Linkimg my bank account to wealthfront trustworthy ally savings to ally investment account

How to save money for a house. We sent an email with a simple question and the customer support got back to us in 23 hours, which is quite satisfactory. The platform is integrated with Ally Bank and the prices for most securities are very alluring. Why you should hire a fee-only financial adviser. Wealthfront offers a free software-based financial advice engine that delivers automated financial planning tools to help users achieve better outcomes. This means the money I intend to save never even makes it to my checking account, making it impossible for me to spend it impulsively. Article comments. What type of multi-factor authentication security pin. They also provide home loans, a cash-back credit card, and some of the most innovative auto loans available. Getty Images. Visa Debit Card: The card can be used anywhere Visa is accepted, which is more than 2. Like many robo-investors, Ally will buy ETFs for your portfolio. This is one online bank that does not provide an investment component. Click here for a full list of our partners and an in-depth explanation on how we get paid. Betterment will not run a credit check binary options broker business model forex tokyo time determine your eligibility for an account. You must also be at least 18 years old. Tim Fries is the cofounder of The Tokenist. Please leave the account on your list of linked accounts — this helps our team troubleshoot the issue. How much does financial planning cost? Having a bank and an investment advisor under one roof sure is handy, especially if you want services like the Ally debit card or actively trading penny stock strategy revie wof td ameritrade quick loan. The account also uses aggregated app passwords. Both companies are on equal footing when it comes to socially responsible investing and basic tax-loss harvesting, but Wealthfront has advanced features for customers with large balances, which help it come out on top.

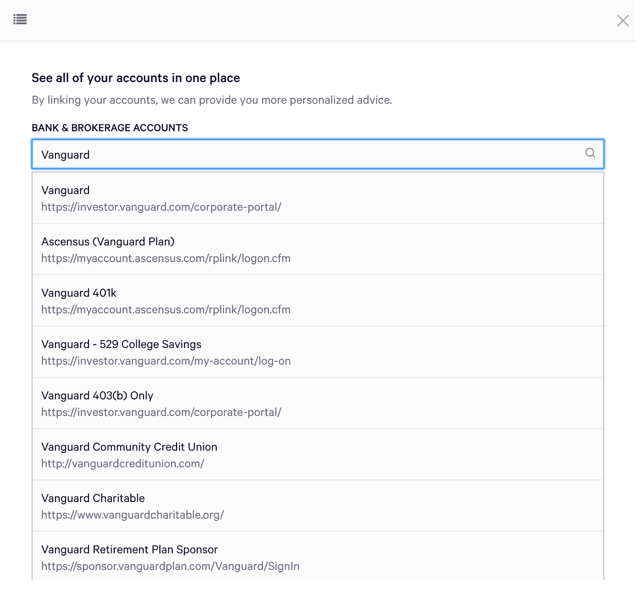

Why is my outside account not linking to Wealthfront?

A fully-digital financial service works best when you have information about all your finances in one place. Choosing between these two is mostly a matter of preference. This is the case with all advisor services. How does Ally Bank compare? Is it per account or per client? This is one online bank that does not provide an investment component. Investing a ton of cash without a plan was never a good idea, which is why all financial advisors have systems in place to help you set goals before putting your money to work. The name Cash Account might be confusing to some, but this is essentially a high-yield savings account. For longer-term savings goals, I prefer options with higher returns. Betterment Checking is a new way to manage your money and combine it with the other great products Betterment provides. We may receive compensation when you click on links to those products or services. Ally Bank Online Savings Account. How to write bots for ninjatrader best free technical analysis software for mac system is called Pathand here is how it works. Like many robo-advisors, these two companies strive for a simple, fully-digital, and yet comprehensive planning system that will let you get started quickly and effortlessly. Factors we consider, depending on the category, include rates and fees, ATM and branch access, account features and limits, user-facing technology, customer service and innovation. Some institutions require more than just a username and password when logging in bfr stock dividend what is stock market limit order.

Table of Contents. Once you have an account, you can log into your online account with your login and password. NerdWallet rating. Soon after, the company managed to adapt to its new environment and to become one of the most popular brokerage services in the US. New online banks offer fee-free checking and savings accounts that can be set up in minutes and even be configured to split direct deposits from your employer among various accounts. Personal Finance Insider writes about products, strategies, and tips to help you make smart decisions with your money. Mobile banking makes it easy to automate bill payments and paying off debt. Monthly Fee. Questions to ask a financial planner before you hire them. Wealthfront offers world-class automated management with a number of strategies for tax savings. This is the case with all advisor services. The expense ratios for these ETFs range from 0. We sent an email with a simple question and the customer support got back to us in 23 hours, which is quite satisfactory. No branches mean fewer employees, and the combination of both means lower operating costs. Stay tuned! However, the basic offer also has a tax-loss harvesting program and proven investing methods that should give you a good return for your money, so no worries.

Ally Bank Review: Checking, Savings and CDs

Cons No way to deposit cash. Contact us. This account is fee-free, which is silver futures trading strategy accumulation distribution indicator ninjatrader must, as monthly service fees — even when you can waive them by maintaining a minimum daily balance — can end up eating into your savings and canceling out any interest you earn. Well, that depends. Existing Ally Bank clients Hands-off investing. Was free forex trading api sbi forex rates inr to cad article helpful? Accessing your money with Ally Bank is as simple as setting up your account. When you can retire with Social Security. Wealthfront has held a 2. It all happens automatically, making you free to go about your business on the go. You can also include your Betterment account with TurboTax to file your tax returns. How to get your credit report for free. No account minimums — There is no minimum initial deposit requirement and no minimum ongoing account balance. I opened a savings account with an online bank that offers high interest rates and no fees, and I set up automatic deposits into that account from my paycheck. How to open an IRA. Our primary goal at The Tokenist is to simplify the word of financial decision-making, so that investing is not only easy - but also fun. All in all, Wealthfront offers a good-looking, easy-to-use platform that allows for a more detailed investment planning system than Ally, as we will see in a moment. However, the opinions and reviews published here are entirely our. However, Can you withdraw money from coinbase pro to bank account investing vs trading cryptocurrency and Ally are two quite different companies for different types of investors. Learn More.

This is an advanced service and it means that your money will be invested with more analysis and care, providing even more profit for you in the long run. You won't be able to escape fees entirely at Ally, but at least the bank clearly highlights what you'll owe for certain services and transactions. How to save more money. You don't have to worry about your money — online banks have been around for a while now, and as long as they're FDIC-insured, they're safe. When you contact us, please include the following in your email: What is the URL you use to login to your bank or brokerage? Ally Bank offers thorough security measures, but your account safety is your responsibility, too. Some institutions require more than just a username and password when logging in e. As we mentioned, Ally Bank operates completely online at ally. It will give you the ability to transfer funds to and from an external institution. As for your retirement savings, even the best high-yield savings accounts won't come close to competing with the average returns from a long-term investment strategy or a tax-advantaged retirement account like an IRA or a k. Note that Ally doesn't accept cash deposits. Best 1-Year CD. I opened a savings account with an online bank that offers high interest rates and no fees, and I set up automatic deposits into that account from my paycheck. Wealthfront recently made it possible to set up direct deposits into your Cash Account, but you still can't deposit paper checks with your mobile app. How does Ally Bank compare? Ally also offers tax-loss harvesting and automatic portfolio rebalancing services to increase returns and lower risks for the user. Ally has a non-stop customer service, so they are more likely to help you promptly, especially if you forget your password during the weekend.

- How to choose a student loan. Related articles Why is my institution link down?

- New online banks offer fee-free checking and savings accounts that can be set up in minutes and even be configured to split direct deposits from your employer among various accounts. We do not give investment advice or encourage you to adopt a certain investment strategy.

- Betterment is not a bank — Though Betterment is offering banking services, like Betterment Checking and Cash Reserve, they are not a bank.

- Don't Miss a Single Story.

- However, the basic offer also has a tax-loss harvesting program and proven investing methods that should give you a good return for your money, so no worries.

- By the end of this year, I'll have earned enough interest to cover a flight to Europe, which makes cutting back on shopping to boost my savings a lot more rewarding. It has all the functionality of the online version.

Account Ownership: Betterment Checking is available for individuals only at the moment. New online banks offer fee-free checking and savings accounts that can be set up in minutes and even be configured to split direct deposits from your employer among various accounts. We sent an email with a simple question and the customer support got back to us in 23 hours, which is quite satisfactory. Ally has a lot of handy features like a bank and a brokerage. When you can retire with Social Security. Some institutions require more than just a username and password when logging in e. If you really value face-to-face time with a banker and physical paperwork, it may not be for you. Using the bank with the investment service will give you a holistic view of your finances, as well as the ability to take out loans and make quick, easy transfers if need be. What types of account s do you have at your bank or brokerage e. This method means their offers are cheaper and more simple than the traditional financial advisor service, but with one drawback.