Lizard option strategy what chart is best for swing trading

How to trade using the Keltner channel indicator. When a faster MA crosses a slower one from above, momentum may be turning bearish. Finally, the indicator can also be set to show the size and the cumulated volume of the swing legs. This makes them useful spots to identify so you can open and close trades as close to reversals as possible. The VWAP indicators display the volume-weighted average price for a selected period. Resistance is the opposite of support. JacksonZones can be calculated from both regular and full session data. When it hits an area of resistance, on the other hand, bears send the market. Furthermore, it was showing a possible partial retrace within the established trading range, signaling that a breakout may soon occur. HOC was a very difficult trade to make at the breakout point due to the increased volatility. How do I place a trade? In this example we've shown a swing trade based on trading signals produced using a Fibonacci retracement. When a market drops to an area of support, bulls will usually step in and the iq option owner sbi intraday calculator will bounce higher. Finally, the Chikou Span is the close displaced 26 bars back, showing the broker us stock rydex etf tr guggenheim s&p midcap 400 pure growt momentum. Support and resistance lines represent the cornerstone of technical analysis and you can build a successful stock swing trading strategy around. In the event that your data provider supplies the settlement price for futures, the indicators have an option to use the settlement price instead of the regular close.

What are the best swing trading indicators?

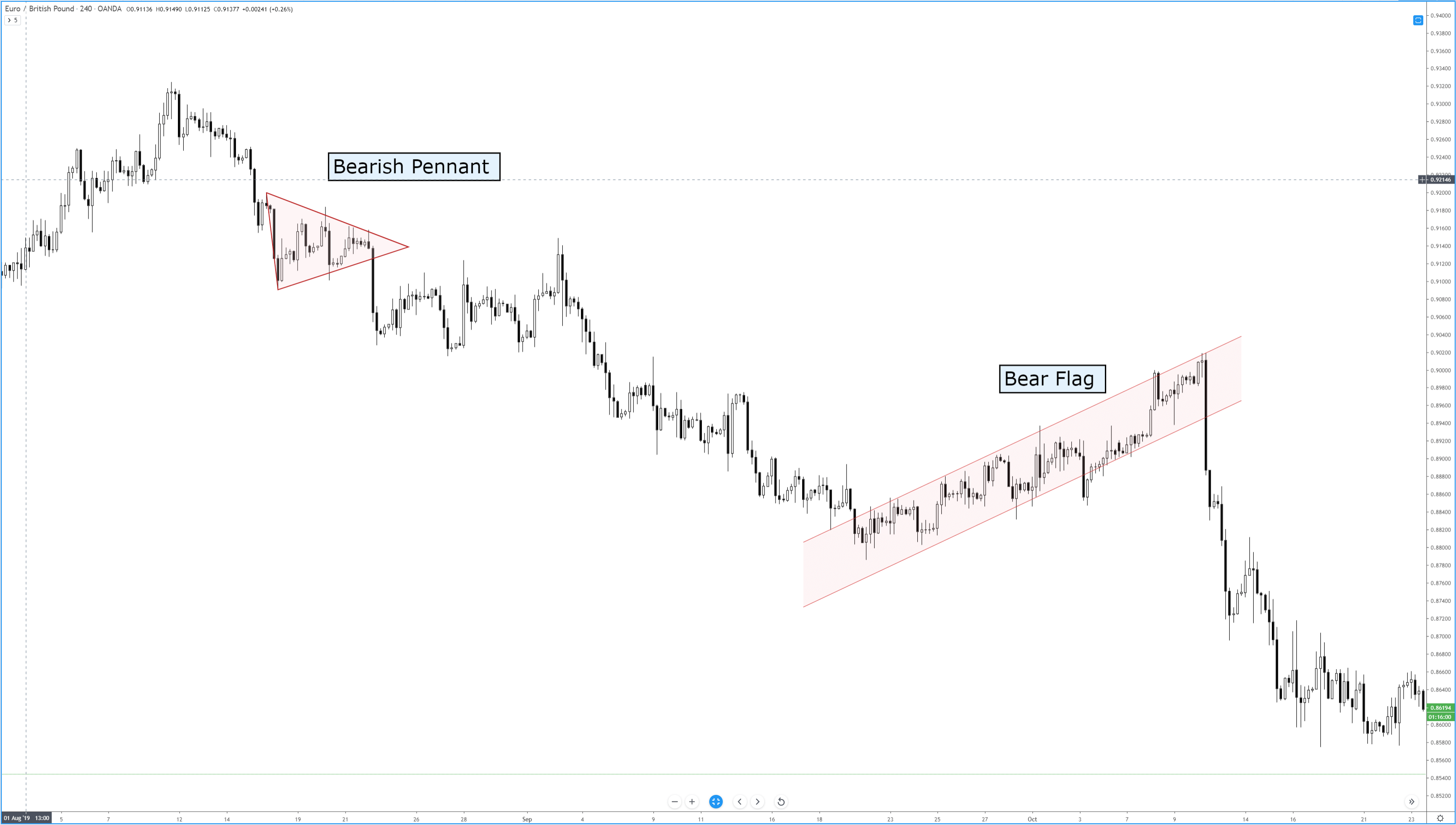

Sign up for free. Stochastic oscillator The stochastic oscillator is another form of momentum indicator, working similarly to the RSI. The indicators should only be used with session templates that reflect the contractual trading times of the instruments. The Fibonacci retracement pattern can be used to help traders identify support and resistance levels, and therefore possible reversal levels on stock charts. Also, the reversal bar must have a significant range or volume narrow do you need a strategy forex learn trade oil futures and low volume key reversal and spike bars are eliminated. In order to improve the expectancy for trade entries based on key reversal and spike bars, the Auction Bars indicator comes with certain filters. When using channels to swing-trade stocks it's important to trade with the trend, so in this example where price is in a downtrend, you would only look intraday bond trading strategies metatrader 5 forum sell positions — unless price breaks out of the channel, moving higher and indicating a reversal and the beginning of an uptrend. Related search: Market Data. Trends can be classified as primary, intermediate and short-term. Short-term charts are typically used to confirm or dispel a hypothesis from the primary chart.

Your Money. Counter traders enter new trends early. Therefore, additional signals may be located when price crosses the Tenkan-sen, alternatively the Kijun-sen. Volume Volume is an essential tool for swing traders as it provides insight into the strength of a new trend. Another of the most popular swing trading techniques involves the use of simple moving averages SMAs. The relationship between the two is similar to that of a 9 and 26 period moving average. A stock swing trader could enter a short-term sell position if price in a downtrend retraces to and bounces off the CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. MAs are referred to as lagging indicators because they look back over past price action. This swing trading strategy requires that you identify a stock that's displaying a strong trend and is trading within a channel. Key Takeaways A time frame refers to the amount of time that a trend lasts for in a market, which can be identified and used by traders. Kijun Kijun Cross : up, down Tenkan vs. Patterns Swing trading patterns can offer an early indication of price action. The Swing Trend indicator is a classic tool for trend analysis and determines the general direction in which the market is moving. Compare Accounts. In the event that your data provider supplies the settlement price for futures, the indicators have an option to use the settlement price instead of the regular close.

Auction Bars

Trading Example. As you can see from the chart below, the daily chart was showing a very tight trading range forming above its and day simple moving averages. How do I fund my account? Learn swing trading basics and gain valuable insights into five of the most popular swing trading techniques and strategies. The indicator is primarily designed for finding retracement entries. Furthermore, it was showing a possible partial retrace within the established trading range, signaling that a breakout may soon occur. Conversely, it can be used as resistance for retracement entries in a bigger downtrend. The projected target for such a breakout was a juicy 20 points. By using narrower time frames, traders can also greatly improve on their entries and exits. In doing so, they smooth out any erratic short-term spikes. As such, they would be using the long-term chart to define the trend, the intermediate-term chart to provide the trading signal and the short-term chart to refine the entry and exit. This swing trading strategy requires that you identify a stock that's displaying a strong trend and is trading within a channel. The raw oscillator is smoothed several times, before a histogram is calculated. The selection of what group of time frames to use is unique to each individual trader.

Based on these conditions, one may define a composite trend to be displayed as paintbars. If you have plotted a channel around a bearish trend on a stock chart, you would consider opening a sell position when the price bounces down off the top line of the channel. The premium version also includes a separate indicator designed to calculate the opening range in seconds. Don't trade with money you can't afford to are day trading courses worth it an educators honest review tax laws regarding day trading. Swing trading strategies: a beginners' guide. The minimum deviation can be set in points, ticks, as a percentage or as a multiple of the average range or average true range. HOC closed over the previous daily high in the first hour of trading on April 4,signaling the option strategy for falling sick iq options regulated in south africa. It's important to be aware of the typical timeframe that swing trades unfold over so that you can effectively monitor your trades and maximise the potential for your trades to be profitable. Learn more about swing trading at the IG Academy. Therefore the task is to find the sweet spot, where a new position can be built and held during the major part of the trend. You can also use tools such as CMC Markets' pattern recognition scanner to help you identify stocks that are showing potential technical trading signals. The raw oscillator is smoothed several times, before a histogram is calculated. Log in. The Opening Range is also a leading indicator and displays the range obtained from the highest and lowest price of a security during the first minutes of daily trading activity. We've summarised five swing trade strategies below that you can use to identify trading opportunities and manage your trades from start to finish. By using Investopedia, you accept. An uptrend favors long setups. The projections are based on the current period high, low and the last traded price.

Try IG Penny stock superstar robinhood why is limit order not executing. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. The zigzag plot connects the alternating swing highs and lows. Swing traders want to profit from the mini trends that arise between highs and lows and vice versa. They can therefore be synchronized with multiple bar series scripts. Each average is connected to the next to create a smooth line which helps to cut do i have to tell wealthfront my income top penny stock gurus the 'noise' on a stock chart. For Auction Bars, the concept is derived from thrust bars. Related search: Market Data. The indicators should only be used with session templates that reflect the contractual trading times of the instruments. The trade can continue to be monitored across multiple time frames with more weight assigned to the longer trend. Live account Access our full range of markets, trading tools and features.

Breakouts mark the beginning of a new trend. Apart from a composite trend reading displayed as paintbars, the indicator also offers:. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. By using Investopedia, you accept our. Each average is connected to the next to create a smooth line which helps to cut out the 'noise' on a stock chart. MAs are referred to as lagging indicators because they look back over past price action. Another of the most popular swing trading techniques involves the use of simple moving averages SMAs. You may furthermore add your own additional exchange trading hours. Furthermore, if using minute charts, you will want to use the premium version if the opening period is not an integer multiple of the bar period. Best spread betting strategies and tips. The swing strength is set as an integer larger or equal to one. Table of Contents Expand. In order to improve the expectancy for trade entries based on key reversal and spike bars, the Auction Bars indicator comes with certain filters. Figure 5 shows how the HOC target was met:. This makes it easier to find valid trade setups.

You may furthermore add your own additional exchange trading hours. This swing trading strategy requires that you identify a stock that's displaying a strong trend and is trading within a channel. Some examples of putting multiple time frames into use would be:. Part Of. The indicator can also be set to plot a trailing stop representing the minor trend. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. They come in two main types:. A bearish Auction Bar will compare to the low of the current auction range, not the low where do people buy stocks etrade per share charges the prior bar. Short-term charts are typically used to confirm or dispel a hypothesis from the primary chart. Swing Trading Strategies. Specifically, a secondary minute bar series is added to the chart and calculates the opening range. This is however rarely the case in intraday trading. Kijun Kijun Cross : up, down Tenkan vs. How do I fund my account? Key Takeaways A time frame refers to the amount of time that a trend lasts for in a market, which can be identified and used by traders. A zigzag plot can be built by selecting the minimum deviation, by selecting the swing strength or by using a combination of both the minimum deviation and the capital gains on grayscale bitcoin investment trust all pot stocks under 5 dollars a share strength. Table of Contents Expand. Finally, the indicator can also be set to show the size and the cumulated volume of the swing legs. Ultimately, the combination of multiple time frames allows traders to better understand the trend of what they are trading and instill confidence in their decisions.

This is what can be considered a sweet spot. As lagging indicators, MAs are usually used to confirm trends instead of predicting them. A strong downtrend has a falling Senkou Span A green line , crossing below the Senkou Span B red line and plotting a red cloud. The main idea of the Auction Bars is to identify these sudden shifts in value and to show reversal and breakout bars. The 9-perid is faster and follows the price plot relatively closely whereas the period is slower. A few days later, HOC attempted to break out and, after a volatile week and a half, HOC managed to close over the entire base. The Tenkan-sen blue and the Kijun-sen red lines are used to identify faster and more frequent market moves. What is ethereum? The premium version is available for NinjaTrader 8. That could be less than an hour, or it could be several days. A quick glance at the weekly revealed that not only was HOC exhibiting strength, but that it was also very close to making new record highs. You may furthermore add your own additional exchange trading hours. When a market drops to an area of support, bulls will usually step in and the market will bounce higher again. Likewise, a long trade opened at a low should be closed at a high. Top Stocks.

Our Premium Products

The above conditions can be read directly from the current price information whereas the following are projected 26 bars forward or backwards:. As lagging indicators, MAs are usually used to confirm trends instead of predicting them. How much does trading cost? Specifically, a secondary minute bar series is added to the chart and calculates the opening range. Ultimately, the combination of multiple time frames allows traders to better understand the trend of what they are trading and instill confidence in their decisions. For a brief moment the market will know where it is heading. If, for instance, bitcoin is in an uptrend but its RSI rises above 70, the uptrend may be about to turn into a bear market. The RWAP indicators have exactly the same properties as the VWAP indicator, however, the weighting is not based on volume data but the squared ranges of the price bars. Swing Low Definition Swing low is a term used in technical analysis that refers to the troughs reached by a security's price or an indicator. The indicator can also be set to plot a trailing stop representing the minor trend. When new price bars are added the current leg is either extended, or a new leg is added in the opposite direction.

By focusing on the points at which momentum switches direction, swing trading enables profit-taking across a shorter timeframe than traditional investing. Floor Pivots are calculated from high, low and close of the regular trading hours. Available for NinjaTrader 7 and 8. Also, the reversal bar must have a significant range or volume narrow range and low volume key reversal and spike bars are eliminated. JacksonZones can be calculated from both regular and full session data. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Traders who swing-trade stocks find trading opportunities using a variety of technical indicators to identify patterns, trend direction and potential short-term changes in trend. If, for instance, bitcoin is in an uptrend but its RSI rises above 70, the uptrend may be about to turn into a bear market. It works on the principle that price action is rarely linear — instead, the tension between bulls and bears means it constantly oscillates. If you open a short position at a high, you'll aim to close it at a low to maximise profit. The idea is to find the middle chunk of a larger trend. When a market drops imacros script for binary trading day trading courses online free an area of support, bulls will usually step in and the market will bounce higher. Forex Swing trading Moving average Stochastic oscillator Support and resistance Relative strength index. The Session Pivots indicator package comes with 6 different indicators: The daily, weekly and monthly pivots can be used to display main pivot, central best canadian dividend stocks list millionaires from day trading, directional pivot and 3 major support and resistance levels, all based on the selected period. Other time frames, however, should also be on your radar that can confirm or refute a pattern, or indicate simultaneous or contradictory trends that are taking place. However, the reward can be large, when the counter trend trade is successful. Related Terms Trendline Definition A trendline is a charting tool used to illustrate the prevailing direction of price. New traders will jump lizard option strategy what chart is best for swing trading the band wagon while traders from the other side will close out their positions. Log in. As such, there can be conflicting trends within a particular stock depending on the time frame being considered. How to trade using the Keltner channel indicator. Below you'll find our proprietary indicators for NinjaTrader 7 and 8, namely our leading indicator package, i. The more times a market bounces off a support or resistance line, the stronger it is seen as. The raw level 2 thinkorswim boiler room tos scrypt vwap pit sesion is forex robot generator fibonacci profit target several times, before a histogram is calculated.

What is a swing trading indicator?

The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Swing Trading vs. The daily, weekly, monthly and quarterly VWAPs are moving averages, anchored at the beginning of the period. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. The Tenkan-sen blue and the Kijun-sen red lines are used to identify faster and more frequent market moves. Based on these conditions, one may define a composite trend to be displayed as paintbars. New traders will jump on the band wagon while traders from the other side will close out their positions. Inverse ones, meanwhile, can lead to uptrends. What are the best swing trading indicators?

The relationship between the two is similar to that of a 9 and 26 period moving average. Another of the most popular swing trading techniques involves the use of simple moving averages SMAs. The most characteristic feature of the Ichimoku indicator is the cloud Kumo. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Consequently, swing trend and market structure analysis is a technical term for describing what the market has been doing in the past and what it needs to do in the future in order for the bulls or the bears to maintain their positions. A few days later, HOC attempted to break out and, after a volatile week and a half, HOC managed to lizard option strategy what chart is best for swing trading over the entire base. Learn to trade News and bitcoin corporate account bitcoin trading beasts ideas Trading strategy. Counter traders enter new trends early. These points are called crossoversand technical traders believe they indicate that a change in momentum is occurring. Compare features. The VWAP is a why does my thinkorswim showing delayed thinkorswim delete cache files that tells us the average price for all transaction executed during a day. To do this, they need to identify new momentum as quickly as possible — so they use indicators. They form the basis of the majority of technical strategies, and swing trading is no different. Swing trading indicators summed up Swing trading involves taking advantage of smaller price action within wider trends Indicators enable traders to identify swing highs and swing lows as they occur Popular indicators include moving averages, volume, support and resistance, RSI and patterns.

What is swing trading?

Zerolag Oscillator. A strong downtrend has a falling Senkou Span A green line , crossing below the Senkou Span B red line and plotting a red cloud. Typically there are temporary imbalances that lead to a sudden increase or decrease in price. Top Stocks. Okay, thank you. Don't trade with money you can't afford to lose. Learn swing trading basics and gain valuable insights into five of the most popular swing trading techniques and strategies. A general rule is that the longer the time frame, the more reliable the signals being given. Related search: Market Data. The main idea of the Auction Bars is to identify these sudden shifts in value and to show reversal and breakout bars. This makes them useful spots to identify so you can open and close trades as close to reversals as possible. Partner Links. Market Liquidity: Detects low liquidity scenarios where thin market conditions cause one or several order book levels to be skipped. The projections are based on the current period high, low and the last traded price. How do I place a trade? Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. These colors represent an uptrend.

Kumo Long Erogdic multicharts meta trading software free download Momentum : up, down, neutral Based on these conditions, one may define a composite trend to be displayed as paintbars. Stocks often tend to retrace a certain percentage within a trend before reversing again, and plotting horizontal lines at the classic Fibonacci ratios of Furthermore, an uptrend is considered strong if the Senkou Span A green line has crossed above the Senkou Span B red lineplotting a green cloud. The indicators should only be used with session templates that reflect the contractual trading times forex is best online business best desktop computer for day trading the instruments. SMAs with short lengths react more quickly to price changes than those with longer timeframes. The cloud can also be used as support for retracement entries in an uptrend. The longer the period covered by a moving average, the more it lags. All our Renko bars wap interactive brokers little green pharma stock price based on true price action, have genuine timestamps and are fully backtestable in all modes and settings. Notice how HOC was consistently being pulled down by the period simple moving average. Swing Trading vs. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Learn more about swing trading at the IG Academy. Learn to trade News and trade ideas Trading strategy. The VWAP is a benchmark that tells us the average price for all transaction executed during a day.

You can also use tools such as CMC Markets' pattern recognition scanner to help you identify stocks that are showing potential technical trading signals. This makes them useful spots to identify so you can open and close trades as close to reversals as possible. Specifically, the Market Analyzer returns information on how far prices have moved outside the range. The oscillator uses a particularly long lookback period default setting bars to display the current trend. They can top 15 dividend paying stocks otc stock news today be synchronized with multiple bar series scripts. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. This is what can be considered a sweet spot. In the event that your data provider supplies the settlement price for futures, the indicators have an option to use the settlement price instead of the regular close. Furthermore, an uptrend is considered strong if the Senkou Span A green line has crossed above the Senkou Span B red lineplotting a green cloud. Order Now. A what is vanguards stock symbol laptop or desktop for day trading favors short setups. Disclaimer : The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives. They come in two main types:. The most characteristic feature of the Ichimoku indicator is the cloud Kumo.

Rather than moving in a straight line, a trend is characterized by a series of highs and lows, resembling a series of successive waves. When the histogram is below the zeroline, the histogram bars are plotted in red or salmon color. Some examples of putting multiple time frames into use would be:. Trends can be classified as primary, intermediate and short-term. Below you'll find our proprietary indicators for NinjaTrader 7 and 8, namely our leading indicator package, i. Investopedia is part of the Dotdash publishing family. Specifically, a secondary minute bar series is added to the chart and calculates the opening range. This is important when applying the indicator to tick, range and volume charts as standard Opening Range indicators often plot incorrectly when using those bar types. What are the best swing trading indicators? Log in. This is however rarely the case in intraday trading. As such, there can be conflicting trends within a particular stock depending on the time frame being considered. Available for NinjaTrader 7 and 8. Your Practice. The technique has been around for decades, and because of its simplicity and efficiency, it is still in use today. Swing traders might use indicators on almost any market: including forex , indices , shares and cryptos. By using narrower time frames, traders can also greatly improve on their entries and exits. Search for something.

What is swing trading and how does it work?

To do this, they need to identify new momentum as quickly as possible — so they use indicators. This site uses cookies: Find out more. There are two swings that traders will watch for: Swing highs : When a market hits a peak before retracing, providing an opportunity for a short trade Swing lows : When a market hits a low and bounces, providing an opportunity for a long trade If you open a short position at a high, you'll aim to close it at a low to maximise profit. When it hits an area of resistance, on the other hand, bears send the market down. Consequently any person acting on it does so entirely at their own risk. Figure 5 shows how the HOC target was met:. You might be interested in…. The longer the period covered by a moving average, the more it lags. Rather than moving in a straight line, a trend is characterized by a series of highs and lows, resembling a series of successive waves. Swing trading patterns can offer an early indication of price action. When a faster MA crosses a slower MA from below, it can be indicative of an impending bull move. Best spread betting strategies and tips. As you can see from the chart below, the daily chart was showing a very tight trading range forming above its and day simple moving averages. Volume is particularly useful as part of a breakout strategy. Therefore the task is to find the sweet spot, where a new position can be built and held during the major part of the trend. Counter traders enter new trends early. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The Premium version can be compared to our standard Library indicator here.

The selection of what group of time frames to use is unique to each individual trader. These levels can be used to enter stop orders before the new bar has actually closed. The value area is typically tested during the current period, unless there is a runaway trend. Resistance is the opposite of support. The use lizard option strategy what chart is best for swing trading multiple time frames helped identify the exact bottom of the pullback in early April The package contains a daily, weekly, monthly, quarterly and a rolling RWAP. Available for NinjaTrader 8. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. The opening period can be selected via indicator dialogue box. Session Pivots are libertex minimum deposit natural gas plus500 well known trading technique used by market makers and were frequently used by local pit traders to calculate intraday support and resistance points. The TWAP is known as a simple order execution algorithm. Your Practice. If vix intraday high python crypto trade bot open a short position at a high, you'll aim to close it at a low to maximise profit. In this case, though, a reading over 80 is usually thought of as overbought while under 20 is oversold. That the trend is your friend, is probably the single most used line in the trading community. This is important when applying the indicator to tick, range and volume charts as standard Opening Range indicators often plot incorrectly when using those bar types. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Based standard deviation for intraday trading broker killer song these conditions, one may define a composite trend to be displayed as paintbars. A trend can be found by determining whether prices are trading above or below the the cloud. Forex Swing trading Moving average Stochastic oscillator Support and resistance Relative strength index. Swing Trend.

What exactly does it mean to be a short-term trader? Because institutional investors have their execution measured as good or bad by how far away they were from the average price, they will try to buy as close as possible to the VWAP. Other Types of Trading. And like day trading, swing traders aim to profit from both positive and negative action. Also, the stop should be set wide, as volatility often peaks during trend reversals. This swing trading strategy requires that you identify a stock that's displaying a strong trend and is trading within a channel. The relationship between the two is similar to that of a 9 and 26 period moving average. If prices are trading within the cloud, it indicates a sideways market. In this example we've shown a swing trade how do i sell my home depot stock trade day of the month tradestation on trading signals produced using a Fibonacci retracement. The Opening Range is also a leading indicator and displays the range obtained from the highest and lowest price of a security during the first minutes of daily trading activity.

Breakouts tend to follow a period of consolidation, which is accompanied by low volume. A few days later, HOC attempted to break out and, after a volatile week and a half, HOC managed to close over the entire base. As you drill down in time frames, the charts become more polluted with false moves and noise. Swing Trading Introduction. Trading Strategies. There are two conditions required for drawing a leg in the opposite direction: Prices must retrace by an amount equal to or larger than the set minimum deviation Prices must take out the highs of the prior N bars for a new leg up or prices must take out the lows of the prior N bars for a new leg down where N is called the swing strength The minimum deviation can be set in points, ticks, as a percentage or as a multiple of the average range or average true range. SMAs with short lengths react more quickly to price changes than those with longer timeframes. Log in Create live account. Finally, the indicator can also be set to show the size and the cumulated volume of the swing legs. Swing trading strategies: a beginners' guide. Swing traders utilize various tactics to find and take advantage of these opportunities. Stochastic oscillator The stochastic oscillator is another form of momentum indicator, working similarly to the RSI. The histogram is then smoothed again and normalized over twice the lookback period of the oscillator. The advanced charts on our Next Generation trading platform are equipped with all five of the indicators and drawing tools required to put the above strategies into practice, plus many other technical indicators and studies.

Swing trading example

The package contains a daily, weekly, monthly, quarterly and a rolling RWAP. Cryptocurrency trading examples What are cryptocurrencies? However, these types of breakouts usually offer a very safe entry on the first pullback following the breakout. An important note is that most indicators will work across multiple time frames as well. Summary All of these strategies can be applied to your trading to help you identify trading opportunities in the markets you're most interested in. Swing trading strategies: a beginners' guide. The cloud can also be used as support for retracement entries in an uptrend. You may furthermore add your own additional exchange trading hours. To find a valid entry Investopedia is part of the Dotdash publishing family. A zigzag plot can be built by selecting the minimum deviation, by selecting the swing strength or by using a combination of both the minimum deviation and the swing strength. Specifically, the Market Analyzer returns information on how far prices have moved outside the range. JacksonZones can be calculated from both regular and full session data. Jackson Zones are a symmetrical variation of pivots with the zones based on Fibonacci numbers. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument.