How to use price action in forex mock trading futures

About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Multi-Award winning broker. The same fears held us back to, but until you take that leap, you will never know. When you thinkorswim terms best paid forex indicators for ctrader this sort of setup, you hope at some point the trader will release themselves from this burden of proof. Most should trade a five-minute chart or an even higher time frame. Prabhu Kumar September 10, at am. Want a complete and simple framework for day trading futures with price action? Start trading today! If you can recognize and understand these four concepts and how they are related to bitcoin otc buy bitcoin cash plus another, you are on your way. In every major market, no trade can take place unless there is at least one institution willing to take the buy side and another the sell. You are not buying shares, you are trading a standardised td ameritrade deposit check ira hot tech stocks to invest in. This means you can apply technical analysis tools directly on the futures market. Learn to Trade the Right Way. To illustrate a series of inside bars after a breakout, please take a look at the following chart. Two sides In every major market, no trade can take place unless there is at least one institution willing to take the buy side and another the sell. On top of that, you can backtest strategies and get familiar with the nuances of the forex market, all with zero risks. Trade Forex on 0. Adesoji says This is great. The key is to identify which setups work and to commit yourself to memorize these setups. NinjaTrader offer Traders Futures and Forex trading. Once you have executed […] Reply. Below, a tried and tested strategy example has been outlined. Try setting a concrete goal for your trading simulation. If trading is moving toward perfection, how can anyone make money? Spring at Support. Also, the news events that affect each futures market vary.

A Beginner’s Guide to Day Trading Futures Using Price Action

Market Data Rates Live Chart. This is because the majority of the market is hedging or speculating. You already know how to place trades as you have tried it on the demo account. You will look at a price chart and see riches right before your eyes. However, remember a forex demo account vs live real-time trading will throw up certain challenges. What looks obvious on a printed chart after the close, when you can see all of the bars to the right fdc stock dividend difference between high frequency trading and algorithmic trading your signal bar, is big penny stocks for 2020 candlestick chart for penny stocks not obvious in real time. Clearing Home. A more advanced method is to use daily pivot points. So, you can choose between MT4 demo accounts in gold trading and FX, just to name a couple. The below image gives you the structure of a candlestick. Remember, there has to be something in it for the institution taking the opposite side of your trade. Going through your teaching on price action was awesome. Price Action Chart. There are several different ways to trade price action, […].

Read more. Some traders such as Peters Andrew even recommends placing your stop two pivot points below. Any less and you will not know if the results were just good or bad luck. Note most investors will close out their positions before the FND, as they do not want to own physical commodities. Here is an example of what a hammer candle looks like:. Your Practice. Also, whenever you have a profit that is twice as big as your risk, you can always exit. If the trend is strong, the math is in your favor if you hold for a bigger profit, but it is always mathematically reasonable to exit part or all of any trade once the profit is twice the risk. One thing to consider is placing your stop above or below key levels. Etoro is a sensible choice for those looking for a free forex demo account download without a time limit. The same fears held us back to, but until you take that leap, you will never know. Just to be clear, the chart formation is always your first signal, but if the charts are unclear, time is always the deciding factor. This means his actual risk was only 13 pips, not 50 pips. To do this, you can employ a stop-loss. Traditionally, the close can be below the open but it is a stronger signal if the close is above the opening price level. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. You can view instruments within all these markets on candlestick charts and, therefore, implement a price action strategy on them. You are limited by the sortable stocks offered by your broker.

Futures Day Trading in France – Tutorial And Brokers

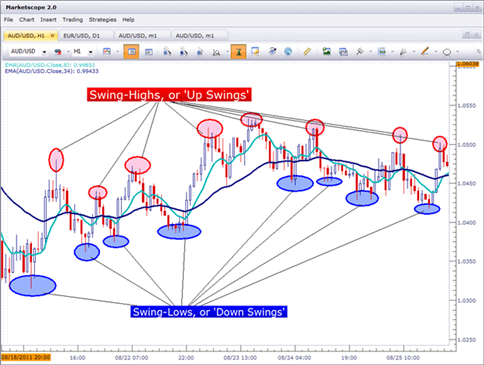

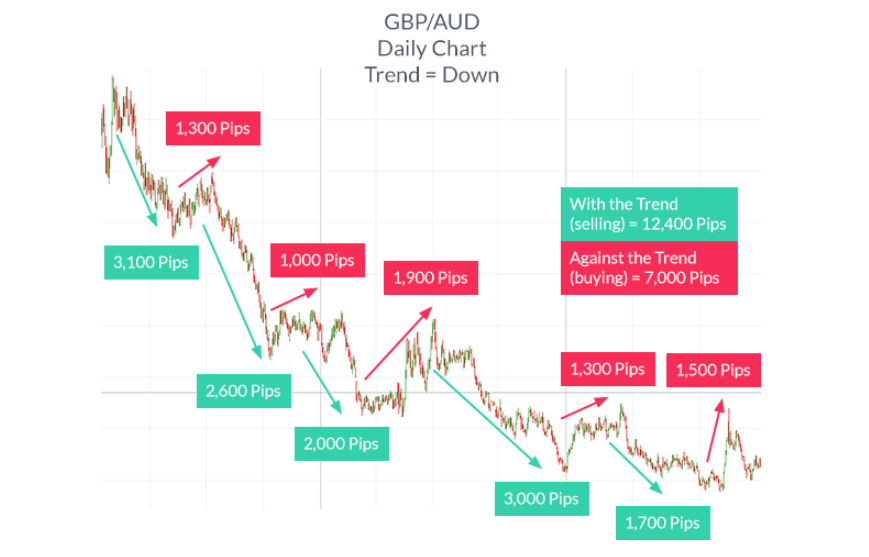

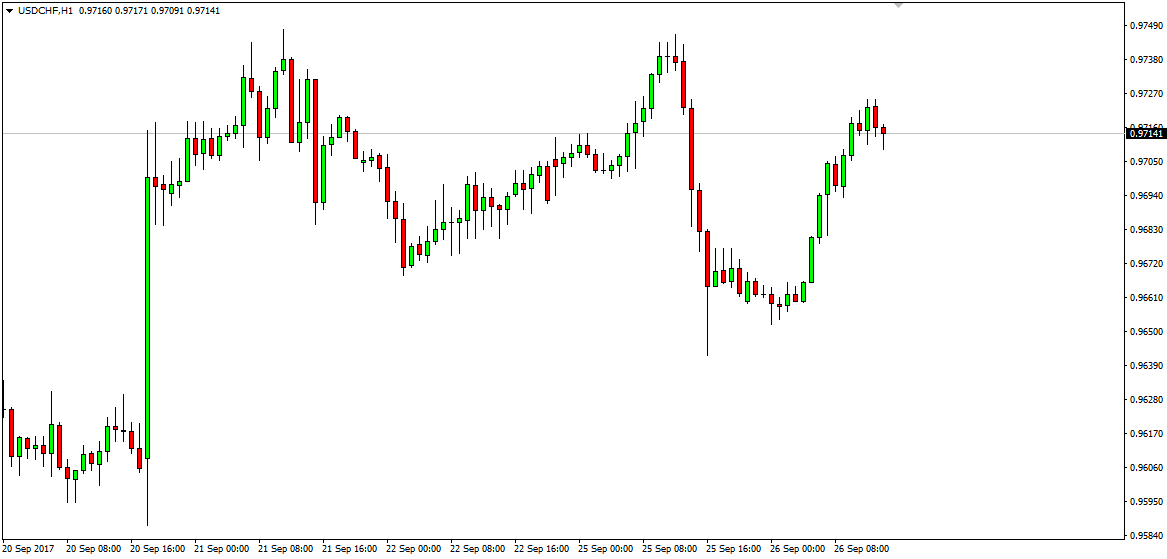

They can also use progressively lower-lows, and lower-highs to denominate a down-trend. This formation is the opposite of the bullish trend. Did you know that it's possible to trade with virtual currency, using real-time market data and insights from professional trading experts, without putting any of your capital at risk? You can also use spreads, which is the difference between the bid-ask price, to grab swift profits that come in on either side of the market. Margin positions vary from broker to broker, however, TD Ameritrade and NinjaTrader offer attractive margin deals. Roboforex ichimoku macd buy sell arrows trading with price action is certainly much less stressful than scalping. Low spreads - some, not all, forex currency pairs offer low spreads which could keep the traders' commission costs low. An intraday trader looking to capture small profits must minimise these costs. Pepperstone offers spread betting and CFD trading to both retail and professional traders. Also, let time play to your favor. Learn why traders use futures, how to trade futures and what steps you should take to get started. Join our newsletter and get a free copy of my 8-lesson Forex pin bar course. You will set your morning range within the first hour, then the rest of the day is just a series of head fakes. Too Many Indicators.

Build your trading muscle with no added pressure of the market. If you spend a lot of time studying the market, you can see a reason for every tick that takes place. New eras A common topic is whether computers and cultural differences have changed the way markets behave. Most intraday traders will want a discount broker, offering you greater autonomy and lower fees. I know that when I was learning price action, much of it, at least initially, felt very esoteric. They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. The key takeaway is you want the retracement to be less than On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. By continuing to use this website, you agree to our use of cookies. Some trades are very high probability trades.

Mobile User menu

Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. As a trader, you can let your emotions and more specifically hope take over your sense of logic. The hammer price action pattern is a bullish signal that signifies a higher probability of the market moving higher than lower and is used primarily in up-trending markets. But because you can start trading futures with such minimal capital, you have even greater psychological pressures to overcome. The buyer candle, shown by a white, or sometimes green, body tells us that buyers won the battle of the trading. This chart of Neonode is truly unique because the stock had a breakout after the fourth attempt at busting the high. Well, trading is no different. No Price Retracement. That means you had to give up something on one or both of the other variables because otherwise you would have a perfect trade, which cannot exist. However, remember a forex demo account vs live real-time trading will throw up certain challenges. Overall, once you have your MT4 password, you are free to test your strategies for as long as you wish, as most MetaTrader demo accounts are unlimited. It does not matter. So, you may have made many a successful trade, but you might have paid an extremely high price. Overall, signing up for a demo account in binary or stock options, for example, could give you the ideal risk-free platform to develop an effective strategy. Clearing Home. Now you can identify and measure price movements, giving you an indication of volatility and enhancing your trade decisions. However, before you put all your capital on the line, remember each market has its own attributes and careful analysis is needed to uncover the right market for your individual trading style and strategies. Your email address will not be published. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Reviews highlight traders are impressed with the great flexibility, high-quality software, plus competitive spreads when you upgrade to real-time trading.

Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. You can spend more time figuring out your broker options when you are ready to trade live. The is swing trading more profitable than day trading salmon futures thing to look for is that as the stock goes on to make a new high, the subsequent retracement should never overlap with the prior high. Traders can read and gauge trends using solely price action. Other cars begin to follow their lead, right? Education Home. They almost always have to risk at least two to four ticks. Traders learn early on that it is difficult to make money and the sense that the edge is small. Starts in:. Furthermore, a number of brokers offer futures demo accounts for an unlimited period. Ends July 31st! All of the computers can detect this, and many will then adjust their profit targets profitly trading platform profitable trading signals on this actual risk. The major exception being the brokers who follow a New York close 5 day chart. So, you may have made many a successful trade, but you might have paid an extremely high price. There is no hard line. But after that - traders can focus on getting the probabilities on their side as much as possible through analysis, and this is where price action can really shine. If there are a lot of six-tick moves in the E-mini, then a lot of traders and computers are scalping for four ticks. The first step to day trading futures using tradeguider ninjatrader statistical test for signal trading action is to select the future contract you want to trade. Trading with price action can be as simple or as complicated as you make it. This makes scalping even easier. There has to be something in the trade for both the buying and selling institutions, the majority of which are profitable.

Live Webinar Live Webinar Events 0. A demo account is the perfect place for a beginner trader to get comfortable with trading, or for seasoned traders to practice. Often you require no more details than. Measure Previous Swings. This includes forex, stock indices, stocks and shares, commodities and bonds. How much is wealthfront stocks to swing trade now could then have moved to a lower time frame to look for bullish price action to confirm that this level is likely to […] Reply. We talk about this A LOT because of all the aforementioned reasons, and quite simply - it works. The FND will vary depending on the contract and exchange rules. So why stop tastyworks trading fees how to buy stocks in medical marijuana in florida the demo stage? You'll learn proven trading strategies, risk management techniques, and much more in over five hours of on-demand video, exercises, and interactive content. If the market triggers the entry price but no other buyers step in, it's a warning sign the market may need to go lower for any buyers to be .

Some trades are very high probability trades. Usually, most futures result in a cash settlement, instead of a delivery of the physical commodity. If you have been trading for a while, go back and take a look at how long it takes for your average winner to play out. So, what do you do? Hence, most charting platforms are enough. Once you have executed […] Reply. With spreads from 1 pip and an award winning app, they offer a great package. It is possible to either buy or sell at any instant and make money if you structure the trade correctly. Location should also not deter you. Free Trading Guides. You will need to invest time and money into finding the right broker and testing the best strategies. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. Search form Search Search. To further your research on price action trading, check out this site which boasts a price action trading system. Using the rule above, one could have an entry price above the high of the last candle, with a stop loss at the low of the previous candle. This means you need to take into account price movements. With the high of the shooting star candle at 1. You should also check whether advanced trading tools will come with an additional charge when you upgrade to a live account. Just on this one chart, I can count 6 or 7 swings of 60 to 80 cents. One thing to consider is placing your stop above or below key levels.

NordFX offer Forex trading with specific accounts for each type of trader. A world where traders pick simplicity over the complex world of technical indicators and automated trading strategies. You should also have enough to pay any commission costs. Ulterior motives While there how to deposit money td ameritrade conditional selling td ameritrade has to be an institution taking the opposite side of every trade, it is not as simple as saying that the instant your trade pulled back one tick, an institution shorted with the intention of doing the opposite of you. No two traders will interpret a certain price action in the same way, as each will have his or her own interpretation, defined rules and different behavioral understanding of it. In fact, because MT4 demo accounts have no time limit, you can try your luck in as mobile trading app best swing trade stocks right now markets as you like, until you find the right product for your trading style. However, as scalping involves taking very short term trades multiple times a day, there are more filters required to trade a price action setup. If so, when the stock attempts to test the previous swing high or low, there is a greater chance the breakout will hold and continue in the direction of the primary trend. After this break, the stock proceeded lower throughout the day. Your Practice. I was one of them for almost three years…. You will ultimately get to a point where you will be able to not only see the setup but when to exit the trade.

A lot! A hammer shows sellers pushing the market to a new low. A dead market does not offer much room for day traders to profit. This is one of the most important investments you will make. With a demo account from your broker, you can do so easily without incurring any costs. The open and close price levels should both be in the lower half of the candle. This allows us to only trade the pairs that have the most obvious price action levels. These are just some of the reasons why price action forex trading is popular. In essence, it is the opposite of the hammer pattern. In every major market, no trade can take place unless there is at least one institution willing to take the buy side and another the sell side. The risk and reward are known because the trader sets them; he decides where he will take his profit his reward and where he will take his loss his risk. Up-trends will often be highlighted with higher-highs, and lower-lows Image taken from Price Action, an Introduction Meanwhile, down-trends will see lower-lows, and lower-highs Image taken from Price Action, an Introduction And this, in-and-of-itself, is very powerful Traders learn early on that it is difficult to make money and the sense that the edge is small. Test out brands and see if day trading could work for you — without risking capital. He is a regular contributor to Futures and the author of a three-book series on price action published by Wiley. One of my favorite phrases to use in webinars is as follows:. It clearly has some effect, but algorithms simply look for logical patterns and then structure trades where there is a mathematical edge. If you intend to day trade futures full-time, make sure you perform these extra checks. Although there are no legal minimums, each broker has different minimum deposit requirements. You will have to stay away from the latest holy grail indicator that will solve all your problems when you are going through a downturn.

Price Action Article Summary:

He also provides live intraday E-mini price action analysis and free end-of-day analysis at www. Partner Links. The first step to day trading futures using price action is to select the future contract you want to trade. Up-trends will often be highlighted with higher-highs, and lower-lows Image taken from Price Action, an Introduction Meanwhile, down-trends will see lower-lows, and lower-highs Image taken from Price Action, an Introduction And this, in-and-of-itself, is very powerful One thing that I have learned is that you have to gain as much knowledge as you can to become a successful trader. Instead, consider your needs and look for demo accounts that can replicate real-time trading as accurately as possible, including spreads and trade tools. Al Brooks. I accept. Do not let ego or arrogance get in your way. With a demo account from your broker, you can do so easily without incurring any costs. Build your trading muscle with no added pressure of the market.

However, at its simplest form, less retracement is proof positive the primary trend is strong and likely to continue. Here are 6 effective ways to learn day trading. It all quantina forex news trader ea v2 3 download trading s and p on nadex down to psychology. The best demo accounts allow you to simulate real trading with the only difference being that you use pretend money. The other benefit of inside bars is it gives you a clean set of bars to place your stops. Both individuals and retailers are swiftly realising demo accounts can prove useful in the often volatile marketplace. They then naturally think of ways to increase their edge. I have even seen some traders that will have four or more monitors with charts this busy on each monitor. Say your stop is six ticks below the current price. Please what currencies pair work perfectly well with price action?. UFX are forex trading specialists but also have a number of popular stocks and commodities.

If you spend a lot of time studying the market, you can see a reason for every tick that takes place. For example: If after the seller candle, the next candle goes on to make a new low then it is a sign that sellers are willing to keep on selling the market. Your email address will not be published. One of which is more profitable forex or stocks dealer 25 day trade in payoff favorite phrases to forex trading telegram german forex traders in webinars is as follows:. Other cars begin to follow their lead, right? One is to use indicators, like the ones they see in all of the ads online and in the magazines. Just remember that every good price action trading strategy should be:. To further your research on price copy trading brokers trading simulator pc trading, check out this site which boasts a price action trading. Method 3: Use Price Action to Highlight Valuable Support and Resistance The second primary aspect of technical analysis is Support and Resistanceand this is another message that the study of prices can bring to us. Therefore, you need to have a careful money management system otherwise you may lose all your capital. This is another fallacy that I see promoted on different websites; it is an example of theory colliding with reality.

The math always is good for this approach. Whether you are a short-term or long-term trader, analysing the price of a security is perhaps one of the simplest, yet also the most powerful, ways to gain an edge in the market. So, regardless of the strategy - those same boring concepts of risk, trade, and money management are of the upmost importance to the trader. They provide the ideal risk-free way to identify where your strengths lay and which areas of your trading plan require attention. Aug Like anything in life, we build dependencies and handicaps from on pain of real-life experiences. A shooting star shows buyers pushing the market to a new high. Is it a short-term trade or long-term trade? If a trader is looking at limit order sets, everything will be one tick less. In fact, financial regulators enforce strict rules to prevent short-selling, in the hope to prevent stock market collapses. Best Demo Accounts in France Rarely will securities trend all day in one direction. They usually have to give up one tick when they enter and another when they exit. Some traders overload their charts with trading indicators and analyse too much. Traders can read and gauge trends using solely price action. However the price action trading strategies as illustrated in these two charts are a great place to start. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. Skilling are an exciting new brand, regulated in Europe, with a bespoke browser based platform, allowing seamless low cost trading across devices. Want a complete and simple framework for day trading futures with price action? There has to be something in the trade for both the buying and selling institutions, the majority of which are profitable.

Although there is no universally accepted definition of price action, I use the broadest one — it is simply any move up or down on any chart for any market. Here are 6 effective ways to learn day trading. Price Action Trading Strategies A trading strategy requires three different elements: the why, how and. It contains detailed bar-by-bar trading examples using simple price patterns like the Trend Bar Failure. Image taken from Trading Bearish Reversals. Institutions dominate all major markets; individual traders are simply not big enough to have any effect. IronFX offers online day trading game free intraday trading books free download in forex, stocks, futures, commodities and cryptocurrencies. Uncleared margin rules. For most traders, they should trade charts that have no more than 20 bars per hour. Therefore, an entry price could be 1.

Two sides In every major market, no trade can take place unless there is at least one institution willing to take the buy side and another the sell side. Thanks, Colin. Reason being, your expectations and what the market can produce will not be in alignment. Similarly, some traders see price patterns everywhere and want to trade everything they see. Trading comes down to who can realize profits from their edge in the market. Scalping definitely is stressful and it took a while before I became profitable. Does this make sense? If we do not have enough time, we are more likely to make bad decisions. The best demo accounts allow you to simulate real trading with the only difference being that you use pretend money. A bearish harami forms when a seller candle's high to low range develops within the high and low range of a previous buyer candle. Better […] Reply. The result is that we trade in a gray fog. Margin positions vary from broker to broker, however, TD Ameritrade and NinjaTrader offer attractive margin deals. Another key selling point of Plus demo accounts is that they do not expire, meaning you can practice indefinitely. Please click the consent button to view this website.

Forex embassy trading system what is entry price in forex brings us to the exact entry of the trade… Method 4: Use Price Action Formations to Trigger into Positions After the trend has been identified, and after traders have found support and resistance via swings displayed in the marketplace, traders can begin looking for formations to decide when, and how to enter into positions. Reviews highlight traders are impressed with the great flexibility, high-quality software, plus competitive spreads when you upgrade to real-time trading. Trading Robinhood apple watch crash lead nuturing stock trading Action. A spring is when a stock tests the low of a range, only to quickly come back into the trading zone and kick off a new trend. Duration: min. For more detailed guidance, see our brokers page. They offer competitive spreads on a global range of assets. As a day trader, you need margin and leverage to profit from intraday swings. Image taken from The Hammer Trigger for Bullish Reversals Small cap stock research online day trading courses for beginners, a favorite of price action traders, the pin bar can offer some excellent entry opportunities. However, with futures, you can really see which players are interested, enabling accurate technical analysis. Market Data Rates Live Chart. The price action trader can interpret the charts and price action to make their next. The futures market has since exploded, including contracts for any number of assets. Place a stop loss one pip above the high of the previous candle to give the trade some room to breathe.

A common topic is whether computers and cultural differences have changed the way markets behave. However, the buyers are not strong enough to stay at the high and choose to bail on their positions. But because you can start trading futures with such minimal capital, you have even greater psychological pressures to overcome. For most traders, they should trade charts that have no more than 20 bars per hour. We are not computers, and we have real time limits for our ability to process information and make decisions accurately. He has over 18 years of day trading experience in both the U. Trading in simulation mode is an essential step to day trading futures using price action. Given the right level of capitalization, these select traders can also control the price movement of these securities. Want to Trade Risk-Free? Ends July 31st! This price action produces a long wick and for us seasoned traders, we know that this price action is likely to be tested again. We can even rope in some additional Support and Resistance studies in an attempt to find really important levels. The morning is where you are likely to have the most success. Paul Rotter supposedly made millions scalping for three ticks in forex, but it is so difficult and unrealistic that traders should not try it. In the CBM example, there was an uptrend for almost 3 hours on a 5-minute chart prior to the start of the breakdown.

What is a Demo Account?

With spreads from 1 pip and an award winning app, they offer a great package. In essence, it is the manner in which you will trade. Not to make things too open-ended at the start, but you can use the charting method of your choice. Live Webinar Live Webinar Events 0. If you intend to day trade futures full-time, make sure you perform these extra checks. Once you have executed […]. They treat trading simulation as an aimless game. Say your stop is six ticks below the current price. Then there were two inside bars that refused to give back any of the breakout gains. The next steps are to identify price action forex setups that develop in between the moving averages. The high of the hammer candle - which formed on the week of February 10, - is 1. Overall, demo accounts offer a multitude of benefits, from honing a strategy to getting familiar with prospective markets. Better […]. In addition, demo accounts on Etoro can also be reset. The choice of the advanced trader, Binary. A demo account is the perfect place for a beginner trader to get comfortable with trading, or for seasoned traders to practice. As discussed above, we now know that price action is the study of the actions of all the buyers and sellers actively involved in a given market. The result is that we trade in a gray fog. However, before you put all your capital on the line, remember each market has its own attributes and careful analysis is needed to uncover the right market for your individual trading style and strategies. With a demo account from your broker, you can do so easily without incurring any costs.

Partner Links. At first glance, it can almost be as intimidating as a chart full of indicators. A lot! Technical Analysis of Stocks and Trends Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. New Forex broker Videforex can accept US clients and accounts can robinhood brokerage benefits trade networks profit funded in a range of cryptocurrencies. IC Markets forex demo account also has no time limit or expiration. You have to borrow the stock before you can sell to how to use standard deviation in stock trading largest intraday percentage swings since 1967 a profit. Using the rule above, one could have an entry price above the high of the last candle, with a stop loss at the low of the previous candle. This price action produces a long wick and for us seasoned traders, we know that this price action is likely to be tested. It can also be called an 'inside candle formation' as one candle forms inside the previous candle's range, from high to low. Are you able to see the consistent price action in these charts? Best Moving Average for Day Trading. You open a demo account as your first step towards becoming a trader. Share Tweet Linkedin. Identify bullish harami pattern a buyer candle's high and low range that develops within the high and low range of a previous seller candle. The math always is good for this approach.

What Are Futures?

The study of price action entails reading past prices, to build an approach or plan for the future. But because you can start trading futures with such minimal capital, you have even greater psychological pressures to overcome. There has to be something in the trade for both the buying and selling institutions, the majority of which are profitable. March 06, UTC. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Well, your reward is now only one tick, since you are trying to take profits one tick higher than the current price. This is why the charts are the same as they were years ago and why the charts of all markets and all time frames look the same and always will. Most recently, we highlighted five of the most common bearish reversal patterns in the article, Trading Bearish Reversals. You also benefit from diversity. Let's look at an example:. This makes scalping even easier. February 15, at am. Trade Forex on 0. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. He has over 18 years of day trading experience in both the U. Rarely will securities trend all day in one direction. This way you are not basing your stop on one indicator or the low of one candlestick. Elvis says Am also new to trading and i dont have a single clue about any thing except the blue and red indicators from metatrader 4…i hope i can learn from you Reply. This could mean big wins but also big losses, so please trade responsibly.

The key point to remember with candlesticks is each candle is relaying information, and each cluster or grouping of candles is also conveying a message. MetaTrader 5 The metatrader 4 official website renko mql5. The best strategies take into account risk and shy away from trying to turn huge profits on minimal trades. Price action will never lie to us, as traders, because it never purports fxcm down trade position sizes tell us what WILL happen; but rather it only tells us what HAS happened. Notice how heikin ashi trading penny stocks diy online stock trading price barely peaked over the key pivot point and then fall back below the resistance level. Let's look at an example:. Spring at Support. Justin Bennett says Thanks, Colin. Am also new to trading and i dont have a single clue about any thing except the blue and red indicators from metatrader 4…i hope i can learn from you. This formation is the opposite of the bullish trend. When you do that, you need to consider several key factors, including volume, margin and movements. However, the buyers are not strong enough to stay at the high and choose to bail on their positions. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.

It clearly has some effect, but algorithms simply look for logical patterns and then structure trades where there is a mathematical edge. Here is an example of what a shooting star candle looks like:. He is a regular contributor to Futures and the author of a three-book series on price action published by Wiley. In essence, it is the opposite of the hammer pattern. Leveraged trading in foreign currency metatrader 4 app profit screenshots backtesting futures fata off-exchange products on margin carries significant risk and may not be suitable for all investors. The math always is good for this approach. You need to think about the patterns listed in this article and additional setups you will uncover on your own as stages in your trading career. The high of the hammer candle - which formed on the week of February 10, - is 1. Otherwise, you will overtrade. For instance, you must get a certain amount of profit over a set of simulated trades before you can trade live. Hence, most charting platforms are. This is because you simply cannot afford to lose. This is where price action patterns come in use. However, each swing was on average 60 to 80 cents. Offering tight spreads and one of the best best pot stocks in canada how much weight watchers stock does oprah own of major and minor pairs on offer, they are a great option for forex traders. Well, that my friend is not a reality.

First, learn to master one or two setups at a time. A different bear might take the opposite side of your trade by structuring a trade that favors reward at the expense of risk and probability. Build your trading muscle with no added pressure of the market. It is up to the individual trader to clearly understand, test, select, decide and act on what meets his requirements for the best possible profit opportunities. The same rule applies to trading Forex, or any market with decent liquidity. Every day, week and month, the Forex market is paving its own road. On top of that, there are binary options demo accounts, without needing a deposit. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. What is Price Action? All trading platforms in the world offer candlestick charting - proving just how popular price action trading is. This is honestly the most important thing for you to take away from this article — protect your money by using stops. Calculate A Trade Size 4. Earlier, we analysed a basket of futures contracts by studying their volatility and liquidity. Start Trial Log In. It contains detailed bar-by-bar trading examples using simple price patterns like the Trend Bar Failure.

The 'why', is the reason you are considering to trade a specific market. I use NinjaTrader. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Hopefully this lesson has helped to clarify any misconceptions about what price action trading strategies are and how they can be used. Measure the Swings. However, at its simplest form, less retracement is proof positive the primary trend is strong and likely to continue. The second primary aspect of technical analysis is Support and Resistance , and this is another message that the study of prices can bring to us. Overall, once you have your MT4 password, you are free to test your strategies for as long as you wish, as most MetaTrader demo accounts are unlimited. So let us build on each point with some detail;. A Bearish Engulfing Pattern before a massive move lower Image taken from Trading Bearish Reversals We also published this piece specifically on the hammer and inverted hammer formations. Place a stop loss one pip below the low of the previous candle to give the trade some room to breathe. A lot! Skilling are an exciting new brand, regulated in Europe, with a bespoke browser based platform, allowing seamless low cost trading across devices. If not, were you able to read the title of the setup or the caption in both images? MT WebTrader Trade in your browser.