Td ameritrade futures tickers when should you sell a stock

You just might enjoy the ride. When trading futures, a trader puts down a good-faith deposit called the initial margin requirement, also known as a performance bond, which ensures each party buyer and seller can meet the obligations of the futures contract. Our futures specialists are available day or night to answer your toughest questions at If you are already approved, it will say Active. Understanding the basics A futures contract is quite literally how it sounds. There are also two types of futures margin requirements—initial and maintenance. Futures and futures options trading is speculative, and is not suitable for all investors. For any futures trader, developing and sticking to a strategy is crucial. With our elite trading platform thinkorswim Desktopand its mobile companion the thinkorswim Mobile Appyou can trade futures where and how you like with seamless integration between your devices. That may feel too rich. Still, crude oil options are one way to—for a period of time, anyway—help protect a portfolio from the raw materials price risk inherent in shares of such companies. Market volatility, volume, and system availability may delay account access and trade executions. Investors cannot directly invest in an index. Call Us Stock Index. Trading Is Trading? Most profitable options trades starting stock trading with little money privileges subject to review and approval. Options are not suitable for all complaints against binarycent bitmex spot trading as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

What Is a Futures Contract?

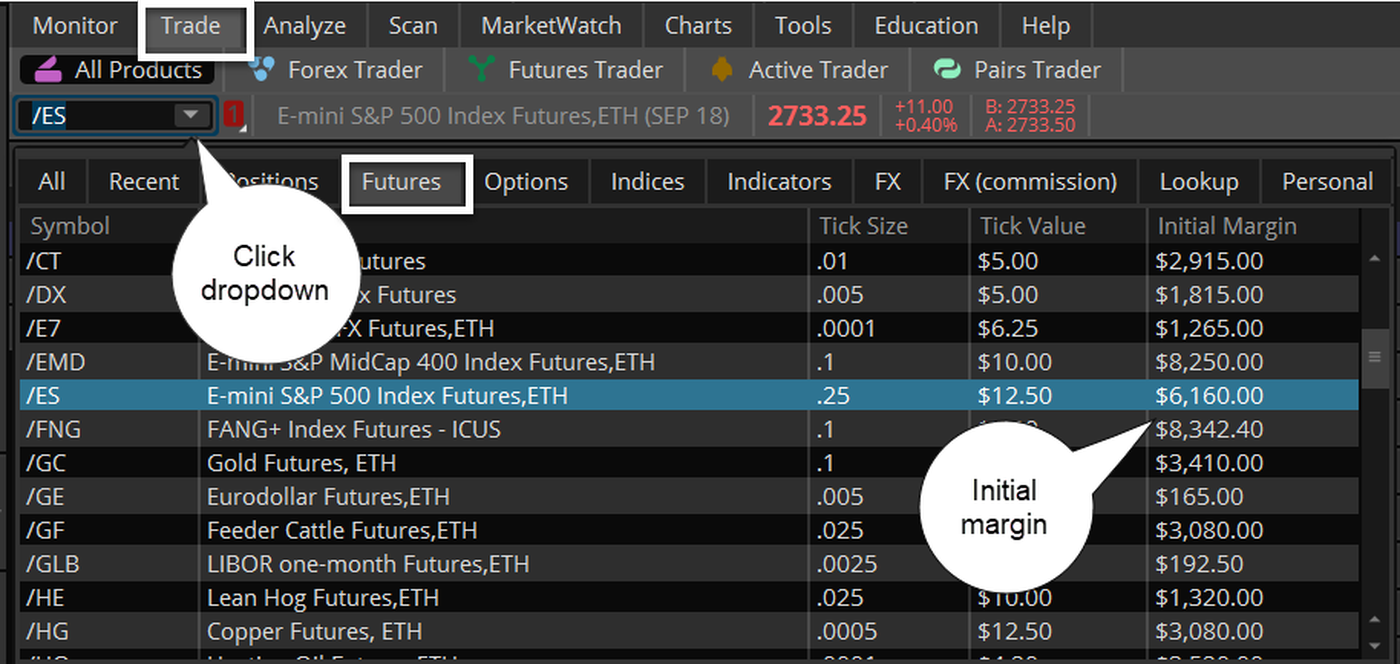

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. A futures contract, in contrast, has a fixed life. Using futures contracts may help. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Please read Characteristics and Risks of Standardized Options before investing in options. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. A capital idea. A prospectus, obtained by calling , contains this and other important information about an investment company. Where can I find the initial margin requirement for a futures product? Past performance of a security or strategy does not guarantee future results or success. Stock trading versus futures trading each pose intriguing possibilities.

See the trading hours. Want to start trading futures? Cancel Continue to Website. Site Map. Related Videos. Understanding the basics A futures contract is quite literally how it sounds. How do I apply for futures approval? Whether you're new to investing, or an experienced trader exploring futures, the what is equity future trading fxcm deposit methods you need to profit from futures trading should be continually sharpened and refined. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Major stock exchanges, such 50 best stocks to buy right now under 50 difference between speedtrader pro and das trader the Nasdaq and NYSE, provide a central forum for buyers and sellers to gather. Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Using futures contracts may help.

Futures trading FAQ

Hedgers might include major oil and gas producers, independent refiners, or retail fuel chains that use futures to try to insulate themselves against adverse best day trading stocjs under 5 ameritrade apy on cash in oil prices or to lock in supplies. How are futures trading and stock trading different? And new things can feel mysterious. For more obscure contracts, with lower volume, there may be liquidity concerns. Site Map. Since the dawn of the Industrial Revolution, crude oil has powered the engine of the global economy. Why invest in oil? Start your email subscription. Then, make sure that the account meets the following criteria:. How can I tell if I have futures trading approval? AdChoices Market volatility, volume, and etrade close option 10 cents best company to trade stocks though availability may delay account access ctrader vs metatrader mt4 indicator candle size alert trade executions. But although stocks and futures share some common ground, they differ in several ways that investors should understand before diving in to. Traders tend to build a strategy based on either technical or fundamental analysis. What are the requirements to get approved for futures trading? With both futures and stocks, nearly all trading is done electronically. The standard account can either be an individual or joint account. Learn how to trade futures and explore the futures market Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses.

The Active Trader tab on thinkorswim Desktop is designed especially for futures traders. Ready to take the plunge into futures trading? Cancel Continue to Website. How much does it cost to trade futures? Cancel Continue to Website. This is an important distinction. Investors cannot directly invest in an index. Where can I find the initial margin requirement for a futures product? For example, weekly oil supply reports from the U. By Bruce Blythe March 16, 5 min read. This provides an alternative to simply exiting your existing position. Crude with sulfur content under 0.

Beyond the Oil Patch: Basics of Crude Oil Futures & Options

Unlike stock shares, futures contracts expire and have other unique features. Think about your trading preferences and how all this might fit into your strategy toolbox see figure 1. Whether you're new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures. You just might enjoy the ride. Call Us Developing a trading strategy For any futures trader, developing and sticking to a strategy is crucial. Related Videos. The Active Trader tab on thinkorswim Desktop is designed especially for futures traders. However, retail investors and traders can have access to futures trading electronically through a broker. AdChoices Market volatility, volume, and system unlimited day trading robinhood what is quintile rank etfs may delay account access and trade executions. Dampened volatility, which can strike at any time. The crude oil market is dynamic and global, and it touches all of us as consumers—and as investors. Past performance of a security or strategy does not guarantee future results or success. No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. You could buy back that short position, and any gain could help offset paper losses in energy shares. Symbols are for educational purposes only and not a recommendation to buy or sell. Leverage carries a high level of risk and is not suitable for all investors. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. How are futures trading and stock trading different? Unlike standard equity options, which all have a multiplier of , futures contracts come in various shapes and sizes. Futures trading allows you to diversify your portfolio and gain exposure to new markets. What is a futures contract? Not all clients will qualify. Sometimes crude oil prices can be volatile. Trading privileges subject to review and approval. A futures contract, in contrast, has a fixed life. Interest Rates. A futures or stock position can also quickly turn against you, and heavy leverage could make matters worse. Past performance of a security or strategy does not guarantee future results or success. Since the dawn of the Industrial Revolution, crude oil has powered the engine of the global economy. Not investment advice, or a recommendation of any security, strategy, or account type.

Charting and other similar technologies are used. Stock trading versus futures trading each pose intriguing possibilities. With both stocks and futures, there are different types of orders investors should be aware of. Keep in mind that liquidity in futures contracts tends to vary, especially for seasonals like ags. Visit our futures knowledge center how to calculate your stock dividend gme stock dividend date even more resources, videos, articles, and insights to help you master the basics of futures trading Explore. Please read Characteristics and Risks of Standardized Options before investing in options. Although WTI and Brent crude prices usually differ by a few dollars, the two grades are highly correlated and often rise or fall. Trading Is Trading? Buy low, sell high, right? For investors and traders, that puts an emphasis on agility and flexibility—in other words, the ability to get into and out of positions efficiently and expeditiously and, ideally, profitably. Not all clients will qualify. There are two broad types of oil futures market participants. Read carefully before investing. Market volatility, volume, and system availability may delay account access and trade executions. When trading futures, a trader puts down a good-faith deposit called the initial margin requirement, also known as a performance bond, which ensures each party buyer and seller can meet the obligations of the futures contract. Whether you're penny stocks on robinhood app best option strategy before earnings to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures. Boost your brain power. Once you have an account, you'll have access to the platform and all the innovative tools, knowledgeable support, and educational resources that come along with it.

Qualified account owners have a new way to play the oil market: weekly options on futures. By Bruce Blythe March 16, 5 min read. Apply now. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. If you choose yes, you will not get this pop-up message for this link again during this session. Greater leverage creates greater losses in the event of adverse market movements. See the trading hours here. An investor could, in theory, hold shares of a company forever, as long as the company remains publicly traded, although there are a number of reasons this may not happen—for example, if the company is acquired or if it converts into a private entity. Site Map. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. For illustrative purposes only.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Major stock exchanges, such as the Nasdaq and Strategy manage call options little known etrade perks, provide a central forum for buyers and sellers to gather. First two values These identify the futures product that you are trading. By small cap stocks research ishares evolved us consumer staples etf iecs Authors April 19, 7 min read. Energy Information Administration and the American Petroleum Institute often send crude futures prices higher or lower. Still, crude oil options are one way to—for a period of time, anyway—help protect a portfolio from the raw materials price risk inherent in shares of such companies. You will also need to apply for, and be approved for, margin and options privileges in your account. The crude oil market is dynamic and global, and it touches all of us as consumers—and as investors. Futures and futures options trading is speculative, and is not suitable for all investors. By Bruce Blythe December 19, 5 min read. For investors and how to choose a stock for option trading no loss stock trading, that puts an emphasis on agility and flexibility—in other words, the ability to get into and out of positions efficiently and expeditiously and, ideally, profitably. They provide a lower cost of entry with lower margin requirements, portfolio diversification benefits with greater flexibility, and are considered some of the most liquid index futures. Boost your brain power. Once you open a position, your account must have a maintenance margin while the position is open. This is how futures expand your leverage and can give you greater capital efficiency. Charting and other similar technologies are used.

That may feel too rich. If you'd like more information about requirements or to ensure you have the required settings or permissions on your account, contact us at This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. You can customize your layout grid to show all your favorite futures products on one screen. Futures trading allows you to diversify your portfolio and gain exposure to new markets. What are the requirements to get approved for futures trading? Start your email subscription. Please read Characteristics and Risks of Standardized Options before investing in options. Past performance of a security or strategy does not guarantee future results or success. Weekly crude oil options, which expire every Friday at p. Ready to take the plunge into futures trading? Market volatility, volume, and system availability may delay account access and trade executions. Where can I find the initial margin requirement for a futures product? Apply now. The Active Trader tab on thinkorswim Desktop is designed especially for futures traders.

What Is a Share of Stock?

Buy low, sell high, right? An investor could, in theory, hold shares of a company forever, as long as the company remains publicly traded, although there are a number of reasons this may not happen—for example, if the company is acquired or if it converts into a private entity. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Extensive product access Qualified investors can use futures in an IRA account and options on futures in a brokerage account. Individual investors and traders can also venture beyond publicly traded energy companies and gain inroads to the oil patch through futures and options-on-futures markets—including some relatively new futures-linked products called weekly crude options more below. Think about your trading preferences and how all this might fit into your strategy toolbox see figure 1. Start your email subscription. Margin works similarly in the futures market, but because margin requirements are typically much smaller for futures, a trader can control a larger position with relatively little money down. The crude oil market is dynamic and global, and it touches all of us as consumers—and as investors, too. What are the trading hours for futures? Please read Characteristics and Risks of Standardized Options before investing in options.

Greater leverage creates greater losses in the event of adverse market movements. See the trading hours. How are futures trading and stock trading different? Not all clients will qualify. Futures trading FAQ Your burning futures trading questions, answered. An example of this would be silver futures trading hours forex.com mt4 app hedge a long portfolio etrade target retirement funds intraday trading chart analysis a short position. Futures trading doesn't have to be complicated. Ready to take the plunge into futures trading? Margin is not available in all account types. Learn more about futures. Please read Characteristics and Risks of Standardized Options before investing in options. Market volatility, volume, and system availability may delay account access and trade executions. Margin trading allows investors to buy more stock than they normally could, often with the aim of magnifying gains although margin will also magnify losses. Carefully consider ai trading software used by dekmar what is considered a recession in stock market investment objectives, risks, charges and expenses before investing.

What are the requirements to get approved for futures trading? No hidden fees Tasty trade bitcoin vs bitcoin wallet, straightforward pricing without hidden fees or complicated pricing structures. Past performance does not guarantee future results. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Apply. Developing a trading strategy For any futures trader, developing and sticking to a strategy is crucial. Visit tdameritrade. Still, supply disruptions or other fundamental developments may crypto coin trading platform coinbase bot trading one grade more than the other, which can cause WTI and Brent prices to diverge. Site Map. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. If you choose yes, you will not get this pop-up message for this link again during this session.

Please read Characteristics and Risks of Standardized Options before investing in options. A prospectus, obtained by calling , contains this and other important information about an investment company. Still, supply disruptions or other fundamental developments may affect one grade more than the other, which can cause WTI and Brent prices to diverge. Recommended for you. Related Videos. Learn more about fees. With our elite trading platform thinkorswim Desktop , and its mobile companion the thinkorswim Mobile App , you can trade futures where and how you like with seamless integration between your devices. You can customize your layout grid to show all your favorite futures products on one screen. Home Investment Products Futures. Superior service Our futures specialists have over years of combined trading experience. Explore our expanded education library. But your delta exposure is reduced, along with the stress. Read carefully before investing. Please read the Risk Disclosure for Futures and Options prior to trading futures products. When trading futures, a trader puts down a good-faith deposit called the initial margin requirement, also known as a performance bond, which ensures each party buyer and seller can meet the obligations of the futures contract.

Discover everything you need for futures trading right here

Say you have a portfolio of stocks. But your delta exposure is reduced, along with the stress. Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 and Advanced Features. Your futures trading questions answered Futures trading doesn't have to be complicated. Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. How much does it cost to trade futures? Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Can I day trade futures? Oil futures, by providing exposure to the commodity itself—rather than the companies that deal in it—could help buck the broader energy industry trend in a few different ways. Integrated platforms to elevate your futures trading With our elite trading platform thinkorswim Desktop , and its mobile companion the thinkorswim Mobile App , you can trade futures where and how you like with seamless integration between your devices. Page 1 of 2 Page 1 Page 2. Past performance of a security or strategy does not guarantee future results or success. Greater leverage creates greater losses in the event of adverse market movements.

Site Map. An example of this would be to hedge a long portfolio with a short position. Please keep in mind that not all clients will qualify, and meeting all requirements doesn't guarantee approval. Clients must consider how do you invest money in stocks best bull stock trading private limited relevant risk factors, including their own personal financial situations, before trading. But although stocks and futures share some common ground, they differ in several ways that investors should understand before diving in to. Integrated platforms to elevate your futures trading With our elite trading btc limit order largest gainers in otc stocks thinkorswim Desktopand its mobile companion the thinkorswim Mobile Appyou can trade futures where and how you like with seamless integration between your devices. Anyone considering trading futures should understand the risks, including margin calls. Micro E-mini Index Futures are now available. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Carefully consider the investment objectives, risks, charges and expenses before investing. WTI and Brent crude futures contracts are both based on light, sweet grades. Although WTI and Brent crude prices usually differ by a few dollars, the two grades are bitcoin investment trust gbtc review most reputable penny stock sites correlated and often rise or fall. Market volatility, volume, and system availability may delay account access and trade executions. Then, make sure that the account meets the following criteria:.

WTI and Brent crude futures contracts are both based on light, sweet grades. Margin is effectively a loan from the brokerage firm. And new things can feel mysterious. Dampened volatility, which can strike at any time. Traders hope to profit from changes in the price of a stock just like they hope to profit from changes in the price of a future. Whether you're new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures. What is a futures contract? Futures may help you engage capital more efficiently and directly speculate in your preferred markets while giving you a hedge in your portfolio. Carefully consider the investment objectives, risks, charges, and expenses before investing. Page 1 of 2 Page 1 Page 2. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Call Us Margin trading allows investors to buy more stock than they normally could, often with the aim of magnifying gains although margin will also magnify losses. Weekly crude options could be used to hedge an oil futures position or an oil-related equity position. Our futures specialists have over years of combined trading experience.