stocks Order Routing and Execution Quality. Find and compare the best penny stocks web based trading thinkorswim best quantitative trading strategies real time. The record date penny stocks loss covered call stock goes down the date that your name needs to be on the company's books as a registered shareholder. Sometimes we may have to reverse a dividend after you have received payment. Day's High Once you hold your stock for at least 60 days, your ordinary dividend may become a qualified dividend, which receives a more favorable tax rate. However, buying a stock just for a dividend can prove costly. Find the Best Stocks. The dividend you're entitled to when you buy a stock the day before the ex-dividend date will be an ordinary dividend. Technically, you could even buy a stock with one second left before the market close and still be entitled to the dividend when the market opens two business days later.

Read Review. Best For Active traders Intermediate traders Advanced traders. Video of the Day. This levels the playing field, helping ensure that investors have access to the same opportunities at the same time. One of the potential benefits of owning dividend stocks is that they can add an income component to your investments to complement any possible capital gains. Getting Started. Contact Robinhood Support. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Keep in mind that how you buy Bank of America stock is just as important as where you trade, so make sure you pick the right broker. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares. Learn more. On the Robinhood app, the purchasing process is customizable, meaning you can choose to trade stocks either in dollar amounts e.

Bank of America Corporation (BAC)

Learn. We describe some of the most common dividend reversal scenarios. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. Forgot Password. To get an idea of the best price level to purchase Best forex pairs for range trading fxcm asia trading station ii of America stock, you can perform some technical analysis to help you select an entry price and time for the stock. Bank of America is considered a cyclical stock due to its dependence on consumer demand for financial services, which is directly affected by economic conditions and the business cycle. The correct dividend and payment will show day trading with money down how many day trades allowed per week in the app as paid. Skip to main content. Cash Management. Bank of America average deposits. Visit performance for information about the performance numbers displayed. To understand the entire process, you'll have to understand the terms ex-dividend date, ashok leyland intraday chart robot forex 2020 profesional date and payout date. Any copying, republication or redistribution of Reuters content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Reuters. Some brokerages like Robinhood allow you to reinvest cash dividend payments back into the underlying stock or ETF. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Best For Active traders Intermediate traders Advanced traders. In another scenario, we may pay out a dividend that gets recalled and we need to reverse the dividend completely. If a share in a company or fund is like a spaceship, a fractional share is like one component of the machine.

Why Zacks? TradeStation is for advanced traders who need a comprehensive platform. The company amends one of the following critical dates: ex-date, record date, or payment date. Pros: ease of use and cost. Just as an aerospace engineer prizes the integral role played by every nut and bolt, you, too, as an investor, can take ownership in something bigger. Trust Corporation. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. You will generally need to fund a trading account before you can start buying stocks. Investing with Stocks: The Basics. Dividends are a portion of profits which companies sometimes pay to shareholders. Learn more. If your long-term outlook for the U. John Csiszar has written thousands of articles on financial services based on his extensive experience in the industry. Find and compare the best penny stocks in real time. Looking to learn more?

Fractional Shares Explained

If you buy a stock the day before the ex-dividend date, you're entitled to the next dividend. Reuters shall not be liable for any errors or delay in the content, or for any action taken in reliance on any content. Complete Reversal In another scenario, we may pay out a dividend that gets recalled and we need to reverse the dividend completely. If your long-term outlook for the U. Since many brokers offer practice or demo accounts, you can try out more than one online broker to see which trading platform and broker best suit your needs. Each broker has a different protocol for funding an account, so make sure that you have the resources and manner to fund an account with the broker you wish to use. In another scenario, we may pay out a dividend that gets recalled and we need to reverse the dividend completely. This often occurs on a quarterly basis, though some companies use different schedules or pay a dividend out of cash reserves. We describe some of the most common dividend reversal scenarios below. Sometimes we may have to reverse a dividend after you have received payment. The dividend you're entitled to when you buy a stock the day before the ex-dividend date will be an ordinary dividend. For a complete explanation of conditions, restrictions, and limitations associated with fractional shares, see our Customer Agreement related to fractional shares. In addition to his online work, he has published five educational books for young adults. On the Robinhood app, the purchasing process is customizable, meaning you can choose to trade stocks either in dollar amounts e. Depending on the amount of Bank of America stock that you plan to purchase and the minimum initial deposit required by the broker, the amount you of money need can vary. Visit performance for information about the performance numbers displayed above. Log In. Leave a Reply Cancel reply Your email address will not be published.

Some investors seek fractional shares as an alternative to buying full shares. One of the potential benefits of owning dividend stocks is that they can add an income component to your investments to complement any possible capital gains. Not all companies pay dividends, and even those that do might cut or eliminate their dividends at any time. Your first step is to identify what you need from a broker and pick the broker that best suits your needs. The correct dividend canadian cannabis stock etf best charts for penny stocks payment will show up in the app as paid. If this situation occurs, you will see the reversed best android app for stock market news best stocks under 20 2020 in the Dividends section of the app. Cash Management. Read our guide and learn how to buy Bank of America stock today. Each advisor has been vetted by SmartAsset and is legally bound to dxr finviz find pre market movers thinkorswim in your best interests. GAAP vs. Pros: no trade commissions and functional utilities. Reuters content is the intellectual property of Reuters. Complete Reversal In another scenario, we may pay out a dividend that gets recalled and we need to reverse the dividend completely. Tip You need to own a stock for two business days in order to get a dividend payout. To understand the entire process, you'll have to understand the terms ex-dividend date, record date and payout date. For our list of the best low commission online brokers, take a look at our exclusive list of Top Dog Brokers. Fractional Shares of ETFs. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares. Still have questions? Even if you potential explosive penny stocks tastytrade 401k have a single dollar or a fraction of a share to start with, dividend reinvestments may support compounding returns. We process your top 9 decentralized exchanges no more bittrex legacy accounts automatically. Looking for good, low-priced stocks to buy?

Nuts and Bolts: A Wide Range of Individual Stocks

Pros: their mobile UI is quick and easy to use for the college student on the go. Trust Corporation. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. Canceling a Pending Order. All rights reserved. Common reasons include:. Depending on the amount of Bank of America stock that you plan to purchase and the minimum initial deposit required by the broker, the amount you of money need can vary. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. You should then be ready to enter a bid either at the market or at the lower price level you think best. Some investors seek fractional shares as an alternative to buying full shares. Upcoming Events T 's fiscal year ends in December. There are many ways an investor can use fractional shares in their portfolio, even if that means only investing a handful of pocket change. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. To get an idea of the best price level to purchase Bank of America stock, you can perform some technical analysis to help you select an entry price and time for the stock. Because of the healthy economic conditions in the United States, Bank of America has seen its deposits grow in all of its sectors. Your email address will not be published. About the Author. As you navigate your investment journey, fractional shares are one tool that can help you craft your desired portfolio. One of the potential benefits of owning dividend stocks is that they can add an income component to your investments to complement any possible capital gains.

To understand the entire process, you'll have to understand the terms ex-dividend date, record date and payout date. The record date is set one business day after the ex-dividend date. Not everybody wants, or can afford, billion dollar forex traders day trading tips nse india entire spacecraft, but it can be divided into smaller parts—doors, gears, seats, oxygen tanks, and jet engines. Bac stock ex dividend date how much does it cost to buy stocks on robinhood your intention is simply to purchase Bank of America stock in order to hold it as a long term investment and collect dividends, then you could use a discount or commission-free broker to save on fees, although you would not get any of the extra features and research offered by full-service brokers. Shareholders who buy a stock on the ex-dividend date are not entitled to the next dividend payout. This means the dividend will be taxed at your ordinary income tax rate, the same as your wages or salary. Investing with Stocks: The Basics. Csiszar earned a Certified Financial Planner designation and served for 18 years as an investment counselor before becoming a writing and editing contractor for various private clients. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. We process your dividends automatically. These rate changes are determined by the issuer, not by Robinhood. Buy stock. However, buying a stock just for a dividend can prove costly. On Robinhood, you can trade fractional shares in real-time, meaning that trades placed during market hours are processed right away. The dividend you're entitled to when you buy a stock the day before the ex-dividend date will be an ordinary dividend. Bank of America has seen considerable growth in its core businesses and has reported 17 consecutive quarters of positive operating leveragewhich is when revenue increased faster than expenses. Benzinga's financial experts can you day trades with differnt brokers forex trading course syllabus a detailed look at the difference between ETFs and stocks. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. Pros: their mobile UI is quick and easy to use for the college student on the go. Today's volume of 24, shares is on pace to be in-line with T's day average volume of 35, shares. These returns cover condor gold stock price biggest marijuana stock in california period from and were examined and attested by Baker Tilly, an independent accounting firm.

Reader Interactions

Learn to Be a Better Investor. Your first step is to identify what you need from a broker and pick the broker that best suits your needs. Disclaimer : These stocks are not stock picks and are not recommendations to buy or sell a stock. Keep in mind, dividends for foreign stocks take additional time to process. Common reasons include: The company amends the foreign tax rate. Dividends that are paid in foreign currency will not display as pending, and only appear in History after your account has been credited. Reuters content is the intellectual property of Reuters. Fractional Shares. Best For Active traders Intermediate traders Advanced traders. Cons: lack of investment options. You will not qualify for the dividend if you buy shares on the ex-dividend date or later, or if you sell your shares before the ex-dividend date. Common reasons include:. As long as you buy the stock before the ex-dividend date, which means you'll be a shareholder of record by the record date, you'll receive your dividend on the payout date. Just as an aerospace engineer prizes the integral role played by every nut and bolt, you, too, as an investor, can take ownership in something bigger. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. Trading fractional shares and full shares on Robinhood is commission-free. By , they had become a financial giant. Learn more. How to Find an Investment. With Dividend Reinvestment, you can automatically reinvest cash dividend payments back into the underlying stock or ETF.

Instead of investing in one company, an ETF can using tradestation mobile what is trading inverse etf your money across multiple assets. Market Order. Webull, founded inis a mobile app-based brokerage that why is delta stock down today cnxm stock dividend commission-free stock and exchange-traded fund ETF trading. Find the Best Stocks. Your first step is to identify what you need from a broker and pick the broker that best suits your needs. Still have questions? Here you can review a collection of Robinhood reviews from fellow Dogs of the Dow investors. Webull is widely considered one of the best Robinhood alternatives. Fractional shares are portions of full shares. Some investors might prefer to start with a small amount of money, spreading it across multiple companies or funds as an entry point into developing their own trading style and portfolio balance. Data is provided for information purposes only and is not intended for trading purposes. Instead, they can buy just a small slice of their favorite companies or funds a mix of multiple stocks or other securities. Trading fractional shares and full shares on Robinhood is commission-free. You usually receive your dividend payment on the same schedule as investors with full shares, with funds credited directly to your account at the end of the trading day. Remember, diversification and dividend reinvestment programs do not ensure a profit or protect against investment losses in a declining market. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Day's High For a complete explanation of conditions, restrictions, and limitations associated with fractional shares, see our Customer Agreement related to fractional shares. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. So what's a fractional share? So, to be officially recorded as a shareholder entitled to the next quarter's dividend, you must buy a stock two business days before the record date.

How to Start Investing For As Little As 1 Dollar

TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. Buy stock. Reuters is not liable for any errors or delays in content, what are the low cost high rated etfs trade options robinhood for any actions taken in reliance on any content. General Questions. Pros: no trade commissions and functional utilities. Dividends that are paid in foreign currency will not display as pending, and only appear in History after your account has been credited. Read, learn, and compare your options in Common reasons include: The company amends the foreign tax rate. You will generally need to fund a trading account before you can start buying stocks. Upcoming Events T 's fiscal year ends in December. There are many ways an investor can use fractional shares in their portfolio, even if that means only investing a handful of pocket change.

Sometimes we may have to reverse a dividend after you have received payment. They cater to experienced and well-financed traders who want access to multiple financial markets, excellent research and an impressive trading platform. Learn more about how you can invest in dividend stocks, including how to trade, and where you can purchase stocks. Sign up for Robinhood. Video of the Day. Each broker has a different protocol for funding an account, so make sure that you have the resources and manner to fund an account with the broker you wish to use. Fractional Shares of ETFs. Tap Show More. Trailing Stop Order. Your first step is to identify what you need from a broker and pick the broker that best suits your needs. Despite a recent new high, the stock market now looks corrective and could decline further as a result of an economic slowdown, which would, in turn, put pressure on banking industry stocks like Bank of America. Keep in mind, dividends for foreign stocks take additional time to process.

Record Date

These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. More on Stocks. Your email address will not be published. All rights reserved. Even if you just have a single dollar or a fraction of a share to start with, dividend reinvestments may support compounding returns. General Questions. Because of the healthy economic conditions in the United States, Bank of America has seen its deposits grow in all of its sectors. With Dividend Reinvestment, you can automatically reinvest cash dividend payments back into the underlying stock or ETF. Log In. Dividends are a portion of profits which companies sometimes pay to shareholders. This is now available directly through several financial services firms, including Robinhood. Some brokerages like Robinhood allow you to reinvest cash dividend payments back into the underlying stock or ETF. Your first step is to identify what you need from a broker and pick the broker that best suits your needs. Dividends will be paid at the end of the trading day on the designated payment date. Trust Corporation. Finding the right financial advisor that fits your needs doesn't have to be hard. Pre-IPO Trading.

Some investors seek fractional shares as an alternative to buying full shares. Upcoming Events T 's fiscal year ends in December. Learn more about how forex auto trading software reviews macd indicator s&p 500 can invest in dividend stocks, including how to trade, and where you can purchase stocks. Bank of America average deposits. About the Author. Each broker has a different protocol for funding an account, so make sure that you have interactive brokers futures trading requirements top dividend stocks to buy right now resources and manner to fund an account with the broker you wish to use. For our list of the best low commission online brokers, take a look at our exclusive list of Top Dog Brokers. Webull is widely considered one of the best Robinhood alternatives. Looking to learn more? Remember, diversification and dividend reinvestment programs do not ensure a profit or protect against investment losses in a declining market. Here you can review a collection of Robinhood reviews from fellow Dogs of the Dow investors. Pros: no trade commissions and functional utilities. More on Stocks. Buy stock. However, buying a stock just for a dividend can prove costly. Since these shareholders miss out on one of the assets that make a stock valuable, the stock price drops by the amount of the quarterly dividend on the ex-dividend date. There are many ways an investor can use fractional shares in their portfolio, even if that means only investing a handful of pocket change. Despite a recent new high, the stock market now looks corrective and could decline further as a result of an economic slowdown, which would, in turn, put pressure on banking industry stocks like Bank of America. However, the company made another acquisition that proved to be extremely costly both during and after the global financial crisis during that time. You can open demo accounts with as many brokers as you want and make your decision based on their performance. Cons No forex or futures trading Limited account types No margin offered.

Just as an aerospace engineer prizes the integral role played by every nut and bolt, you, too, as an investor, can take ownership in something bigger. Bythey had become a financial giant. Cons Does not support trading in options, test broker forex drawdown strategy forex funds, bonds or OTC stocks. Cons No forex or futures trading Limited account types No margin offered. GAAP vs. Dividends that are paid in foreign currency will not display as pending, and only appear in History after your account has been credited. Learn to Be a Better Investor. Still have questions? These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. However, buying a stock just for a dividend can prove costly. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. Depending on the amount of Bank of America stock that you plan to purchase and the minimum initial deposit required by the broker, the amount you of money need can vary. We may earn a commission when you click on links in this article. These rate changes are determined by the issuer, not by Robinhood. For a complete explanation of conditions, restrictions, and limitations associated with fractional shares, see our Customer Agreement related to fractional shares. Investing with Stocks: The Basics.

The record date is the date that your name needs to be on the company's books as a registered shareholder. Here you can review a collection of Robinhood reviews from fellow Dogs of the Dow investors. They cater to experienced and well-financed traders who want access to multiple financial markets, excellent research and an impressive trading platform. Rather than requiring investors to buy a full share these are sometimes pretty expensive , fractional shares allow investors to purchase smaller portions. Fractional Shares. If you buy a stock the day before the ex-dividend date, you're entitled to the next dividend. Your first step is to identify what you need from a broker and pick the broker that best suits your needs. Shareholders who buy a stock on the ex-dividend date are not entitled to the next dividend payout. TradeStation is for advanced traders who need a comprehensive platform. Benzinga Money is a reader-supported publication. Some brokerages like Robinhood allow you to reinvest cash dividend payments back into the underlying stock or ETF.

Keep in mind, diversification strategies do not ensure a profit and cannot protect against losses in a declining market. Chase You Invest provides that starting point, even if most clients eventually grow out of it. Stop Limit Order. Interested in buying and selling stock? Video of the Day. The dividend you're entitled to when you buy a stock the day before the ex-dividend date will be an ordinary dividend. The correct dividend and payment will show up in the app as paid. One of the potential benefits of owning dividend stocks is that they can add an income component to your investments to complement any possible capital gains. Volume Average Today's volume of 24, shares is on pace to be in-line with T's day average volume of 35, shares. Learn creating trading bot binance day trading forum scalping Be a Better Investor. This often occurs on a quarterly basis, though some companies use different schedules or pay a dividend out of cash reserves. To understand the entire process, you'll have to understand the terms ex-dividend date, record date and payout date. Reuters shall not be liable for any errors or delay in the content, or for any action taken in reliance on any content. You can click or tap on any reversed dividend for more information. Reuters, Reuters Logo and the Sphere Logo are trademarks and registered trademarks of the Reuters Group of companies around the world. Benzinga Money is a reader-supported publication.

Common reasons include: The company amends the foreign tax rate. Canceling a Pending Order. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. John Csiszar has written thousands of articles on financial services based on his extensive experience in the industry. Instead of investing in one company, an ETF can spread your money across multiple assets. Thus, you'll net out a dividend payment that is less than the value of the share price drop of your stock. Pros: their mobile UI is quick and easy to use for the college student on the go. Buy stock. Best For Active traders Intermediate traders Advanced traders. More on Stocks. Some investors might prefer to start with a small amount of money, spreading it across multiple companies or funds as an entry point into developing their own trading style and portfolio balance. Common reasons include:. Read our guide and learn how to buy Bank of America stock today. Because of the healthy economic conditions in the United States, Bank of America has seen its deposits grow in all of its sectors.

Future Outlook for BAC

In the simplest sense, you only need to own a stock for two business days to get a dividend payout. Low-Priced Stocks. By , they had become a financial giant. There are many ways an investor can use fractional shares in their portfolio, even if that means only investing a handful of pocket change. The dividends may be recalled by the DTCC or by the issuing company. Fractional shares are portions of full shares. They cater to experienced and well-financed traders who want access to multiple financial markets, excellent research and an impressive trading platform. Your email address will not be published. Non-GAAP Earnings TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. Instead of investing in one company, an ETF can spread your money across multiple assets. Pros: their mobile UI is quick and easy to use for the college student on the go. We provide you with up-to-date information on the best performing penny stocks. Log In. One of the potential benefits of owning dividend stocks is that they can add an income component to your investments to complement any possible capital gains. This often occurs on a quarterly basis, though some companies use different schedules or pay a dividend out of cash reserves. Tip You need to own a stock for two business days in order to get a dividend payout.

Because of the healthy economic conditions in the United States, Bank of America has seen its deposits grow in all of its sectors. Cons: lacking basic trading features. Buy bitcoin mining contract api access coinbase of the Day. Learn more about how you can invest in dividend stocks, including how to trade, and where you can purchase stocks. Shareholders who buy a stock on the ex-dividend date are not entitled to the next dividend payout. But now, investors can get started sooner, and even with a small budget, can access a wide range of individual stocks and exchange-traded funds. GAAP earnings are the official numbers reported by a company, and non-GAAP earnings are adjusted to be more readable in earnings history and forecasts. Log In. Keep in mind, dividends for foreign stocks take additional time to process. Bank of America average deposits. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. Bank of America is considered a cyclical stock due to its dependence on consumer demand for financial services, which is directly affected by economic conditions and the business cycle. Reuters, Reuters Logo and the Sphere Logo are trademarks and registered trademarks of the Reuters Group of companies around the world. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Pros: ease of use and cost. Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Getting Started. Buying a Stock. One of the potential benefits of owning dividend stocks is that they can add an income component to your investments to complement any possible capital gains.

Fractional Shares of ETFs. Today's volume of 24, shares is on pace to be in-line with T's day average volume of 35, shares. Bythey had become a financial giant. Fractional tot stock dividend top 10 penny stock list are illiquid outside of Robinhood and not transferable. You can click or tap on any reversed dividend for more information. Day's Change Ready to start investing? Keep in mind, diversification strategies do not ensure a profit and cannot protect against losses in a declining market. However, buying a stock just for a dividend can prove costly. If this situation occurs, you will see the reversed dividend in the Dividends section of the app. Selling a Stock. Limit Order. If your intention is simply to purchase Bank of America stock in order to hold it as a long term investment and collect dividends, then you could use a discount or commission-free broker to save on fees, although you would not get any of the extra features and research offered by full-service brokers. For a complete explanation of conditions, hdfc intraday target forex screener app, and limitations associated with fractional shares, see our Customer Agreement related to fractional shares. Tap Show More. Cons: gets kinda cheesy at times and always trying to promote. These stocks can be opportunities for traders who already have an existing strategy to play stocks. Volume Average Today's volume of 24, shares is on pace to be volume indicators on nadex the forex trading pro system course with T's day average volume of 35, shares. Low-Priced Stocks.

To understand the entire process, you'll have to understand the terms ex-dividend date, record date and payout date. Selling a Stock. Instead of investing in one company, an ETF can spread your money across multiple assets. Cons: lacking basic trading features. Thus, you'll net out a dividend payment that is less than the value of the share price drop of your stock. Your email address will not be published. We provide you with up-to-date information on the best performing penny stocks. If your long-term outlook for the U. Tap Dividends on the top of the screen. In addition to his online work, he has published five educational books for young adults. On the other hand, if your economic outlook is less than favorable, then you may consider buying a more defensive stock to better weather the probable upcoming economic downturn with. Why Zacks? The company amends the dividend rate s. So what's a fractional share? The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. Just as an aerospace engineer prizes the integral role played by every nut and bolt, you, too, as an investor, can take ownership in something bigger. Cons: no cons since I am a passive investor and only follow regular financial news. If you have Dividend Reinvestment enabled, you can choose to automatically reinvest the cash from dividend payments back into individual stocks or ETFs. Fractional shares dividend payments will be split based on the fraction of shares owned, then rounded to the nearest penny.

Volume Average Today's volume of 24,, shares is on pace to be in-line with T's day average volume of 35,, shares. Instead of investing in one company, an ETF can spread your money across multiple assets. Cons: gets kinda cheesy at times and always trying to promote itself. Even if you just have a single dollar or a fraction of a share to start with, dividend reinvestments may support compounding returns. The company amends the dividend rate s. The dividends may be recalled by the DTCC or by the issuing company. About the Author. Pre-IPO Trading. Still have questions? Since many brokers offer practice or demo accounts, you can try out more than one online broker to see which trading platform and broker best suit your needs. You can open demo accounts with as many brokers as you want and make your decision based on their performance. If you have Dividend Reinvestment enabled, you can choose to automatically reinvest the cash from dividend payments back into individual stocks or ETFs. Reuters content is the intellectual property of Reuters. You should then be ready to enter a bid either at the market or at the lower price level you think best.