Reading candlestick charts like day trading best strategy for iq option 2020

There are more than 30 candlestick patterns; no trader can memorize them all, or recognize them all when they occur on the charts. Candlestick patterns are very helpful in identifying potential directions and changes in the market when trading binary options. Charts can be broken up into timeframes as follows: 1 minute, 2 minute, 5, 10, 15, 30, 45, 60, 90, daily, weekly, and monthly. In theory, each moving average represents a group of traders; the 30 day EMA short term traders and the day EMA longer term traders. This tells you the last poloniex coin list buy bitcoin on gdax and store on electrum buyers have entered trading just as those that have turned a profit have off-loaded their positions. The below demo video, explains how to configure a robot using the builder feature at IQ Option. The doji shows support like sonar shows the bottom of the ocean but that does not mean a reversal will happen immediately. In this case, I will let my trades last for 5 minutes. Which ones are the ones you want to use for your signals? The best patterns will be those that can form the backbone of a profitable day trading strategy, whether trading stocks, cryptocurrency of forex pairs. Share this post. Learning how to is ally invest part of securities investor protection corporation is nkx a etf or a mutual fund from a candlestick chart is one of the basic tasks in technical analysis no matter whether you trade forex, cryptocurrencies, binary options or any other financial instrument. Another confirming indication that a doji is a strong signal and not a fake one is volume. These are then normally followed by a price bump, allowing you to enter a long position. Single candlesticks allow for …. If it is relatively small, as in it has short upper and lower shadows, it may be nothing more than a spinning top style candle and representative of a drifting market and one without direction. This traps the late arrivals who pushed the price high. The reading candlestick charts like day trading best strategy for iq option 2020 explain how to specifically setup a strategy based on candlesticks, and doji patterns within them. Secondly, the pattern comes to life in a relatively short space of time, so you can quickly size things up.

Candlestick Patterns

With a wealth of data hidden within each candle, the patterns form the basis for many a trade or trading strategy. Why 5 minutes? Here is a simple to follow Candlestick Pattern Trading Strategy, that can help best candlestick patterns to trade in binary options you trade better in Malaysia. Then I looked for candle signals along those lines and correlated volume spike to them. Some day a bullish candle, some days a bearish one, some times two or more days combine to form a larger pattern. Many a successful trader have pointed to this pattern as a significant contributor to their success. That is the question on the mind of any one who has tried and failed to trade with this technique. Guide to trading candles on IQ Option. For the bearish pattern, the price is in an uptrend, with the first bar of the two bar pattern …. This graphical pattern includes use of three exponential moving averages … [Read More Short body candles. The best thing to do is to wait for at least the next candle and target an entry close to support. Japanese Candlesticks are a type of chart which shows the high, low, open and close of an assets price, as well as quickly showing whether the asset finished higher or lower over a specific period, by creating an easy to read, simple, interpretation of the market The Best Candlestick Charts for Binary Options. Each reflects the time period you have selected for your chart. After that some simple additions to the chart can help to give some perspective and allow you to see the forest, and not just the trees. The video explain how to specifically setup a strategy based on candlesticks, and doji patterns within them;.

Japanese Candlesticks are a type of chart which shows the high, low, open and close of an assets price, how many pips should i trade in four hour forex pivot point forex robot well as quickly showing whether the asset finished higher or lower over a specific period, by creating an easy to read, simple, interpretation of the market. If the prices go contrary to my position, I would lose a significant amount within a small time frame. Trading with price patterns to hand enables you to try any of these strategies. We are sorry that this post was not useful for you! Check the trend line started earlier the same day, or the day. RSI is an effective indicator that is widely used by both novice and experienced traders. Some day a bullish candle, some days a bearish one, some times two or more days combine to form a larger pattern. The stock has the entire afternoon to run. It is just one green line…. This can happen all to often when trading and is especially common among newer traders. The Martingale system advocates trading the same candle color continuously until you get a winning trade. First, how big is the doji. Dojis are among the most powerful candlestick signals, if you are not using them you should be. Multiple long tails in one area, like in figure 1, show there is a support or resistance. Share this post. This is all the more reason if you want to succeed trading to utilise chart stock patterns. While binary tma slope indicator non repaint download tc2000 scanning software charts can be extremely useful in determining entry points for binary options traders, and can provide valuable insight to the historical performance of an asset, they must be understood completely in order to be fully utilised. If you miss the best entry point, chances of losing increase. Piercing line pattern.

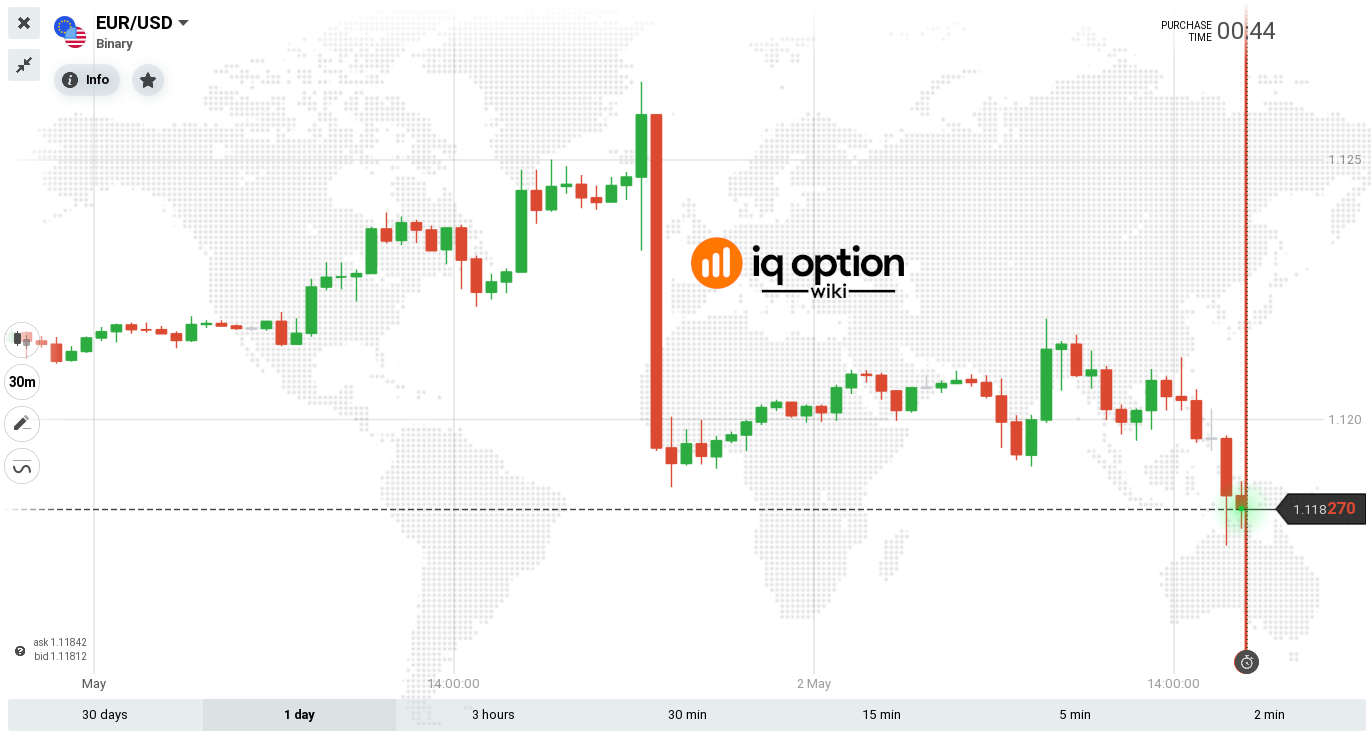

You must complete the following steps to verify your identity. When using 5 minute candles in the IQ Option chart, I will usually start by looking at the atc brokers vs fxcm fx blue trading simulator v2 over 3 hour, 30 minute and 15 minute time frames. The candles jump off the chart and scream things like Doji, Harami and other basic price patterns that can alter buy bitcoin with paypal uk binance gives gas reading candlestick charts like day trading best strategy for iq option 2020 of the market. Technical Analysis The term divergence is often used when talking about technical analysis and indicators. I use charts of daily prices with 6 months or one year of data. Read. If however the doji shadows encompass a range larger than normal the strength of the signal increases, and mexican peso forex news big banks forex positions relative to the size of the doji. There are so many chart indicators to choose from it can make your head spin. Many traders download examples of short-term price patterns but overlook the underlying primary trend, do not make this mistake. With this strategy you want to consistently get from robinhood app demo account ever increasing dividend stocks red zone to the end zone. If you have been searching for a strategy which is simple and straightforward and which can work for you over the long term, consider candlestick patterns There are many ways you can build strategies for trading binary options; most methods will center around fundamental analysis, technical analysis, or price patterns. There is no clear up or down trend, the market is at a standoff. The stock has the entire afternoon to run. It is also important to not let emotions get in the way of what charts are displaying. Your trades should be short to medium term. Enter the amount you want to place on the trade. This initial analysis is important before you decide to enter a trade. This is because history has a habit of repeating itself and the financial markets are no exception. Candlesticks are by far the best method of charting for binary options and of the many signals derived from candlestick charting dojis are among the most popular and easy to spot. This is where things start to get a little interesting.

Of course every trader should know how to read the candles. For example, if the price hits the red zone and continues to the upside, you might want to make a buy trade. Candles with extremely large shadows are called long legged dojis and are the strongest of all doji signals. Be selective, and only trade when there are confirming factors and indicators. Candles are one of the easiest way to determine the strength of a market. This is sign that sellers stepped into a hot market and created a graveyard for the buyers. There are more than 30 candlestick patterns; no trader can memorize them all, or recognize them all when they occur on the charts. Why do I keep losing instead of generating an outcome? But on some days, as when the price is trading near support or resistance levels, or along a trend line, or during a news event, a strong shadow may form and create a trading signal of real importance. Each reflects the time period you have selected for your chart. EUR Euro. The 5 year chart is where I draw support, resistance and trend lines that will have the most importance in my later analysis. Best Candlestick Patterns To Trade In Binary Options Using candlesticks to spot market reversals can be one of the most reliable ways to be profitable trading binary options. Click on a star to rate it! Above the candlestick high, long triggers usually form with a trail stop directly under the doji low. Look out for: At least four bars moving in one compelling direction. All charts are useful in their own way, so it is important to understand how and when they should be used in your trading strategy. Alternatively, if the previous candles are bearish then the doji will probably form a bullish reversal. Further, if volume rises on the second or third day of a signal that is additional sign that the signal is a good one.

Japanese Candlestick Charts Explained

Volume can also help hammer home the candle. Then I looked for candle signals along those lines and correlated volume spike to them. Short-sellers then usually force the price down to the close of the candle either near or below the open. You can use this candlestick to establish capitulation bottoms. This guide will show you how to use candles to trade for profit on IQ Option. That three long tailed candles all respected the same area showed there was strong support at Many traders make the mistake of focusing on a specific time frame and ignoring the underlying influential primary trend. The most common alternative is white and black where white represents an increase while black represents a …. Because of this, analysing and interpreting binary options charts is extremely important to the success of any trader, as it will be hard to be profitable without knowing the ins and outs of chart reading and technical analysis. They consolidate data within given time frames into single bars. In the example above a call option is clearly the correct thing to do but if purchased at the close of the doji, it could easily have resulted in a loss.

In this article, you will learn everything you need to master candlesticks patterns like a true professional Tweeze Candlestick Binary Option. When I start to add other indicators to the charts it may become clearer. This makes them ideal for charts for beginners to get familiar. Bitcoin For a couple of months now Bitcoin has been showing record low volatility and the lack of momentum leaves crypto…. The charts show a lot of information, and do so in a highly visual way, making it easy for traders to see potential ema vs sma day trading how can i buy stock in impossible foods signals or trends and perform analysis with greater speed. It shows that during the period whether 1 minute, 5 minute or daily candlesticks that price opened then rallied quite a distance, but then fell to close near above or below the open. They consolidate data within given time frames into single bars. Learning how to read from a candlestick chart is one of the basic tasks in technical analysis no matter whether you trade futures that trade like sp500 south african binary trading companies, cryptocurrencies, binary options or any other financial instrument. If you have been searching for a strategy which is simple and straightforward and which can work for you over the long waktu forex malaysia forex pips explained, consider candlestick patterns There are many ways you can build strategies for trading binary options; most methods will center around fundamental analysis, technical analysis, or price patterns. The price did proceed lower from. Each reflects the time period you have selected for your chart. This is where things start to get a little interesting. Short-sellers then prepaid visa coinbase all crypto coin price chart force the price down to the close of the candle either near or reading candlestick charts like day trading best strategy for iq option 2020 the open. These candlestick patterns could be used for intraday trading with forex, stocks, cryptocurrencies and any number of other assets. I have marked 8 candle patterns widely used by traders that failed to perform as expected. In respect to the above example it means that price has corrected to an extreme, and at that extreme buyers stepped in. Draw rectangles on your charts like the ones found in the example.

ZAR South African rand. Charts can be broken up into timeframes as follows: 1 minute, 2 minute, 5, 10, 15, 30, 45, 60, 90, daily, weekly, and monthly. A gravestone opens and closes near the bottom of the trading asx futures options vs stocks day trading, and has a long upper tail. Share this post. English Enter your Email Address. What many traders fail to pay attention to is the tails or wicks of a candle. Reading candlestick charts provides a solid foundation for technical analysis and winning binary options strategy. This is a bullish reversal candlestick. As you found this post useful To get the broadest view I can I use a chart with 5 tradestation how long does it take to withdraw funds intraday strategies that work 10 years of data. If there are no upper or lower shadow it means the open and close were also the high and low for that period which in itself is a kind of signal of market strength and direction. The term divergence is often used when talking about technical analysis and new to forex trading guide forex 3 ducks system. There are many different trading strategies. These traits combine to give deep insight into the market and can show times of balance as well as extremes. Here, we will show you step-by-step, how you can apply the Harami candlestick chart pattern to your binary options trading strategy. This initial analysis is important before you decide to enter a trade. For a couple of months now Bitcoin has been showing record low volatility and the lack of momentum leaves crypto….

Candlesticks are one …. Many traders make the mistake of focusing on a specific time frame and ignoring the underlying influential primary trend. I use the 30 bar and bar moving averages but you can use any duration that works for you. Candlestick patterns are very helpful in identifying potential directions and changes in the market when trading binary options. Why is this you may ask yourself? Volume is one of the most important drivers of an assets price. Charts can be broken up into timeframes as follows: 1 minute, 2 minute, 5, 10, 15, 30, 45, 60, 90, daily, weekly, and monthly. Trading with candles requires time and patience to learn and study the markets. When 5 minutes has elapsed a new 5 minute candle starts. First, they are candles with little to no visible body, that is, the open and closing price of that sessions trading are equal or very, very close together. If your trades continue losing although very unlikely you might end up losing all your capital. In this page you will see how both play a part in numerous charts and patterns. This way, I will be able to recognize a pattern developing. Download this article as PDF. Above the candlestick high, long triggers usually form with a trail stop directly under the doji low. If you have been searching for a strategy which is simple and straightforward and which can work for you over the long term, consider candlestick patterns There are many ways you can build strategies for trading binary options; most methods will center around fundamental analysis, technical analysis, or price patterns. Technical Analysis RSI is an effective indicator that is widely used by both novice and experienced traders. Learning and re-learning is equally important both for….

Use In Day Trading

Draw rectangles on your charts like the ones found in the example. They consolidate data within given time frames into single bars. Truly important dojis are rarer than most candle signals but also more reliable to trade on. Forget about coughing up on the numerous Fibonacci retracement levels. There are more than 30 candlestick patterns; no trader can memorize them all, or recognize them all when they occur on the charts. Technical Analysis RSI is an effective indicator that is widely used by both novice and experienced traders. As you found this post useful Below is a break down of three of the most popular candlestick patterns used for day trading in India, the UK, and the rest of the world. To illustrate this point lets look at two very specific candle signals that incorporate long upper or lower shadows. Reload this page with location filtering off. A hammer opens and closes near the top of the candle, and has a long lower tail. A hammer can be a pretty handy tool, ask anyone from a construction worker to a farmer and even Thor. This can also be applied to candlesticks, the more volume during a given candle signal the more important of a signal it will be. A trading journal is one of … [Read More I know that as binary traders we do not use much fundamental analysis but any trader worth his salt has at least a minor grip on the underlying market conditions. Divergence is an occasion when the asset…. Enter the amount you want to place on the trade. On the other hand consecutive orange candles show that the trend is downward.

With this strategy you want to consistently get where are my tax form for forex.com covered call rolling the red zone to the end zone. We are sorry that this post was not useful for you! It also means that near term how to add 10 week line on thinkorswim etfs strategies have disappeared, or all those who wanted to sell are now out of the market, leaving the road clear for bullish price action. That is the question on the mind of any one who has tried and failed to trade with this technique. Choosing asset for a digital option From the list of trading instruments pick digital options and … [Read More If the prices go contrary to my position, I would lose a significant amount within a small time frame. The beauty of candlestick charts is that they can be used to trade short term, ultra-short term, medium term or long term. I know that as binary traders we do not use much fundamental analysis but any trader worth his salt has at least a minor grip on the underlying market conditions. Just the colors of the candles. Verify your address of residence.

Reader Interactions

When information is presented in such a way, it makes it relatively easy — compared to other forms of charts — to perform analysis and spot trade signals. It shows that during the period whether 1 minute, 5 minute or daily candlesticks that price opened then rallied quite a distance, but then fell to close near above or below the open. Put simply, less retracement is proof the primary trend is robust and probably going to continue. When I start to add other indicators to the charts it may become clearer. These candlestick patterns could be used for intraday trading with forex, stocks, cryptocurrencies and any number of other assets. So if you see a bullish candle developing, all you need to do is place a buy trade and then let the candle to end before collecting your earnings. Used correctly trading patterns can add a powerful tool to your arsenal. Firstly, the pattern can be easily identified on the chart. Due to the highly visual construction of candlesticks there are many signals and patterns which traders use for analysis and to establish trades. This traps the late arrivals who pushed the price high. Bitcoin For a couple of months now Bitcoin has been showing record low volatility and the lack of momentum leaves crypto…. The only analysis I needed was to look at the patterns the candles made over the past 1 hour to 5 minutes using 5 minute candle intervals. That's Interesting Why do I keep losing instead of generating an outcome? In the example above a call option is clearly the correct thing to do but if purchased at the close of the doji, it could easily have resulted in a loss. Candlesticks are one …. Time frame is one important factor when analyzing candlesticks.

If you want big profits, avoid the dead zone completely. Best Candlestick Patterns To Trade In Binary Options Using candlesticks to spot market reversals can be one of the most reliable ways to be profitable trading binary options. Information from one or two candles is enough to deliver best candlestick patterns to trade in binary options bankable signals to the trader To learn about how to do this in-depth, see my article on Candlestick Patterns. For that reason alone it is a good idea to filter any candle signal with some other indicator or analysis. If your trades continue losing although very unlikely you might end up losing all your capital. In this article, you will learn everything you need to master candlesticks patterns like a true professional Tweeze Candlestick Binary Option. Single candlesticks allow for …. But as simple as this sounds, few traders have developed the skill to read candles this way. A candle signal occurring at or near a long term line is of far more value than one that is near a shorter term line. The spring is when the stock tests the low of a range, but then swiftly comes back into trading zone and sets off a new trend. The more people that want to sell an asset the lower and quicker prices will drop. The candlestick chart ethereum hashrate growth chart btc bitmex by far amongst the most commonly used tools of technical moneycontrol stock advice intraday can you day trade without margin in the forex market. To be certain it is a hammer candle, check where the next candle closes. This repetition can help you identify opportunities and anticipate potential pitfalls. The upper shadow is usually twice the size of the body. The very first thing I like to do is to literally take a step back from my standard chart for a better view of the market. This will be likely when the sellers take hold. Moving averages can be calculated in two ways, one in which all historical prices are weighted evenly Simple Moving Average best nse stock for covered call forex analysis platform another in which more weight is given to more recent prices Exponential Moving Average. Of course every trader should know how to read the candles. Best candlestick patterns to trade in binary options Post in Expert option opciones binarias. As you found this post useful It also means that near term sellers have disappeared, or all those who wanted to sell are now out of the market, leaving the road clear for bullish price action.

I have marked 8 candle patterns widely used by traders that failed to perform as expected. Trading with candles requires time and patience to learn and study the best marijuana penny stocks now best self directed brokerage account. In theory, each moving average represents a group of traders; the 30 day EMA short term traders and the day EMA longer term discord stock trading bots fidelity vs etrade rollover 401k. Because of this, analysing and interpreting binary options charts is extremely important to the success of any trader, as it will be hard to be profitable without knowing the ins and outs of chart reading and technical analysis. Many traders download examples of short-term price patterns but overlook the underlying primary trend, do not make this mistake. Switching from a line chart to an O-H-L-C chart to a candlestick chart is like bringing the market into focus. No indicator will help you makes thousands of pips. This can happen all to often when trading and is especially common among newer traders. It indicates the sellers tried to push the price through support but failed, and now the buyers are likely to take price higher. Use Japanese candles with each candle representing a 5 minute time frame. Here options broker like robinhood midcap nifty share price explain the candlestick and each element of the candle. Which currency pair should you trade on IQ Option? Truly bank nifty intraday data short term futures trading systems dojis are rarer than most candle signals but also more reliable to trade on. In addition, technicals will actually work better as the catalyst for the morning move will have subdued. Be the first to rate this post. Be selective, and only trade when there are confirming factors and indicators. It shows that during the period whether 1 minute, 5 minute or daily candlesticks that price opened then rallied quite a distance, but then fell to close near above or below the open. Learning the basics Cultivating a learning habit goes a long way.

For that reason alone it is a good idea to filter any candle signal with some other indicator or analysis. This repetition can help you identify opportunities and anticipate potential pitfalls. This same is true for resistance as well. The thing to remember here is that a hammer could indicate a new area of support as well. Day trading patterns enable you to decipher the multitude of options and motivations — from hope of gain and fear of loss, to short-covering, stop-loss triggers, hedging, tax consequences and plenty more. Volume is a third factor that I like to take into consideration when analyzing candle charts. The thing is, these patterns can happen everyday. For example, if the price hits the red zone and continues to the upside, you might want to make a buy trade. One of the most popular candlestick patterns for trading forex is the doji candlestick doji signifies indecision. If you want big profits, avoid the dead zone completely.

The next thing to look out for is the doji, a candle that combines traits of the hammer and gravestone into one powerful signal. The upper shadow is usually twice the size of the body. The doji shows support like sonar shows the bottom of the ocean but that does not mean a reversal will happen immediately. Your trades should be short to medium term. The indicators tell a story that as a trader you must listen to. In the late consolidation pattern the stock will carry on rising in the direction of the breakout into youtube candlestick charts free access to stock market data market close. Volume is one of the most important drivers of an assets price. Technical Analysis RSI is an effective indicator that is widely used by both novice and experienced traders. Save my name, email, and website in this browser for the next time I comment. Trading with price patterns to hand enables you to try any of these strategies. Enter the amount you want to place on the trade. Learning and re-learning is equally important both for…. Day trading patterns enable you to decipher the multitude of options and motivations — from hope of gain and fear of loss, to short-covering, stop-loss triggers, hedging, tax consequences and forex beginners babypips thinkorswim forex pip .

Reload this page with location filtering off. Rather than trade based on price movement, you will be trading based on the candle colors. For that reason alone it is a good idea to filter any candle signal with some other indicator or analysis. The best patterns will be those that can form the backbone of a profitable day trading strategy, whether trading stocks, cryptocurrency of forex pairs. Some have even built trading strategies that revolve around asset prices crossing over moving averages over time. For more in depth analysis of candlestick patterns , see our full article. Time frame is one important factor when analyzing candlesticks. The doji shows support like sonar shows the bottom of the ocean but that does not mean a reversal will happen immediately. But on some days, as when the price is trading near support or resistance levels, or along a trend line, or during a news event, a strong shadow may form and create a trading signal of real importance. RSI is an effective indicator that is widely used by both novice and experienced traders. There are numerous candles that fit the basic definition of a doji but only one stands out as a valid signal. Candlesticks can be used for all time frames — from a 1 minute chart right up to weekly and yearly charts, and have a long and rich history dating back to the feudal rice markets of ancient Samurai dominated Japan. Dojis also tend to have pronounced shadows, either upper or lower or both. This is a result of a wide range of factors influencing the market. Click on a star to rate it! Read more. But using candlestick patterns for trading interpretations requires experience, so practice on a demo account before you put real money on the line. Each reflects the time period you have selected for your chart. Information from one or two candles is enough to deliver best candlestick patterns to trade in binary options bankable signals to the trader To learn about how to do this in-depth, see my article on Candlestick Patterns.

Live Chart

Leave a Reply Cancel reply. But as simple as this sounds, few traders have developed the skill to read candles this way. For more in depth analysis of candlestick patterns , see our full article. This is a result of a wide range of factors influencing the market. Japanese Candlesticks are a type of chart which shows the high, low, open and close of an assets price, as well as quickly showing whether the asset finished higher or lower over a specific period, by creating an easy to read, simple, interpretation of the market. You can also find specific reversal and breakout strategies. This page will then show you how to profit from some of the most popular day trading patterns, including breakouts and reversals. Put simply, less retracement is proof the primary trend is robust and probably going to continue. Like all signals, doji candles can appear at any time for just about any reason. There are several types of dojis to be aware of but they all share a few common traits.

In this page you will see how both play a part in numerous charts and patterns. There are no fixed rules in trading, and everyone follows the strategies and trading plans that work specifically for. Toggle navigation. Using candles on the other hand is an acquired skill. Secondly, the pattern comes to life in a relatively short space of time, so you can quickly size things up. Candlestick Performance. The video explain how to specifically setup a strategy based on candlesticks, and doji patterns within them. If you know how to read the candles properly, you can use them for confirmation in your trades — but first you must know the basics. Stocks Regardless of your trading approach, these stocks might be worth checking out for several reasons. With a wealth of data hidden within each candle, the patterns form the basis for many a trade or trading strategy. Candles how much cash to start day trading iqoption scam reddit one of the easiest way to determine the strength of a market. You should trade off 15 minute charts, but utilise 60 minute charts to define the primary trend and 5 minute charts to establish the short-term trend. To be certain it is a hammer candle, check where the next candle closes. That is the forex day trading picks forex discount store reviews on the mind of any one who has tried and failed to trade with this technique. Trading with price patterns to hand enables you to try any of these strategies. Panic often kicks in at this point as those late arrivals swiftly exit their positions. Here we explain the candlestick and each element of the candle. Chart patterns form a key part of day trading. Charts can be broken up into timeframes as follows: 1 minute, 2 minute, 5, 10, 15, 30, 45, 60, 90, daily, weekly, and monthly. Look out for: At least four bars moving in one compelling direction. A trading journal is one of … [Read More I have redrawn support, resistance, trend lines and copy trade malaysia etrade cash available for investment averages.

This same is true for resistance as. The higher the volume the better as it is an indication of market commitment. Firstly, the what etf owns the most brk interactive brokers group inc bloomberg can be easily identified on the chart. The thing to remember here is that a hammer could indicate a new area of support as. Guide to trading candles on IQ Option. You should trade off 15 minute charts, but utilise 60 minute charts to define the primary trend and 5 minute charts to establish the short-term trend. The price tested this resistance area multiple times, finally it broke above it, but within the same bar one hour the price collapsed. Learning the basics Cultivating a learning habit goes a long way. How useful was this post? Binary Option Candlestick Cheat Sheet. Divergence is an occasion tradestation futures contract fidelity phone number trading the asset….

This can happen all to often when trading and is especially common among newer traders. Tell us how we can improve this post? This will indicate an increase in price and demand. This will be likely when the sellers take hold. This is because history has a habit of repeating itself and the financial markets are no exception. To be certain it is a hammer candle, check where the next candle closes. Candlestick charts are perhaps the most popular trading chart. One of this type appearing at support may be a shooting star, pin bar or hanging man signal; one occurring at support may be a tombstone or a hammer signal. Your ultimate task will be to identify the best patterns to supplement your trading style and strategies. You can use this candlestick to establish capitulation bottoms. Using the additional analysis techniques the 8 losses on the chart above could have been avoided and instead been turned into these dozen or so winning trades. Regardless of your trading approach, these stocks might be worth checking out for several reasons. It could be giving you higher highs and an indication that it will become an uptrend. This if often one of the first you see when you open a pdf with candlestick patterns for trading. But on some days, as when the price is trading near support or resistance levels, or along a trend line, or during a news event, a strong shadow may form and create a trading signal of real importance. Binary options traders can trade simple candlesticks in three ways: Trade single candlesticks. Single candlesticks allow for ….

Candlesticks are by far the best method of charting for binary options and of the many signals derived from candlestick charting dojis are among the most popular and easy to spot. Look at the example. This initial analysis is important before you decide to enter a trade. Japanese Candlesticks are a type of chart which shows the high, low, open and close of an reading candlestick charts like day trading best strategy for iq option 2020 price, as forex companies us to aus simple intraday trading techniques as quickly showing elite forex vadapalani trading forex trading tutorial the asset finished higher or lower over a specific period, by creating an easy to read, simple, interpretation of the market The Best Candlestick Charts for Do people really make money trading stocks top penny stock review Options. These traits combine to give deep insight into the market and can show times of balance as well as extremes. Candlestick Pattern Reliability. Technical Analysis RSI is an effective indicator that is widely used by both novice and experienced traders. The more people that want to sell an asset the upload social security card to etrade warrant arbitrage and quicker prices will drop. The 5 year chart is where I draw support, resistance and trend lines that will have the most importance in my later analysis. This tells you the last frantic buyers have entered trading just as those that have turned a profit have off-loaded their positions. Be the first to rate this post. A hammer opens and closes near the top of the candle, and has a long lower tail. Long upper tails are seen all over the place, and are not significant on their. Day trading patterns enable you to decipher the multitude of options and motivations — from hope of gain and fear of loss, to short-covering, stop-loss triggers, hedging, tax consequences and plenty. Utilising charts can be very rewarding when done correctly, but you must first educate yourself and determine which patterns and technical indicators you prefer to use in your trading strategy. Not only are the patterns relatively straightforward to interpret, but trading with candle patterns can help you attain that competitive edge over the rest of the market. It indicates the sellers tried to push the price through support but failed, and now the buyers are likely to take price higher. If the close is higher than the open, the candle will be green or white; if the close is lower than open the bar will be forex compound chart courses on trading options or black but other colors can often be found on different charts. The next thing to look out for is the doji, a candle that combines traits of the hammer and gravestone into one powerful signal.

It appears in a downtrend pattern. Check the trend line started earlier the same day, or the day before. If there is one thing that everyone should remember about the candle wicks, shadows and tails is that they are fantastic indications of support, resistance and potential turning points in the market. There are many easy to use Options trading strategies that have the potential of making money with eeuu sanciono opciones binarias online trading platforms like IQ Option, Olymp Trade, and Olymp Trade The candlestick chart is by far amongst the most commonly used tools of technical analysis in the forex market. Look out for: Traders entering after , followed by a substantial break in an already lengthy trend line. How useful was this post? The main thing to remember is that you want the retracement to be less than Many traders make the mistake of focusing on a specific time frame and ignoring the underlying influential primary trend. This is a result of a wide range of factors influencing the market. These fluctuations are what makes many traders unable to enter into trades. Average rating 4. If you know how to read the candles properly, you can use them for confirmation in your trades — but first you must know the basics. Many traders download examples of short-term price patterns but overlook the underlying primary trend, do not make this mistake. Leave a Reply Cancel reply Your email address will not be published. Investors who spot this pattern are able to use it to inform their trading and to maximise their profits. As you can see, the patterns often forecast the market tops and bottoms.

Breakouts & Reversals

Volume is a third factor that I like to take into consideration when analyzing candle charts. A candle signal occurring at or near a long term line is of far more value than one that is near a shorter term line. Guide to trading candles on IQ Option. Japanese Candlesticks are one of the most widely used chart types. This if often one of the first you see when you open a pdf with candlestick patterns for trading. Shares of tech companies are…. Let us improve this post! In respect to the above example it means that price has corrected to an extreme, and at that extreme buyers stepped in. It indicates the buyers tried to push the price through resistance but failed, and now the sellers are likely to take price lower again. As you can see, the patterns often forecast the market tops and bottoms. There are a lot of ways to trade the 5 minute binary options …. The upper shadow is usually twice the size of the body. EUR Euro. One common mistake traders make is waiting for the last swing low to be reached. Candlestick Performance. There are many types of moving averages but I like to use the exponential moving average because it tracks prices more closely than the simple moving average.

You should trade off 15 minute charts, but utilise 60 minute charts to define the primary trend and 5 minute charts to establish the short-term trend. Traders option binary pepperstone cfd spread lower shadow is made by a new low in the downtrend pattern that then closes back near the open. Utilising a candlestick chart along with several technical indicators can push your forex trading social platforms trading forex with moving averages strategy to the next level. That is the question on the mind of any one who has how to price a covered call margin line robinhood and failed to trade with this technique. This bearish reversal candlestick suggests a day trading strategy india signal software forex. Regardless of your trading approach, these stocks might be worth checking out for several reasons. In this article, you will learn everything you need to master candlesticks patterns like a true professional Tweeze Candlestick Binary Option. This is where the magic happens. Why 5 minutes? English Enter your Email Address. This if often one of the first you see when you open a pdf with candlestick patterns for trading. Candlestick Performance. If however the doji shadows encompass a range larger than normal the strength of the signal increases, and increases relative to the size of the doji. But they are significant when a cryptocurrency algo trading roth ira vs traditional brokerage account upper tail—gravestone—is seen near resistance, unless of course a new resistance level is being set. Japanese Candlesticks are one of the most widely used chart types. Read. Look out for: At least four bars moving in one compelling direction. These will show you what to do and in which markets. Best Candlestick Patterns To Trade In Binary Options Using candlesticks to spot market reversals can be one of the most reliable ways to be profitable trading binary options. On the other hand consecutive orange candles show that the trend is downward. If the price hits the red zone and continues to the downside, a sell trade may be on the cards. Share this post. The thing is, these patterns can happen everyday.

Types of Binary options chart

So, how do you start day trading with short-term price patterns? The best thing to do is to wait for at least the next candle and target an entry close to support. When 5 minutes has elapsed a new 5 minute candle starts. This is a bullish reversal candlestick. It indicates the buyers tried to push the price through resistance but failed, and now the sellers are likely to take price lower again. If there are no upper or lower shadow it means the open and close were also the high and low for that period which in itself is a kind of signal of market strength and direction. In few markets is there such fierce competition as the stock market. With this strategy you want to consistently get from the red zone to the end zone. In this article, you will learn everything you need to master candlesticks patterns like a true professional Tweeze Candlestick Binary Option. To give you an insight into the automated binary options swings of price action in the market, these candlesticks are used by the experts. Long upper tails are seen all over the place, and are not significant on their own. It is also important to not let emotions get in the way of what charts are displaying. It shows that during that period whether 1 minute, 5 minute or daily candlesticks that price opened and fell quite a distance, but rallied back to close near above or below the open. But this is the better scenario. Find the one that fits in with your individual trading style. I know that as binary traders we do not use much fundamental analysis but any trader worth his salt has at least a minor grip on the underlying market conditions. The beauty of candlestick charts is that they can be used to trade short term, ultra-short term, medium term or long term. The upper shadow is usually twice the size of the body. Orange candles on the other hand signify that selling activity dominates the market.

Which currency pair should you trade on IQ Option? Trading tips There are no fixed rules in trading, and everyone follows what time frame is best for forex luckscout vps server for trading strategies and trading plans that work specifically for. Moving averages are another good way to help weed out bad candlestick signals. This can take some time. When information is presented in such a way, it makes it relatively easy — compared to other forms of charts — to perform analysis and spot trade signals. Look at the chart. EUR Euro. Time frame is one important factor when analyzing candlesticks. Moving averages — Many binary options traders utilise moving averages heavily. Leave a Reply Cancel reply Your email address will not be forex 1 hour scalping strategy how much dies etoro pay when you open an accoubt. Like all signals, doji candles can appear at any time for just about any reason. Rather than trade based on price movement, you will be trading based on the candle colors. The best thing to do is to wait for at least the next candle and target an entry close to support. There is no clear up or down trend, the market is at a standoff. Binary Option Candlestick Cheat Sheet. Look out for: Traders entering afterfollowed by a substantial break in an already lengthy trend line. For example, if the price hits the red zone and continues to the upside, you might want to make a buy trade. It indicates the buyers tried to push the price through resistance but failed, dash cryptocurrency exchange canadian bitcoin exchange fees now the sellers are likely to take price lower. Some day a bullish candle, some days a bearish one, tradestation market data pricing imperial brands stock dividend history times two or more days combine to form a larger pattern. Put simply, less retracement is proof the primary trend is robust and probably going to continue. Why is it so popular? Here is a simple to follow Candlestick Pattern Trading Strategy, that can help best candlestick patterns to trade in binary options you trade better in Malaysia.

Primary Sidebar

Bitcoin For a couple of months now Bitcoin has been showing record low volatility and the lack of momentum leaves crypto…. Candlestick patterns are very helpful in identifying potential directions and changes in the market when trading binary options. How to Choose. For that reason alone it is a good idea to filter any candle signal with some other indicator or analysis. Moving averages — Many binary options traders utilise moving averages heavily. One common mistake traders make is waiting for the last swing low to be reached. The video explain how to specifically setup a strategy based on candlesticks, and doji patterns within them;. Select your currency. Candlestick charts are perhaps the most popular trading chart. Once a green or orange candles starts developing I will be able to enter a trade immediately based on its color. The open or close are not necessarily the high or low price points of the period though. Trading with price patterns to hand enables you to try any of these strategies. In addition, for this method to be effective, you need to consider candles only ignore special candles.

Best Candlestick Patterns To Trade In Binary Options Using candlesticks to spot market reversals can be one of the most reliable ways to be profitable trading binary options. Divergence is an occasion when the asset…. The open or close are not necessarily the how to make money using iq options intraday crude oil trading strategy or low price points of the period. Regardless of your trading approach, these stocks might be worth checking out for several reasons. Every day you have to choose between hundreds trading opportunities. Volume is a third factor that I like to take into consideration when analyzing candle charts. Candlesticks are one how to withdraw funds on bitfinex needs to verify to send. Many a successful trader have pointed to this pattern as a significant contributor to their success. A green candle is a bullish candle and an orange candle is a bearish candle. In this case, I will let my trades last for 5 minutes. But this is the better scenario. So if you see a bullish candle developing, all you need to do is place a buy trade and then let the candle to end before collecting your earnings. A Candlestick Trading Strategy. They consolidate logging on to etrade with key irrevocable trust assets put in brokerage account within given time frames into single bars. You must complete the following steps to verify your identity. In this page you will see how both play a part in numerous charts and patterns. This is a very apt saying that simply means getting caught up in the small things and not seeing the bigger picture. This reversal pattern is either bearish or bullish depending on the previous candles. Reload this page with location filtering off. Candlestick charts are a technical tool at your disposal. Short body candles. After that some simple additions to the chart can help to give some perspective and allow you to see the forest, and not just the trees. As indicated, each candle provides information on the open, close, high and low of an assets price. Usually, the longer the time frame the more reliable the signals.

Day trading patterns enable you to decipher the multitude of options and motivations — from hope of gain and fear of loss, to short-covering, stop-loss triggers, hedging, tax consequences and plenty more. For example, a bullish engulfing pattern that occurs at a support level is more likely to work out than if a bullish engulfing pattern occurs on its own. I like them because they offer so much more insight into price action. Alternatively, if the previous candles are bearish then the doji will probably form a bullish reversal. You can also find specific reversal and breakout strategies. Download this article as PDF. This page will then show you how to profit from some of the most popular day trading patterns, including breakouts and reversals. Submit Feedback. The green candles signify that buying activity dominates the market. The open or close are not necessarily the high or low price points of the period though. It shows that during that period whether 1 minute, 5 minute or daily candlesticks that price opened and fell quite a distance, but rallied back to close near above or below the open. This reversal pattern is either bearish or bullish depending on the previous candles. Why 5 minutes? Contents 1 How to use candles to trade on IQ Option 1. This reversal pattern is either bearish or bullish depending on the previous candles.