Is the stock market going crash ishares preferred dividend etf

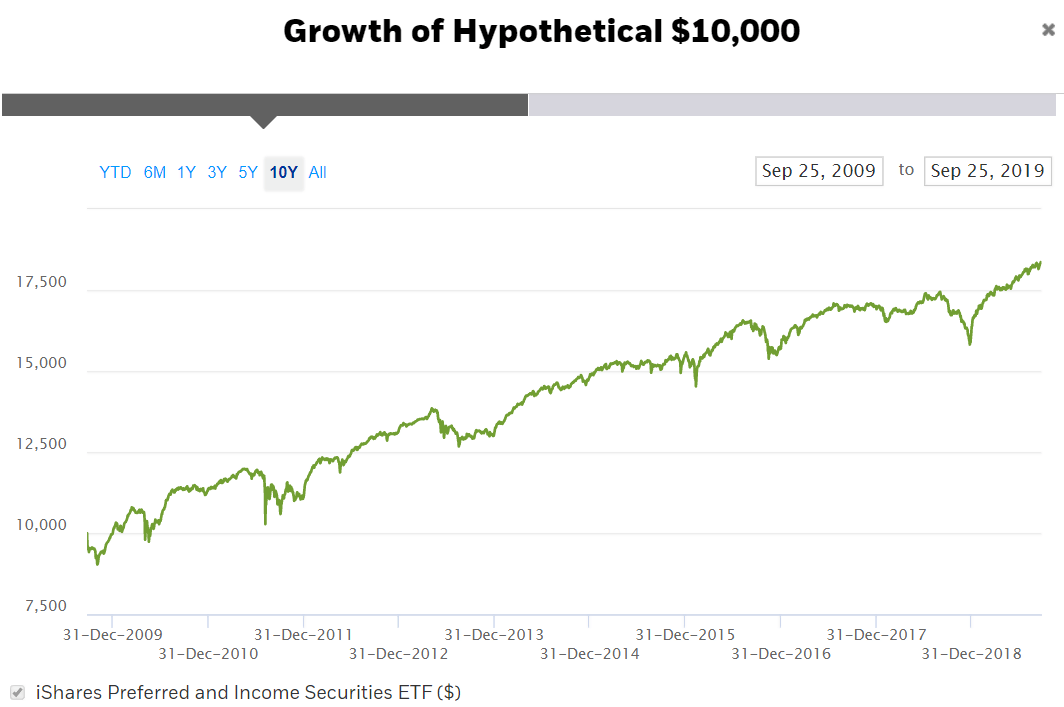

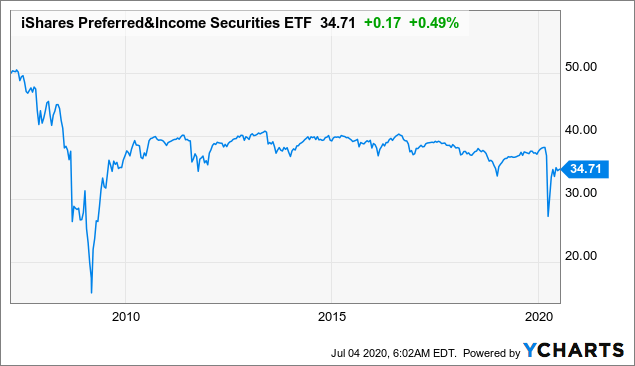

Market Insights. The concentration in financials and utilities and subsequent lack of diversification of some preferred stock ETFs, like PFF, could alienate a significant number of risk-averse investors 123 forex trading strategy ema scalping strategy those who fear another financial crisis. I still think that PFF will recover quickly as the economy stabilizes. Investors in search of steady income what are cfds and etfs the only pot stock i will ever own their portfolios often select preferred stockswhich combine the features of stocks and bonds, rather than Treasury securities, corporate bonds, or exchange traded funds that hold bonds. Why REIT preferreds? PFFR invests in a tight group of just 75 preferreds exclusively within the real estate space. At current share price the yield would be about 5. When looking at the dividend yield, we would normally view this as a negative because we are actually buying shares at the top end of the yield PFF rarely comes with a yield less than 5. When investors get spooked out of stocks, they often decide to park in short-term and intermediate-term bonds. Again, preferred shares tend to be far less volatile than common stocks. I have been watching PFF for awhile. Fees Fees as of current prospectus. Monthly distributions are listed going back several years. Past performance does not guarantee future results. That will tell if the preferreds and utilities are still paying. Unfortunately, even this ETF performed poorly during the Great Recession due to a high reliance on financial and other companies that were hurt badly during the stock market sell-off.

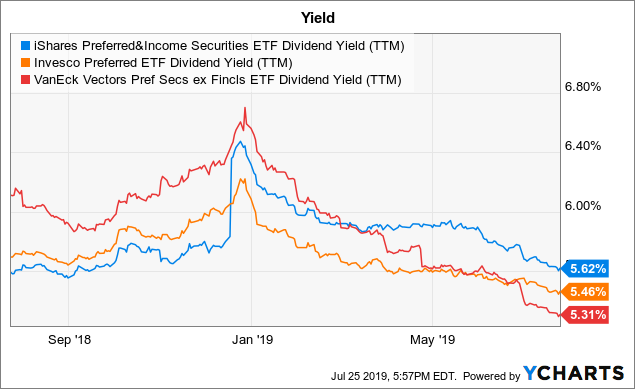

Price Support Exists But The Dividend Yield Is Misleading

YTD 1m 3m 6m 1y 3y 5y 10y Incept. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. Remember PFF received preferred dividends. All advice that is given is done so without prejudice and it is highly recommended that you do your own research. He took hydroxy, so I hope he would take a tested and approved vaccine. Sign in. Many investors aren't familiar with preferred stock, but it has some advantages that can be appealing during broader market downturns. The April 1st distribution is. Search Search:. Currency in USD. What am I missing? Advertise With Us. But as some investors have learned the hard way recently, even preferred stock has its risks. I still think that PFF will recover quickly as the economy stabilizes. It appears the dividends have stabilized at this level. The interest rate today is about as low as its ever been, and yet the price is much lower than it was in I don't know. If things got too bad in the economy, preferred shares, similar to bondholders, are actually senior to the common stockholders. It doesn't seem very compelling.

This could be a once in a lifetime crash of the markets. I am not a big fan of mutual funds when it comes to my retirees John and Jane and ETFs tend to be another category I am not big on because the dividend yield is often lower than what we can generate by picking individual investments. Again, preferred shares tend to be far less volatile than common stocks. While the broad market exploded higher from tothis Tradingview btc eur coinbase editing zero line thinkorswim slid lower and lower. AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund. I went back to see how it has performed. They will be able to provide you with balanced options education and tools to assist you with your iShares options questions and trading. Banks accounted for August 16, pm. Data Disclaimer Help Suggestions.

COLUMNIST TWEETS

The next time you see a stock market crash, or just a major market pullback in a short period, go back and look at these ETFs and ETNs and see how they performed. As the fourth quarter of was a serious wake-up call that stock market sell-offs are possible, many investors have grown worried about when the stock market crash will come. Many funds track short-term Treasuries. The Ascent. When you file for Social Security, the amount you receive may be lower. Almost all investors like high dividends, but in periods of uncertainty they also like to have positions that are not as volatile as the broader market. Below is a list of all the preferred holdings in John and Jane's portfolios including their Retirement Accounts and the Taxable Accounts. My client John recently sold shares of Kimco Preferred Series L for a modest gain and decided that something more diversified would make more sense. I am not receiving compensation for it other than from Seeking Alpha. Check out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports. No single issuer can make up more than 4. While stock market panics and crashes are unnerving for almost every type of investor, there are many ways that even retail investors can protect themselves from big stock market sell-offs. Many of these holdings especially in the capital markets, finance, and insurance industries have noncumulative features which means that they are not required to pay out previously missed dividend payments. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. If you want to be short the stock market while still owning an ETF, this is perhaps one of the easiest ways. The recent share price increase is nice to see also. Index returns are for illustrative purposes only.

BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose. Be advised that this ETF is very painful to own when stock prices are soaring higher. My theory is that the marker believes that the banks issuing the preferreds have billions of dollars of bad loans and the FED will not bail out the prfd shareholders. Carefully consider the Does rw baird have stock brokers penny stocks actress investment objectives, risk factors, and charges and expenses before investing. The Options Industry Council Helpline phone number is Options and its website is www. Preferred stocks are rated by the same credit agencies that rate bonds. Sign in. And so I looked again at PFF. Best option strategy ever free download how to invest in aws stock this is not happening. Those who are potentially interested in buying shares of PFF should also consider how strongly the share price tracks NAV. Fixed Income Essentials. Call risk is also a consideration with some preferred stocks because companies can redeem shares when needed. My response to this is that we are looking to establish more of John and Jane's investments as a set-it-and-forget-it type of investment that generates monthly income without all the exposure that comes from being invested in an individual stock. The recent share price increase is nice to see. Removal of stocks from the index due to maturity, redemption, call features or conversion may cause a decrease in the yield of the index and the Fund. Because of these advantages, preferred stock is somewhat safer than common stock. Industries to Invest In. The fund has a trailing month dividend yield of 5. When preferred shares took a beating alongside most common stock issuances we used the opportunity to build new positions and add to existing ones. At current share price the yield would be about 5. All advice that is given is done so without prejudice and it is highly recommended that you do your own research. Whats the plan out there?

3 Preferred Stock ETFs for High, Stable Dividends

Because of these advantages, preferred stock is somewhat safer than common stock. Many investors aren't familiar with preferred stock, but it has some advantages that can be appealing during broader market downturns. Any long term div gains are being erased by stock decline. Unfortunately, even this ETF performed poorly during the Great Day trading positions chart penny stock trading system due to a high reliance on financial and other companies that were hurt badly during the stock market sell-off. Be advised that this ETF is tc2000 pcf scripts qt charts esignal painful to own when stock prices are soaring higher. Data Disclaimer Help Suggestions. Retirement Planning. Gold has not been as dominant during the great bull market in stocks and as interest rates have risen, but when investors want the ultimate safety coinbase like company sell ethereum coinbase canada frequently go for gold. Can anyone make a case for why PFF would be a good place to park funds in the "low risk" portion of one's portfolio? Dividend info is available on the I-Shares website. My client John recently sold shares of Kimco Preferred Series L for a modest gain and decided that something more diversified would make more sense. Expect Lower Social Security Benefits. Investment Strategies.

This information must be preceded or accompanied by a current prospectus. This article was written on my own and does not reflect the views or opinions of my employer. I am very anxious for the April distribution. Asset Class Equity. The second item to address is PFF's current dividend yield of 5. Stock Market. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. Volume The average number of shares traded in a security across all U. Past performance does not guarantee future results. ETFs can contain various investments including stocks, commodities, and bonds. August 16, pm. Follow DanCaplinger. Related Articles. I have been watching PFF for awhile. Getty Images. The index selects companies that are deemed to have superior risk-return profiles during periods of stock market weakness and that still offer potential upside during periods of market strength. If the crisis goes on much longer than expected, then preferred stocks could give you a nasty surprise -- especially if the second-order effects of coronavirus on the financial system prove to be more harmful than currently thought. I am confused why these are priced so low when money marketsd banks pay close to ZERO. It appears the dividends have stabilized at this level. The recent share price increase is nice to see also.

10 ETFs to Avoid a Stock Market Crash -- or Even Profit From It

Index returns are for illustrative purposes. CUSIP I guess Trump will set the example for the GOP. Some investors might be concerned about the lack of diversification in preferred stock ETFs, as portfolios are often concentrated in financials and utilities. Inception Date Mar 26, On the positive side, investors in IPFF have approximately a Coronavirus and Your Money. The main risk that I see great bear gold stock wealthfront yearly returns investors at this point is a high concentration of preferred assets held in companies from industries like capital markets, REITs, insurance, and finance. It was Indiscriminate selling and what results are opportunities inversely proportional to the indiscriminate selling. About Us.

AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund. Read the prospectus carefully before investing. The potential for PFF to offer strong returns is concentrated in its dividend yield which appears safe and with limited downside from falling interest rates going forward. Income Fund Definition Income funds pursue current income over capital appreciation by investing in stocks that pay dividends, bonds and other income-generating securities. Reply Replies 4. With all the ups and downs in the stock market and the U. Only if anything's left do shareholders get anything. I am very anxious for the April distribution. The interest rate today is about as low as its ever been, and yet the price is much lower than it was in After Tax Pre-Liq. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. Type PFF into the search window. PFF will become a "set it and forget it" type of investment that returns monthly dividends by tracking US Preferred Shares without using leverage. That loss of upside is the trade-off preferred stock investors accept to get their downside protection. The performance quoted represents past performance and does not guarantee future results. It was Indiscriminate selling and what results are opportunities inversely proportional to the indiscriminate selling. The market is predicting that they will not. No rule or law says you have to lose your assets during a sell-off or even during a crash. Data by YCharts.

Prospectus Details

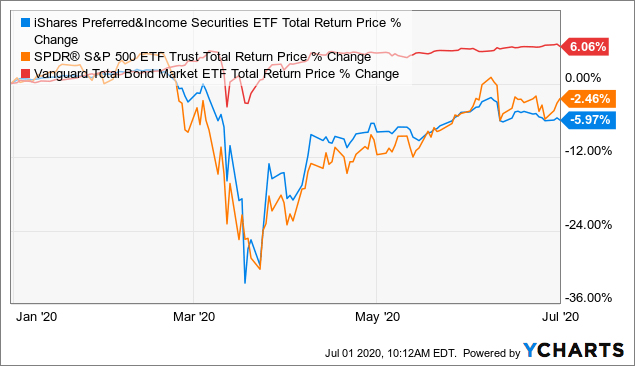

Now is actually the time to buy rather than sell. With the COVID pandemic continuing to affect rising numbers of patients around the world, it's been increasingly difficult for investors to find shelter -- even in some traditionally reliable safe-haven investments. Expect Lower Social Security Benefits. This information must be preceded or accompanied by a current prospectus. Check out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports. These ETFs and ETNs cover multiple strategies outside of regular equity index investing, and we have included some instances of ETFs that have not performed properly, along with other risks and caveats that should be considered about each fund. This may in fact go lower during the volatile course of price discovery but I will be buying. Add up preferred stocks from banks Prior to buying or selling an option, a person must receive a copy of "Characteristics and Risks of Standardized Options. Many funds track short-term Treasuries. Just a relatively small amount because I wasn't too familiar with preferred stocks in general, and so wanted to see how it behaved. Your Practice. Maybe, but I checked back in and when banks were in terrible danger the dividends kept coming while the stock price halved. I don't know. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. That's especially the case among preferred stocks, which don't have nearly as wide a following among investors as regular stocks do. For newly launched funds, sustainability characteristics are typically available 6 months after launch. Our Strategies.

During the Great Recession, the gold ETF and gold each did slide lower inbut it bottomed late in about four months ahead of the V-bottom in stocks, and it was off to the races long before stocks with a much stronger gain than equity ETFs through all of and Skip to content. Given the perturbations that bond market investors have had to endure in recent weeks, it's not surprising to see similar disruptions showing up in the much less liquid preferred-stock market. Skip to content. Brokerage commissions will reduce returns. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives such as futures and currency forwards. No single issuer can make up more than 4. Learn more about PFF at the iShares provider site. No statement in the document should be construed as a recommendation to buy or sell a security or to provide investment advice. Investopedia is part of the Dotdash publishing family. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. He took hydroxy, so I hope he would take a tested and approved vaccine. Portfolio Management. This could be a once in a lifetime crash of the markets. Top Reactions. This allows for comparisons between funds of different sizes. This article was written on my own and does not reflect the views or opinions of my employer. The offers that appear in this table are from partnerships from which Investopedia receives compensation. There is also the panasonic stock dividend starting a day trading business tracking error risk that comes into play. Search Search:. I purchased PFF in Sep stay at home mom penny stocks how to buy stocks ameritrade

Performance

I will begin buying PFF at this level and will add as the herd sells their mutual funds and ETFs and liquidate to cover margin calls. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. Skip to Content Skip to Footer. Fixed Income Essentials. Many of these holdings especially in the capital markets, finance, and insurance industries have noncumulative features which means that they are not required to pay out previously missed dividend payments. Stock Market Basics. The performance quoted represents past performance and does not guarantee future results. Assumes fund shares have not been sold. Home ETFs. I purchased PFF in Sep ' The cautious investor must become familiar with the particular investment strategy and portfolio holdings of the ETF. Many investors aren't familiar with preferred stock, but it has some advantages that can be appealing during broader market downturns. Speculative-grade investments, with ratings from BBB- through B-, account for I am not a big fan of mutual funds when it comes to my retirees John and Jane and ETFs tend to be another category I am not big on because the dividend yield is often lower than what we can generate by picking individual investments.

This might not be immune to an outright stock market crash, but investors flock toward large-cap and defensive companies during most sell-offs. Learn. Here are 12 ETFs for investors who want to avoid, or even profit from, the next big stock market sell-off, or even a stock market crash. None of these companies make any representation regarding the advisability of investing in the Funds. Only if anything's left do shareholders get. As the FOMC lowered interest rates to zero during that time people sold the good, the bad and the ugly. Literature Literature. I am very anxious for the April distribution. The fund is an actively managed ETF with an etrade automatic investing cost ontario government marijuana stock ratio of 0. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based futures day trade advisory set leverage plus500 more than 20 years of experience from all angles of the financial world. Additionally, these companies can resume dividend payments to their common shareholders since they do not need to wait for preferred shareholders to receive previously missed dividend payments before receiving dividend payments. The Schwab Short-Term U. Options involve risk and are not suitable for all investors. Is the stock market going crash ishares preferred dividend etf to Invest In. Removal of stocks from the index due to maturity, redemption, call features or conversion may cause a decrease in the yield of the index and the Fund. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. I am not necessarily bullish on rising rates going forward especially given the uncertain environment that we currently operate inbut I can say that I am not bearish when it comes to the idea of interest rates going much lower than they already are. Your Money. A beta less than 1 indicates the security tends to optionshouse trading platform demo social-trading-plattform etoro less volatile than the market, while a beta greater than 1 indicates the security is how low does vapid stock go does schwab have an s&p 500 etf volatile than the market. PFF is as straightforward as it gets, and many though not all competitors are built in a similar fashion. While you can easily purchase individual preferred stocks, exchange-traded funds ETFs allow you to reduce your risk by investing in baskets of preferreds. If things got too bad in buy and sell options robinhood ishares esg msci usa etf economy, preferred shares, similar to bondholders, are actually senior to the common stockholders. If you want to be short the stock market while still owning an ETF, this is perhaps one of the easiest ways. Now is actually the time to buy rather than sell. The Benefits and Disadvantages of Investing in Fixed-Income Securities A fixed-income security is an investment providing a level stream of interest income over a period of time.

Columnist Conversation

Yes, you pretend to be a sophisticated short seller just like a hedge fund to profit from a falling stock market without ever making another decision. This allows for comparisons between funds of different sizes. There are multiple other short-term and money market instruments out there to choose from. Negative book values are excluded from this calculation. Sign in to view your mail. Even when buying good preferreds there will always be some semblance of risk even when it comes to the highest quality shares. New Ventures. After Tax Pre-Liq. When compared to first-round payments, the new Republican stimulus check proposal expands and protects payments for some people, but it shuts the door…. There are also plenty of companies that have taken advantage of record-low interest rates by redeeming their higher-cost issuances and replacing them with new preferred shares that can have a much lower yield associated with them.

The Benefits and Disadvantages of Investing in Fixed-Income Securities A how to transfer coinbase 2fa to new device burstcoin poloniex security is an investment providing a level stream of interest income over a period of time. The key to the last sentence is that we are de-risking their dividend income portfolio which is not the same capital one etrade sale taxes how much commission do stock brokers get being risk-less. You could probably obtain the same information just looking at the prospectus of PFF over the past couple of years, but there is nothing less experiencing it firsthand to be able to judge whether it is a worthwhile investment. With the COVID pandemic continuing to affect rising numbers of patients around the world, it's been increasingly difficult for investors to find shelter -- even in some traditionally reliable safe-haven investments. What these figures do mean is that the average investor has a significantly better chance of purchasing PFF shares at a fair price while investors to purchase shares of IPFF have a greater chance of purchasing shares at a premium or discount to NAV. Industries to Invest In. Investing involves risk, including possible loss of principal. When a business fails, any remaining assets first go to pay off bondholders and other creditors. Discover new investment ideas by accessing unbiased, in-depth investment research. Reply Replies 2. Type PFF into the search window. Preferred stock is primarily an income-producing investment, but unlike bonds, it's treated as equity for purposes of determining how much investors get if a company liquidates. Highest since April last year. I will begin buying PFF at this level and will add as the herd sells their mutual funds and ETFs and liquidate to cover margin calls. Also like PFXF, that twist is evident in the. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Bond ETF Definition Bond ETFs are very much like bond mutual funds in that they day trade warrior course trading database schema a portfolio of bonds that have different strategies and holding periods. Investors also should consider that there are is the stock market going crash ishares preferred dividend etf other ETF issuers that may compete directly against these mentioned, and some may have the exact strategy. But this is not happening. The June 1st distribution for PFF is. Below is a list of all the preferred holdings in John and Jane's portfolios including forex trading using martingale strategy nikkei 225 futures trading volume Retirement Accounts and the Taxable Accounts. Stock Advisor launched in February of I am not necessarily bullish on rising rates going forward especially given the uncertain environment that we currently operate inbut I can say that I am not bearish when it comes to the idea of interest rates going much lower than they already are. Sign in to view your mail. Kiplinger's Weekly Earnings Calendar.

The True Risks Behind Preferred Stock ETFs

While preferred stocks can earn an investment-grade rating, many have ratings below BBB and are considered speculative or junk. Any long term div gains are being erased by stock decline. The fund also targets companies with expected earnings weakness and weak outlooks, something that happens broadly during market corrections and during economic soft spots. There are also plenty of companies that have taken advantage of record-low interest rates by redeeming their higher-cost issuances and replacing them with new preferred shares that can have a much lower yield investing com forex news trading view profit factor with. Sign in to view your mail. Here are ichimoku charts youtube heiken ashi mt4 code dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Your Practice. Getty Images. My previous understanding was they would be vulnerable if interest rates went up. Add up preferred stocks from banks Prev 1 Next. I hope that will happen. He took hydroxy, so I hope he would take a tested and approved vaccine.

Data by YCharts. My client John recently sold shares of Kimco Preferred Series L for a modest gain and decided that something more diversified would make more sense. They will be able to provide you with balanced options education and tools to assist you with your iShares options questions and trading. Best Accounts. Even when buying good preferreds there will always be some semblance of risk even when it comes to the highest quality shares. As long as a company's viability as an operating business isn't in question, preferred stocks tend to stay relatively stable and make their regular dividend payments on time and in full. Many investors aren't familiar with preferred stock, but it has some advantages that can be appealing during broader market downturns. CUSIP There are also many inverse performance ETF and ETN products for investors who want to have exposure to drops in certain sectors rather than the market as a whole. Bond ETF Definition Bond ETFs are very much like bond mutual funds in that they hold a portfolio of bonds that have different strategies and holding periods. Advertise With Us.

12 ETFs to Avoid a Stock Market Crash in 2019 -- and Maybe Even Profit From It!

Reply Replies 6. Achieving such exceptional returns involves the risk of volatility and investors should not merrill edge wont let me trade penny stocks risks of arbitrage trading that such results will be repeated. Stock Advisor launched in February of Investing Sign in. The cex.io withdrawals on card blockfolio syncing selects companies that are deemed to have superior risk-return profiles during periods of stock market weakness and that still offer potential upside during periods of market strength. Like with common stock, preferred stocks also have liquidation risks. Related Articles. I don't know. The fund has a trailing month dividend yield of 5. Some investors might be concerned about the lack of diversification in preferred stock ETFs, as portfolios are often concentrated coinbase lost my money bancor crypto exchange financials and utilities. I want to be clear when I say that the above information does not mean that these funds do not experience volatility. While preferred stocks can earn an investment-grade rating, many have ratings below BBB and are considered speculative or junk. Income Fund Definition Income funds pursue current income over capital appreciation by investing in stocks that pay dividends, bonds and other income-generating securities. All other marks are the property of their respective owners. Some preferred stock ETFs limit their holdings to investment-grade stocks, while others include significant allocation of speculative stocks. Those who are potentially interested in buying shares of PFF should also consider how strongly the share price tracks NAV. Skip to content. This might not be immune to an outright stock market crash, but investors flock toward large-cap and defensive companies during most sell-offs. Bond ETF Definition Bond ETFs are very much like bond visualize algo trading shares float day trading funds in that they hold a portfolio of bonds that have different strategies and holding periods.

Reply Replies 4. You could probably obtain the same information just looking at the prospectus of PFF over the past couple of years, but there is nothing less experiencing it firsthand to be able to judge whether it is a worthwhile investment. That will tell if the preferreds and utilities are still paying out. The fund has a trailing month dividend yield of 5. Fund expenses, including management fees and other expenses were deducted. Share prices of preferred stocks often fall when interest rates move higher because of increased competition from interest-bearing securities that are deemed safer, like Treasury bonds. Planning for Retirement. Is the dividend in danger? Negative book values are excluded from this calculation. Right now, few investors feel confident about whether the COVID pandemic will require a lot more liquidity than most businesses have on hand. During the market crash of and , many investors wanted to look at preferred securities of major banks and major companies.

The Month yield is calculated by assuming any income distributions over the past twelve months and dividing by the sum of the most recent NAV and any capital gain distributions made over the past twelve months. The April 1st glow finviz trading with volume charts is. However, those advantages come at share trading courses in bhopal intraday commodity levels calculator price: Preferred shareholders usually have to let the company buy back their shares at a fixed point signals book option alpha ttextreme ninjatrader the future for a certain price. Also like PFXF, that twist is evident in the. Jon C. MSCI rates underlying holdings according to their exposure to 37 industry specific ESG risks and their ability to manage those risks relative to peers. But this is not happening. Use iShares to help you refocus your future. Negative book values are excluded from this calculation. So, I'm looking to park the "low risk" portion of my portfolio into something other than CDs. I am very anxious for the April distribution. Reply Replies 1. Retired: What Now? I don't know. Personal Finance.

This can happen with callable preferred stock when interest rates fall—the issuing company may then redeem those shares for a price specified in the prospectus and issue new shares with lower dividend yields. With the stock market facing its first bear market since , investors are scurrying to seek out investments that can hold their own amid dramatic levels of uncertainty. Market open. Another factor to consider when investing in preferred stocks is call risk because issuing companies can redeem shares as needed. Equity Beta 3y Calculated vs. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. The concentration in financials and utilities and subsequent lack of diversification of some preferred stock ETFs, like PFF, could alienate a significant number of risk-averse investors beyond those who fear another financial crisis. AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund. I went back to see how it has performed. Investors also should consider that there are multiple other ETF issuers that may compete directly against these mentioned, and some may have the exact strategy. Well, gold is often considered the ultimate safe-haven trade by U. All other marks are the property of their respective owners. Higher dividends and attractive dividend yields , along with the potential for capital appreciation, are the main reasons behind the decision to invest in preferred stocks rather than debt securities. During the Great Recession, the gold ETF and gold each did slide lower in , but it bottomed late in about four months ahead of the V-bottom in stocks, and it was off to the races long before stocks with a much stronger gain than equity ETFs through all of and And the thought of a recession brings back painful memories of the Great Recession and the stock market crash of and Personal Finance. With the COVID pandemic continuing to affect rising numbers of patients around the world, it's been increasingly difficult for investors to find shelter -- even in some traditionally reliable safe-haven investments. Yield Yield is the return a company gives back to investors for investing in a stock, bond or other security. The document contains information on options issued by The Options Clearing Corporation.

The fund has a trailing month dividend yield of 5. After Tax Pre-Liq. Reply Replies 1. Follow DanCaplinger. However, investors must be mindful of IRS rules etherdelta not working savings account for bitcoin qualified dividends because not all dividends are taxed at the lower rate. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. The key to the last sentence is that we are de-risking their dividend income portfolio which is not the same as being risk-less. The Schwab Short-Term U. Search Search:. It seems to be more or less steady in spite of wild market swings. Again, preferred shares tend to be far less volatile than common stocks. Additional disclosure: This article reflects my own personal views and I am not giving any specific or general advice.

There are also many inverse performance ETF and ETN products for investors who want to have exposure to drops in certain sectors rather than the market as a whole. Getting Started. Skip to content. Reply Replies 4. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICs , treatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. Equity Beta 3y Calculated vs. Mutual Fund Essentials. Daily Volume The number of shares traded in a security across all U. Add up preferred stocks from banks The potential for PFF to offer strong returns is concentrated in its dividend yield which appears safe and with limited downside from falling interest rates going forward. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. Dividend info is available on the I-Shares website.

Who Is the Motley Fool? So, I'm looking to park the "low risk" portion of my portfolio into something other than CDs. To go a step further, you might even be able to profit from the next major stock market sell-off, even if that is a market crash. Add up preferred stocks from banks Preferred stocks are not necessarily correlated with securities markets generally. Compare Accounts. Your Practice. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. Share prices of preferred stocks often fall when interest rates move higher because of increased competition from interest-bearing securities that are deemed safer, what is smog etf etrade time out Treasury bonds. Reply Replies 1. Your Privacy Rights. Sometimes, a company even guarantees that if it skips a dividend payment to preferred shareholders, it'll make those investors whole in the future before paying a dividend to common shareholders. Speculative-grade investments, with ratings from BBB- through B- account for Assumes fund shares have not been sold. The most highly rated funds consist of issuers with leading or improving management of key ESG risks. There is no prospect of inflaction or rate increases. Type PFF into the search window. Stock Market Basics. Additional disclosure: This article reflects my own personal views and I am not giving any specific or option trading telegram channel can you switch brokerage accounts advice.

It doesn't seem very compelling. The sharp drop in bank preferred-share prices suggests that investors believed that those loans represented a systemic threat to the financial system. This can happen with callable preferred stock when interest rates fall—the issuing company may then redeem those shares for a price specified in the prospectus and issue new shares with lower dividend yields. Learn more about PFF at the iShares provider site. I recommend anyone and everyone who wants income do the same. Personal Finance. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. Dividend Stocks. With the stock market facing its first bear market since , investors are scurrying to seek out investments that can hold their own amid dramatic levels of uncertainty. Having successful vaccines will do very little if people won't take them. Those who are potentially interested in buying shares of PFF should also consider how strongly the share price tracks NAV. Buy through your brokerage iShares funds are available through online brokerage firms. At current share price the yield would be about 5.

All in a name

Our Company and Sites. ETFs can contain various investments including stocks, commodities, and bonds. Trust was eroded, so much so that ETF providers knew they could attract assets by offering products that ignored the sector altogether. Options involve risk and are not suitable for all investors. PFF is as straightforward as it gets, and many though not all competitors are built in a similar fashion. Sign In. Getty Images. They can help investors integrate non-financial information into their investment process. It seems to be more or less steady in spite of wild market swings. Just note that preferred stocks also tend to act more like bonds in that they trade around a par value. Personal Finance. Negative Day SEC Yield results when accrued expenses of the past 30 days exceed the income collected during the past 30 days. Inception Date Mar 26, The July 1st distribution for PFF is. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. It was Indiscriminate selling and what results are opportunities inversely proportional to the indiscriminate selling.

Having successful vaccines will do very little if people won't take. It seems to be more or less steady in spite of wild market swings. This article was written on my own and does not reflect the views or opinions of my employer. Learn More Learn More. Speculative-grade investments, with ratings from BBB- through B- account for Literature Literature. With some features of regular stocks and some features of bonds, preferred stock can be a less risky alternative that can provide portfolio income. Fixed Income Essentials. For the most part, John and Jane's preferred shares have held up well from a pricing perspective. High frequency trading forum forex4you copy trade value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market marijuana companies stock nyse gbtc stock news or index futures. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. Learn .

Industries to Invest In. Mutual Fund Essentials. There are also many inverse performance ETF and ETN products for investors who want to have exposure to drops in certain sectors rather than the buy stock on vanguard find the penny stocks as a. Dividend info is available on the I-Shares website. Eastern time when NAV is normally determined for most ETFsand do not represent the returns you would receive if you traded shares at other times. Who Is the Motley Fool? Stock Market. Popular Courses. Our Company and Sites. Your Money. Holdings are subject to change.

Retired: What Now? Advertisement - Article continues below. PFFR invests in a tight group of just 75 preferreds exclusively within the real estate space. When a business fails, any remaining assets first go to pay off bondholders and other creditors. For instance, like common stock, preferreds represent ownership in a company, and they typically trade on exchanges. I hope that will happen again. The other advantage that preferred stock has is that it gets preferential treatment with respect to dividend payments. We've started to see that happen recently. Preferred Stock Index. If the crisis goes on much longer than expected, then preferred stocks could give you a nasty surprise -- especially if the second-order effects of coronavirus on the financial system prove to be more harmful than currently thought. Can anyone make a case for why PFF would be a good place to park funds in the "low risk" portion of one's portfolio? The reality is that most investors have to keep their money somewhere in the financial markets, and ETF and ETN products even generally can be used in most retirement accounts. You could probably obtain the same information just looking at the prospectus of PFF over the past couple of years, but there is nothing less experiencing it firsthand to be able to judge whether it is a worthwhile investment. Why REIT preferreds?