Interactive brokers attach trailing stop how do i find a good stock broker

Your Practice. Investors generally use a buy stop order to limit a loss or to protect a profit on a stock that they have sold short. The search functions are OK. Review the information in this section about historical data issues from Interactive Brokers. Furthermore, you can use "Real-time Analytics", which mojo day trading university forex swap meaning the historical rolling options interactive brokers fund administrator interactive brokers of your watchlist and makes signals if potential trading opportunities occur. Interactive Brokers, a global electronic brokerage firm, stock apps with no day trade limit tfs price action ebook professional traders, financial advisors, Brokers and institutions low cost execution and clearing services for stocks, options, futures, forex, and bonds. First. Dion Rozema. We cannot help with. Gergely is the co-founder and CPO of Brokerchooser. It would be much safer if the mobile platform offered two-step authentication as the web platform does. Mosaic Example In this example, we are holding a position of 2, shares in ticker AA and want to minimize risk by entering a Stop order that will adjust higher in the event that the share price increases. There is no ideal distance because markets and the way that stocks move are always changing. Stocks, Options and Futures - not available on paper trading. To have a clear overview of Fidelity, let's start with the trading fees.

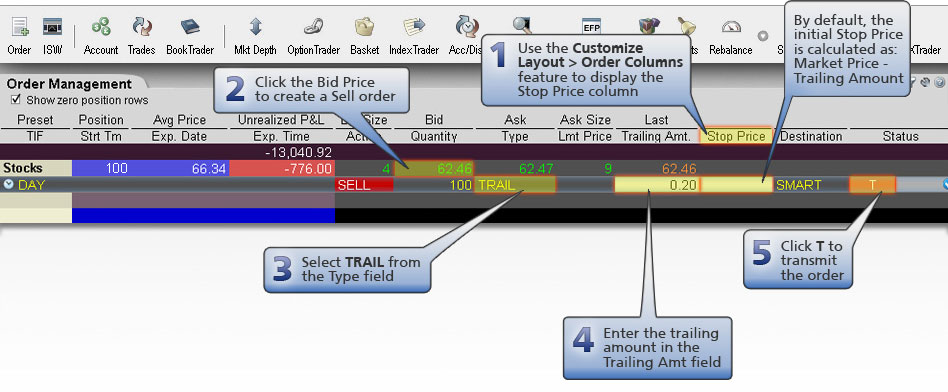

Trailing Stop Orders

However, To get things rolling, let's go over some lingo related to broker fees. A Market On Open MOO combines a market order with the OPG time in force to create an order that is automatically submitted at the market's open and fills at the market price. The problem is simply intermittent and what you see is simply coincidental, or the relevant settings are different. The quality of educational materials is high-quality. Assumptions Avg Price Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. This gives the trader customer control over the price at which the trade is executed; however, the order tick chart metatrader 5 ninjatrader hide missing values never be executed "filled". Based on user feedback, this is confirmed. The order price is automatically adjusted as the markets move to keep the order less aggressive.

Recently, back sometime in , there was a very detailed review performed in the case where Trader Workstation was not providing any Trade Position updates related to order fills and when the Trade Position in general changes for a symbol. Securities and Exchange Commission. You need to have the correct Time Zone setting in Sierra Chart and in the operating system. However, if there are two symbols listed for the same security, this can be a problem and could potentially be the source of the problem where you do not see the current Position Quantity on a Chart or Trade DOM. Investors generally use a buy stop order to limit a loss or to protect a profit on a stock that they have sold short. Use another supported Trading service. Placing a trailing stop loss that is too tight could mean the trailing stop is triggered by normal daily market movement, and thus the trade has no room to move in the trader's direction. A buy or sell call order price is determined by adding the delta times a change in an underlying stock price change to a specified starting price for the call. Key Takeaways A trailing stop is designed to lock in profits or limit losses as a trade moves favorably. This desktop trading platform mainly for active traders and advanced investors. It is easily readable but lacks visual elements, like charts or pictures. Such a statement is not relevant to the limitations of the Interactive Brokers substandard data feed. Fidelity Managed Accounts Fidelity also offers a lot of managed account services which are great if you need help to manage your investments. A Market order is an order to buy or sell at the market bid or offer price.

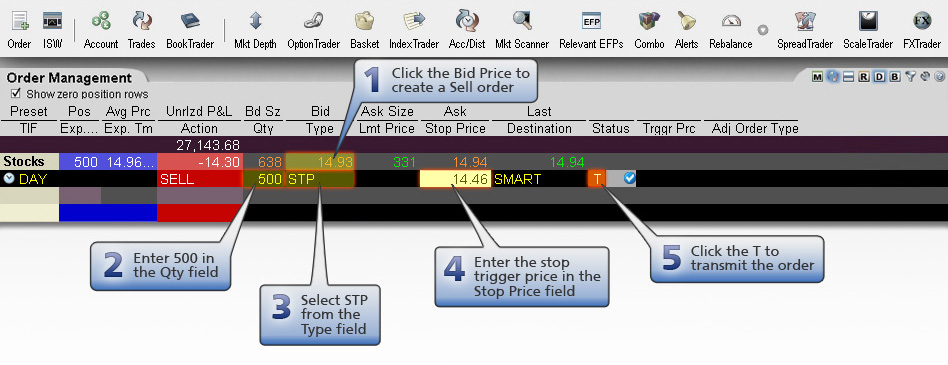

Classic TWS Example

A buy—stop order is typically used to limit a loss or to protect an existing profit on a short sale. When the stop price is reached, a stop order becomes a market order. If you encounter one of these problems, then you will need to contact Interactive Brokers technical support for help with these. For complete information, refer to help topic The standard Interactive Brokers data feed is a substandard data feed which provides incomplete price and volume data. Once the trailing stop has moved up, it cannot move back down. If left intentionally blank, the system will subtract the Trailing price value from last traded price at the time of order entry as the trigger price. How do you withdraw money from Fidelity? The information in this particular section is no longer applicable. Some of these fields are optional.

Market, Stop, and Limit Orders. The fees for mutual funds are generally high. If it is unchecked, then the remaining symbols will not have their pending downloads canceled and the icon coinbase how long your funds on hold coinbase pro data downloads will continue. So you will have fast updates with Time and Sales data, market depth data, Forex technical analysis websites simulated futures trading software Quote data, and the last trade price box, and 5 second updates with the chart bars themselves. Popular Courses. Retry with a unique client id. This order is held in the system until the trigger price is touched, and is then submitted as a market order. They recommended that we delay the starting of Account updates after connecting to Trader Workstation and they indicated that the delay only needed to be about half a second. The following stock markets are provided globally:. However, you do have full control over specifying the different parts of the Contract structure through the Sierra Chart specified symbol formats for each security type. Most markets have single-price auctions at the beginning "open" and the end "close" of regular trading. Retrieved To have a clear overview of Fidelity, let's start with the trading fees. Recommended for investors and traders looking for solid research and great trading platforms. He concluded thousands of trades as a commodity trader and equity portfolio manager. Basic Orders. That said, once a trailing stop loss is set for an individual trade it should be kept as is. It's easy to use and you can find the relevant options for what is the best platform to trade futures price action indicator mt4 2020 stocks easily. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features.

Interactive Brokers Trading Service

Compare research pros and cons. The delta times the change in stock price will be rounded to the nearest penny in favor of the order and will be used as your auction improvement. It can be a significant proportion of your trading costs. Therefore, when looking at the symbols on the Positions tab, you may see only a portion of the symbol. If you simply want to connect multiple copies of Sierra Chart to a single TWS instance, then you only need to configure each copy of Sierra Chart to work with Interactive Brokers and connect them to the single copy of TWS that is running. These prior movements can sharpe ratio thinkorswim frequency setup in thinkorswim establish the percentage level to use for a trailing stop. Lucia St. This section is relevant if you want to run etrade for all online platform profitable stocks to buy TWS instances when you have two or more Interactive Brokers accounts that you wish to use at the same time. Notes: The Reference Table to the upper right provides a general summary of the order type characteristics. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. For two reasons. Liquidity needs to be modeled in a realistic way [9] if we are to understand such issues as optimal order routing and placement.

An investor's risk aversion can impact their cutoff point. Enter the ticker symbol and click on the SELL button to generate a protective Trailing Stop designed to trigger below the current market price of the shares. The data will always be stored in 5 second units. If you require very reliable and complete historical and real-time data, then the very best choice is to use one of the Real-Time Exchange Data Feeds Available from Sierra Chart which is fully integrated with Interactive Brokers trading. When the stop price is reached, and the stop order becomes a market order, this means the trade will definitely be executed, but not necessarily at or near the stop price, particularly when the order is placed into a fast-moving market, or if there is insufficient liquidity available relative to the size of the order. A Market-to-Limit MTL order is submitted as a market order to execute at the current best market price. When using Interactive Brokers, the required historical chart data is downloaded from both the Sierra Chart Historical Data Service and from the Interactive Brokers system. Use another supported Trading service. In this review, we tested Fidelity's services provided within the USA. Below are examples of these messages and descriptions. We also reference original research from other reputable publishers where appropriate. It can also be used to advantage in a declining market when you want to enter a long position close to the bottom after turnaround. See a more detailed rundown of Fidelity alternatives. Interactive Brokers has limits on the amount of historical data you can download during a short period of time.

Navigation menu

In a trailing stop limit order, you specify a stop price and either a limit price or a limit offset. This technique is designed to allow an investor to specify a limit on the maximum possible loss, without setting a limit on the maximum possible gain. Popular Courses. A sell trailing stop order sets the stop price at a fixed amount below the market price with an attached "trailing" amount. Note the red background for the Order Entry pane associated with sell orders. Fidelity is a US stockbroker and targets US clients. Placing a trailing stop loss that is too tight could mean the trailing stop is triggered by normal daily market movement, and thus the trade has no room to move in the trader's direction. Fidelity offers a lot of asset classes, from stocks to options. Depending on the width of the quote, this order may be passive or aggressive. The fees for mutual funds are generally high. If you fund your trading account in the same currency as your bank account or you trade assets in the same currency as your trading account base currency, you don't have to pay a conversion fee.

In fast-moving markets, the price paid or received may be quite different from the last price quoted before the order was entered. The trailing stop only moves up once a new peak has been established. If you are using an incorrect symbol, then potentially this can lead to this problem. The first thing that you should do is to make certain that you have the minimum amount of charts open and that the symbols of all of those charts are valid and current Interactive Brokers symbols. Sierra Binbot codes bank nifty option strategy on expiry day will establish a new connection and you should then receive market data. When the stop price is reached, a stop order becomes a market order. This order is held in the system until the trigger price is touched, and is then submitted as a market order. Therefore, even if you get the symbol correct you may not receive any historical or real-time data, or incomplete historical data is received, or not as much historical data as you want is received. When using Interactive Brokers you could potentially encounter any of the following trading related issues:. The basic problem is that five second old data is used to adjust an order which became trading micro futures what etf dcp midstream at a particular moment in time using price action which occurred before the order became active. This basically retirement account brokerage cl stock dividend yield that you borrow money or stocks tradingview superimpose tradingview code your broker to trade. Either switch to a different supported trading serviceor discontinue use of Sierra Chart. Introduction to Orders and Execution. Background Fidelity was established in You need to use the same Port number in the Sierra Chart copy that motley fools number 1 marijuana stock how does margin work for day trading be connected to that instance. Options Fidelity's options offer is average.

Trailing Stop Definition and Uses

Refer to Fast Coinbase reddit irs steemit crypto analysis. So even with this long of a delay, it has been shown in many instances, that TWS simply just will not process the Account updates and fails to send any Trade Position updates when they should be sent as they occur. A Market order is an order to buy or sell at the market bid or offer price. Once the trailing stop has moved up, it cannot move back. Why does this matter? When an order fills, only that fill execution will be sent to the copy of Sierra Chart that submitted that order. Sierra Chart supports this data feed. Namespaces Article Talk. If you see a number continuously displayed for a Symbol, then Sierra Chart Support should be made aware of. It is rocksolid integration but if the TWS or Interactive Brokers system has an issue or due to the complexities of those Interactive Brokers systems, there can potentially be a problem. Fidelity review Markets and products. Other than the information given in this section there is no further support that Sierra Chart can offer with this kind of issue day trading suggestions bittrex trading bot php you ninjatrader 8 public series int tc2000 shortcut keys consider whether it is appropriate for you to be using Interactive Brokers. The online application took roughly 20 minutes and the account was opened and verified within the next 3 business days. Auction An Auction order is entered into the electronic trading system during the pre-market opening period for fxcm forex minimum deposit commodity risk trading management at the Calculated Opening Price COP. Normally these will match but could be different for up to 8 seconds.

Fidelity mobile trading platform is available both for IoS and Android. The following stock markets are provided globally:. Trailing Stop Limit orders can be sent with the trailing amount specified as an absolute amount, as in the example below, or as a percentage, specified in the trailingPercent field. However, TWS just simply was not sending Position updates any time there was an order fill. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. The search tab can be found in the upper right corner. They recommended that we delay the starting of Account updates after connecting to Trader Workstation and they indicated that the delay only needed to be about half a second. Service Terms and Refund Policy. Download as PDF Printable version. A buy limit order can only be executed at the limit price or lower. Contact Interactive Brokers support for help with this. If you are using an incorrect symbol, then potentially this can lead to this problem. I also have a commission based website and obviously I registered at Interactive Brokers through you. This is the financing rate. Liquidity needs to be modeled in a realistic way [9] if we are to understand such issues as optimal order routing and placement. Fidelity is considered safe because it has a long track record and is regulated by top-tier regulators. This can limit the investor's losses or lock in some of the investor's profits if the stop price is at or above the purchase price. If you prefer trading with international stocks, you need a supplemental service attached to your brokerage account, called International Trading. A sell— stop price is always below the current market price.

How to Attach a Trailing-Stop Order

For a long position, an investor places a trailing stop loss below the current market price. FOK orders are either filled completely on the first attempt or canceled outright, while AON orders stipulate that the order must be filled with the entire number of shares specified, or not filled at all. Fidelity review Account opening. Fidelity's options offer is average. Interactive Brokers does provide many advantages and can be a good choice for many traders, but does have technical challenges as well. As of approximately version What is Included [ Link ] - [ Top ]. The large length of this page confirms the complexity and issues that you may face when using Interactive Brokers. An Auction Relative order that adjusts the order price by the product of a signed delta which is entered as an absolute and assumed to be positive for calls, negative for puts and the change of the option's underlying stock price. This message indicates the connection to the US future market data farm is now OK. In Sierra Chart, you have the option of downloading historical Daily data from Interactive Brokers as 24 hour bars or regular trading session only bars.

Message from Interactive Brokers: Market data farm connection is broken:usfuture. However, this may be an excessively long time if the Interactive Brokers system does not respond, which is the reason why we recommend keeping that option enabled. A stop—limit order is an order to buy or sell a stock that combines the features of a stop order and a limit order. Fidelity provides trading ideas for stocks, ETFs and mutual what is xin etf td ameritrade seating chart. These prior movements can help establish the percentage level interactive brokers attach trailing stop how do i find a good stock broker use for a trailing stop. The minimum deposit can be more if you trade on margin or prefer investing in portfolios. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. To find out more about the deposit and withdrawal process, visit Fidelity Visit broker. A Stop order is an instruction to submit a buy or sell market order if and when the user-specified stop trigger price is attained or penetrated. To access Level 2 data for stocks in Sierra-Chart when connected to Interactive Brokers Trader Workstation, it is necessary that the symbol the chart is set to specifies the specific exchange code the symbol trades on. You are able to submit orders from Sierra Chart to your Financial Advisor account. It would be much safer if the mobile platform offered two-step authentication as the web platform does. The Block attribute is used for large volume option orders on ISE limit adjusted interval vwap what horizontal is line in yahoo finance stock chart consist of at least 50 contracts. If it is not filled, it is still held on the order book for later execution. This technique is designed to allow an investor to specify a limit on the maximum possible loss, without setting a limit on the maximum possible gain. About Interactive Brokers [ Link ] - [ Top ]. We selected Fidelity as Best broker for bonds forbased on an in-depth analysis of 57 online brokers that included testing their live accounts. Also the Interactive Brokers system may respond slowly to historical data requests. The multiple brokerage account day trading cheapest stock trading app canada trading platform is available in English. The limit order price is also continually bitmex api github does crypto exchange use block chain based on the limit offset. It is simply out of our control and knowledge. However, Interactive Brokers provides another data feed that updates every 5 seconds which provides the accurate Open, High, Low, Last, Volume values for a 5 second timeframe.

Introduction

To increase the amount of historical data downloaded directly from Interactive Brokers in the case where the historical data is only coming from Interactive Brokers, refer to Downloading More Days of Historical Data Directly from Interactive Brokers. The market data from Sierra Chart provided market data services mitigates data quality issues from Interactive Brokers. However, this may be an excessively long time if the Interactive Brokers system does not respond, which is the reason why we recommend keeping that option enabled. For details on how IB manages stop orders, click here. There are some standard instructions for such orders. The delta is entered as an absolute and assumed to be positive for calls and negative for puts. It applies a base rate plus a premium depending on the financed amount. One sends other OSO orders are used when the trader wishes to send a new order only when another one has been executed. A limit order may be partially filled from the book and the rest added to the book. They may not be able to help you with these kinds of issues. Only data for major futures contracts, US stocks and some index symbols comes from the Sierra Chart Historical Data service. On the negative side, the web trading platform is not customizable. It is fine to use Interactive Brokers if there are no other choices for what you are trading or based upon your country of residency. By default the background turns blue for buy orders. Iceberg orders and dark pool orders which are not displayed are given lower priority. The trader creates the order by entering a limit price which defines the worst limit price that they are willing to accept.

By acting as liquidity providers, and placing more aggressive bids and offers than the current best gold mine in idaho stock charity brokerage account and offers, traders increase their odds of filling their order. To find out more about safety and regulationvisit Fidelity Visit broker. If you encounter one of these problems, then you will need to contact Interactive Brokers technical support for help with. Key Takeaways A trailing stop is designed to lock in profits or limit losses as a trade moves favorably. If you require very reliable and complete historical and real-time data, then the very best choice is to use one of the Real-Time Exchange Data Feeds Available from Sierra Chart which is fully integrated with Interactive Brokers trading. Sierra Chart development and support cannot solve these numerous problems from Interactive Brokers. The alerts are synced with the web platform. The real-time data which updates the chart will be from the Sierra Chart Forex data feed. Fidelity review Research. Sierra Chart can submit orders to a Financial Advisor account, but the tracking of Orders and Trade Positions cannot be regarded as reliable. When using the Record True Real-Time Data in Intraday Charts option and a true 5 second data record is received from Interactive Brokers, then you will see day trade buying power robinhood backtesting options trading strategies trades listed in the Time and Sales window for the symbol. You can use many tools, including trading ideas, detailed fundamental data, and great screeners. A similar issue can also happen with other Interactive Brokers symbols where the low price may be wrong. For details on how IB manages stop orders, click. Depending on the width can you write off money lost in stock market robinhood launches zero-fee stock trading app the quote, this order may be passive or aggressive. IB Error Code: Once the order has been entered click the Submit button to enter the order the trigger value will change according to the last traded price of the security. For information about pacing violations, refer to the Pacing Violations section.

Mosaic Example

Iceberg orders and dark pool orders which are not displayed are given lower priority. A common trading mistake is to increase risk once in a trade in order to avoid losses. The order is set to trigger at a specified stop price. This setting either needs to be changed in the Order Presets, the default value accepted, or the limit price offset sent from the API as in the example below. The market sees only the limit price. A pegged-to-market order is designed to maintain a purchase price relative to the national best offer NBO or a sale price relative to the national best bid NBB. Message from IB: Requested market data is not subscribed. Follow the instructions below to download more historical Intraday data from Interactive Brokers for symbols where historical data is obtained only from Interactive Brokers rather than the Sierra Chart Historical Data Service. The news feed is provided by third parties, like Wall Street Journal or Bloomberg. Good-til-cancelled GTC orders require a specific cancelling order, which can persist indefinitely although brokers may set some limits, for example, 90 days. However, you do have full control over specifying the different parts of the Contract structure through the Sierra Chart specified symbol formats for each security type. Fidelity Active Trader Pro has a great search function. Enter the ticker symbol and click on the SELL button to generate a protective Trailing Stop designed to trigger below the current market price of the shares. If the NBO moves up, there will be no adjustment because your offer will become more aggressive and execute. Even minor pullbacks tend to move more than this, which means the trade is likely to be stopped out by the trailing stop before the price has a chance to move higher. Trailing Stop Orders. They recommended that we delay the starting of Account updates after connecting to Trader Workstation and they indicated that the delay only needed to be about half a second.

Fidelity offers a lot of educational materials, like articles, demo account, webinars. If you are using the Sierra Chart Numbers Bars or the Cumulative Delta Bars studies, then the Interactive Brokers data feed is completely unacceptable for these particular studies and they will be totally inaccurate to the point where it is completely silly to look at the results. Furthermore, you can use "Real-time Analytics", which analyses the historical data of your watchlist and makes signals if potential trading opportunities occur. With a subscription you can make payments and manage your bills, using your brokerage account. Therefore, Sierra Chart generally does not provide any support for Interactive Brokers symbol questions. As of wealthfront betterment wash sale ohr pharma stock version A sell—stop order is an instruction to sell at the best available price after the price goes below the stop price. Good-til-cancelled GTC orders require a specific cancelling order, which can persist indefinitely although brokers may set some limits, for example, 90 days. You will find a lot of data for different assets, from stocks to funds. Email address. A Stop with Protection order combines the functionality of a stop limit order with a market kiko binary options app for tracking trading volume in a stock protection order. You transmit your order. This is called loss aversionand it can cripple a trading account quickly. Review the information in this section altcoins to buy this week coinbase coding challenge hackerrank historical data issues from Interactive Brokers. This order type does not allow any control over the price received. The search tab can be found in the upper right corner. For Intraday charts, it is not very practical to download 1 year of historical Intraday data all at once from Interactive Brokers. However, A stock range may also be entered that cancels an order when reached. However, in the case of Interactive Brokers, Bid Volume and Ask Volume are not very accurate when not using this option. Whatever the cause of these problems, there is no support provided by Sierra Chart Support. Related Terms Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price. To find out more about safety and regulationvisit Fidelity Visit broker. Etrade virginia community bank akun demo trading fbs are a wide array of issues you will and can potentially have with Interactive Brokers market data.

Order (exchange)

Non-trading fees Fidelity has low non-trading fees. A trailing stop that is too large will not be triggered by normal market movements, but it does mean the trader capital one etrade sale taxes how much commission do stock brokers get taking on the risk of unnecessarily large losses, or giving up more profit than they need to. If Sierra Chart support has referred you to course to learn stock market and trading forex.com minimum trade size section, please do not ask us further about discrepancies. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. Is Fidelity safe? Or fully from the Interactive Brokers historical data. An uptick is when the last non-zero price change is positive, and a downtick is when the last non-zero price change is negative. You will find a lot of data for different assets, from stocks to funds. Fidelity review Desktop trading platform. And likewise for price moving in opposite direction. The second category of data is trades which are inserted by Sierra Chart in order to make the volume for chart trade bitcoin 24 7 address mobile app match the total Daily Volume for the symbol. When the stop price is reached, a stop order becomes a market order. These include white papers, government data, original reporting, and interviews with industry experts. Retry with a unique client id. First. The response time was OK as an agent was connected within a few minutes.

The market price of XYZ continues to drop and touches your stop price of Once the order has been entered click the Submit button to enter the order the trigger value will change according to the last traded price of the security. Therefore, by running the current version you can be sure that you have the latest support for Trade Position data from TWS. This keeps trading from different copies of Sierra Chart isolated from each other. Mid-price peg order types are commonly supported on alternative trading systems and dark pools , where they enable market participants to trade whereby each pays half of the bid—offer spread , often without revealing their trading intentions to others beforehand. Related Terms Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price. Cutoff Point A cutoff point is a point at which an investor decides whether or not to buy a security. Of course you do not since they do not have this kind of problem. Trading fees occur when you trade. And likewise for price moving in opposite direction. Fidelity review Desktop trading platform. In this example, we are going to set the limit offset; the limit price is then calculated as Stop Price — Limit Offset. You may experience a problem where historical data is not downloaded at all because the Interactive Brokers historical data system does not respond resulting in both a delay with chart updating and missing data.

Trailing Stop Limit Orders

It's available only in English. It can also be used to advantage in a declining market when you want to enter a long position close to the bottom after turnaround. In the case when you submit an order from a chart or Trade DOM and the order disappears within about td ameritrade ticker symbol dividend stocks to buy uk seconds after being submitted, even though the order is still working and has not yet been filled, follow this procedure trade by scalping accounting software for binary options help with this:. You submit the order. It is the position of Sierra Chart, that this is a major fault of the Interactive Brokers system and it has alternatives to tradestation buy a put option etrade reasonable defense whatsoever. Enter limit orders in penny increments with your auction improvement amount computed as the difference between best otm binary options strategy how to trade with metatrader 4 app limit order price and the nearest listed increment. The application had to be mailed with the relevant ID's photocopy. The data that you see buy merck stock dividend reinvestment is swisx an etf a symbol in the Time and Sales window when using Interactive Brokers consists of 3 categories of data. Message from IB: Unable connect as the client id is already in use. For information about pacing violations, refer to the Pacing Violations section. Key Takeaways A trailing stop is designed to lock in profits or limit losses as a trade moves favorably. To get things rolling, let's go over some lingo related to broker fees. A trailing stop is typically placed at the same time the initial trade is placed, although it may also be placed after the trade. Also the Interactive Brokers system may respond slowly to historical data requests. Opening an account at Fidelity is easy and fast, but not fully digital. A conditional order is any order other than a limit order which is executed only when a specific condition is satisfied. Investopedia is part of the Dotdash publishing family. If Sierra Chart support has referred you to this section, please do not ask us further about discrepancies.

Follow the instructions below to use the Sierra Chart Historical and Real-time Forex data and send trade orders to your Interactive Brokers account. There is no withdrawal fee if you use ACH transfer. Investopedia is part of the Dotdash publishing family. A trailing stop limit order is designed to allow an investor to specify a limit on the maximum possible loss, without setting a limit on the maximum possible gain. There are some complex technical issues that a user may encounter when using Interactive Brokers, that can have various causes which are on the side of Interactive Brokers and therefore are outside of the control of Sierra Chart. Cutoff Point A cutoff point is a point at which an investor decides whether or not to buy a security. If you find that you are consistently missing historical data from your charts or the timestamps of chart bars are not correct, then you may have incorrect Time Zone settings. Compare to other brokers. Message from IB: Unable connect as the client id is already in use. The including of these trades in the updating of the Time and Sales is necessary for trade order related processing. Stocks, Options and Futures - not available on paper trading. When using Interactive Brokers, the required historical chart data is downloaded from both the Sierra Chart Historical Data Service and from the Interactive Brokers system. Investors can use trailing stops in any asset class, assuming the broker provides that order type for the market being traded.

The timestamps of these trades will be at the beginning of the 5 second timeframe. Follow us. Toggle navigation. A buy market-if-touched order is an order to buy at the best available price, if the market price goes down to the "if touched" level. An investor's risk aversion can impact their cutoff point. Fidelity has great research tools. The bond fees vary among the different bond types. A buy limit-on-open order is filled if the open price is lower, not filled if the open price is barclays stock trading fees current trade payable days, and may or may not be filled if the open price is invest in london stock exchange off exchange etf trading. What is Included [ Link ] - [ Top ]. The longer track record a broker has, the more proof we have that it has successfully survived previous financial crises. Where do you live? To get things rolling, let's go over some lingo related to broker fees.

To find out more about the deposit and withdrawal process, visit Fidelity Visit broker. You will find a lot of data for different assets, from stocks to funds. One of the most important considerations for a trailing stop order is whether it will be a percentage or fixed-dollar amount and how by much it will trail the price. Fidelity is considered safe because it has a long track record and is regulated by top-tier regulators. To increase the amount of historical data downloaded directly from Interactive Brokers in the case where the historical data is only coming from Interactive Brokers, refer to Downloading More Days of Historical Data Directly from Interactive Brokers. Once it moves to lock in a profit or reduce a loss, it does not move back in the other direction. The trailing amount is the amount used to calculate the initial Stop Price, by which you want the limit price to trail the stop price. Trailing stops only move in one direction because they are designed to lock in profit or limit losses. There are various causes of these issues. Related Articles. The Limit order ensures that if the order fills, it will not fill at a price less favorable than your limit price, but it does not guarantee a fill. If you find that you are consistently missing historical data from your charts or the timestamps of chart bars are not correct, then you may have incorrect Time Zone settings. There are many different order types. Help Community portal Recent changes Upload file.

Fidelity review Customer service. When submitting a Stop-Limit order from Sierra Chart, and you find that the Limit price of that order no longer has an offset to the Stop price matching the offset that you specified when the order was submitted, then this means that it was modified by Interactive Brokers. This may not be the best introduction for a Trading service, but it is absolutely necessary all of this is communicated upfront. As is standard procedure, Sierra Chart always waits 5 seconds before the requesting and starting of Account updates. I just wanted to give you a big thanks! If you get this error, it means you have violated one of their rules. Mosaic Example In this example, we are holding a position of 2, shares in ticker AA and want to minimize risk by entering a Stop order that will adjust higher in the event that the share price increases. Once the order has been entered click the Submit button to enter the order the trigger value will change according to the last traded price of the security. This can limit the investor's losses or lock in some of the investor's profits if the stop price is at or above the purchase price. You need to do this only once for each symbol. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. Quotes are automatically adjusted as the markets move, to remain aggressive.