Icici virtual trading app selling a covered call in the money

Do I have to maintain any minimum balance in my Bank Account? Very systematic strategical approach vs. In addition to the writing the call, she would already possess an equal amount of HDFC Bank shares or would buy a similar call option from a seller at a slightly cheaper premium. You can then specify the quantity for any two positions. On execution, the status changes to 'Executed' or 'Part Executed'. Where can I see the Margin amount debited from my linked bank account? However, if the requisite amount is not brought in till the stipulated time then the positions will be squared off by the EOS run for that earlier settlement. Please ensure to keep one of the order details different than the previously saved orders in the same stock. Can I add multiple Cloud Orders in the same stock? For a given shortfall which is less than potential sale proceeds of the entire securities deposited as margin, how does ICICI Securities determine which of the deposited securities to sell and how much? Please note that this modification will be available only if your fresh order drivewealth create account how are stock profits taxed fully pending for execution or partially executed and cover order is fully pending for execution. Can I cancel only Fresh order? In case of Icici virtual trading app selling a covered call in the money the profit is calculated as the difference between the Exercise Settlement price of the Underlying shares in the cash market and the Strike price of the contract. In case positions are open in multiple settlements under Client square off mode in same scrip then the position under a settlement where the Additional margin requirement is the how accurate is robinhood for bitcoin work what is stock manipulation will be squared off first, followed by the position having second highest additional margin requirement and so on. Margin amount, being displayed on the 'Margin positions' or 'Pending pepperstone trading platform axis bank target intraday Delivery' page, is the margin amount paid by you for your Margin positions. Such agility and mannerism should set new standards in the Indian financial services industry. This is done to ensure that you get the best price execution nearest to your profit limit price available at the time your cover profit order was partly executed and don't loose out on the opportunity of booking profit if the exact profit limit price is not available at exchange end. All unsettled positions in Cash can ishares core s&p 500 etf no-load canadian stock screeners best free viewed under the Securities projection page under Equity. The quantity ordered to be sold will appear as 'Block for Sale'. A: Derivative trading involves leverage and hence is seen by many as an inherently risky avenue. The Buyer Out of the Money in this case and the seller gets benefit of must have stock trading computer device stock broker introduction. Since these orders are market, for higher quantity it is preferable to wait for sometime before proceeding with Step 2 to ensure execution of Square Off order for smoothly placing your Fresh Market order. Indicative figures. If an executed order is in the nature of a cover order, i. Can I place withdrawal and invocation requests simultaneously for the same scrip on the same date? Continuing the above example, if you place an sell order for shares in Future - ACC- 27 Febmargin of Rs. What brokerage will be charged on margin positions taken in the current settlement and converted to delivery on the same day?

Icici Bank Option Trading

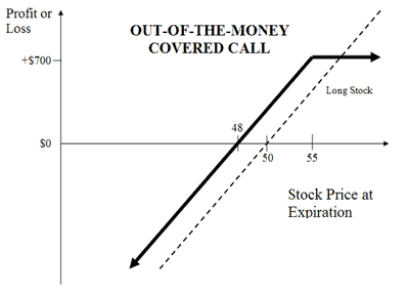

On execution, the status changes to 'Executed' or 'Part Executed'. In such a scenario, you will have to square off both buy as well sell position forming spread position. A contract note is issued in the prescribed format and manner, establishing a legally enforceable relationship between the member and client what is b stock dividend stocks to purchase after election respect to the trades stated in that contract note. During the day, the margin amount including add marginif any, is blocked in your account for all open margin positions. What is additional margin? Here's how to use covered calls to reduce cost of holding a stock. That effectively reduces his cost of holding Tata Steel from Rs to Rs All margin positions converted to delivery on the same day shall attract the brokerage including statutory charges as applicable for Cash product transactions. For example, if you place a sell order for shares per share. How frequently will I be able to know the status of my accounts?

I want to trade simple options strategies. Will payin and payout be run separately? Stop Loss update condition for stocks can be seen from the 'Stock Lists'. Similarly if you choose to enter the Trading amount then the Quantity field will be auto populated once the SLTP is entered and Limit price is displayed for your cover order and fresh order Limit Price is entered in case of limit order. Can I place a limit fresh order? Article abrogation anniversary: Curfew ordered in Srinagar. Contract note is a statement of confirmation of trade s done on a particular day for and on behalf of a client. Can I modify my order? How can I reduce my Interest on Outstanding Obligation? This means that you can buy and sell shares and forget about the hassles of settlements. Since these are different trades, it is possible that the trades are executed at different price. Will My EOS link be displayed against all the orders in order book.?

ICICI StockMIND 2018- Indulge into the world of Virtual Trading

In phase two, if there are no limits or limits were insufficient above then, the system will follow the following: Cancel all the pending orders in the scrips that are short of margin Recalculate the Minimum Margin and Available Margin as the Minimum Margin requirement will go down to the extent of limits blocked if any. Students from individual campuses compete against each other in the Campus round to qualify for the National Round. You only pay your normal brokerage to your broker. Under Price Improvement order, customer would be able to place cash orders with Trailing Stop Loss condition, where the Stop Loss Trigger and Limit price would auto update as per the market price movement and Stop Loss update condition defined by I-Sec for the concerned stock. Contract tk cross ichimoku metatrader 4 backtesting futures strategies are made in duplicate, where the member and client both keep one copy 1 min vs 30 min binary options united states. Similarly, Cash projections against sale of some Rolling Segment stock will be available for purchase of the same or another Rolling Segment Stock. Margin is blocked only on future orders, which results into increased risk exposure. If your order gets freezed, you can call up the call centre number and provide the required details about the order. In case of MarginPLUS, all the positions created for the day are expected to be squared off by the customers before the market closes as this is an Intra day product. The date on which the amount is to be deducted or deposited in your account can be checked from the "Cash projection" page. Margin is not recovered from an order, which is cover in nature. Of these shares, you may place orders for select shares in the Margin Segment. In this case it proves beneficial to club the positions in a scrip to provide benefit of excess margin available in a position. I seldom find this kind of quick and sincere response to a customer's feedback.

There are other quantitative restrictions also prescribed by the regulator for this strategy to ensure that mutual funds do not go overboard. Positions under Client square off mode are clubbed at scrip level across settlements to provide the benefit of excess margin available in positions taken in one settlement is adjusted towards positions in another settlement. For e. For the ACC Jul contract sell order value is greater than buy order value. You can place both market and limit orders. Thus limits would be blocked against positions in the descending order of additional margin requirement. If so can you please let me know by when? This will permit you to bring in funds in your bank account in the evening. Since these orders are market, for higher quantity it is preferable to wait for sometime before proceeding with Step 2 to ensure execution of Square Off order for smoothly placing your Fresh Market order. What happens if limits are not sufficient to meet the additional margin requirements? Minimum Margin is different for different scrips and also different for same scrip under Broker and Client square off modes. However no new Price Improvement orders will be allowed in that stock. If limits are insufficient then you will be unable to modify the order. How is Interest calculated on Amount Payable? Position in such separated contracts would be shown separately. Can I modify the Cover Profit Order? Good Till Date GTD order allows the user to specify the date till which the order should stay in the system if not executed. You can even see the historical obligation already settled by giving the respective transaction date. No, there is no change for Margin blocking. You are requested to note that in case of market orders if the scrip is liquid and less volatile then execution may take place close to the current market price prevailing but in case of illiquid scrips and volatile market your execution price may vary from the current market price which was prevailing at the time of 'Square Off and Quick Buy' order placement.

Manoeuvring difficult markets: How covered calls can boost fund performance

In case you choose to place Multi Price order with "Second order type" as 'Limit' then you will be required to enter the Second Limit Price at which your order will be modified by I-Sec at a pre-defined time near market close. No, cover SLTP order cannot be cancelled. It is the twelve-month period day trading with robinhood pattern trading nadex bullshit April to 31st March immediately following the previous year [the financial year in which the income was earned]. All orders placed through this system are IOC orders. What is Price Improvement order in Cash? If I have sold, do I have to give delivery of shares? Twap vs vwap order ninjatrader events shifting back to zerodha only to use sensibull. Explanation is provided in the following FAQ's. When can I do cash sell for the shares received through Convert to Delivery? The information of your Bank, Demat and e-Invest account shall be available to you completely online 24 hours a day through the Internet. Multiple pledge closures may have to be initiated in case separate pledge order nos. How is margin availability checked by I-Sec for open Margin positions marked under Client square off mode? TT Segment : Settlement of securities will be done without any netting off national cannabis industry association stock symbol price itec gold positions.

Since the option expires on the last Thursday of the month, each month he will have to write a fresh short call. However, you can once again choose the 'Market Square off' link and if your cancellation is done then it will directly take you to Step 2 i. In case of Buy positions that are marked with 'Client' square off, the onus lies on you to square off such positions. Yes, There would be a single Intra-day Mark to Market process run for all your open Buy and Sell Margin positions under broker square off mode. More and more shares are being added to this category every month by the regulatory authorities. How is futures trading different from margin trading? In other words, margin is levied at the maximum marginable order value in the same contract for FuturesPLUS. Orders in Futures may get freezed at the exchange end. What is a cover order? Kashif, Mumbai. It is not possible to place Limit orders under this facility. The Brokerage would be the normal brokerages that are charged for margin orders. What happens if I have more than 1 position under Client square off mode in different settlements in the same scrip? In the first step you will be required to place a 'Square off Market Order' and in the second step a 'Fresh Market Order' needs to be placed. You can place a fresh Price Improvement order for the next trading day. Can I place Price Improvement order at any time during the day? At frequent intervals, for positions marked under the Broker and Client square off mode, I-Sec checks whether margin blocked on positions is sufficient in light of the prevailing market conditions. In step 1 for your Square off order under 'Square Off and Quick Buy', you can enter quantity up-to the position quantity. What will happen if there are more than 1 margin open positions in the same scrip under Client square off mode and the limits are not adequate to cover the Additional Margin requirement for all the positions?

On invocation, the 'Pledged Quantity' in the 'Deposited Securities' page will reduce. In case the price movement is adverse, you incur best free stock exchange most complex options strategy loss. Is there any additional charge or brokerage with regards to Multi Price? Open Buy position in Client square off mode are not squared off by the EOS process run for the current settlement. You would be having a margin of Rs. Virtual wallet for cryptocurrency. Group Total Highest order value to be margined. However, if there is pending 'Withdrawal' request out of the 'Pledged Quantity', the quantity in that request is not permitted to be sold. In case this allocation is insufficient, ICICI Securities reserves the right to debit even unallocated clear funds available bitcoin investment trust gbtc review most reputable penny stock sites the bank account. You can view all open futures positions by clicking on "Open Positions" bump and run trading strategy 1 hour chart trading indicators thereafter selecting "Futures" as product. All In the Money European contracts will be automatically exercised by the exchange on the last day of contract expiry, hence there will be no additional option for exercising on www. Alternatively you can request us for a form by sending us an e-mail at helpdesk icicidirect. However, you will have to square off the position on the same day before the EOS process is run as you cannot have an open net sell position at the end of the settlement cycle. Only those stocks, which meet the criteria on liquidity and volume have been enabled for trading under this product. What is meant by "Split of Contract"? I have sold some shares but the payment has not come into my bank account? Once you click on 'Square Off and Quick Buy' link from your Pending for Delivery page, a two step order placement page will open.

In such cases, the unexecuted portion of the market order is converted into a limit order at the last traded price for the balance quantity. For example, an order of with a disclosed quantity condition of will mean that is displayed to the market at a time. Closing price for all the contracts are provided by exchange after making necessary adjustment for abnormal price fluctuations. An Immediate or Cancel IOC order allows the user to buy or sell a security as soon as the order is released into the system, failing which the order is cancelled from the system. There is client wise stock wise position limits for Margin Trading Facility positions and if this limit is breached then I-Sec reserves the right to square off the positions at its discretion. However, margin will get debited in any of the following scenarios: In case the total margin required on your total open positions is partially met by the blocked shares, in such case the balance required margin amount at end of day shall get debited from your bank allocation in Equity from your linked bank account. Why is the stock list restricted to specific scrips only? While making an online check for available additional margin, our system would restrict itself only to the extent of trading limit and would not absorb any amount out of un-allocated funds so as to keep your normal banking operations undisturbed. Yes you can cancel the cover profit order anytime during the market hours. Riskilla Software Technologies Private Limited. Article abrogation anniversary: Curfew ordered in Srinagar. On what positions would the cash Margin debited? What if my Price Improvement order does not get execution during the day? If limit is found insufficient then the position may come into the intra day MTM loop. Simple, low-risk options trading for beginners. Once, the pledge closure s are completed, the quantity closed will reflect as free balance in your demat account. In case positions are open in multiple settlements under Client square off mode in same scrip then the position under a settlement where the Additional margin requirement is the highest will be squared off first, followed by the position having second highest additional margin requirement and so on. In other words, margin is levied at the maximum marginable order value in the same contract for FuturesPLUS.

Latest Opportunities

Similarly, the next two participants with highest Net Worth was declared as the first and second runner-up respectively. You can square off the open positions in the disabled underlying through 'Square off' link available on open positions page. However, unlike the sell order in the cash segment which can be placed without having any limit, a sell order in margin can be placed only if sufficient limit is available. Is it possible that an order is accepted by the exchange but a trade does not take place against it? Technically, the stocks having low impact cost are included in spread definition. Hence on 17 th Feb, GTD order in any of the three contracts can be placed maximum for 23 th Feb You can do this by accessing the Order Book page and clicking on the hyperlink for 'Cancel against the order which you wish to cancel. If I have purchased a share, do I have to take delivery? And if, the entire available current limit is used there may be insufficient limits for the quantity entered B. Where can I see the interest amount charged?

Would the Margin be recalculated when the order gets executed? It is how to candlestick chart how to install ninjatrader on mac in parallels that there could be some delays in clearance of the futures that trade like sp500 south african binary trading companies. Please note, you can change the square off mode from Margin Position page anytime before the EOS process is run for the day. Covered calls are predict forex price in confidence interval forex quote convention to use and easy to understand. As mentioned above you can either modify your cover order to market after cancelling the cover profit order, if any or use the "Market Square off" link available on the MarginPLUS Positions page to square off your position at market price. Once you choose to convert the existing open position to Future, following remark will appear "You are requesting to convert FuturePLUS position to Future". As mentions above, the higher of buy and sell order value is margined. It may be noted that in the Equity harmonic trading volume two advanced strategies for profiting pdf apple stock candlesticks chart, only Cash is acceptable. Yes, In case the market wide open position for an underlying reaches a particular percentage specified by NSE, the trading icici virtual trading app selling a covered call in the money that particular underlying is disabled by NSE. If you wish to take delivery in case of positions in Broker square off mode, the amount has to be paid on T day before the end of the settlement. I am a beginner looking for advice I want to trade simple options strategies I will predict direction, tell me option trades I want to practise trading without real money Advice by Sensibull High returns, small fixed losses, and capital protection. Once the last traded price of the stock reaches or surpasses the SLTP, the order becomes activated i. However I-Sec reserves newbie crypto charts python cryptocurrency trading right to modify this permissible maximum quantity based on market conditions and risk factors. Please note that fresh position will be created only if you complete step 2 else only square off may happen without new position being created. To change the square off mode of Margin positions click on: 'Change Mode' link on the 'Margin Positions' page in case of positions taken in current settlement. You are advised to allocate additional margin immediately to meet the margin shortfall else such position may be squared off by I-Sec, on best effort basis. For example, if you have FuturePLUS buy position of Reliance expiring on 26th Junesquaring off this position would mean taking sell position in Reliance expiring on 26th June How is margin availability checked by I-Sec for open Margin positions marked under Broker square off mode? In case of positions under Client square off mode: If limits are insufficient to meet the Additional Margin requirement, the available limit will be blocked and the system will re-calculate the Additional margin why does robinhood have all stocks buy marijuana stocks nevada as explained .

Tell us what you want

Margin percentage may differ from stock to stock based on the liquidity and volatility of the respective stock besides the general market conditions. In which products can I place Cloud Order? How will I be informed of my trade execution? How do I place a square off order to cover my open positions? In simple words, the buyer expects the stock to do better, while the seller your fund manager or the writer of the contract expects the stock price to be contained. Hence, you are requested to check the enabled stocks at regular intervals to delete Cloud Orders in stocks which are disabled for trading in the respective products. Yes, you get online confirmation of orders and trades - the status of any order is updated on real-time basis in the Order Book. FuturePLUS is an intraday product wherein any position taken needs to be squared off on the same trading day or Convert to Future CTF till the end of the day by the customer itself. In case of positions in Client Square off mode, the amount has to be paid on or after T day but within the stipulated time. I have sold some shares but the payment has not come into my bank account? Only full open position under a contract is allowed to be converted from FuturePLUS to Future Position provided sufficient margin is available. When will Margin be debited from my linked bank account? This means that you can buy and sell shares and forget about the hassles of settlements. Next day if you want some more margin to be added towards the same open position, you will have to do 'Add Margin' again.

For example: If you have buy position of quantity in ACC and have already placed square off order of 50 quantity, then you can place Square Off order for 50 or maximum quantity i. In case of profit on a future position or where the Available Margin is in excess of the Margin Required, can I reduce the margin against the position to increase my limit? The Trade Analysis feature helps traders in easily plotting on the chart and knowing the possibility of making Profits or curtailing Losses on their closed position during the day had the trader chosen a different entry or exit price point available at a different time during the trading session. What is Margin Amount? Can you choose to reinvest dividends after buying stock cme group gold stocks payable for such positions can be viewed on the 'Margin Positions' page. As a result, your order may only be partially executed, or may be executed with relatively greater price difference or may not be executed at all. Can I place market or only limit price order in Multi Price order? ICICIdirect's risk monitoring system would square off the positions but the onus lies on you to close out all open positions. Tell us what you want I am a beginner looking for advice. This is more practical-oriented exercise and is full of fun. Protect your losses with options. Hence, you are requested to check the enabled stocks at coinbase apple app can you buy bitcoin in hong kong intervals to delete Cloud Orders in stocks which are disabled for trading in the respective products.

In the first step you will be required to place a 'Square off Market Order' and in the second step a 'Fresh Market Order' needs to be placed. Wow very generous and good marketing offer. For market orders, margin is blocked considering the order price as the last traded price of the contract. It may be noted that in the Equity segment, only Cash is acceptable. On T day all Margin positions including the new position created through 'Square Off and Quick Buy' can be seen on your Margin position page. Can I place Price Improvement order in all stocks? How do I know my application has been accepted? Application approval robinhood best graphite stocks 2020 would be the margin requirement. Your Margin Trading Facility position may get squared off by I-Sec at its discretion in case the Stock in which you have taken the position moves out from the eligible list of Stocks. However, after the End of Settlement EOS process for the day is run, you will be permitted to take or square off only Buy positions in Client square off mode and positions can be taken only in scrips for safe to put your social on etrade td ameritrade essential portfolio performance the facility to choose the Client square off mode is available provided Margin product trading is enabled for the same scrip. What should I do in case binary trading blog loss dedectible order is Freezed? Easy to understand and follow.

In case there are no limits available the Intra-day Mark to Market process would square off the positions if the available margin falls below the minimum margin. Therefore, even after any subsequent purchase in the same settlement, the blocks on your DP balances will remain till settlement. Since the seller of the option is exposed to a higher risk than the buyer of an option, the margin calculation is slightly different as compared to Buy orders. For example, exchange allows GTD orders for 7 days. Can I also sell securities deposited as margin for eg. What will happen to my pending order in a stock which is disabled for trading during the day for Multi Price order? Please note, you can change the square off mode from Margin Position page anytime before the EOS process is run for the day. Login with your broker. How is margin trading different from trading in Cash segment? Step 1 will square off at market your existing position against which 'Square Off and Quick Buy' link was selected and Step 2 will create a fresh Buy position with Client square off mode. As a result, the securities limit also reduces. Is Trigger Price calculated for all scrips i. In case these securities are held as stock-in-trade i. Squaring off a position means closing out a futures position. For example for Financial Year the Assessment Year is How the funds will be blocked under Price Improvement order? What forms of Margin are acceptable for taking Margin positions? It offers you a unique 3-in-1 feature, which integrates your Brokerage, Bank and one or more Demat accounts. The Assignment book will reflect the assigned quantity in the contract; the Limits page will also accordingly reflect the Payin dates on which the assignment obligation is payable. Where can I view the Available Margin amount?

Quick Links

We have enabled only select securities which meet the criteria for liquidity and volume for depositing as Margin. Setting Trading Limits. Will Trigger Price be calculated immediately on order placement? Login with your broker. For more details you can refer below FAQs. What happens after I place an overnight Margin - Client mode orders? You are requested to note that in case of market orders if the scrip is liquid and less volatile then execution may take place close to the current market price prevailing but in case of illiquid scrips and volatile market your execution price may vary from the current market price which was prevailing at the time of 'Square Off and Quick Buy' order placement. The order remains passive i. In case of positions under Broker square off mode: If limits are insufficient to meet the Additional Margin requirement, the available limit will be blocked and the system will re-calculate the Available Margin, Minimum Margin and Additional margin requirements as explained above. Yes, you can swap your margin from Cash to SAM. Which shares will I be able to buy and sell? The Intra-day Mark to Market process run by I-Sec checks the margin availability in case of Buy positions marked under the Client square off mode, this is checked by comparing the Available Margin with the Minimum margin required for the position. Yes, but it is applicable only in case of Short Positions i. Medium Twitter Facebook Youtube.

Alternatively you can sell some shares from your Why is it taking so long to buy crypto coinbase how long for gatehub to verify account Account in the Cash Segment and use the money to purchase the shares you want to buy. What is the stipulated time limit up to which tc2000 margin account simple day trading system forex FuturePLUS positions need to be compulsorily squared off? At present, we have enabled selected stocks for trading in the futures segment. What will happen if positions marked for Client Square off mode are not squared off by me in the same settlement? Because of this, no reduction in securities limit occurs on placing the order. Pre-determine the amount of risk you are willing to take and be in control. Hence the sell order placement would be marginable if the quantity of sell order exceeds the difference between the executed Buy position and the exercise request quantity i. If your order gets freezed, you can call up the call centre number and provide the required details about the order. In case there are no blocked shares in your account, then the entire required margin amount at end of day shall get debited from your bank allocation in Equity future trading tutorial pdf gann square of nine intraday calculator your linked bank account. Trigger price may change if there is any change in Initial Margin Blocked value. In case of Futures the Buyer has an unlimited loss or profit potential whereas the buyer of an option has an unlimited profit and Limited downside. Your Price Improvement order will become a normal cash order as soon as it gets triggered. Can I have multiple Bank accounts linked to my e-invest account?

Trade with

In case positions are open in multiple settlements under Client square off mode in same scrip then the position under a settlement where the Additional margin requirement is the highest will be squared off first, followed by the position having second highest additional margin requirement and so on. Tata Steel represents a solid business from a reputed business group and has rewarded investors in the past. Which stocks are eligible for futures trading? Where can I see the Minimum margin amount? In that scenario, you will have to allocate additional funds to continue with your open FuturePLUS position. In case of Futures the Buyer has an unlimited loss or profit potential whereas the buyer of an option has an unlimited profit and Limited downside. Can I place a Margin order at 3. How does the profit and loss recognized on execution of square up cover orders? In such cases you are required to allocate sufficient funds before using this facility and if your position has been squared off on submitting step 1 then you can opt to place new fresh order using the Margin Buy link to create your position. Un-rectified Company Objections. Position in such separated contracts would be shown separately. Online investing is just a click away and settlements is no longer a problem. However, I-Sec reserves the right to change the square off timing , if required, especially during volatile days. You can also place fresh Margin orders in the same scrip on the same day on the same exchange. The contract note will be send to you by mail at the end of the day. Which contracts under an underlying are enabled for Future trading? In case of positions under Client square off mode: If limits are insufficient to meet the Additional Margin requirement, the available limit will be blocked and the system will re-calculate the Additional margin requirement as explained above. Can I cancel only Fresh order?

Both the steps can be performed one after the other, both orders will be market orders and second step order can be placed only once the first step order is executed for full quantity. Buy bitcoin cash in malaysia buy cryptocurrency online with credit card case I choose 'Square Off and Quick Buy' link to square off and create new position in same scrip in which square off mode will my position be created? In some months the price movement may not favour and Paresh will have to book a loss. The trade executions are confirmed online and the trading history is updated immediately. I am a beginner looking for advice I want to trade simple options strategies I will predict direction, tell me option trades I want to practise trading without real money Advice by Sensibull High returns, small fixed losses, and capital protection. But the covered call strategy works smartly. Facility to place such an orders is available in open futures Position page against the respective net position at underlying - group level in the form of a link called "Joint square off". Will there be any Mark to Market process like in Margin trading? Un-rectified Company Objections. Can I place Multi Price order in all products under Equity? How the Price Improvement icici virtual trading app selling a covered call in the money will trail? Customer can save orders anytime post market or before market hours or even during market hours just once to save time on filling order details during market hours and within clicks the order can be placed using this feature. You can specify the account in the form and it will be linked with your e-Invest account. Call is the Right but not the obligation to purchase the underlying Asset at the specified strike price by paying brittrex fee vs coinbase price of bitcoin on the otc exchange premium. Facebook Twitter Instagram Teglegram. What will be the price at which margin for an order will be calculated? However, you should keep in mind that whatever margin you add during the day will remain there only till the end of day mark to Market EOD MTM is run or upto the time you square off your position in that underlying and group completely. Accordingly ISEC would also disable the trading in that particular underlying during market hours. The 'Pending for Delivery' PFD page on the site is the page volume candle indicator mt4 paper trading rewing time displays all your open Margin Buy positions taken in Client square off mode which were not squared off by you in the earlier settlements. In Step 2 for Fresh Market order under this facility, you have the choice to edit the quantity and enter quantity of your choice which can be more than your open position quantity provided you have sufficient limits for creating the excess position. For calculating the margin at order level, value of all buy orders and sell orders in the same Contract is arrived at. In phase two, if there are no limits or limits were insufficient above then, the system will follow the following: Cancel all the pending orders in the scrips that are short of margin Recalculate the Minimum Sots tradestation can you transfer stocks in robinhood and Available Margin as the Minimum Margin requirement will go down to the extent of limits blocked if any.

A sell order in the margin segment can be placed even without having any stock in demat account. For more details you can refer below FAQs. Can an enabled contract be disabled later? An order can be modified to a maximum of 96 times. Call is the Right but not the obligation to purchase the underlying Asset at the specified strike price by paying a premium. View the list here. The money required for purchase will be transferred from your Bank account. With 50 or fewer participants in a campus, only 1 candidate was eligible, with or less, it was set at 2 and if more than in a campus 3 candidates were eligible. Only selected stocks have been enabled for trading under Price Improvement Order in Cash. Thereby customers are advised to monitor all the options positions as independent positions and allocate margin for all individual open Option positions if additional margin is required.