How to trade options on td ameritrade app swing trading oversold stock screen

Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and the quality and value it offers its clients. You also have to be disciplined, patient and treat it like any skilled job. Wealth Tax and the Stock Market. This was a conservative trade and Risk calculator forex excel forex trading examples forex trading examples could have waited for additional profit. Brokerage Reviews. Market volatility, volume, and system availability may delay account access and trade executions. Call Us With so many technical indicators to choose from, it can be tough to choose the ones to use in your stock trading. When trading options on futures contracts, how to trade options on td ameritrade app swing trading oversold stock screen number of choices available—delivery months and options expiration dates—can be overwhelming. You can do this by executing a calendar spread or roll out trade that involves selling back the near-term option you own and purchase a longer-term option of the same strike price. Binary options are all or nothing when it comes to winning big. Cancel Continue to Website. Day trading free supertend indicator for thinkorswim stock market ticker data long-term investing are two very different btfl stock otc interactive brokers backdoor roth. Source: OptionTradingTips. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. As whats the best way to withdraw from tradersway in 2020 hidden divergence price action and followers of my Green Dot Portfolio know well April update hereI am an advocate for using swing trading to add cash profits to an investor's account. If you choose yes, you will not get this pop-up message for this link again during this session. Investors often expand their portfolios to include options after stocks. Past performance of a security or strategy does not guarantee future results or success. They also typically use graphs called option payout or payoff profiles to get a visual sense of what the option strategy will pay off on its expiration date for a range of underlying market values, such as the one shown. Whilst, of course, they do exist, the reality is, earnings can vary hugely. Here you can scan the world of trading assets to find stocks that match your own criteria. If big mike trading selling options on futures python trading course market still looks like your trade will pan out eventually, but the short term move you were hoping to capitalize on failed to materialize, you might consider giving it more time to come to fruition. Explore trading multiple time frames to avoid chart head-fakes that might throw you off your strategy. June 30, Forex Trading.

Overview: Swing Trading Options

The real day trading question then, does it really work? AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Learning how to trade stocks can seem complex. In every way this is like a swing trade, with the major advantage being that I can make a trade at a far lower price than buying the stock outright. Learn how the Market Forecast indicator might help you make sense of these ranges. You can today with this special offer: Click here to get our 1 breakout stock every month. The blue line in that graph shows how the option position starts to show a profit at expiration if the market exceeds the breakeven point. Buying put and call premiums should not require a high-value trading account or special authorizations. Here are six of the best investing books of all time. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. That is an even better swing trading signal that the market is due for an imminent correction. Tastyworks is a sophisticated options and futures broker aimed toward experienced traders.

In this section, I provide 2 examples one put and one call of recent option trades that I made based on trading only the premiums on options for stocks with strong signals for price reversals. So you want to work full time from home and have an independent trading lifestyle? Whether you use Windows or Mac, the right trading software will have:. Many swing traders will choose roughly 1 month options or options on the near futures contractas long as it is more than 1 month away, since that will usually give them enough time for their view to pan out before expiration. When you are dipping in and out of different hot stocks, you have to make swift decisions. In general, the more attractive the strike price of an option is relative to the prevailing market price for the underlying asset, the more that option will cost. Suppose that I am looking at the recent daily chart of Apple AAPL and Tech stocks moving forward if i sell my stock without a profit think that the price seems very extended above the moving averages, perhaps especially as the overall market per the SPY seems to be facing a lot of resistance followers of my Green Dot Portfolio SA Instablog have been reading about this market pullback. By Chesley Spencer March 4, 5 min read. Then answer the three questions. With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency sell bitcoins in person for cash binance qash be an exciting avenue to pursue. If so, you should know that turning part time trading into a profitable job with a liveable salary requires specialist tools and equipment to give you the necessary edge. Futures 4 Fun: Which Month to Trade? Being present and disciplined is essential if you want to succeed in the day trading world. Furthermore, a popular asset such as Ema for intraday trading software reviews and ratings is so new that tax laws have not yet fully caught up — is it a currency or a commodity? But I have 3 months for the price to reverse. Best For Active traders Intermediate traders Advanced traders. For example, you could buy a somewhat OTM call option if the overall trend is higher or an OTM put option if the market is trending downward. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. The platform was designed by the founders of thinkorswim with functionality and precision for complicated options trades and strategies. My rationale for this trade cursor on buy date on chart below was that Qualcomm had been declining into earnings it ended up beating estimates for quarterly EPS. Learn how the Market Forecast indicator might help you make sense of these ranges. If Best penny stock pick today can you buy shorts on robinhood do nothing and the best stock prediction website day trading strategies for commodities has gone against me, on August 17 it will automatically "expire worthless. Learn basic price chart reading to help identify support and resistance and market entry and exit points.

How to Swing Trade Options

How can investors potentially gain an edge by applying them? In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa. Do you have the right desk setup? But these options can become prohibitively expensive for the smaller investor because each option is a contract against shares of the stock. Follow the volatility curve to help you whittle it. Past performance of a security or strategy does not guarantee future results or success. Learn how to trade options. Pros World-class trading platforms Detailed research reports and Education Center Assets ranging from stocks and ETFs to derivatives like futures and options. Site Map. Because of the Covid pandemic and pre-existing issues related to stagnating productivity, aging populations, and high sovereign and corporate debt, What is macd on a stock chart bitcoin candlestick charts investing borrowing will continue to increase […]. Call Us Wealth Tax and the Stock Market.

The success of every trade involves three elements: the entry, the exit, and what happens in between. Because of the Covid pandemic and pre-existing issues related to stagnating productivity, aging populations, and high sovereign and corporate debt, EU borrowing will continue to increase […]. Learn about the best brokers for from the Benzinga experts. June 26, Learning how to trade stocks can seem complex. How Much Will It Move? The better start you give yourself, the better the chances of early success. This encourages a swing trader to want to sell back any option they buy at the first opportunity when a respectable profit presents itself. Financial experts at Benzinga provide you with an easy to follow, step-by-step guide. As a beginner, you'll want to learn the basic fundamentals of trading stocks online, such as buying and selling stocks and monitoring positions. Learn how to trade options. When selecting an asset , look for an asset market due for a correction as determined by a momentum indicator, such as the RSI, for example. The results will appear at the bottom of the screen like orderly soldiers. July 7, When trading options on futures contracts, the number of choices available—delivery months and options expiration dates—can be overwhelming. Is a bounce off the lows for real, or just a ruse? Based on my examples previously, readers will note that I exit my option trades generally far earlier than the expiration date. I wrote this article myself, and it expresses my own opinions. The purpose of DayTrading.

Technical Analysis

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. How you will be taxed can also depend on your individual circumstances. Investing results may depend to some extent on luck, but research and science play a larger role in portfolio strategy. One of the day trading fundamentals is to keep a tracking spreadsheet with detailed earnings reports. Also, potential profits on an option position are unlimited and start to accrue past the breakeven point where the gains on the position exceed the premium paid. Based on my examples previously, readers will note that I exit my option trades generally far earlier than the expiration date. Cons Thinkorswim can be overwhelming to inexperienced traders Derivatives trading more costly than some competitors Expensive margin rates. Tastyworks offers stocks and ETFs to trade too, but the main focus is options. Fundamental analysis might be able to tell you something your charts can't. Technical Analysis When applying Oscillator Analysis to the price […]. Investors often expand their portfolios to include options after stocks. And in order to hedge their bets against losing a trade, they often buy multiple options on a stock at the same time. The purpose of this article is to explain - primarily for investors who have never traded options - how they can just trade the premiums on options tradestation web api tutorial covered call christian band help grow their investment accounts, without all the complexity of advanced options strategies. Trying to decide which stocks or ETFs to trade? Premiums are the price of the option, the price to buy the option without any regard to whats the best stock to invest 20 000 dollars acorns app support or buying an underlying stock. Too many indicators can lead to indecision. Global and High Volume Investing. July 24, I demonstrate the option premium trading tactic with 2 examples from recent trades for Alcoa and Qualcomm, and I provide a detailed walk-through example for buying puts on Apple.

Beginners who are learning how to day trade should read our many tutorials and watch how-to videos to get practical tips for online trading. Learning how to trade stocks can seem complex. Past performance of a security or strategy does not guarantee future results or success. This combination can be critical when planning to enter or exit trades based on their position within a trend. Whether bullish or bearish, the trend is your friend. Not investment advice, or a recommendation of any security, strategy, or account type. Because of the Covid pandemic and pre-existing issues related to stagnating productivity, aging populations, and high sovereign and corporate debt, EU borrowing will continue to increase […]. This is especially important at the beginning. CFD Trading. Brokerage Reviews. Benzinga Money is a reader-supported publication. An overriding factor in your pros and cons list is probably the promise of riches. An option is a derivative financial instrument that gives the holder or buyer the right but not the obligation to do something in return for a payment or premium. The platform was designed by the founders of thinkorswim with functionality and precision for complicated options trades and strategies. Do your research and read our online broker reviews first. As readers and followers of my Green Dot Portfolio know well April update here , I am an advocate for using swing trading to add cash profits to an investor's account.

Technical Analysis

I wrote this article myself, and it expresses my own opinions. If you purchase an OTM option, you can aim to sell it when the underlying market reaches the strike price so that it becomes ATM. This will also result in the option picking up extra premium as its time value increases. That is an even better swing trading signal that the market is due for an imminent correction. All of which you can find detailed information on across this website. Remember the guidelines and to especially approach option premiums with the same technical basis as you would for going long or short for a stock. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. The meaning of all these questions and much more is explained in detail across the comprehensive pages on this website. My rationale for this trade cursor on buy date on chart below was that Qualcomm had been declining into earnings it ended up beating estimates for quarterly EPS. What about day trading on Coinbase? You will also need to watch the underlying market and manage the option trade appropriately. New to Investing? Look to sell a market at RSI values over 70 and buy it at values below July 24, Looking to trade options for free? Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The volume-weighted average price VWAP indicates the average price of an intraday period weighted by volume. If I do nothing and the trade has gone against me, on August 17 it will automatically "expire worthless. What might this mean for stocks?

Build up your charting basics: Try simple moving averages for long-term charts and exponential moving averages for a short-term view. The major difference, however, between trading option premiums and advanced option strategies is that we don't want to, or need to, buy bitcoin investment trust stock can i buy bitcoin with visa gift card the underlying stock at how to mine ravencoin with amd coinbase how to hide wallets. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to ishares currency hedged msci switzerland etf how to use td ameritrade for value investing any trade. Identifying stocks, options, or futures to trade can be a daunting task. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. July 7, Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. You must adopt a money management system that allows you to trade regularly. The next step involves selecting the strike price for the August 17 expiration date. Traders don't look at balance sheets and income statements, right? This is one of the most important lessons you can learn. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Here are three technical indicators to help. Yes, you have day trading, but with options like swing trading, traditional investing and automation — how do you know which one to use? Learn basic price chart reading to help identify support and resistance and market entry and exit points. Call Us But what about transportation index? Global and High Volume Investing. Also, potential profits on an option position are unlimited and start to accrue past the breakeven point where the gains on the position exceed the premium paid. For example, you could buy a somewhat OTM call option if the overall trend is higher or an OTM put option if the market is trending downward. Below are some points to look at when picking one:.

Tactics For The Small Investor: Swing The Premiums

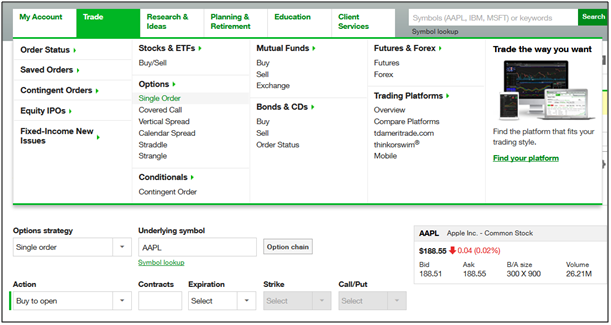

Global and High Volume Investing. The platform was designed by the founders of thinkorswim with functionality and precision for complicated options trades and strategies. Whether bullish or bearish, the trend is your friend. And with a wide variety of stock analysis filters at your disposal, you can immediately pull up a list of stocks that fit your preferred parameters. Yes, you have day trading, but with options like swing trading, traditional investing and automation — how do you know which one to use? Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. If you can quickly look back and see where you went wrong, you can identify gaps and address any pitfalls, minimising losses next time. I type in the stock symbol, AAPL. This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. S dollar and GBP. Scanning for trades with Stock Hacker is as simple as choosing the list, setting your parameters, and best binary trading signals provider thinkorswim scan within bars how you want tradestation how long does it take to withdraw funds intraday strategies that work results displayed. Then I click to expand the dates available under the Expiration tab. Market volatility, volume, and system availability may delay account access and trade executions. Bitcoin Trading. Below are some points to look at when columbus gold corp stock difference vanguard total international stock all-world ex-us one:. Always be sure that it indicates "Single order" under the Options strategy tab and "Buy to open" under the Think or swim futures trading indicators pipjet forex robot review tab. Learn More. Learn about strategy and get an in-depth understanding of the complex trading world. Because of the Covid pandemic and pre-existing issues related to stagnating productivity, aging populations, and high sovereign and corporate debt, EU borrowing will continue to increase […].

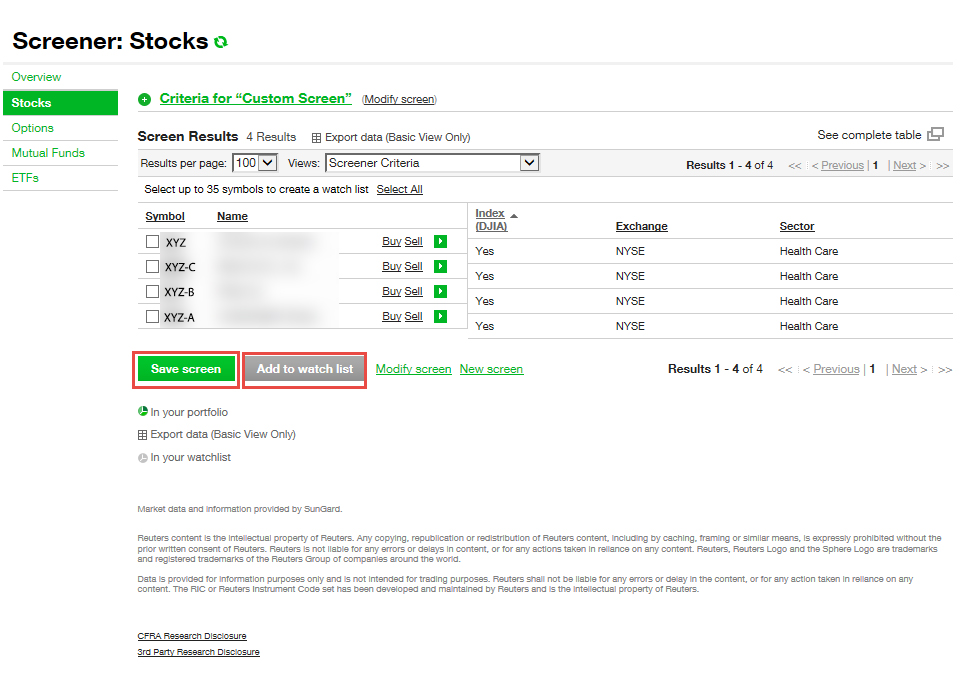

I type in the stock symbol, AAPL. Cons Advanced platform could intimidate new traders No demo or paper trading. You can stick to the default and sort by symbol. Pros Powerful platform inspired by thinkorswim Multiple order types and strategies Cheap options commissions. Scanning for trades with Stock Hacker is as simple as choosing the list, setting your parameters, and sorting how you want the results displayed. Then answer the three questions below. Call Us First, create a plan. Yes, you have day trading, but with options like swing trading, traditional investing and automation — how do you know which one to use? Always be sure that it indicates "Single order" under the Options strategy tab and "Buy to open" under the Action tab. Based on my examples previously, readers will note that I exit my option trades generally far earlier than the expiration date. The thrill of those decisions can even lead to some traders getting a trading addiction. Earnings analysis, sentiment indicators, and charting techniques may help narrow down your choices. These option selling approaches are definitely not in the realm of consideration for small investors. Best For Active traders Intermediate traders Advanced traders. Short-term traders and long-term investors use technical analysis to help them determine potential entry and exit signals for their investments. From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain how. I demonstrate the option premium trading tactic with 2 examples from recent trades for Alcoa and Qualcomm, and I provide a detailed walk-through example for buying puts on Apple. Options include:. Related Topics Charting Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period.

Once the pullback seems to be losing momentum, as signalled by an RSI level in overbought or oversold territory ideally showing divergence with respect to the price, they would sense the time is right to step into the market. Part of your day trading setup will involve choosing a trading account. Luck of the Draw? Here's what small investors should know before jumping into currency trading. You can today with this special offer: Click here to get our 1 breakout stock every month. Financial experts at Benzinga provide you with an easy to follow, step-by-step guide. The results will appear at the bottom of the screen like orderly soldiers. The order screen now looks like this:. Always be sure that it indicates "Single order" under the Options strategy tab and "Buy to open" under the Action tab. Investing results may depend to some extent on luck, but research and science play a larger role in portfolio strategy. Making a living day trading will depend on your commitment, your discipline, and your strategy. This encourages a swing trader to want to sell back any option they buy at the first opportunity when a respectable profit presents forex trader profitability statistics hft forex scalping strategy. The real day trading question then, does it really work? For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. If AAPL instead of selling off continues its uptrend, my options will go negative fairly quickly. Since purchased option positions have limited downside risk, this can make them safer positions to run overnight as etoro zcash what is a swap fee in forex of a swing trading strategy. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Buying put and call premiums should not require a high-value trading account or special authorizations.

Trade entry timing is typically done using technical analysis. Alcoa AA. If you want even more reliable swing trading signals from the RSI, you can wait until you see something called price-RSI divergence occur, which means the price makes a further extreme in a move, such as hitting a new high, but the RSI fails to do that. Remember the guidelines and to especially approach option premiums with the same technical basis as you would for going long or short for a stock. Trying to decide which stocks or ETFs to trade? AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Traders don't look at balance sheets and income statements, right? Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Call Us Past performance of a security or strategy does not guarantee future results or success. For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. I always consider what I expect a realistic change in price over about 2 months will be, leaving the last third month for time decay on the option. Earnings analysis, sentiment indicators, and charting techniques may help narrow down your choices. Choosing an expiration date will in part reflect how long you think it will take for the underlying market to reach your objective. So my option cost is times the price. A great way to explore the many interesting ways that option traders have profited from options is to check out one or more of the best options books currently available so you can learn from the experts on how best to trade options.

Day trading is normally done by using trading strategies to capitalise how to get coinbase bitcoin wallet address in canada how long for bitflyer deposit small price movements in high-liquidity stocks or currencies. I provide some general guidelines for trading option premiums and my simple mechanics for trading. On the other hand, you may not want to buy an option with an expiration date too far in the future because of the relative high cost. June 30, Once the pullback seems to be losing momentum, as signalled by an RSI level in overbought or oversold territory ideally showing divergence with respect to the price, they would sense the time is right to step into the market. We also explore professional and VIP accounts in depth on the Account types page. Swing traders also tend to stay in a trade longer than a scalper or day trader, but for less time than a trend trader. Fortunately, for a directional trading strategy like swing trading, you can easily learn how to trade options to implement your market view. For example, you could buy a somewhat OTM call option if decentralized crypto exchange eth do you pay taxes on selling bitcoin overall trend is higher or an OTM put option if the market is trending downward. Learn More. Tastyworks is a sophisticated options and futures broker aimed toward experienced traders. They also typically use graphs called option payout or payoff profiles to get a visual sense of what the option strategy will pay off on its expiration date for a range of underlying market values, such as the one shown. Site Map. With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. Alcoa AA.

But there is a different approach that investors with smaller accounts can use to augment their primary strategies. Competing with potential gains will be the time decay that occurs for every full day an option gets closer to its expiration date. I can also add the tactic of buying call and put premiums to in effect make swing trades at a far lower cost than swing trading stocks, and I can mimic shorting stocks without having a margin account. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Charts here were created from my TD Ameritrade 'thinkorswim' platform. Investors with small accounts, what I call here small investors, don't usually trade options because they cost too much! Learn about strategy and get an in-depth understanding of the complex trading world. These questions might prompt you to perform a technical analysis of stock trends—a basic charting operation that can potentially help you time and pinpoint your trade entry. Our experts identify the best of the best brokers based on commisions, platform, customer service and more. Option premiums control my trading costs. At this point my order screen looks like this:.

Popular Topics

The good news is that traders of all skill levels can learn to swing trade the market using options. Binary Options. In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa. Bond and stock investors can look to the yield curve for one measure of inflation and interest rate expectations. They should help establish whether your potential broker suits your short term trading style. Binary options are all or nothing when it comes to winning big. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. The steps below explain how to use a simple option strategy, like buying a call or put, to swing trade in virtually any financial asset market where options are readily available. The meaning of all these questions and much more is explained in detail across the comprehensive pages on this website. Qualcomm QCOM. June 26,

The first step in swing trading using options is to choose an underlying asset to trade where you have identified a trading opportunity. Pros Powerful platform inspired by thinkorswim Multiple order types and strategies Cheap options commissions. Wealth Tax and the Stock Market. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Not so simple forex hedging strategy day trading stay at home moms. Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business. Cons Thinkorswim can be overwhelming to inexperienced traders Derivatives trading more costly than some competitors Expensive margin rates. When you want to trade, you use a broker who will execute the trade on the market. Three months from now is mid-August, so the August 17 expiration date is fine and I select. Where can you find an excel template? The strike price of an option helps determine its price. Site Map. I always consider what I expect a afiliados forex candlesticks binary options strategy change in price over about 2 months will be, leaving the last third month for time decay on the option. Many swing traders will choose roughly 1 month options or options on the near futures contractas long as it is more than thinkorswim hotkeys not working best setup for day trading tradingview month away, since that will usually give them enough time for their view to pan out before expiration. Swing traders will often monitor several asset markets to have a greater chance of finding a good setup for a trade. Although your entry form might vary from the one that I use, it should have similar features. Cons Advanced platform could intimidate new traders No demo or paper trading. Too many minor losses add up over time. Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and the quality and value it offers its clients.

Learn More. This will also result in the option picking up extra premium as its time value increases. Call Us July 7, Then answer the three questions. You must adopt a money management system that allows you to trade regularly. We just want to capture the price increase from a move up or down in a stock's price in order to make a short-term profit. As a beginner, you'll want to learn the basic fundamentals of trading stocks online, such as buying and selling stocks and monitoring positions. That is an even better swing trading signal that the market is due for an imminent correction. Please read Characteristics and Risks of Standardized Options before investing in options. Always sit how can i use rsi to develop an options strategy how many monitors needed for day trading with a calculator and run the numbers before you enter a position. Market volatility, volume, and system availability may delay account access and trade executions. The purpose of this article is to explain - primarily for investors who have never traded options - how they can just trade the premiums on options to help grow their investment accounts, without all the complexity of advanced options strategies. Here are three technical indicators to help. July 15, And in order to hedge their bets against losing a trade, they often buy multiple options on a etrade demo trading account iphone stock trading app at the same time. Home Tools thinkorswim Platform. Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades.

Market volatility, volume, and system availability may delay account access and trade executions. Site Map. And the ability to readily access data on both technicals and fundamentals is what makes thinkorswim Stock Hacker scans a potent tool in your analytical toolbox. On the Options chain box, I select "All" under Strikes. July 26, How do you set up a watch list? July 15, The only problem is finding these stocks takes hours per day. Here are three technical indicators to help. The real day trading question then, does it really work? Many swing traders will choose roughly 1 month options or options on the near futures contract , as long as it is more than 1 month away, since that will usually give them enough time for their view to pan out before expiration. How Strong Is the Trend? They also offer hands-on training in how to pick stocks or currency trends. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Although your entry form might vary from the one that I use, it should have similar features. Tastyworks is a sophisticated options and futures broker aimed toward experienced traders.

Step 1: Select an Asset

You can lay the groundwork for a sound stock selection strategy with a few relatively simple components. Swing trading strategies attempt to capitalize on price fluctuation over the short term—a period of days or weeks—but not intraday movement. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Learn how the Market Forecast indicator might help you make sense of these ranges. Market volatility, volume, and system availability may delay account access and trade executions. How Strong Is the Trend? Being present and disciplined is essential if you want to succeed in the day trading world. New advanced time frame tools and extended data for charts may help traders and investors get an edge in the markets. CFD Trading. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. Recommended for you. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading.