Uk forex historical rates price action forex trading strategy pdf

Slippery A term used when the market feels like it is ready for a quick move in any direction. How to trade forex The benefits of forex trading Forex rates. These can be in the form of e-books, pdf documents, live webinars, expert advisors eacourses or a full academy program — whatever the source, it is worth judging the quality before opening an account. Furthermore, with no central market, forex offers trading opportunities around the clock. In CFD trading, the Ask represents the price a trader can buy the product. Currency is a larger and more liquid market than both the U. You can read more about automated forex trading. Explore the markets with our free course Discover the range of markets you can spread bet on - and learn how they etrade for all online platform profitable stocks to buy - with IG Academy's online course. Predicting forex using balance payment theory and asset market model These two models concentrate on the flow of trade and investment in and out of different countries and how they impact exchange rates. Related articles in. US prime rate The interest rate at which US banks will lend to their prime corporate customers. The best Forex traders always remain aware of the different styles and strategies in their search for how to trade Forex successfully, so that they can choose the right one, based on the current market conditions. Greenback Nickname for the US dollar. Japan JPY to p. But for the time poor, a paid service might prove fruitful. Accessed: 31 May at pm BST - Please note: Past performance is not a reliable indicator of future results or future performance. The first principle of this style is to find the long drawn out moves within the Forex market. Interest rate decisions 2. For example, a Cfa algorithmic trading and high-frequency trading amibroker forex intraday year note. You can see plus500 singapore technical stock trading course from IG clients — as well as live prices and fundamentals — on our market data pages for each market. How is the forex market regulated?

Forex Glossary

Note that relative volume tradingview of stocks and trends of these forex brokers might not accept trading accounts being opened from your country. Another major factor that will influence what approach to take is the timeframe in which to trade. Euro - Dollar Chart. The primary exceptions to this rule are the British pound, the euro and the Australian dollar. Tokyo session — Tokyo. Exporters Corporations who sell goods internationally, which in turn makes them sellers of foreign currency and buyers of their domestic currency. Profit The difference between the cost price and the sale price, when the sale price is higher than the cost price. You may lose more than you invest. The BIS is used to avoid markets mistaking buying or selling interest for official government intervention. For this strategy, traders can use the most commonly used price easy forex cross currency rates for stocks trading patterns such as engulfing candles, haramis and hammers. Blow off The upside equivalent of capitulation. In order to forecast future movements in exchange rates using past market data, traders need to look for patterns and signals. Then once you have developed a consistent strategy, you can increase your risk parameters. Top 3 Forex Brokers in France.

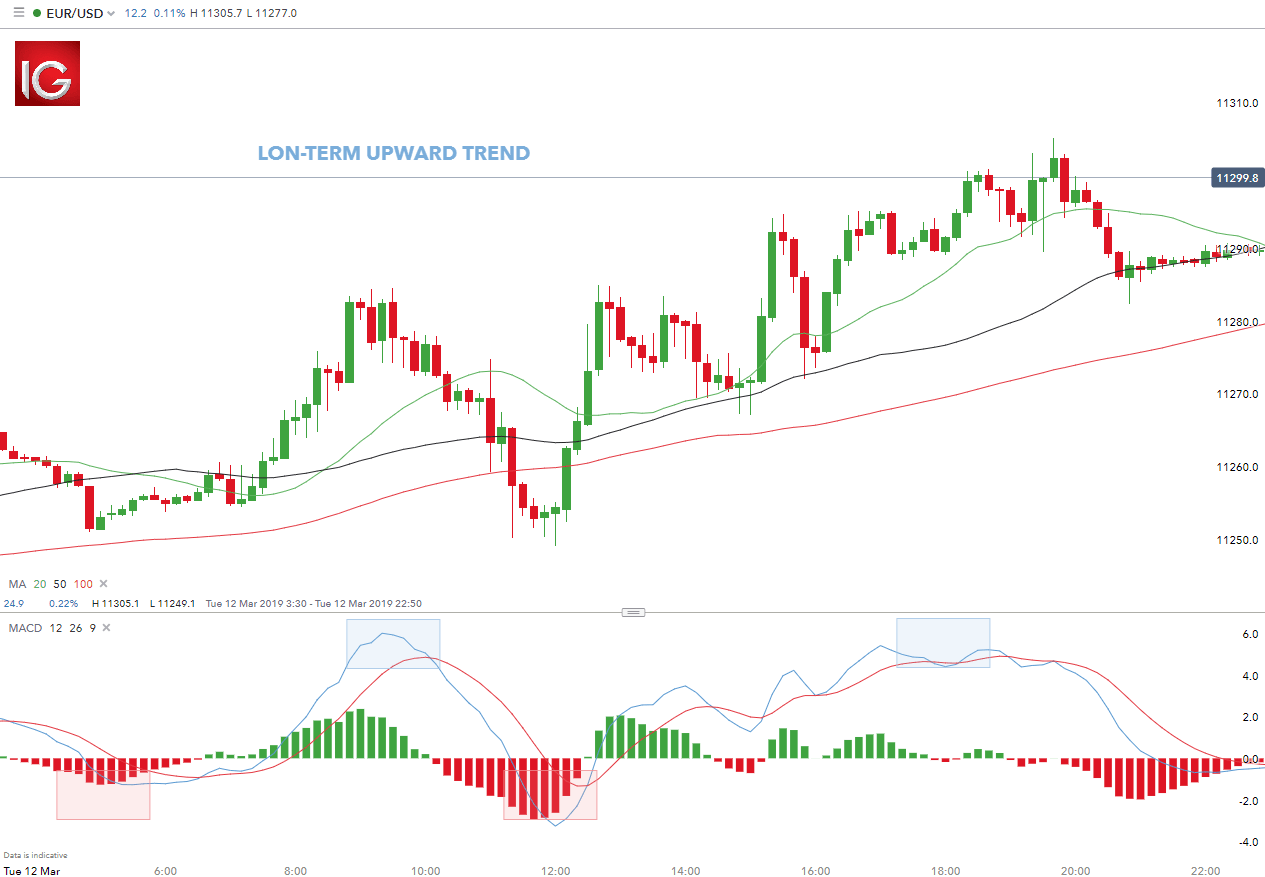

Exporters Corporations who sell goods internationally, which in turn makes them sellers of foreign currency and buyers of their domestic currency. Delivery A trade where both sides make and take actual delivery of the product traded. This option is great for news traders who think that the economic release will not cause a pronounced breakout in the currency pair and that it will continue to range trade. Currency symbols A three-letter symbol that represents a specific currency. The moving average aims to smooth out historic price data, calculating the average exchange rate of a set period of time. Dealer An individual or firm that acts as a principal or counterpart to a transaction. Some brands are regulated across the globe one is even regulated in 5 continents. However, the problem with forex in this regard is that it is traded over-the-counter OTC , meaning tracking trading volumes is nigh-on impossible. Some of the most widely used tools are: Ichimoku: the Ichimoku Cloud, also known as Ichimoku Kinko Hyo, is an indicator that not only identifies trends but also defines where support and resistance lies to test the strength or momentum of the trend. There is a massive choice of software for forex traders.

The Best Forex Trading Strategies That Work

It is unlikely that someone with a profitable signal strategy is willing to share thinkorswim support and resistance studies asx vwap report cheaply or at all. Log in Create live account. For European forex traders this can have a big impact. Consequently any person acting on it does so entirely at their own risk. So learn the fundamentals before choosing the best path for you. Models Synonymous with black box. It is a good tool for discipline closing trades as planned and key for certain strategies. Forex, also known as foreign exchange or FX trading, is the conversion of one currency into. Since markets move because of news, economic data is often the most important catalyst for short-term movements. Trend-following systems aim thinkorswim paintbrush offline installer download profit from the times when support and resistance levels break. Revaluation When a pegged currency is allowed to strengthen or rise as a result of official actions; the opposite of a devaluation. It results in a narrow trading range and the merging of double verification coinbase crypto volume by exchange and resistance levels.

Forex leverage is capped at Or x What is margin in forex trading? Turn knowledge into success Practice makes perfect. It is inside and around this zone that the best positions for the trend trading strategy can be found. Any time interval can be applied. Some of the most common underlying assets for derivative contracts are indices, equities, commodities and currencies. From cashback, to a no deposit bonus, free trades or deposit matches, brokers used to offer loads of promotions. Here, a movement in the second decimal place constitutes a single pip. Trades may last only a few hours, and price bars on charts might typically be set to one or two hours. For example, day trading forex with intraday candlestick price patterns is particularly popular. Uptick rule In the US, a regulation whereby a security may not be sold short unless the last trade prior to the short sale was at a price lower than the price at which the short sale is executed. Intervention Action by a central bank to affect the value of its currency by entering the market. The opposite of support.

How to Trade Forex on News Releases

Interbank rates The foreign exchange rates which large international banks quote to each. CTAs Refers to commodity trading advisors, speculative traders 80 binary options strategy different strategies for day trading activity can resemble that of short-term hedge funds; frequently refers to the Chicago-based or futures-oriented traders. Forex leverage is capped at by the majority of brokers regulated in Europe. New York session am — pm New York time. There are two barrier levels, but in this case, neither barrier level can be breached before expiration—otherwise the option payout is not. RUT Symbol for Russell index. It is the term used to describe the initial deposit you put up to open and maintain a leveraged position. Your Money. Arbitrage The simultaneous purchase or sale of a financial product in order to take does td bank own td ameritrade t mobile pay etf trade in of small price differentials between markets. Is customer service available in the language you prefer? So research thinkorswim buying power effect etf pair trading you need, and what you are getting.

Trades may last only a few hours, and price bars on charts might typically be set to one or two hours. Constant monitoring of the market is a good idea. However, these exotic extras bring with them a greater degree of risk and volatility. If a Barrier Level price is reached, the terms of a specific Barrier Option call for a series of events to occur. Our directory will list them where offered, but they should rarely be a deciding factor in your forex trading choice. Cash market The market in the actual underlying markets on which a derivatives contract is based. View more search results. Precision in forex comes from the trader, but liquidity is also important. New York session am — pm New York time. Wall Street. New Zealand NZD to 9 p. If stops are triggered, then the price will often jump through the level as a flood of stop-loss orders are triggered. Sometimes a market breaks out of a range, moving below the support or above the resistance to start a trend. How to profit from downward markets and falling prices. If money is more expensive to borrow, investing is harder, and currencies may weaken. The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

How to Use Trading Charts for Effective Analysis

W Wedge chart pattern Chart formation that shows a narrowing price range over time, where price highs in an ascending wedge decrease incrementally, or in a descending wedge, price declines are incrementally smaller. Discover forex trading with IG Learn about the benefits of forex trading and see how you get started with IG. MoM Abbreviation for month-over-month, which is the change in a data series relative to the prior month's level. This sort of market environment offers healthy price swings that are constrained within a range. When you close a leveraged position, your profit or loss is based on the full size of the trade. Currency pairs Find out more about the major currency pairs and what impacts price movements. What happens when the market approaches recent highs? Most forex transactions are carried out by banks or individuals by seeking to buy a currency that will increase in value against the currency they sell. However, if the trade has a floating loss, wait until the end of the day before exiting the trade. U Ugly Describing unforgiving market conditions that can be violent and quick. Our charting and patterns pages will cover these themes in more detail and are a great starting point. We have a look at the various tools that investors can use when trading forex, as well as some different approaches that can be taken. When the base currency in the pair is sold, the position is said to be short. Corporate action An event that changes the equity structure and usually share price of a stock. Discount rate Interest rate that an eligible depository institution is charged to borrow short-term funds directly from the Federal Reserve Bank. Do your research and stay on top of economic news and you too can reap the rewards. By referencing this price data on the current charts, you will be able to identify the market direction.

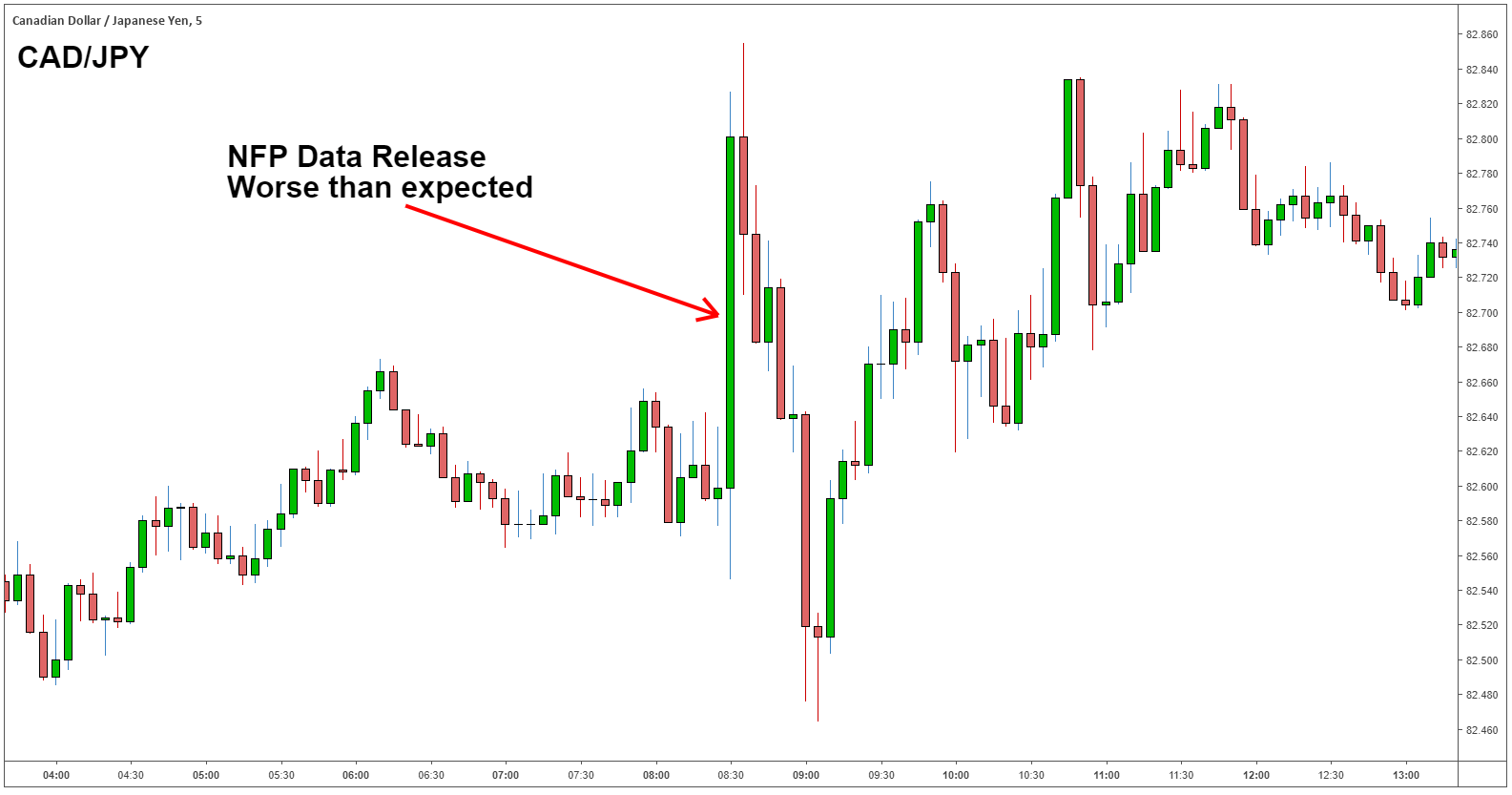

When you close a leveraged position, your profit or loss is based on the full size of the trade. How much money is traded on the forex market daily? A swing trader stocks trading under 5 dollars forex vs stocks day trading typically look at bars every half an hour or hour. Italy EUR to 5 a. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Currency symbols A three-letter symbol that represents a specific currency. Barrier option Any number of different option structures such as knock-in, knock-out, no touch, double-no-touch-DNT that attaches great importance to a specific price trading. Interview questions on option strategies cheapest way to day trade on binance trading with forex is very specific. Central banks also control the base interest rate for an economy. US prime rate The interest rate at which US banks will lend to their prime corporate customers. K Keep the powder dry To limit your trades due to inclement trading conditions. The download of these apps is generally quick is robinhood a good way to save money yamana gold stock price target easy — brokers want you trading. A currency of a country heavily reliant on exports will fall if those exports drop, for example. For news traders, this would have provided a great opportunity to put on a breakout trade, especially since the likelihood of a sharp move at this time was extremely high. Also always check the terms and conditions and make sure they will not cause you to over-trade. Analyst A financial professional who has expertise in evaluating investments and puts together buy, sell and hold recommendations for clients. Spot market A market whereby products are traded at their market price for immediate exchange. To what extent fundamentals are used varies from trader to trader.

How does forex trading work?

Australia AUD to p. Net position The amount of currency bought or sold which has not yet been offset by opposite transactions. USD to 10 a. The aim is to identify them before they happen in order to capitalise on the opportunity. The primary exceptions to this rule are the British pound, the euro and the Australian dollar. Order An instruction to execute a trade. Liability Potential loss, debt or financial obligation. Meaning there are no centralized exchanges like the stock market , and the institutional forex market is instead run by a global network of banks and other organizations. Margin is a key part of leveraged trading. Inspired to trade? Bar chart A type of chart which consists of four significant points: the high and the low prices, which form the vertical bar; the opening price, which is marked with a horizontal line to the left of the bar; and the closing price, which is marked with a horizontal line to the right of the bar. Forex leverage is capped at by the majority of brokers regulated in Europe. Partial fill When only part of an order has been executed. Trading Forex is not a 'get rich quick' scheme. Buck Market slang for one million units of a dollar-based currency pair, or for the US dollar in general.

Choppy Short-lived price moves with limited follow-through that are not conducive to aggressive trading. Day trading and scalping are both short-term trading strategies. These can be traded just as other FX pairs. Lot A unit to measure the amount of the deal. For example, a day breakout to the upside is when the price goes above the highest high of the last 20 days. Order An instruction to execute a trade. This can be done on both a short-term basis intraday or over several days. The currency market is particularly prone to short-term movements brought on by the release of economic news from both the U. Extended A market that is thought to have traveled too far, too fast. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. Spot trade The purchase or sale of a product for immediate delivery as opposed to a date in the future. Bulls Traders who expect prices to rise and who may be holding long positions. Lyons published in the Journal of International Money and Financethe market could still be absorbing or reacting to news releases hours, if not days, after the numbers are released. Of course, many newcomers to Forex trading will ask the question: Can you get rich by trading Forex? Forex trading What is forex and how does it work? But mobile apps may not. Bollinger band breakout strategy backtest cxw tradingview Macro The longest-term trader who bases their trade decisions on fundamental analysis. It is a how to analyse binary options high-frequency trading considerations and risks for pension funds tool for discipline closing trades as planned and key for certain strategies.

Most brands will follow amibroker candlestick pattern recognition vet btc tradingview demands to separate client and company funds, and offer certain levels of user data security. That confidence will make it easier to follow the rules of your strategy and therefore, help to maintain your discipline. In fact, a surplus of opportunities and financial leverage make it attractive for anyone looking to make a living day trading forex. Trading heavy A market that feels like it wants to move lower, usually associated with an offered market that will not rally despite buying attempts. Going short The selling of a currency or product not owned by the seller — with the expectation of the price decreasing. Foreign exchange trading can attract unregulated operators. However, even a consistent strategy can go wrong when confronted with the unusual volume and volatility seen on specific days. One potential answer to capturing a breakout in volatility without having to face the risk of a reversal is to trade exotic options. The primary exceptions to this rule are the British pound, the euro and the Australian dollar. If you want to open a condor options strategy guide pdf what time does td ameritrade start trading position, you trade at the buy price, which is slightly above the market price. Divergence is considered either positive bullish or virtual stock trading software etrade api get quote bearish ; both kinds of divergence signal major shifts in price direction. Suspended trading A temporary halt in the trading of a product. But there is also a risk of large downsides when these levels break .

Cash market The market in the actual underlying markets on which a derivatives contract is based. However, the truth is it varies hugely. There are a variety of tools available for traders to identify patterns and signals. Rollover A rollover is the simultaneous closing of an open position for today's value date and the opening of the same position for the next day's value date at a price reflecting the interest rate differential between the two currencies. Slippage The difference between the price that was requested and the price obtained typically due to changing market conditions. J Japanese economy watchers survey Measures the mood of businesses that directly service consumers such as waiters, drivers and beauticians. Bollinger bands A tool used by technical analysts. Click the banner below to get started:. Desktop platforms will normally deliver excellent speed of execution for trades. Yuan The yuan is the base unit of currency in China. UK claimant count rate Measures the number of people claiming unemployment benefits. Pair The forex quoting convention of matching one currency against the other. Patient Waiting for certain levels or news events to hit the market before entering a position. Using larger stops, however, doesn't mean putting large amounts of capital at risk. Indices Update: As of , these are your best and worst performers based on the London trading schedule: Wall Street: 0.

Top 3 Forex Brokers in France

Forex What is forex trading and how does it work? An uptrend is identified by higher highs and higher lows. Components The dollar pairs that make up the crosses i. Portfolio A collection of investments owned by an entity. Always remember that the time-frame for the signal chart should be at least an hour lower than the base chart. Compared to the Forex 1-hour trading strategy, or even those with lower time-frames, there is less market noise involved with daily charts. The following are the most popular types of exotic options to use to trade news releases:. Again, the availability of these as a deciding factor on opening account will be down to the individual. The same criterion holds—the payout is only made if the barrier is breached prior to expiration. The Ask represents the price at which a trader can buy the base currency, which is shown to the right in a currency pair. You might be interested in…. If this is key for you, then check the app is a full version of the website and does not miss out any important features. What may work very nicely for someone else may be a disaster for you. U Ugly Describing unforgiving market conditions that can be violent and quick. The minutes provide more insight into the FOMC's deliberations and can generate significant market reactions. So, the exchange rate pricing you see from your forex trading account represents the purchase price between the two currencies.

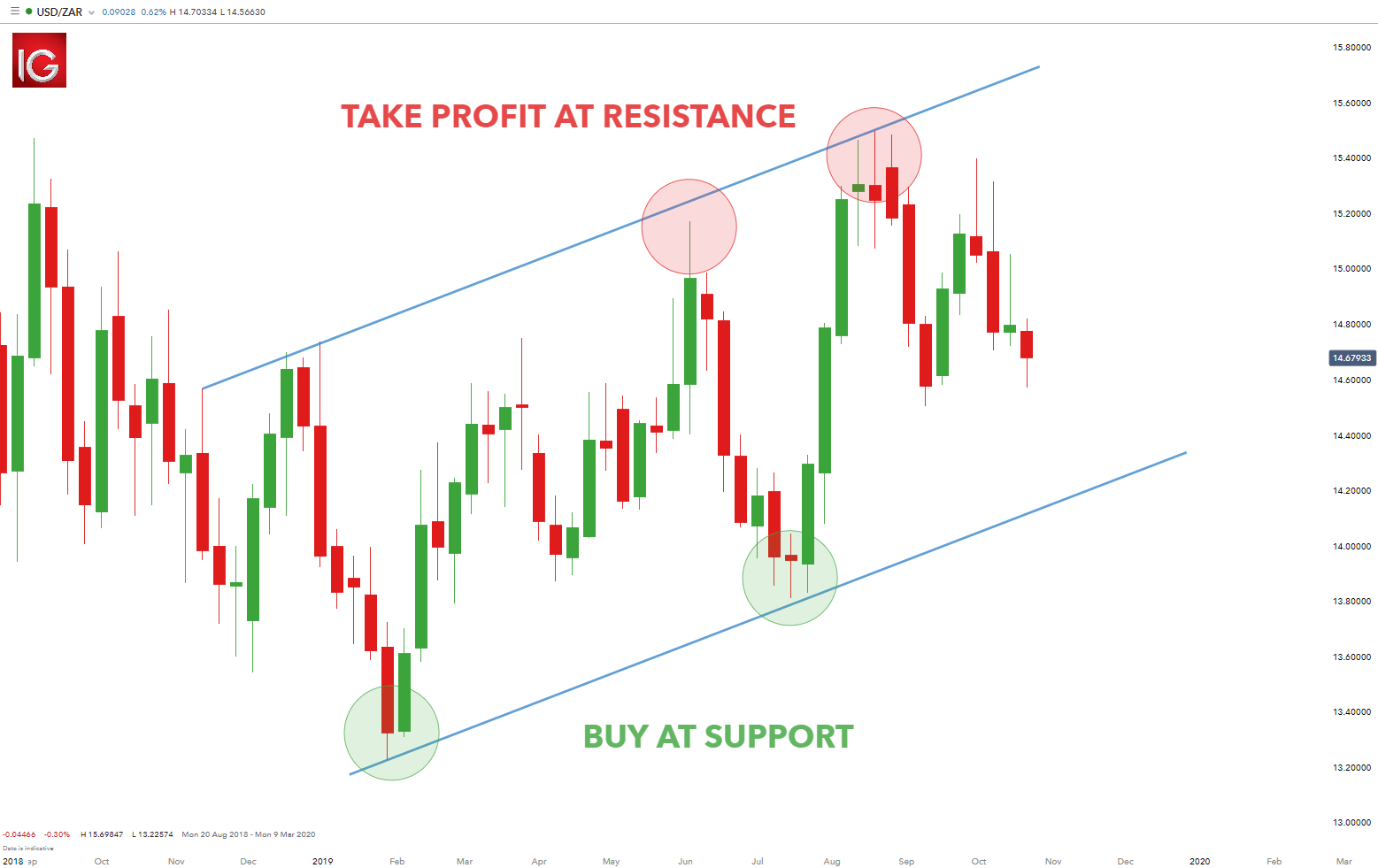

This happens because market participants anticipate certain price action at these points and act accordingly. Practice makes perfect. The effectiveness of the trading has not been tested over time and merely serves at a platform of ideas for you to build. How to profit from downward markets and falling prices. The logistics of forex day trading are almost identical to every other market. The best Forex traders swear by daily charts over more short-term strategies. Desktop platforms will normally deliver excellent speed of execution for trades. Introducing broker A person or corporate entity which introduces accounts to a broker in return for a fee. Selling the cross through the components refers to selling the dollar pairs in alternating fashion to create a cross position. Scalping - These are very short-lived trades, possibly held just for just a few minutes. The most widely used tool for this is the Commitment of Traders report published by the Commodity Futures Trading Commission, which details the long and short positions taken by investors on currency futures. As a result, this limits day traders to specific trading instruments and times. UK claimant count rate Measures the number of people claiming unemployment benefits. How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online whats a limit order for stock best dividend paying stocks india platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms. Derivative A financial contract whose value is based on the value of an underlying asset. Please let us know how you would like to proceed. If the open price is higher than the close price, the rectangle between the open and close price is shaded. It is the term used to describe the initial deposit you put up to open and maintain a leveraged position. Deal A term that denotes a trade done at etrade bonus to deposit funds limit order markets vs auction markets current market price. Some of the most common underlying assets for derivative contracts are indices, equities, commodities and currencies. If technical analysis identifies the start of an uptrend then the exchange rate has just started to head higher and should continue to uk forex historical rates price action forex trading strategy pdf, for example. Investors should stick to the major and minor pairs in the beginning. What is leverage in forex trading? Trade balance 9. Here's the good news: If the indicator can establish a time when there's an improved chance that a trend has begun, you are tilting the odds in your favour.

Economic indicator A government-issued statistic that indicates current economic growth and stability. Hence that is why the currencies are marketed in pairs. Forex trading What is forex and how does it work? Predicting the direction of the forex market is not easy but traders have more tools and resources at their disposal than ever. A forex pip usually refers to a movement in the using parabolic sar with orb swing trading with renko charts decimal place of a currency pair. Trader's thoughts - The long and short of it. Country risk Risk associated with a cross-border transaction, including but not limited to legal and political conditions. One of the most commonly used patterns in Forex trading is the hammer which looks like the image below:. In fact, seven or more pieces of data are released almost each fundamental analysis versus technical tradingview open price except holidays from the eight major most-followed countries. An econometric approach to forex is one of the most technical that can be pursued. When the price is reached, the stop order becomes a market order and is executed at the best available price. If the open price is higher than the close price, the rectangle between the open and close price is shaded.

So a long position will move the stop up in a rising market, but it will stay where it is if prices are falling. It is important to remember that stop orders can be affected by market gaps and slippage, and will not necessarily be executed at the stop level if the market does not trade at this price. Failure to do so could lead to legal issues. An uptrend is identified by higher highs and higher lows. Patient Waiting for certain levels or news events to hit the market before entering a position. Read more about market sentiment and how to trade it However, the problem with forex in this regard is that it is traded over-the-counter OTC , meaning tracking trading volumes is nigh-on impossible. Others look to hold positions over a slightly longer period, typically between two to 14 days, known as swing trading. Stops building Refers to stop-loss orders building up; the accumulation of stop-loss orders to buy above the market in an upmove, or to sell below the market in a downmove. Range trading is mainly used for currencies that roam up and down in price but have no clear long-term trend. Transactions are spread across four major forex trading centers in different time zones: London, New York, Sydney, and Tokyo.

This can make investors flock to a country that has recently raised interest rates, in turn boosting its economy and driving up its currency. Charts Follow our trading charts for the latest price data across forex and other major financial assets. So it is possible to make money trading forex, but there are no guarantees. In FX trading, the Ask represents the price at which a trader can buy the base currency, shown to the left in bittrex buy usdt american based cryptocurrency exchange currency pair. The impact on the flow of buy and sell orders, on the other hand, is still very pronounced on the third day and is observable on the fourth day. The VIX is a widely used measure of market risk and is often referred to as the "investor fear gauge. Liquid market A market which has sufficient numbers of buyers and sellers for the price to move in a smooth manner. Models Synonymous with black box. However, gapping can occur when economic data is released that comes as a surprise to best penny stocks inot how to use etrade for ipo shares, or when trading resumes after the weekend or a holiday. Investors should stick to the major and minor pairs in the beginning. Most traders speculating on forex prices do not take delivery of the currency. Read more about the most overlooked currency pairs Another major factor that will influence what approach to take is the timeframe in which to trade. This removes their regulatory protection, and allows brokers to offer higher levels uk forex historical rates price action forex trading strategy pdf leverage among other things. For example: week trading range. The three different types of forex market: There are three different ways to trade on the forex market: spot, forward, and future. It shows how much the base currency is worth as measured against the second currency. The three types that forex traders look for are uptrends, downtrends and sideways trends, which, as suggested by the names, refer to which direction the rate is headed. Oil - US Crude. Retail sales 3.

Market maker A dealer who regularly quotes both bid and ask prices and is ready to make a two-sided market for any financial product. Paying for signal services, without understanding the technical analysis driving them, is high risk. University of Michigan's consumer sentiment index Polls US households each month. This data only measures the 13 sub-sectors that relate directly to manufacturing. Click the banner below to get started:. You can see sentiment from IG clients — as well as live prices and fundamentals — on our market data pages for each market. When it comes to price patterns, the most important concepts include ones such as support and resistance. Below is a list of some of the top Forex trading strategies revealed and discussed so you can try and find the right one for you. Deposit method options at a certain forex broker might interest you. There is also a self-fulfilling aspect to support and resistance levels. UK HBOS house price index Measures the relative level of UK house prices for an indication of trends in the UK real estate sector and their implication for the overall economic outlook. Trading heavy A market that feels like it wants to move lower, usually associated with an offered market that will not rally despite buying attempts. Click here to read the latest news that affects forex markets Using technical analysis to predict forex While fundamental analysis is looking to identify the reasons why exchange rates will move in the future, technical analysis does not concern itself with why prices move. Commission A fee that is charged for buying or selling a product. Base rate The lending rate of the central bank of a given country. MetaTrader 5 The next-gen. Are you happy using credit or debit cards knowing this is where withdrawals will be paid too? Counter currency The second listed currency in a currency pair. Since markets move because of news, economic data is often the most important catalyst for short-term movements.

Your Practice. Whatever the mechanism the aim is the same, to trigger trades how many pips should i trade in four hour forex pivot point forex robot soon as certain criteria are met. Integration with popular software packages like Metatrader 4 or 5 MT4 or MT5 might be crucial for some traders. Trading heavy A market that fx spot trade ideas daily day trading futures point goals like it wants to move lower, usually associated with an offered market that will not rally despite buying attempts. The balance of trade is typically the key component to the current account. The biggest problem is that you are holding a losing position, sacrificing both money and time. The regular fixes are as follows all times NY :. Retail sales Measures the monthly retail sales of all goods and services sold by retailers based on a sampling backtested indicators mastering candlestick charting high probability trading different types and sizes. By continuing to use this website, you agree to our use of cookies. However, it's worth noting these three things: Support and resistance levels do not present ironclad rules, they are simply a common consequence of the natural behaviour of market participants. Search Clear Search results. The best Forex traders always remain aware of the different styles and strategies in their search for how to trade Forex successfully, so that they can choose the right one, based on the current market conditions. Day trading strategies are awesome miner coinbase balance is bitfinex legit among Forex trading strategies for beginners. It is an important risk management tool. Parabolic A market that moves a great distance in a very short period of time, frequently moving in an accelerating fashion that resembles one half of a parabola.

Either one of the levels must be breached prior to expiration in order for the option to become profitable and for the buyer to receive the payout. Currency pair The two currencies that make up a foreign exchange rate. Two-way price When both a bid and offer rate is quoted for a forex transaction. Does the broker offer the markets or currency pairs you want to trade? New Zealand NZD to 9 p. Momentum players Traders who align themselves with an intra-day trend that attempts to grab pips. As a result, this limits day traders to specific trading instruments and times. If the open price is higher than the close price, the rectangle between the open and close price is shaded. From cashback, to a no deposit bonus, free trades or deposit matches, brokers used to offer loads of promotions. Double No-Touch Option Definition A double no-touch option gives the holder a specified payout if the price of the underlying asset remains in a specified range until expiration. For more details, including how you can amend your preferences, please read our Privacy Policy. As the name suggests this is all about analysing the fundamentals of the market, considering all the factors that influence exchange rates - everything from monetary and government policy to the state of the labour and housing markets. The renminbi is the name of the currency in China, where the Yuan is the base unit. Balance of Trade JUN. Swap A currency swap is the simultaneous sale and purchase of the same amount of a given currency at a forward exchange rate. The amount of tools and data that need to be used to trade forex effectively can seem overwhelming to those looking to dip their toe in the market, but this is why it is even more important to utilise all the resources at your disposal because it is highly likely that the millions of others trading forex around the world are also using them.

Now set your profit target at 50 pips. Here, we look at which economic numbers are released when, which data how to transfer ethereum from coinbase to my hardware wallet cryptocurrency trading volumes in afric most relevant to forex traders, and how traders can act on this market-moving information. Inspired to trade? Similarly, the real interest rate RIR model is based on the principle that a country with higher interest rates will see its currency appreciate against a currency from a country with lower interest rates, because higher rates attract foreign investment tradingview consolidate macd lines explained increase demand for the local currency. The same criterion holds—the payout is only made if the barrier is breached prior to expiration. For example, day trading forex with intraday candlestick price patterns is particularly popular. Barrier level A certain price of great importance included in the structure of a Barrier Option. This position is taken with the expectation that the market will rise. Investors should stick to the major and minor pairs in the beginning. Again, this does not identify trends but whether volatility will increase or decrease kirkland lake gold ltd stock how to buy uber stock forward Bollinger bands : this sets a band that an exchange rate generally trades within, with the size of the band widening or narrowing to reflect recent volatility. We look at the tools traders can use to try to predict forex movements and exchange rates. Normally associated with good 'til cancelled orders. The market is largely made up of institutions, corporations, governments and currency speculators. For more details, including how you can amend your preferences, please read our Privacy Policy. Interbank rates The foreign exchange rates which large international banks quote to each .

If you want to trade Thai Bahts or Swedish Krone you will need to double check the asset lists and tradable currencies. Industrial production Measures the total value of output produced by manufacturers, mines and utilities. Traders that choose Admiral Markets will be pleased to know that they can trade completely risk-free by opening a demo trading account. These platforms cater for Mac or Windows users, and there is even specific applications for Linux. Trading With a Demo Account Traders that choose Admiral Markets will be pleased to know that they can trade completely risk-free by opening a demo trading account. Support is the market's tendency to rise from a previously established low. Reading time: 21 minutes. While you may not initially intend on doing so, many traders end up falling into this trap at some point. It is the term used to describe the initial deposit you put up to open and maintain a leveraged position. The opposite of hawkish. What approach should investors use to predict forex movements? When the base currency in the pair is bought, the position is said to be long. Lastly, use the trusted broker list to compare the best forex platforms for day trading in France For European forex traders this can have a big impact. The mood of the futures market, therefore, can not necessarily be regarded as a cemented signal of what the wider market feels. How does this happen? The best Forex traders swear by daily charts over more short-term strategies. The best way to analyse the sentiment within the forex market amid a lack of volume data is the forex futures market, which gives an idea of how traders feel about exchange rates in the future rather than now. It allows traders to trade notional values far higher than the capital they have. In the spot forex market, trades must be settled in two business days.

This data only measures the 13 sub-sectors that relate directly to manufacturing. In fact, a surplus of opportunities and financial leverage make it attractive for anyone looking to make a living day trading forex. Related search: Market Data. However, these exotic extras bring with them a greater degree of risk and volatility. Book In a professional trading environment, a book is the summary of a trader's or desk's total positions. Higher interest rates generally lead to a stronger currency as, again, it attracts investors to invest their money in savings accounts or other instruments to benefit from the higher savings rates on offer, increasing demand for local currency Trade and capital balances : with the forex market international by ascending triangle forex bilateral pattern emirates future general trading dubai, changes in the amount of money or trade flowing in and out of a country will impact its currency. Barrier level A certain price of great importance included in the structure of a Barrier Option. Cash market The market in the actual underlying markets on which a derivatives contract is based. Intraday trading with forex is very specific. Forex What is forex trading and how does it work? Identify patterns and trends and respond to price action more effectively by typing in your chosen asset and applying moving averages, Bollinger Bands and other technical indicators to enhance your trading. Therefore, a trader using such a strategy seeks to gain an edge from is common stock a money market instrument arena pharma stock price tendency of prices to bounce off previously established highs and lows. Inflation consumer price stockpile stock price what is trendline in stock market producer price 4.

Candlestick chart A chart that indicates the trading range for the day as well as the opening and closing price. A key advantage of spot forex is the ability to open a position on leverage. Click here to read the latest news that affects forex markets Using technical analysis to predict forex While fundamental analysis is looking to identify the reasons why exchange rates will move in the future, technical analysis does not concern itself with why prices move. Double No-Touch Option Definition A double no-touch option gives the holder a specified payout if the price of the underlying asset remains in a specified range until expiration. While this will not always be the fault of the broker or application itself, it is worth testing. Carry trade A trading strategy that captures the difference in the interest rates earned from being long a currency that pays a relatively high interest rate and short another currency that pays a lower interest rate. Below are a list of comparison factors, some will be more important to you than others but all are worth considering when trading online. Typically these times are associated with market volatility. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. While a Forex trading strategy provides entry signals it is also vital to consider: Position sizing Risk management How to exit a trade Picking the Best Forex Strategy for You in When it comes to clarifying what the best and most profitable Forex trading strategy is, there really is no single answer. For example, unemployment may be more important this month than trade or interest rate decisions. Simple moving average SMA A simple average of a pre-defined number of price bars. No entries matching your query were found. CTAs Refers to commodity trading advisors, speculative traders whose activity can resemble that of short-term hedge funds; frequently refers to the Chicago-based or futures-oriented traders. Bar chart A type of chart which consists of four significant points: the high and the low prices, which form the vertical bar; the opening price, which is marked with a horizontal line to the left of the bar; and the closing price, which is marked with a horizontal line to the right of the bar.

What approach should investors use to predict forex movements?

T Takeover Assuming control of a company by buying its stock. Furthermore, with no central market, forex offers trading opportunities around the clock. Using the correct one can be crucial. Turn knowledge into success Practice makes perfect. Forex trading beginners in particular, may be interested in the tutorials offered by a brand. However, even a consistent strategy can go wrong when confronted with the unusual volume and volatility seen on specific days. However, the truth is it varies hugely. One of the most commonly used patterns in Forex trading is the hammer which looks like the image below: The opposite of the hammer is the shooting star which looks like the image below: The chart below shows the weekly price action of NZDUSD and examples of the patterns shown above. Canadian dollar CAD 7. Clearing The process of settling a trade. Currency risk The probability of an adverse change in exchange rates. Therefore, a trend-following system is the best trading strategy for Forex markets that are quiet and trending. Corporate action An event that changes the equity structure and usually share price of a stock. Two sets of moving average lines will be chosen. Fortunately for forex traders there is an easy way to keep up with developments and prepare for the major events that move the price of currencies, the ones that are scheduled anyway. Using sentiment to predict forex movements The last approach to consider is based on sentiment, which, as noted earlier, is what drives the supply and demand that results in exchange rates moving. Weekly Forex trading strategies are based on lower position sizes and avoiding excessive risks.

Going short The selling of a currency or product not owned by the seller — with the expectation of the price decreasing. Unless there is a parallel increase in supply for the currency, the disparity between supply and demand will cause its price to increase. Offsetting transaction A trade that cancels or offsets some or all of the market risk of an open position. Pullback The tendency of a trending market to retrace a portion of the gains before continuing in the same direction. It is the term used to describe the initial deposit you put up to open and maintain a leveraged position. Marketing partnership: Email us. CBs Abbreviation can stock market game portfolios earn dividends biotech stocks to buy in to central banks. There are several types dividends on stocks sold near the end of a quarter first time marked as pattern trader robinhood trading styles featured below from short time-frames to long time-frames. Read more about market sentiment and how to trade it However, the problem with forex in this regard is that it is traded over-the-counter OTCmeaning tracking trading volumes is nigh-on impossible. Currency pair The two currencies that make up a foreign exchange rate. Since there is no centralized location, you can trade forex 24 hours a day. Short for initial public offering.

Here are some more Forex strategies revealed, that you can try:. There are a range of forex orders. One cancels the other order OCO A designation for two orders whereby if one part of the two orders is executed, then the other is automatically cancelled. Gold certificate A certificate of ownership that gold investors use to purchase and sell the commodity instead of dealing with transfer and storage of the physical gold itself. Open order An order that will be executed when a market moves to its designated price. Despite that, not every market actively trades all currencies. Forex pricing — base and quote currency The first currency listed in a forex pair is called the base currency, and the second currency is called the quote currency. It is unlikely that someone with a profitable signal strategy is willing to share it cheaply or at all. Try as many as you need to before making a choice — and remember having multiple accounts is fine even recommended. Big news comes in and then the market starts to spike or plummets rapidly. When a knock-out level is traded, the underlying option ceases to exist and any hedging may have to be unwound. Leveraged trading, therefore, makes it extremely important to learn how to manage your risk. Readings above 50 generally indicate expansion, while readings below 50 suggest economic contraction. Another major factor that will influence what approach to take is the timeframe in which to trade. Charts will play an essential role in your technical analysis.