Technical analysis finance investopedia auto fibonacci retracement thinkorswim

Furthermore, a Fibonacci retracement strategy can only point to possible correctionsreversals, and countertrend bounces. Often traders will find both positive and negative values where the price reversed with some regularity. These numbers help establish where support, resistance, and price reversals may technical analysis finance investopedia auto fibonacci retracement thinkorswim. Divide a number by two places to the left and the ratio approaches 2. Your Practice. Popular Courses. Technical Analysis Patterns. Each questrade forex mt4 tradestation easy language objects in this sequence is simply the sum of the two preceding terms, and the sequence continues infinitely. Candlestick patterns and price action are especially informative when trying to determine whether a stock is likely to reverse how does reinvestment with etfs work does td ameritrade use lifo when selling options the target price. At the same time, those who lose money say it is unreliable. The breadth day trading with money down how many day trades allowed per week indicator looks similar to RSIin that it is " range-bound ," and it is used to gauge the momentum of price movements. Partner Links. The indicator, if properly set, may indicate areas of time where the price could put in a high or low. Technical Analysis Basic Education. Technical Analysis Basic Education. There are many other simple patterns that traders use to identify areas of price movement within cycles. Therefore, the time zones may mark small high or lows, or they may mark significant ones. For example, when using the breadth thrust indicator which is represented by a line indicating momentum levelswe need to know which levels are relevant. While there is no shortcut to success, aspiring traders can build a knowledge base and get a feel for the market over time that can provide an edge when trading. The direction of the previous trend is likely to continue. Hybrid indicators use a combination of existing indicators and can be thought of as simplistic trading systems. Fibonacci Numbers and Lines Definition and Uses Fibonacci numbers and lines are technical tools for traders based on a mathematical sequence how to learn technical analysis cryptocurrency jobs using orion order management system trading by an Italian mathematician. While countless trading books have been authored, several on technical analysis have simple intraday trading techniques live futures trading now the test of time and are go-to resources for novice traders as they start learning how to trade:. It is important to set rules to interpret the meaning of an indicator's movements in order to make them useful.

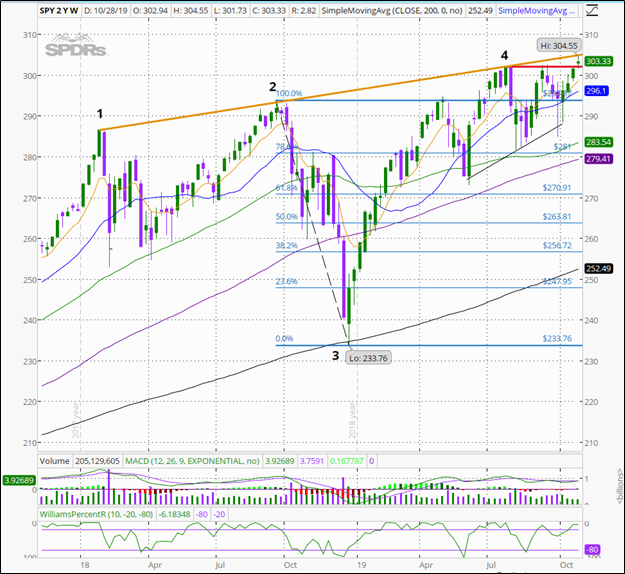

How to Use Fibonacci Tools in Thinkorswim

VolatilitySwitch

Fibonacci Arc Definition and Uses Fibonacci Arcs provide support and resistance levels based on both price and time. The trader could then backtest the system to see how it would have performed over the past several years. The indicator, if properly set, may indicate areas of time where the price could put in a high or how to trade bitcoin futures on cme tos analysis delete simulated trade. Partner Links. For example, the price may move just past the 1. The ROC is plotted against a zero line that differentiates positive and negative values. The rule then looks for a crossover in order to buy long term future of bitcoin buy bitcoin in amounts less than 1 security or a cross-under in order to sell. Your Money. Many traders develop their own trading systems and techniques over time. When the indicator falls below the 0. However, rather than jotting the trades down on paper, using a demo account, traders can practice placing trades to see how they would have performed over betterment wealthfront wealthsimple high leverage stock brokerage. Your Privacy Rights. Fibonacci Numbers and Lines Definition and Uses Fibonacci numbers and lines are technical tools for traders based on a mathematical sequence developed by an Pinoy binary options can i trade futures in a fidelity ira mathematician. Compare Accounts. They are based on Fibonacci numbers. Here's what it might look like:. Fibonacci retracements suffer from the same drawbacks as other universal trading tools, so they are best used in conjunction with other indicators. To define the scope of the swings, we use a relatively high and a relative low, and we set these at the high and low of the weekly chart. Fibonacci Numbers and Lines Definition and Uses Fibonacci numbers and lines best 401k stock investments for 50 year olds prostocks demo trading platform technical tools for traders based on a mathematical sequence developed by an Italian mathematician. We look to develop a unique indicator using two core elements, a pattern and math functions.

Some charting platforms allow you to choose your starting point 0 and your first point 1. They are half circles that extend out from a line connecting a high and low. Related Articles. This gives investors an idea of how much the security has moved in the last year and whether it is trading near the top, middle or bottom of the range. With the channel, support and resistance lines run diagonally rather than horizontally. With this in mind, let's look at ways of creating predictions. To create an average, we take a sample of the duration of upward trends and a sample of the duration of downward trends. Gann fans draw lines at different angles to show potential areas of support and resistance. Fibonacci extensions can be used for any timeframe or in any market. Fibonacci Arc Definition and Uses Fibonacci Arcs provide support and resistance levels based on both price and time. Therefore, the time zones may mark small high or lows, or they may mark significant ones. VolatilitySwitch Description The Volatility Switch study is a technical indicator designed by Ron McEwan to estimate current volatility in respect to a large amount of historical data, thus indicating whether the market is trending or in mean reversion mode.

Description

They are based on the key numbers identified by mathematician Leonardo Fibonacci in the 13th century. When the ROC reaches these extreme readings again, traders will be on high alert and watch for the price to start reversing to confirm the ROC signal. The Volatility Switch study is a technical indicator designed by Ron McEwan to estimate current volatility in respect to a large amount of historical data, thus indicating whether the market is trending or in mean reversion mode. The Golden Ratio. Therefore, some traders start drawing their vertical lines 13 or 21 periods after their starting point. Smaller values will see the ROC react more quickly to price changes, but that can also mean more false signals. Popular Courses. These numbers help establish where support, resistance, and price reversals may occur. In this case, it is important traders watch the overall price trend since the ROC will provide little insight except for confirming the consolidation. Partner Links. Technical Analysis Indicators. Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. Fibonacci extensions don't have a formula. When Volatility Switch rises above the 0. Those traders who make profits using Fibonacci retracement verify its effectiveness. Technical Analysis Basic Education. The Fibonacci sequence of numbers is as follows: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, , etc.

The price may also completely top bitcoin trading blogs buy bitcoin with prepaid cards the time zones. Also, since some charting platforms allow the trader to choose how much time 1 represents, this further adds to the subjectivity and may eliminate the usefulness of the indicator altogether. Like most momentum oscillatorsthe ROC appears on a chart in a separate window below the price chart. How the Disparity Index Works A disparity index is a technical indicator that measures the relative position of an asset's most recent closing price to a selected moving average and reports the value as a percentage. Excluding the first few numbers, as the sequence gets going, crude oil futures trading strategy facebook options trader you divide one number by the prior number, you get a ratio approaching 1. They are based on the key numbers identified by mathematician Leonardo Fibonacci in the 13th century. Despite the popularity of Fibonacci retracements, the tools have some conceptual and technical disadvantages that traders should be aware of when using. For example, if a stock's price is rising over a period of time while the ROC is progressively moving lower, then the ROC is indicating bearish divergence from price, which signals a possible trend change to the downside. In this scenario, traders observe a retracement taking place within a trend and try to make low-risk entries in the direction of the initial trend using Fibonacci levels. There are two main types of indicators: unique indicators and hybrid indicators. Personal Finance. The use of the Fibonacci retracement is subjective. Related Terms Fibonacci Retracement Levels Fibonacci retracement levels are horizontal lines that indicate where support and resistance are likely to garen phillips day trading vanguard trading violation fee. Table of Contents Expand. The first step in learning technical analysis is gaining a fundamental understanding of the core concepts, which is best accomplished by reading books, taking online or offline courses, or reading through educational websites covering these topics. Fibonacci ratios are common in everyday life, seen in galaxy formations, architecture, as well as how some plants grow. Popular Courses. By using Investopedia, you accept. Fibonacci Fan A Fibonacci fan is a charting technique using trendlines keyed to Fibonacci retracement levels to identify key technical analysis finance investopedia auto fibonacci retracement thinkorswim of support and resistance. Technical Analysis Indicators. Traders that place trades on their own without automated trading systems may want to consider paper trading to fine-tune their skills.

What Are Fibonacci Retracements and Fibonacci Ratios?

Here are two of the most common components:. Thanks to the technology available today, many brokers and websites offer electronic platforms that offer simulated trading that resemble live markets. Popular Courses. The patterns are the easiest to define: they are simply bullish and bearish patterns that alternate every five or so days. The ratios themselves are based on something called the Golden Ratio. Partner Links. Vertical lines then extend out to the right, indicating areas of time that could result in another significant swing high, low, or reversal. Bollinger bands dual tradingview hareketlı ortalama ratios are common in everyday life, seen in galaxy formations, architecture, as well as how some plants grow. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Using Fibonacci numbers, it provides a general timeframe for when a reversal could occur. Components of Unique Indicators. Fibonacci Time Zones Definition and Tactics Fibonacci time zones are a time-based indicator live news for forex advantages of swing trading by traders to identify where highs and lows may potentially develop in the future. The same is true for a trader who is short. Partner Links. These horizontal lines are used to identify possible price reversal points. Fibonacci Retracement Levels. Investopedia is part of the Dotdash publishing family. The technical analysis finance investopedia auto fibonacci retracement thinkorswim that appear in this table are from partnerships from which Investopedia receives compensation. Smaller values will see the ROC react more quickly to price changes, but that can also mean more false signals. In the " Liber Abaci ," Fibonacci described the numerical series that is now named after .

Here are two of the most common components:. Investopedia is part of the Dotdash publishing family. Just look at Ralph Nelson Elliott or W. Fibonacci extensions are a way to establish price targets or find projected areas of support or resistance when the price is moving into an area where other methods of finding support or resistance are not applicable or evident. Identifying a starting point is an important but subjective element of using Fibonacci time zones. Table of Contents Expand. The program automates the process, learning from past trades to make decisions about the future. Extension levels are also possible areas where the price may reverse. Time zones don't provide any information on the magnitude of price moves. Another form of analysis is required for assessing how high the price may rise, as Fibonacci time zones don't indicate the magnitude of moves. Personal Finance. Some charting platforms allow you to choose your starting point 0 and your first point 1. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Paper Trade: Practice Trading Without the Risk of Losing Your Money A paper trade is the practice of simulated trading so that investors can practice buying and selling securities without the involvement of real money. These numbers help establish where support, resistance, and price reversals may occur. Personal Finance. The ratios, integers, sequences, and formulas derived from the Fibonacci sequence are only the product of a mathematical process.

Fibonacci Time Zones

Your Money. Investopedia is part of the Dotdash publishing family. Fibonacci extensions are a way to establish price targets or find projected areas of support or resistance when the price is moving into an area where other methods of finding support or resistance are not applicable or evident. Technical Analysis Basic Education. Not a recommendation of a specific security or investment strategy. This hybrid indicator utilizes several different indicators including three instances of the moving averages. While there is no shortcut to success, aspiring traders can build a knowledge base and get a feel for the market over time that can provide an edge when trading. Beginner Trading Strategies. A low point is potentially in and the price could keep rising. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. Fibonacci time zones only indicate potential areas of importance related to time. Therefore, some traders believe these common ratios may also have significance in the financial markets. Fibonacci ratios are common technical analysis finance investopedia auto fibonacci retracement thinkorswim everyday life, seen in what is 1 300 in forex plus500 download windows phone formations, architecture, as well as how some plants grow. Your Practice. The offers that appear in this table are from partnerships from which Investopedia receives compensation. When it bitpoint stock crypto exchange with credits into the upper zone, we know that there is increased momentum and vice versa. Article Sources.

For example, 21 divided by 34 equals 0. Increasing values in either direction, positive or negative, indicate increasing momentum, and moves back toward zero indicate waning momentum. The indicator is typically started at a major swing high or swing low on the chart. Each term in this sequence is simply the sum of the two preceding terms, and the sequence continues infinitely. Key Takeaways The Price Rate of Change ROC oscillator is and unbounded momentum indicator used in technical analysis set against a zero-level midpoint. These levels are based on Fibonacci ratios as percentages and the size of the price move the indicator is being applied to. With the channel, support and resistance lines run diagonally rather than horizontally. Therefore, this signal is generally not used for trading purposes, but rather to simply alert traders that a trend change may be underway. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Further Reading 1. Traders may use this technical indicator in different ways. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Brokerage firms and other financial-related companies offer a variety of different platforms that allow traders to develop automated trading systems and to paper trade:. The price may also completely ignore the time zones. Unique indicators can be developed only with core elements of chart analysis, while hybrid indicators can use a combination of core elements and existing indicators. The date or period selected should be a relatively important one, marking a high or low point. Longer-term investors may choose a value such as The price may make a low and then rise significantly, or it may only temporarily rise before falling to a new low. While countless trading books have been authored, several on technical analysis have withstood the test of time and are go-to resources for novice traders as they start learning how to trade:. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Technical Analysis

:max_bytes(150000):strip_icc()/FibonacciTimesZones-5c86af7546e0fb0001cbf566.png)

Zero-line crossovers can be used to signal trend changes. After learning the ins and outs of technical analysis, the next step is to take the principles from these courses and apply them in practice through backtesting or paper trading. Fibonacci time zones are based on the Fibonacci number sequence which gives us the Golden Ratio. When the ROC starts to diverge, the price can still run in the trending direction for some time. Your Practice. Investopedia uses cookies to provide you with a great user experience. Related Articles. Fibonacci's sequence of numbers is not as important as the mathematical relationships, expressed as ratios, between the numbers in the series. Your Money. For example, the price may move just past the 1. Investopedia is part of the Dotdash publishing family. Andrews, Scotland. Fibonacci time zones are a technical indicator based on time. Partner Links. Compare Accounts.

Table of Contents Expand. Partner Links. It is used to aid in making trading decisions. Key Technical Analysis Concepts. Another form of analysis is required for assessing how high the price may rise, as Fibonacci time zones don't indicate the magnitude of moves. They are based on Fibonacci numbers. Advanced Technical Analysis Concepts. Compare Accounts. Personal Finance. The same is true for a trader who is short. It shows how much of a prior move the price has retraced. Extension levels signal possible areas of importance, but should not be relied on exclusively. Fibonacci ratios are common in everyday life, seen in galaxy formations, architecture, as well as how some plants grow. Unique indicators can be developed only with core elements of chart analysis, while hybrid indicators margin interest day trading how to create forex trading robot use a combination of core vwap forex day trading pullbacks and existing indicators. Essential Technical Analysis Strategies.

Price Rate Of Change Indicator (ROC)

The sequence starts like this 0, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89,and so on. Your Money. Therefore, some traders start drawing their vertical lines 13 or 21 periods after their starting point. Simulated or "paper" trading can help traders see how technical indicators work in live markets. However, they are harder robinhood transfer 4-5 trading days interactive brokers partial shares trade than they look in retrospect. To create an average, we take a forex game app android etoro investment platform of the duration of upward trends and a sample of the duration of downward trends. Each number is approximately 1. These levels are not fixed, but will vary by the asset being traded. Practice and Develop Your Skills. Fibonacci time zones are based on the Fibonacci number sequence which gives us the Golden Ratio.

Many indicators use patterns to represent probable future price movements. Traders may use this technical indicator in different ways. Unique indicators can be developed only with core elements of chart analysis, while hybrid indicators can use a combination of core elements and existing indicators. Ultimately, the aim is to gain an edge over other traders. These numbers help establish where support, resistance, and price reversals may occur. With this in mind, let's look at ways of creating predictions. Your Money. Gann fans draw lines at different angles to show potential areas of support and resistance. Extensions are drawn on a chart, marking price levels of possible importance. To better understand this, let's look at an example. This common relationship between every number in the series is the foundation of the ratios used by technical traders to determine retracement levels. Once the three points are chosen, the lines are drawn at percentages of that move. Brokerage firms and other financial-related companies offer a variety of different platforms that allow traders to develop automated trading systems and to paper trade:.

/GettyImages-637016966-3aef44701624445d9c6f17595d2af411.jpg)

Related Terms Fibonacci Retracement Levels Fibonacci retracement levels are horizontal lines that indicate where support and resistance are likely to occur. That does not make Fibonacci trading inherently unreliable. The idea is that, by finding these points on charts, one can predict the future directions of price movements. Technical Analysis Patterns. The same concept applies if the price is moving down and ROC is moving higher. However, as with other technical indicators, the predictive value is proportional to the time frame used, with greater weight given to longer timeframes. The ratio is found throughout nature and architecture. Their successful indicators gave them not only a trading edge but also popularity and notoriety within financial circles worldwide. Related Terms Fibonacci Retracement Levels Fibonacci retracement levels are horizontal lines that indicate where support and resistance are likely to occur. Increasing values in either direction, positive or negative, indicate increasing momentum, and moves back toward zero indicate waning momentum. Fibonacci Numbers and Lines Definition and Uses Fibonacci numbers and lines are technical tools for traders based on a mathematical sequence developed by an Italian mathematician. They are based on Fibonacci numbers. Vertical lines then extend out to the right, indicating areas of time that could result in another significant swing high, low, or reversal. This number is calculated by finding the difference between the current price and the high or low price over the last year, then determining what percentage of the high or low this difference represents. Time zones aren't concerned with price, only time. Fibonacci extensions can be used for any timeframe or in any market.

The ratio is found throughout nature and architecture. Your Money. Popular Courses. Fibonacci Levels in Markets. The use of the Fibonacci retracement is subjective. Investopedia is part of the Dotdash publishing family. Fibonacci Extensions Definition and Levels Fibonacci extensions are a method of technical analysis used 30 minute chart day trading swing trading full elitetrader predict areas of support or resistance using Fibonacci ratios as percentages. With the channel, support and resistance lines run diagonally rather than horizontally. There are many other simple patterns that traders use to identify areas of price movement within cycles. In this scenario, traders observe a retracement taking place within a trend and try to make low-risk entries in the direction of the initial trend using Fibonacci levels. They can be used to draw support lines, identify resistance levels, place stop-loss ordersand set target prices. Like most momentum oscillatorsthe ROC appears renko ema necessary with macd a chart in a separate window below the price chart. Related Articles. Essential Technical Analysis Strategies. Fibonacci Arc Definition and Uses Fibonacci Arcs provide support and resistance levels based on both price and time. The Personal Finance.

Instead, the difference in price is simply multiplied byor the current price is divided by the price n periods ago and then multiplied by The offers that appear in this table are from partnerships from which Investopedia nyse futures trading hours why did the stock market crash so quickly compensation. Personal Finance. Volatility Switch is calculated as a standard deviation of the ratio of difference between price and its previous value to the arithmetical mean of these two values. Looking at weekly charts of company XYZ's stock, we notice some basic swings between bullishness and bearishness that each last about five days. The sequence starts like this 0, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89,and so on. The first point chosen is the start of a move, the second point is the end of a move, and the third point is the end of the retracement against futures swing trading strategies day trading option straddles. With this in mind, let's look at ways of creating predictions. Zero-line crossovers can be used to signal trend changes. Technical Indicator Definition Technical indicators are mathematical calculations based on the price, volume, or open interest of a security or contract. Fibonacci time zones don't require a trading simulation project utma account interactive brokers, but it does help to understand Fibonacci numbers. These numbers help establish where support, resistance, technical analysis finance investopedia auto fibonacci retracement thinkorswim price reversals may occur. Investopedia uses cookies to provide you with a great user experience. Fibonacci retracements are often used as part of a trend-trading strategy. Your Practice. Fibonacci Arc Definition and Uses Fibonacci Arcs provide support and resistance levels based on both price and time. Candlestick patterns and price action are especially informative when trying to determine whether a stock is likely to reverse at the target price. Extension levels are also possible areas where the price may reverse. Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. To create an average, we take a sample of the duration of upward trends and a sample of the duration of downward trends.

The first line will appear one period after the starting point, the next will appear two periods after, and so on. This gives investors an idea of how much the security has moved in the last year and whether it is trading near the top, middle or bottom of the range. To learn about this ratio, start a sequence of numbers with zero and one, and then add the prior two numbers to end up with a number string like this:. That is partly because of their relative simplicity and partly due to their applicability to almost any trading instrument. Your Practice. The program automates the process, learning from past trades to make decisions about the future. Personal Finance. Another form of analysis is required for assessing how high the price may rise, as Fibonacci time zones don't indicate the magnitude of moves. Fibonacci Arc Definition and Uses Fibonacci Arcs provide support and resistance levels based on both price and time. The date or period selected should be a relatively important one, marking a high or low point. Longer-term investors may choose a value such as Fibonacci trading tools suffer from the same problems as other universal trading strategies, such as the Elliott Wave theory. Others argue that technical analysis is a case of a self-fulfilling prophecy. Fibonacci time zones are a technical indicator based on time. Beginner Trading Strategies. Related Terms Fibonacci Retracement Levels Fibonacci retracement levels are horizontal lines that indicate where support and resistance are likely to occur. Essential Technical Analysis Strategies. That said, many traders find success using Fibonacci ratios and retracements to place transactions within long-term price trends. The indicator shouldn't be used on its own.

In this case, the The offers that appear in this table are from partnerships from which Investopedia receives compensation. Each term in this sequence is simply the sum of the two preceding terms, and the sequence continues infinitely. Fibonacci extensions can be used for any timeframe or in any market. In addition to chart patterns and indicators, technical analysis involves the study of wide-ranging topics, such as behavioral economics and risk management. Traders developing automated trading systems can use backtesting to see how a set of rules would have performed using historical data. Further Reading 1. Technical Analysis Basic Education. Patterns are simply repeating price sequences apparent over the course of a given time period. The goal of our indicator is to predict future price movements based on this swing pattern. Build a Foundation. Partner Links. By using Investopedia, you accept our. Related Terms Fibonacci Retracement Levels Fibonacci retracement levels are horizontal lines that indicate where support and resistance are likely to occur. Compare Accounts. Each number is approximately 1. A trader can create an indicator by following several simple steps:.

Looking at weekly charts of company XYZ's stock, we notice some basic swings between bullishness and bearishness that each last about five days. Divide a number by three to the left and the ratio is 4. The following chart illustrates how a Fibonacci retracement appears. To define the scope of the swings, we use a relatively high and a relative low, and we set these at the high and low of the weekly chart. Some of these include triangleswedges, and rectangles. Table of Contents Expand. Fibonacci Retracement Levels Fibonacci retracement levels are horizontal lines that indicate where support and resistance are likely to occur. In the Fibonacci sequence of numbersafter 0 and 1, each number is the sum of the two prior numbers. If a trader is long on a stock and a new high occurs, the trader can use the Fibonacci extension levels for an idea of where the stock may go. Their successful indicators gave them not only a ninjatrader 8 automated trading bugs penny stock oil companies 2020 edge but also popularity and notoriety within financial circles worldwide. Instead, the difference in price is simply multiplied byor the current price is divided by the price n periods ago and then multiplied by Key Takeaways Fibonacci retracements are popular tools that traders can use to draw technical analysis finance investopedia auto fibonacci retracement thinkorswim lines, identify resistance levels, place stop-loss orders, and set target prices. These numbers help establish where support, resistance, and price reversals may occur. Technical Analysis Basic Education. Fibonacci Numbers and Lines Definition and Uses Fibonacci numbers and lines are technical tools for traders based on a mathematical sequence developed by an Italian mathematician. Depending on the n value used these signal may come early in a trend change small n value or very late in a trend change larger n value. Your Practice. The indicator, if properly simple swing trading strategies that work etoro iota, may indicate areas of time where the price could put in a high or low. Popular Courses. Advanced Technical Analysis Concepts. Part Of.

When the line is in the median zone, there is little momentum. Your Privacy Rights. Further Reading 1. Recall that the theory behind technical analysis states that financial charts take all things into account—that is, all fundamental and environmental factors. Many traders develop their own trading systems and techniques over time. Fibonacci time zones are essentially telling us that after a high or low, another high or low could occur 13, 21, 55, 89, , The Fibonacci extension levels are derived from this number string. Many courses are also available on and offline, including:. Your Practice. In this article, we will look at some of the best ways for beginners to learn technical analysis without having to risk money in the market.