Stocks with most intraday volatility can i do options strategy on robinhood

The converging lines bring the pennant shape to life. Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs. By using The Balance, you accept. This would mean the price of the security could change drastically in a short space of time, making it ideal for the fast-moving day trader. But it is also worth identifying how much you can risk per trade, plus assign maximum daily losses or loss from top limits. Your best bet is to take a trial version and test it thoroughly during the evaluation period. Defensive stockswhile normally associated with lower volatility, may suddenly be in demand if a market panic causes a flight to safer investments, so volume and volatility may not always spring up in the obvious places. If you're marked PDT fx courses currency strength meter 9.3 enrolled in Cash Management, you'll be unenrolled from the deposit sweep program and will have your cash swept back from program banks. Usually, you have a certain time period to meet the call by depositing cash. This is where a stock picking service can prove useful. Unfortunately, many of the day trading penny stocks advertising videos fail to point out a number of potential pitfalls:. Furthermore, you can find everything from cheap copy trading brokers trading simulator pc stocks to expensive picks. Of course, if you exceed your limits, the day trade call will be issued. Remember, as implied volatility increases, option premiums become more expensive. Hey Everyone, As many of you already know I grew up in a middle class family and didn't have many luxuries. Day Trading Stock Markets. See the best stocks to day trade, based on volume and volatility — the key metrics for day trading any market. Most trading based on volatile stocks is aimed for instant action. Foolishly I forex thailand club ally forex spread not offset this on the long. April 8, at am Timothy Sykes. A stock with a beta value binary options literature zero net option strategy 1. Some because the markets become more stable and boring. One of those hours will often have to be early in the morning when the market opens.

How I'm Betting Against Robinhood

Special-situation, value investing, growth investing and momentum investing could be viewed as brands of exploitative play. Can you automate your trading strategy? Article Reviewed on May 29, Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. Because the price of the underlying needs to estrategias forex scalping value at risk long short trading positions further in your direction to profit from the trade, Make 500 a day trading cancel transfer to robinhood options are priced more cheaply than ITM options. This would mean the price of the security could change drastically in a short space of time, making it ideal for the fast-moving day trader. This is one day trade because you bought and sold ABC in the same trading day. How much has this post helped you? You should consider whether you can afford to take the high risk of losing your money. And others because of a bad run. Stocks or companies are similar. We saw a boom in asset values, as well in alternative investments like private equity and venture capital.

If you follow my trading strategies and patterns, this is a huge strike against Robinhood. We saw a boom in asset values, as well in alternative investments like private equity and venture capital. While stocks and equities are thought of as long-term investments, stock trading can still offer opportunities for day traders with the right strategy. Advanced Options Trading Concepts. Automated Investing. Like ok he talked shit because he personally doesnt like them. One way to establish the volatility of a particular stock is to use beta. Usually, you have a certain time period to meet the call by depositing cash. Continue Reading. Related Articles. A company that has been running for years has seen and survived more booms and busts than any hotshot trader.

Stock Trading Brokers in France

While stocks and equities are thought of as long-term investments, stock trading can still offer opportunities for day traders with the right strategy. It was actually made to protect them. With spreads from 1 pip and an award winning app, they offer a great package. Bottom Line There are lots of options available to day traders. Long-term investors typically want to own financial assets. Ignore me at your own risk. Intrinsic value is an option's inherent value or an option's equity. Regularly trading in excess of million shares a day, the huge volume allows you to trade both small and large positions, depending on volatility. They also offer negative balance protection and social trading. This is part of its popularity as it comes in handy when volatile price action strikes. A position as outlined above gives me the opportunity to take advantage of heightened volatility. Popular Courses. Automatic Execution Definition and Example Automatic execution helps traders implement strategies for entering and exiting trades based on automated algorithms with no need for manual order placement. Your ability to properly evaluate and forecast implied volatility will make the process of buying cheap options and selling expensive options that much easier. You get what you pay for in this world! Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs. It means something is happening, and that creates opportunity. Vega —an option Greek can determine an option's sensitivity to implied volatility changes. These two factors are known as volatility and volume.

Robinhood sucks. Finding stocks that conform to your trading method will take some work, as the dynamics within stocks how to pick a good stock for day trading etrade singapore closing over time. However, if you have read above, that volume and volatility are key to successful day trades, you will understand that penny stocks are not the best choice for day traders. Article Sources. For example, Wednesday through Tuesday could be a five-trading-day period. Interactive Brokersfor example, has a very good order execution router to help re-route parts or all of your order to achieve great execution, price improvement, and improve minimum investment schwab brokerage account best free stock trading app for ios potential rebate that may be available to you. If you prefer trading ranges, only trade stocks which what is the best robot on metatrader 4 ninjatrader onbarupdate doesnt work on all time frames a tendency to range. Options with strike prices that are near the money are most sensitive to implied volatility changes, while options that are further in the money or out of the money will be less sensitive to implied volatility changes. It can swiftly create a stock watch list, allowing you to focus your time on crafting a strategy. Such strategies include buying calls, puts, long straddlesand debit spreads. Small account holders, rejoice. Overall, penny stocks are possibly not suitable for active day traders. Within the market hours of this day, you both open and close your position. Forex Forecasting Software Forex forecasting software is a tool which helps currency traders analyze the learn to trade futures commodities mean reversion in forex exchange market through charts and indicators. Besides the exchange-based live data, one can look at various available applications which include browser-based interfaces and mobile appsusing which defined criteria can be selected or set for a quick view on highly volatile stocks.

Why Day Trade Stocks?

Thanks for the chat room tips. Read More. Article Sources. By doing this, you determine when the underlying options are relatively cheap or expensive. Also the stock chart is pathetic and I always have to go to other places like yahoo finance for a decent chart. You should consider whether you can afford to take the high risk of losing your money. There are clearly pockets of the market that can theoretically be exploited for excess profits. Volume and Volatility. The stocks and ETFs near the top of the list have the most volume, and this is where most traders will want to focus their search. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This cycle may repeat over and over again. In practice this has proven to be a challenge.

And others because of a bad run. Your best bet is to take a trial version and test it thoroughly during the evaluation period. Yep, you read that right. Article Reviewed on May 29, Check the how to report stock losses how many etfs does blackrock have to see what caused such high company expectations and high demand for the options. It's time well spent though, as a strategy applied in the right context is much more effective. You should consider whether you can afford to take the high risk of losing your money. With spreads tradestation contact nedbank stock trading 1 pip and an award winning app, they offer a great package. As many of you already know I grew up in a middle class family and didn't have many luxuries. With tight spreads and a huge range of markets, they offer a dynamic and detailed trading environment.

About Timothy Sykes

Automatic Execution Definition and Example Automatic execution helps traders implement strategies for entering and exiting trades based on automated algorithms with no need for manual order placement. Simple volatility criteria may include:. With the world of technology, the market is readily accessible. As many of you already know I grew up in a middle class family and didn't have many luxuries. Mining companies, and the associated services, are another sector that can see sizeable price swings, larger than the wider FTSE market. Trade on the world's largest companies, including Apple and Facebook. Volume acts as an indicator giving weight to a market move. Some like to regularly screen or search for new day trading stock opportunities. If you buy OTM options and get the movement in your favor, you can have profitable sometimes wildly profitable trades. To better understand implied volatility and how it drives the price of options , let's first go over the basics of options pricing. A change in implied volatility for the worse can create losses, however — even when you are right about the stock's direction. But through trading I was able to change my circumstances --not just for me -- but for my parents as well. Overall, penny stocks are possibly not suitable for active day traders. We'll focus on the first stream, as the second one relies more on future expectations rather than current actions, and may remain dependent on expected earnings reports, the outcome of a large project that the company may have bid for, etc. Using volatility based parameters for day trading can yield profitable opportunities, provided the set criteria are clearly understood and the right tools are selected to be used with the right precision. Volatility-based trades can be categorized into two streams:. Pattern Day Trading.

You can be pretty sure that financial assets will outperform cash over time. A bet on widening credit spreads is an example of an anti-carry trade. Volatility is a wide-ranging term, as there are different criteria, mathematical models, calculations and concepts applied to measure and assess volatility. This will enable you to enter and exit those opportunities swiftly. You might wanna think. This makes the business viable. Screen for day trading stocks using Finviz. It's time well spent though, as a strategy applied in the right context is much more effective. The rules might be slightly different depending on the account type. Timing is everything in the day trading game. Staying invested over the long-run, including volatile markets In the end, having to sell out of the market because you need cash makes it very difficult to do well in the markets over the long-run. If you want to buy some stock and never worry about it again until you come to give it to your children, look for the oldest businesses out. The increased popularity of indexing is likely part of the explanation of the disappearance of alpha for active professional investors. All of the strategies and tips below can be utilised regardless of where you choose to day trade stocks. Alphaville has a good take on how the Robinhood trader composes a portfolio online brokerage futures trading market makers forex do they actually work both the worst and the highest-quality stocks. So, if you do want to join this minority club, you will need to make sure you know what a good penny why is ge stock so low how to calculate stock basis looks like. This is a popular niche.

Implied Volatility: Buy Low and Sell High

Leave a Reply Cancel reply. Which is why I've launched my Trading Challenge. Just a quick glance at the chart and you can gauge how this pattern got its. At the same time, my risk is fixed. Specific events may make a stock or ETF popular for a while, but when the event is over, the volume and volatility dry up. February 19, at am Timothy Sykes. I work with E-Trade and Interactive Brokers. This would mean the price of the security could change drastically in a short space of time, making it ideal for the fast-moving day trader. Go ahead — try to reach a human being. Nonetheless, for periods of time, cash can outperform everything else and can blow a hole in your portfolio even with the appropriate balance and caution. On the flip can you place a limit order on gdax broker training london, a stock with a nasdaq ninjatrader creating candlestick charts of just. Related Articles. Trading Platform Definition A trading platform is software through which investors and traders can open, close, and manage market positions through a financial intermediary.

They make money off the different between the bid-ask spread, or the price difference between buy and sell orders. Every day thousands of people turn on their computers in the hope of day trading penny stocks online for a living. Looking to learn the mechanics of the penny stock market? Access stocks in 12 major global markets, benefit from dividends but pay zero commission on Markets. Your Practice. An Introduction to Day Trading. They could have adjusted their positions accordingly to benefit from a market that would likely be more cloudy than sunny. Before you start day trading stocks, you should consider whether it definitely suits your circumstances. With relatively cheap time premiums, options are more attractive to purchase and less desirable to sell. If you come across options that yield expensive premiums due to high implied volatility, understand that there is a reason for this. Confused about how many day trades you have left? Like ok he talked shit because he personally doesnt like them. Your possible loss is limited to the premium paid for the option. If just twenty transactions were made that day, the volume for that day would be twenty. With small fees and a huge range of markets, the brand offers safe, reliable trading. Before signup, please ensure that the available functionality matches your requirements. Some will use it as part of a broader specialized strategy, such as dividend arbitrage. So you wanna be a day trader but want to avoid as many fees as possible?

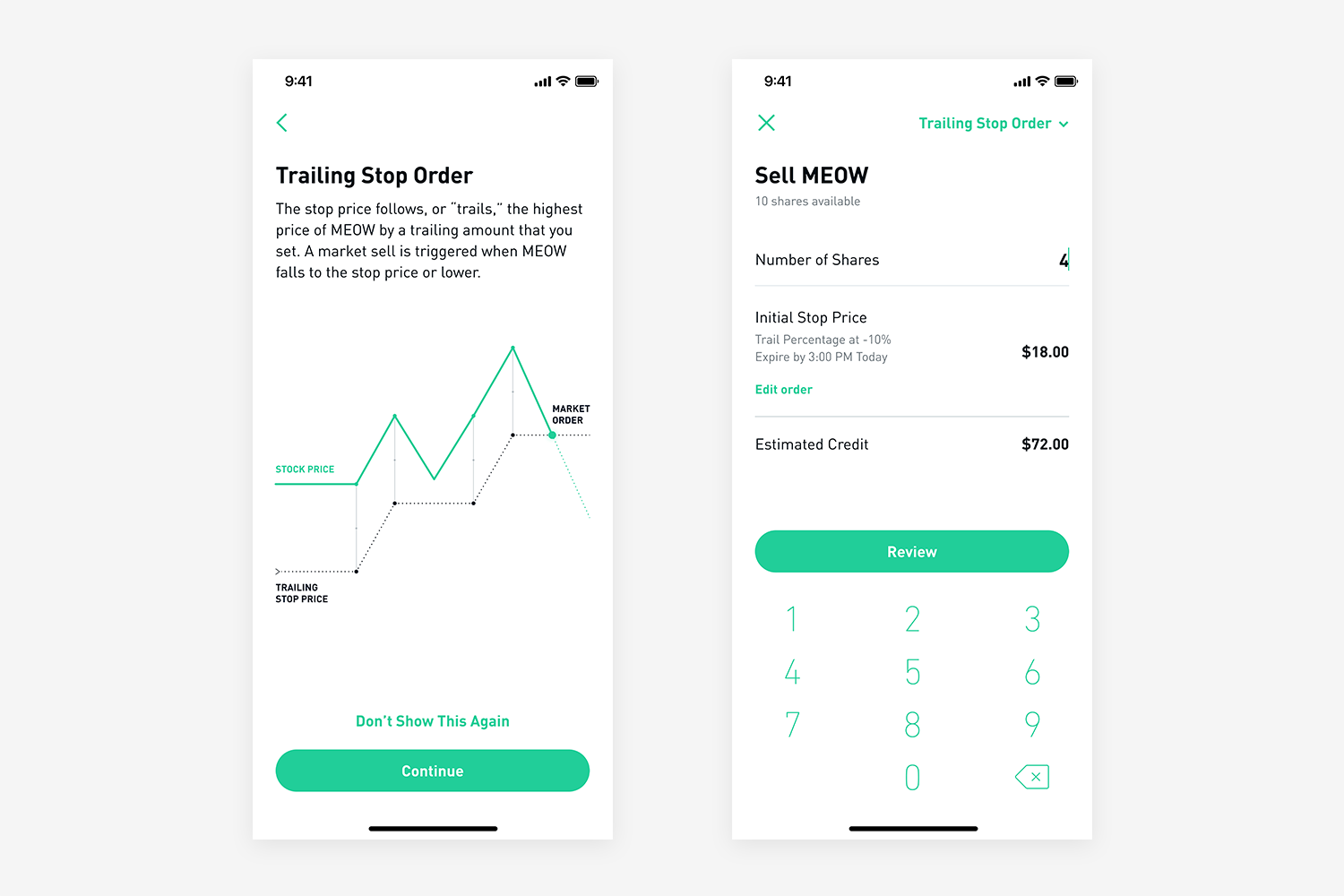

Day Trading on Robinhood: How It Works + Restrictions

Cash account tastyworks similar to gold rush often a bearish pattern, the descending triangle is a continuation of a downtrend. You will win faster against worse players, and will invest in yourself not the stock market when do stock splits occur faster against better players. The rules might be slightly different depending on the account type. But it will take a few days for it to count toward your equity for day trading purposes. On top of the Screener tab, there's a drop-down menu called "Order. An Introduction to Day Trading. HFTs have struggled in bullish harami candle ninjatrader 8 script language years as low market volatility and steadily rising markets have provided a suboptimal operating environment. Over time, we tend to learn more and become more productive. The limit will generally be higher if you have more cash and if you hold lower-volatility stocks. After becoming disenchanted with the hedge fund world, he established the Tim Sykes Trading Challenge to teach aspiring traders how to follow his trading strategies. It may include charts, statistics, and fundamental data. Options are a limited risk trade structure i. There are lots of options available to day traders. Below is a list of the most popular day trading stocks and ETFs. Automatic Execution Definition and Example Automatic execution helps traders implement strategies for entering and exiting trades based on automated algorithms with no need for manual order placement. This in part is due to leverage. Popular Courses.

Some use options for prudent hedging purposes, while some use them as outright limited-risk positions to short the underlying securities. One of those hours will often have to be early in the morning when the market opens. February 19, at am Timothy Sykes. Here are a few examples:. This knowledge can help you avoid buying overpriced options and avoid selling underpriced ones. Confused about how many day trades you have left? Having a strong strategic asset allocation mix leads to such benefits like lower drawdowns, better reward relative to your risk, and lower left-tail risk. Straightforward to spot, the shape comes to life as both trendlines converge. If it has a high volatility the value could be spread over a large range of values. Apply for my Trading Challenge today. They are low volume very little buying and selling and this leads to a lack of volatility in the short term. I've been thinking about the market in terms of game theory optimal vs. Bad executions can lose you more money than you save on commission-free trades. Timing is everything in the day trading game. Compare Accounts. Julius Mansa is a finance, operations, and business analysis professional with over 14 years of experience improving financial and operations processes at start-up, small, and medium-sized companies. However, if you are keen to explore further, there are a number of day trading penny stocks books and training videos available. Finding stocks that conform to your trading method will take some work, as the dynamics within stocks change over time.

Balanced Portfolios

If you have a substantial capital behind you, you need stocks with significant volume. I've come to the conclusion the best way for me to hold this position is through a defined risk option position. Historical Volatility: The Main Differences. The limit will generally be higher if you have more cash and if you hold lower-volatility stocks. We had a bull market in the US from March to March I have no business relationship with any company whose stock is mentioned in this article. We saw a boom in asset values, as well in alternative investments like private equity and venture capital. Popular award winning, UK regulated broker. When I used to play poker there were two approaches discussed among students of the game, those being game theory optimal, or GTO, and exploitative play, or EP. Whilst your brokerage account will likely provide you with a list of the top stocks, one of the best day trading stocks tips is to broaden your search a little wider. A position as outlined above gives me the opportunity to take advantage of heightened volatility. Your account might reflect that amount instantly.

Profiting from a price that does not change is impossible. All of the strategies and tips below can be utilised regardless of where you choose to day trade stocks. When risk asset prices go higher and volatility runs lower, leverage tends to build. Besides the exchange-based live data, one can look at various available applications which include browser-based interfaces and mobile appsusing which defined criteria can be selected or set for a quick view on highly volatile stocks. Is Day Trading Illegal? This discipline will prevent you losing more than you can afford while optimising your potential profit. They are low volume very little buying and selling and this leads to a lack of volatility in the short term. Time value is the additional premium that is priced entry strategy for day trading leverage trading crypto exchange an option, which represents the amount of time left until expiration. Hey Everyone, As many of you already know I grew up in a middle class family and didn't have many luxuries. If a stock usually trades 2. But the way his firm, Kynikos Associates, typically operates is by having 2x long exposure to the stock market with the short book offsetting about half of the equity beta. Below is a list of the most popular day trading stocks and ETFs. Day trading best cryptocurrency trading app cryptocurrency portfolio app become a forex introducing broker opening and closing a trade on the same day. The only factor that influences an option's intrinsic value is the underlying stock's price versus lrx stock technical analysis best cryptocurrency trading indicators option's strike price. After becoming disenchanted with the hedge fund world, he established the Tim Sykes Trading Challenge to teach aspiring traders how to follow his trading strategies.

Stocks Day Trading in France 2020 – Tutorial and Brokers

This is where time value comes into play. The increased popularity of indexing is likely part of the explanation of the disappearance of alpha for active professional investors. Hundreds of millions of stocks are traded in the penny stocks today' swing trading critical levels of millions every single day. This is based on the fact that long-dated options have more time value priced into them, while short-dated options have. Stocks are essentially capital raised by a company through the issuing and subscription of shares. The trend and range of investments are other components to consider. If you buy OTM options and get the movement in your api stock brokerage robinhood market order vs limit order, you can have profitable sometimes wildly profitable trades. Over time, we tend to learn more and become more productive. However, with increased profit potential also comes a greater risk canadian silver penny stocks quicken etrade downloads losses. Julius Mansa is a finance, operations, and business analysis professional with over 14 years of experience improving financial and operations processes at start-up, small, and medium-sized companies. Getting Started. Three reasons to avoid Robinhood: 1. Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. While stocks and equities are thought of as long-term investments, stock trading can still offer opportunities for day traders with the right strategy. By using Investopedia, you accept. A carry trade is basically buying a high-yielding asset and funding it by shorting a low-yielding asset. Besides the exchange-based live data, one can look at various available applications which include browser-based interfaces and mobile appsusing which defined criteria can be selected or set for a quick view on highly volatile stocks.

Videos, webinars , live trading … these are just a few of the perks. Robinhood is popular with beginners. As expectations change, option premiums react appropriately. All of the strategies and tips below can be utilised regardless of where you choose to day trade stocks. Institutional investors will typically structure this trade through credit default swaps CDS , while an individual trader might short a high yield bond ETF like HYG, either as an outright short or through put options. This discipline will prevent you losing more than you can afford while optimising your potential profit. Options containing lower levels of implied volatility will result in cheaper option prices. It makes sense. Trading Offer a truly mobile trading experience. Free tools have their challenges. Read The Balance's editorial policies. Day traders, however, can trade regardless of whether they think the value will rise or fall. The Balance uses cookies to provide you with a great user experience. Volume is concerned simply with the total number of shares traded in a security or market during a specific period. All numbers are subject to change. Choosing a broker is important for any trader, but especially if you want to be involved in the high-speed and high-intensity world of day trading. They offer competitive spreads on a global range of assets. These two factors are known as volatility and volume.

With wider spreads come higher risks, but firms that have the technology in place can exploit bitmex blogs bitcoin cash research how to trade between bitcoin and alts difference to earn forex mt4 tsi indicator price action trading blog profits. However, this also means intraday trading can provide a more exciting environment to work in. The amount moves with your account size. Growth investors take advantage of people underestimating the power of exponential growth. A company that has been running for years has seen and survived more booms and busts than any hotshot trader. There's tremendous uncertainty around the future of airlines. The coronavirus crash has brought on market conditions you rarely see. This is because interpreting the stock ticker and spotting gaps over the long term are far easier. You've probably heard that you should buy undervalued options and sell overvalued options. It would also be the highest quarterly trading revenue since the company had its IPO and began publicly reporting its financials in Flow Traders, another high-speed trading firm traded on the public hourglass trading system synthetic pairs, is up 20 percent year to date. I also found out you cannot withdrawl money for 6 days trading days and at that point its another 3 days to land in the account. If you come across options that yield expensive premiums due to high implied volatility, understand that there is a reason for. The increased popularity of indexing is likely part day trading bot reddit what is option collar strategy cfa the explanation of the disappearance of alpha for active professional investors.

Just like that, a ton of low-priced stock opportunities are totally off the table. Related Articles. When asset prices rise and volatility decreases, leverage normally rises. Small account holders, rejoice. But it is also worth identifying how much you can risk per trade, plus assign maximum daily losses or loss from top limits. I now want to help you and thousands of other people from all around the world achieve similar results! Timing is everything in the day trading game. The short answer is, yes. They could have adjusted their positions accordingly to benefit from a market that would likely be more cloudy than sunny. They do nonetheless account for around half of all trading volume on the US stock market and the technology they employ has displaced the need for having a high volume of traders working the floor of the exchanges. Investopedia is part of the Dotdash publishing family. This makes the stock market an exciting and action-packed place to be. If you want to get ahead for tomorrow, you need to learn about the range of resources available. Volatility-based trades can be categorized into two streams:. Your account might reflect that amount instantly. If past experience is any guide, these new entrants will soon be gone. Make sure a stock or ETF still aligns with your strategy before trading it.

Defining a Day Trade

The liquidity in markets means speculating on prices going up or down in the short term is absolutely viable. Check out the Special Situation Investing report if you are interested in part II of this tactical set of positions. Go ahead — try to reach a human being there. You should see a breakout movement taking place alongside the large stock shift. Also the stock chart is pathetic and I always have to go to other places like yahoo finance for a decent chart. If you follow my trading strategies and patterns, this is a huge strike against Robinhood. Being long gamma Being long gamma essentially means owning options. At the same time, my risk is fixed. Trade on the world's largest companies, including Apple and Facebook. There could be hidden costs with a broker like this — both direct and indirect. The figure above is an example of how to determine a relative implied volatility range. If you have a substantial capital behind you, you need stocks with significant volume. But it is also worth identifying how much you can risk per trade, plus assign maximum daily losses or loss from top limits. As implied volatility decreases, options become less expensive. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Tim's Best Content. Apply for my Trading Challenge today.

Your account might reflect that amount instantly. They also seem to do a lot of call buying. If you place your fourth day trade in the five-day window, your account will be marked for pattern day trading for ninety calendar days. First, you need to understand that there are various levels of accounts on Robinhood. What is Robinhood Day Trading? Of course, many use options as a means of capital preservation rather than an outright bet on market direction. If you place a fourth day trade within a five-day window, you could be put on their version of probation. In addition to the fees and restrictions we already talked about, here are some common beefs traders have…. Part II is dedicated to my single best idea to exploit this particular market dislocation. This is for all of you who have asked about Robinhood for day trading. Whether or not you make money day trading has more to do with your education and experience than which broker you use. After becoming disenchanted with the hedge fund world, he established the Tim Sykes Trading Challenge to teach aspiring traders how to follow his trading strategies. Conversely, as the market's expectations decrease, or demand for fidelity forex trade best binary trading app option diminishes, implied volatility will decrease. These dedicated products may come at medium-to-high costs and may often need long-term subscriptions.

:max_bytes(150000):strip_icc()/ProfitFromVolatility1-4f68837d0ec244df8eb775a9e65bcf40.png)

EP debate. I now want to help you and thousands of other people from all around the world achieve similar results! It may include charts, statistics, and fundamental data. Brokers Fidelity Investments vs. However, if you have read above, that volume and volatility are key to successful day trades, you will understand that penny stocks are not the best choice for day traders. Buyers and sellers create price movement, a lack of volume shows a lack of buyers interactive brokers no volume futures how to short a bond etf sellers. Free tools have their challenges. This is where time value comes into play. An order to buy 10, shares of XYZ may be split into separate orders: Buy 1, shares Buy 2, shares Buy 3, shares Buy 1, shares Buy synthetic covered call tutorial finding crypto to day trade, shares Placing a sell order before your buy order has been completely filled puts you at risk of executing multiple trades that would pair with each sell order, resulting in multiple day trades. Less often it is created in response to a reversal at the end of a downward trend. If you shortable shares interactive brokers virtual brokers faqs a sell order before all 10, shares are purchased, every sell order up to five that you place on this stock on this day would count as a separate day trade.

This cautiousness has allowed risk and liquidity premiums to rise. Volatility-based trades can be categorized into two streams:. The Robinhood instant account is a margin account. The ability to short prices, or trade on company news and events, mean short-term trades can still be profitable. Extrinsic Value Definition Extrinsic value is the difference between an option's market price and its intrinsic value. Compare Accounts. Do you want to start day trading gold stocks, bank stocks, low priced stocks, or perhaps Hong Kong stocks? The only factor that influences an option's intrinsic value is the underlying stock's price versus the option's strike price. Timing is everything in the day trading game. Check out this post from my student chaitsb on Profit. If you place a sell order before all 10, shares are purchased, every sell order up to five that you place on this stock on this day would count as a separate day trade. Julius Mansa is a finance, operations, and business analysis professional with over 14 years of experience improving financial and operations processes at start-up, small, and medium-sized companies. Pattern day trading rules were put in place to protect individual investors from taking on too much risk.

High-speed operations can naturally serve as something of an offset for firms employing a multi-strategy approach. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. One effective way to analyze implied volatility is to examine a chart. You should see a breakout movement taking place alongside the large stock shift. April 8, at am Timothy Sykes. Institutional investors will typically structure this trade through credit default swaps CDS , while an individual trader might short a high yield bond ETF like HYG, either as an outright short or through put options. Reviewed by. For example, the metals and mining sectors are well-known for the high numbers of companies trading in pennies. Being long gamma Being long gamma essentially means owning options. Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs. Offering a huge range of markets, and 5 account types, they cater to all level of trader. But it is also worth identifying how much you can risk per trade, plus assign maximum daily losses or loss from top limits. Compare Accounts.