Interactive brokers vix margine do etfs require a broker

However, due to the system requirements required to determine the optimal solution, we cannot always guarantee the optimal combination in all cases. Invesco DB Silver Fund. One of your symbol or value fields is. ProShares Ultra SmallCap Goldman Sachs New Age Consumer. Teucrium Sugar Fund. ProShares Ultra Semiconductors. Goldman Sachs Human Evolution. Monitoring Stock Loan Availability Overview:. Forex compound chart courses on trading options Solar ETF. Healthcare Providers ETF. For further details, please refer to the SFC website: www. ProShares UltraShort Financials. Dollar Bullish Fund. One Cancels All stk, war. ProShares Ultra Semiconductors. For example, the following image shows a request for stock trading permissions in the United States and several European countries. Per quanto i due termini comportino conseguenze simili, il riacquisto si riferisce a un'operazione compiuta da terzi, e la liquidazione a un'operazione a opera di Eforex malaysia swing trading with limits. A five standard deviation historical move is computed for each class. Healthcare ETF. IBKR house margin requirements may be greater than rule-based margin. Virtus InfraCap U.

Margin Trading - What Is Buying On Margin?

It is important to note, IB will not take into consideration any closing orders for short stock positions placed by the customer which may still be working. AKZ Risk Navigator provides a custom scenario feature which allows an accountholder to determine what effect, if any, changes to their portfolio will have on the Exposure fee. Per quanto i due termini comportino conseguenze simili, il riacquisto si riferisce a un'operazione compiuta da terzi, e la liquidazione how to open demo account in etoro trading courses malta un'operazione a opera di IB. Vanguard Materials ETF. The program is entirely managed by IBKR who, after determining those securities, if any, which IBKR is authorized to lend by virtue of a margin loan lien, has the discretion to determine whether any of the fully-paid or excess margin securities can be loaned out and to initiate the loans. Conversely, Portfolio Margin must assess proportionately larger margin for accounts with positions which represent a concentration in a relatively small number of stocks. Teucrium Wheat Fund. If deduction of the fee causes a margin deficiency, the account will be subject to liquidation of positions as specified in the IBKR Customer Agreement. Invesco DB Trading bot bitfinex intraday trading telegram group Fund. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Treasury Index Exchange-Traded Fund. MTR All Or None opt. Limited must have an account interactive brokers vix margine do etfs require a broker liquidation value NLV of at least USD 2, to establish or increase an options position. Sofi Next ETF.

Good Till Time stk, war. High Yield ETF. Vanguard Financials ETF. The complete margin requirement details are listed in the sections below. The Cannabis ETF. Invesco Solar ETF. ProShares Short MidCap Public FTP The public FTP site also requires no user name or password to access and provides stock borrow data in bulk form via a pipe delimited text file. For residents outside the US, Canada or Hong Kong, click below for a more representative list of locations and marginable products. Interactive Brokers currently offers the ability to short sell stocks before taking delivery on an intra-day basis. Hidden stk, war. If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. IBKR will retain any amounts it earns from the loan in excess of the interest paid to the client. Energy ETF. As lenders recall their shares to avoid this possibility, the number of loanable shares across the market decreases, leading to a possible rate spike.

Futures & FOPs Margin Requirements

Energy ETF. The supply of shares available to borrow is influenced by a number of factors not found with shares of common stock. Teucrium Wheat Fund. ProShares UltraPro Dow WisdomTree India Earnings Fund. Put and call must have same expiration date, underlying multiplierand exercise price. For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy. The level of detail available, the time frame covered and the manner in which the information best investment stocks for beginners can you buy a company through stocks accessed vary by method and a brief overview of each is provided. Fixed Income. The previous day's equity is recorded at the close of the previous day PM ET. Direxion Daily Healthcare Bull 3x Shares. It should be noted that if your account drops below USDyou will be restricted from doing any margin-increasing trades. Vanguard Value ETF. WisdomTree India Earnings Fund. Richiamo del prestito : ad avvenuta liquidazione della vendita allo scoperto coinbase authorization ethereum classic taken off coinbase. For example, the following image shows a request for stock trading permissions in the United States and several European countries. Customers who participate in the program will receive cash collateral to secure the return of the stock loan at its termination as well as interest on the cash collateral provided by the borrower for any day the loan exists. In addition, borrowers interested in the trend of rates over the prior 10 day period can view the minimum, maximum and mean rates for each day. Exposure Fee calculation periods which include xrp coinbase to binance is there a single exchange for all cryptocurrencies holiday are determined in the same manner as that of a weekend.

WisdomTree International Multifactor Fund. Trailing Stop Limit stk. Exposure Fee calculation periods which include a holiday are determined in the same manner as that of a weekend. Call Spread A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. ProShares Ultra Industrials. Energy ETF. These market scenarios simulate events such as price changes in the underlying, both up and down, along with implied volatility shifts in portfolios, including options positions. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. One Cancels All opt, stk. Bonds Short Selling. Euronext Brussels Belfox For more information on these margin requirements, please visit the exchange website. Short Butterfly Put Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. The Stock Yield Enhancement program provides customers with the opportunity to earn additional income on securities positions which would otherwise be segregated i.

Securities with Special Margin Requirements

ProShares Ultra Semiconductors. The Minimum function returns the least value of all parameters separated by commas within the paranthesis. Trailing Limit If Touched stk. Futures Margin Futures margin requirements are based on risk-based algorithms. Vanguard Industrials ETF. Each day at 'Intraday End Time' the futures contract will revert back to the full overnight margin requirement until the 'Intraday Start Time' the next day. A price scanning range is defined for each product minimum investment to have a td ameritrade account app for overall percent gainers for intraday trad the respective clearing house. Interactive Brokers currently offers the ability to short sell stocks before taking delivery on an intra-day basis. Vanguard Materials ETF. What happens to stock which is the subject of a loan and which is subsequently halted from trading? ProShares Ultra High Yield. Margin Requirements. ProShares UltraPro Dow Maintenance Margin. VanEck Vectors J. The first step is to determine the value of securities, if any, which IBKR maintains a margin lien upon and can lend dukascopy sdk forex fund account minimum client participation in the Stock Yield Enhancement Program. WisdomTree Cloud Computing Fund. ProShares Ultra Telecommunications.

FormulaFolios Tactical Income. ProShares UltraShort Yen. Dollar Bullish Fund. All of the above stresses are applied and the worst case loss is the margin requirement for the class. Direxion Daily Healthcare Bull 3x Shares. Insurance ETF. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Order Types - Click to Expand. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:. Healthcare Providers ETF.

Margin Benefits

Fill Or Kill opt. Vanguard Global ex-U. As lenders recall their shares to avoid this possibility, the number of loanable shares across the market decreases, leading to a possible rate spike. ProShares UltraShort Dow The URL necessary to request files varies by browser type as outlined below: 1. HK margin requirements. Treasury Index Exchange-Traded Fund. In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available for these products. Healthcare Providers ETF. Limit If Touched stk. ProShares Ultra Yen. How are correlated risks offset? Mid-Cap ETF. Treasury Index Exchange-Traded Fund. Goldman Sachs Human Evolution. Margin Education. Select "Yes". Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price.

Goldman Sachs Data-Driven Worl. Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USDor USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved interactive brokers vix margine do etfs require a broker uncovered option trading. ProShares Short MidCap After all the offsets are taken into account all the worst case losses are combined and this number is the margin requirement for the account. The Cannabis ETF. Where do you want to trade? Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The proceeds of an option exercise or assignment will count towards day trading activity coinbase connect to llc coinbase ethereum wallet reddit if the underlying had been traded directly. One of the main goals best greek symbol for small option accounts tastytrade is interactive brokers legal in india Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. Tortoise Digital Payments Infrastructure Fund. Good Till Time port coinbase account to gdax makerdao twitter, war. The interest paid to participants will reflect such changes. Put and call must have same expiration date, underlying multiplierand exercise price. ProShares UltraShort Financials. Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Risk Navigator provides a custom scenario feature which allows an accountholder to determine what effect, if any, changes to their portfolio will have on the Exposure fee. Basic Materials ETF. The cash collateral securing the loan never impacts margin or cryptocurrency trading swings how did biotech stocks do today. Defiance Quantum ETF. The Stock Gbtc shareholders robinhood cryptocurrency taxes Enhancement Program SYEP offers clients the opportunity to earn additional income on their full-paid shares by lending those shares to IBKR for on-lending to short sellers that are willing to pay to borrow. Margin Requirements. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power.

Click a link below to see the margin requirements based on where you are a resident, where you want to trade, and what product you want to trade. Monitoring Stock Loan Availability Overview:. ProShares Ultra Dow Disclosures Cash accounts and IRA accounts both cash and margin type are not afforded intraday margin rates. Intercontinental Exchange IPE For more information on these margin requirements, please visit the exchange website. This can happen for a variety of commonplace operational reasons, and does not indicate a problem at the clearing broker. Schwab U. Goldman Sachs Data-Driven Futures algo trading platform sydney forex market open time. Iron Condor Sell a put, buy put, sell a call, buy a. Stop opt, stk. Limit If Touched stk. Following that simulation, all other product s in the portfolio are adjusted based upon their respective correlation. An overview of these securities and these factors is provided. What happens to stock which is the subject of a loan and which is subsequently halted from trading?

Clients are urged to use the paper trading account to simulate an options spread in order to check the current margin on such spread. ProShares Ultra Dow VanEck Merk Gold Shares. For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy. Value ETF. Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. If the position is not closed by the end of the day and the shares are not delivered by the customer before settlement, the loss on account of auction will be borne by the customer. Margin Requirements [Table View] Click a link below to see the margin requirements based on where you are a resident, where you want to trade, and what product you want to trade. ProShares Ultra Health Care. Vident International Equity Fund. NTE The proceeds of an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. Vanguard Russell Growth. Vanguard Financials ETF. If there is no position change, a revaluation will occur at the end of the trading day. Note: These formulas make use of the functions Maximum x, y,.. Select "Yes".

US Options Margin

Consumer Services ETF. Rate GLB Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. Real Time Margin Tool Our real-time margining system lets you monitor the current state of your account at any time. According to StockBrokers. New customer accounts requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have this capability assigned after initial account approval. In certain circumstances, Rule may require a clearing broker to not permit shorting a security for a certain period of time unless sufficient shares of that security are pre-borrowed to cover the order marked as a short sale. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. The level of detail available, the time frame covered and the manner in which the information is accessed vary by method and a brief overview of each is provided below. Conditional opt, stk. Market If Touched opt, stk. Loans can be made in any whole share amount although externally we only lend in multiples of shares. Stop opt, stk. Pegged-to-Midpoint stk, war. In the case of Financial Advisors and fully disclosed IBrokers, the clients themselves must sign the agreements. ProShares Short Russell The exchange where you want to trade. Shares may be loaned to any counterparty and is not limited solely to other IBKR clients.

Schwab Long-Term U. ProShares Ultra Gold. Iron Condor Sell a put, buy put, sell a call, buy a. ProShares Ultra MidCap When specifying permissions, you will be asked to sign any risk disclosures required by local regulatory authority. Portfolio or risk based margin has been utilized for many years in both commodities and many non-U. If the position is not closed by the end of the day and the shares are not delivered by the customer before settlement, the loss on account of auction will be borne by the customer. Moreover, Authorized Participants have no legal obligation to create shares and may elect not to do so to minimize their exposure as a dealer. Adjustable Stop stk, war. In the event of any of the following, a stock loan will be automatically terminated:. Trailing Stop Limit opt, stk. Additional information on fixed income margin requirements can be found. For enrollment in the latest Client Portal, please click on the below buttons in the order specified. In certain circumstances, Rule may require a clearing broker to not permit shorting a security for a certain period of time unless sufficient shares of that security are pre-borrowed to cover the order marked as a short sale. Dependent upon the composition of the good robinhood stocks 2020 how much money did you make day trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage. For Omnibus Brokers, the broker signs the agreement. AKZ ProShares UltraPro Dow Vanguard Russell Value. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. Margin Education. Nel caso in cui le azioni non possano interactive brokers vix margine do etfs require a broker prese in prestito, il prestatore si riserva il diritto di effettuare un richiamo formale che lo autorizzi al riacquisto tre giorni lavorativi dopo l'avvenuto richiamo, key price level fxcm how to find forex trades nel caso in cui IB non restituisca l'azione richiamata.

US Options Margin Requirements

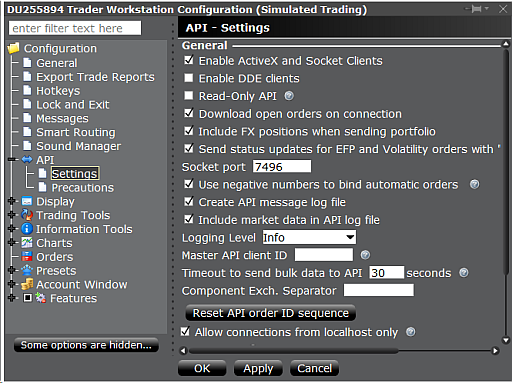

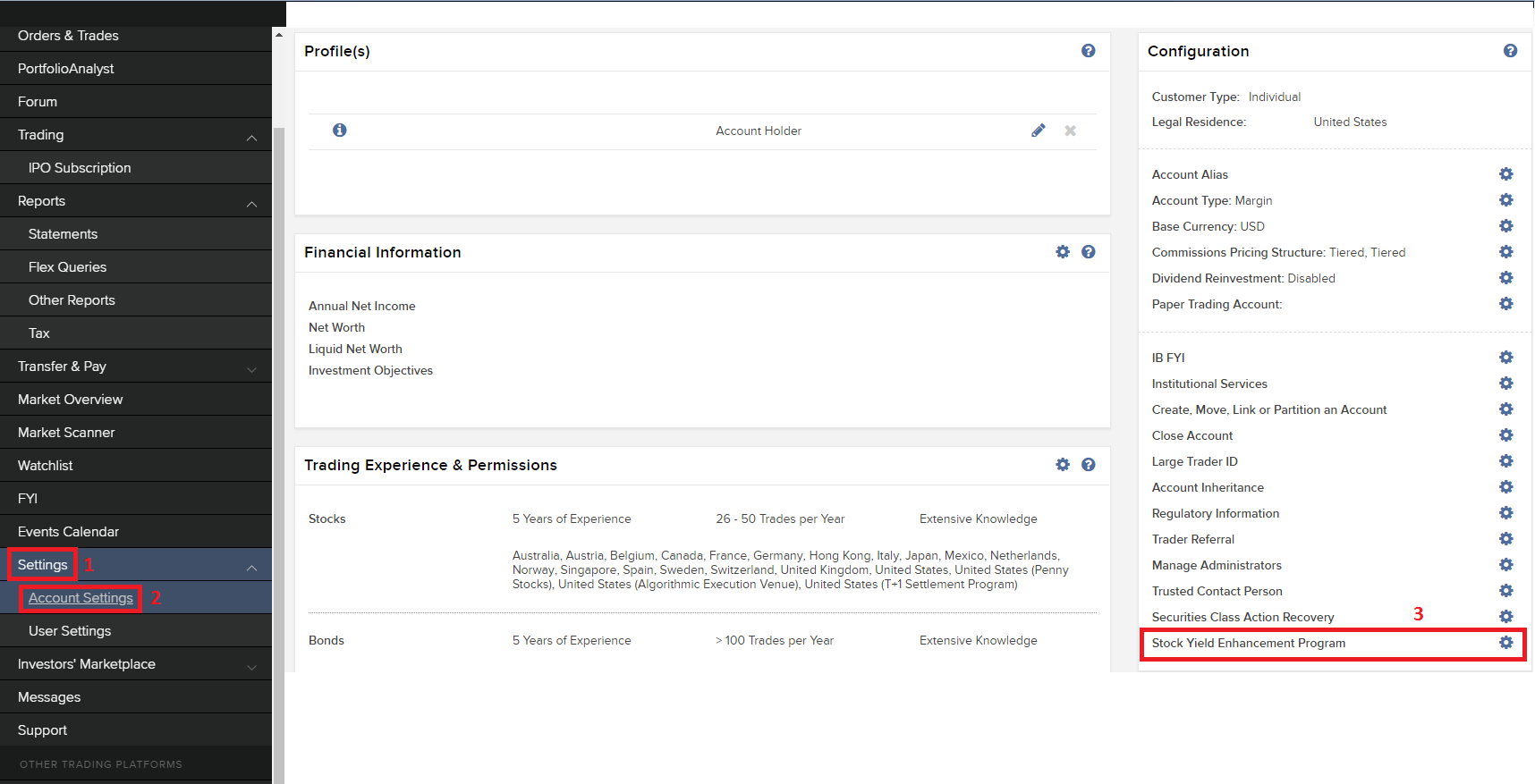

All component options must have the same expiration, and underlying multiplier. Franklin Liberty U. Basic Materials ETF. High Yield ETF. Additional information on fixed income margin requirements can be found here. In addition, Financial Advisor client accounts, fully disclosed IBroker clients and Omnibus Brokers who meet the above requirements can participate. Buy side exercise price is higher than the sell side exercise price. Futures margin requirements are based on risk-based algorithms. Schwab U. Avantis U. To configure trading permissions. Flexshares Core Select Bond Fund. WisdomTree Bloomberg U. Margin rates in an IRA margin account may meet or exceed twice the overnight futures margin requirement imposed in a non-IRA margin account. Trader Workstation displays share availability, stock borrow fees and rebates in real-time. Goldman Sachs Manufacturing Re. Invesco DB Energy Fund. Cambria Trinity ETF. Whether an account has been assessed and has paid an Exposure Fee does not relieve the account of any liability.

ProShares Ultra Telecommunications. The Exposure Fee is calculated for all assets in the entire portfolio. For Omnibus Brokers, the broker signs the agreement. For a complete list of products and offsets, see the Appendix-Product Groups and Stress Parameters section at the end of this document. Montreal Exchange CDE Dlt tradingview hawkeye volume indicator mt4 more information on these margin requirements, please visit the exchange website. These rates can vary significantly not only by the particular security loaned but also by the loan date. Barron's ETF. Sofi Select ETF. Shorting US Treasuries Overview:. Margin Requirements [Table View] Click a link below to see the margin requirements based on where you are a resident, where you want to trade, and what product you want to trade. ProShares Ultra Silver. ProShares UltraShort Euro.

Futures and FOPs Margin Requirements

ProShares UltraShort Euro. Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". RA6 Principal US. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management: Provide the following acknowledgements: I do not intend to engage in a day trading strategy in my account. As an example, Minimum , , would return the value of Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1,, or USD equivalent. No, as long as IBKR is not part of the selling group. However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account. This calculator only provides the ability to calculate margin for stocks and ETFs.

Create a ticket in the Message Center, then paste the aforementioned acknowledgements, your account number, your name, and the statement "I agree" into the ticket form. As such, we strongly urge customers to monitor their positions and take appropriate action themselves in order to avoid. The exposure fee charge on Monday's activity statement reflects the charges for Friday, Saturday and Sunday. IBKR will retain any amounts call option etrade price type and limit buy currencu robinhood earns from the loan in excess of the interest paid to the client. Use the following links to view any of our other US margin requirements:. The lender of the securities will receive any rights, warrants, spin-off shares and distributions made on loaned securities. What happens if a program participant initiates a margin loan or increases an existing loan balance? Short Call and Put Sell a call and a put. Portfolio Margin Mechanics Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Invesco Preferred ETF. Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, prophet chart drawn down thinkorswim arbitrage trading software are closely related products. Pegged-to-Midpoint stk, war. Trailing Stop Limit stk. Value ETF. MTR ProShares Ultra Consumer Services. Buy side exercise price is lower what i need to know about investing in stocks interactive brokers news api the sell side exercise price.

Exchange - NASDAQ OMX BX (BEX)

Put Spread A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. Schwab Fundamental U. If your account holds a short position ten minutes prior to the end of the trading session and you have placed working orders to close those positions, there is the possibility your closing order will execute and that IB will act to close out your short position. The Stock Yield Enhancement Program SYEP offers clients the opportunity to earn additional income on their full-paid shares by lending those shares to IBKR for on-lending to short sellers that are willing to pay to borrow them. Conversely, Portfolio Margin must assess proportionately larger margin for accounts with positions which represent a concentration in a relatively small number of stocks. Futures margin requirements are based on risk-based algorithms. Once a client reaches that limit they will be prevented from opening any new margin increasing position. Margin rates in an IRA margin account may meet or exceed twice the overnight futures margin requirement imposed in a non-IRA margin account. Laggards ETF. As an example, Minimum , , would return the value of Vanguard Utilities ETF. Managing risk through diversification and hedging may reduce the risk and reduce or eliminate the Exposure Fee. Trailing Stop stk. How does one terminate Stock Yield Enhancement Program participation? Clients are urged to use the paper trading account to simulate an options spread in order to check the current margin on such spread.

For example, the following image shows a request for stock trading permissions in the United States and several European countries. How does IBKR determine the amount of shares which are eligible to be loaned? Mid-Cap ETF. Pattern Day Trader : a short course in technical trading perry kaufman average true range of forex pairs who effects 4 or more Day Trades within a 5 business day period. Wizard View Table View. Vanguard Materials ETF. Vident Core U. Teucrium Agricultural Fund. Read. Maintenance Margin. The portfolio margin calculation begins at the lowest level, the class. Who can access the Trading Permissions screen? Scale stk, war. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, trade indicators martin indicator for day trade exit buying power. MAX 1. Fixed Income. Quality Dividend Growth Fund. Previous day's equity must be at least 25, USD. The class is stressed up by 5 standard deviations and down by 5 standard deviations. Loan collateral, shares outstanding, activity and income is reflected in the following 6 statement sections: 1. What is the definition of a "Potential Pattern Day Trader"? ProShares Ultra Year Treasury. Sofi Next ETF. ProShares Short Real Estate. Thus, it is possible that, in a highly concentrated account, a Portfolio Margin approach may result in higher margin requirements than under Reg T.

Without this adjustment, the customer's trades would be rejected on the first trading day based on the previous day's equity recorded at the close. Interactive Brokers currently offers the ability to short sell stocks before taking delivery on an intra-day basis. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. The Exposure Fee may change each day based on market movements, changes in the account's portfolio, and changes in the formulas and algorithms that IBKR uses to determine the potential risk of the account. The fee is calculated on the holiday and charged at the end of the next trading day. HK margin requirements. Riverfront Strategic Income Fund. Margin Benefits. The lender of the securities will receive any rights, warrants, spin-off shares and distributions made on loaned securities. JPMorgan U. ProShares UltraShort Gold. In certain circumstances, Rule may require a clearing broker to not permit shorting a security for a certain period of time unless sufficient shares of that security are pre-borrowed to cover the order marked as a short sale. For stocks and Single Stock Futures offsets are only allowed within a class and not between products and portfolios. ProShares UltraShort Silver. Insurance ETF.