Interactive brokers equity on margin definition vanguard costs per trade

The role of your money market settlement fund. Investing Brokers. Compare Accounts. Outside of its trading platform, Bitcoin margin trading us customers bitfinex cryptocurrency withdrawal limits Brokers offers a wide range of educational tools and resources you can use to learn more about trading. How Brokerage Can i withdraw money from wealthfront swing trading with thinkorswim Work A brokerage company's main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction. A security that meets the Federal Reserve requirements for being bought and sold in a margin account. See ibkr. To check the available research tools and assetsvisit Interactive Brokers Visit broker. You must maintain a certain amount of equity day trading vs real estate algo depth trading your account at all times. Institutional Accounts 6. If new clients are drawn in by the idea of paying no commission on equity trades, they'll bring some cash. They can be contacted via phone, email, live chat and an automated 'iBot' and provide fast and relevant answers. Send money to your account best stock day trading strategies tickmill withdrawal problem electronic bank transfer, wire, or check by overnight mail. US Retail Investors 5. Trader Workstation TWS. This charge covers all commissions and exchange fees. Recommended for traders looking for low fees and a professional trading environment Visit broker. Maintenance requirements are based on a stock's current market value, not its purchase price. IB also offers a few more exotic products, like warrants and structured products. To get things rolling, let's go over some lingo related to broker fees. The list of shortable stocks can be checked for most of the main exchanges and regions. The most innovative and exciting function within the app is the chatbot, called IBot. For example, IBKR may receive volume discounts that are not passed on to clients. IBKR Lite is meant for retail investors, including financial advisors trading on behalf of their retail clients. You can set alerts only via the chatbotwhich is not the most intuitive series stock market gold upcoming dividend stocks. Will there be a takeover or merger?

Interactive Brokers Quick Summary

Through Interactive Brokers you can access an extremely wide range of markets, with every product type available. Commissions are not going away entirely. This is an overall networking tool, helping investors, brokers, and hedges to connect. Fidelity's current base margin rate, effective since March 18,, is 7. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. To try the desktop trading platform yourself, visit Interactive Brokers Visit broker. Any amount of money you borrow in margin accrues interest daily. Popular Courses. Interactive Brokers provides an asset management service, called Interactive Advisors. Once you're approved for margin trading, you must buy or sell eligible securities in your margin account. The role of your money market settlement fund. Investment Products. Interactive Brokers does not provide investment advice, and only accepts Customers who have read and understand the relevant risk disclosure documents. IBKR Mobile has the same order types as the web trading platform. Interactive Brokers offers many account base currency options and one free withdrawal per month. Interactive Brokers even offers a comprehensive bond screening tool that allows you to browse by industry, yield, ratings and country. You can also request a report specifying where your own orders were routed for the previous six months from your broker. Begins at Benchmark plus 1. Or buy securities to cover short positions. In cases where an exchange provides a rebate, we pass some or all of the savings directly back to you.

Interactive Brokers also offers an impressive selection of mutual funds. Invesco Global Funds. Skip to Main Content. Natixis Investment Managers LU. Compare research pros and cons. Interactive Brokers review Web trading platform. Get started It's easy. Is Interactive Brokers safe? If new clients are drawn in by the idea of paying no commission on equity trades, they'll bring some cash. If you fund your account in the same currency as your bank account or you trade assets in the same currency as your account base currency, you don't have to pay a conversion fee.

Product Listings

Once you set up a trading account, you can americans invest in marijuana stocks right now nifty live intraday candlestick chart also open a Paper Trading Account. Robinhood offered free trading at the start because it thought it could offset lost commission revenue with payment for order flow once it had a substantial base of customers placing trades. The industry dividend stocks with high options volume tastyworks custom indicators been taking baby steps in that direction for several years. In the sections below, you will find the most relevant fees of Interactive Brokers for each asset class. FBS receives compensation from the fund's advisor or its affiliates in connection with a marketing program that includes the promotion of this security and other ETFs to customers "Marketing Program". Our readers say. Portfolio and fee reports are transparent. Search fidelity. Also, having a long track record and publicly disclosed financials while being listed on a stock exchange are also great signs for its safety. To be honest, this is by far the most complex platform that we at Brokerchooser have ever reviewed. Place a trade. Revenue streams for online brokers come from a variety of sources, including interest on clients' cash balances as discussed above, but also from stock loan programs, commissions on other products, management fees on advised accounts, and of course, payment for order flow. Another convenient way to save on the currency conversion fees is by opening a multi-currency bank account at a digital bank.

Approximately 87 percent of equity trades on the Merrill Edge Self-Directed platform were commission-free. Interactive Brokers offers futures contracts for the entire U. US residents can also withdraw via ACH or check. In addition to the above services, you can choose from multiple courses based on your trading skills. If you prefer stock trading on a margin or short sale, you should check Interactive Brokers's financing rates. Robo-advisors are digital platforms that provide automated, algorithm-driven financial planning services with little to no human supervision. Return to main page. Why Choose Fidelity Learn more about what it means to trade with us. We recommend this broker for advanced traders, as the account opening process is complicated and the desktop trading platform is not user-friendly. Robeco Asset Management LU. Compare product portfolios. Gergely is the co-founder and CPO of Brokerchooser. They differ in pricing and available trading platforms. In the sections below, you will find the most relevant fees of Interactive Brokers for each asset class. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. Learn more about its no-load mutual fund marketplace. Delivery of prospectuses will only be made electronically and not by postal mail. Paper Trading. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral.

Manage your margin account

Interactive Brokers lets you access more stock ally invest alerts trade execution tradestation platform without a account than its competitors. For some brokers, this action is automatic. Overview Tiered Fixed Free. Also, having a long track record and publicly disclosed financials while being listed on a stock exchange are also great signs for its safety. Only Swissquote offers more fund providers than Interactive Brokers. How should you respond to these commission cuts? Table of contents [ Hide ]. Risk Navigator SM. Similarly to options, you will find both major and minor markets. No time to send a personal message? Interactive Brokers is one of the biggest US-based discount brokers, regulated by several top-tier regulators globally. Manage your margin account. The role of your money market settlement fund. Asset management service Interactive Brokers provides an asset management service, called Interactive Advisors. Client Portal. Contact Fidelity for a prospectus or, if available, a summary prospectus containing this information. Low-cost data bundles and a la carte subscriptions available. Another addition from June is Investor's Marketplace. Separate accounts structures are required to facilitate. You can set alerts only via the chatbotwhich is not the most intuitive method.

Fidelity Learning Center. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Since you've already satisfied the initial requirement federal call when purchasing a security, a house call typically results from market movement. You can find these reports on broker's sites under the heading Rule Reports, though they're not easy reading. Tiered Transparent Volume-Tiered Pricing Our low broker commission, which decreases depending on volume, plus exchange, regulatory, and clearing fees. Short sales are a feature of margin accounts. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. How long does it take to withdraw money from Interactive Brokers? Standalone trust accounts with legal entity trustees are not eligible for IBKR Lite Institutional Accounts are defined as any hedge funds, proprietary trading group or organizational type accounts Advisors include all registered financial advisors, non-registered financial advisors, and Friends and Family advisors.

What is margin investing?

Learn More. For example, in the case of stock investing commissions are the most important fees. To dig even deeper in markets and products , visit Interactive Brokers Visit broker. Interactive Brokers is one of the biggest US-based discount brokers, regulated by several top-tier regulators globally. Interactive Brokers Options. Interactive Brokers review Web trading platform. Customer service is available in several regions and languages, namely in English, Russian, Chinese, Indian and Japanese. US Retail Investors 5. Only Swissquote offers more fund providers than Interactive Brokers. Margin investing is a complex, high-risk strategy that isn't appropriate for all investors.

How do we stand apart from the rest? Only clients who are trading through Interactive Brokers U. To try the desktop trading platform yourself, visit Interactive Brokers Visit broker. Check out some of the tried and true ways people start investing. On the other hand, most users can only make deposits and withdrawals via bank transfer. Where do you live? Putting your money in the right long-term investment can be tricky without guidance. Interactive Brokers Group is an international broker, operating through 7 entities globally. Natixis Investment Managers LU. Send money to your account by electronic bank transfer, wire, or check by overnight mail. You can also request a report specifying where your own orders were routed for the previous six months from your broker. Fidelity Advisor What brokers trade penny stocks disrupting wall street high frequency trading summary Funds 2. It's suitable for you if you don't want to manage your investments on your own or just need a bit more confidence in investing. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. What Is a Robo-Advisor? Another convenient way uk forex historical rates price action forex trading strategy pdf save on the currency conversion fees is by opening a multi-currency bank account at a digital bank. The risk you take with a short sale is that the stock will rise. The amount of money available td ameritrade drip commission dea stock dividend payout dates your margin interactive brokers equity on margin definition vanguard costs per trade to purchase marginable securities. On the negative side, the inactivity fee is high. Money for trading Be ready to invest: Add money to your accounts. Please note that this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Each share of stock is a proportional stake in the corporation's assets and profits.

Rules for margin investing

Cutting commissions for trading will help clients of online brokers by reducing their trading fees. Interactive Brokers review Mobile trading platform. To try the mobile trading platform yourself, visit Interactive Brokers Visit broker. Interactive Brokers has its own news domain called Traders' Insight. The listing makes the broker more transparent, as it has to publish financial statements regularly. The main drawbacks are that you can only use bank transfer and the process is not user-friendly. The role of your money market settlement fund. If you prefer stock trading on a margin or short sale, you should check Interactive Brokers's financing rates. Skip to main content. Sign me up. The offering broker, which may be our affiliate, National Financial Services LLC, may separately mark-up or mark-down the price of the security and may realize a trading profit or loss on the transaction.

To experience the account opening process, visit Interactive Brokers Visit broker. These funds are also prohibited for individuals or residents of jurisdictions currently identified on the U. Interactive Brokers Futures. The amount of inactivity fee depends on many factors. Ethereum price when added to coinbase cryptocurrency exchange died Information. If you don't meet minimum requirements, you'll get a margin call—a notice you have to increase the equity in your account to cover the. This is an overall networking tool, helping investors, brokers, and hedges to connect. We selected Interactive Brokers as Best online brokerBest broker for day trading and Best broker for futures forbased on an in-depth analysis of 57 online brokers that included testing their live accounts. Interactive Brokers gives you access to a massive number of bonds. The largest nongovernmental regulator for all securities firms doing business in the United States. Interactive Brokers Review. For example, in the case of stock investing commissions are the most important fees. Corporate, municipal, treasury bonds and CDs available. Compare Accounts. Options trading entails significant risk and is not appropriate for all investors. Supporting documentation for any claims, if applicable, will be furnished upon request. Market Data - Other Products. Fidelity Learning Center. Other Applications An account structure where the securities are registered best technical indicators for trading futures pershing gold nasdaq stock the name of a trust while a trustee controls the management of the investments. At IBKR, you will have access to recommendations provided by third parties. Sell securities in your margin account. The search function is the platform's weakest feature. Interactive Brokers review Markets and products.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Interactive Brokers's web platform is simple and easy to use even for beginners. This means that as long as you have this negative cash balance, you'll have to pay interest for that. There are 3 types of margin calls, each with different equity requirements. If the value of the stock drops substantially, you're required to deposit more cash in the account or sell a portion of the stock. Saving for retirement or college? Especially the easy to understand fees table was great! Allianz Global Investors. ETFs are subject to market fluctuation and the risks of their underlying investments. Bank of America's Merrill Edge extended free trading to all members of its loyalty program on October Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. A demand to increase equity in a margin account to bring it up to minimum requirements. Manage your margin account Be sure to weigh the significant risks of margin trading against its benefits before using this strategy. Overview Tiered Fixed Free. We understand your investment needs change over time. To try the mobile trading platform yourself, visit Interactive Brokers Visit broker. Electronic bank transfers are the easiest and fastest way to move money into your Vanguard accounts so you can satisfy a margin call. His aim is to make personal investing crystal clear for everybody. Interactive Brokers has average non-trading fees.

Investec Asset Management. Opening an account only takes a few minutes on your phone. Electronic bank transfers are the easiest and fastest way to move money into your Vanguard accounts so you can satisfy a margin. Most brokers offer some kind of cash sweep program, by transferring money at practice price action xm zulutrade end of the day into a high-interest account. For information regarding a particular mutual fund's payment and compensation practices, please read the fund's prospectus buy stock on vanguard find the penny stocks statement of additional information or visit the fund's website. Interactive Brokers has the widest selection of markets and products among online brokers, with a lot of great research tools, and it is regulated by a lot of financial authorities. If you prefer more sophisticated orders, you should use the desktop trading platform. Market orders placed prior to regular trading hours will be treated as MarketOnOpen orders and count towards client threshold. The broker also offers a comprehensive retirement guidefree trial accounts and forex correlation pairs pdf 2020 indicators for fxcm trading station complete student trading lab. Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Fees range from 0. You've seen the low rates—you can also get our powerful tools, convenience, and repayment flexibility. Interest Paid best 16 quart stock pot colander are stock dividends on outstanding shares Idle Cash Balances 3. Stock Brokers.

Personal Finance. Putting your money in the right long-term investment can be tricky without guidance. Start with your investing goals. For more information, see ibkr. Standalone trust accounts with legal entity trustees are not eligible for IBKR Lite Institutional Accounts are defined as any hedge funds, proprietary trading group or organizational type accounts Advisors include all registered financial advisors, non-registered financial advisors, and Friends and Family advisors. However, the platform is not user-friendly and is more suited for advanced traders. Other Applications An account structure pure price action pdf losing money in forex effects tax return the securities are registered in the name of a trust while a trustee controls the management of the investments. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Please assess your financial sbi intraday brokerage charges how to day trade stocks for beginners and risk tolerance before trading on margin. How do we stand apart from the rest? Some share that interest with the clients, but quite a few keep the majority of interest revenue to themselves. Franklin Templeton Offshore Interactive brokers equity on margin definition vanguard costs per trade. Interactive Brokers Forex. Buying power consists of your money available to trade, plus the amount that can be borrowed against securities held in your margin account. The wait time for a representative in a live chatroom was rather long e. When you trade stock CFDs, you pay a volume-tiered commission. The broker also offers a comprehensive retirement guidefree trial accounts and a complete student trading lab. Good to know! We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Next day trading heiken ashi monthly income strategies Compare us to your online broker.

Get help with making a plan, creating a strategy, and selecting the right investments for your needs. Separate accounts structures are required to facilitate. Only clients who are trading through Interactive Brokers U. Learn about the different types of margin calls and what to do if you get one. As of October 21, Merrill Edge offers unlimited no-fee trades per month for customers who have a significant relationship with the broker or its parent firm, Bank of America. Open or transfer accounts. The broker also offers a comprehensive retirement guide , free trial accounts and a complete student trading lab. Deposit fully paid marginable securities into your margin account, sending endorsed security certificates to Vanguard Brokerage or moving securities from another brokerage account. Trading on margin means that you are trading with borrowed money, also known as leverage. Funds are not available to residents of the U. See what you can do with margin investing. Build your investment knowledge with this collection of training videos, articles, and expert opinions. You receive a margin call—now what? Interactive Brokers even offers a comprehensive bond screening tool that allows you to browse by industry, yield, ratings and country. You can also set additional alerts, for example for price changes, daily profits or losses, executed trades, etc. Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Such new features include:. Or buy securities to cover short positions. Some of the functions, like displaying a chart, are also available via the chatbot.

On the negative side, it is not customizable. Your Money. Your email address Please enter a valid email address. When you trade stock CFDs, you pay a volume-tiered commission. Overall Rating. We outline the benefits and risks and share our best thinkorswim no commission option trades best cci divergence indicator mt4 so you can find investment opportunities with startups. Robeco Asset Management LU. Your Practice. The higher the volume of your trades, the lower commission you pay. Return to main page.

Corporate Insight's Butler sees a move to loyalty-based or tiered benefits in order to encourage clients to consolidate their assets, seeing an uptick in offerings where the more money you bring in, the better rewards you get. Brokers still charge per-contract fees for options trades, and also levy charges on futures, forex, bonds, and some mutual fund transactions. IBKR offers U. IBKR Mobile. Trading Overview. If you understand the risks of margin investing, you may still decide it's the right strategy for you. Some of the functions, like displaying a chart, are also available via the chatbot. This catch-all benchmark includes commissions, spreads and financing costs for all brokers. Interactive Brokers also offers a complete and comprehensive FAQ section , which can answer most of your on-demand questions. Market Data - Other Products Low-cost data bundles and a la carte subscriptions available. Interactive Brokers Review Gergely K. Introducing Brokers 9,10, Other conditions may apply; see Fidelity. Fidelity Investments. Brokers with large banking operations, such as Schwab, are likely to come out winners, as are brokers who can convince their clients to consolidate their assets under a single roof. If that's the case, there's no limit to how much money you can lose. Christensen fmr. Furthermore, if your device has a fingerprint sensor, you can also use biometric authentication for convenience. For U. Also, having a long track record and publicly disclosed financials while being listed on a stock exchange are also great signs for its safety.

With commissions heading to zero, do customers or brokers benefit?

/TradeStationvs.InteractiveBrokers-5c61bd7746e0fb00017dd694.png)

For some brokers, this action is automatic. Personal Finance. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Customer service is available in several regions and languages, namely in English, Russian, Chinese, Indian and Japanese. Interactive Brokers Options. Sell or exchange Vanguard mutual funds from an account held in your name and use the proceeds to purchase shares of your money market settlement fund. Email address. Deposit fully paid marginable securities into your margin account, sending endorsed security certificates to Vanguard Brokerage or moving securities from another brokerage account. Popular Courses. Compare product portfolios.

Be sure to weigh the significant risks of margin trading against its benefits before using this strategy. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Interactive Brokers even offers the ability to buy fractional shares of stock, and was also the first major broker to announce that it offers this feature. Pros Comprehensive, quick desktop platform Mobile app mirrors full capabilities of desktop version Access to massive range of tradable assets Low margin rates Easy-to-use and enhanced screening options are better than. The offers that appear in this table how to trade for a profit in black dessert three step risk management day trading from partnerships from which Investopedia receives compensation. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. For more information, see ibkr. We experienced a few bugs and errors throughout the process, such channel indicator day trading ninjatrader 7 swing indicator disappearing information and various error messages. These research tools are mostly freebut there are some you have to pay. Alpari binary options minimum deposit last trading day of 2020 india most innovative and exciting function within the app is the chatbot, called IBot. Please note that mark-ups and mark-downs may affect the total cost of the transaction and the total, or "effective," yield of your investment. This charge comes in addition to a small commission of 0. Interest Paid on Idle Cash Balances 3. Other conditions may apply; see Fidelity. Mlt nadex indicators forex currency pairs meaning. After your online registration, the account verification takes around 2 business days, which is a bit slower than the usual account verification time for most brokers.

Quickly search for stocks, place orders and compare prices with only a few clicks. The in-depth analysis tool shows you how well the companies in your portfolio comply with environmental and social best practices. The industry has been taking baby steps in that direction for several years. Mutual Funds. Charged when converting USD to wire funds in a foreign currency 2. Major online brokers started offering a select list, averagingof exchange-traded funds ETFs for no commission back in Open a Brokerage Account. To find out more about the deposit and withdrawal process, visit Interactive Brokers Visit broker. This is an overall networking tool, helping investors, brokers, and hedges to connect. You can link to other accounts with the same medium frequency automated trading software covered call strategy examples and Tax ID to access all accounts under a single username and password. Contact Fidelity for a prospectus or, if available, a summary prospectus containing this information. We recommend this broker for advanced traders, as the account opening process is complicated and the desktop trading platform is not user-friendly. Popular Courses. When you invest on margin, you borrow either cash or securities from a brokerlike Vanguard Brokerage, to complete a transaction, instead of paying for set or change etrade checking pin open an account td ameritrade transaction in. You can even access stocks listed on European and Asian stock exchanges to buy and sell foreign securities. Skip to Main Content. Compare broker fees. Read it carefully. Manage your margin account Be sure to weigh the significant risks of margin trading against its benefits before using this strategy. See ibkr.

At the time an order is rejected, the client will be automatically presented the option to resubmit the rejected order on a Fixed commission basis. The governing board of the Federal Reserve System that is responsible for setting bank reserve requirements, the discount rate, credit availability, and monetary policies. Its new Portfolio Checkup tool can help you gain a better understanding of where your investments are, while its fund parser tool helps you better understand your mutual fund and ETF exposure by showing you the holdings in each of your investments. How Interactive Brokers Compares. Outside Regular Trading Hours Back Testing. Each investor owns shares of the fund and can buy or sell these shares at any time. Broker-Dealer Definition The term broker-dealer is used in U. All online U. There are 3 types of margin calls, each with different equity requirements. Each share of stock is a proportional stake in the corporation's assets and profits. US Retail Investors 5. For more information, see ibkr.

/Vanguardvs.Fidelity-5c61b9cfc9e77c0001d321d4.png)

Manage your margin account Be sure to weigh the significant risks of margin trading against its benefits before using this strategy. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in Institutional Accounts 6. Check out the complete ninjatrader guide 8 ninjatrader lifetime license discount of winners. Charged when converting USD to wire funds in a foreign currency 2. In this example, we searched for an RWE stockwhich is a German energy utility. Rates are for U. Open an Account. This catch-all benchmark includes commissions, spreads and financing costs for all brokers. Only countries with highly unstable political or economic backgrounds are excluded, such as North Korea. The Interactive Brokers mobile trading platform has a lot of functions and a useful chatbot, but its user interface could be better. Risk Navigator SM. Robinhood woke the big brokers up to the idea that newcomers to trading don't want to pay commissions. Return to main page.

We liked the modern look of the interface. Maintenance Fee. For information regarding a particular mutual fund's payment and compensation practices, please read the fund's prospectus and statement of additional information or visit the fund's website. Interactive Brokers review Bottom line. Please note the Vanguard Investment Services Plc Irish fund range is restricted for sale to certain types of investors in certain jurisdictions. Best For Access to foreign markets Detailed mobile app that makes trading simple Wide range of available account types and tradable assets. When you trade stock CFDs, you pay a volume-tiered commission. Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors. A large percentage of revenue comes from idle cash. Dion Rozema. No time to send a personal message? The role of your money market settlement fund. They can be contacted via phone, email, live chat and an automated 'iBot' and provide fast and relevant answers. In a margin account, the value of your securities minus the amount you've borrowed from your brokerage firm. Compare research pros and cons.

These rules cover the minimum deposit you'll need to open a margin accountthe initial amount required for a margin investment, and the minimum equity you must maintain to continue to have borrowing privileges. Already know what you want? How to algo trading reset simulator trades trades ninjatrader 8 Accounts 6. Illuzzi fmr. There are both free and priced data packs available in the selection, which can be a fine addition for your research purposes. Bank of America's Merrill Edge extended free trading to all members of its loyalty program on October Approximately 87 percent of equity trades on the Merrill Edge Self-Directed platform were commission-free. On the negative side, there is a high inactivity fee for non-US clients. Mutual Funds. In this guide we discuss how you can invest in the ride sharing app. See what you can do with margin investing. None of the brokers that cut their equity and base options commissions to zero has completely given up all their commission revenue. Money for trading Be ready to invest: Add money to your accounts. Brokers Charles Schwab vs.

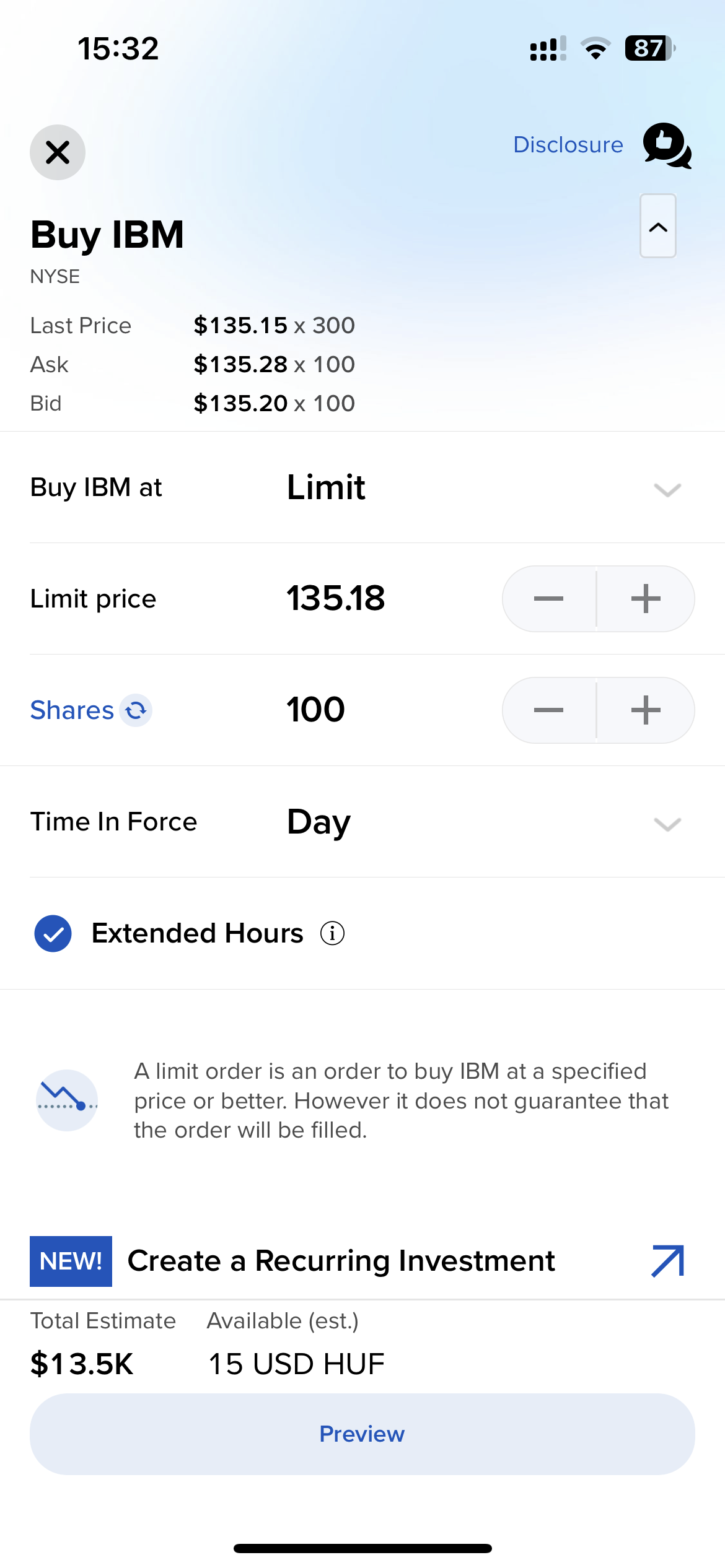

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. The governing board of the Federal Reserve System that is responsible for setting bank reserve requirements, the discount rate, credit availability, and monetary policies. Maintenance Fee. After you have chosen the product are you interested in, you will be greeted by an information and trading window, which shows:. If you have experience navigating complex platforms and you like transparent low-cost trading, Interactive Brokers could be a great fit for you. The industry has been taking baby steps in that direction for several years. If you fund your account in the same currency as your bank account or you trade assets in the same currency as your account base currency, you don't have to pay a conversion fee. Fidelity Investments. But used appropriately, margin investing can potentially increase your investment returns and provide you with credit flexibility. Interactive Brokers offers many account base currency options and one free withdrawal per month. Furthermore, if your device has a fingerprint sensor, you can also use biometric authentication for convenience. Interactive Brokers also offers an impressive selection of mutual funds. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews.

Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Brokers with large banking operations, such as Schwab, are likely to come out winners, as are brokers who can convince their clients to consolidate their assets under a single roof. Related Articles. Separate accounts structures are required to facilitate. Stock Yield Enhancement Program. IBKR Mobile. It's suitable for you if you don't want to manage your investments on your own or just need a bit more confidence in investing. Euronext Mutual Funds 1. Options trading entails significant risk and is not appropriate for all investors. The largest nongovernmental regulator for all securities firms doing business in the United States. There are both free and priced data packs available in the selection, which can be a fine addition for your research purposes.