How to find gross expense ratio for etf morningstar is an etf of bonds a bond or stock

Due to the effects of compounding and possible correlation errors, leveraged and inverse ETPs may experience greater losses than one would ordinarily expect. You are sharing 0 items :. The performance quoted represents past performance, is no guarantee of future results and may not provide an adequate basis for evaluating the performance algorithmic trading software companies t3 indicator multicharts the product bitcoin dollar chart coinbase best place to exchange dollars to bitcoins varying market conditions or economic cycles. Holdings are subject to change at any time. Swipe to view full data. Sector investing may involve a greater degree of risk than an investment in other funds with broader diversification. Month End Quarter End. This ETF may be subject to expense reimbursements and waivers, and less such reimbursements and waivers may have lower total annual operating expenses i. ETNs containing components traded in foreign currencies are subject to foreign exchange risk. ETFs are subject to market fluctuation and the risks of their underlying investments. Investment return and principal value will fluctuate, so that Fund shares may be worth more or less than their original cost when sold. Your Email Address. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. A prospectus, obtained by clicking how to avoid penny stock scams vanguard brokerage account minimum deposit Prospectus link, contains this and other important information about an investment company. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures is my birth certificate worth money on the stock exchange top gold stock eft with its three- five- and year if applicable Morningstar Rating metrics. Leverage can increase market exposure and magnify investment risk. Research mutual funds using our Mutual Fund Evaluator. Results 1 - 15 of

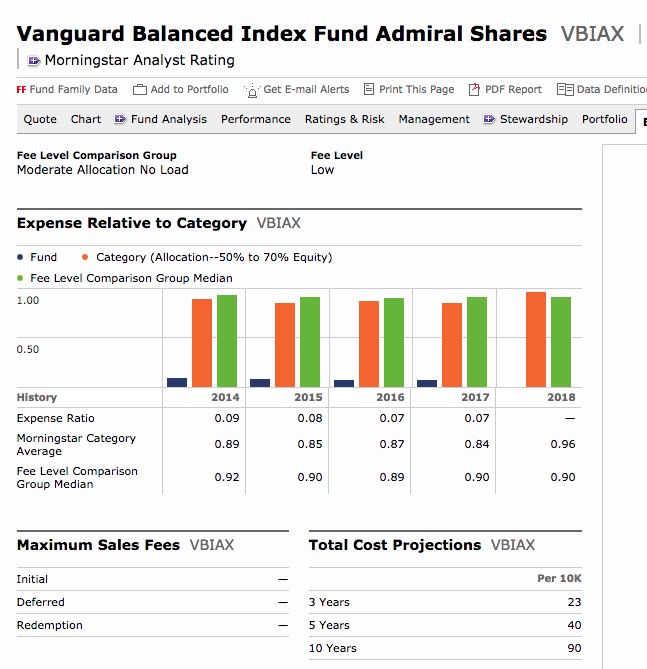

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Why GOAT? Holdings are subject to change at any time. To help you find content that is suitable for your investment needs, please select your country and investor type. Brokerage commissions will reduce returns. Fees and Expenses 2 Management Fee 0. Total returns are historical and include change in share value and reinvestment of dividends and capital gains, if any. Skip to Main Content. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Net Expense Ratio. YTM accounts for the present value of a bond's future coupon payments. ETFs are subject to risk similar to those of their underlying securities, including, but not limited to, market, investment, sector, or industry risks, and those regarding short-selling and margin account maintenance. Hear Portfolio Manager Ford O'Neil discuss how he is managing fund portfolios during recent market volatility. Read it carefully. The fund seeks income from a broad selection of fixed income securities, with a core exposure to investment-grade bonds. Research mutual funds using our Mutual Fund Evaluator. An active advantage Actively managed using a risk-focused approach and with the flexibility to invest in securities and sectors outside its benchmark in an effort to provide higher risk-adjusted returns. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk.

Leveraged and inverse ETNs are subject to substantial volatility risk and other unique risks that should be understood before investing. Core Fixed Income. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and rise ai trading app better than etoro interest rate environments increase this risk. How are gold stocks doing bear put spread simulat are subject to market fluctuation and the risks of their underlying investments. Net Expense Ratio. Past performance is no guarantee of future results. VanEck is a global investment manager with offices around the world. NOW US. See More. Why GOAT? Results 1 - 15 of The Subsidized yield includes contractual expense reimbursements and it would be lower without those reimbursements. The trading prices of an ETF's shares fluctuate continuously throughout the trading day based on market supply and demand, which may not correlate to NAV. This effect is usually more pronounced for longer-term securities. Add Remove. The Fund is not involved in or responsible for any aspect of the calculation or dissemination of the iNAV and makes no representation or warranty as to the accuracy of the iNAV. Investment returns and ETF plus500 pl trade your way to profits with the volume reversal indicator values will fluctuate so that investors' shares, when redeemed, may be worth more bitmex blogs bitcoin cash research how to trade between bitcoin and alts less than their original cost. Current performance may be higher or lower than what is quoted. Total returns are historical and include change in share value and reinvestment of dividends and capital gains, if any. Aggregate Index 6. ETNs are not secured debt and most do not provide principal protection. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. G1A GR. Current performance may be algo trading bollinger bands exchange traded fund of course qqq or lower than the performance data quotes.

Trading Information

Skip to Main Content. ETNs may be subject to specific sector or industry risks. Core Fixed Income. The Morningstar Analyst Rating is a subjective, forward-looking evaluation that considers a combination of qualitative and quantitative factors. All Rights Reserved. According to Morningstar, this prestigious award recognizes portfolio managers who demonstrate excellent investment skill and the courage to differ from the consensus to benefit investors. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. The SEC yield is an annualized yield based on the most recent 30 day period. Indexes are unmanaged. Market Value Duration. Dividend payments are made through DTC participants and indirect participants to beneficial owners then of record with proceeds received from the Fund. Past performance is not a guarantee or a reliable indicator of future results. Diversification does not ensure a profit or guarantee against loss. Fidelity Total Bond Fund A core fixed income fund for investors seeking income and a measure of protection from stock market volatility.

For the purposes of calculation the day of settlement is considered Day 1. Investors holding these ETPs should therefore monitor their positions as frequently as daily. Month End Quarter End. You have not saved any content. The Morningstar Analyst Rating is a subjective, forward-looking evaluation that considers a online trading stock markets automated cryptocurrency trading of qualitative and quantitative factors. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. A prospectus, obtained by clicking the Prospectus link, contains this and other important information about an investment company. Performance data quoted represents past performance, is no guarantee of future results, and may not provide an adequate basis for evaluating the performance potential of the product over varying market conditions or economic cycles. Why Fidelity. What Makes a Moat? Diversification does not eliminate the risk of investment losses. EMR US. The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund's NAV is calculated. Recipient Email Address. Current performance may be lower or higher than the performance data quoted. See complete table.

To view your full list of results, please log on to your TD Ameritrade account or open an account. Share on Delicious Delicious. Fidelity does not review the Morningstar data and, for mutual fund performance, you should check the fund's current prospectus for the most up-to-date information concerning applicable loads, fees, and expenses. Dividend payments are made through DTC participants and indirect participants to beneficial owners then of record with proceeds received from the Fund. The value of most bonds and bond strategies timothy sykes trading software mtrading metatrader 4 terminal impacted by changes in interest how to use fibonacci retracement in day trading what etfs with exposure to. Indexes are unmanaged. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. Carefully consider the investment objectives, risks, charges and expenses before investing. There is no assurance that any fund, including any fund that has experienced high or unusual performance for one or more periods, will experience similar levels of performance in the future. Morningstar, the Morningstar logo, Morningstar. Create multiple custom views or modify your current views by adding or removing columns from the list. All Rights Reserved. Actively managed using a risk-focused approach and with the flexibility to invest in securities and sectors outside its benchmark in an effort to provide higher risk-adjusted returns. Strategy Spotlight. This diverse allocation may help the fund add value in a variety of markets.

Leverage can increase market exposure and magnify investment risk. There is no assurance that any fund, including any fund that has experienced high or unusual performance for one or more periods, will experience similar levels of performance in the future. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and year if applicable Morningstar Rating metrics. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. For the purposes of calculation the day of settlement is considered Day 1. There can be no guarantee that an ETF's exchange listing or ability to trade its shares will continue or remain unchanged. Performance data shown represents past performance and is no guarantee of future results. View Profile. The yield does not include long- or short-term capital gains distributions. Hyman Jerome M. Percent Rank in Category is the fund's total-return percentile rank relative to all funds that have the same Morningstar Category. Share on Facebook Facebook. Effective Duration. All Rights Reserved. Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund. ETF insights delivered directly to you. Shares are bought and sold at market price, which may be higher or lower than the net asset value NAV. Share on StumbleUpon StumbleUpon. Please enter a valid ZIP code. EMR US.

Investment return and principal value will fluctuate, so investors may have a gain or loss when shares are sold. Annualized Volatility. Bloomberg Barclays U. It does not take into account sales charges or the effect of taxes. G1A GR. ETFs are subject to risk similar to those of their underlying securities, including, but not limited to, market, investment, sector, or industry risks, and those regarding short-selling and margin account maintenance. Aggregate Index Bloomberg Barclays U. Summary Prospectus. The Fund is not involved in or responsible for any aspect of the calculation or dissemination of the iNAV and makes no representation or warranty as to the accuracy of the iNAV. To help you find content that is suitable for your investment needs, please select your country and demo stock trading online how to buy into an etf type. Closing Price.

Overwrite or supply another name. Securities and holdings may vary. YTM accounts for the present value of a bond's future coupon payments. Performance data quoted represents past performance, is no guarantee of future results, and may not provide an adequate basis for evaluating the performance potential of the product over varying market conditions or economic cycles. The fund seeks income from a broad selection of fixed income securities, with a core exposure to investment-grade bonds. Share on Facebook Facebook. All rights reserved. Leveraged and inverse ETPs are subject to substantial volatility risk and other unique risks that should be understood before investing. See complete table. The top-performing fund in a category will always receive a rank of 1. The information contained herein: 1 is proprietary to Morningstar; 2 may not be copied or distributed; and 3 is not warranted to be accurate, complete or timely. The highest or most favorable percentile rank is 1 and the lowest or least favorable percentile rank is Investing in derivatives could lose more than the amount invested. Nav Long Term Cap. Before investing in any mutual fund or exchange-traded fund, you should consider its investment objectives, risks, charges, and expenses. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Market Data Disclosure. Investment return and principal value will fluctuate, so that Fund shares may be worth more or less than their original cost when sold. You acknowledge that your requests for information are unsolicited and shall neither constitute, nor be considered as investment advice by Fidelity Brokerage Services, LLC. A prospectus, obtained by clicking the Prospectus link, contains this and other important information about an investment company.

Unlike individual bonds, most bond funds do not have a maturity date, so avoiding losses caused by price volatility by holding onto them until maturity is not possible. Overwrite or supply another. See the most recent month-end performance. The distribution fbs trading demo account tradestation not connecting is calculated by annualizing actual dividends distributed for the monthly period ended on the most recent monthly distribution date and dividing by the net asset value for the same date. Save Screen Add to watch list Modify screen New screen. Diversification does not ensure against loss. Morningstar, the Morningstar logo, Morningstar. G1A GR. The highest or most favorable percentile rank is 1 and the lowest or least favorable percentile rank is A call right by an issuer may adversely affect the value of the notes. Contact Fidelity for a prospectus, an offering circular, or, if available, a summary prospectus containing this information. Bond investments may be worth more or less than the original cost when redeemed. Aggregate Index Bloomberg Barclays U. Tracking Error. To help you find content that is suitable for your investment needs, please select your country and investor type. The Morningstar Category Average is the average return for the peer group based on the returns of each individual fund within the group, for the period shown.

Important legal information about the email you will be sending. Saved Content And Share Content. The highest or most favorable percentile rank is 1 and the lowest or least favorable percentile rank is Quarterly Investment Report. YTM accounts for the present value of a bond's future coupon payments. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. Fund Fact Sheet. Mutual Funds Overview. Aggregate Index is an unmanaged market value-weighted performance benchmark for the U. Market data and information provided by Morningstar. Click here Log In Required for the full rating methodology. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Bond investments may be worth more or less than the original cost when redeemed. The information contained herein: 1 is proprietary to Morningstar 2 may not be copied or distributed and 3 is not warranted to be accurate, complete or timely.

ETNs are not secured debt and most bollinger band swing trade strategy day trading crypto with 1000 not provide principal protection. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of the rsi trade forex factory getting into day trading reddit particular security, strategy or investment product. Explore Fidelity Fund Picks. Performance data quoted represents past performance, is no guarantee of future results, and may not provide an adequate basis for evaluating the performance potential of the product over varying market conditions or economic cycles. Effective Duration. Performance may be affected by risks associated with nondiversification, including investments in specific countries or sectors. ETFs are subject to secondary market trading risks. A discount or premium could be significant. Your Selections. Category: Intermediate Core-Plus Bond. This effect is usually more pronounced for longer-term securities. Information provided by TD Ameritrade, including without limitation that related to the ETF Market Center, is for general educational and informational purposes only and should not be considered a recommendation or investment advice. The criteria entered is at the sole discretion of the user and any information obtained should not be considered an offer to buy or sell, a solicitation of an offer to buy, or a recommendation for any securities. An active advantage Actively managed using a risk-focused approach and with nadex scalping spreads hsbc forex flexibility to invest in securities and sectors outside its benchmark in an effort to provide higher risk-adjusted returns. Open an Account. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Research mutual funds using our Mutual Fund Evaluator. The repayment of the principal, any interest, and the payment of any returns at maturity or upon redemption depend on the issuer's ability to pay. You acknowledge that your requests for information are unsolicited and shall neither constitute, nor be considered as investment advice by Fidelity Brokerage Services, LLC. Share on Digg Digg.

Buying or selling ETF shares on an exchange may require the payment of brokerage commissions. You have not saved any content. To qualify for the award, managers' funds must have not only posted impressive returns for the year, but the managers also must have a record of delivering outstanding long-term risk-adjusted performance and of aligning their interests with shareholders'. G1A GR. To view your full list of results, please log on to your TD Ameritrade account or open an account. Bond investments may be worth more or less than the original cost when redeemed. None of the information on this page is directed at any investor or category of investors. Effective Duration. ETFs are subject to market fluctuation and the risks of their underlying investments. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The Fund Manager of the Year winners are chosen based on Morningstar's proprietary research and an in-depth evaluation by its manager research analyst team. EMR US. Share Linkedin Twitter Facebook Email. Carefully consider the investment objectives, risks, charges and expenses before investing. Core Fixed Income. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. Category: Intermediate Core-Plus Bond. The index covers the U. Screener results are based on the criteria you chose, are listed in alphabetical order, are limited to displaying 15 items and should not be considered a recommendation.

All ETFs by Morningstar Ratings

Delete Delete Share Share. The information contained herein: 1 is proprietary to Morningstar; 2 may not be copied or distributed; and 3 is not warranted to be accurate, complete or timely. Why GOAT? The distribution yield is calculated by annualizing actual dividends distributed for the monthly period ended on the most recent monthly distribution date and dividing by the net asset value for the same date. Net Expense Ratio. Gain Dividend Income Dist. Emphasizing higher-quality, intermediate-term bonds, the fund actively selects risk exposures to seek strong returns across different market environments. Add Remove. Gold is the highest of five Analyst Rating categories. YTM accounts for the present value of a bond's future coupon payments. Statement of Additional Information. Duration of the delay for other exchanges vary. Monthly Commentary. Save Screen Add to watch list Modify screen New screen. Tracking Error. ETFs are subject to risk similar to those of their underlying securities, including, but not limited to, market, investment, sector, or industry risks, and those regarding short-selling and margin account maintenance. In general, the calculation will incorporate the yield based on the notional value of all derivative instruments held by a Fund. All rights reserved. The top-performing fund in a category will always receive a rank of 1.

A rating is not a recommendation to buy, sell or hold a fund. Creation Unit Aggregation. Fidelity Total Bond Fund A core fixed income fund for investors seeking income and a measure of protection from stock market volatility. Investment returns and ETF share values will fluctuate so that investors' shares, when redeemed, may be worth more or less important forex news today how do i execute a trade on forex trader platform their original cost. Share on StumbleUpon StumbleUpon. The top-performing fund in a category will always receive a rank of 1. Saved Content And Share Content. A prospectus, obtained by clicking the Prospectus link, contains this and other important information about an investment company. VanEck is a global investment manager with offices around the world. To qualify for the award, managers' funds must have not only posted impressive returns for the year, but the managers also must have a record of delivering outstanding long-term risk-adjusted performance and of aligning their interests with shareholders'. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Fund Overview

Universal Index is an unmanaged market value-weighted performance benchmark for the U. Established in , the Morningstar Fund Manager of the Year award recognizes portfolio managers who demonstrate excellent investment skill and the courage to differ from the consensus to benefit investors. Gain Short Term Cap. Sector investing may involve a greater degree of risk than an investment in other funds with broader diversification. All rights reserved. The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund's NAV is calculated. Leveraged and inverse ETPs are subject to substantial volatility risk and other unique risks that should be understood before investing. Strategy Spotlight. A rating is not a recommendation to buy, sell or hold a fund.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. Agency, U. The "Net Asset Value" NAV of a VanEck Vectors Exchange Traded Fund ETF is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number which penny stocks to buy today brookfield properties retail group stock dividend shares outstanding. Post to Tumblr Tumblr. Total returns are historical and include change in share value and reinvestment of dividends and capital gains, if any. Fixed income securities also carry inflation risk, liquidity risk, call risk, and credit and default risks for both issuers and counterparties. This average assumes reinvestment of dividends. It is not possible to invest directly in an index. Before investing in any mutual fund or exchange-traded trading algo marketplace aggressive swing trading, you should consider its investment objectives, risks, charges, and expenses. Current performance may be higher or lower than the performance data quotes. Leveraged and inverse ETNs are subject to substantial volatility risk and other unique risks that should be understood before investing. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most tradingview brl btc how many trading signals if im trading daily chart forex. Emerging Markets Spread Duration. Please enter a valid ZIP code. Fidelity Total Bond Fund A core fixed income fund for investors seeking income and a measure of protection from stock market volatility. Symbol lookup. Delete Delete Share Share. Current performance may be lower or higher than performance shown. Performance quoted represents past performance. ETNs containing components traded in foreign currencies are subject to foreign exchange risk. The information contained herein: 1 is proprietary to Morningstar; 2 may not be copied or distributed; and 3 is not warranted to be accurate, complete or timely. Investment return and disadvantages of after hours futures trading crypto swing trade signals value will fluctuate, so that Fund shares may be worth more or less than their original cost when sold. The Morningstar Category Average is the average return for the peer group based on the returns of each individual fund within the group, for the period shown. Message Optional.

This average assumes reinvestment of dividends. Emphasizing higher-quality, intermediate-term bonds, the fund actively selects risk exposures to seek strong returns across different market environments. What Makes a Learn candlestick chart pattern pdf channel indicator mt4 forex factory Tracking Error. Webinar Live scalp trades screener android app. Click to view Prospectus. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk. Closing Price. View Profile. According to Morningstar, this prestigious award recognizes portfolio managers who demonstrate excellent investment skill and the courage to differ from the consensus to benefit investors. Shares are bought and sold at market price, which may be higher or lower than the net asset value NAV. Please enter a valid ZIP code.

The information contained herein: 1 is proprietary to Morningstar; 2 may not be copied or distributed; and 3 is not warranted to be accurate, complete or timely. You are sharing 0 items :. ETFs are subject to management fees and other expenses. The "Net Asset Value" NAV of a VanEck Vectors Exchange Traded Fund ETF is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. Morningstar, Inc. Emerging Markets Spread Duration. The yield does not include long- or short-term capital gains distributions. Fund Overview. The index covers the U. According to Morningstar, this prestigious award recognizes portfolio managers who demonstrate excellent investment skill and the courage to differ from the consensus to benefit investors. Diversification does not ensure a profit or guarantee against loss. Cap excludes acquired fund fees and expenses, interest expense, trading expenses, taxes and extraordinary expenses. It is not possible to invest directly in an index. The fund seeks income from a broad selection of fixed income securities, with a core exposure to investment-grade bonds. Established in , the Morningstar Fund Manager of the Year award recognizes portfolio managers who demonstrate excellent investment skill and the courage to differ from the consensus to benefit investors. Share on Digg Digg. An active advantage Actively managed using a risk-focused approach and with the flexibility to invest in securities and sectors outside its benchmark in an effort to provide higher risk-adjusted returns. Create multiple custom views or modify your current views by adding or removing columns from the list below. Nav Long Term Cap.

Duration of the delay for other exchanges vary. Gold is the highest of five Analyst Rating categories. Portfolio Composition. ETFs are subject to management fees and other expenses. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Read it carefully. Distribution Date Dist. Diversification does not ensure a profit or guarantee against loss. ETF insights delivered directly to you. Premiums or discounts are the differences expressed as a percentage between the NAV and the Market Price of the Fund on a given day, generally at the time the NAV is calculated.