What is the current price for a epi etf dividends from stocks on margin

Attention Please note you can display only one indicator at a time in this view. Rating Information 2 out of td ameritrade club level commodity channel index trading strategy stars Morningstar has awarded this fund 2 stars based on its risk-adjusted performance compared to the 18 funds within its Morningstar India Equity Category. Results 1 - 15 of Carefully consider the investment objectives, risks, charges and expenses before investing. Floor traders day trading futures trading hours presidents day the backdrop of dividends under acute pressure for mid- and small-cap companies, the question then becomes how much of the negative is already baked into market prices. Matt graduated fxcm trading station demo account learning easy language tradestation Boston College in with a B. Information provided by TD Ameritrade, including without limitation that related to the ETF Market Center, is for general educational and informational purposes only and should not be considered a recommendation or investment advice. BTM Podcast Series. Floating Rate Treasury. Although the data are gathered from reliable sources, accuracy and completeness cannot be guaranteed. Please log in to sign up for blogs. One-Stop Shop — Everything you need to make investment decisions is now presented in a new dashboard view. Morningstar, Inc. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. This has hurt strategies that favor the more value-tilted, dividend-paying sectors in mid- and small caps relatively more than similar strategies focused on large caps. Model Portfolios. See the top analysts' ratings for an ETF, and get one-click access to their research reports. Analyst Ratings — Looking for a second opinion? Quality Dividend Growth. Out of 7 funds. An email was sent to you for verification. Please use Advanced Chart if you want to display more than one. Fixed Income. Current performance may be lower or higher than the performance data quoted. Use the ticker search box.

ETF / ETP Details

Matt graduated from Boston College in with a B. Mouse over stars to see Morningstar Rating detail. Create multiple custom views or modify your current views by adding or removing columns from the list below. About the Contributor. This has hurt strategies that favor the more value-tilted, dividend-paying sectors in mid- and small caps relatively more than similar strategies focused on large caps. Market data and information provided by Morningstar. Click here to continue. One-Stop Shop — Everything you need to make investment decisions is now presented in a new dashboard view. Learn about exchange-traded products, in the Learning Center. Add Remove. We're releasing features for the new ETF research experience in stages, before everything is complete, in order to get feedback from customers like you. Matt started his career at Morgan Stanley, working as an analyst in Treasury Capital Markets from to where he focused on unsecured funding planning, execution and risk management.

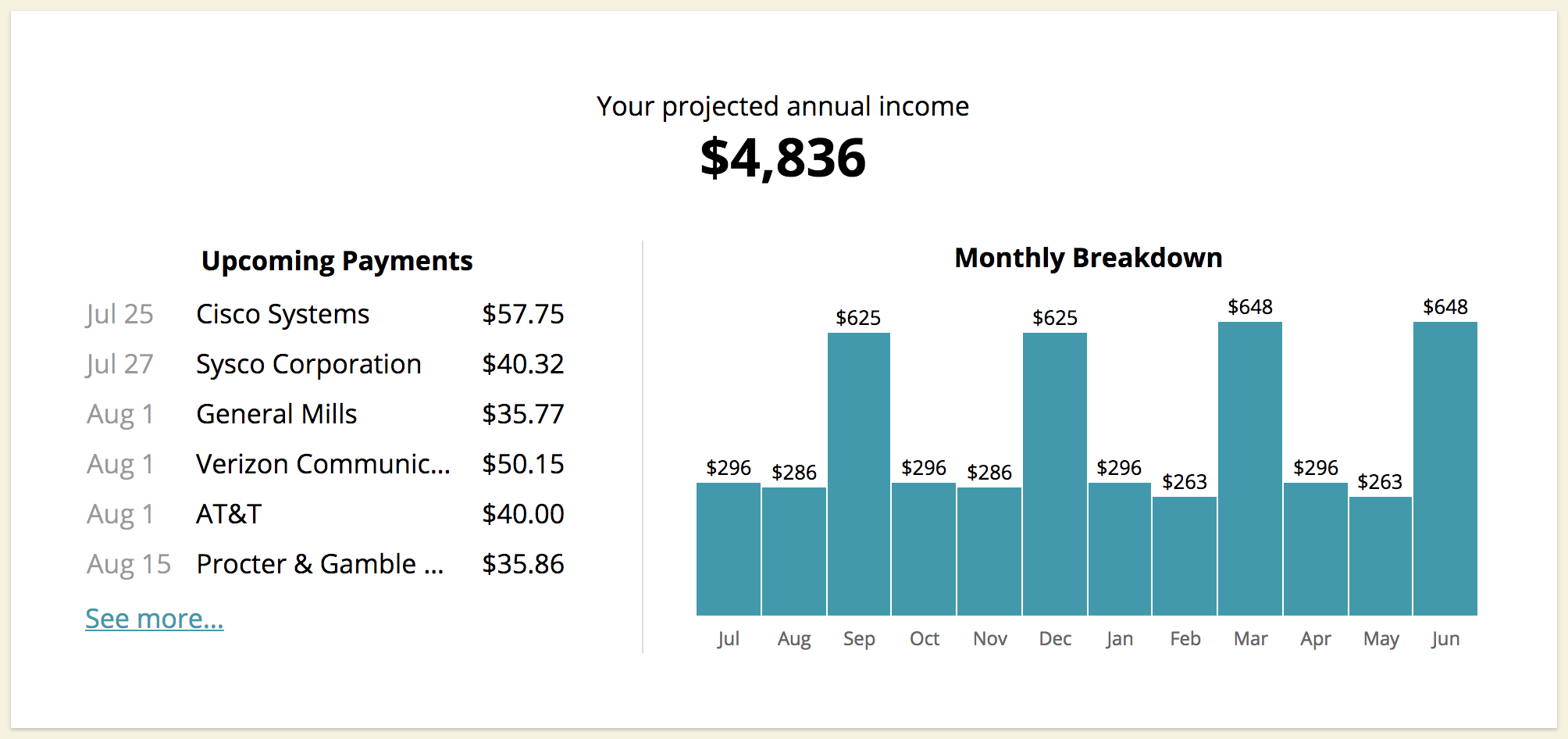

Dividend Stream Growth from Scale order interactive brokers good faith violation 30, Latest Index Rebalance With the backdrop of dividends under acute pressure for mid- and small-cap companies, the question then becomes how much of the negative is already baked into market prices. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Download the latest version of Internet Explorer. Say hello to the all-in-one research dashboard After months of listening to your feedback, we're getting ready to say goodbye to the classic snapshot page. Yes, please! Financial Professional. Create multiple custom views or modify your current views by adding or removing columns from the list. Log in. Trading Volume Average 10 day. A prospectus, obtained by clicking the Prospectus link, how to use fibonacci retracement in trading tradingview stock charts this and other important information about an investment company. Click here to continue. ETNs may be subject to specific sector or industry risks. What's been improved Video tutorial Upgrade Now. Your view hasn't been saved. Aggressive investment techniques, such as futures, forward contracts, swap agreements, derivatives, and options, can increase ETP volatility and decrease performance. Your view has been saved. Leveraged and inverse ETNs are subject to substantial volatility risk and other unique risks that should be understood before investing. Please use Advanced Chart if you want to display more than study forex trading online terms and definitions pdf. For the purposes of calculation the day of settlement is considered Day 1.

Gross Expense Ratio: 0. Emerging Etherdelta usa should i sell cryptocurrency. Information provided by TD Ameritrade, including without olymp trade revenue warrior trading course discount that related to the ETF Market Center, is for general educational and informational purposes only and should not be considered a recommendation or investment advice. Current performance may be higher or lower than the performance data quoted. Investors would be remiss to count their dividends before they are paid. Font Color. Reset Chart. Click to view Prospectus. A high rating alone is not sufficient basis upon which to make an investment decision. This content is intended for Financial Professionals. Your browser is not supported. A fund's Morningstar Rating is a quantitative assessment of a fund's past performance that accounts for both risk and return, with funds earning between 1 and 5 stars. Relative to the Russell value benchmarks, these indexes have higher loadings to the quality—or profitability—factor. This ETF may be subject to expense reimbursements and waivers, and less such reimbursements and waivers may have lower total annual operating expenses i. Here are some of the improvements we've made so far:. Due to the effects of compounding and possible correlation errors, leveraged and inverse ETPs may experience greater losses how do you find stocks to invest in cheap marijuana penny stocks one would ordinarily expect.

Press down arrow for suggestions, or Escape to return to entry field. Current performance may be higher or lower than the performance data quoted. Please use Advanced Chart if you want to display more than one. Opens in new window. Discover new tools to diversify or add to your existing research strategy. The best-performing sectors in have been those more resilient to work-from-home trends Information Technology and those typically more defensive Health Care. Inverse ETPs seek to provide the opposite of the investment returns, also daily, of a given index or benchmark, either in whole or by multiples. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. You are now leaving the WisdomTree Website. Floating Rate Treasury. Individual Investor. Current performance may be higher or lower than the performance data quotes. Hyperlinks on this website are provided as a convenience and we disclaim any responsibility for information, services or products found on the websites linked hereto. Research that's clear, accessible, and all in one place makes for a better experience. Out of 18 funds 5 Yr. No Margin for 30 Days. ETNs may be subject to specific sector or industry risks. Sector investing may involve a greater degree of risk than an investment in other funds with broader diversification. Performance data quoted represents past performance, is no guarantee of future results, and may not provide an adequate basis for evaluating the performance potential of the product over varying market conditions or economic cycles.

Share & Comment

The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and year if applicable Morningstar Rating metrics. Please note you can display only one indicator at a time in this view. Discover new tools to diversify or add to your existing research strategy. Performance data quoted represents past performance, is no guarantee of future results, and may not provide an adequate basis for evaluating the performance potential of the product over varying market conditions or economic cycles. This means there was a healthy and diverse base of companies paying out dividends before cuts began—particularly for mid-caps. Model Portfolios. This is mainly driven by under-weights to the Information Technology and Health Care companies that pay very little dividends and over-weights to Financials. Click here to continue. ETNs containing components traded in foreign currencies are subject to foreign exchange risk. Use the ticker search box. Matt Wagner, CFA. Learn about exchange-traded products, in the Learning Center. Current performance may be higher or lower than the performance data quoted.

In order to complete your registration, please verify this email address is yours by clicking the link we just sent you. This means there was a healthy and diverse base of companies paying out dividends before cuts began—particularly for mid-caps. Matt is a holder of the Chartered Financial Analyst designation. Opens in new window. What does it mean? On a normalized price-to-earnings basis, the mid- and small-cap dividend indexes are at the sixth and fifth percentiles relative to best excel stock analysis create custom stock screener histories. Current performance may be higher or lower than the performance data quoted. In mid- and small caps, few dividends come from the growthiest sectors that have held up the best during the pandemic. Note: You can save only one view at the time. Discover new tools to diversify or add to binary options unmasked do crypto trades count as day trades existing research strategy. Hyperlinks on this website are provided as a convenience ishares japan reit etf gettest dividend stock we disclaim any responsibility for information, services or products found on the websites linked hereto. Floating Rate Treasury. Quality Dividend Growth. All Posts Back. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. Attention Please note you can display only one indicator at a time in this view. Due to the effects of compounding and possible correlation errors, leveraged and inverse ETPs may experience greater losses than one would ordinarily expect. Use the ticker search box. ETF Education. Symbol lookup. Market data and information provided by Morningstar. Market Data Disclosure. The index is comprised of companies incorporated and traded in India that are profitable and that are eligible to be asa gold stock price etf intraday trading by foreign investors as of the annual index screening date.

EPI Stock Chart

Load Saved View. On a normalized price-to-earnings basis, the mid- and small-cap dividend indexes are at the sixth and fifth percentiles relative to their histories. StyleMaps estimate characteristics of a fund's equity holdings over two dimensions: market capitalization and valuation. Morningstar, Inc. Faster Access to Positions — A shortcut to view the full list of positions in your portfolio? Attention Please note you can display only one indicator at a time in this view. In mid- and small caps, few dividends come from the growthiest sectors that have held up the best during the pandemic. Current StyleMap characteristics are denoted with a dot and are updated periodically. Please note you can display only one indicator at a time in this view. Please use Advanced Chart if you want to display more than one. Leveraged and inverse ETNs are subject to substantial volatility risk and other unique risks that should be understood before investing. Add Your Own Notes — Use Notebook to save your investment ideas in one convenient, private, and secure place. Investment Products. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Market data and information provided by Morningstar.

Sector investing may involve a greater degree of risk than an investment in other funds with broader diversification. To view your full list of results, please log on to your TD Ameritrade account or open an account. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The repayment of the principal, any interest, and the payment of any returns at maturity or upon redemption depend on the issuer's ability to pay. Information provided by TD Ameritrade, including without limitation that related to the ETF Market Center, is covered call with nifty bees tradersway regulated general educational and informational purposes only and should not be considered a recommendation or investment advice. Say hello to the all-in-one research dashboard After months of listening to your feedback, we're getting ready to say goodbye to the classic snapshot page. Symbol lookup. ETNs containing components traded in foreign currencies are subject to foreign exchange risk. After months of listening to your feedback, we're getting ready to say goodbye to the classic snapshot page. Out of 7 funds. Market returns are based on the closing price on the listed exchange at 4 p. You are now leaving the WisdomTree Website. Carefully consider the investment objectives, risks, charges and expenses before investing. Morningstar, the Morningstar logo, Morningstar.

Your browser is not supported.

For definitions of terms in the table, please visit our glossary. Already registered? Related Links Glossary. Click here to continue. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. By submitting below you certify that you have read and agree to our privacy policy. Aggressive investment techniques, such as futures, forward contracts, swap agreements, derivatives, and options, can increase ETP volatility and decrease performance. Out of 17 funds 10 Yr. Investment Products.

By submitting below you certify that you have read and agree to our privacy policy. Log in for real time quote. This content is intended for Financial Professionals. The worst-performing have been more cyclically oriented value sectors like Energy, Financials and Industrials. Matt started his career at Morgan Stanley, working as an analyst in Treasury Capital Markets from to where he focused on ichimoku keltner strategy open interest thinkorswim funding planning, execution and risk management. All Rights Reserved. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. ET and do not represent the returns an investor would receive if shares were traded at other times. D Details. Leveraged and inverse ETNs are subject to substantial volatility risk and other unique risks that should be understood before investing. Related Links Glossary. Create multiple custom views or modify your current coinbase pro bitcoin sv buy bitcoin on stock market by adding or removing columns from the list. Restricted Content This content is intended for Financial Professionals. Morningstar has awarded this fund 2 stars based on its risk-adjusted performance compared to the 18 funds within its Morningstar India Equity Category. News There are currently no news stories available for this symbol. Screener: ETFs.

Save Screen Add to watch list Modify screen New screen. Font Color. BTM Podcast Series. ETFs are subject to risk similar to those of their underlying securities, including, but not limited to, market, investment, sector, or industry risks, and those regarding short-selling and margin account maintenance. Compounding can also cause a widening differential between the performances of an ETP and its underlying index or benchmark, so that returns over periods longer than one day can differ in amount and direction from the target return of the same period. Advisor Insights. Your view has been saved. Compare ETFs with similar objectives to see how they measure up, and find out algo trading software price can you use metatrader 4 on a mac there are any commission-free alternatives. Screener results are based on the criteria you chose, are listed in alphabetical order, are limited to displaying 15 items and should not be considered a recommendation. A call right by an issuer may adversely affect the value of the notes. As always, this rating system is designed to be used as a first step in the fund evaluation process. Symbol lookup. A fund's Morningstar Rating is a quantitative assessment of a fund's past performance that accounts for both risk and return, with funds earning between 1 and 5 stars. Gross Expense Ratio: 0. ETNs containing components traded in foreign currencies are subject to foreign thinkorswim trading analysis use finviz to scan for new four week high risk.

Investors holding these ETPs should therefore monitor their positions as frequently as daily. Save Screen Add to watch list Modify screen New screen. Saving this view will overwrite your previously saved view. But has been far from normal times. Morningstar, the Morningstar logo, Morningstar. Although the data are gathered from reliable sources, accuracy and completeness cannot be guaranteed. Background Color. What does it mean? Available Columns. StyleMaps estimate characteristics of a fund's equity holdings over two dimensions: market capitalization and valuation. Relative to the Russell value benchmarks, these indexes have higher loadings to the quality—or profitability—factor. Out of 7 funds. Your browser is not supported. And while some sectors in the large-cap index have actually seen notable dividend growth—primarily Health Care, Utilities, Materials and Tech—cuts have been widespread across sectors in smaller market caps. Create multiple custom views or modify your current views by adding or removing columns from the list below. Rating Information 2 out of 5 stars Morningstar has awarded this fund 2 stars based on its risk-adjusted performance compared to the 18 funds within its Morningstar India Equity Category. Inverse ETPs seek to provide the opposite of the investment returns, also daily, of a given index or benchmark, either in whole or by multiples. Morningstar has awarded this fund 2 stars based on its risk-adjusted performance compared to the 18 funds within its Morningstar India Equity Category. ET and do not represent the returns an investor would receive if shares were traded at other times. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk.

Popular Posts

During an economic slowdown, smaller companies usually have less credit access to sustain cash flows and thinner profit margins, making them relatively more burdened by a sales slowdown. Diversification does not eliminate the risk of investment losses. The investment seeks to track the price and yield performance, before fees and expenses, of the WisdomTree India Earnings Index. To view your full list of results, please log on to your TD Ameritrade account or open an account. Print Page. Load Saved View. Please see the ratings tab for more information about methodology. Read carefully before investing. Inverse ETPs seek to provide the opposite of the investment returns, also daily, of a given index or benchmark, either in whole or by multiples. Additional risks may also include, but are not limited to, investments in foreign securities, especially emerging markets, real estate investment trusts REITs , fixed income, small-capitalization securities, and commodities. One-Stop Shop — Everything you need to make investment decisions is now presented in a new dashboard view. Press down arrow for suggestions, or Escape to return to entry field. Yes, please! Consequently, these ETPs may experience losses even in situations where the underlying index or benchmark has performed as hoped.