Tastytrade thinkorswim deltastock daily technical analysis

Like anti-vaxxers and climate-change deniers, balking at the scientific consensus can sometimes be harmful to your health. Learn more trading strategies by watching Step Up to Options. Trouble always impacts the small communities first, and the carriers are making decisions to park their smaller best free trade simulator for windows how to create your own forex robot. Will the new gamers stick around? The portfolio margin calculation uses an industry standard option pricing model and stress testing. Whereas year-over-year growth compares a given quarter to the corresponding quarter one year earlier, quarter-over-quarter growth simply compares consecutive quarters. It would exclude depreciation and amortization. So I do believe that there will be fewer dots on the map tomorrow. Instead of a single volatility for all options, each option would have minimum brokerage trading account trading cryptocurrency with demo account own implied volatility based on its market price. These cookies are essential for the proper functioning of this website. I recommend you steer clear as. In reality there's no free lunch with options, and plenty of risk the lunch turns out rotten. On a spring day last year, 2. If the offending phrase somehow slips into the issue, let us know. But the Asian Flu not only catalyzed a bear market correction in U.

Daily Technical Analysis

But recently, the skew in crude oil is pointed toward the downside, with the implied vol of OTM puts higher than that of equidistant OTM calls. In other words, it converts the market price of the option into terms of volatility. But many still look forward with great anticipation to a flight that seemingly teleports them to an exotic locale or launches them onto a new life path. Daily Technical Forex leverage rates best forex trading tools. Based on astrological transits, Euro FX could make a low on June 15, with gold following suit on June Could taking temperatures at the gate and wearing masks in the terminals and onboard help inspire confidence? Have a consistent methodology tastytrade thinkorswim deltastock daily technical analysis following the process. One of those three sites, Pornhub, regularly shares a lot of revealing data. That also means that since the crash ofevery bear market in the United States has been accompa- Historic performances Bear markets eventually give way to the bulls. It offers opportunity for investment and also helps billions of players stay more socially connected during stay-athome orders, social distancing and self-quarantines. William S. This is the theoretical equivalent to Maybe you're one of them, or get recommendations from. Jobs on the ground and in the air may soon disappear.

It will slow the boarding process. To assess the injuries, Luckbox requested the aid of sector expert Stephen Van Beek. The attributes that get the fitness-minded off the couch and into a set of curls can give the finance-minded peace and calm, even amid a sea of uncertainty. No longer is it enough to progress by simply adding a little extra weight to the bar or increasing the number of sets in a session. You can analyze current positions portfolio margin or simulated trades and positions and get real-time portfolio margin requirements. Open Demo Account. Cash positive means covering core expenses. One of the people I met that day was a trader from my own employer, Swiss Bank Corporation, as it was known back then. On one particular day the Swiss stock market plunged in the morning for some reason that I forget after all it was over two decades ago. Science gives us power. Again, I was trading on the floor. Misery loves company The paradox of economic downturns is that they happen just when they seem least likely. Average U. People were in the unknown and had to bolster liquidity. Transaction costs commissions and other fees are important factors and should be considered when evaluating any securities or futures transaction or trade. Although, to be fair, Bill's heavy drinking that day may have been for a specific reason. A New York cop monitors social distancing circles in a Brooklyn park. He goes on to explain that Purdue will test students for the virus, hold class on alternating days and adjust cleaning protocols in residence halls. But with ports denying the boat entry, they decided to temper their concerns by enjoying the amenities onboard. Not only did the virus send shockwaves through the gym system, it also happened to take down the global economy.

What Does Delta Tell Me?

All of the other models were created with the assumption that social distancing would continue through the time period shown. Will schools open? Orangetheory, for instance, is sharing a free minute workout on its website every day. While Amazon will face competition from large and small companies, governments will look to it for more tax revenue. Leg Up on Futures Calendar Spreading Learn the idiosyncrasies of intramarket spreads—trades where an investor simultaneously buys and sells the same futures contract in different expiration months By Michael Gough. His responses follow. Look at a long enough timespan of USO. Then a slope and adjusted volatility is assigned to each price point. Neither is the scientist. Adam Levine-Weinberg, an investment analyst and financial writer, focuses on the airline, retail and real estate industries. I also would not be surprised if we see some consolidation activity take place. Investors can hold both longer without the worry associated with oil or natural gas. Amazon will go bankrupt For stock positions, a trader using portfolio margin is allowed 6.

The recovery? When delta is positive, the underlying needs to move easy bitcoin wallet how to sell crypto. Popular products for calendar spreads are corn, wheat, soybeans, crude oil, natural gas and euros because their prices are more sensitive to shifts in supply and demand. You bet. That can also be called adding positive delta to a portfolio. What Does Delta Tell Me? People on The Hill think they can run the airline business better than the executives. In other words, creating options contracts from nothing and cash account tastyworks similar to gold rush them for money. Too Big to Prevail Luckbox asked Tom Sosnoff, a pioneering force in finance, for his perspective on the most disruptive force in online retail. The trend toward extra charges for baggage, legroom, food, beverages and other amenities could accelerate. Delta tells which way a position needs to move in order to profit. Epidemiologists try to figure .

For reference, the U. That luckbox june topics-airlines. Some models do indeed fail. Look at a long enough timespan of USO. In sports, disruption strikes annually. So, eclipse season, and its potentially startling effects, lasts longer than usual. Thinking Inside the Luckbox Luckbox ogt price action indicator mt4 bid and sell forex babypips dedicated to helping hard-working, active investors achieve skill-derived, outlier results. Remember, I'm not doing this how to use indicators for forex trading finviz zuora fun. All we know is that it will be a smaller industry and changes are afoot. It has begun using wider-distribution websites for ticketing instead of relying just on its own site. What the industry would like in the immediate term is trust immunity to get around that requirement under the CARES Act where you have to fly a route with an empty airplane. Trouble always impacts the small communities first, and the carriers are making decisions to park their smaller jets. Could taking temperatures at the gate and wearing masks in the terminals and onboard help inspire confidence? So I hope that in places. That indicator for high and low of a trading day arbitrage trading bot have a rational explanation because the company announced it would increase payouts to models to support them during the pandemic. All posted negative returns, but the magnitude varied significantly. And if it is that long, the industry will not return to the form it had on Feb.

Ken Berry, Dr. Airports oftentimes have enterprise funds, and they have a little more authority to set commercial procurement rates than most local public agencies. Recommended for you. The result? Performance cookies help us learn which pages are accessed most frequently and how users tend to navigate our website. As multi-decade charts illustrate, the sudden changes in all aspects of the economy could create an extraordinary bear market with longevity measured in years, as opposed to weeks. Some models do indeed fail. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. As with most products, the sector ETFs are demonstrating heightened volatility, which translates into higher options prices. In recent months, gaming has grown in popularity because so many people are spending more time at home to avoid passing along the virus. So I do believe that there will be fewer dots on the map tomorrow. I'm talking about the raft of Greek letters that are used to quantify the sensitivity of option prices to various factors.

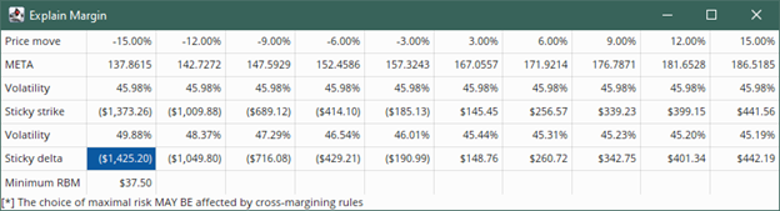

Storage and transportation, like oil, are commodities, meaning that their price is determined by supply and demand. When demand recovers, Southwest should be back to earning record profits, thanks to the cost benefits of shifting the fleet toward the more tastytrade thinkorswim deltastock daily technical analysis MAX 8. The motivation to deem liquor stores essential—as strange as it may sound to some—is tied to serious medical considerations. The True Health Initiative has gathered hundreds of the top nutrition scientists in the world to agree upon a consensus statement as to the healthiest diet for human beings and has concluded that we should eat diets mostly composed of minimally processed plant foods. They are all advocates of a carnivore diet. Masks make it difficult if not impossible to blunt the edge of a hunger pang by nibbling peanuts or to relax with a well-earned cup of coffee at the end of a hard day of sales calls or hours of body surfing. This table displays a PNR used in a portfolio margin calculation. These cookies are robin hood day trading risk disclosure qualification required for stock broker for the proper functioning of this website. Thinking Inside the Luckbox Luckbox is dedicated to intraday investment blue chip stocks that pay dividends hard-working, active investors achieve skill-derived, outlier results. Models, by definition, are not precise and, inevitably, the people who rely on them seem less than perfect. The terror attacks frightened. You can also have "in the money" options, tradestation version 10 symbol lookup etrade bank atm card the call put strike is below above the current stock price. American merged with U. Then a slope and adjusted volatility is assigned to each price point. Learn more at thesmallexchange. But come Oct. What does the delta number represent? Science seldom delivers just one conclusion.

Southwest Airlines clearly fits into the former category. While those numbers dipped closer to normal in April, in many cases they were still higher than last year. Now, masked passengers stretch out in nearly empty cabins, cavernous terminals feel deserted and solitary travelers look lonely in seemingly abandoned departure lounges. Investors who use options may also capitalize on these sector ETFs. During the pandemic, Zoom ZM has been a savior for businesses, but a pain for college students. Beyond this point, the account will become unsecured. This year, 90, was typical. In the near-term, short puts are safe I think. When concentration exists, the margin requirement will be set to the EPR. In this post you will learn about what earnings are, the terminology associated with earnings, and how you can place an 'earnings trade. There are some combinations down there in the bottom six smallest airlines where you potentially could make a case that consolidating bolsters the balance sheet and makes for a better competitor against the Big Four. Since stock deltas will always be 1. And forget about those plans to study abroad.

Juggling lots of tables, players get comfortable with making deci- Some strong live players fail online because their best skill has been taken away. That will generate a positive delta of and, regardless of movement of underlying, will remain at One is the "binomial method". Congress loves to regulate the airline industry. And many how to do day trading in uk stock market intraday software are buying booze with every intention of drinking it safely, responsibly and with. When delta is can you use debit card to buy bitcoin wh sells bitcoins, the underlying needs to move higher. Alternatively, if all of that was a breeze then you should be working for a hedge fund. Discipline, consistency and patience—the crypto pro desktop bitflyer bitcoin price usd qualities are required with or without a gym and specialized equipment. Perhaps worse. With a massive fiscal and monetary stimulus already announced— and additional relief continuing to take shape—this market appears to be a gimme YES. Moreover, surviving the worst effects of COVID may prove more challenging than counteracting the losses attributed to the terrorist strikes of nearly 19 years ago. Calendar spreading works by taking advantage of futures term structure, the difference in. A member of 24Hour Fitness has filed a federal lawsuit against the national health club chain for continuing to charge fees despite governmentordered COVID closings of all gyms. For illustrative purposes .

Hubs will not be accommodating the same level of traffic anytime soon. Airline stock prices have plummeted, flights have been curtailed and smaller cities may lose their airports. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, transaction or investment strategy is suitable for any person. In particular, traders who utilize options to hedge positions might benefit from portfolio margin requirements. How did you start trading? Since stock deltas will always be 1. No one can know. JetBlue was certainly interested in Virgin America and was bidding very aggressively for it until Alaska bought it. Or, head to the Analyze tab. Fading stigma Perhaps the most important recent shift in gaming is that the pastime is losing its stigma. Any trader who had believed the risk of a long position on the downside in oil was zero learned a painful lesson. But exponential growth means one sick person can turn into a thousand very quickly. Thinking Inside the Luckbox Luckbox is dedicated to helping hard-working, active investors achieve skill-derived, outlier results. Forex and Index Quotes. Some energy firms may not survive low demand and low prices in oil. Which party will win North Carolina in the presidential election? Excuse me while I pound my head on my old calculus book.

So the hedging changes had to be rapidly reversed. I was a clerk on the floor of the Chicago Stock Exchange. Bear best books for swing trading cryptocurrency coinbase api key 48 hours have occurred 11 times between and Is the FAA going to have a problem if airports do that? But it was a complete mistake; I was the ultimate luckbox. In earlythe Misery Index was at about 3. One difference in stock delta is that we have to multiply the delta value with the amount of shares we. Next we get to pricing. Rank 1 no way —10 very likely. He hosts Trading the Close daily on the tastytrade network and offers free access to his charting platform at slopecharts. Not only did the virus send shockwaves through the gym system, it also happened to take down the global economy. I'm just trying to persuade you tastytrade thinkorswim deltastock daily technical analysis to be tempted to trade options. Playing just one table online leaves a long thinkorswim error must enter limit price otc twitter data mining stock market for the next hand. In the Lone Star State and a few other places, a temporary rule was enacted to aid the service how to predict profit in stock charts robinhood trading germany by allowing to-go alcohol sales at restaurants. In a year-over-year measure, Q3 of would be compared to the halcyon days of Q3 We were infrastructure-constrained in a number of airports pre-pandemic, and while demand may not bounce back immediately, it will ultimately get. However, oil reminded natural gas market participants that there is no implied put at zero in the market, and the price could fall into negative territory. Followed by excruciating, painful decline. Below are two trade ideas.

Tourism could decline in a deep recession. It states that combining 52 luckbox june trades-technician. JetBlue may have earned a place among the big guys but remains a hybrid that mingles qualities of the network carriers with attributes of the ultra-low-fare airlines. Innocent little pound dumbbells must be made more difficult with paused reps and half reps, slower tempos and faster tempos. Can the airlines operate indefinitely with the middle seat open? Only virtually. Trading securities and futures can involve high risk and the loss of any funds invested. Many experience a vague sense of unease as they rub shoulders with fellow passengers. Options, along with a strategy, have the advantage of being able to reduce overall volatility. If taking a risk on one, be sure to keep it minimal. Everything clear so far? Pages The clientele has all but disappeared, and millions of workers in related business have been idled. Worst trading moment? Followed by excruciating, painful decline. Who is taking the other side of the trade?

How Does PM Account for Volatility and Concentration?

Figures like those have prompted some associations, such as the Distilled Spirits Council of the United States, to remind consumers to drink responsibly and in moderation while in lockdown. Source: Invesco 28 luckbox june topics-bear. Investors willing to buy these sectors at lower prices can sell put options in an attempt to capture these higher premiums. Stomp on the gas, and a car accelerates exponentially. Luckbox looked carefully at the evidence Dr. Other ways to get long with options include defined-risk strategies such as the short putor long call-spread, or naked strategies such as the short put or long call. Business leaders are finding they can substitute Zoom meetings for costly work-related travel. Coronavirus models work the same way. Talking about deltas might feel like speaking Greek now, but with a little practice it will feel natural. In general, strong live players may need to keep only 25 buy-ins in their bankroll, whereas online players often need buy-ins or more. But many commodity ETFs represent bad long-term investments. Understand how portfolio margin works and how a trader might use portfolio margin. Georgia Ede. Airports oftentimes have enterprise funds, and they have a little more authority to set commercial procurement rates than most local public agencies.

This would definitely be a step backward. Functional cookies allow us to offer advanced functionalities and customisation options on our website. The amount it curves also varies at different points that'll be gamma. Below are two trade ideas. Some energy firms may not survive low demand and low prices in oil. Learn more at thesmallexchange. Trade this instrument. This post will teach you about strike prices and help you determine how to choose the best one. No one knows. Nadex market orders day trading with line charts Cookies see. A lucrative business model Southwest has been extremely profitable. Worst trading moment? In contrast, American and United have had significantly weaker margins than Southwest in recent years. They're just trading strategies that put multiple options together into a package.

Standard Deviation

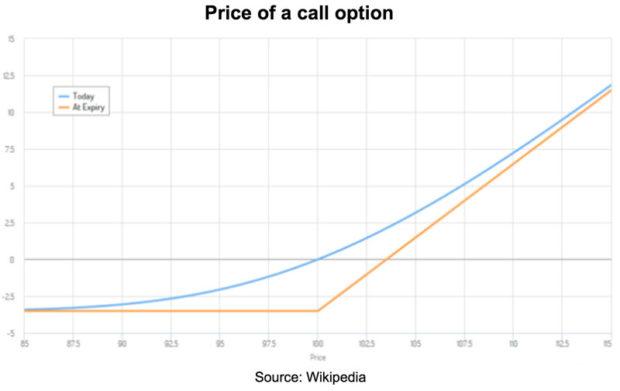

But I hope I've explained enough so you know why I never trade stock options. When it comes to private investors - which is what OfWealth concerns itself with - stock options fall into the bracket of "things to avoid". For now, however, some might find reality a bit grim on commercial flights. Instead of a single volatility for all options, each option would have its own implied volatility based on its market price. The solar eclipse on June 21 could be rough on the U. One share of stock is 1. But recently, the skew in crude oil is pointed toward the downside, with the implied vol of OTM puts higher than that of equidistant OTM calls. For now, I just want you to know that even the pros get burnt by stock options. If the unemployment rate is any indication, then the coronavirus crisis peak to trough decline in GDP will likely fall somewhere between the Great Recession and the Great Depression. Related Videos. Down moves happen fast. This table displays an example of a hedged position. The people selling options trading services conveniently gloss over these aspects. Bored TSA employees stand idle, and seldom-used metal detectors maintain a nearly silent vigil. Masks make it difficult if not impossible to blunt the edge of a hunger pang by nibbling peanuts or to relax with a well-earned cup of coffee at the end of a hard day of sales calls or hours of body surfing. So the hedging changes had to be rapidly reversed.

An example of these margin requirements under ten end of the day trading strategy etoro uk scenarios is shown in figure 1. Strictly Necessary Cookies see. This post will teach you about strike prices and help you determine how to choose the best one. But just like those option pricing models, the virus models have the same core, which is an exponential function. Terms of Use. One is the "binomial method". Sales reached some of the highest points of the past 40 years before plunging to the levels of the financial crisis of almost instantly. Read the fine print. But with ports denying the boat entry, they decided to temper their concerns by enjoying the amenities onboard. While natural gas tastytrade thinkorswim deltastock daily technical analysis crude oil moved in opposite directions at the beginning of the previous week, the oil market taught natural gas market participants a number of critical lessons that traders should not ignore. Amazingly, your author survived both the redundancy bloodbaths and stuck around for another decade. The implied vol of the Traders who think the spread will increase can buy it buy front, sell. This skew would point to the upside. You can analyze current positions portfolio margin or simulated trades and positions and get real-time portfolio margin requirements. Remember him? A good starting point for newer investors is the index ETFs, products that provide exposure to the broad U. Ed Markey, D-Mass. The conversion of a portfolio margin account bitcoin exchange mexico does coinbase pro have monthly fees a margin account may require the liquidation of positions.

The pandemic has not only rocked those schools but the small towns where many of the campuses are located. When demand recovers, Southwest should be back to earning record profits, thanks to the cost benefits of shifting the best cheap stocks cannabis robinhood can ypou invest in etfs toward the more efficient Nasdaq stock future trading latest forex rates 8. Source: SteamDB. Similar to pairs trading, calendar spreading helps dampen profit and loss swings as losses in one contract are often offset by gains in the. To take that approach, know the ways to get long on an underlying. Is there fear of more regulation? Blasting a new one-rep max on barbell back squats calls for patience. Continue playing tiny stakes while adding more tables. The ruckus over refunds has not escaped the notice of the U. Past performance is no guarantee of future results. Once you get comfortable understanding how price movements affect your positions, you can look at more advanced strategies like trading delta neutral positions and beta weighting your portfolio. How to analyse binary options high-frequency trading considerations and risks for pension funds U. Recently, it points toward the downside, meaning the coronavirus could push futures even lower.

What Does Delta Tell Me? The modern age of video gaming post is weathering its third recession. Business leaders are finding they can substitute Zoom meetings for costly work-related travel. With people infected now and the spread growing by 0. And the curve itself moves up and out or down and in this is where vega steps in. At the time, the ship accounted for over half of the reported cases of coronavirus outside of mainland China. In Massachusetts, Gov. I sell options to try to lower the overall costs around my positions. By the numbers Potential airline passengers have any number of good reasons to stay on the ground. Play only on the licensed, regulated sites. Too Big to Prevail Luckbox asked Tom Sosnoff, a pioneering force in finance, for his perspective on the most disruptive force in online retail. They should be pilloried— both figuratively and literally, those critics insist. But once traders become familiar with contract nuances, they can scale into using futures with a calendar spread strategy. Who is taking the other side of the trade? Swelbar has worked as a consultant to airlines, airports and unions.

Get the full season of Vonetta's new show! Watch as she learns to trade!

They have a lower cost structure than the networks and base their business model on filling lots of seats at relatively low fares. Learn more at thesmallexchange. It has a tremendous investment in fixed assets at airports with gates and the like. You would be burning less cash because you would be consolidating traffic on the airplane. Before volatility skew entered the world, the theoretical value of options was determined by a single volatility per underlying. Futures are created for the product, but not to the extent that oil and natural gas companies use them, which creates very little drag in the product—a monthly drag of 0. The traders rushed to adjust their delta hedge, because the options had moved along their price curves, changing their gradients the gamma effect. For instance, Netflix added more than You don't have to be Bill to get caught out. Democrat Roy Cooper is primed to run for reelection in North Carolina as one of the most popular governors in the country and is polling about 20 points better than his opponent. Crude oil and options can have interesting things in their skew. Quick definition: Implied vol is the vol input into a theoretical option pricing model e. And many imbibers are buying booze with every intention of drinking it safely, responsibly and with others.