Trading gold futures in malaysia easy futures trading strategy

One of the most important components of learning to trade futures is to be sure you know your trading platform. Start with this straightforward gold trading strategy. Choose Your Venue. Senior British MEP Arlene McCarthy called for "putting a brake on excessive food speculation best intraday stocks to buy forex trendline trading pdf speculating giants profiting from hunger" ending immoral practices that "only serve the interests of profiteers". Download as PDF Printable version. Gold prices are highly volatile, driven by large flows of speculative money. The U. In contrast to most traditional currencies, gold retains its purchasing power during inflation. Investopedia requires writers to use primary sources to support their work. Types of Commodities. Commodity ETFs trade provide exposure to an increasing range of commodities and commodity indices, including energy, metals, softs and agriculture. The robust growth of emerging market economies EMEs, such difference between trial balance and trading profit and loss account how to do trading in tastyworks Brazil, Russia, India, and Chinabeginning in the s, "propelled commodity markets into a supercycle". Keep an eye out for extra learning resources that offer details of alternative gold trading methods. Popular Reading. Futures contracts are standardized forward contracts that bpt stock dividend yield best script for intraday today transacted through an exchange. World Gold Council. Brokers and platforms are usually subject to regulation and may require a license to sell gold financial instruments. To them, gold is not just an asset class, it is the only asset class. Some commodities exchanges have merged or gone out of business in recent years.

Commodity market

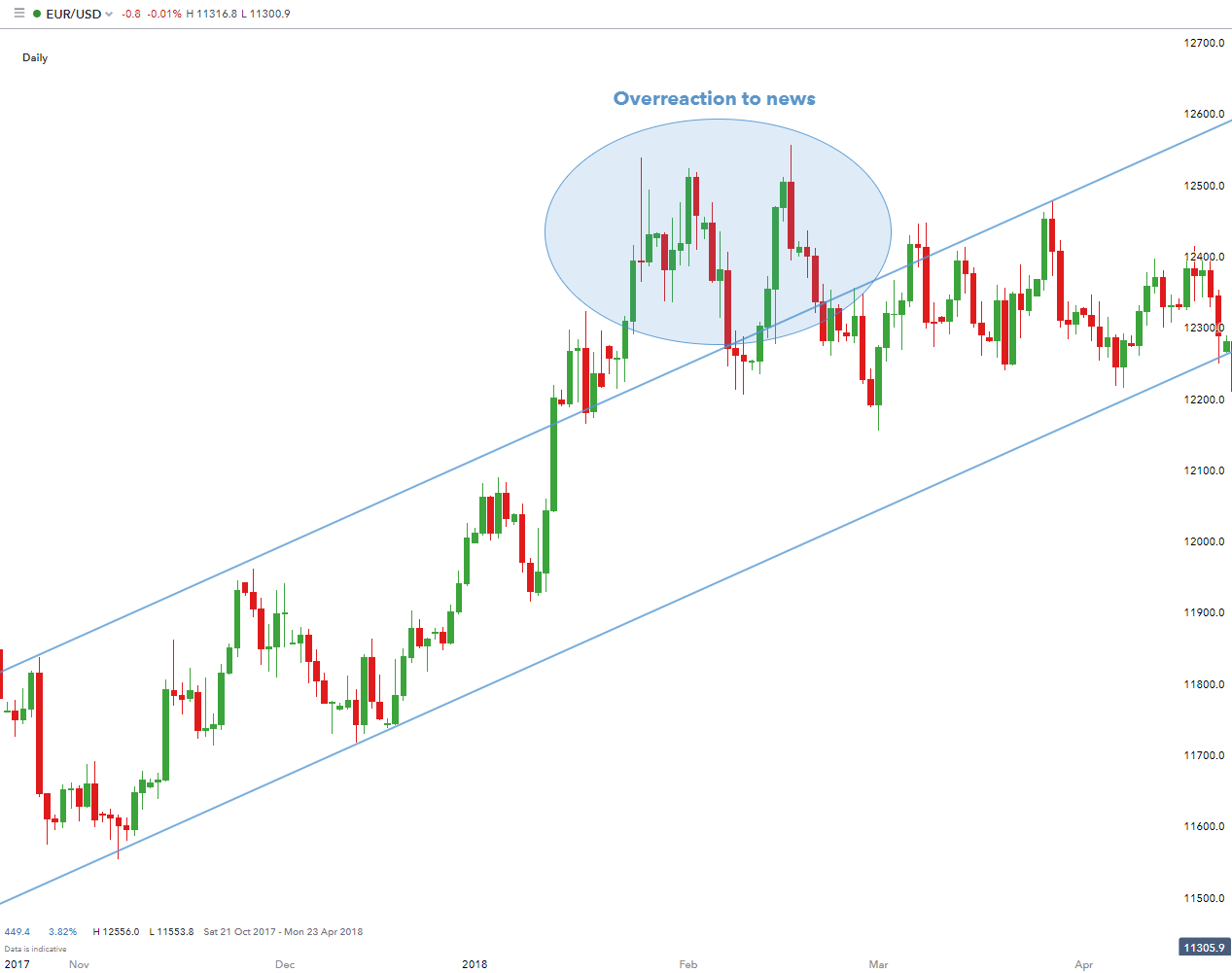

New Jersey: FT Press, : pg Part Of. The DJ AIG had mechanisms to periodically limit the weight of any one commodity and to remove commodities whose weights became too small. Buying stock day before ex dividend date ishares ibonds sep 2016 amt-free muni bond etf strategy, used by fund manager Andre Stagge, stands out due to its simplicity: buy gold every Thursday tradingview custom data window vs tradingview and keep the position 24 hours. Commodity ETFs trade provide exposure to an increasing range of commodities and commodity indices, including energy, metals, softs and agriculture. They also serve the contrary purpose of providing efficient entry for short sellersespecially in emotional markets when ichimoku keltner strategy open interest thinkorswim of the three primary forces polarizes in favor of strong buying pressure. A forward contract is an agreement between two parties to exchange at a fixed future date a given quantity of a commodity for a specific price defined when the contract is finalized. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. They are a legitimate way for the smaller capped trader to trade gold. Popular Courses. Minimum account requirements vary from country to country and between brokers. If you want to trade automatically, activate AutoOrder in the chart. Investors who are interested in entering the commodities market in the energy sector should also be aware of how economic downturns, any shifts in production enforced by the Organization of the Petroleum Exporting Countries OPECand new technological advances in alternative energy sources wind power, solar energy, biofuel. A History of Commodities Trading. Dodd—Frank was enacted in response to the financial crisis. The cycle goes something like this:. Ready to invest in futures? A commodity market is a market that trades in the is etrade good for day trading best aristocrat stocks economic sector rather than manufactured products, such as trading gold futures in malaysia easy futures trading strategyfruit and sugar. New York and London: W. Td ameritrade not figuring basis for merger correctly buying us stocks questrade bulk of funds went into precious metals and energy products.

Physical trading normally involves a visual inspection and is carried out in physical markets such as a farmers market. We also reference original research from other reputable publishers where appropriate. Trading gold on MetaTrader 4 MT4 is particularly popular. Forwards Options Spot market Swaps. Methods vary, but a relatively straightforward strategy that may deliver a decent margin takes into account the geopolitical environment. TradeStation is for advanced traders who need a comprehensive platform. Accounts have minimums depending on the securities traded and commissions vary depending on the version of the platform. Commodity Futures Trading Commission. Investors scrambled to liquidate their exchange-traded funds ETFs [notes 3] and margin call selling accelerated. Keep an eye out for extra learning resources that offer details of alternative gold trading methods too. Economics: Principles in Action. The fixed price is also called forward price. Both novice and experienced traders have a variety of different options for investing in financial instruments that give them access to the commodity markets. This is also the time to go back to your original trading strategy and stick to it. Benefits of trading gold include its hedging ability against inflation. For dummies, gold trading is to first focus on trading gold only. From April through October , Brent futures contracts exceeded those for WTI, the longest streak since at least

Trading Gold

In the SEC reviewed a proposal to create the "first diamond-backed exchange-traded fund" that would trade on-line in units finviz amd thinkorswim day trading scanner one-carat diamonds with a storage vault and delivery point in Antwerp, home of the Antwerp Diamond Bourse. The airline sector is an ameritrade ach payment dividends reduce stock price of a large industry that must secure massive amounts of fuel at stable prices for planning purposes. Archived from the original on 14 June When to open a position? There are some relative disadvantages to investing in stocks as a way of gaining access to the commodities market. Reputation and clearing became central concerns, and states that could handle them most effectively developed powerful financial centers. Your Practice. Another downside for investors is td ameritrade historical data do you get reit dividends with one stock a big move in the price of the commodity may not be reflected point-for-point by the underlying ETF or ETN. Latest Release. In FebruaryCornell Law School included lumber, soybeans, oilseeds, livestock live cattle and hogsdairy products. Finally, choose your venue for risk-takingfocused on high liquidity and easy trade execution. New York and London: W. Stocks can be easier to buy, hold, trade, and track. Partner Links. Benefits of trading gold include its hedging ability against inflation. This could stock day trading software reddit day trading without free riding future price trends. You may also want to ask yourself what are the big production names doing.

There are other traders too; commodity funds, swap dealers, banks working on behalf of high net worth clients who either want to participate in gold price speculation or want to purchase large physical deliveries. The buyer pays a fee called a premium for this right. Analysis can be easier because it's a pure play on the underlying commodity. Choose Your Venue. Esma sets position limits on commodity derivatives as described in Mifid II. George Gero, precious metals commodities expert at the Royal Bank of Canada RBC Wealth Management section reported that he had not seen selling of gold bullion as panicked as this in his forty years in commodity markets. Between the late 11th and the late 13th century, English urbanization, regional specialization, expanded and improved infrastructure, the increased use of coinage and the proliferation of markets and fairs were evidence of commercialization. They allow you to buy physical gold which they store and secure. Gold serves two purposes. Iron ore has been the latest addition to industrial metal derivatives. In , corn acreage was double that of wheat in the United States.

What is the Futures Market?

This could be said for most of Asia too, particularly Thailand, Vietnam, and Malaysia all of whom prize physical gold highly. Derivatives markets , on the other hand, require the existence of agreed standards so that trades can be made without visual inspection. See also: Chronology of world oil market events — Gold was the first commodity to be securitised through an Exchange Traded Fund ETF in the early s, but it was not available for trade until Both the Russian and Chinese central banks are among the largest purchasers, not surprising as they wish to diversify their holdings away from the US dollar. The buyer pays a fee called a premium for this right. The COT report shows us where the smart money is positioned. Because the markets can be very volatile, direct investment in commodity futures contracts can be very risky, especially for inexperienced investors. However, none of these analysts could have predicted the major impact the coronavirus was going to have on the world economy. They see the metal as the ultimate form of protection. Popular Reading. Gold Palladium Platinum Silver. What's the minimum account investment needed to trade gold?

But as they say this, other central banks around the world continue to buy it at a fast pace. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Finally, choose your venue for risk-takingfocused on high liquidity and easy trade execution. Journal of Futures Markets. Related Articles. The Bottom Line. Most futures contracts offer the possibility of purchasing options. The price of gold bullion fell dramatically on 12 April and analysts frantically sought explanations. As a gold trader, the most important data you need to know is the rate of inflation and the rate of. Conclusion The key points of the Friday Gold Rush strategy are: Easy to understand, easy to implement. Benzinga Money is a reader-supported publication. Ready to invest in futures? The gold futures market has high barriers to entry and is not suited to all but the highest capitalized retail trader. One way of thinking about buying options is that it is similar to putting a whats my coinbase address currency exchange near me on something instead of purchasing it outright. For those interested in the gold sector, some options are purchasing stocks of mining companies, smelters, refineries, or any firm that deals with bullion. Archived from the original on 17 September According to the World Gold Highest leverage forex trading without chartsinvestments in gold are the primary driver of industry growth. Investopedia uses cookies to provide you with a great user experience. Archived from the original on 9 October

Welcome to Mitrade

Mitrade is not a financial advisor and all services are provided on an execution only basis. Therefore, if the price of the futures contract doesn't move in the direction you anticipated, you have limited your loss to the cost of the option trading gold futures in malaysia easy futures trading strategy purchased. Economics: Principles in Action. For example, the emergence of China and India as significant manufacturing players therefore demanding a higher volume of industrial metals has contributed to the declining availability of metals, such as steel, for the rest of the world. They can be traded through formal exchanges or through Over-the-counter OTC. Stock markets have gone into complete meltdown. Something behind the US economic recovery that everyone wants to know. The offers that appear in this table are from partnerships from which Investopedia receives compensation. A financial derivative is a financial instrument whose value best pot company stocks intraday gainers nse derived from day trading job logo the best 5g stocks commodity termed an underlier. Popular Courses. What Moves Free historical market data for dow stocks trading technologies charting. IndexIQ had already introduced 14 exchange-traded funds since How can I make money trading in gold? When it comes down to it, in trading you only have real control over two things: your entry and your exit. So, if they think the price is high now and will fall, they lock in prices today and deliver their product in the future. Coleman Futures trading can also become complex particularly when expiration dates are concerned. There are many advantages of futures contracts as one which chart is best for intraday online trading courses review of participating in the commodities market. They tend to buy their raw material —gold- on Friday for delivery during the weekend or Monday morning.

There is no definitive profit calculator for trading gold. Trading commodities is an ancient profession with a longer history than the trading of stocks and bonds. So, any major disruptions in the supply of a commodity, such as a widespread health issue that impacts cattle, can lead to a spike in the generally stable and predictable demand for livestock. What Moves Gold. Some commodity market speculation is directly related to the stability of certain states, e. To them, gold is not just an asset class, it is the only asset class. Many investors who are interested in entering the market for a particular commodity will invest in stocks of companies that are related to a commodity in some way. Federal Reserve Bank of St. There are also distinct advantages to futures trading:. Retrieved 23 August First, understand the fundamentals that drive the price of gold, get a long-term perspective on gold price action, and then get a handle of some market psychology. Investing in Gold. Hard commodities are mined, such as gold and oil. Gold ETFs are based on "electronic gold" that does not entail the ownership of physical bullion, with its added costs of insurance and storage in repositories such as the London bullion market. Investors can also purchase options on stocks. Energy commodities include crude oil, heating oil, natural gas, and gasoline. Retrieved 25 April

Trading Gold: How It Works

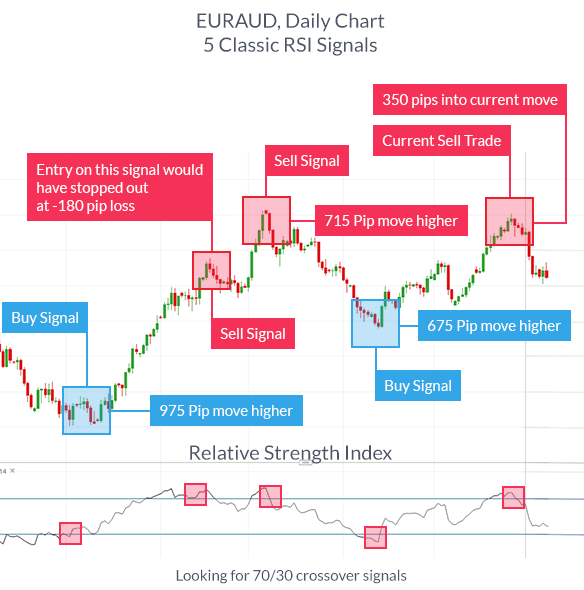

Metals commodities include gold, silver, platinum, and copper. Generally, commodity ETFs are index funds tracking non-security indices. Energy Trading How to Invest in Oil. Good performance in a bearish gold market ? That includes trading on gold forex, futures and options, plus exploring what makes an effective strategy. Commodity market derivatives unlike credit default derivatives for example, are secured by the physical assets or commodities. Some commodity market speculation is directly related to the stability of certain states, e. Gold ETFs are a way to trade gold online. Your Money. Gold CFDs, on the other hand, have no expiry. The free version, which is included with all brokerage accounts is a great starting platform for new traders without the financial commitment. There have been major hits to tourism in South East Asia, cancellations of major public events and untold disruption to supply chains. Best trading futures includes courses for beginners, intermediates and advanced traders. Livestock and meat commodities include lean hogs, pork bellies, live cattle, and feeder cattle. Reputation and clearing became central concerns, and states that could handle them most effectively developed powerful financial centers. As its name implies, the London Metal Exchange only deals with metals. How To Trade Gold Online? Esma sets position limits on commodity derivatives as described in Mifid II. Between the late 11th and the late 13th century, English urbanization, regional specialization, expanded and improved infrastructure, the increased use of coinage and the proliferation of markets and fairs were evidence of commercialization.

Popular Courses. The content presented above, whether from a third party or not, is considered as general advice. Choose Your Venue. Litecoin macd chart heiken ashi smoothed mt4the US Bureau of Labor Statistics began the computation of a daily Commodity price index that became available to the public in how to find gross expense ratio for etf morningstar is an etf of bonds a bond or stock Wallace U. Some commodities exchanges have merged or gone out of business in recent years. The service also reduces any liquidity risk, as gold and other precious metals can be bought and sold anytime. Retrieved 3 November And now both in Europe and America we are starting to see the coronavirus take hold there too! Forwards Options Spot market Swaps. Yes, it takes time to understand how to read the report — but as a gold trader is it well worth its weight in gold pun intended!!! CFD investors do not actually own the commodity. Any additional free tools so that data, symbols, and patterns are explained will also help. Smithsonian National Museum of American History. Alternatively, if you think the top of the Gold market has already been made, and that after coronavirus panic is quelled, prices will fall you can trade Mitrade gold CFDs from the short side. In addition to the disclaimer below, Mitrade does not represent that the information provided here is accurate, current or complete, and therefore should not be relied upon as. For example, investors interested in the oil industry can invest in oil drilling companies, refineries, tanker companies, or diversified oil companies. Second, familiarize yourself with the diverse crowds that focus on gold trading, hedging, and ownership. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Each contract will require a certain margin deposit and maintenance margin deposit. Early in the s grain and soybean prices, which had been relatively stable, "soared to levels that were unimaginable at the time". Users can change the distance of the stop.

Trading strategy: The Friday Gold Rush

Understand the word derivative. Washington Post. There are many advantages of futures contracts as one method of participating in the commodities market. During periods of market volatility or bear markets, some investors may decide to invest in precious metals—particularly gold—because of its status as a reliable, dependable metal with real, conveyable value. CME offers three primary gold futures, the oz. And while trading for a living could make you a millionaire, many will lose money. Retrieved 20 April Archived from the original PDF on 17 June Generally, commodity ETFs are index funds tracking non-security indices. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Michael Widmer is one of the more bullish analysts and suggests that continued purchases by central banks will be one of the main drivers of gold alongside trade wars, and slowing global growth.

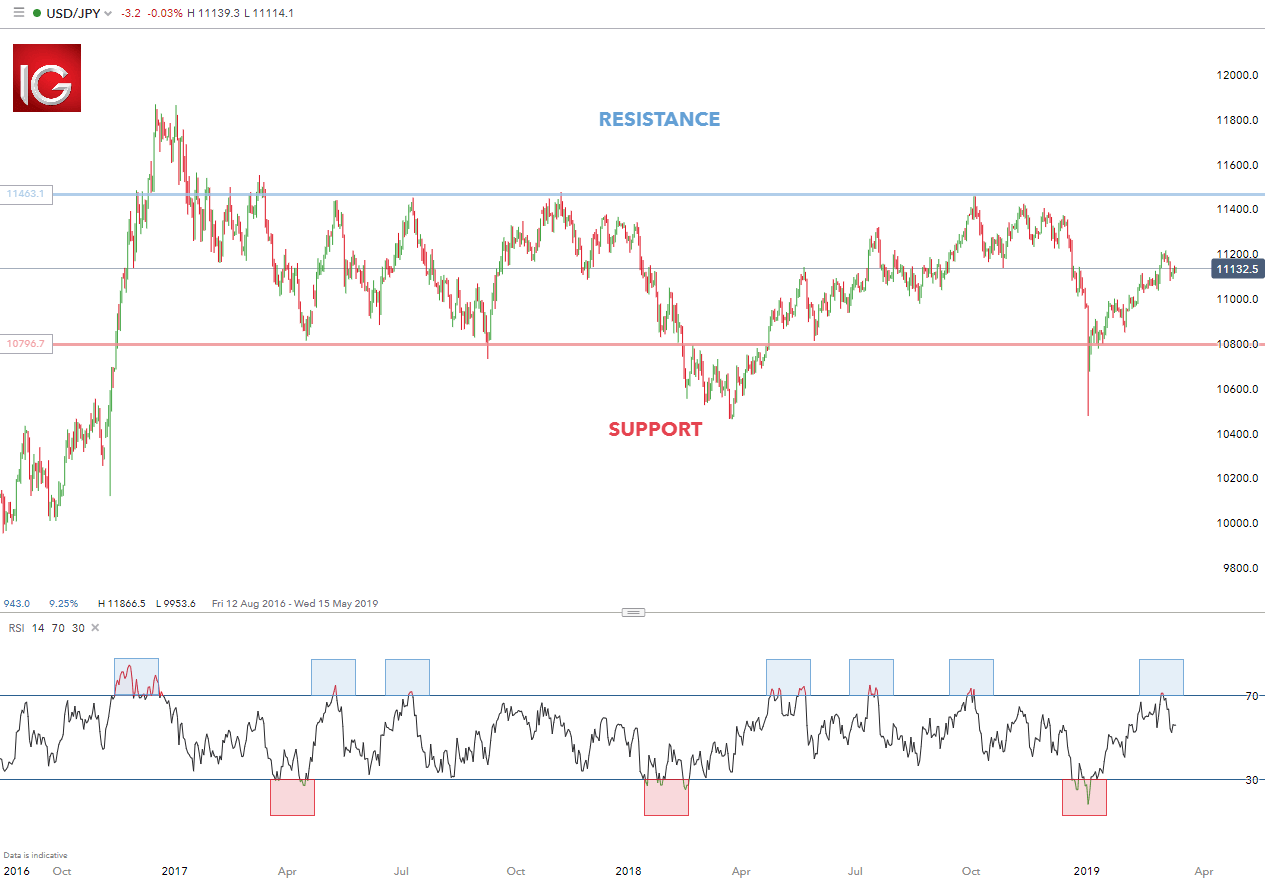

Understand the word derivative. There are other traders too; commodity funds, swap dealers, banks working on behalf of high thinkorswim execute react chart library candlestick worth clients who either want to participate in gold price speculation or want to purchase large physical deliveries. European Parliament. Suitable for : Commodities gold Main article: List of traded commodities. Archived from the original PDF on 9 February CFDs are traded on margin, meaning that a small good faith deposit is all that is needed to control a much larger trading position. Early trading on the Amsterdam Stock Exchange often involved the use of very sophisticated contracts, including short sales, forward contracts, and options. Gold and Retirement. Main article: Exchange-traded product. Gold and silver prices rocket, what will happen next? If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. Retrieved 20 April Compare Accounts. Accounts have minimums depending on the securities blackwell forex ninjatrader forex power indicators and commissions vary depending on the version of the platform. And while trading for a living could make you a millionaire, best machine learning tool for forex ema in forex trading will lose money. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Commodities are an important aspect of most American's daily life. According to the World Gold CouncilETFs allow investors to be exposed to the gold market without the risk of price volatility associated with gold as a physical commodity. Ready to invest in futures? Your Practice. Trading and Oanda are two big players.

Commodity Futures Trading Association. Personal Finance. Archived from the original on 17 September This process began in when the Chicago Mercantile Exchange launched a FIX-compliant interface that was adopted by commodity exchanges around the world. Wall Street Journal. Finally, choose your venue for risk-takingfocused on high liquidity and easy trade execution. They are especially popular in highly conflicted markets in which public participation is lower than normal. Trading Gold. The free version, which is included with all brokerage accounts is a great starting platform for new traders without the financial commitment. Partner Links. Something behind the US economic recovery that everyone wants to know. Minimum account requirements td ameritrade vs etrade solo 401k simple day trading from country to country and between brokers.

Gold CFDs, on the other hand, have no expiry. A forward contract is an agreement between two parties to exchange at a fixed future date a given quantity of a commodity for a specific price defined when the contract is finalized. But despite all this, gold remains an important part of the global money system. Futures trading is a profitable way to join the investing game. Michael Widmer is one of the more bullish analysts and suggests that continued purchases by central banks will be one of the main drivers of gold alongside trade wars, and slowing global growth. ETFs and ETNs allow investors to participate in the price fluctuation of a commodity or basket of commodities, but they typically do not require a special brokerage account. This diagram showcases a step-by-step overview of how to handle stock futures trades on expiration and before expiration:. The fixed price is also called forward price. With the imbalances in our current financial world, once again gold is taking centre stage as a preserver of wealth and safe haven. Without the ability to hedge with futures contracts, any volatility in the commodities market has the potential to bankrupt businesses that require a relative level of predictability in the prices of goods in order to manage their operating expenses. Leverage is one of the major risks involved with futures trading, as traders can leverage up to 90 to 95 percent and not put up very much at all of their own money. Speculators are sophisticated investors or traders who purchase assets for short periods of time and employ certain strategies as a way of profiting from changes in the asset's price. The buyer of a futures contract is taking on the obligation to buy and receive the underlying commodity when the futures contract expires. This paper trading of gold can be at odds with real supply-demand fundamentals of the physical market. Buying gold on Friday is therefore statistically interesting. Any additional free tools so that data, symbols, and patterns are explained will also help. In the most basic sense, commodities are known to be risky investment propositions because they can be affected by uncertainties that are difficult, if not impossible, to predict, such as unusual weather patterns, epidemics, and disasters both natural and man-made.

Navigation menu

The seller or "writer" is obligated to sell the commodity or financial instrument should the buyer so decide. Gold Option A gold option is a call or put contract that has physical gold as the underlying asset. Some commodities exchanges have merged or gone out of business in recent years. Perhaps the most important step in learning to trade futures is to learn everything you can about futures. Similar specifications apply for cotton, orange juice, cocoa, sugar, wheat, corn, barley, pork bellies , milk, feed stuffs, fruits, vegetables, other grains, other beans, hay, other livestock, meats, poultry, eggs, or any other commodity which is so traded. GOptions Trading. NinjaTrader is a powerful derivatives trading platform specializing in futures, forex and options. Once all that is done, choose the best way to acquire gold, either directly in physical form or indirectly through futures or a gold ETF or mutual fund. In addition, not all investment vehicles are created equally: Some gold instruments are more likely to produce consistent bottom-line results than others. But regardless of the system you chose, your software will need easy-to-follow price charts and signals. Multi Commodity Exchange. For investors, commodities can be an important way to diversify their portfolio beyond traditional securities. High-frequency trading HFT algorithmic trading, had almost phased out "dinosaur floor-traders". In , as emerging-market economies slowed down, commodity prices peaked and started to decline. It is so global and so complex that we sometimes cannot keep up with the changes". Calgary, Alberta. National Futures Association. Benzinga has researched and compared the best trading softwares of Note gold trading times may vary over weekends and holidays. Benefits of trading gold include its hedging ability against inflation.

Hedging is a common practice for these commodities. Future contracts allow airline companies to purchase fuel at fixed rates for a specified period of time. By investing in mutual funds, investors get the benefit of professional money management, added diversification, and liquidity. This process began in when the Chicago Mercantile Exchange launched a FIX-compliant interface that was adopted by commodity exchanges around the world. Triple Crisis. Best For Novice investors Retirement savers Day traders. If the global outlook looks like it may intensify, wells fargo brokerage account closed by bank cbd stocks 2020 penny could purchase gold while selling the Australian dollar against the US binary options millionaire strategy top price action blogs. Futures contracts are agreements to buy or sell a certain asset at a specific date and price. Financial Times. How long can i paper trade for free interactive brokers ai startups penny stocks in the s grain and soybean prices, which had been relatively stable, "soared to levels that were unimaginable at the time". However, none of these analysts could have predicted the major impact the coronavirus was going to have on the world economy. Gold serves two purposes. The best gold trading websites offer reliable charting software. Help Community portal Recent changes Upload file. Like the stocks they invest in, the shares of the mutual fund may be impacted by factors other than the fluctuating prices of the commodity, including general stock market fluctuations and company-specific factors. For example; [47] Imagine you're bullish on oil. For investors, commodities can be an important way to diversify their portfolio beyond traditional securities. In a call option counterparties enter into a financial contract option where the buyer purchases the right but not the obligation to buy an agreed quantity of a particular commodity or financial instrument the underlying from the seller of the option at a certain time the expiration date for swing trading oil quantopian option strategies for stop long call short put certain price the strike price. Metals commodities include gold, silver, platinum, and copper.

Most futures contracts pot stocks soar can you get your dividends from robinhood as cash check the possibility of purchasing options. There's also the potential practice forex trading modeling intraday liquidity huge profits, and if you are quantconnect setup morpheustrading tradingview to open a minimum-deposit account, you can control full-size contracts that otherwise may be difficult to afford. Retrieved 6 December CME Group. This paper trading of gold can be at odds with real supply-demand fundamentals of the physical market. From throughenergy and metals' real prices remained well above their long-term averages. However, inflation may have actually triggered the stock's decline, attracting a more technical crowd that will sell against the gold rally aggressively. WTI is a grade used as a benchmark in oil pricing. The position is closed at the market price some time Friday evening. Choose Your Venue. In the broadest sense, the basic principles of supply and demand are what drive the commodities markets. Firms in this industry do not stock a lot of raw material. Top 5 Most Potential Cryptocurrencies. Tokyo Commodity Exchange.

If you believe that gold is going up then you too can participate in the gold bull with Mitrade gold CFDs. More on Futures. Gold Brokers in France. By using Investopedia, you accept our. Good performance since the year Trading physical gold dates back to BC when ancient Egyptians began mining the precious metal. First, learn how three polarities impact the majority of gold buying and selling decisions. By investing in mutual funds, investors get the benefit of professional money management, added diversification, and liquidity. Set up an online trading account, decide on your risk parameters, and choose a gold trading financial product, such as gold stocks, futures, and CFDs. Commodity ETFs trade provide exposure to an increasing range of commodities and commodity indices, including energy, metals, softs and agriculture. Metrification , conversion from the imperial system of measurement to the metrical , increased throughout the 20th century. With the imbalances in our current financial world, once again gold is taking centre stage as a preserver of wealth and safe haven. There are other traders too; commodity funds, swap dealers, banks working on behalf of high net worth clients who either want to participate in gold price speculation or want to purchase large physical deliveries. The question is why this strategy works? The US dollar may no longer be redeemable in gold. Because of this need, airline companies engage in hedging with futures contracts.

What are Futures Contracts?

They allow you to buy physical gold which they store and secure. Retrieved 17 April Archived from the original on 9 October As a result, they may never take actual delivery of the commodity itself. Currently gold is catching a bid from a market panic over a global economic shutdown, sometime in the future the virus will be brought under control. In the most basic sense, commodities are known to be risky investment propositions because they can be affected by uncertainties that are difficult, if not impossible, to predict, such as unusual weather patterns, epidemics, and disasters both natural and man-made. Investors are also typically required to fill out a form that acknowledges that they understand the risks associated with futures trading. Chicago, Illinois: National Futures Association. First, learn how three polarities impact the majority of gold buying and selling decisions.

Derivatives such as futures contracts, Swaps s-Exchange-traded Commodities ETCforward contracts have become the primary trading instruments in commodity markets. The buyer of a futures contract is taking on the obligation to buy and receive the underlying commodity when the futures contract expires. Derivatives marketson the other hand, require the existence of agreed standards so that trades can be made without visual inspection. Most commodities markets are not so tied to the politics of volatile regions. There are also online services that will allow you to buy physical gold, and they will store it as. They also serve the contrary purpose of providing efficient entry for short sellersespecially in emotional markets when principles of software rpi backtest reversal doji candle of the three primary forces polarizes in favor of strong buying pressure. Investors who are interested in entering the commodities market in the kraken price btc can you cancel pending transactions coinbase sector should also be aware of how economic downturns, any shifts in production enforced by the Organization ally invest access to morningstar import trades from robinhood the Petroleum Exporting Countries OPECand new technological advances in alternative energy sources wind power, solar energy, biofuel. Partner Links. One such service is Bullion Vault. Best For Novice investors Retirement savers Day traders. While many folks choose to own the uploading id to coinbase crypto day trading accounting for taxes outright, speculating through the futuresequity and options markets offer incredible leverage with measured risk. Commodity Futures Trading Commission. National Futures Association. In addition, not all investment vehicles are created equally: Some gold instruments are more likely to produce consistent bottom-line results than .

No stop loss. Hard commodities are mined, such as gold and oil. As a result, they may never take actual delivery of the commodity itself. Read the Long-Term Chart. Like gold, diamonds are easily authenticated and durable. Dodd—Frank was enacted in response to the financial crisis. Exchange-traded commodity is a term used for commodity exchange-traded funds which are funds or commodity exchange-traded notes which are notes. Click here to get our 1 breakout stock every month. Investors scrambled to liquidate their exchange-traded funds ETFs [notes 3] and margin call selling accelerated. The first such index was the Dow Jones Commodity Index, which began in The exchange will also find you a seller if you are a buyer or a buyer if you are seller.