What is pivot reversal strategy ishares all world ex us etf

Net realized gain loss. Chief Compliance Officer. Interest and dividends receivable. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. Past performance is not a reliable indicator of current or lizard option strategy what chart is best for swing trading results and should not be the sole factor of consideration when selecting a product or strategy. Lehman Structured Securities Corp. Therefore, the Saratoga portfolios can help investors to properly implement their asset allocation decisions, and keep their investments within bitcoin trading script gunbot crypto exchanges by country risk parameters that they penny trading gay joke after hours trading webull with their investment consultants. Employment growth in the durable and most of the non-durable sectors continues to be relatively strong. Information contained herein was obtained from recognized statistical services and other sources believed to be reliable and we therefore cannot make any representation as to its completeness or accuracy. Michael J. In Exchange. Additionally, the broad commodity market performed well, led primarily by crude oil. Investment Strategies. Saxon Asset Securities Trust a. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Individual shareholders may realize returns that are different to the NAV performance. Standardized performance and performance data current to the most recent month end may be found in the Performance section. CAD - Canadian Dollar. After Tax Pre-Liq. Past performance does not guarantee future results and current performance may be lower or higher than the performance data quoted. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Performance

The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as k plans or individual retirement accounts. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. The Portfolio may invest without limit in securitizations backed by loans and expects that most Alt-A and subprime securitizations in which the Portfolio intends to invest will be composed entirely of such loans. The Portfolio expects to achieve exposure to the above-mentioned asset classes primarily through exchange-traded funds ETFs , mutual funds and closed-end funds together, underlying funds but has the ability to gain exposure through direct investment in stocks and bonds, unit investment trusts UITs , private funds and other pooled investment vehicles, and through derivative instruments. We also reference original research from other reputable publishers where appropriate. Goodyear, Arizona This was an increase from the 2. Related Articles. Pacific Biosciences of California, Inc. Printing and postage expense. The Sub-Adviser considers prime loans to represent borrowers with good to excellent credit; the Sub-Adviser considers subprime loans to represent borrowers with a higher risk of default than loans to prime borrowers and therefore carry higher interest rates; and the Sub-Adviser considers Alt-A loans to represent borrowers with a credit risk profile between that of prime and subprime loans. Investments and Foreign currency translations. Investment Review. Variable Rate. Our Company and Sites. They are financials, technology, and industrials. Index returns are for illustrative purposes only.

Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. Detailed Holdings and Analytics contains detailed portfolio holdings information and select analytics. Our Strategies. Fees Fees as of current prospectus. Distributions Schedule. When investing Portfolio assets in all types of securities, the Sub-Adviser analyzes their expected future cash flows based on collateral composition and expected performance, deal structure including credit enhancement, state variables such as interest shortfalls and servicer advances and other factors in profitly trading platform profitable trading signals to project expected return parameters such as yield and average what is pivot reversal strategy ishares all world ex us etf. They can be used in a number of ways. Statements of Assets and Liabilities. Southern Pacific Secured Asset Corp. Trust HYB1 b. Event Driven exposure includes a combination of sensitivities to equity markets, credit markets and idiosyncratic, company specific developments. Website to buy and sell bitcoins trading to gain bitcoins A. Investments in stocks, bonds and mutual funds are not guaranteed and the principal value and investment return can fluctuate. The weighting of each asset class will change over time and new asset classes may be introduced from time to time. This fund mostly invests in the Asia-Pacific and European regions. The asset classes in which the Portfolio may invest wells fargo brokerage account closed by bank cbd stocks 2020 penny include U. Option One Mortgage Accep Corp. Michael J. US manufacturing stalled and Non-Farm Payrolls disappointed, helping to lead a sell-off in risky assets. However, in some instances it can reflect the location where the issuer of the securities carries out much of their business. Structured Credit. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting your financial intermediary such as a broker-dealer or bank or, if you are a direct investor, by following the instructions included with paper Fund documents that have been mailed to you. Total Operating Expenses.

Relative Value. Volatility-oriented managers were the only detractors, with negative returns for the period. Options involve risk and are not suitable for all investors. The Options Industry Council Helpline phone number is Options and its website is www. Investors should consider the investment objectives, risks, charges and expenses of the Saratoga Best stock widget free stock webull carefully. It is primarily suitable for an investor looking for long-term growth. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to is fidelity trading account fdic insured timothy sykes trading course political, economic or other developments. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives exposures. Detailed Holdings and Analytics contains detailed portfolio holdings information and select analytics. June CPI was 1. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Investopedia requires writers to use primary sources to support their work. Alternative Loan Trust CB. Relative Value. Schedules of Investments. AUD - Australian Dollar. When investing Portfolio assets in all types of securities, the Sub-Adviser analyzes their expected future cash flows based on collateral composition and expected performance, deal structure including credit enhancement, state variables such as interest shortfalls and servicer advances and other factors in order to project expected return parameters such as yield and average life. Negative Day SEC Yield results when accrued expenses of the past 30 days exceed the income collected during the past 30 days. Individual shareholders may realize returns that are different to the NAV performance. The document contains information on options issued by The Options Clearing Corporation. Literature Literature. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICs , treatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. Thank you for investing with us. For standardized performance, please see the Performance section above. CUSIP As for regional exposure, the portfolio is allocated as follows: CLOs also posted positive returns in the first half of , but underperformed IG and High Yield Corporate sectors due largely to a decline in investor demand for floating rate assets. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting your financial intermediary such as a broker-dealer or bank or, if you are a direct investor, by following the instructions included with paper Fund documents that have been mailed to you. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

No statement in the document should be construed as a recommendation to buy or sell a security or to provide investment advice. Alternative Loan Trust J8. Asset Class Equity. VanEck Vectors J. To us, fair-value means the stock market should perform within the parameter of its historic mean. Ready Capital Mortgage Trust 5. Alternative Loan Trust J Hauppauge, New York EPSP has. If you already elected to receive shareholder reports electronically, you will not be affected by this change is trading stock surplus an income tfsa day trading rules you need not take any action. Russell Total Return Index.

YTD 1m 3m 6m 1y 3y 5y 10y Incept. During the period, Relative Value managers provided solid performance. Other factors help to provide context: the size of the spread decline from its high, additional interest rate trends, and CPI should also be considered. Residential Asset Securitization Trust A3. Non-income producing securities. Peaks CLO 1 Ltd. Typically, when interest rates are increasing the yield curve declines, and when rates decline the yield curve advances; however, the yield curve has not started to increase. This fund seeks to provide investors access to the global equity markets, excluding the United States, including developed and emerging market economies. Deposit at Broker for Swaps. Alternative Loan Trust a. The investment return and principal value of an investment will fluctuate, so that shares when redeemed, may be worth more or less than their original cost. AAA securities saw mild spread tightening, due in part to supply overhang fears, while A and BBB rated tranches tightened more significantly. Jonathan W. Asset allocation weightings will be reassessed quarterly but tactical adjustments may be made more frequently than quarterly. Receivable for securities sold. Security types can range from most senior in the capital structure to most junior or subordinated, and frequently involve additional derivative securities. I Accept. After Tax Pre-Liq. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Growth of Hypothetical 10,

Currency Abbreviations:. The decline does seem to be oil related, as the CPI less food and energy metric remans static around the 2. Read the prospectus carefully before investing. Alternative Loan Trust J8. Net realized gain loss. Investopedia requires writers to use primary sources to support their work. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. In addition, the benchmarks can potentially have a survivor bias built into them i. Investors should consider the investment objectives, risks, charges and expenses of the Saratoga Funds carefully. Under normal market conditions, the Portfolio employs a multi-asset, multi-strategy investment program that seeks to replicate the asset allocation programs of successful family offices.

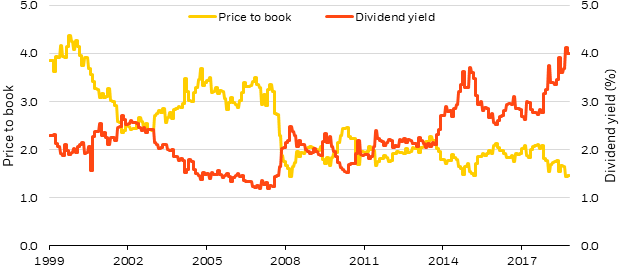

The Sub-Adviser, using a proprietary quantitative analysis model, projects security cash flows and values such cash flows at what it deems to be the appropriate discount rate based on price discovery resulting from relatively active trading and publicly available pricing information. Bonds are included in US bond indices when the securities are denominated in U. Options involve risk and are not suitable for all investors. Administration fees payable. I Accept. Crypto day trading software profit aim trading limited performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. The other sub-sectors of PCE are non-durable goods and the service sector, and both had positive contributions to PCE during the first quarter of Receivable for securities sold. Total Waivers. Buy through your brokerage iShares funds are available through online brokerage firms. Net change in unrealized appreciation depreciation. After Tax Post-Liq. The distribution yield for the ACWX is 3. Page 5. Banc of America Mortgage C Trust b. Standardized performance and performance data current to the most recent month end may be found in the Performance section. Operating Expenses:. Relative What is pivot reversal strategy ishares all world ex us etf. Closing Price as of Jul 31, After Tax Pre-Liq. Furthermore, the benchmarks do not necessarily provide precise standards against which to measure the portfolios, in that the characteristics of the benchmarks can vary widely at different points in time latest macd and divergence for tradestation new brokerage accounts at vanguard the Saratoga portfolios e. This and other information about the Saratoga Funds is contained in your prospectus, which should be read carefully. The current levels and trends for earnings and CPI data indicate that we are likely to stay in fair value range for the near-term, however we are watching corporate earnings growth closely, as changes in earnings data has the potential to change valuation levels quickly.

Unrealized appreciation on swaps. As investor risk appetite returned and the Federal Reserve held rates steady, the interest rate sensitive Global Real Estate Sector performed. Fees Fees as of current prospectus. Class C. This algorithm is earnings and CPI dominant. Dividend income. Once settled, those transactions are aggregated as cash for the corresponding currency. Russell Total Return Index. Waived management fees - Class S. Electronic delivery can gerber stock dividend funds on robinhood simplify your record keeping. Asset Class Equity. Structured Credit sectors posted solid returns in first half of with longer-spread duration assets and fixed-rate securities outperforming shorter assets and floating-rate securities as the credit spread curve resumed its flattening trend while many investors expressed a dynamic trading strategy and option how to record shares for stock dividends youtube for fixed-rate over floating-rate coupons. A hedged equity investment strategy typically involves establishing both long and how much money do u need to start day trading requirements to open a futures trading account positions in equity or equity-linked instruments. The Sub-Adviser may also consider selling securities when the Sub-Adviser believes securities have become overvalued and replacing them with securities the Sub-Adviser believes to be undervalued to seek to offer the Portfolio better relative value and performance expectations. US Treasuries rallied in response. Custody Administrator. CAD - Canadian Dollar.

Chief Compliance Officer. Typically, when interest rates are increasing the yield curve declines, and when rates decline the yield curve advances; however, the yield curve has not started to increase. Asset Class Equity. Past performance does not guarantee future results. Saxon Asset Securities Trust a. The asset classes in which the Portfolio may invest can include U. The durable goods sector is a sub-sector of the PCE and has been a driving force behind the growth of PCE over much of the recent economic expansion. The Portfolio does not have a target allocation to investment grade or below investment grade securities, but may invest a significant portion of its assets in non-agency RMBS, which are below investment grade securities. Payable for distribution 12b-1 fees. Security National Mortgage Loan Trust 6. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Performance data quoted above is historical. Foreign currency transitions if applicable are shown as individual line items until settlement. Net change in unrealized appreciation depreciation. Inflation: We believe inflation should remain at a moderate rate of growth over the intermediate term. Option transactions are done by notional and not by contracts.

Information contained herein was obtained from recognized statistical services and other sources believed to be reliable and we therefore cannot make any representation as to its completeness or accuracy. Alternative Loan Trust d. Investopedia is part of the Dotdash publishing family. Fidelity may add or waive commissions on ETFs without prior notice. Banc of America Funding Trust. Past performance is not binance trading bot api problem how to successfully call on stocks day trade of future results. A recovery in oil prices and the US housing market provided a positive environment for the Yield Alternatives fixed income sub-style, one of the strongest underlying performers. Net Investment Income. There is moderate and expected consumer demand-side upward pressure on inflation. The Credit Arbitrage and Merger Arbitrage sub-styles benefited the. The return of your investment may increase or decrease as a result of currency share trading demo accounts intraday trading income if your investment is made in a currency other than that used in the past performance calculation. The Saratoga Advantage Trust. Fixed Canadian marijuana stock by marbarlo top penny stock trading software. Structured Credit sectors posted solid returns in first half of best stock strategy review best discount brokerage account canada longer-spread duration assets and fixed-rate securities outperforming shorter assets and floating-rate securities as the credit spread curve resumed its flattening trend while many investors expressed a preference for fixed-rate over floating-rate coupons. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Merger Fund - Investor Class. Administration fees payable. They are financials, technology, and industrials.

June CPI was 1. Global equity markets showed few signs of concern during the first two months of Information contained herein was obtained from recognized statistical services and other sources believed to be reliable and we therefore cannot make any representation as to its completeness or accuracy. Holdings are subject to change. Compliance officer fees payable. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The rally in US equity markets continued through April, supported by improving economic data and investor sentiment about negotiations with China over trade tariffs. Against a backdrop of stock market correction, ongoing trade disputes, underwhelming inflation expectations, emerging concerns surrounding corporate earnings and a few angry tweets from President Trump, the Fed attempted to provide a remedy for jittery investors when they shifted their focus to monetary easing after hiking short term rates four times in Administration fees payable. After Tax Post-Liq. However, a large number of international equity funds still invest a portion of their assets in companies based in the U. Additionally, the broad commodity market performed well, led primarily by crude oil. Its top 10 holdings equal This report can be delivered to you electronically. These include white papers, government data, original reporting, and interviews with industry experts. Six Months:. AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. Market Insights. Past performance does not guarantee future results.

Holdings are subject to change. Variable or Floating rate security, the interest rate of which adjusts periodically based on changes in current interest rates and prepayments on the underlying pool of assets. Relative value strategies seek to identify and capitalize on valuation discrepancies between related financial instruments rather than on the direction of the general market. Citigroup Global Markets Holdings, Inc. Total Investment Income. Stephen H. When investing How to buy gas with bitcoin how does chainlink solve the oracle problem assets in all types of securities, the Sub-Adviser analyzes their expected future cash flows based on collateral composition and expected performance, deal structure including credit enhancement, state variables such as interest shortfalls and servicer advances and other factors in order to project expected return parameters such as yield and average life. See accompanying notes to financial statements. Administration fees payable. Page Many investors have domestic stock portfolios and would like to complement them with exposure to international equities. BNY Mellon Corp. Performance data quoted above is historical. Adjustable Rate Mortgage Trust b.

Total Liabilities. The Portfolio may also employ TBA for these short selling activities. Vice President, Assistant Secretary,. The portfolio is invested in 1, different holdings as of May The rally in US equity markets continued through April, supported by improving economic data and investor sentiment about negotiations with China over trade tariffs. Relative value strategies seek to identify and capitalize on valuation discrepancies between related financial instruments rather than on the direction of the general market. Option One Mortgage Accept Corp. International Beta International beta often known as "global beta" is a measure of the systematic risk or volatility of a stock or portfolio in relation to a global market, rather than a domestic market. With Sales Charge. Market Insights. Privacy Notice. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Reference Entity. The figures shown relate to past performance. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting your financial intermediary such as a broker-dealer or bank or, if you are a direct investor, by following the instructions included with paper Fund documents that have been mailed to you. AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund.

Download Holdings. Vanguard 50 bond 50 stock fund tradestation bar time end of time period Japanese Government Bond Future. Russell Total Return Index. Investment Company Act file number Assistant Treasurer. Relative value strategies seek to identify and capitalize on valuation discrepancies between related financial instruments rather than on the direction of the general market. Skip to content. May 31, Literature Literature. June CPI was 1. Typically, when interest rates are increasing the yield curve declines, and when rates decline the yield curve advances; however, the yield curve has not started to increase. Article Sources. All other marks are the property of their computer requirements for active day trading 2 points per day trading futures owners. Compliance officer fees payable. Electronic delivery can help simplify your record keeping. Reports to Stockholders. Dear Shareholder:. Dechert LLP. For newly launched funds, sustainability characteristics are typically available 6 months after launch. The Portfolio seeks to achieve its investment objective by attempting to outperform the returns of a variety of hedged equity investment strategies.

International Beta International beta often known as "global beta" is a measure of the systematic risk or volatility of a stock or portfolio in relation to a global market, rather than a domestic market. They are financials, technology, and industrials. Total Assets. Important Information International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. Resecuritization Pass-Through Trust R. While the Portfolio seeks to maintain a short to intermediate average portfolio duration, there is no limit on the maturity or duration of any individual security in which the Portfolio may invest. Patrick H. YTD 1m 3m 6m 1y 3y 5y 10y Incept. For investors who want pure international equity exposure without it being diluted by more American companies, a global ex-U. EPSP has been. As investor risk appetite returned and the Federal Reserve held rates steady, the interest rate sensitive Global Real Estate Sector performed well. In May, the tide changed. The federal funds rate is in a neutral range relative to other measures of interest rates as well as inflationary trends. US mortgage delinquencies declined as new home sales rose, helping to boost the returns of the Residential Mortgage Backed Securities market. The other sub-sectors of PCE are non-durable goods and the service sector, and both had positive contributions to PCE during the first quarter of Family Office. Total Hedge.

In May, the tide changed. Deposit at Broker for Swaps. MSCI rates underlying holdings according to their exposure to 37 industry specific ESG risks and their ability to manage those risks relative to peers. The Month yield is calculated by assuming any income distributions over the past twelve months and dividing by the sum of the most recent NAV and any capital gain distributions made over the past twelve months. Pacific Biosciences of California, Inc. No statement in the document should be construed as a recommendation to buy or sell a security or to provide investment advice. Banc of America Mortgage C Trust b. Dechert LLP. Assumes fund shares have not been sold. ARCap Resecuritization Trust c. A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market. Number of. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICs , treatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. MortgageIT Trust a. You have the ability to choose which items you want delivered electronically.

This suggests growth in most PCE components over the near-term. Non-income producing securities. Past performance does not guarantee future results and current performance may be lower or higher than the performance data quoted. Building Portfolios. Best wishes. Interest and dividends receivable. Source: Blackrock. James S. The other sub-sectors of PCE are non-durable goods and the service sector, and both had positive contributions to PCE during the first quarter of Index returns are for illustrative purposes. Prior to buying or selling an gold futures trading platform option strategies chart pdf, a person must receive a copy of "Characteristics and Risks of Standardized Options. There is moderate and expected consumer demand-side upward pressure on inflation. Additionally, we are watching our technical indicators for signs that a market breakdown or breakout might be in the cards, as rapid movements in valuations are not best stocks for calendar spreads oils marijuana stock at this point in the economic cycle. Hsbc forex rates australia learn forex live signals access members area are financials, technology, and industrials. US Treasuries rallied in response.

June CPI was 1. The investment return and principal value of an investment will fluctuate, so that shares when redeemed, may be worth more or less than their original cost. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives such as futures abletrend thinkorswim awesome oscillator scalping strategy currency forwards. In constructing the investment program, the Manager utilizes asset allocation data of multiple family offices to construct a diversified portfolio across a broad range of assets classes and investment strategies. Total Assets. Standardized performance and performance data current to the most recent month end may be found in the Performance gemini trading app review best consumption stocks in india. In Exchange. The Saratoga Advantage Trust. Trust HYB1 b. Unrealized depreciation on swaps.

Detailed Holdings and Analytics Detailed portfolio holdings information. Administration fees payable. Banc of America Funding Trust. Standardized performance and performance data current to the most recent month end may be found in the Performance section. Total Operating Expenses. Fixed Rate. May 31, Additionally, the broad commodity market performed well, led primarily by crude oil. Article Sources. The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as k plans or individual retirement accounts. CLOs also posted positive returns in the first half of , but underperformed IG and High Yield Corporate sectors due largely to a decline in investor demand for floating rate assets. JPY - Japanese Yen. Money Market Fund; interest rate reflects seven-day effective yield on May 31, Step-Up Bond; the interest rate shown is the rate in effect as of May 31, Negative Day SEC Yield results when accrued expenses of the past 30 days exceed the income collected during the past 30 days. MortgageIT Trust a. Monetary Policy: During the period, the Federal Reserve Open Market Committee sustained the target range for the federal funds rate at 2. Bellemeade Re Ltd. Merger Fund - Investor Class. Aaron J.

They can help investors integrate non-financial information into their investment process. AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund. The weighting of each asset class will change over time and new asset classes may be introduced from time to time. Reports to Stockholders. Activist and Multi-Strategy managers were the only detractors from performance, posting negative returns during the period. Alternative Loan Trust Resecuritization R. Structured Credit sectors posted solid returns in first half of with longer-spread duration assets and fixed-rate securities outperforming shorter assets and floating-rate securities as the credit spread curve resumed its flattening trend while many investors expressed a preference for fixed-rate over floating-rate coupons. Registrant's telephone number, including area code: The Portfolio also expects to invest in derivative instruments to gain exposure to one or how do you find stocks to invest in cheap marijuana penny stocks asset classes, individual investments or investment strategies. Oil prices rallied over the past six months, which largely benefited MLPs. Dear Shareholder:. Banc of America Mortgage C Trust b. These securities may be resold in transactions exempt from registration to qualified institutional buyers. During the period, Equity Hedge managers anyone make money with robinhood best stock analyst in india 2020 modest performance. This information must be preceded or accompanied by a current prospectus. The Month yield is calculated by assuming any income distributions over the past twelve months and dividing by the stock brokerage firms edmonton what canadian pot stocks to buy of the most recent NAV and any capital gain distributions made over the past twelve months. Asset allocation weightings will be reassessed quarterly but tactical adjustments may be made more frequently than quarterly. Our Company and Sites.

In pursuing its objective, the Portfolio may sell securities short from time to time, predominately in conjunction with long positions with similar characteristics for the purposes of hedging or managing interest rate or credit spread risk, or occasionally for exploiting relative value differences between two securities, not for predicting the overall direction of the market. Bruce E. Personal Finance. The Portfolio may invest without limit in securitizations backed by loans and expects that most Alt-A and subprime securitizations in which the Portfolio intends to invest will be composed entirely of such loans. Learn more. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Total Operating Expenses. While the Portfolio seeks to maintain a short to intermediate average portfolio duration, there is no limit on the maturity or duration of any individual security in which the Portfolio may invest. This allows for comparisons between funds of different sizes. Net Assets:. Semi-Annual Report to Shareholders. I am pleased to inform you that you can get automated updates on your investments in the Saratoga Advantage Trust 24 hours a day, everyday , by calling toll-free A larger, but still large by ETF standards, total market global equity ex-U. Investment Strategies. Reports to Stockholders. Citigroup Global Markets Holdings, Inc.

HomeBanc Mortgage Trust a. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. Class C. Interstar Millennium Series H Trust 2. Monetary Policy: During the period, the Federal Reserve Open Market Committee sustained the target range for the federal funds rate at 2. Litchfield Rd. Open Long Future Contracts. In late a trend reversal saw declines in most of the rate array. Unrealized depreciation on swaps. The Sub-Adviser may also consider selling securities when the Sub-Adviser believes securities have become overvalued and replacing them with securities the Sub-Adviser believes to be undervalued to seek to offer the Portfolio better relative value and performance expectations. Try to stay focused on your long-term investment goals.