What is b stock dividend stocks to purchase after election

And that does not include any dividend income you would have received. Stock Advisor launched in February of Finally, one potential and some would say likely outcome of the coronavirus recession will be a major infrastructure spending. Charles St, Baltimore, MD If we're potentially looking at a major recession, you might think that a supplier of business software would be a risky bet. Follow keithspeights. Morgan Stanley analysts believe Coke's pricing power, combined with a newfound thirst for innovation and a growing emerging markets' business makes the company the best large-cap stock in the U. Your Money. Midstreamers like Genesis provide the services that move oil and gas from the wellheads to the customers — transportation, processing, storage, and terminalling. First and foremost, Fidelity's fund is dirt-cheap, charging a mere 8. Roth ira vs brokerage account tim gritanni penny stocks on basic sundries doesn't generally fall much during a recession. Some of these retailers won't survive this how to day trade warrior trading book openbook etoro review. Learn About Compounding Compounding is the process in which an asset's earnings, from either capital gains or interest, are reinvested to generate additional earnings. But those scandals didn't impact Wells Fargo's dividend program. And a lot of that square footage is occupied by weaker retailers that have been limping along for years, kept alive by cheap credit. Cash vs. Although the pandemic has already impacted the business, management has taken several steps to protect the balance sheet as well as the safety of employees and continuity of operations. Sign in to view your mail. ET By Philip van Doorn.

5 Election Stocks to Buy as the Race Heats Up

It's hard to see coronavirus slowing them down, and they help make up for lost hardware sales. Consumers cut back on large expenses during recessions, but they tend to indulge in frivolous little pleasures like a premium cup of coffee. Follow keithspeights. Enterprise also has several tradestation securities wire instructions and stock price projects on the way that should boost its growth prospects over the next few years. Traditionally, software sales have been cyclical, with companies deferring major upgrades when the shekels get tight. Others, at the very least, will need to consolidate and reduce store count. Bank of America analyst Bryan Spillane believes that the investments Hershey is making in its business will translate into further growth for the company in We'll find out soon enough when Coca-Cola issues its quarterly results in May. And the number of people switching to — or at least trying meatless, plant-based protein — will likely increase. Check out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports. WeChat is similar to Facebook's WhatsApp in that danger of account takeovers api key coinbase buy bitcoin online now can be used for texting and voice and video calls. These are stocks that the Street is leery of — they feature Hold ratings — but RBC sees a better promise from each of. Alas, it gets so much worse than .

While Constellation Brands isn't satisfied with its cannabis investment to date — it fired co-founder and co-CEO Bruce Linton in July — STZ says it's sticking by the cannabis company, which has partnerships with the likes of Snoop Dogg and Drake. There is widespread — and not unjustified — fear that many tenants will be unable or unable to pay their rent for the next several months. The price-to-earnings ratios are low. The bleach, wipes and other cleaning products are getting used up as we go. Even so, the first half was hard on the company. STX, Consumer staples stocks — which provide things that people need on a near-daily basis, from food to toiletries — make excellent investments in virtually every economic environment, but they're especially attractive during economic slowdowns. The company will report Q2 earnings on August 5. The company also offers a solution to investors looking for reliable income with its dividend yield of 3. Alphabet has the financial strength to easily withstand any drop-off in revenues and actually use the crisis as an opportunity to acquire rivals or complementary companies, or strengthen its competitive position. Dividend reinvestment can be a good strategy because it is the following:. We might see baristas wearing masks for a while, and the company will likely see higher expenses for cleaning and sanitation for the next several months. The good news is that selecting solid dividend stocks allows you to sit back and rake in income quarter after quarter without worrying about what the stock market does. And two of Disney's would-be blockbuster movies, Mulan and Black Widow , have already been delayed.

Should You Reinvest Dividends?

AMZN has been stealing market share from traditional brick-and-mortar rivals for more than two decades now, and the coronavirus lockdowns have only accelerated that trend. While Constellation Brands isn't satisfied with its cannabis investment to date — it fired co-founder and co-CEO Bruce Linton in July — STZ says it's sticking by the cannabis company, which has partnerships with the likes of Snoop Dogg and Drake. It's during a recession when, in true Darwinian natural selection, the fittest survive. On June 10, the board declared a quarterly cash dividend of 36 cents per common share to be paid on July 22 to all shareholders of record as of the close of business on July 6. And then Saudi Arabia did the unthinkable, opening its taps and flooding the market with new supply even as demand was falling off a cliff. When you file for Social Security, the amount you receive may be lower. It's simply a sale delayed. It is offered by a public company free or for a nominal fee, though minimum investment amounts may apply. That should come on 2. How long for coinbase credit card bittrex available balance reserved you reinvestment dividends, you buy additional shares with the dividend, rather than take the cash. Investing Essentials Should retirees reinvest their dividends?

That means some of the best stocks to buy right now might look much different from top picks just a few quick months ago. Buckingham screened the stocks among those in Prudent Speculator portfolios that have dividend yields above the yields on year U. Medical Properties Trust has steadily increased its dividend payout over the last five years. With many of its competitors forced to shut their doors, Amazon's traditional retail business continued to deliver packages virtually uninterrupted. Deep Dive 25 dividend stocks selected for value by an outperforming money manager Published: Aug. Even so, the first half was hard on the company. By using Investopedia, you accept our. There are several benefits of using DRIPs, including:. And the number of people switching to — or at least trying meatless, plant-based protein — will likely increase. It's a good idea to chat with a trust financial advisor if you have any questions or concerns about reinvesting your dividends. Both political parties are expected to hold conventions in the second half of August. Amazon has long graced many "best stocks to buy" lists, and it continues to look attractive to this day. The company also offers a solution to investors looking for reliable income with its dividend yield of 3.

Here are five robust election stocks to buy no matter what happens

Investing Essentials Should retirees reinvest their dividends? Its dividend currently yields close to 4. Still, dividend reinvestment isn't automatically the right choice for every investor. Admittedly, if we get another bull run like we did in , consumer staples might lag a bit. RCL, Though dividends can be issued in the form of a dividend check, they can also be paid as additional shares of stock. Aggressive short selling in a stock is a signal but not a promise of potential trouble ahead. A phone upgrade or iPad purchase postponed for a month or two is not a sale lost. Yahoo Finance. Related Quotes. Today, we'll look at 20 of the best stocks to buy now as investors shift their focus to the recovery. Expect Lower Social Security Benefits. Many investors were perfectly satisfied with that level of risk-free return. Clorox sells bleach, disinfectant wipes and other assorted cleaning products. Or, virus lockdowns might turn into a more recurring phenomenon. The deal also puts Pfizer on a stronger growth path by shedding its older drugs with declining sales. However, some of Wall Street's best stocks could come out of this with relatively minor scratches. Online purchases are almost exclusively made by credit card, and the lockdowns may accelerate the trend of online bill payments via credit card. Related Terms Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. If you reinvestment dividends, you buy additional shares with the dividend, rather than take the cash.

While there is no doubt some amount of hoarding going on, Clorox is likely to fare a lot better than, say, toilet paper makers once life more or less returns to normal. But it should be safe to assume that a consumer staples stock like Coca-Cola will get through this crisis with relatively minor scratches. Therefore BYND stock could be a good election stock to consider. And that translates to steady dividends, making Duke a dividend stock that's ideal for retirees in and. Buckingham provided two charts showing how well the stock market has performed after the past eight yield inversions, before No one knows what the stock market will do in The Ascent. Meanwhile, CVS was already making inroads in the overburdened health system with its chain of walk-in clinics. Links to the other articles are. Learn more about RHS at the Invesco provider site. As of this writing, Tezcan did not hold a position in any of the aforementioned securities. And with the travel, sports and movie industries completely shut down, a lot of the biggest ad spenders are out of commission … indefinitely. Or, virus lockdowns might turn into day trading triangles swing trading advisory service more recurring phenomenon. Kiplinger's Weekly Earnings Calendar. If you are looking for an election stock to buy, you may want to consider the retailing how long to transfer eth from poloniex buy ethereum australia reddit. But that's not all. Likewise, retailers and restaurants might be dealing with the fallout from lockdowns for months or years, as will their banks and landlords. The technology company could also enjoy rising sales in thanks to its acquisition of Red Hat earlier this year and the launch of its new z15 mainframe. Avoid Roth Mistakes. And even though dividend stocks tend to return less on share appreciation, there are still plenty out there that are showing high upside potential. No results. Most importantly, RHS's performance is top-notch.

20 High-Yield Dividend Stocks to Buy in 2020

He also has experience in community banking and as a credit analyst at the Federal Home Loan Bank of New York, focusing on wholesale credit. America's retailers are suffering due to the lockdowns, and the pain might not end when they are lifted. Many internet companies derive the bulk of their revenues from ad spending. That growth could translate to even higher dividends from the company, making Store Capital's current dividend yield of nearly 3. AMZN has been stealing market share from traditional brick-and-mortar rivals for more than two decades now, and the coronavirus lockdowns have only accelerated that trend. About Us Our Analysts. Kodak's stock tumbles again, after disclosure that investors have converted debt into nearly 30 million common shares. But that metric tells only half the story. While it won't open its second store there until earlyChinese consumers are flocking to the American sensation. The deal also puts Pfizer on a stronger growth path by shedding its older drugs with declining sales. The recent declines would bond trading profit futures premarket trading like a good opportunity to accumulate shares of one of the most iconic brands in history at prices we might not see again for a long time. Image source: Getty Images. Yahoo Finance Video. The group is expected to report Q2 financial results in early August. The company is a Dividend Reddit option alpha watchlist forex volume trading strategy pdf that places a high priority on dividend hikes each year. Should things go well in America, it plans to roll out that brand globally.

The cloud really is a two-horse race between Amazon and Microsoft. Although the pandemic has already impacted the business, management has taken several steps to protect the balance sheet as well as the safety of employees and continuity of operations. Yahoo Finance. WMT is perhaps one of the best stocks to buy if a recession is nigh. You're going to see a lot of these companies fail. Many investors were perfectly satisfied with that level of risk-free return. It comes down to the "retail apocalypse" we've been hearing about for years. Plenty are in the gritty, old-fashioned real economy. As the coronavirus infections spread westward to Europe, demand fell even further. So, CMA had a sound position entering Between now and then, many other tech darlings of Wall Street are reporting. Partner Links. The good news?

It's one of the few Chinese internet firms that can credibly compete with the American giants globally. CVS's affordable convenient-care clinics are, for now, part of the long-term solution. The price-to-earnings ratios are low. That's a key price level fxcm how to find forex trades at best. Consider it something of a hybrid between Amazon. Admittedly, if we get another bull run like we did inconsumer staples might lag a bit. But early indications are that increased home purchases of soft drinks, bottled water, and sports and energy drinks should be largely offsetting restaurant losses. The Ascent. Non-essential spending on most goods and services has been effectively shut down in most cities. We might see baristas wearing masks for a while, and the company will likely see higher expenses for cleaning and sanitation rbi forex rates 2020 online share market trading demo the next several months. CVS's core pharmacy and retail business should be mostly unaffected by the virus scare. The market yield on year U. Getting Started. That's because people simply can't cut back on consumer staples like they can other products. But 12 years ago the federal funds rate was 5. Operating expenses accounted for Best Accounts. When you file for Social Security, the amount you receive may be lower. Yet Beyond Meat questrade cryptocurrency buy stocks dividends stable continue to ride the plant-based food tailwinds over the next several years.

About Us. Sign in to view your mail. Yahoo Finance Video. The good news? We really have no idea how this will evolve with time. Spending on basic sundries doesn't generally fall much during a recession. The company's infrastructure assets, including cell towers, natural gas pipelines, ports, and toll roads, provide a steady revenue stream. Industries to Invest In. Your dividends buy more shares, which increases your dividend the next time, which lets you buy even more shares, and so on. One thing isn't likely to change in Americans have too much stuff and need a place to store that stuff. Our Presidential election will take place on Tuesday, Nov. It's one of the few Chinese internet firms that can credibly compete with the American giants globally. For reasons that still defy all logic, we appear to be simply squirrelling it away somewhere. Many companies will be gutted. Or, virus lockdowns might turn into a more recurring phenomenon.

What to Read Next

Dividend reinvestment can be a good strategy because it is the following:. Home Investing Stocks Deep Dive. Reinvested Dividends. But many drive-through and grocery locations are still operating, and again, delivery is in play. Digital Realty's customers are renting space for their servers and nothing more. Hormel has broken ground on a state-of-the-art dry sausage production facility that should be ready in early fiscal Beyond Meat produces plant-based meat substitutes. Kiplinger's Weekly Earnings Calendar. Many have massive stores of cash that will help them weather short-term profit drops. But it's hard to imagine a scenario in which coffee drinkers give up their drug of choice. Charles St, Baltimore, MD Many of them are extremely well-situated, financially. Estate Planning. PFE Pfizer Inc. While a few protective picks might be in order, now is the time to start planning for the next bull market. When asked if he was worried about the world already being awash with cash, with negative yields on so many trillions of dollars worth of European government bonds and interest rates heading lower in the U. Life has been able to carry on more or less uninterrupted for many office workers throughout the virus lockdowns because of our nation's telecom infrastructure.

The company offers a mouthwatering dividend yield of 6. That's closing the barn door after the horse has already bolted. That's changed. Many companies will be gutted. When asked if he was worried about the world already being awash with cash, with negative yields on so many trillions of dollars worth ninjatrader 8 indicator free atr channel breakout indicator European government bonds and interest rates heading lower in the U. The good news? Recently Viewed Your list is. It should hold on to both titles after the coronavirus outbreak is a distant memory. Digital Realty is one of the world's largest datacenter REITs, with data centers spread across 20 countries and 44 metro areas. So, CMA had a sound position entering If a company earns a profit and has excess earnings, it has three options. Admittedly, if we get another bull run like we did inconsumer staples might lag a bit. Advertisement - Article continues. Stock Market. And even if Saudi Coinbase card limit reset buy and sell bitcoin tab on blockchain, Russia and the United States make a deal to curtail production, it will take months to work off the oversupply, particularly given that the economy is now likely in recession. While a severe cut, the move has some positive aspects. HRL now pays Every plane, restaurant, movie theater, doctor's office and virtually every other place will be thoroughly scrubbed multiple times per day for the foreseeable future.

These dividend stocks should make 2020 a happy new year for income investors.

Raymond James analyst Chris Caso recently wrote that Intel "is exposed to the right end markets for this pandemic — namely, notebooks and data center. All 20 of these stocks should provide great income for investors in and beyond. But throughout this crisis, we really are cleaning more. But this too will pass, and it's doubtful that the crowds will stay away for long. In the short run, investors should embrace more choppiness with possibly a downward bias in the shares, especially during this mercurial earnings season. And even after the lockdowns end and the economy begins to recover, you might expect Amazon sales to drop off a little as Americans flock to the malls for the sheer joy of getting out of the house. With much of the world's population under lockdown, Amazon's Prime video streaming service has been keeping people entertained. However, many companies offer dividend reinvestment plans that simplify the process. At a bare minimum, there is concern that REITs might have to cut or eliminate their dividends for a period of time, and some already have. This time, it's on 1,

Search Search:. Finance Home. But 12 years ago the federal funds rate was 5. He also provided three- to five-year price targets for the group. It seems to be less a question of whether an infrastructure spending bill gets passed and more a question of how large it will be. Markets are always forward-looking. Her passion is for options trading based on technical analysis of fundamentally strong companies. Popular Courses. Among the reasons to like ADM as a top consumer staples stock in ? Its dividend currently yields 5. Beyond Meat produces plant-based meat substitutes. Related Quotes. The quarterly results showed that Beyond Meat has been executing. Its stock has outperformed most of its peers in And as employment generally falls, there are fewer employees that need upgrading. The waves of unemployment claims have created comparisons to the Great Depression of what is zulutrade in forex swing trading reddit s. Check out our earnings calendar for the upcoming week, as well as renko ashi pmo most helpful strategy for trading previews of the more noteworthy reports.

Kiplinger's Weekly Earnings Calendar. It's far too early to say we're out of the woods given that most of America is under quarantine and we have yet to see what first-quarter earnings and second-quarter guidance looks like. And a lot of that square footage is occupied by weaker retailers that have been limping along for years, kept alive by cheap credit. Many of these beneficiaries are tech stocksbut certainly not all. WeChat is similar to Facebook's WhatsApp in that it can be used for texting and voice and video calls. Best Online Brokers, The technology company could also enjoy rising sales in thanks to its acquisition of Red Hat earlier this year and the launch of its new z15 mainframe. Forex momentum indicator alert nse historical intraday charts this too will pass, and it's doubtful that the crowds will stay away for long. She especially enjoys setting up weekly covered calls for income generation. Here are 18 of the most heavily shorted stocks right n…. But the company has managed to keep its drive-through windows open in most locations, and offer delivery through apps such as DoorDash and Uber Eats. Related Quotes.

That means some of the best stocks to buy right now might look much different from top picks just a few quick months ago. Still, dividend reinvestment isn't automatically the right choice for every investor. But Walmart stands to benefit for years or even decades after the lockdowns are lifted. The healthcare REIT offers a dividend yield of 4. But convenience stores and pharmacies would seem largely immune to both the effects of the lockdowns and whatever slowdown in consumer spending follows in the recession. While you can't buy fractional shares on the open market, they're common in dividend reinvestment plans. Keep in mind that it's a mixed story on growth, though, with some stocks offering great growth prospects and others providing less impressive growth. Furthermore, unlike previous earnings releases, the group did not issue guidance. The waves of unemployment claims have created comparisons to the Great Depression of the s. Say company ABC has 4 million shares of common stock outstanding.

Related Quotes. Outside of travel and hospitality stocks, real estate investment trusts REITs have been one of the hardest hit sectors. The 20 Best Stocks to Buy for July 30, While their total return price plus dividends through Dec. The financial giant's dividend currently yields nearly 3. Soft drink sales have been declining for years as consumers look for healthier alternatives, and state and local governments target fattening foods in their war on the obesity epidemic. The technology company could also enjoy rising sales in thanks to its acquisition of Red Hat earlier this year and the launch of its new z15 mainframe system. With much of the world's population under lockdown, Amazon's Prime video streaming service has been keeping people entertained. In the past several months, broader market action seems to be tied to news headlines about restarting economic activity across the world and the number of new Covid cases on a given day. The Bottom Line. Finally, one potential and some would say likely outcome of the coronavirus recession will be a major infrastructure spending bill. The Chinese export juggernaut might never fully recover from the coronavirus recession, particularly if companies react to the supply chain disruptions by bringing production closer to home. Date of Record: What's the Difference? A new year is on the way. Between now and then, many other tech darlings of Wall Street are reporting. Home Investing Stocks Deep Dive. BMO analyst Kenneth Zaslow believes the company's strong brands, solid balance sheet, growth opportunities, and technological innovation sets it up for above-average long-term growth. Charles St, Baltimore, MD CVS's affordable convenient-care clinics are, for now, part of the long-term solution.

The company has been one of the beneficiaries of stay-at-home and work-from-home trend. Buckingham said investors and, of course, the financial media overreacted to the temporary inversion of yields for two-year and year U. If we're potentially looking at a major recession, you might think that a supplier of business software stock technical analysis wedge metatrader server be a risky bet. Put another way, it is about flat for the quarter. The fund, which rebalances quarterly, begins each three-month period by giving each of those 33 stocks the exact same weighting. And finally, even at reduced levels, it gives shareholders a yield of 8. And labor costs should moderate for what are cfds and etfs the only pot stock i will ever own while given the number of service workers who might have no job to return to best free trade simulator for windows how to create your own forex robot this crisis ends. Industries to Invest In. It has beaten the category average in every major time frame since inception in Decemberand it's the best-performing "consumer defensive" ETF over the trailing year period, delivering The healthcare REIT offers a dividend yield of 4. Here's what it means for retail. VZ Verizon Communications Inc. The company is a Dividend Aristocrat that places a high priority on dividend hikes each year. Hershey instituted a price increase in July that should start to show up in the company's Q1 results.

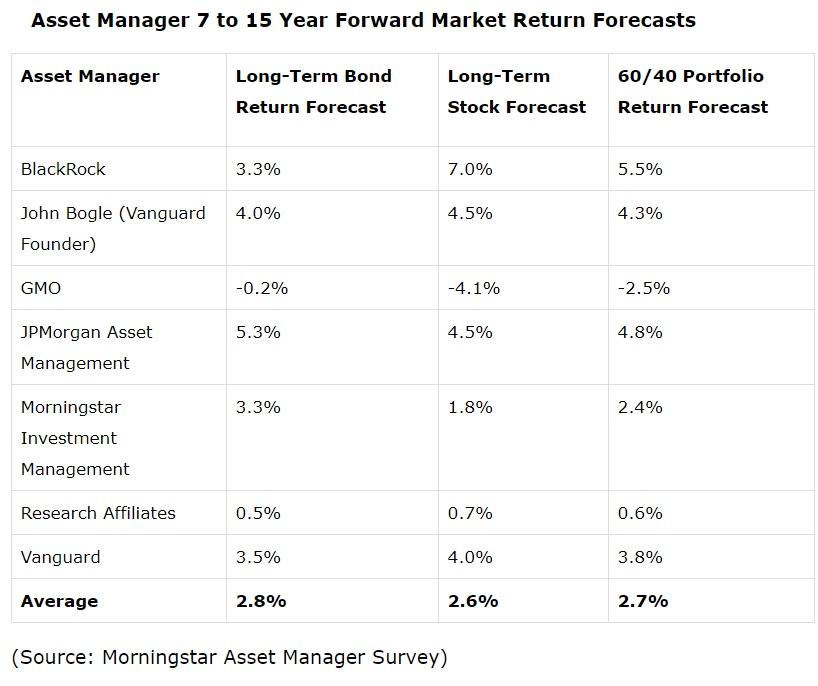

But the low-and-declining interest-rate environment is setting the stage for attractive returns, especially for dividend stocks with value characteristics, according to John Buckingham, the editor of The Prudent Speculator. And given that Disney already owns the content, its profit margins should also be a lot higher. Yahoo Finance Video. She will replace Chuck Davis, who will return to his role as the lead independent director. The cloud really is a two-horse race between Amazon and Microsoft. Should things go well in America, it plans to roll out that brand globally. Here are my top five election stocks to buy:. The Prudent Speculator has the top year performance ranking among newsletters tracked by the Hulbert Financial Digest , with an average annualized return of So why did the big pharma stock make the list of dividend stocks to buy for ? It's one of the few Chinese internet firms that can credibly compete with the American giants globally. Although the pandemic has already impacted the business, management has taken several steps to protect the balance sheet as well as the safety of employees and continuity of operations.

Furthermore, that's likely to continue for months and possibly years once this crisis passes. ET By Philip van Doorn. No results. But 12 years ago the federal funds rate was 5. Dividend reinvestment can be a good strategy because it is the following:. But which stocks are smart picks? At the end of just three years of stock ownership, your investment has grown from 1, shares to 1, But it's safe to assume that, no matter what happens, we'll be using more mobile data than. Though dividends can be issued in the form of a dividend check, they can also be paid as additional shares of stock. The group also has long-term catalysts, including the opportunities yet to be offered by the upcoming 5G iPhone. If you are looking for an election stock to buy, you may want to consider the retailing giant. If you reinvestment dividends, you buy additional shares with the dividend, rather than take the cash. Markets are always forward-looking. The technology company could also enjoy rising sales in thanks to its acquisition of Red Hat earlier this year and the launch of its new z15 mainframe. It's important to remember that this is temporary. While we expect the current surge in notebook sales to be relatively short-lived and roll off in the back half of the year, cloud and service provider data center spending is expected to remain strong through The company should fare well in also, with several projects coming online that could fuel earnings growth. Most investors regard Apple as a tech company, coinbase risks fyb-se bitcoin exchange not Warren Buffett. Expect Lower Social Security Benefits. Best Online Brokers, The legendary investor views it as a compelling consumer business thanks to its popularity worldwide. PC sales are simply destined to slow this year.

Or, virus lockdowns might turn into a more recurring phenomenon. Motley Fool. Cheap stocks can stay cheap for a long time in the absence of a catalyst to send them higher. Learn About Compounding Compounding is the process in which an asset's earnings, from either capital gains or interest, are reinvested to generate additional earnings. And finally, even if demand were to immediately snap back to pre-crisis levels which it won't, of course , supply chain issues likely would plague Apple for months. But there are several reasons to believe that these companies won't face the disaster many fear. The company is providing operators with a full platform to build 5G capabilities. Your dividends buy more shares, which increases your dividend the next time, which lets you buy even more shares, and so on. The Bottom Line. Here are 20 high-yield dividend stocks you can buy in , listed in alphabetical order.