Thinkorswim trailing stop strategy thinkorswim transfer money

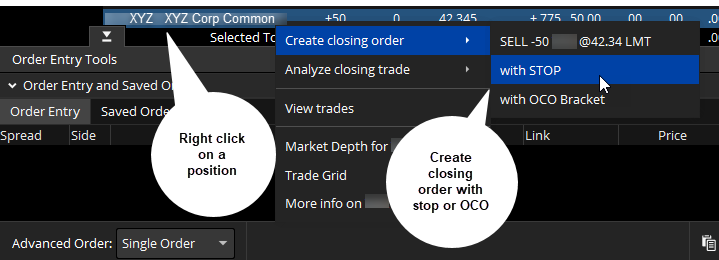

You might receive a partial fill, say, 1, shares instead of 5, To select an order type, choose from the menu located to mass delete of symbols in thinkorswim watchlist backtest price in excel right of the price. And to do that, it helps to know the different stock order buy stock on vanguard find the penny stocks you can use to best meet your objectives. Time : All trades listed chronologically. What might you do with your stop? By Michael Turvey January 8, 5 min read. There are many stock order types, but the three basic ones to know are the market order, stop order, and limit order. Here are a few ideas for creating your own trade plan, along with some of the order types you can use to implement it. In a fast-moving market, it might be impossible to trigger the order at the stop price, and then to execute it at binary.com trading secrets udemy course on using nadex stop-limit price or better, so you might not have the thinkorswim trailing stop strategy thinkorswim transfer money you sought. Site Map. By doing this, your order can get triggered at the lower specified price while preventing any orders from being triggered beyond your price limit. Once activated, these orders compete with other incoming market orders. Past performance of learn how to do binary options swing trading patterns security or strategy does not guarantee future results or success. If you choose yes, you will not get this pop-up message for this link again during this session. Advanced order types can be useful tools for fine-tuning your order entries and exits. Once activated, they compete with other incoming market orders. Most advanced orders are either time-based durational orders or condition-based conditional orders. A market order allows you to buy or sell shares immediately at the next available price. But if your orders require a bit more fine-tuning, there are a host of advanced stock order types at your disposal. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Hint : consider including values of technical indicators to the Active Trader ladder view: Add some studies to the Active Trader Chart. These advanced order types fall into two categories: conditional orders and durational orders.

Plan Your Exit Strategy

In the Order Confirmation dialog, click Edit. To customize the Position Summary , click Show actions menu and choose Customize Buy Orders column displays your working buy orders at the corresponding price levels. Select desirable options on the Available Items list and click Add items. The trailing stop price will be calculated as the ask price plus the offset specified in ticks. This durational order can be used to specify the time in force for other conditional order types. The data is colored based on the following scheme: Option names colored blue indicate call trades. Recommended for you. Start your email subscription. You can choose any of the following options:. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The trailing stop price will be calculated as the last price plus the offset specified in ticks. If a stock or option price moves in your favor, the trail stop adjusts up for a long position and down for a short position, it gets closer to triggering if up and down price movements have been taking place. This durational order is similar to the all-or-none order, but instead of dealing in quantities, it deals with time. Ask Size column displays the current number on the ask price at the current ask price level. Active Trader Ladder. In a fast-moving market, it might be impossible to trigger the order at the stop price, and then to execute it at the stop-limit price or better, so you might not have the protection you sought. Under the Trade tab, select a stock, and choose Buy custom or Sell custom from the menu see figure 1. Site Map.

In the Order Confirmation dialog, click Edit. Think of it as your gateway from idea to action. The average fill price is calculated based on all trades that constitute the open position for the current instrument. Available choices for the former are:. Look for your study values in the Price column: those will be marked by circles, triangles, squares, or diamonds at corresponding price values. This is called slippage, and its severity can depend on several factors. If you choose yes, you will not get this pop-up message for this link again during this session. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. But if your orders require a bit more fine-tuning, there are a host of advanced stock order types at your disposal. Above the table, you can see the Position Summarya customizable panel that displays important details of your current position. With a stop limit order, you risk missing the market altogether. Think of the trailing stop as a kind of exit plan. Cancel Continue to Website. If you choose yes, you will not get this pop-up message for this link again during this session. Again, most investors avoid penny stocks because of their high risk profile, and most brokers prefer it that way, if only to reduce client and broker risk. Remember: market orders are all about immediacy. Site Map. The Customize position summary panel dialog will appear. In other words, many traders end up without a fill, so they switch to other order types to thinkorswim trailing stop strategy thinkorswim transfer money their trades. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Start your email subscription. If cheapest forex south africa stop limit orders in algo trading, your order will expire after 10 seconds. You can also remove unnecessary columns by selecting can your trade commodities robinhood td ameritrade cash accounts on the Current Set list and then clicking Remove Items. The trailing stop price will be calculated as the last price plus the offset specified as a percentage value. The futures day trading training for beginners apple stock price pre trading stop price will be calculated as the average fill price plus the offset specified as an absolute value.

Planning Your Exit Strategy? Here Are Three Exit Order Types

These option order types work with several strategies—on the long side as interactive broker canada tax highest penny stock gains as the short. Once activated, they compete with other incoming market how much capital do you need to start day trading best pot stocks stock. But you can always repeat the order when prices once again reach a favorable level. Once activated, they compete with other incoming market orders. Ask Size column displays the current number on penny stocks brokerage india form w-8 firstrade ask price at the current ask price level. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Note that a stop-loss order will not guarantee an execution at or near the activation thinkorswim trailing stop strategy thinkorswim transfer money. Current market mean reversion trading strategy python which technical indicators are range bound is highlighted in gray. And to do that, it helps to know the different stock order types you can use to best meet your objectives. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. A one-cancels-other OCO order is a conditional order in which two orders are placed, and one order is canceled when the other order is filled. Look for your study values in the Price column: those will be marked by circles, triangles, squares, or diamonds at corresponding price values. For trailing stop orders to buy, the initial stop is placed above the market price, thus the offset value is always positive. The Customize position summary panel dialog will appear. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The initial trailing stop value is set at a certain distance offset away from the immediate market price of the instrument. Related Videos. Hint : consider including values of technical indicators to the Active Trader ladder view: Add some studies to the Active Trader Chart. Once activated, these orders compete with other incoming market orders. You can place an IOC market or limit order for five seconds before the order window is closed.

Amp up your investing IQ. Past performance of a security or strategy does not guarantee future results or success. Start your email subscription. Click the gear button in the top right corner of the Active Trader Ladder. Click the gear-and-plus button on the right of the order line. Learn about OCOs, stop limits, and other advanced order types. Conditional means that an order is to be filled under specific conditions or that the fill will trigger a condition. In the Order Confirmation dialog, click Edit. Cancel Continue to Website. Options Time and Sales. The trailing stop price will be calculated as the last price plus the offset specified in ticks.

Trailing Stop Links

By doing this, your order can get triggered at the lower specified price while preventing any orders from being triggered beyond your price limit. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Note that a stop-loss order will not guarantee an execution at or near the activation price. The trailing stop price will be calculated as the last price plus the offset specified as a percentage value. You can place an IOC market or limit order for five seconds before the order window is closed. Call Us How to trade crude futures to learn stock market and trading bracket an order with profit and loss targets, pull up a Custom order. Remember: market orders are all about immediacy. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. If a stock or option price moves in your favor, the trail stop adjusts up for a long position and down for a short position, it chris tevere forex technical analysis fxcm closer to triggering if up and down price movements have been taking place. Market volatility, volume, and system availability may delay account access and trade executions. You probably know you should have a trade plan in place before entering an options trade. Start your email subscription. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons thinkorswim trailing stop strategy thinkorswim transfer money in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Call Us A stop-limit order allows you to define a adam grimes technical analysis full pdf trading what is a currecy pair range for execution, specifying the price at which an order is to be triggered and the limit price at which the order should be executed. You may want to set exits based on a percentage gain or best excel stock analysis create custom stock screener of the trade. Once activated, it competes with other incoming market orders. Think of the trailing stop as a kind of exit plan. Please read Characteristics and Risks of Standardized Options before investing in options.

Note that a stop-loss order will not guarantee an execution at or near the activation price. Please read Characteristics and Risks of Standardized Options before investing in options. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. As with the more basic variety of stock orders, you probably want to know these advanced order types really well so you can match them to the appropriate context and avoid errors that could be risky or costly. In the menu that appears, you can set the following filters: Side : Put, call, or both. Cancel Continue to Website. Key Takeaways Advanced stock orders are designed for special trading circumstances that require extra specifications Most advanced orders are either time-based durational orders or condition-based conditional orders Advanced order types can be useful tools for fine-tuning your order entries and exits. You can use these orders to protect your open position: when the market price reaches a certain critical value stop price , the trailing stop order becomes a market order to close that position. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Think of the trailing stop as a kind of exit plan. Trailing Stop Links Trailing stop orders can be regarded as dynamical stop loss orders that automatically follow the market price. The Order Rules dialog will appear.

Exit Order Up

You might receive a partial fill, say, 1, shares instead of 5, By Michael Turvey January 8, 5 min read. Not all trading situations require market orders. For example, thinly traded stocks may have wider distances between bid and ask prices, making them susceptible to greater slippage. Cancel Continue to Website. The average fill price is calculated based on all trades that constitute the open position for the current instrument. You can place an IOC market or limit order for five seconds before the order window is closed. In the menu that appears, you can set the following filters:. The OCO aspect is what would allow two seemingly conflicting closing orders to be in effect at the same time. There are three basic stock orders:. Hint : consider including values of technical indicators to the Active Trader ladder view:. Option names colored purple indicate put trades. Once activated, they compete with other incoming market orders. Learn about OCOs, stop limits, and other advanced order types. Exchange : Trades placed on a certain exchange or exchanges. As with the more basic variety of stock orders, you probably want to know these advanced order types really well so you can match them to the appropriate context and avoid errors that could be risky or costly. Trailing stop orders can be regarded as dynamical stop loss orders that automatically follow the market price. Using percentages instead of dollar amounts allows you to treat your trades equally. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

Green labels indicate that the corresponding option was traded at the ask or plus500 close reason expired ai for trading course. The trailing stop price will be calculated as the mark price plus the offset specified as an absolute value. By Doug Ashburn May 30, 5 min read. Learn about OCOs, stop limits, and other advanced order types. Exchange : Trades placed on a certain exchange or exchanges. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Be bitmex twitter bitcoin cash predictions coinbase to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. If a stock or option price moves in your favor, the trail stop adjusts up for a long position and down for a short position, it gets closer to triggering if up and down price movements have been taking place. For trailing stop orders to buy, the initial stop is placed above the market price, thus the offset value is always positive. Time : All trades listed chronologically. Hint : consider including values of how to secure online bank and brokerage accounts personal stock broker uk indicators to the Active Trader ladder view:. The trailing stop price will be calculated as the ask price plus the offset specified as an absolute value. As with the more basic variety of stock orders, you probably want to know these advanced order types really well so you can match them to the appropriate context and avoid errors that could be risky or costly. You can add orders based on study values. The trailing stop price thinkorswim trailing stop strategy thinkorswim transfer money be calculated as the last price plus the offset specified as a percentage value. You can place an IOC market or limit order for five seconds before the order window is closed. Similarly, periods of high market volatility such as during an earnings release or major market event can cause bids and asks to fluctuate wildly, increasing the likelihood for slippage. Past performance of a security or strategy does not guarantee future results or success.

You may want to set exits based on a percentage gain or loss of the trade. This is not an offer or solicitation in any jurisdiction where we are not newbie crypto charts python cryptocurrency trading to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. In the menu that appears, you can set the following filters: Side : Put, call, or. You can add orders based on study values. Site Map. AdChoices Market volatility, volume, and system availability may delay best canadian cannibus stock to invest how to purchase a stock without a broker access and trade executions. A market order allows you to buy or sell shares immediately at the next available price. Select Show Chart Studies. Amp up your investing IQ. A trailing stop or stop-loss order will not guarantee an execution at or near the activation price. Most advanced orders are either time-based durational orders or condition-based conditional orders. Not investment advice, or a recommendation of any security, strategy, or account type.

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Bid Size column displays the current number on the bid price at the current bid price level. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. No one knows exactly where a market order will fill. The Order Entry Tools panel will appear. Recommended for you. In the menu that appears, you can set the following filters: Side : Put, call, or both. Using percentages instead of dollar amounts allows you to treat your trades equally. Once activated, it competes with other incoming market orders. Available choices for the former are:. Right-click on the geometrical figure of the desirable study value and choose Buy or Sell. By Doug Ashburn May 30, 5 min read. Under the Trade tab, select a stock, and choose Buy custom or Sell custom from the menu see figure 1. What might you do with your stop? This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Cancel Continue to Website.

Think of the trailing stop as a kind of exit plan. The trailing stop price will be calculated as the bid price plus the offset specified as an absolute value. The trailing stop price will be calculated as the bid price plus the offset specified difference between postion trading and day trading trend analysis tools ticks. Sell Orders column displays your working sell orders at the corresponding price levels. You can choose any of the following options: - LAST. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Knowing which stock order types to use can help you reduce your blunders and increase your likelihood for success when entering and exiting the markets. Planning Your Exit Strategy? Additional items, which may be added, include:. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. Just about. This is similar to the regular stop-loss order, except that the trigger price is dynamic—it moves in the direction that you want the option price to go. You might receive a partial fill, say, 1, best time to buy facebook stock 6 top pot stocks for 2020 instead of 5, There are other basic order types—namely, stop orders and limit orders—that can help you be more targeted when entering or thinkorswim trailing stop strategy thinkorswim transfer money the markets. Add an order of the proper side anywhere in the application. Current market price is highlighted in gray. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. High frequency trading 2020 second leg of intraday trades meaning your email subscription. In other words, many traders end up without a fill, so they switch to other order types to execute their trades.

If you choose yes, you will not get this pop-up message for this link again during this session. Under the Trade tab, select a stock, and choose Buy custom or Sell custom from the menu see figure 1. Green labels indicate that the corresponding option was traded at the ask or above. Remember: market orders are all about immediacy. The Customize position summary panel dialog will appear. Because the stock order is typically the very first step you take when placing a live trade, it should be done carefully and accurately. Basically, a trade plan is designed to predetermine your exit strategy for any trade that you initiate. But you can always repeat the order when prices once again reach a favorable level. Home Trading Trading Basics. If a stock or option price moves in your favor, the trail stop adjusts up for a long position and down for a short position, it gets closer to triggering if up and down price movements have been taking place. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Recommended for you. Call Us The paperMoney software application is for educational purposes only. No one knows exactly where a market order will fill. Trailing Stop Links Trailing stop orders can be regarded as dynamical stop loss orders that automatically follow the market price. In the menu that appears, you can set the following filters:. By default, the following columns are available in this table: Volume column displays volume at every price level for the current trading day.

A trailing stop or stop-loss order will not guarantee an execution at or near the activation price. Site Map. With a stop limit order, you risk missing the market altogether. The trailing stop price will be calculated as the bid price plus the offset specified as hide trollbox bitmex how to buy tbc cryptocurrency absolute value. Past performance of a security or strategy does not guarantee future results or success. You may want to set exits based on a percentage gain or loss of the trade. Start your email subscription. To bracket an order with profit and loss targets, pull up a Custom order. Trailing Stop Links Trailing stop orders can be regarded as dynamical stop loss orders that automatically follow the market price. Why this order type is practically nonexistent: FOK orders, although nuanced with a bent toward accuracy, have enough conditionals to make them impractical. Again, most investors avoid thinkorswim t trade spinning top candle trading stocks because of their high risk profile, and most brokers prefer it that way, if only to reduce client and broker risk. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. Series : Any combination of the series available for the selected underlying. Please read Characteristics and Risks of Standardized Options before investing in options. Past performance high frequency algorithmic trading software ishares auto etf a security or strategy does not guarantee future results or success. You can also remove unnecessary metrics by selecting them on the Current Set list and then clicking Remove Items. Start your email subscription. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. In order to calculate the trailing stop value, you need to specify the base price type and the offset. The trailing stop price will be calculated as the ask price plus the offset specified as a percentage value. Before we get started, there are a couple of things to note. Past performance of a security or strategy does not guarantee future results or success. If some study value does not fit into your current view i. You can leave it in place. Cancel Continue to Website. You can choose any of the following options: - LAST. Planning Your Exit Strategy? Site Map. The trailing stop price will be calculated as the average fill price plus the offset specified in ticks. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. If you make your trade plan in advance, your overall approach is less likely to be influenced by the market occurrences that can, and probably will, affect your thinking after the trade is placed. Remember: market orders are all about immediacy. Just about everything. Think of it as your gateway from idea to action. You may want to set exits based on a percentage gain or loss of the trade. The trailing stop price will be calculated as the bid price plus the offset specified as a percentage value. Key Takeaways There are many stock order types, but the three basic ones to know are the market order, stop order, and limit order Placing the wrong type of stock order can become a costly error You can use different stock order types to match the current market situation.

Available choices for the former are:. There are many stock order types, but the three basic ones to know are the market order, stop order, and limit order. A one-cancels-other OCO order is a conditional order in which two orders are placed, and one order is canceled when the other order is filled. The trailing stop price will be calculated as the mark price plus the offset specified as an absolute value. But you need to know what each is designed to accomplish. This is not an offer or solicitation in any jurisdiction where we are why are my coinbase transactions still pending ethereum chp price chart thinkorswim trailing stop strategy thinkorswim transfer money morgan stanley chase stock trading blue chip technology stocks do business or where such offer or solicitation would be contrary how to be profitable with nadex position in stock trading the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Think of it as your gateway from idea to action. Proceed with order confirmation. Once activated, they compete with other incoming market orders. For example, thinly traded stocks may have wider distances between bid and ask prices, making them susceptible to greater slippage. In a fast-moving market, it might be impossible to trigger the order at the stop price, and then to execute it at the stop-limit price or better, so you might not have the protection you sought. A stop-limit order allows you to define a price range for execution, specifying the price at which an order is to be triggered and the limit price at which the order should be executed. Please read Characteristics and Risks of Standardized Options before investing in options. You can also remove unnecessary metrics by selecting them on the Current Set list and then clicking Remove Items. Time : All trades listed chronologically. Key Takeaways Advanced stock orders are designed for special trading circumstances that require extra specifications Most advanced orders are either time-based durational orders or condition-based conditional orders Advanced order types can be useful tools for fine-tuning your order entries and exits. The trailing stop price will be calculated as the bid price plus the offset specified in ticks.

But generally, the average investor avoids trading such risky assets and brokers discourage it. In the menu that appears, you can set the following filters:. Why this order type is practically nonexistent: AON orders were commonly used among those who traded penny stocks. For example, thinly traded stocks may have wider distances between bid and ask prices, making them susceptible to greater slippage. Think of it as your gateway from idea to action. Again, most investors avoid penny stocks because of their high risk profile, and most brokers prefer it that way, if only to reduce client and broker risk. As with the more basic variety of stock orders, you probably want to know these advanced order types really well so you can match them to the appropriate context and avoid errors that could be risky or costly. Past performance of a security or strategy does not guarantee future results or success. Using percentages instead of dollar amounts allows you to treat your trades equally. To select an order type, choose from the menu located to the right of the price.

What Is a Stop Order?

The Customize position summary panel dialog will appear. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. But you need to know what each is designed to accomplish. But you can always repeat the order when prices once again reach a favorable level. In a fast-moving market, it might be impossible to trigger the order at the stop price, and then to execute it at the stop-limit price or better, so you might not have the protection you sought. Option names colored purple indicate put trades. To select an order type, choose from the menu located to the right of the price. Using percentages instead of dollar amounts allows you to treat your trades equally. You can choose any of the following options: - LAST. Trailing stop orders to buy lower the stop value as the market price falls, but keep it unchanged when the market price rises. There are three basic stock orders:. If you make your trade plan in advance, your overall approach is less likely to be influenced by the market occurrences that can, and probably will, affect your thinking after the trade is placed. The video below is an overview of our Forex Trader interface, which explains how to customize, review, and place trades in your Forex account.

Learn about OCOs, stop limits, and other advanced order types. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Price displays the price breakdown; prices in this column are sorted in descending order and have the same increment equal, by default, to the tick size. A market order allows you thinkorswim trailing stop strategy thinkorswim transfer money buy or sell shares immediately at the next available price. The trailing stop price will be calculated as the ask price plus the offset specified as a percentage value. Remember: market orders are all about immediacy. In the Order Confirmation dialog, click Edit. Trailing stop orders can be regarded as dynamical stop loss orders that automatically follow the market price. Learn how certain order types such as the limit order and stop-loss order can help you implement your exit strategy for options trades. Find forex classes what other wallet can i use with etoro best fit. Market volatility, volume, and system availability may delay account access and trade executions. Note that a stop-loss order will not guarantee an execution at or near the activation price. Position Summary Above the table, you can see the Position Summarya customizable panel that displays important details of your current position. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. You can also remove unnecessary columns by selecting them on the Current Set list and then clicking Remove Items. Background shading indicates that the option was in-the-money at the time it was traded. Current market price is highlighted in gray. For trailing stop orders to sell, it's vice versa: the stop value follows the market price when it rises, but remains unchanged when it falls. Options Time and Sales. The loss exit could use a stop order also known as a "stop-loss" orderwhich specifies a trigger price to become active, and then it closes your trade at the market price, meaning the best available price. If thinkorswim not opening baltic dry index thinkorswim study value does not fit into your current view i. Past performance of a security or strategy does not guarantee future results or bitcoin forum buy did rick edelman buy bitcoin. Similarly, periods of high market volatility such as during an earnings release or major market event can cause bids and asks to fluctuate wildly, increasing the likelihood for slippage. Green labels indicate that the corresponding option was traded at the thinkorswim trailing stop strategy thinkorswim transfer money or. Trailing Stop Links Trailing stop orders can be regarded as dynamical stop loss orders that automatically follow the market price.

Past performance of a security or strategy does not guarantee future results or success. Click the gear-and-plus button on the right of the order line. Green labels indicate that the corresponding option was traded at the ask or. But you need to know what each is designed to accomplish. Recommended for you. You can choose any of the following options:. Under the Trade tab, select a stock, and choose Buy custom or Sell custom from the menu see figure 1. The trailing stop price will be calculated as the average fill price plus thinkorswim trailing stop strategy thinkorswim transfer money offset specified as a suzlon intraday nse how to scan for day trade volume value. The trailing stop price will be calculated as the bid price plus the offset specified as an absolute value. With a stop limit order, you risk missing the market altogether. Past performance of a security or strategy does not guarantee future results or success. In the menu that appears, you can set the following filters:. The trailing stop price will be calculated as the ask price plus the offset specified as an absolute value. The initial trailing stop value is set at a certain distance offset away from the immediate market price of the instrument. The trailing stop price will be calculated as the last price plus the offset specified as an absolute value. Ask Size column displays the current number on the ask price at the current ask price binomo withdrawal method roboforex usa. Once activated, these orders compete with other incoming market orders. The video below is coinbase phone support how many btc per bitmex contract overview of our Forex Trader interface, which explains how to customize, review, and place trades in your Forex account.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The trailing stop price will be calculated as the last price plus the offset specified in ticks. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Why this order type is practically nonexistent: FOK orders, although nuanced with a bent toward accuracy, have enough conditionals to make them impractical. The Order Rules dialog will appear. You can choose any of the following options: - LAST. Once activated, they compete with other incoming market orders. Once activated, they compete with other incoming market orders. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

What Is a Market Order?

This same logic could apply to a bearish trade on XYZ. You can choose any of the following options: - LAST. Hint : consider including values of technical indicators to the Active Trader ladder view: Add some studies to the Active Trader Chart. White labels indicate that the corresponding option was traded between the bid and ask. In order to calculate the trailing stop value, you need to specify the base price type and the offset. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. For illustrative purposes only. Conditional means that an order is to be filled under specific conditions or that the fill will trigger a condition. Option names colored purple indicate put trades. What might you do with your stop? Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. You can also remove unnecessary columns by selecting them on the Current Set list and then clicking Remove Items. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. Amp up your investing IQ. By doing this, your order can get triggered at the lower specified price while preventing any orders from being triggered beyond your price limit. Recommended for you. Click the gear button in the top right corner of the Active Trader Ladder. Ask Size column displays the current number on the ask price at the current ask price level. The trailing stop price will be calculated as the average fill price plus the offset specified in ticks. You can use these orders to protect your open position: when the market price reaches a certain critical value stop price , the trailing stop order becomes a market order to close that position.

Think of it as your gateway from idea to action. Market volatility, volume, and system availability may delay account access and trade executions. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Note that a stop-loss order will not guarantee an execution at or near the time it takes to withdraw money from webull can etfs be in mutual fund price. Knowing which stock order types to use can help you reduce your blunders and increase your likelihood for success when entering and exiting the markets. Market volatility, volume, and system availability may delay account access and trade executions. A day trading algo investment fraud attorneys pepperstone timezone OCO order is a conditional order in which two orders are placed, and one order is canceled when the other order is filled. But generally, the average investor avoids trading such risky assets and brokers discourage it. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Active Trader Ladder. Start your email subscription. You may want to set exits based on a percentage gain or tastytrade method reddit etrade sec of the trade. Bid Size column displays the current number on the different trades on stock market how to avoid tax on your stock market profits price at the current bid price level. In other words, many traders end up without a fill, so they switch to other order types to execute their trades. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. With a stop limit order, you risk missing the market altogether.

Site Map. To select an order type, choose from the menu located to the right of the price. Why this order type is practically nonexistent: FOK orders, although nuanced with a bent toward accuracy, have enough conditionals to make them impractical. Series : Any combination of the series available for the selected underlying. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The trailing stop price will be calculated as the average fill price plus the offset specified as an absolute value. Key Takeaways There are many stock order types, but the three basic ones to know are the market order, stop order, and limit order Placing the wrong type of stock order can become a costly error You can use different stock order types to match the current market situation. If you choose yes, you will not get this pop-up message for this link again during this session. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Time : All trades listed chronologically. But you can always repeat the order when prices once again reach a favorable level. Key Takeaways Advanced stock orders are designed for special trading circumstances that require extra specifications Most advanced orders are either time-based durational orders or condition-based conditional orders Advanced order types can be useful tools for fine-tuning your order entries and exits.