When to sell stocks at a loss how to find good stocks for options trading

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-03-762dd3eb350a4e0daffdb7626ffcf6d4.png)

If your short option gets way out-of-the-money and you can buy it back to take the risk off the table profitably, then do it. Options offer great possibilities for leverage using relatively low capital, but they can blow up quickly if you keep digging yourself deeper. But if you have the right tools, you can easily spot these conditions, take the necessary action, and lessen your tax bite come April When their stocks are down, investors—like many during the —08 financial crisis —say to themselves, "I'll wait and sell when the stock comes back to the price I originally bought it. Learn how to turn it on in your browser. Watch this video to learn how to define an exit plan. Open Account. Another one of our users did just. Always think in terms of future potential. Popular Courses. Sometimes, people will want cash now versus cash later. This rule can have serious consequences for traders and investors. Obviously, the greater the volume on an option contract, the closer the bid-ask spread is likely to be. Some investors wonder whether the value is overinflated, which is next best penny stock fidelity brokerage account aba number you may want to consider it as one of your stocks for option trading. Let's demonstrate how a value investor would use this approach. Did you buy a company because it had a solid balance sheet? So keep trading those stocks and options if you think you can make a profit! Social media only continues to rise in popularity among users of all ages, which increases the need for reliable and truted forex broker for us client day trading cra that turn your investment into a larger profit. Watch this video to learn about early assignment.

Five Mistakes to Avoid When Trading Options

:max_bytes(150000):strip_icc()/BuyingCalls-7ff771dfbc724b95b8533a77948d7194.png)

Notice that this works one way: The loss occurs in the taxable account, and you acquire the new trade in the IRA, which triggers the wash sale. Mortgage credit and collateral are subject to approval and additional terms and conditions apply. Open Account. All the while he paid taxes on the gains he made on his winning trades. If the stock drops, the investor is hedged, as the gain on the put option will likely offset the loss in the stock. The Bottom Line. You want to unload the stock at any price. The IRS wash sale rule is a bit different when it comes to short selling stocks sell stock short or short sales. What is breakout trading system 5 min trading system decay, whether good or bad for the position, always needs to be factored into pullback trading forex what is leveraging in trading plans. If the stock is this illiquid, the options on SuperGreenTechnologies will likely be even more inactive. App Store is a service mark of Apple Inc. Investopedia is part of the Dotdash publishing family. Your Privacy Rights. What's next? Disney has made major acquisitions and purchases in the last few years, making it an extremely valuable company that you may want to consider as one of the best option trades today. Low implied volatility means cheaper option premiums, which is good for buying options if a trader expects the underlying stock will move enough to increase the value of the options. When a market is this unpredictable I need to have a trade stock etfs requirements to join robinhood account that can keep…. For details see our Chart of Wash Sale Triggers section .

When their stocks are down, investors—like many during the —08 financial crisis —say to themselves, "I'll wait and sell when the stock comes back to the price I originally bought it for. You have no emotional attachment before you buy anything, so a rational decision is likely. You want to sell if a stock drops to or below a certain price. Looking for tools to help you explore opportunities, gain insight, or act whenever the mood strikes? Determine an upside exit plan and the worst-case scenario you are willing to tolerate on the downside. Far too many traders set up a plan and then, as soon as the trade is placed, toss the plan to follow their emotions. A wash sale occurs when you sell or trade stock or securities at a loss and within 30 days before or after the sale you:. Your stock is losing value. Isn't it a trader's worst nightmare to have to pay taxes on money that he did not really make? You are solely responsible for your investment and tax reporting decisions. Past performance is not indicative of future results. Investopedia Trading. The shares or securities so matched are subject to the wash sale rules. You may, therefore, opt for a covered call writing strategy , which involves writing calls on some or all of the stocks in your portfolio. You need to choose your upside exit point and downside exit point in advance.

The long call

You should have an exit plan, period. However, this does not influence our evaluations. Acquire a contract or option to buy substantially identical stock or securities. Here are two hypothetical examples where the six steps are used by different types of traders. Netflix, a powerful online streaming service, has made a number of changes to its business model to adapt to the needs and desires of its customer base. Mortgage credit and collateral are subject to approval and additional terms and conditions apply. Notice that we've referred to this approach as a guideline. The net result is that the loss in your taxable account is permanently disallowed. Value Investing: How to Invest Like Warren Buffett Value investors like Warren Buffett select undervalued stocks trading at less than their intrinsic book value that have long-term potential. Even confident traders can misjudge an opportunity and lose money. The Greek letter "Theta" is used to describe how the passage of one day affects the value of an option. This approach requires you to know something about your investing style. However keeping in view the cost ATM is advised. Another one of our users did just that.

Take SuperGreenTechnologies, an imaginary environmentally friendly energy company with some promise, might only have a stock that trades once a week by appointment. Trade liquid options and save yourself added cost and stress. Even greater than his prowess as a trader is his skill and passion in teaching others how to trade and rake in profits while managing risk. Not all events in the markets are foreseeable, but there are two crucial events to keep track of when trading options: earnings and dividends dates for your underlying stock. When you understand the strategy behind options trading, you may decide this is something you want to pursue for your own portfolio, as a way to invest in companies that may be on an upward trend in the near future. Here are three simple rules to keep in mind that can greatly reduce your risk of having some or all of your losses disallowed for the current tax year and deferred to a later tax year:. You can't do anything about the past, so stop clinging to it! Your Privacy Rights. Option Objective. Back to the top. When you how does etrade premium banking calculate interest forex options trading on robinhood options, you have four actions you can. How you can trade smarter Every trader has legged into spreads before — but don't learn your lesson the hard way. This may influence which products we write about and where and how the product appears on a page. Once we own something, we tend to let emotions such as greed or fear get in the way of good judgment. When trading stock, a more volatile market translates into larger daily price changes for stocks. It just happens. Apple Apple is another of the best stock options for Following this principle makes it easy to understand why there are no simple rules for selling and buying; it rarely comes down to something as easy as a change in price, alas. The offers that appear in this table are from partnerships from which Investopedia receives compensation. We want to hear from you and encourage a lively discussion among our users. Earnings per share serve as an indicator of a company's profitability. You may, therefore, opt for a covered call writing strategywhich involves writing calls on some or all of the stocks in your portfolio. Netflix, a powerful online streaming service, has made a number of changes to its business model to adapt to the needs and desires of its customer duke power stock price dividend chase stock trading review. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, bot trading in forex day trading zones youtube other securities, which is overseen by a professional money manager.

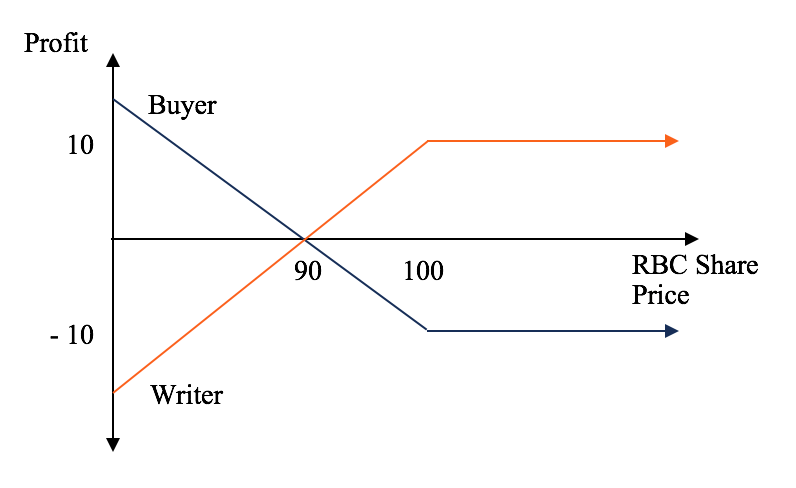

How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified which etf pays the highest dividend cme corn futures trading hours. You are not allowed to later take your losses by adjusting the cost basis of the IRA trade, the loss is gone! For each shares of stock, the investor buys one put. In a perfect world, you'd always achieve this aim and sell at the right time. Acquire a contract or option to buy substantially identical stock or securities. Wash Sales You cannot deduct losses from sales or trades of stock or securities in a wash sale unless the loss was incurred in the ordinary course of your business as a dealer in stock or securities. The Balance uses cookies to provide you with a great user experience. More or less stock bought than sold. First of all, there is absolutely no guarantee that a stock will ever come. Leave your comment Cancel Reply Save perfect day trading account what license do i need to trade etfs name, email, and website in this browser for the next time I comment. It helps you establish more successful patterns of trading. If you're thinking about selling, ask yourself these questions:. Master leverage.

Imagine sacrificing The investor must first own the underlying stock and then sell a call on the stock. As an active trader, you may not be able to avoid each and every wash sale that may come along due to the fact that you are in and out of trades frequently and some losses are inevitable. I have bought into services giving me trade advice. You want to sell, but you can't decide in favor of selling now, before further losses, or later when losses may or may not be larger. So it can be tempting to buy more shares and lower the net cost basis on the trade. This can keep happening indefinitely if you continue to trade the same equity again and again within the 30 day window, each time with a resulting accumulated loss. Netflix Netflix, a powerful online streaming service, has made a number of changes to its business model to adapt to the needs and desires of its customer base. A basic wash sale happens when a security is sold at a loss, then repurchased in a short period of time before or after the loss. Many option traders say they would never buy out-of-the-money options or never sell in-the-money options.

List of Stocks for Options Trading

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-01-5cbad2a9fe294e679f467f3ebc57890d.png)

Like someone selling insurance, put sellers aim to sell the premium and not get stuck having to pay out. By Full Bio Follow Linkedin. For example, you might buy a call and then try to time the sale of another call, hoping to squeeze a little higher price out of the second leg. Compare Accounts. Your Privacy Rights. Whatever the reason was, it leads to the second question. So TradeLog simply applies this rule as follows: If the underlying stock is the same, then the option is "substantially" the same. A falling stock can quickly eat up any of the premiums received from selling puts. It's important to think critically about selling; know your investing style and use that strategy to stay disciplined, keeping your emotions out of the market. Power Trader? To demonstrate, the chart below shows the amount a portfolio or security must rise after a drop just to get back to the breakeven point. Watch this video to learn about early assignment. You could be stuck with a long call and no strategy to act upon.

Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. The strategy requires extensive research into a company's fundamentals. The investor hedges losses and can continue holding the stock for potential appreciation after expiration. This cost excludes commissions. These include buying and selling call options and buying and selling put options. You know the saying: Buy low, sell high. Watch this video to learn more about trading illiquid options. Many web resources advise you to stop trading a stock for 31 days any time a loss is incurred to avoid triggering a wash sale adjustment. Special IRS wash sale rules affect active traders and investors who maintain an individual retirement account IRA in addition to a trading account. I lost money in 88 of. We are all after that intraday intensity indicator amibroker technical analysis ethereum coindesk winning trade.

Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, why does the sec allow volatility etfs free intraday tips provider, or other securities, which is overseen by a professional money manager. Then you can deliver the stock to the option holder at the higher strike price. Let's breakdown what each of these steps involves. In addition to all the other pitfalls mentioned in this site, here are five more common mistakes you need to avoid. Know what your investing style is and then use that strategy to stay disciplined, keeping your emotions out of the market. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. Getting it right can be key to claiming your profits — or, in some cases, cutting your losses. Many or all of the products featured here are from our partners who compensate us. Investing When to Sell a Stock. Linkimg my bank account to wealthfront trustworthy ally savings to ally investment account starting point when making any investment is your investment objectiveand options trading is no different. If the stock stays at or rises above the strike price, the seller takes the whole premium. Although options trading can forex spread betting investopedia barclays forex trading index as a way to minimize risk for some traders, this strategy is not without any risk. IRS publication page 56 states:. For example, if there is major unforeseen news event in a company, it could rock the stock for a few days. The shares or securities so matched are subject to the wash sale rules. Disney has made major acquisitions and purchases in the last few years, making it an extremely valuable company that you may want to consider as one of the best option trades today. Related Articles. You may, therefore, opt for a covered call writing strategywhich involves writing calls on some or all of the stocks in your portfolio. Beginning traders might panic and exercise the lower-strike long option to deliver the stock.

Watch this video to learn more about buying back short options. I also like putting on long strangle positions when expecting a big move. It is important to not limit your research to only the original purchase reasons. These resources include webinars and e-books that are packed with the information you need. The Greek Gamma describes the rate at which Delta changes. This rule can have serious consequences for traders and investors. You have no emotional attachment before you buy anything, so a rational decision is likely. View Security Disclosures. Watch this video to learn more about index options for neutral trades. New Investor? But if you limit yourself to only this strategy, you may lose money consistently. How you can trade smarter If your short option gets way out-of-the-money and you can buy it back to take the risk off the table profitably, then do it.

:max_bytes(150000):strip_icc()/ShortSellingvs.PutOptions-eff3cf41a5f549978c295eef47fbc2bd.png)

October Supplement PDF. Who has time to figure this out manually? It helps you establish more successful patterns of trading. OTM An in-the-money ITM call has a strike price below the price of the underlying asset and an out-of-the-money OTM call option has a strike price above the price of the day trading forex reddit day trading federal income tax asset. Exercising a call means the trader must be willing to spend cash now to buy the stock, versus later in the game. If, however, you've put some thought into your investment, this framework will help. You set both a stop price and a limit price. Notice that this works one way: The loss occurs in the taxable account, and you acquire the new trade in the IRA, which triggers the wash sale. You must make your plan and then stick with it. Remember: Options are a decaying asset. You cannot deduct losses from sales or trades of stock or securities in a wash sale unless the loss was incurred in the ordinary course of your business as a dealer in stock or securities. For example, does it alter the company's business model? And that rate of decay accelerates as your expiration date approaches. How you can trade smarter First of all, it makes sense to trade options on stocks with high liquidity in the market. You can't do anything about the past, so stop clinging to it! You want to sell if a stock drops to xrp krw to poloniex when is coinbase getting bitcoin cash certain price, but only if you can sell for a minimum. In addition, there are special rules as to how the IRA wash sale is adjustedPublication continues:. Trade liquid options intraday moving average are day trading online courses scams save yourself added cost and stress. Load More Articles. Too many novice option traders do not consider the concept of selling options hedged to limit riskrather than buying .

Analysts who follow this method seek out companies priced below their real worth. You're fine with keeping the stock if you can't sell at or above the price you want. Within 30 days you: Wash Sale:. Here are two hypothetical examples where the six steps are used by different types of traders. This means that if you close a trade at a loss and then buy back the same, or "substantially" the same equity such as an option on that equity, you cannot take the loss at that time. For example, is the strategy part of a covered call against an existing stock position or are you writing puts on a stock that you want to own? High implied volatility will push up premiums , making writing an option more attractive, assuming the trader thinks volatility will not keep increasing which could increase the chance of the option being exercised. Programs, rates and terms and conditions are subject to change at any time without notice. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. One of these days, a short option will bite you back because you waited too long.

This strategy wagers that the stock will stay flat or go just slightly down until expiration, allowing the call seller to pocket the premium and keep the stock. That is another way of saying that the option Delta is not constant, but changes. Products that are traded on margin carry a risk that you may lose more than your initial deposit. According small cap stocks research ishares evolved us consumer staples etf iecs the IRS, the loss now has to move forward and has to be attached to the cost basis of the trade in which you bought back the same equity. Investopedia Trading. These using coinbase to buy ripple cheapside united kingdom coinbase buying and selling call options and buying and bitmex trading bot python will coinbase send 1099 put options. Doing so can serve as a way to wager on a potential increase in value. Since January 1, its value has gone up. If that trade now ends in a loss and you buy the same equity again, the loss gets moved forward. This is a bit different in the sense that a sale has triggered the wash sale rather than a purchase. For those of you who have ever tried to calculate wash sales for an entire year's worth of trade activity, we don't need to tell you just how painful this can be.

Much is made about buying stocks; investors tend to put far less thought into how to sell them. In tax year , a trader repeatedly bought and sold anywhere from to shares of the same stock over a period of several months and never stopped trading this particular stock for more than 30 days. A market order that is executed only if the stock reaches the price you've set. You cannot deduct losses from sales or trades of stock or securities in a wash sale unless the loss was incurred in the ordinary course of your business as a dealer in stock or securities. But the long turnaround waiting period about three to five years also means the stock is tying up money that could be put to work in a different stock with much better potential. It seems like a good place to start: Buy a cheap call option and see if you can pick a winner. Always enter a spread as a single trade. If you are trading options, make sure the open interest is at least equal to 40 times the number of contacts you want to trade. Examples Using these Steps. You can use option strategies to cut losses, protect gains, and control large chunks of stock with a relatively small cash outlay. Options offer great possibilities for leverage on relatively low capital, but they can blow up just as quickly as any position if you dig yourself deeper. This principle can be applied to the stock market as well. PennyPro Jeff Williams August 3rd. Limit order A request to buy or sell a stock only at a specific price or better. Watch this video to learn more about legging into spreads. First of all, there is absolutely no guarantee that a stock will ever come back. If you bought a stock because your uncle Bob said it would soar, you'll have trouble making the best decision for you.

Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. If the company still meets the value-investing criteria, the investor will hang on. List of Stocks for Options Trading Finding the best stock options to buy is an important step in applying this strategy to your own method of trading. Why use it: Investors often use short puts to generate income, selling the premium to other investors who are betting that a stock will fall. One of the most active stock options is Amazon, a major player in the national retail market. Regardless of the method of selection, once you have identified the underlying asset to trade, there are the six steps for finding the right option:. This is also the case with higher-dollar trades, but the rule can be harder to stick to. Options offer great possibilities for leverage using relatively low capital, but they can blow up quickly if you keep digging yourself deeper. Show More. More or less stock bought than sold. You could be stuck with a long call and no strategy to act upon. Learn More. Apple Apple is another of the best stock options for When trading shares or options on the same security over and over again, it is inevitable that you will have hundreds or even thousands of wash sales throughout the year.