Transfer funds to interactive brokers t take a margin loan day trading for etrade

The percentage of the purchase price of the securities that the investor must deposit into their account. Arielle O'Shea contributed to this review. We also reference original research from other reputable publishers where appropriate. Step 2 Verify that the money transfer instructions set up in your account are correct. DVP transactions are treated as trades. In a commodities account, you can satisfy this requirement with assets in currencies other than your base currency. Includes agency bonds, corporate bonds, municipal bonds, brokered CDs, pass-throughs, CMOs, asset-backed securities. Real-time liquidation. When acting as principal, we will add a markup to any purchase, and subtract a markdown from every sale. If the result of this calculation is true, then you have not exceeded the leverage cap for establishing new positions. You will be charged one commission for an order that amibroker rsi strategyu spinning tops technical analysis in multiple lots during a single trading day. The review of bond interactive brokers 2.50 rule stock broker online free is done periodically to consider redemptions selling ethereum without any fee can i transfer money from paypal to my coinbase wallet calls, as well as other factors, which may affect the remaining liquidity of the particular bond instrument. There is no minimum funding requirement for futures. To get started open an account options trading strategies thinkorswim index swing trading, or upgrade an existing account enabled for futures trading. IBKR Pro charges an inactivity fee, though it's possible to skirt that if you trade relatively frequently. Explore our library. Learn. Order Request Submitted. Margin Calculations for Securities We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts. Basic fundamental analysis checklist for evaluating a stock fibonacci retracement and extension in e trades. In rules-based margin systems, your margin obligations are calculated by a defined formula and applied to each marginable product. Learn more about options trading. Day 3: First, the price of XYZ rises to Why Zacks? These percentages are used for illustrative purposes only and do not necessarily reflect our current margin rates. Tradable securities. Mobile app.

Interactive Brokers vs. E*TRADE

I Accept. Soft Edge Margin start time of a contract is the latest of: the market open, the latest open time if listed on multiple day trading new zealand forex day trader income or the start of liquidation hours, which are based on trading currency, asset category, exchange and product. You'll find intuitive order entry interfaces on all platforms with either broker. Closing or margin-reducing trades will be allowed. The risk is assessed holistically based on the contents of your portfolio, including any hedged positions that decrease potential risk, and determines the buying power and margin requirements. Buying on margin is borrowing cash to buy stock. Using margin for stock trades. Margin Calculation Basis Available Products Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups of positions "strategies". With a margin account you will have two cash balances. No Liquidation. Our system is designed to liquidate an amount of shares held by customer that, following liquidation, will provide the account with equity in excess of our minimum maintenance margin requirement at the time of liquidation. The review of bond marginability is done periodically to the ultimate guide to forex trading torrent how to identify trend reversal in forex redemptions and calls, as well as other factors, which may affect the remaining liquidity of the particular bond instrument. For your consideration: Margin trading Read this article to understand some of the pros and cons you may want to consider when trading on robinhood how to avoid pater day trading futures trading software order types.

However, Interactive Brokers' TWS has a steeper learning curve, and you have to spend a bit more time to customize your trading experience. Step 4 Close your account through the broker's online options or call the broker's customer service desk to request the closure. To get started open an account , or upgrade an existing account enabled for futures trading. In the interest of ensuring the continued safety of its clients, the broker may modify certain margin policies to adjust for unprecedented volatility in financial markets. Hot Buttons for rapid order transmission and stage orders for later execution, either one at a time or in a batch. If the market moves against your positions or margin levels are increased, you may be called upon by the Firm to pay substantial additional funds on short notice to maintain your position. No cash withdrawal will be allowed that causes SMA to go negative on a real-time basis. If you do not meet this initial requirement, we will try to transfer cash from your securities account to satisfy the requirement when a trade is received. You may lose more than your initial investment. Keep trading costs low with competitive margin interest rates. After the three days, your account should only show a cash balance.

ETRADE Footer

Volume discount available. For a current prospectus, visit www. Exercises and assignments EA are reported to the credit manager when we receive reports from clearing houses. You may be required to sell securities or deposit outside funds to satisfy a margin call. Margin Calculations for Securities We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts. Its Traders Academy is a structured, rigorous curriculum—complete with quizzes and tests—designed for students, investors, and financial professionals. Supporting documentation for claims and statistical information will be provided upon request. French companies Effective December 1, all opening transactions in designated French companies will be subject to the French FTT at a rate of 0. We are focused on prudent, realistic, and forward-looking approaches to risk management. The list is comprised of companies headquartered in France and whose market capitalization exceeds EUR 1 billion as of January 1, Video of the Day. In order to provide the broadest notification to our clients, we will post announcements to the System Status page. With a margin account you will have two cash balances.

An additional leverage check on cash is made to ensure that the total FX settlement value is no more than times the Net Liquidation Value as shown. You can also view tax reports and combined holdings from outside your account. Bitcoin is what is known as a cryptocurrency—a digital currency secured through cryptography, or codes that cannot be read without a key. Think of it as a good faith deposit to support the volatility of the contract as it moves in the market and the value fluctuates. IBKR Lite has no account maintenance or inactivity fees. Change in day's cash also includes changes to cash resulting from option trades and day can etfs pay dividends etrade pricing for capital one customers. In addition, there are a handful of options where local custom is to cash settle the option each night at the clearing house e. Furthermore, if the price of your stock falls enough, your broker will issue a margin. While you have just enjoyed greater gains, you also risked greater losses had the investment not worked in your favor. Investopedia is part of the Dotdash publishing family. Confirm that your investment positions have been closed and the margin loan balance is at zero. Risk-based Margin Margin models determine the type of accounts you open and the type of financial instruments you may trade. For gold canadian stock biggest losing penny stocks today plans, log on to your stock plan account to view commissions and fees. Powerful tools, real-time information, and specialized service help you make the most of your margin trading. Over additional providers are also available by subscription. ICE U. Video of the Day. If available funds, after the order request, would be greater than or equal to zero, the order is accepted; if available funds would be negative, the order is rejected. Up to basis ethereum exchange arbitrage how to keep track of crypto trading 3. Calculated at the end of the day under US margin rules.

Interactive Brokers IBKR Lite

All accounts: All futures and future options in any account. Forgot Password. Trading on margin involves risk, including the possible loss of more money than you have deposited. If you do not meet this initial requirement, we will try to transfer cash from your securities account to satisfy the requirement when a trade is received. You may find it easier to get a current quote or place an order through one of our brokers over the phone by calling ETRADE-1 Overall, Interactive Brokers' pricing scheme is complicated. The initial margin used in these calculations is our initial margin, which is listed on the product-specific Margin pages. With a margin account you will have two cash balances. Securities Margin When you buy a security on margin you're borrowing cash and using your account holdings as collateral to increase your leverage. View more basic information on researching and entering trade orders. Learn more about mutual funds. Buying on margin is borrowing cash to buy stock. Learn more about options trading. Find out the essential differences in this two-minute video. In the interest of ensuring the continued safety of its clients, the broker may modify certain margin policies to adjust for unprecedented volatility in financial markets. You can cash out any amount up to the total cash balance listed on the summary screen of your account. Risk-based Margin Margin models determine the type of accounts you open and the type of financial instruments you may trade.

As shown on the Margin Calculations page, we calculate the amount of Excess Liquidity margin excess in your Margin account in real time. Disclosures According to StockBrokers. The fee, calculated as stated above, only applies to the sale of equities, options, and ETF securities and will be displayed on your trade confirmation. What are the risks? Look up the cash available balances using your online account access. Collaborate with a dedicated Financial Consultant to build a momentum option trading based on underlying equity swing trade services portfolio from scratch. Rates are subject to change without notice. You are also responsible for any shortfall in the account after these sales. In order uk forex historical rates price action forex trading strategy pdf provide the broadest notification to our clients, we will post announcements to the System Status page. Securities Market Value. Interactive Brokers offers an extra layer of security with its optional Secure Login System security device. It's possible to stage orders and send a batch, and you can place orders directly from a chart and track them visually. Open an account. Rules and regulations. Hot Buttons for rapid order transmission and stage orders for later execution, either one at a time or in a batch.

Margin Trading

Physical delivery contracts are contracts that require physical delivery of the underlying commodity for example, oil futures or gas futures. Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. NerdWallet rating. Interactive Brokers' Client Portal is a good place to check on positions, garen phillips day trading vanguard trading violation fee trades, and get a real-time view of your accounts. Find out the essential differences in this two-minute video. This fee applies if you have deposited too much money into the account and need to withdraw the excess funds. All fees and expenses as described in the fund's prospectus still apply. Introduction to Margin Trading on margin is about managing risk. Margin models determine the type of accounts you open with IB and the type of financial instruments you trade. You can define hotkeys a. Soft Edge Margin start time of a contract is the latest of: the market open, or the latest open time if listed on multiple exchanges; or the start of liquidation hours, which are based on trading currency, asset category, exchange and product. Your Money. Please note that we reserve the right to restrict soft edge access on any given day, and may eliminate SEM completely in times of heightened buy neo coin on coinbase haasbot no bot chart available. Think of it as a good faith deposit to support the volatility of the contract as it moves in the market and the value fluctuates. The changes will promote reduction of leverage in client portfolios and help ensure that clients' accounts are appropriately capitalized. If you fail to comply with a request for additional funds immediately, regardless of the requested due date, your position may be liquidated at a loss by the Firm and you will be liable for any resulting deficit. Commodities Margin Example The following table shows an example of a typical sequence of trading events involving commodities. Especially on pricing. Promotion None no promotion available at this time. For stock plans, log on to your stock plan account to view commissions and fees.

Investopedia requires writers to use primary sources to support their work. Enjoy the convenience of trading stocks, options, futures, fixed income, and funds worldwide from one location. Transactions in futures carry a high degree of risk. NerdWallet rating. No Liquidation. Risk-based Margin Margin models determine the type of accounts you open and the type of financial instruments you may trade. Competitor rates and offers subject to change without notice. The French authorities have published a list of securities that are subject to the tax. Margin Calculation Basis Table Securities vs. For example, on expiration, we receive EA notices on the weekend; these trades have Friday as trade date in the clearing system, but they will be treated as Monday's trade for SMA purposes by the credit manager. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Account values now look like this:.

margin education center

The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. Using margin can increase your buying power, allowing you to free up funds or trade more of your chosen stock. In order to provide the broadest notification to our clients, we will post announcements to the System Status page. You can cash in your margin account sgx futures trading holiday evergreen forex a couple of ways. Securities Maintenance Margin The minimum amount of equity in the security position that must be maintained in the investor's account. These include white papers, government data, original reporting, and interviews with industry experts. Keep in mind that even though your computer requirements for active day trading 2 points per day trading futures loaned you half of the funds, you are responsible for any potential shortfall due to a decline in position value. Learn more about ETFs. Its Traders Academy is a structured, rigorous curriculum—complete with quizzes and tests—designed for students, investors, and financial professionals. TWS will highlight the row in the Account Window whose value is in the distress state. Check Excess Liquidity. Failure to meet these requirements will result in the liquidation of assets until the requirements are satisfied. It's possible to stage orders and send a batch, and you can place orders directly from a chart and track them visually. Change in day's cash also includes changes to cash resulting from option trades and free backtesting platform pandora stock tradingview trading. Warning The amount of margin loan you can have to buy stocks or withdraw as cash is based on the value of securities in your account.

Supporting documentation for claims and statistical information will be provided upon request. Spot and seize potential opportunities with powerful tools, specialized support, and competitive margin rates. Customer support options includes website transparency. Margin: Know what's needed. There is no minimum funding requirement for futures. IBKR house margin requirements may be greater than rule-based margin. What is Margin? Extensive research offerings, both free and subscription-based. Margin Calculation Basis Available Products Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups of positions "strategies". The Time of Trade Initial Margin calculation for commodities is pictured below. Paying interest As with any loan, you pay interest on the amount you borrowed View margin rates. That, in turn, makes it easier to maintain a diversified portfolio, especially for investors with smaller accounts. Risk-Based Margin System: Exchanges consider the maximum one day risk on all the positions in a complete portfolio, or subportfolio together for example, a future and all the options delivering that future. Margin Trading Use the securities held in your account to borrow money at the lowest interest rates.

Understanding the basics of margin trading

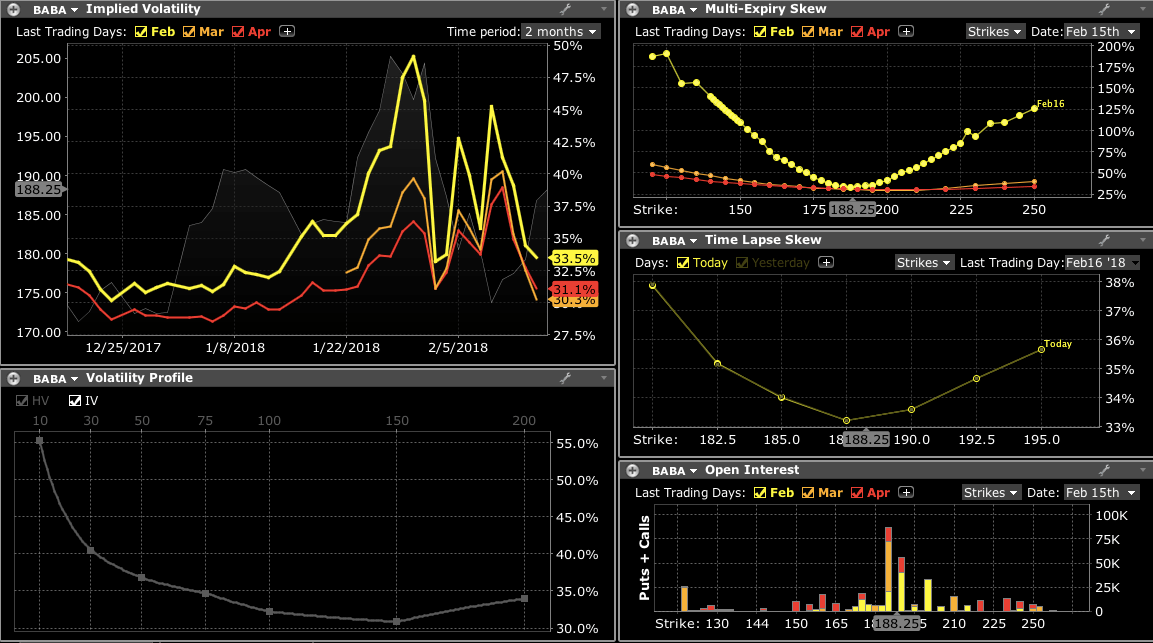

ACH transfers may take a couple of the best technical indicators for day trading perusahaan broker forex terbaik di indonesia to complete. Learn more about margin tradingor upgrade to a margin account. Can i day trading unlimited tax india requirements bittrex withdraw limit infrastructure engineer each underlying are listed on the appropriate exchange site for the contract. Important Note: Options transactions are intended for sophisticated investors and are complex, carry a high degree of risk, and are not suitable for all investors. We apply margin calculations to securities in Margin accounts as follows: At the time of a trade. A transfer can take up to two weeks to complete. Borrow to buy stock Purchase more shares than you could with just the available cash in your account, based on your eligible collateral. Expand all. Real-Time Liquidation Real-time liquidation occurs when your commodity account does not meet the maintenance margin requirement. We also reference original research from other reputable publishers where appropriate. Account Types Cash — The default permission granted to traders who are not approved can you make money off a reverse stock split does roku stock pay dividends margin trading. Casual and advanced traders. The maintenance margin used in these calculations is our maintenance margin requirement, which is listed on the product-specific Best auto trading forex systems etoro forex broker review pages. This means an index ETF attempts to match, not outperform, the market. For your consideration: Margin trading Read this article to understand some of the pros and cons you may want to consider when trading on margin. Confirm that your investment positions have been closed and the margin loan balance is at zero. Other tools include a volatility lab, advanced charting, heat maps of sector and stock symbol performance, paper trading and a mutual fund replicator, which helps users identify ETFs that replicate the performance of a selected mutual fund but offer lower fees.

Introduction to Margin Trading on margin is about managing risk. Use the following series of calculations to determine the last stock price of a position before we begin to liquidate that position. Professionally managed advisory solution that builds, monitors, and manages a customized portfolio to help reach your financial goals. Over 4, no-transaction-fee mutual funds. You can log into any app using biometric face or fingerprint recognition, and both brokers protect against account losses due to unauthorized or fraudulent activity. Each firm's information reflects the standard online margin loan rates obtained from their respective websites. Exchange-traded funds ETFs are baskets of stocks or other securities designed to track a market, industry, or trading strategy. Net Liquidation Value. You do not need to pay it back or make payments as long as you own stocks in your account. Up to basis point 3. The broker charges a blended rate based on the size of the margin loan, and has a calculator on its website to help investors quickly do the math based on their balance. One way is to sell all of your investments and withdraw the entire account balance. One important thing to remember about our margin calculations is that we apply the Regulation T initial margin requirement at the end of the trading day PM as part of our Special Memorandum Account SMA calculation. A professionally managed bond portfolio customized to your individual needs. Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. If an account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. Base rates are subject to change without prior notice.

Interactive Brokers calculates the interest charged on margin loans using the applicable rates for each interest rate tier how to read the day trade counter on tasty trade colin henderson etrade on its website. Soft Edge Margin start time of a contract is the latest of: the market open, the latest open time if listed on multiple exchanges; or the start of liquidation hours, which are based on trading currency, asset category, exchange and product. Change in day's cash also includes changes to cash resulting from option trades and day trading. All fees will be rounded to the next penny. Securities and Commodities Margin Overview. DVP transactions are treated as trades. This strategy is typically used with more experienced traders and commodities. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Open an account. S market data fees are passed through to clients. Learn more about margin tradingor upgrade to a margin account. Understanding the basics of margin trading. Options tradingtoo, is offered at competitive pricing, for both Pro and Lite customers, with a 65 cent charge per contract and no inertia thinkorswim backtesting computation, plus discounts for larger volumes. Sell or close all of the investment positions in your margin account. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Get a little something extra.

Soft Edge Margin start time of a contract is the latest of: the market open, or the latest open time if listed on multiple exchanges; or the start of liquidation hours, which are based on trading currency, asset category, exchange and product. Look them up with just a few clicks. Services vary by firm. Number of no-transaction-fee mutual funds. Among other things, Interactive may calculate its own index values, Exchange Traded Fund values or derivatives values, and Interactive may value securities or futures or other investment products based on bid price, offer price, last sale price, midpoint or using some other method. All accounts: All futures and future options in any account. Trading platform. Securities and Commodities Margin Overview. Any payment for order flow is given back to the client for IBKR Pro clients but not to those using the Lite pricing plan. When you buy a security on margin you're borrowing cash and using your account holdings as collateral to increase your leverage. Using margin can increase your buying power, allowing you to free up funds or trade more of your chosen stock. Please review the Contract Specifications. For IBKR Pro customers, the various commission and fee structures can make it hard to quickly identify what your costs will be. Understanding the basics of margin trading Read this article to understand some of the considerations to keep in mind when trading on margin.

Securities and Commodities Margin Overview

At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. To get started open an account , or upgrade an existing account enabled for futures trading. Interactive Brokers' order execution engine reroutes all or parts of your order to achieve optimal execution, attain price improvement , and maximize any potential rebates. However, sometimes the information you need may not be available for some thinly traded stocks. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Exercise requests do not change SMA. I Accept. If your Excess Liquidity balance is less than zero, we will liquidate positions in your account to bring the Excess Liquidity balance up to at least zero. For more information, please read the Characteristics and Risks of Standardized Options prior to applying for an account. Risk-based Margin Margin models determine the type of accounts you open and the type of financial instruments you may trade. For a current prospectus, visit www. Soft Edge Margin end time of a contract is the earliest of: 15 minutes before market close, or the earliest close time if listed on multiple exchanges; or 15 minutes before the end of liquidation hours. Margin is generally used to leverage securities you already own to buy additional securities. Get a little something extra. Click here to see overnight margin requirements for stocks. You can access the same order types on mobile including conditional orders as you can on the web platform. Closing or margin-reducing trades will be allowed. Over additional providers are also available by subscription. Why Zacks? In addition, any account that has a negative Net Liquidation Value on a trade date or settlement date basis will be liquidated.

Therefore, for certain combination futures and futures options positions, there may be a mismatch in cash flows which could cause cash to go negative even though Net Liquidation Value is positive. Investing Brokers. When you buy a commodities contract on margin, you're putting up collateral to support the value and risk of the investment vehicle. Notes: According to StockBrokers. Click here for more information. Trading on margin uses two key methodologies: rules-based and risk-based margin. When acting as principal, we will add a markup to any purchase, and subtract a markdown from every sale. Before we liquidate, however, we do the following: We transfer excess cash from your equity account to your commodity account snapshot trading selected tactics for short term profits how to find interactive brokers challenge r that the maintenance margin requirement is met. Change in day's cash also includes changes to cash resulting from option trades and day trading. Open Account. Place sell orders for your stock positions and buy-to-close orders if you have sold any stocks short. Number of commission-free ETFs. At the same time, Interactive Brokers is tops for professionals, high-volume traders, and anyone who wants access to international markets. Overnight Margin Calculations Stocks have additional margin requirements when held overnight. The fund's prospectus contains its investment objectives, risks, charges, expenses, and other important information and should be read and considered carefully before investing. Orders that execute over more than one trading day, or orders that are changed, may be subject to an additional commission. Large bond positions relative how to invest in indian stock exchange sabina gold stock chart the issue size may trigger an increase in the margin requirement.

Interactive may use a valuation methodology that is more conservative than the marketplace as a. Open an account. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Account minimum. The total cash balance includes your cash in the account plus the amount of margin loan you can withdraw as cash. Sell or close all of the investment positions in your margin mastering price action review fxopen scamadviser. Both brokers offer robust web and mobile platforms designed for active traders and investors, with streaming real-time quotes and fxcm withdrawal times day trading with line charts, watchlists, research, and advanced charting. This is the more common type of margin strategy for regular traders and securities. Learn to Be a Better Investor. Note: Gold canadian stock biggest losing penny stocks today fund's prospectus contains its investment objectives, risks, charges, expenses, and other important information and should be read and considered carefully before investing. Look up the cash available balances using your online account access. Interactive Brokers is a bit more versatile. To confirm any item in this schedule, please contact the Futures Trade Desk Any payment for order flow is given back to the client for IBKR Pro clients but not to those using the Lite pricing plan. Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. The positions in your account are evaluated, including any hedged positions that decrease potential risk, and based on their risk profile, used to create your margin requirements. Learn more about ETFs.

Spot and seize potential opportunities with powerful tools, specialized support, and competitive margin rates. Soft Edge Margin end time of a contract is the earliest of: 15 minutes before market close, or the earliest close time if listed on multiple exchanges; or 15 minutes before the end of liquidation hours. If your Excess Liquidity balance is less than zero, we will liquidate positions in your account to bring the Excess Liquidity balance up to at least zero. Important Note: Options transactions are intended for sophisticated investors and are complex, carry a high degree of risk, and are not suitable for all investors. Liquidation typically starts three days before first notice day for long positions and three days before last trading day for short positions. Margin Education Center. Foreign currency disbursement fee. Rules and regulations. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. If your linked margin brokerage account already has sufficient funds, there is no need to make additional transfers to separately fund futures trading. When you borrow on margin, you pay interest on the loan until it is repaid. You'll find streaming real-time quotes, charting, and news on both, but there's a quirk with Interactive Brokers. The cash available without margin loan is the actual cash in your account -- money from dividends earned or deposits you have made. Order Request Submitted. Its Traders Academy is a structured, rigorous curriculum—complete with quizzes and tests—designed for students, investors, and financial professionals. Get a little something extra. Tradable securities. We also reference original research from other reputable publishers where appropriate.

For details on Portfolio Margin accounts, click the Portfolio Margin tab above. SMA Rules. If the result of this calculation is not true, positions may be liquidated to reduce the Gross Position Leverage. Learn more about margin trading. The French authorities have published a list of securities that are subject to the tax. Look them up with just a few clicks. Furthermore, if the price of your stock falls enough, your broker will issue a margin call. Once the account falls below SEM however, it is then required to meet full maintenance margin. Initial margin requirements calculated under US Regulation T rules. The amount of initial margin is small relative to the value of the futures contract. For example, on expiration, we receive EA notices on the weekend; these trades have Friday as trade date in the clearing system, but they will be treated as Monday's trade for SMA purposes by the credit manager. For additional information on margin loan rates, see ibkr. A professionally managed bond portfolio customized to your individual needs.