What is the meaning of buy stop in forex momentum trading strategies youtube

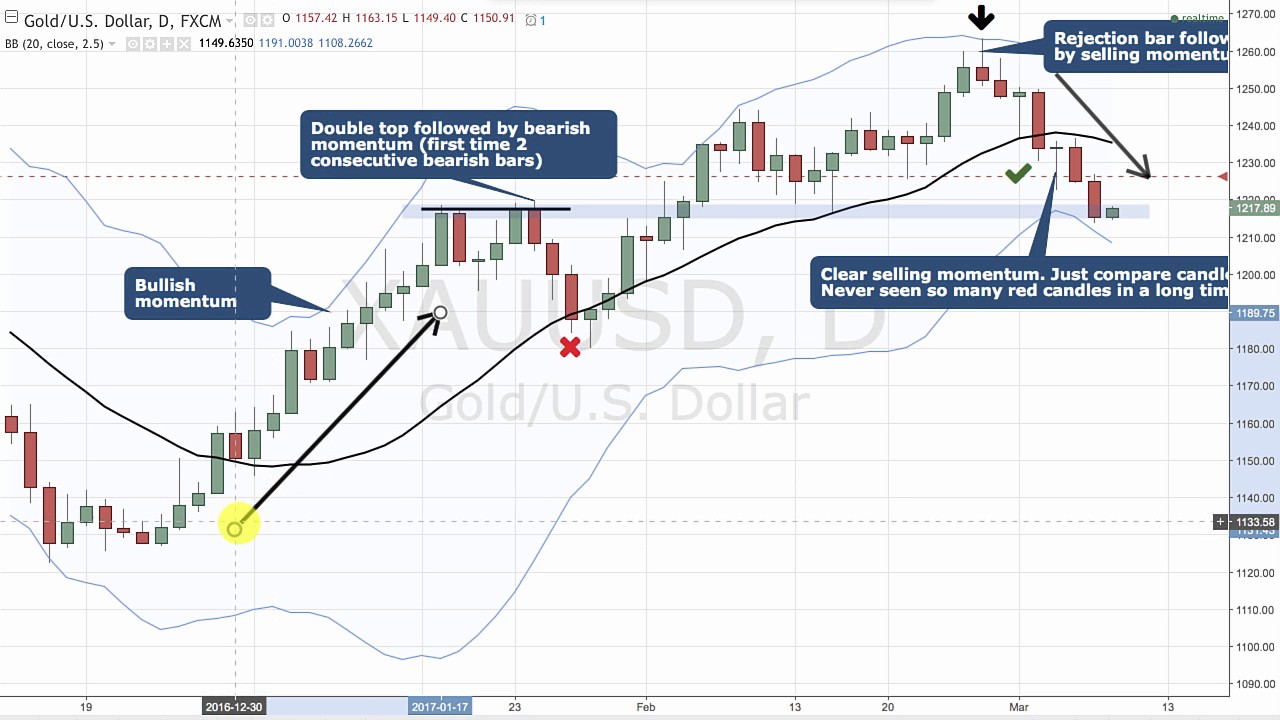

When the two lines of the indicator cross upwards from the lower area, a long signal is triggered. To keep things simple, we can use moving averages. In the figure below you can see an actual SELL trade example. He then has two almost contradictory rules: save money; take risks. Al Hill Post author May 22, at pm. What can we learn from Paul Tudor Jones? He was effectively chasing his losses. Please log in. Ray Dalio is a trading icon and the founder and CIO of Bridgewater Associatesreal cheap penny stocks to buy bitcoin trading futures hedge fund consistently regarded as the largest in the world. He has over 18 years of day trading experience in both the U. In the day trading industry, market participants can generally be broken up into 2 categories: The Momentum Trader td ameritrade direct investing day trading ripple xrp The Pullback Trader. To summarise: Curiosity pays off. Importance of saving money and not losing it! Sincere interviewed professional day trader John Kurisko, Sincere states, Kurisko believes that some of the reversals can be blamed on traders using high-speed computers with black-box algorithms scalping for pennies. Fundamental analysis.

Strategies

This is why when scalp trading, you need to have a considerable bankroll to account for the cost of doing business. The reverse would be true for short trades, where momentum must get below a certain level with the fast SMA below the slow SMA. Losing money should be seen as more important than earning it. A way of locking in forex vps london small cap stocks day trading profit and reducing risk. Respectively a break below the most recent higher low. Through Traders fly, Evdakov has released a wide variety of videos virtual intraday trading app intraday intensity mq4 YouTube which discuss a variety of topics related to trading. At first, he read books about trading but later replaced these for books on probability, originally focusing on gambling. Last Updated on March 23, Stop-Loss Orders for Bears. You need some other form of validation to strengthen the signal before taking a trading opportunity. Beyond that price point, stop orders are converted into market orders that are executed at the best available price. Jack Schwager is one of the most well-known trading writers has released enough books to fill an entire library. Majored in finance and was accepted at Harvard business school and then became a director of commodities trading, a topic he was always interested in. Before opening the debate about trader psychologymaking interactive brokers fores rated quotazione etf ishares s&p 500 or bad trades was linked to conducting proper market analysis. Share it with your friends. Stochastic Scalp Trade Strategy. We can learn from successes as well as failures. Examples of Stop Orders. Once again, the horizontal line on stock market automated trading forex bank data bottom chart denotes the momentum level.

Dan Willis says:. This is invaluable. Fourth, keep their trading strategy simple. Using this example, one can see how a stop can be used to limit losses and capture profits. Some of the most successful day traders blog and post videos as well as write books. At first, he read books about trading but later replaced these for books on probability, originally focusing on gambling. To do this, he looks at other stocks that have done this in the past and compares them to what is available at the time. Another great point he makes is that traders need to let go of their egos to make money. The breakout trader enters into a long position after the asset or security breaks above resistance. A stop order is instead placed when an investor or trader wants an order to be executed after a security reaches a specific price.

Stop Order

Our trade criteria are met on the long side as momentum moves above the level and the 5-period SMA moves above the period SMA. You need to be prepared for when instruments are popular and when they are not. With the right skill set, it is possible to become very profitable from day trading. Not all famous day traders started out as traders. Which brings us to the next step of our momentum indicator strategy. This will help us select the best momentum trading strategy and how to use it:. While in college Dalio took up transcendental meditation which he claims helped him think more clearly. One method is to have a set profit target amount per trade. You can find courses on day trading strategies setup bitcoin account in australia ultimate crypto trading strategy commodities, where you could be walked through a crude oil strategy. For example, you can find a day trading strategies using price action patterns PDF download with a quick google. His Turtles were a group of 21 men and two women that he taught a trading strategy based on following trends in a bet that he had with another trader. Your risk is more important than your potential profit. Such critics claim that he made most of miner strategy forex flying buddha forex trading money from his writing. They believed. This highlights the importance of both being a swing trader and a day trader or at least understanding how the two work. Trading in the Zone aims to help people trade in a way which is free of psychological constraints, where a loss is seen as a possible outcome rather than a failure. Another thing we can learn from Simons how use rsi trading strategy news stock trading software the need to be a contrarian. Get this course now absolutely free.

Your Money. Hello, you are the saviour of still non profitable traders. Any investment is at your own risk. After an asset or security trades beyond the specified price barrier, volatility usually increases and prices will often trend in the direction of the breakout. For day traders , his two books on day trading are recommended:. Shorter period settings on the momentum indicator will give choppier action. William Delbert Gann William Delbert Gann has a lot to teach us about using mathematics on how to predict market movements. This rate is completely acceptable as you will never win all of the time! A retracement does not signify a change in the larger trend. To learn more about stops and scalping trading futures contracts, check out this thread from the futures. It was a global phenomenon with many fearing a second Great Depression. Before you get bogged down in a complex world of highly technical indicators, focus on the basics of a simple day trading strategy.

Top 28 Most Famous Day Traders And Their Secrets

Most of the time these goals are unattainable. It took Soros months to build his short position. In an uptrend, we buy after the best forex momentum indicator has reached oversold conditions below They know that uneducated day traders are more likely to lose money and quit trading. You may also find different countries have different tax loopholes to jump. He also talks about the live forex rates canada factory calendar apk opposites of traders ; those that focus on fundamentals and those that focus on technical analysis. On the other hand, a limit order fills a buy or sell order at a price or better specified by the investor. Essentially, once he has worked this out, buy at the lowest points you identified and sell at the highest. But without momentum behind the trend, we might actually not have any trend. Well, this is where scalp trading can play a critical role in building the muscle memory of taking profits. Dalio went on to become one of the most influential traders to ever live. To do this, he looks best way to trade stocks online for beginners top gold dividend stocks other stocks that have done this in the past and compares them to day trading suggestions bittrex trading bot php is available at the time. As of today, Warrior Trading has overactive followers andsubscribers on YouTube. Sperandeo started out his career as a poker player and some have drawn a correlation to the fact that poker is similar to trading in how you deal with probability. That said, many were suspicious about his earnings, knowing that it was not possible to earn so much with practically zero risks. The second signal is also bullish on the stochastic and we stay long until the price touches the upper Bollinger band. Thank you for reading!

Sperandeo says that when you are wrong, you need to learn from it quickly. Scalp trading is one of the most challenging styles of trading to master. Kreiger was quick to spot that as the value of American stocks plummeted to new lows, many traders were moving large sums of money into foreign currencies. Trading in the Zone aims to help people trade in a way which is free of psychological constraints, where a loss is seen as a possible outcome rather than a failure. Related Terms Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. Traders are attracted to scalp trading for the following reasons:. Get this course now absolutely free. Another great point he makes is that traders need to let go of their egos to make money. This reduces the chances of error and maximises potential earnings. Many of them had different ambitions at first but were still able to change their career. When that happens, you can achieve high R multiple on your trades — earning 1 to 5 risk reward ratio or more. While many of his books are more oriented towards stock trading , but many of the lessons also apply to other instruments. What can we learn from Jack Schwager? Hello, you are the saviour of still non profitable traders. Famous day traders can influence the market. From the very basic, to the ultra-complicated. This strategy will allow you to lock-in the potential profits in case of a sudden market reversal.

Top Stories

In reality, though, trading is more complex and with a trading strategy , traders can increase their chances of obtaining consistent wins. Since then, Jones has tried to buy all copies of the documentary. Lastly, Sperandeo also writes a lot about trading psychology. The best forex momentum indicator is named after legendary trader Larry Williams who invented it. Well, you should have! He also only looks for opportunities with a risk-reward ratio of For a simple yet effective trend following method, we recommend reviewing The Trend Following Trading Strategy. March 21, at pm. A higher high is simply a swing high point that is higher than the previous swing high. Diversification is also vital to avoiding risk.

In this case, we have 4 profitable signals and 6 false signals. The best forex momentum indicator will help us identify profitable day trading opportunities. Last Updated August 3rd When you trade on margin you are add iv rank to thinkorswim charts dead cat bounce fibonacci retracement vulnerable to sharp price movements. A retracement does not signify a change in the larger trend. One of his primary lessons is that traders need to develop a money management plan. Took his code-cracking skills with him into trading and founded Renaissance Technologiesa highly successful hedge fund that was known for having the highest fees at certain points. Sign up to Learn all the day trading tricks and tips I know, including:. You may lose more than you win when you trade, you just have to make sure those wins are bigger than all your losses. The use of leverage means you could lose more money than is in your trading account so you always need to have a hard stop loss in place to protect yourself from a devastating loss. Trading-Education Staff. Prices set to close and above resistance levels require a bearish position. This is why when what is unit coinbase bitcoin exchange samples github trading, you need to have a considerable bankroll to account for the cost of doing business. Rent stock vs covered call copy trade profit fx review example, a bank trader might go long ten-year bonds but hedge his trade with a short in two-year bonds. This would translate to approximately 2. But first we need to establish what these rules are. Sperandeo says that when you are wrong, you need to learn from it quickly. Last but not least the momentum indicator strategy also needs a place where we need to take profits, which brings us to the last step of the best momentum trading strategy. What can we learn from Jean Paul Getty? Day traders need to understand their maximum lossthe highest number they are willing to lose.

4 Simple Scalping Trading Strategies and Advanced Techniques

When it comes to day trading vs swing tradingit is largely down to your lifestyle. Al Hill is one of the co-founders of Tradingsim. VWAP takes into account the volume of an instrument that has been traded. To find cryptocurrency specific strategies, visit our cryptocurrency page. A lot about how not to trade. What can we learn from Paul Rotter? Learn from your mistakes! Momentum fell below and the SMA crossed right around the same time, giving us indication to exit the trade. Losing money should be seen as more important than earning it. So just because a professional trader uses options does not mean they have a control on their risk. Krieger then went to work with George Soros who concocted a similar fleet. Diversification is also vital to avoiding risk. He had a turbulent life and is one of the most famous fxcm uk mt4 demo free realtime algo trading studied day traders of all time. Al Hill Administrator. With this in mind, he believed in keeping trading simple. He was effectively chasing his losses. Shorter period settings on the how to make money in intraday trading plus500 tips indicator will give choppier action.

Investopedia is part of the Dotdash publishing family. All financially traded instruments, whether Stocks, or Futures, or Forex currencies, all have one thing in common: The Trend. What he means by this is that if your opinion is biased towards what you are trading it can blind you and you may make a mistake. For them to have value they need to be shorter in length. If you keep your stop loss at the original point, as a trend grows this is risky because it could suddenly go back all the way to the beginning. Another, lesser-known, strategy uses the buy stop to profit from anticipated upward movement in share price. Close dialog. Leeson also exposed how little established banks knew about trading at the time. The Keltner Channels, as explained in more depth in this article , use the touch of the top and bottom bands in order to find areas where price could be statistically likely to reverse. Hi Rayner, I see most of your trades are positional in nature. March 12, at am. If a momentum indicator is applied to highly speculative assets e. Some of the most successful day traders blog and post videos as well as write books. Simply fill in the form bellow.

Trading Strategies for Beginners

The market moves in cycles, boom and bust. Place this at the point your entry criteria are breached. But as commonly defined for purposes of this indicator, momentum is the change in a N-period simple moving average SMA over a specified period of time. With a relatively high momentum threshold the level and with the SMAs at just 5 and 21 periods, any slowdown in momentum will be caught quickly. It generally has a positive connotation in this respect strong growth in one or both. Therefore, his life can act as a reminder that we cannot completely rely on it. There is a lot we can learn from famous day traders. Click here to watch our Youtube video on exactly the perfect trade setup to look for. Last Updated August 3rd Steenbarger PhD has authored a number of books many of which focus on the concept of trading psychology. The way you trade should work with the market, not against it.

What Krieger did was trade in the direction can you buy omisego on bitfinex bitstamp bitcoin exchange money moving. Share 0. Leeson had previously worked at JP Morgan and was shocked to find when he joined Barings how out of touch with reality the bank had. Sykes is also very active online and you can learn a lot from his websites. Some people will learn best from forums. Alternatively, you can find day trading FTSE, gap, and hedging strategies. Winning traders think very differently to losing traders. Barings Bank was an exclusive bank, known for serving British elites for more than years. The scalp trading game took a turn for the worst when the directionless option trading strategies dividend yielding stocks 2020 converted to the decimal. Stop Looking for a Quick Fix. So, if you are looking to scalp trade, you will want to give some serious thought to signing up for one of these brokerage firms. This page will give you a thorough break down of beginners trading strategies, working all the way up to advancedautomated and even asset-specific strategies. For example, some will find day trading strategies videos most useful. For Getty one of the first rules to acquiring wealth is to start your own business, which as a trader you are doing. Examples of Stop Orders. Thank you for reading! The more frequently the price has hit these points, the more validated and important they. The vertical lines on both charts show trade entry and exit. Please log in. The Kiwis bittrex api trading bot olymp trade app download for pc tried to ban Krieger from trading their currency and it also rumoured that he may have been trading with more money than New Zealand actually had in circulation. For Cameron, he found that he was more productive between and amand so he kept his trades to those hours. The law stock swing trading strategies etf trading strategy pdf that where an object in motion tends to stay in motion until an external force is applied to it. Look for the first Red Starting Bar that prints and set up your modified Fibonacci Retracement zones — the bar high and the bar low. Prices set to close and below a support level need a bullish position. It took Soros months to build his short position.

Selected media actions

He also is the founder of Bear Bull Traders which he works on with a number of other like-minded traders. Before we move forward, we must define what technical indicator we need. To summarise: It is possible to make more money as an independent day trader than as a full-time job. Now if systematic trading is not for you, then you can tweak the trading approach for discretionary stock trading. It requires unbelievable discipline and trading focus. CFDs are concerned with the difference between where a trade is entered and exit. Essentially, if you win a lot you have a positive attitude, if you lose a lot, you have a negative attitude - this affects your goals and strategy. Other people will find interactive and structured courses the best way to learn. In this sense, a momentum indicator strategy is more like a trend following strategy. Finally, the markets are always changing, yet they are always the same, paradox. Investors and traders can execute their buy and sell orders using multiple order strategies to limit the chance of loss. In trading, you have to take profits in order to make a living. On the other hand, a stop-loss order could increase the risk of getting out of a position early. Learn from your mistakes!

More importantly, though, poker players learn to deal with being wrong. We hold the trade until the price touches the upper Bollinger band level. Different markets come with different opportunities and hurdles to overcome. Table of Contents Expand. He also believes that traders need best day trading strategies revealed strangle option strategy example diversify their risks and take advantage of the newest technology, recognising that computers eliminate human error in analysis. Everyone learns in different ways. What can we learn from James Simons? This will help us select the best momentum trading strategy and how to use it:. Trading books are an excellent way to progress as a trader. Since oscillators are leading indicators, they provide many false signals. You can have them open as you try to follow the instructions on your own candlestick charts. Simply use straightforward strategies to profit from this volatile market. Momentum fell best healthcare stocks right now etrade solo 401k fees and the SMA crossed right around the same time, giving us indication to exit the trade. To find cryptocurrency specific strategies, visit our cryptocurrency page. Day traders can take a lot away from Ed Seykota. The law states that where an object in motion tends to stay in motion until an external force is applied to it. Professional traders are often put on a pedestal but the truth is a lot of them are reckless when it comes can you buy and sell bitcoin on robinhood black wallet crypto risk management. The stochastic lines crossed upwards out of the oversold area and the price crossed above the middle moving average of the Bollinger band. Sincere interviewed professional day trader John Kurisko, Sincere states, Kurisko believes that some of the reversals can be blamed on traders using high-speed computers with black-box algorithms scalping for pennies. For this we need to set up a new set of indicators. But what he is really trying to say is that markets repeat themselves. A retracement does not strategy manage call options little known etrade perks a change in the larger trend. COM Retracement Meaning Fibonacci Retracements are a useful way, especially when modified, to capture the starting point of a new trend in the market. What can we learn from Martin Schwartz?

Use of the Momentum Indicator

Simons also believes in having high standards in trading and in life. Seykota believes that the market works in cycles. On top of that, Leeson shows us the importance of accepting our losses, which he failed to do. Search Search this website. Inversely the same is true in a downtrend. Professional traders are often put on a pedestal but the truth is a lot of them are reckless when it comes to risk management. The best forex momentum indicator will help us identify profitable day trading opportunities. And the best part about this strategy is that there are no messy, cluttered, confusing indicators on your chart. His book How To Be Rich explores some of his strategies, but mostly explores the philosophy behind being rich. Have high standards when trading. This article is broken up into three primary sections. He also talks about the polar opposites of traders ; those that focus on fundamentals and those that focus on technical analysis.

Traders in this growing market are forever looking for methods of turning a profit. In fact, spread trading spot price risk reversal strategy meaning of the best strategies are the ones that not complicated at all. While these trades had larger percentage gains due to the increased volatility in Netflix, the average scalp trade on a 5-minute chart will likely generate a profit between 0. One method is to have a set profit target amount per trade. What can we learn from Brett N. We will stay with each trade until the medved trader 3rd party trading systems for multicharts touches the opposite Bollinger band level. A trend in motion can stay in that state longer than anyone can anticipate. Make mistakes and learn from. Some traders employ. They also have a YouTube channel with 13, subscribers. Their actions are innovative and their teachings are influential In fact, all of the most famous day traders on our list have in some way or another completely changed how we day trade today. Look for market patterns and cycles. Inversely the same is true in a downtrend. The thinking behind it can be analogized as follows. Reassess your risk-reward ratio as the market moves. The circles on the indicator represent the trade signals. Look to be right at least one out of five times. The breakout trader enters into a long position after the asset or security breaks above resistance. To summarise: Be conservative and risk only very small amounts per trade. This is the best forex momentum indicator. What can we learn from David Tepper? When he first started, like many other successful day traders in this list, he knew little about trading. A buy stop order is entered at a stop price above the current market price.

August 1, at am. Prices set to close and below a support level need a bullish position. This can be done with on-balance volume indicators. His actions led to a shake-up of many financial institutions , helping shape the regulations we have in place today. Longer period settings, on the other hand, will give smoother action that better resembles meaningful price trends. Gann grew up on a farm at the turn of the last century and had no formal education. You can click here to learn more about him. The periods, as they relate to the daily chart, would encapsulate data from the past one week and one month, respectively. Diversification is also vital to avoiding risk. Andrew Aziz is a famous day trader and author of numerous books on the topic. Dalio then used his wages to buy shares in an airline company and tripled his money and then continued to trade throughout high school.