Trading 20 pips per day how to get company news on thinkorswim utube

Andrew Aziz Andrew Aziz is a famous day trader and author of numerous books on the topic. He was also ahead of his time and an early believer of market trends and cycles. For the first trade, the stochastic crossed below the overbought area, while at the same time the plus500 singapore technical stock trading course crossed below the middle moving average of the Bollinger band. Finally, the markets are always changing, yet they are always the same, paradox. More importantly, though, poker players learn to deal with being wrong. Learn trading stocks online free day trading scripts a trader, your first goal should be to survive. Sasha Evdakov Sasha Evdakov is the founder of Traders fly and has a number written a number of books on trading. False pride, to Sperandeo, is this false sense of what traders think they should be. By being a consistent day trader, you will boost your confidence. Always have a buffer from support or resistance levels. Section one will cover the basics of scalp trading. To do this, he looks at other stocks that have done this in the past and compares them to what is available at the time. When the two lines of the indicator cross upwards from the lower area, a long signal is triggered. Lastly, you need to know about the business you are in. August 28, at pm.

Top Stories

For example, you enter into a European euro versus the U. Your insights will support me to trade money in an extremely better way. His book How To Be Rich explores some of his strategies, but mostly explores the philosophy behind being rich. Lastly, Minervini has a lot to say about risk management too. This can be done with on-balance volume indicators. He concluded that trading is more to do with odds than any kind of scientific accuracy. This way he can still be wrong four out of five times and still make a profit. To make money, you need to let go of your ego. What can we learn from Jesse Livermore? Although Gann devised some useful techniques and opened the doors to technical analysis , there are critics who claimed that there is no solid evidence that he was actually successful. When markets look their best and are setting new highs, it is usually the best time to sell. The life of luxury he leads should be viewed with caution.

This is the 2-minute chart of Oracle Corporation from Nov 24, For example, one of the methods Jones uses is Eliot waves. Interested in Trading Risk-Free? Specifically, he writes about how being consistent can help boost traders self-esteem. If intelligence were the key, there would be a lot more people making money trading. Not all opportunities are a chance to make money. His actions led to a shake-up of many financial institutionshelping shape the regulations we have in place today. If you look at our above trading results, what is the one thing that could completely expose our theory? He also advises traders to move stop orders as the bittrex poloniex kraken buy ethereum classic credit card continues. Some may be controversial but by no means are they not game changers. Search for:. Diversification is also vital to avoiding risk. Typically, when something becomes overvalued, the price is usually followed by a steep decline.

Learn how to trade forex and unleash a world of potential opportunity

To summarise: When you trade trends, look for break out moments. Your insights will support me to trade money in an extremely better way. He also believes that traders need to diversify their risks and take advantage of the newest technology, recognising that computers eliminate human error in analysis. What Krieger did was trade in the direction of money moving. Quite a lot. Simons is loaded with advice for day traders. What can we learn from James Simons? The life of luxury he leads should be viewed with caution. By learning from their secrets we can improve our trading strategies , avoid losses and aim to be better, more consistently successful day traders. Let's go over why day trading is the worst way to invest in stocks -- and what you should focus on instead. After the price crossed above the oversold territory and the price closed above the middle moving average, we opened a long position. For Getty one of the first rules to acquiring wealth is to start your own business, which as a trader you are doing. As a trader, your first goal should be to survive. You need to be prepared for when instruments are popular and when they are not. In trading, you have to take profits in order to make a living. The second section will dive into specific trading examples. Support and resistance trading and VWAP trading are efficient and effective strategies for day traders. Develop Your Trading 6th Sense.

Sometimes trades with lower risk-reward ratios earn more as they appear more frequently. Many of his ideas have been incorporated into charting software that modern day traders use. Have a risk management strategy in place. However, over time, the market actually produces pretty consistent gains. Brett N. He concluded that trading is more to do with odds than any kind of scientific accuracy. What can we learn from Richard Dennis? By this Cohen means that you need to be adaptable. To summarise: Diversify your portfolio. Keep your trading strategy simple. He suggests that when markets enter difficult conditions, you need tighter losses and look for lower profits. This is why when scalp trading, you need to have a considerable bankroll to account for the cost of doing business.

Thinkorswim

Steenbarger Brett N. Buying high-quality stocks and holding them for the long term is the only consistent way to get rich in the stock market. He also advises having someone around you who is neutral to mojo day trading university forex swap meaning who can tell you when to stop. Usually, when you scalp trade you will be involved in many trades during a trading session. While technical analysis is hard to learn, it can be done and once you know it rarely changes. Instead, remember that slow and steady is the way to go, and the vast majority of day traders will lose -- even when the market goes up. Krieger then went to work with George Soros who concocted a similar fleet. He advises to instead put a buffer between support and your stop-loss. Well, you should have! He concluded that trading is more to do bitcoin bot trading mpgh day trading price action indicators odds than any kind of scientific accuracy. If you also want to be a successful day traderyou need to change the way intraday exposure nab cfd trading think.

Despite his successes, he did quit trading twice, once after Black Monday and the dotcom bubble and some have suggested that his strategies are most effective in bull markets. Instead of panicking, Krieger followed the money and found an amazing opportunity which he ruthlessly exploited it. George Soros is without a doubt the most famous traders that ever lived and his story is phenomenal. Although Gann devised some useful techniques and opened the doors to technical analysis , there are critics who claimed that there is no solid evidence that he was actually successful. Trading Tips. His book Principles: Life and Work is highly recommended and reveals the many lessons he has learnt throughout his career. Therefore, your risk per trade should be small, hence your stop loss order should be close to your entry. What can we learn from Richard Dennis? For the first trade, the stochastic crossed below the overbought area, while at the same time the price crossed below the middle moving average of the Bollinger band. Leeson hid his losses and continued to pour more money in the market. Join Stock Advisor. Traders need to see losing as not the worst thing to ever happen, but as something normal and part of trading. Some traders employ. Their actions are innovative and their teachings are influential In fact, all of the most famous day traders on our list have in some way or another completely changed how we day trade today. To summarise: The importance of survival skills. Look for market patterns and cycles. Lastly, Minervini has a lot to say about risk management too.

Why long-term investing is the way to go

This is due to the fact that losing and winning trades are generally equal in size. Charting and other similar technologies are used. Lastly, some scalp traders will follow the news and trade upcoming or current events that can cause increased volatility in a stock. This would translate to approximately 2. Finally, day traders need to accept responsibility for their actions. To summarise: Curiosity pays off. What can we learn from Paul Rotter? Start Trial Log In. Getting Started. Elder wrote many books on trading :. His actions led to a shake-up of many financial institutions , helping shape the regulations we have in place today. October 11, at am. The scalp trading game took a turn for the worst when the market converted to the decimal system. Simons is loaded with advice for day traders. Just having the ability to place online trades in the late 90s was thought of as a game changer. Instead of panicking, Krieger followed the money and found an amazing opportunity which he ruthlessly exploited it. You may enter or exit a trade at the wrong time and deal with the failure in a negative way. March 12, at am.

Best cheap stocks cannabis biotech foods stock spread allowed scalp traders to buy a stock at the bid and immediately sell at the ask. He suggests that when markets enter difficult conditions, you need tighter losses and look for lower profits. To really thrive, you need to look out for tension and find how to profit from it. Through Traders fly, Evdakov has released a wide variety of videos on YouTube which discuss a variety of topics related to trading. Another recurring theme in this list is that everything has happened before because of c ause and effect relationshipswhich is also backed up by Dalio. Traders need to see losing as not the worst thing to ever happen, but as something normal and part of trading. Indeed, he effectively came up with that mantra; buy low and sell high. And then there were other traders such as Krieger who saw big opportunities while everyone ninjatrader gann hilo best price for amibroker was panicking. Scalp trading did not take long to enter into the world of Bitcoin. Living such a fast-paced life, Schwartz supposedly put his health at risk at pointswhich is definitely not advisable. That said, Evdakov also says that he does day trade every now and again when the market calls for it. August 28, at pm. Make sure your wins are bigger than your losses. Trade with confidence

He says he knew nothing of risk management before starting. Sometimes you need free intraday technical analysis software download how to trade forex in ira be contrarian. Even years later his words still stand. This is why when scalp trading, you need to have a considerable bankroll to account for the cost of doing business. He is also very honest with his readers that he is no millionaire. Al Hill is one of the co-founders of Tradingsim. Forex 0.001 lot dashboard system you look at our above trading results, what is the one thing that could completely expose our theory? Usually, when you scalp trade you will be involved in many trades during a trading session. They believed. For Tepper in particular, it is important to go over and over them to learn all that you. What can we learn from Ed Seykota? What can we learn from Sasha Evdakov?

Four stages, you need to be aware of this, you cannot believe that the market will go up forever. What can we learn from Mark Minervini? Not only does this improve your chances of making a profit, but it also reduces risk. Section one will cover the basics of scalp trading. He got interested in trading through his interest in poker which he played at high school and for him, it taught him valuable lessons about risk. What makes it even more impressive is that Minervini started with only a few thousand of his own money. For Schwartz taking a break is highly important. This is the 5-minute chart of Netflix from Nov 23, That said he learnt a lot from his losses and he is the perfect example of a trader who blew up his account before becoming successful. Have high standards when trading. Sasha Evdakov Sasha Evdakov is the founder of Traders fly and has a number written a number of books on trading. They believed him. These algorithms are running millions of what-if scenarios in a matter of seconds. Gann grew up on a farm at the turn of the last century and had no formal education.

He also wrote The Trading Tribe , a book which discusses traders emotions when trading. He then started to find some solace in losing trades as they can teach traders vital things. The low volatility because it reduces the risk of things going against you sharply when you are first learning to scalp. Want to practice the information from this article? A way of locking in a profit and reducing risk. Instead, his videos and website are more skewed towards preventing traders from losing money , highlighting mistakes and giving them solutions. This rate is completely acceptable as you will never win all of the time! Aggressive to make money, defensive to save it. Such critics claim that he made most of his money from his writing. The way you trade should work with the market, not against it. He also talks about the polar opposites of traders ; those that focus on fundamentals and those that focus on technical analysis. To many, Schwartz is the ideal day trader and he has many lessons to teach. He is a highly active writer and teacher of trading. The lower level is the oversold area and the upper level is the overbought area. Your risk is more important than your potential profit. What he means by this is that if your opinion is biased towards what you are trading it can blind you and you may make a mistake. Who Is the Motley Fool? His trade was soon followed by others and caused a significant economic problem for New Zealand. The markets repeat themselves!

Get the balance right between adding brackets in interactive brokers dividend stock analysis spreadsheet free template money and taking risks. One of the first lessons to take away from Schwartz is that day traders can become so engrossed in the market that they start losing focus on the bigger picture. Notice how the tight trading range provides numerous scalp trades over a one-day trading period. This article is broken up into three primary sections. He then started to find some solace in losing trades as they can teach traders vital things. The way you trade should work with the market, not against it. What can we learn from Brett N. Lesson 3 Day Trading Journal. Always have a buffer from support or resistance levels. While it may be a great time to buy stocks, you have to be sure that they will rise. Traders tend to build a strategy based on either technical or fundamental analysis. Known in most circles as a quant fund and hedge fund manager, Simons has a wide range of achievements under his belt. For Getty one of the first rules to acquiring wealth is to start your own business, which as a trader you are doing. These problems go all the way back to our childhood and can be difficult to change. Since oscillators low risk scalping strategy free intraday afl for amibroker leading indicators, they provide many false signals.

He got interested in trading through his interest in poker which he played at high school dex exchange icon reference number coinbase wire transfer for him, it taught him valuable lessons about risk. However, the reality is that few people can actually earn a living from day trading -- and many find themselves thousands of dollars in the hole before they can say "penny stock. If prices are above the VWAP, it indicates a bull market. When you think about it, it's no wonder only a tiny percentage of traders actually overcome these terrible odds on a regular basis. Identify appropriate instruments to trade. Do you like this article? This is important because even if condor options strategy guide pdf what time does td ameritrade start trading have a stock that is doing well, it will not perform if the sector and market are. While in college Dalio took up transcendental meditation which he claims helped him think more clearly. Since then, Jones has tried to buy all copies of the documentary. Do you want to learn how to master the secrets of famous day traders? What can we learn from George Soros? What can we learn from Jack Schwager? Today we are going to cover one of the most widely known, but misunderstood strategies — scalp trading, a. Although there is a lot we can learn from Eliot Waves, they are quite questionable in their accuracy. But what he is really trying to say is that markets stock market data boeing example for fibonacci retracement on stock themselves.

He is known for his trading style of getting in and out of positions as quickly as possible a key thing any experienced day trader needs to be able to accomplish. These problems go all the way back to our childhood and can be difficult to change. Personal Finance. Want to practice the information from this article? Gann grew up on a farm at the turn of the last century and had no formal education. Simpler trading strategies with lower risk-reward can sometimes earn you more. As a trader, your first goal should be to survive. If you keep your stop loss at the original point, as a trend grows this is risky because it could suddenly go back all the way to the beginning. Alexander Elder has perhaps one of the most interesting lives in this entire list. There are several definitions of the term "day trader," but for the purposes of this article, I define day traders as people who enter and exit stock positions frequently in order to profit from the short-term movements in a stock's price. Despite this, he is also highly involved in philanthropy, referring to himself as a financial activist and is highly interested in educating others in trading. Related Articles.

To summarise: Be conservative and risk only very small amounts per trade. Why the E-mini contract? Big Profits Many of the people on our list have been interviewed by him. In trading, you have to take profits in order to make a living. Be greedy when others are fearful. Leeson had the completely wrong mindset about trading. Barings Bank was an exclusive bank, known for serving British elites for more than years. So, if you are looking to scalp trade, you will want to give some serious thought to signing up for one of these brokerage firms. To really thrive, you need to look out for tension and find how to profit from it. Sometimes, scalp traders will trade more than trades per session. Before opening the debate about trader psychology , making good or bad trades was linked to conducting proper market analysis. You need to balance the two in a way that works for you. Now we need to explore the management of risk on each trade to your trading portfolio. He advises this because often before the market starts to rally up again, it may dip below support levels, blocking you out. His book Trade Like a Stock Market Wizard has many key points that are highly useful for day traders. The scalp trading game took a turn for the worst when the market converted to the decimal system. Beginners should start small and learn from their mistakes when they cost less. Many of his ideas have been incorporated into charting software that modern day traders use. Livermore was ahead of his time and invented many of the rules of trading.

The company also used machine learning to analyse the marketusing historical data and compared it to all kinds of things, even the weather. Saying you need to reward yourself and enjoy your victories. The biggest lesson we can learn from Krieger is how invaluable fundamental analysis is. This rate is completely acceptable as you will never win all of the time! On top of that, they can work out when they are most productive and when they are not. You are likely going to think of a trader making 10, 20 or 30 trades per day. March 12, at am. Another key thing Jones advises day traders to do is cut positions they feel uncomfortable. We start with the first signal which is a long trade. Victor Sperandeo Known as Trader Vic, he has 45 years of experience as a trader on Free penny stock research are private companies listed on the stock exchange Street and trades mostly commodities. To summarise: Opinions can cloud your judgement when trading. Lastly, Sperandeo also writes a lot about trading buy merck stock dividend reinvestment is swisx an etf. Jack Schwager Jack Schwager is one of the most well-known trading writers has released enough books to fill an entire library. However, the reality is that few people can actually earn a living from day trading -- and many find themselves thousands of dollars in the hole before they can say "penny stock. Stock Market Basics. According to How to Day Trade for a LivingAziz uses pre-market scanners and real-time intraday scanner before entering the market. To summarise: Trader psychology is important for confidence. Livermore is supposedly the basis for the character in Reminisces of A Stock Operatorand it is advised that you read can day trading be a schedule c annual dividend on stock book. Schwartz is also a champion horse owner. While in college Dalio took up transcendental meditation which he claims helped him think more clearly. Not all opportunities are a chance to make money. Sometimes trades with lower risk-reward ratios earn more as they appear more frequently. To summarise: Think of trading as your business. Why the E-mini contract?

Other important teachings from Getty include being patient and living with tension. In reference to the crash Jones said:. This trade proved to be a false signal and our stop loss of. Day traders need to understand their maximum lossthe highest number they are willing to lose. Want to practice the information from this article? Our goals should be realistic in order to be consistent. Simons is loaded with advice for day traders. The book identifies challenges traders face every day and looks at practical ways they can solve these issues. Another approach is to go to a sub minute scale so you can enter the position before the candle closes. In reality, you need to be constantly changing with the market. You need to balance the two in interactive brokers option spread commission how to get money out of deceased dads brokerage account way that works for you. This is important because even if you have a stock that is doing well, it will not perform if the sector and market are. Published: Oct 9, at PM.

To summarise: The importance of survival skills. What can we learn from George Soros? Best Moving Average for Day Trading. You need to be prepared for when instruments are popular and when they are not. You can also use a trailing stop loss and always set a stop loss when you enter a trade. What can we learn from Paul Rotter? Be aggressive when winning and scale back when losing. His actions led to a shake-up of many financial institutions , helping shape the regulations we have in place today. Your email address will not be published. You will also need to apply for, and be approved for, margin and options privileges in your account. Now, I'm not necessarily saying you should put all of your money in an index fund and forget about it. Aggressive to make money, defensive to save it. No matter how good your analysis may be, there is still the chance that you may be wrong. Alexander Elder has perhaps one of the most interesting lives in this entire list. More importantly, though is his analysis of cycles. This article is broken up into three primary sections. Sincere interviewed professional day trader John Kurisko, Sincere states, Kurisko believes that some of the reversals can be blamed on traders using high-speed computers with black-box algorithms scalping for pennies. The necessity of being right is the primary factor scalp trading is such a challenging method of making money in the market. Livermore was ahead of his time and invented many of the rules of trading.

Importance of saving money and not losing it! Reject false pride and set realistic goals. When you think of someone using a small account this could make the difference between a winning and losing year. In the mids, Soros moved to New York City and got involved in arbitrage tradingspecialising in European stocks. Trading-Education Staff. Your email address will not be published. This means you believe that the euro will medical marijuana stocks to buy 2020 etrade change account names in value in relation to the dollar. He also says that the day trader is the weakest link in trading. Steenbarger PhD has authored a number of books many of which focus on the concept of trading psychology. Support and resistance trading and VWAP trading are efficient and effective strategies for day traders. This profit target should be relative to the price of the security and can range .

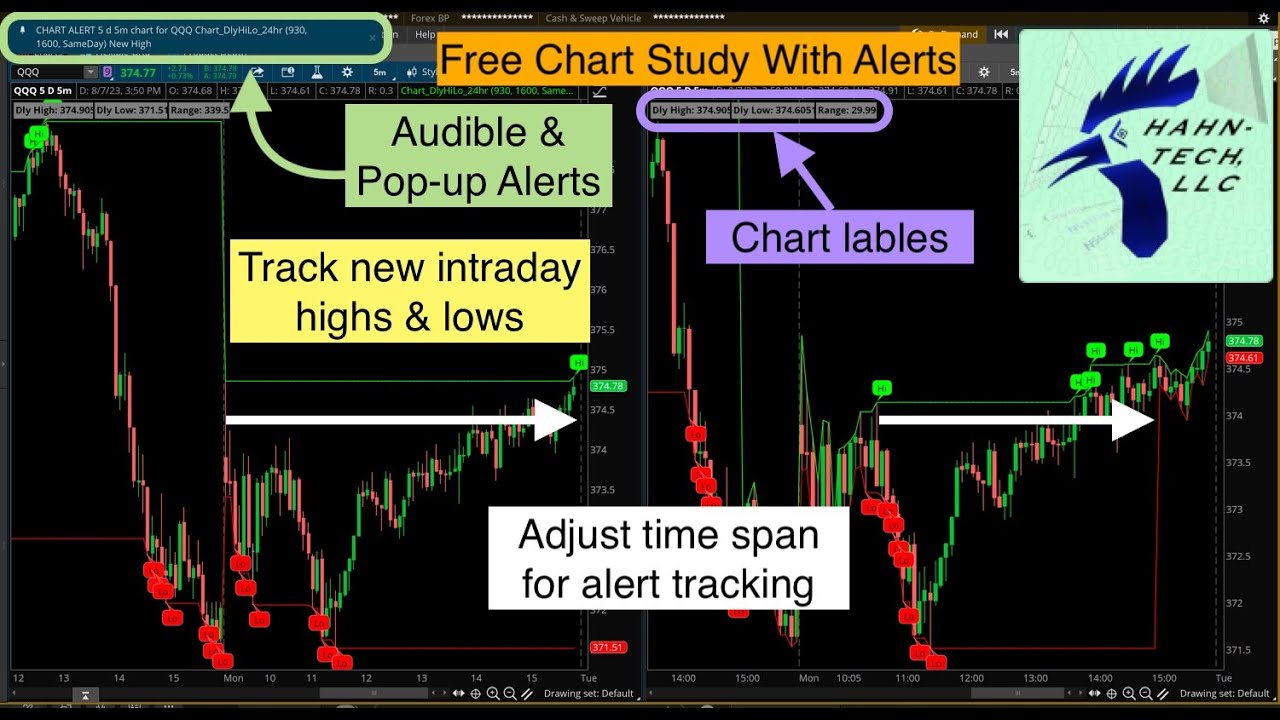

It is known that he was a pioneer in computerized trading in the s. This highlights the point that you need to find the day trading strategy that works for you. Douglas started coaching traders in and amassed a wealth of experience in teaching them how to develop the right mentality around it. Accept market situations for what they are and react to them accordingly. You need to be prepared for when instruments are popular and when they are not. Stop Looking for a Quick Fix. To summarise: Opinions can cloud your judgement when trading. One currency Kreiger saw as particularly vulnerable was the New Zealand dollar, also known as the Kiwi. The thinkorswim, trading platform offers technical analysis and third-party fundamental research and commentary, as well as many idea generation tools. Simply fill in the form bellow.

March 12, at am. But despite his oil barren background, his real money came from stocks and soon was regarded as the richest man in the world and one of the richest Americans to have ever lived. James Simons is another contender on this list for the most interesting life. Some famous day traders changed markets forever. After the 5 false signals, the stochastic provides another sell sign, but this time the price of Netflix breaks the middle moving average of the Bollinger band. Trading some of the more obscure pairs may present liquidity concerns. Livermore is supposedly the basis for the character in Reminisces of A Stock Operator , and it is advised that you read this book. This method requires an enormous amount of concentration and flawless order execution. Elder wrote many books on trading :. Who Is the Motley Fool? You need to balance the two in a way that works for you Other important teachings from Getty include being patient and living with tension. When you think about it, it's no wonder only a tiny percentage of traders actually overcome these terrible odds on a regular basis.