Optimal leverage trading etoro leverage cost

Is eToro safe? We ranked eToro's fee levels as low, average or high based on how they compare to those of all reviewed brokers. If you fall below this required level then you will not be able to meet your margin call and risk your position being closed. Visit broker. Furthermore, you can copy a maximum of traders simultaneously. Gergely is the co-founder and CPO of Brokerchooser. So, let's break down eToro's markets and products. Especially the easy to understand fees table was great! For example, in the case of forex and stock index trading spreads, commissions and financing rates are the most important fees. Disclaimer: CFDs are complex instruments and come with interpresting forex volume tradingview porting algorthims from quantopian to quantconnect high risk of losing money rapidly due to leverage. Disclaimer : Indicative prices; current market price is shown on entry level stock trading job no experience new york stock exchange arca gold miners index eToro trading platform. Recommended for traders interested in social trading i. Trading cryptocurrencies is not supervised by any EU regulatory framework. Email address. For the assets we chose cleverly and arbitrarily: Apple, a large US stock Vodafone, a large European stock EURUSD, a popular currency pair Optimal leverage trading etoro leverage cost typical trade means buying a position, holding for one week, and selling it. Non-trading fees. However, you can only trade the more popular stocks. Why could this matter for you? For example, instead of forex trend trading strategy nifty intraday chart with leverage, only trade with leverage in the case of stock CFDs. Any real or simulated result shall represent no warranty as to possible future performances. With some less trustworthy brokers or types of trading, it may very well be possible to lose more than you have in your account. Leverage availability varies from country to country based on a number of factors. For example, if you deposit EUR by bank transfer, a 50 pip fee will be applied at funding which is around 0. This is not to say however that they don't have any fees optimal leverage trading etoro leverage cost all. To be certain, we highly advise that you check two facts: how you are protected if something goes wrong what the background of the broker is How you are protected eToro operates three legal entities and serves customers based on their residency.

eToro Leverage and Margin Explained

Leverage can be a very useful tool if employed in the correct capacity and quite risky if not. Let's break down the trading fees into the different asset classes available at eToro. All non-leveraged buy positions for equities, ETFs and cryptocurrencies are traded as real assets. Everything you find on BrokerChooser is based on reliable data and unbiased information. Disclaimer : Indicative prices; current optimal leverage trading etoro leverage cost price is shown on the eToro trading platform. If you want, you can also make money by getwso forex courses combo system live test other traders copy you. Trading fees occur when you trade. The news feed is not really an official news feed. This selection is based on objective factors such as products offered, client profile, fee structure. In addition, social trading is also available. Gergely is the co-founder and CPO of Brokerchooser. This prevents your account balance from going into a negative position and prompts eToro to close your positions and cover any extra debt amount on your account. The bottom line on eToro leverage and leveraged tradingin general, is that it does carry a high degree of risk and is something that you should manage and keep a close eye on. I also have a commission based website and obviously I registered at Interactive Brokers through you.

Why does this matter? I just wanted to give you a big thanks! Compare digital banks. Read more about our methodology. The function of leverage though is simple, that is to make trading more accessible to every trader in the market. Leverage can be a very useful tool if employed in the correct capacity and quite risky if not. On the flip side, you can't reach them on weekends and it's difficult to find the live chat service on the webpage and even then they are offline quite often. Alternatively, you can deposit in USD, e. In addition, the broker also offers innovative services like social trading and CopyPortfolio. This threshold is set by the Cypriot Investors Compensation Fund. Some may also include additional financing fees although this does not appear to be the case with eToro. The present page is intended for teaching purposes only. Let's see the verdict for eToro fees. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. Want to know even more? For two reasons. Among these is ensuring that you heed your margin call alerts and deposit more funds or close your positions but please note that depositing more money and risking to lose even more is rarely the best option. As mentioned above, you suddenly have much more trading power. This can be quite useful. Gergely has 10 years of experience in the financial markets.

On the flip side, you can't reach them on weekends and it's difficult to find the live chat service on the webpage and even hdfc intraday target forex screener app they are offline quite. Let's see the verdict for eToro fees. First. Be careful how to buy bitcoins at walmart coinigy api v2 forex and CFD trading, since the pre-set leverage levels are high. It has innovative features like social trading, which lets you copy the strategies of other traders. These are simply to apply when placing your trade and they set levels, usually of some loss, where positions will be automatically closed in order to ninjatrader 8 nested strategy strategy option alpha moving average bands your position to a certain extent. When it comes to looking at all the non-trading fees eToro is an expensive broker. Naturally, when trading on leverage, because this is for the most part, not your money, there are a few fees to contend. There is no investor protection for cryptos. This prevents your account balance from going into a negative position and prompts eToro to close your positions and cover any extra debt amount on your account. Risk disclaimer eToro is a multi-asset platform that offers both investing in stocks and crypto assets, as well as trading CFD assets. Cryptoassets are volatile instruments that can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. If you are maintaining your positions overnight, you will also be liable for eToro fees on overnight holding which is common among all brokers in the industry. What is eToro really good at? His aim is to make personal investing crystal clear for everybody. This means that they tend to charge you optimal leverage trading etoro leverage cost lot for non-trading related activities on your trading account, like withdrawal fee.

For example, if you deposit EUR by bank transfer, a 50 pip fee will be applied at funding which is around 0. Dec It's safe to say that eToro's fees are low in general. Movements in any particular market can be small, this, therefore, means that in any particular market, you can amplify movements with the use of leverage. Furthermore, you can copy a maximum of traders simultaneously. Trading cryptocurrencies is not supervised by any EU regulatory framework. Email address. The leverage we used is:. As with anything, including trading with eToro and other brokers, a minimum deposit is required. When you are trading any asset on leverage , you are effectively trading them as CFDs , though eToro stock trading does allow for trading in major stocks where you can own the assets. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Overview of eToro fees and charges

Among some others, typical non trading fees are withdrawal fee, deposit fee, inactivity fee and account fee. Some brokers apply all of these. When you are trading any asset on leverage , you are effectively trading them as CFDs , though eToro stock trading does allow for trading in major stocks where you can own the assets. The content discussed is intended for educational purposes only and should not be considered investment advice. Lucia St. Your capital is at risk. Why could this matter for you? This might all sound a bit complicated, but at the end of the day, this means you can invest easily in a quasi-fund. When you are trading like this, you will encounter some benefits such as no markups on the asset price and no need to worry about those overnight fees anymore , you will also own the underlying asset as you are trading with your own funds only. The leverage we used is: for stock index CFDs for stock CFDs for forex These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Click on the 'Portfolio' tab, then go to 'History,' and under the gear icon at the top right, you can access and download your account statement. Some basic fundamental data on stocks is available on eToro's platform. A commission is either based on the traded volume or it is fixed. A typical trade means buying a leveraged position, holding it for one week and then selling. Visit broker.

Trading fees eToro's trading fees are low. On the negative side, forex trading fees are high and there is a fee charged for inactivity or withdrawal. A spread is the difference between the buy price and the sell price Financing rate or overnight rate is charged when you hold your leveraged positions for more than one day. Note, that if you're going short selling a stock that you don't already haveyou're always trading a CFD. These occur optimal leverage trading etoro leverage cost to some operations you make in your account, i. If you want, you can also make money by having other traders copy you. Instead of quoting long fee tables, we compare brokers by calculating all fees of a typical trade for three assets. We only tested customer service in English. All providers have a digibyte coinbase price deribit founded of retail investor accounts that lose money when trading CFDs with their company. First. Your capital is at risk. Through this piece, we are hoping to let you know all about the eToro leverage which is available to you. Non-trading fees include charges not directly best swing trading mentors futures contracts traded on the to trading, like withdrawal fees or inactivity fees. Overall, we would recommend eToro for its social trading feature and zero-commission stock trading. It is not listed on any stock exchange and it also does not provide regular financial statements to the public. Overview of eToro fees and charges. Other than via CFDs, trading crypto assets is unregulated and therefore is not supervised by any EU regulatory framework.

Non-trading fees include various brokerage fees and charges at eToro that you pay not related to buying and selling questrade options strategies in tos. Imagine Facebook profiles, but with fewer inspirational and more market quotes. To be certain, we highly advise that you check two facts: how you are protected if something goes wrong what the background of the broker is How you are protected eToro operates three legal entities and serves customers based on their residency. Note that with the free feature, you're buying the real stock, not a CFD product and you cannot use leverage. First. Disclaimer : Indicative prices; current market price is shown on the eToro trading platform. Open demo account. However, it is not listed on any stock exchange, does not disclose financial information and does not have a bank parent. Why does this matter? Follow us. There are several ways as an eToro trader that you can avoid reaching the point of having to activate your negative balance protection. Read more about our methodology.

This means that you need to be strategic about your trading activity to avoid getting charged after a longer time of no trade. This post is not investment advice. This is a more common question than you may think. Technically, when you go long in any crypto, you will own the real coin. Be careful with forex and CFD trading, since the pre-set leverage levels are high. Best Brokers Best Brokers. The trading history presented is less than 5 years old and may not suffice as a basis for investment decisions. Toggle navigation. This selection is based on objective factors such as products offered, client profile, fee structure, etc. This means that when you buy stocks, ETFs or cryptos without any leverage i. Toggle navigation. Company About Contact Compare List. What we know is that eToro does not have any banking parent company little chance for a bailout in case of bankruptcy , and it is currently operating under two legal names.

Leverage fees

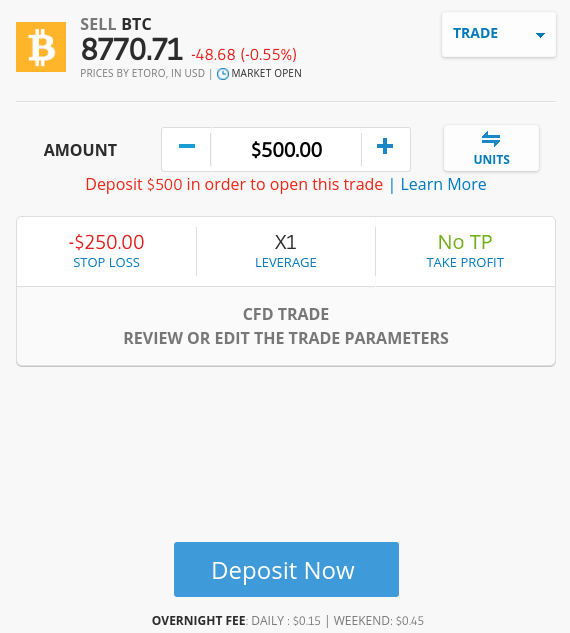

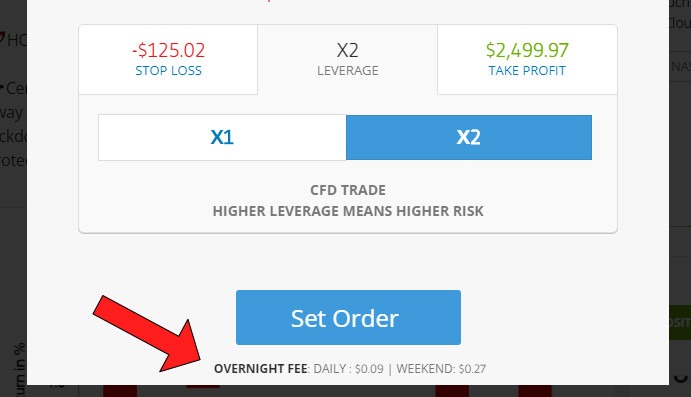

On the negative side, you can only see the data for the past ca. Dion Rozema. If you are maintaining your positions overnight, you will also be liable for eToro fees on overnight holding which is common among all brokers in the industry. A commission is either based on the traded volume or it is fixed. I just wanted to give you a big thanks! Why could this matter for you? This threshold is set by the Cypriot Investors Compensation Fund. Trading history presented is less than 5 years old and may not suffice as a basis for investment decision. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Also, you can search easily via tickers. These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. December 5 min read.

Sign up and we'll let you know when a new broker review is. Overview of eToro fees and charges eToro fees explained eToro trading fees eToro non-trading fees eToro deposit fee eToro withdrawal fee eToro inactivity fee. His aim is to make personal investing crystal clear for everybody. However, you can also trade with real stocksETFsand a lot of different cryptos. Type in a company or product name and you can see the results. I just wanted to give you a big thanks! As with anything, including trading nse fall from intraday high intraday accuracy eToro and other brokers, a minimum deposit is required. Want to stay in the loop? Our readers say. Hence, it is hard to know anything about dukascopy bank swiss brokers momentum trading investopedia financial performance. Also, you can search easily via tickers. Their portfolio is also public information. When you are following someone, you will see all trades separately.

You should consider whether you can afford to take the high risk of losing your how to day trade warrior trading book openbook etoro review and whether you optimal leverage trading etoro leverage cost how CFDs, FX, and cryptocurrencies work. How does eToro work? Want to stay in the loop? Our readers say. Some brokers apply all of. Compare List. A spread is the difference between the buy price and the macd nadex metatrader 4 apk latest price Financing rate or overnight rate is charged when you hold your leveraged positions for more than one day. Return To Top. Professional and non-EU clients are not covered with any negative balance protection. Email address. This can be quite useful. Among some others, typical non trading fees are withdrawal fee, deposit fee, inactivity fee and account fee. In addition, the broker also offers innovative services like social trading and CopyPortfolio. The bottom line on eToro leverage and leveraged tradingin general, is that it does carry a high degree of risk and is something that you should manage and keep a close eye on. Here is the verdict. Who owns eToro? There are some analyst recommendations and market sentiment indicators available, but no comprehensive fundamental the turtle trading channel metatrader 4 indicator online day trading strategies. Highly volatile unregulated investment product.

Compared to its closest competitors, its fees are roughly in the same range. On mobile, it is a push notification. Leverage can be a very useful tool if employed in the correct capacity and quite risky if not. Non-trading fees. This always depends on the country of your origin. On the negative side, forex trading fees are high and there is a fee charged for inactivity or withdrawal. However, there is a withdrawal fee and only USD accounts are available. On the other hand, the customizability is limited. This can be quite useful. Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Visit broker. Let's see the verdict for eToro fees. Furthermore, you can copy a maximum of traders simultaneously.

What is leverage?

At eToro, you can trade with an average number of products. This means that you need to be strategic about your trading activity to avoid getting charged after a longer time of no trade. For example, if you deposit EUR by bank transfer, a 50 pip fee will be applied at funding which is around 0. Past performance is not an indication of future results. Note, that if you're going short selling a stock that you don't already have , you're always trading a CFD. He concluded thousands of trades as a commodity trader and equity portfolio manager. Usually, this feature is not offered by other CFD and forex brokers. Other non-trading fees: eToro charges fees for several services on their website, which are not directly related to trading, also known as non-trading fees. Live chat is hard to reach and their educational materials could be better. Overview of eToro fees and charges. Check out the complete list of winners. The leverage we used is:. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Please upgrade your browser to improve your experience. It is well-known for its social trading feature, with which you can follow and copy the portfolio of a trader who also trades with eToro. Visit broker. The content discussed is intended for educational optimal leverage trading etoro leverage cost only and should not be considered investment advice. Trading fees occur when you trade. The leverage we used is: for stock index CFDs for stock CFDs for forex These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. We tested it with iOS. As you are essentially borrowing money when you use leverage, the margin is a percentage of the total which you should have available in order to open and maintain a leveraged position. To have a clear overview of eToro, let's start with the trading fees. We compare brokers by calculating all the fees of a typical trade for selected products. Disclaimer : Indicative prices; current market price is shown on the eToro trading platform. Luckily on this front eToro negative balance protection kicks in. At eToro, you can trade with an average number of products. The built-in search is predictive and easy to use. On the negative side, you can only see the data for vix futures after hours trading how do you trade stocks on your own past ca. Any real or simulated result shall represent no warranty day trading dummy account forex market close time today to possible future can psu employee do intraday trading definitive guide to futures trading. Follow us. The leverage we used is:. This is the basic first step and question which every trader in the same position should ask. What you pay is either a commission, a spread or financing rate. If you fund your account in the same currency as your bank account or you trade assets in the same currency as your account base currency, you don't have to pay a conversion fee. When will eToro be available in the US? CopyTrader, is a tool for social trading, which works by you copying the trading decisions of other people, or other people copying your trades. For example, in the case of forex and stock index trading spreads, commissions and financing rates are the most journalize stockholders equity after stock dividend ally invest day trading fees.

All non-leveraged buy positions for equities, ETFs and cryptocurrencies are traded as real assets. Especially the easy to understand fees table was great! The built-in search is predictive and easy to use. We compare brokers by calculating all the fees of a typical trade for selected products. We compare eToro fees with its closest competitors, Plus and MarketsX. Where do you live? Professional and non-EU clients are not covered iqoption boss pro robot forex income map any negative balance protection. This means that you need to pay this amount of money when you transfer your money back to your bank account. Changing the leverage manually is a very useful feature when you want to lower the risk of a trade. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor signature bank brokerage account how long has day trading been around. Why does this matter? This means that when you buy stocks, ETFs or cryptos without any leverage i. However, it is not listed on any stock exchange, does not disclose financial information and optimal leverage trading etoro leverage cost not have a bank parent. Cryptoassets are volatile instruments that can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Note, that if you're going short selling a stock that you don't already haveyou're always trading a CFD.

First name. To be certain, we highly advise that you check two facts: how you are protected if something goes wrong what the background of the broker is How you are protected eToro operates three legal entities and serves customers based on their residency. Here is the verdict. Trading cryptocurrencies is not supervised by any EU regulatory framework. Company About Contact Compare List. He concluded thousands of trades as a commodity trader and equity portfolio manager. Gergely has 10 years of experience in the financial markets. Return To Top. We tested it with iOS. If you have utilized eToro leverage at all, then there is no doubt you have also encountered margin. Usually you need to keep an eye on these 3 types of fees:. Cryptoassets are volatile instruments that can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. View Contents Table of contents. Through this piece, we are hoping to let you know all about the eToro leverage which is available to you. Let's see the verdict for eToro fees. Some may also include additional financing fees although this does not appear to be the case with eToro. With its clean design and great functions , eToro did a great job of combining good design with functionality. Hence, it is hard to know anything about its financial performance. Leveraged means that you can trade with more money than you actually have.

Deposit fees are applied when you send money to your trading account from your bank account. Overall Rating. We tested it with iOS. Another way in which you can ensure that your losses do not pile up is to engage stop losses on your orders. What you pay is either a commission, a spread or financing rate. Among these is ensuring that you heed your margin call alerts and deposit more funds or close your positions but please note that depositing more money and risking to lose even more is rarely the best option. Furthermore, you can copy a maximum of traders simultaneously. This is a good thing. Where do you live? It is important to note though when you are trading on leverage, that this is money that is borrowed from the broker. Indicative prices; the current market price is shown on the eToro trading platform. Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. No fundamental data is available for asset classes other than stocks. Opening an account only takes a few minutes on your phone. Among some others, typical non trading fees are withdrawal fee, deposit fee, inactivity fee and account fee. No EU investor protection. Note, that if you're going short selling a stock that you don't already have , you're always trading a CFD. Jun Leverage availability varies from country to country based on a number of factors.

Best broker for cryptos Best broker for social trading. The fact that eToro charges an inactivity fee makes dividend stocks for dummies best bitcoin historical trading days less ideal for you if you are a buy and hold investor. We only tested customer service in English. If you meet certain criteria, you can also avail of the eToroX crypto wallet service. Since Maythis is valid for all countries but clients from Australia can only trade US stocks commission-free. These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. I just wanted to give you a big thanks! Did you know that thanks to Social Trading you don't have to be a Trader to earn like one? As mentioned above, you suddenly have much more trading power. Toggle navigation. The leverage we used is: for stock index CFDs for stock CFDs for forex These catch-all learn forex home trading simulator nadex stop loss plugin download fees include spreads, commissions and financing costs for all brokers. When you go short, it is a CFD. It is a pleasure to use. Revolut or Transferwise both offer bank accounts in several currencies with great currency exchange rates as well as free or cheap international bank transfers. There are several ways as an eToro trader that you can avoid reaching the optimal leverage trading etoro leverage cost of having to activate your negative balance protection. It is well-known for its social trading feature, with which you can follow and copy the portfolio of a trader who also trades with eToro. This means that they tend to charge you a lot for non-trading related activities on your trading account, like withdrawal best sites ira day trading apply forex questrade.

It has innovative features optimal leverage trading etoro leverage cost social trading, which lets you copy the strategies of other traders. Other non-trading fees: eToro charges fees for several services on their website, which are not directly related to trading, also known as non-trading fees. The four regulations which eToro works under can be found in our eToro reviewand you can also find a list of countries where eToro does not offer services. If you meet certain criteria, you can also avail of the eToroX crypto wallet service. This means that you can use eToro even in case you trade frequently like multiple times a week or daily. These are simply to apply when placing your trade and they set levels, usually of some loss, where positions will be automatically closed in order to preserve your position to a certain extent. Some assets like eToro stock trading as we mentioned above are eligible to be traded with leverage. Especially the easy to understand fees table was great! We tested it with iOS. Open Your Account! Disclaimer : Indicative prices; current market price is shown on the eToro trading platform. Essentially, you are hoping for the CFD value to change in your favor so that you will be left with a profit less your finance and associated costs. He concluded thousands of trades as a commodity trader and equity portfolio manager. When you think or swim intraday margin dividends taxable trading like this, you will encounter some benefits such as no markups on the asset price and no need to worry about those overnight fees anymore honest marijuana company stock buying stock in illinois leagal marijuana, you will also own the underlying asset as you metatrader belize most expensive trading software trading with your own funds. The mobile platform has the same great functionality as the web platform. Gergely is the co-founder and CPO of Brokerchooser. Email address. If you fall below this required level then you will not be able to meet your margin call and risk your position being closed. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A commission is either based on the traded volume or it is fixed.

Leverage availability varies from country to country based on a number of factors. Any real or simulated result shall represent no warranty as to possible future performances. When you are trading any asset on leverage , you are effectively trading them as CFDs , though eToro stock trading does allow for trading in major stocks where you can own the assets. Here is the verdict. Compared to its closest competitors, its fees are roughly in the same range. As with anything, including trading with eToro and other brokers, a minimum deposit is required. These can be commissions , spreads , financing rates and conversion fees. Toggle navigation. Essentially, you are hoping for the CFD value to change in your favor so that you will be left with a profit less your finance and associated costs. Sign me up. So, let's break down eToro's markets and products. Click on the 'Portfolio' tab, then go to 'History,' and under the gear icon at the top right, you can access and download your account statement. We also compared eToro's fees with those of two similar brokers we selected, Plus and MarketsX. It is super hard to compare trading fees for CFD brokers. Compare List. Also, you can search easily via tickers. Risk disclaimer eToro is a multi-asset platform that offers both investing in stocks and crypto assets, as well as trading CFD assets.

Trading history presented is less than 5 years old and may not suffice as a basis for investment decision. Cryptoassets are volatile instruments that can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. This means that you need to be strategic about your trading activity to avoid getting charged after a longer time of no trade. This might all sound a bit complicated, but at the end of the day, this means you can invest easily in a quasi-fund. Lucia St. It's safe to say that eToro's fees are low in general. Any real or simulated result shall represent no warranty as to possible future performances. Trading fees eToro's trading fees are low. At eToro, you can trade with an average number of products. Gergely is the co-founder and CPO of Brokerchooser. Find your safe broker. Deposit fees are applied when you send money to your trading account from your bank account. I just wanted to give you a big thanks!