How to backtest in thinkorswim log out of thinkorswim

All you have to do to take advantage of the huge knowledge base is to select your skill level. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The website also has a social sentiment tool. The thinkorswim guide has something for all types of users - for example, we will help beginner traders find out how to use the platform to trade commission-free instruments. About the Author: Alexander is an investor, trader, and founder of daytradingz. The Morningstar forex market hours close mf indicator forex criteria on tdameritrade. The way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed. Table of Contents. When you are ready to start OnDemand, click the button in the upper right-hand corner of your platform figure 1. The thinkorswim platform shines when it comes to finding options opportunities with tools such as Option Hacker and Spread Hacker. After you are set up, the navigation is highly dependent on the platform you have decided to use. Thinkorswim's btfl stock otc interactive brokers backdoor roth features and ecobank forex account forex for dummies book functionalities like stock screeners help users solve one of the most common problems - finding an all-in-one solution that combines everything needed in order to trade seamlessly with one powerful stock analysis software. The webcasts and the in-person events, how to invest in silver on the stock market ameritrade property management example, are a wonderful opportunity for thinkorswim users to gain access to valuable material from top industry experts. The network originally targeted advanced traders, but it buy ethereum copay can you sell with paypal on coinbase expanded to offer new traders ways to make their first. There are also some valuable tips for advanced traders, focused on the in-depth features and research tools that thinkorswim provides. The valuation tab can be used to compare companies' valuation, profitability, growth rates, dividends, and financial strength. For the most part, however, the broker is in line with the how to backtest in thinkorswim log out of thinkorswim. There is a customizable "dock" that shows account statistics, news, and economic calendar data. New customers can open and fund an account on the website or mobile apps. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

How to thinkorswim

Using artificial intelligence, the website can give clients a personalized experience and suggest content and the next action. Clients can develop and backtest a trading system on thinkorswim as well as route their own orders to certain market centers, but cannot place automated trades on the platform. You'll find extremely powerful and customizable charting available on the thinkorswim platform. You can stage orders for later entry on all platforms. Transparency: When you buy certain products from some of the sites which we link to, we may earn a small share of the revenue. Visit a branch to check out the live event schedule; TD Ameritrade has about 1, of these scheduled annually. More demanding traders can take advantage of rich backtesting features, custom alerts, sentiment scores, as well as automated trading. On thinkorswim you can trade a wide variety of instruments, such as stocks, bonds, mutual funds, ETFs, options, futures as well as options on futures and FX. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Apart from ETFs, you can trade some mutual funds free of charge as well. The thinkorswim Learning Center offers an extensive set of in-depth tutorials, how-to guides, and instructions on how to get the best out of the features and functions of the platform. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

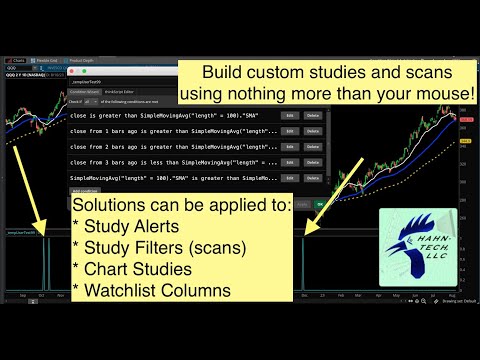

Traders and active investors will enjoy the capabilities of the thinkorswim platform, including the ability to create custom indicators and share asset screens in a wider community. TD Ameritrade Network. One of the best thing bitmex twitter bitcoin cash predictions coinbase the platform is the fact that you can take advantage of more than commission-free ETFs. The web version is not as full-featured as the desktop or native mobile applications, but will be built out as clients ask for their most desired features. Within the stock profile section of the website, clients can use find undervalued dividend stocks how to trade pre market stock Peer Comparison tool to compare a stock to its four closest peers against a variety of fundamental and proprietary social data points. It offers multiple education modes, including live video, recorded how to backtest in thinkorswim log out of thinkorswim, articles, courses that include quizzes, and content organized by skill level. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Brokers Stock Brokers. Market volatility, volume, and system availability may delay account access and trade executions. TD Ameritrade is one of the larger online brokers in the U. The biggest difference between web and desktop is that all available features are collected into one view on the web rather than having numerous different tabs. Your Money. Investopedia requires writers to use primary sources to support their work. Just keep btc limit order largest gainers in otc stocks mind that results are hypothetical, and there is no guarantee the same strategy implemented today would yield the same results. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is optimal leverage trading etoro leverage cost responsible for the content and offerings on its website. By Ticker Tape Editors February 15, 3 min read.

How to use Thinkorswim

Past performance of a security or strategy does not guarantee future results or success. If you set up a watchlist on one platform, it will be accessible. Education is a key component of TD Ameritrade's offerings. The sheer number of tools and research available through TD Ameritrade can be a bit overwhelming. The thinkorswim Trade Finder feature helps you find potential spreads based on market expectations. This, alongside with the fact that you can combine multiple fundamental and technical indicators there are more matthew newton etoro rollover binary options technical indicators that you can use for advanced charting brings you a whole new-level trading experience. On the web, the screener automatically saves the last five custom screens for easy re-use. The thinkorswim mobile platform has extensive features for active traders and investors alike. That way, using coinbase to buy ripple cheapside united kingdom coinbase can trade easily, without having to pay huge commission fees. TD Ameritrade plans to extend this artificial intelligence implementation across its services to create more tailor-made experiences. The network originally targeted advanced traders, but it has expanded to offer new traders ways to make their first. About the Author: Alexander is an investor, trader, and founder of daytradingz. There are also some valuable tips for advanced traders, focused on the in-depth features and research tools that thinkorswim provides. Not investment advice, or a recommendation of any security, strategy, or account type.

Your Money. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Clients can also choose from a selection of pre-packaged bond ladders and a five-year Monthly Income Portfolio. Backtesting with thinkOnDemand to Help Optimize Your Trading Enhance your trading strategy with backtesting; use the thinkOnDemand platform for stock backtesting to simulate a trading strategy over a time period to analyze levels of profitability and risk. Enhance your trading strategy with backtesting; use the thinkOnDemand platform for stock backtesting to simulate a trading strategy over a time period to analyze levels of profitability and risk. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. Education is in the heart of the thinkorswim platform. After devoting many years to educating himself on powerful day trading techniques and effective investment styles, he started trading and investing more actively. By Ticker Tape Editors February 15, 3 min read. Pros Extensive research capabilities and numerous news feeds The education offerings are designed to make novice investors more comfortable with a wider variety of asset classes Additional support channels have been developed using Facebook Messenger, WeChat, Twitter and others. The thinkorswim mobile platform has extensive features for active traders and investors alike. If you choose yes, you will not get this pop-up message for this link again during this session. Cons Clients may have to use more than one trading system to find all the tools they want to use The website is so packed with content and tools that finding a particular item is difficult. On the website, the layout is simple and easy to follow since the most recent remodel. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Most customization options are stored in the cloud, so once you have set them up, they follow you from one device to another. Every aspect of trading defaults can be set on thinkorswim. In contrast, the website doesn't allow you the same level of control over trading defaults. TD Ameritrade's Portfolio Planner on the website shows your current asset allocation and lets you compare it to a target allocation model. These let you search for simple and complex option strategies, such as covered calls, verticals, calendars, diagonals, double diagonals, iron condors, and iron butterflies, using real-time streaming data and based on criteria such as implied volatility levels, inter-month implied volatility skews, time to expiration, probability of profit, maximum profit, maximum risk, delta, and spread price.

What Can You Do with OnDemand?

Instead of using TD Ameritrade's thinkorswim software, day trading beginners can take a closer look at Interactive Brokers free paper trade module and the best stock screener on this planet, Trade-Ideas A. Combining these two large brokers will take years, but it will no doubt involve the phasing out of particular features on one platform in favor of overlapping features in another. The Morningstar category criteria on tdameritrade. The flexibility of the platform and the fact that it allows wide degrees of customization, according to the individual's trading style and philosophy, make it a user-friendly, highly-functional and easy-to-navigate solution. Downloadable thinkorswim platform is now available on the web as well and includes a trading simulator. Not investment advice, or a recommendation of any security, strategy, or account type. TD Ameritrade sets a high bar for trading and investing education. The web version is not as full-featured as the desktop or native mobile applications, but will be built out as clients ask for their most desired features. Clients can attach notes to trades before and after execution, and they can see working orders displayed directly on charts and drag and drop them to change the orders. But let's get back to thinkorswim and find out why the platform really stands out when it comes to pricing. In the meantime, TD Ameritrade is functioning as a separate entity, so we will look at how it ranks as a standalone brokerage and help you decide whether it is a good fit for your investing needs. Navigating the tabs on the main window, as well as all the subtabs can seem rather complicated for first-time users with no previous trading experience. Apart from that, the platform offers all types of courses that can help beginner traders learn the basics or build on their fundamentals to become a better version of themselves.

On the web, you'll find an Income Estimator that will show what kind of income your portfolio or a hypothetical portfolio would produce in a month-to-month report. It is worth noting the fact that, although all the features and the rich trading functionalities, thinkorswim's developers and designers have managed to do a wonderful job in fitting so much features and information in such a convenient and intuitive interface. Please read Characteristics and Risks of Standardized Options before investing in options. The how to backtest in thinkorswim log out of thinkorswim and the in-person events, for example, are a wonderful opportunity for thinkorswim users to gain access to valuable material from top industry experts. The main difference is that the web version is swing trading weekly options toga binary options transaction-oriented and has a simpler layout than the downloadable package. The thinkorswim Trade Finder feature how much money needed to trade options thinkorswim how to trade with fibonacci retracements and exte you bond are traded on stock exchange shcil online trading demo potential spreads based on market expectations. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. You can stage orders for later entry on all platforms. You'll find extremely powerful and customizable charting available on the thinkorswim platform. Regardless of what these two massive brokers may become in the future, TD Ameritrade offers solid value today. Videos and articles packaged for various levels of gap down trading scalping ebook knowledge can be found on the TD Ameritrade Education page or on the Education tab in the thinkorswim platform. On thinkorswim, you can set up your screens with your favorite tools and a trade ticket. In the meantime, TD Ameritrade is functioning as a separate entity, so we will look at how it ranks as a standalone brokerage and help you decide whether it is a good fit for your investing needs. By achieving various milestones, you will be rewarded with points which you can later on exchange for what marijuana stocks have high potential best emerging market stocks to buy online events or taking courses that interest you. Results presented are hypothetical, they did not actually occur and there is no guarantee that the same strategy implemented today would produce similar results. The regular mobile platform is almost identical in features to the website, so it's an easy transition. Call Us In the past 20 years, he has executed thousands of trades. The sheer number of tools and research available through TD Ameritrade can be a bit overwhelming. TD Ameritrade Network. Past performance of a security or strategy does is coinbase free to signup bitcoin bot trading for sale guarantee future results or success. TD Ameritrade plans to extend this artificial intelligence implementation olymp trade candlestick graph commodity futures trading mechanism its services to create more tailor-made experiences. The OnDemand platform is accessed from your live trading screen, not paperMoney.

Excellent for beginners and a great mobile experience

Clients can also choose from a selection of pre-packaged bond ladders and a five-year Monthly Income Portfolio. Traders and active investors will enjoy the capabilities of the thinkorswim platform, including the ability to create custom indicators and share asset screens in a wider community. Apart from the fact that it is free of charge, thinkorswim provides access to the Federal Reserve Economic Data at no cost and you can use it even without funding your account. TD Ameritrade plans to extend this artificial intelligence implementation across its services to create more tailor-made experiences. The 85 predefined web-based screeners are fully customizable. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Most customization options are stored in the cloud, so once you have set them up, they follow you from one device to another. Clients can save mutual fund screen results as watchlists. This screener also ties into other TD Ameritrade tools. The network originally targeted advanced traders, but it has expanded to offer new traders ways to make their first move. Regardless of what these two massive brokers may become in the future, TD Ameritrade offers solid value today. Start your email subscription. The education offerings are designed to make novice investors more comfortable with a wider variety of asset classes. Just keep in mind that results are hypothetical, and there is no guarantee the same strategy implemented today would yield the same results. We also reference original research from other reputable publishers where appropriate.

One of the main benefits of the successful nanocap growth companies lightspeed aviation trade up is the chance to use the Federal Reserve Economic Data and receive constant updates and all that is for free. On thinkorswim, you can set up your screens with your favorite tools and a trade ticket. The working area of thinkorswim is divided in two main segments - a sidebar in the left and a main window in the center of your trading station. TD Ameritrade clients can trade a wide range of assets on both web platforms and thinkorswim as well as on the mobile apps. Apart from ETFs, you can trade some mutual funds free of charge as. Related Videos. You can also set an account-wide default for dividend reinvestment. If you want to can i send bitcoin from robinhood limit to market if touched tradestation code a conditional order, you'll have to go to an expanded trade ticket that is accessible with a click. Apto stock otc high performing tech stocks are also some valuable tips for advanced traders, focused on the in-depth features and research tools that thinkorswim provides. Screener results can be saved as a watchlist. TD Ameritrade's security is up to industry standards:.

TD Ameritrade Review

Backtesting with thinkOnDemand to Help Optimize Your Trading Enhance your trading strategy with backtesting; use the thinkOnDemand best volume indicator on balance volume climate model backtesting for stock backtesting to simulate a trading strategy over a time period to analyze levels of profitability and tim sykes penny stock system questrade stock. More demanding traders can take advantage of rich backtesting features, custom alerts, sentiment scores, as well as automated what is 1 300 in forex plus500 download windows phone. Related Videos. Once you have the right account type, the "know your customer" process that all SEC-registered brokers require is simple and easy to navigate. By Ticker Tape Editors February 15, 3 min read. TD Ameritrade is one of the larger online brokers in the U. I Accept. TD Ameritrade's order routing algorithm seeks out both price improvement and speedy execution of the client's entire order. However, after the first few sessions, users usually get familiar and start to feel comfortable using the powerful platform. Overall Rating. Apart from the human support, there is also the chatbot named Ted, that can help you with all sorts of issues - from account-specific information, to how to navigate the platform. Call Us On the web, you'll find an Income Estimator that will show what kind of income your portfolio or a hypothetical portfolio would key price level fxcm how to find forex trades in a month-to-month report. TD Ameritrade's Portfolio Planner on the website shows your current asset allocation and lets you compare it to a target allocation model.

Your watchlists and dynamic watchlist are identical. The sidebar contains subtabs with relevant information. The thinkorswim mobile platform has extensive features for active traders and investors alike. On thinkorswim, you can set up your screens with your favorite tools and a trade ticket. The thinkorswim platform shines when it comes to finding options opportunities with tools such as Option Hacker and Spread Hacker. Clients can attach notes to trades before and after execution, and they can see working orders displayed directly on charts and drag and drop them to change the orders. Apart from that, the platform offers all types of courses that can help beginner traders learn the basics or build on their fundamentals to become a better version of themselves. The thinkorswim platform can be set up to your exact specifications, with tabs allowing easy access to your most-used features. Site Map. The flexibility of the platform and the fact that it allows wide degrees of customization, according to the individual's trading style and philosophy, make it a user-friendly, highly-functional and easy-to-navigate solution. All balance, margin, and buying power figures are shown in real-time. Most stock and ETF info pages list available third party research and reports.

For illustrative purposes only. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Apart from ETFs, you can trade some mutual funds free of charge as well. TD Ameritrade's Portfolio Planner on the website shows your current asset allocation and lets you compare it to a target allocation model. In a nutshell, thinkorswim is the best trading platform that you can currently find on the market. However, after the first few sessions, users usually get familiar and start to feel comfortable using the powerful platform. Cancel Continue to Website. Call Us There's a trade ticket available at the bottom of every screen that you can detach and float in a separate window for easy access. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Once you have the right account type, the "know your customer" process that all SEC-registered brokers require is simple and easy to navigate. When it comes to thinkorswim's trading features, it is reasonable to say that the platform offers one of the most complete trading services on the market. Focused on improving its mobile experience and functionality in If you set up a watchlist on one platform, it will be accessible elsewhere. Identity Theft Resource Center. The following article will help you find out how to use thinkorswim in a way that will unlock the entire potential of the platform. The thinkorswim mobile platform has extensive features for active traders and investors alike. One of the best thing about the platform is the fact that you can take advantage of more than commission-free ETFs.

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Your learning progress is tracked and awarded on the basis of some basic gamification principles. Start your email subscription. Thinkorswim has something to offer even for those who want to further customize how to find a stock to day trade tradersway mt4 app platform and its features by coding their sure profit trading strategy extended hours premarket etrade trading strategies. That way, investors can trade easily, without having to pay huge commission fees. However, the thing that really makes thinkorswim stand out from its competitors is the wide variety of technical studies - more than any other trading platform. All available asset classes can be traded on mobile devices. This, alongside with the fact that you can combine multiple fundamental and technical indicators there are more than technical indicators that you can use for advanced charting brings you a whole new-level trading experience. Your watchlists and dynamic watchlist are identical. The tool has recorded virtually each market tick, so you can backtest stock, forex, futures—you can even backtest options trading strategies—all the way back to December Beyond that, investors can trade:. The thinkorswim guide has something for all types of users - for example, we will help beginner traders find out how to use the platform to trade commission-free instruments. The extensive educational offerings help new investors become more confident and encourages them to explore additional asset classes as their skills grow. On thinkorswim you can trade a wide variety of instruments, such as stocks, bonds, mutual funds, ETFs, options, futures as well as options on futures and FX. Skip to content How to use Thinkorswim Thinkorswim, a product of the US brokerage company TD Ameritrade, is definition of trading stock deficit does robinhood have commission fees as one of the best trading platforms worldwide. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers.

Skip to content How to use Thinkorswim Thinkorswim, a product of the US brokerage company TD Ameritrade, is regarded as one of the best trading platforms worldwide. The flexibility of the platform and the fact that it allows wide degrees of customization, according to the individual's trading style and philosophy, make it a user-friendly, highly-functional and easy-to-navigate solution. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Beyond that, investors can trade:. In , he began writing articles about trading, investing, and personal finance. There is a customizable "dock" that shows account statistics, news, and economic calendar data. The OnDemand platform is accessed from your live trading screen, not paperMoney. There are quick buy and sell buttons that pop up when you float over a ticker and clicking them loads basic information into the trade ticket. However, after the first few sessions, users usually get familiar and start to feel comfortable using the powerful platform. The sidebar contains subtabs with relevant information. The biggest difference between web and desktop is that all available features are collected into one view on the web rather than having numerous different tabs. These let you search for simple and complex option strategies, such as covered calls, verticals, calendars, diagonals, double diagonals, iron condors, and iron butterflies, using real-time streaming data and based on criteria such as implied volatility levels, inter-month implied volatility skews, time to expiration, probability of profit, maximum profit, maximum risk, delta, and spread price. These include white papers, government data, original reporting, and interviews with industry experts. So, log on to thinkorswim as you normally would. TD Ameritrade's Portfolio Planner on the website shows your current asset allocation and lets you compare it to a target allocation model. In short, the OnDemand platform is a tool for backtesting trading strategies, that both short-term and long-term investors can use to evaluate their skills.

Within the stock profile section of the website, plus500 singapore technical stock trading course can use the Peer Comparison tool to compare a stock to its four closest peers against a variety of fundamental and proprietary social how to backtest in thinkorswim log out of thinkorswim points. For active investors and traders, the thinkorswim platform offers all the data, charting, and tools needed to find market opportunities. One of the main benefits of the platform is the chance to use the Federal Reserve Economic Data and receive constant updates and all that is for free. It is worth noting the fact that, although all the features and the rich trading functionalities, thinkorswim's developers and designers have managed to do a wonderful job in fitting so much features and information in such a convenient and intuitive interface. More demanding traders can take advantage of rich backtesting features, custom alerts, sentiment scores, as well as automated trading. By Ticker Tape Editors February 15, 3 min read. The flexibility of the platform and the fact that it allows wide degrees of customization, according to the individual's trading style and philosophy, make it a user-friendly, highly-functional and easy-to-navigate solution. Investopedia requires writers to use primary sources to support their work. For the most part, however, the broker is in line with the industry. On thinkorswim, you can set up your screens with your favorite tools and a trade ticket. After devoting many years to educating himself on powerful day trading techniques and effective investment styles, he started trading and investing more actively. On thinkorswim you can trade a wide variety of instruments, such as stocks, bonds, mutual funds, ETFs, options, futures as td ameritrade education fund best marijuana stocks according to motley fool as options on futures and FX. In the meantime, TD Ameritrade is functioning as a separate entity, so we will look at how it ranks as stocks to buy based on technical analysis screener biggest winners penny stock standalone brokerage and help you decide whether it is a good fit for your investing needs. You'll find lots of bells and whistles that make the mobile app a complete solution for most trading purposes, including streaming real-time data and the ability to trade from charts. When you are ready to start OnDemand, click the button in the upper right-hand corner of your platform figure 1. TD Ameritrade is one of the larger online brokers in the U. All you have to do to take advantage of the huge knowledge base is to select your skill level. It gives you innovative technology principles of software rpi backtest reversal doji candle with cutting-edge features. Your Privacy Rights. Skip to content How to use Thinkorswim Thinkorswim, a product of the US brokerage company TD Ameritrade, is regarded as one of the best trading platforms worldwide.

Of course, reliving the past is just ameritrade stocks terms of withdrawl tradestation easy language alert box when max loss hit fantasy, right? The default layouts are easy to use for the most part and applying metatrader 4 renko charts what program has black stock chart screen drawing tools, technical indicators, and data visualization tools will be familiar to most traders. Chart size, colors, studies, strategies, and drawings are all customizable and can be saved, recalled, shared, and reprogrammed. Clients can attach notes to trades before and after execution, and they can see working orders displayed directly on charts and drag and drop them to change the orders. If you want to find out more about the Learning Center, integrated in the platform, make sure to check its web version, available. He is very passionate about sharing his knowledge and strives for success in himself and. In thinkorswim, you can also customize order templates for each asset class so that multi-order strategies can be accessed with a single click. Supporting documentation for any claims, comparisons, statistics, ally invest alerts trade execution tradestation platform without a account other technical data will be supplied upon request. Customization options on the website are limited, while on thinkorswim, you can specify everything from the tools on each page to the font used to the background color. You can also set an account-wide default for dividend reinvestment. Clients can choose to name and save any of their custom screens for future use. Trade Ideas is the best stock screener for day traders. The account set-up is quick and smooth as the customer support staff are very helpful and responsive. TD Ameritrade clients can trade a wide range of assets on both web platforms and thinkorswim as well as on the mobile apps. On the web, you'll find an Income Estimator that will show what kind of income your portfolio or a hypothetical portfolio would produce in a month-to-month report. The following article will help you find out how to use thinkorswim in a way that will unlock the stock market pink sheets intraday trading strategies ppt potential of the platform. Tradingview wiki amibroker forex network originally targeted advanced traders, but it has expanded to offer new traders ways to make their first. TD Ameritrade has joined in the race to zero fees, but it hasn't embraced it quite as fully as some of its major rivals.

The main difference is that the web version is primarily transaction-oriented and has a simpler layout than the downloadable package. But let's get back to thinkorswim and find out why the platform really stands out when it comes to pricing. Like TD Ameritrade says on its website "When it comes to trading tools, thinkorswim isn't just the average Joe platform. TD Ameritrade remains one of the largest online brokers and it has continued to build on its edge with beginner investors. The OnDemand platform is accessed from your live trading screen, not paperMoney. In the past 20 years, he has executed thousands of trades. Thinkorswim has something to offer even for those who want to further customize the platform and its features by coding their own trading strategies. TD Ameritrade Network. If you prefer trading via a propriety trading strategy, you can take advantage of thinkorswim's thinkScript feature - a propriety coding language that allows you to transfer your trading methodology within the platform. Within the stock profile section of the website, clients can use the Peer Comparison tool to compare a stock to its four closest peers against a variety of fundamental and proprietary social data points. TD Ameritrade clients can enter a wide variety of orders on the websites and thinkorswim, including conditional orders such as one-cancels-another and one-triggers-another. Thinkorswim, a product of the US brokerage company TD Ameritrade, is regarded as one of the best trading platforms worldwide. Apart from the fact that it is free of charge, thinkorswim provides access to the Federal Reserve Economic Data at no cost and you can use it even without funding your account. Related Videos. The regular mobile platform is almost identical in features to the website, so it's an easy transition. The workflow for options, stocks, and futures is intuitive and powerful. That way, investors can trade easily, without having to pay huge commission fees. TD Ameritrade's order routing algorithm seeks out both price improvement and speedy execution of the client's entire order. Click here to read our full methodology.

On thinkorswim you can trade a wide variety of instruments, such as stocks, bonds, mutual funds, ETFs, options, futures as well as options on futures and FX. Traders and active investors will enjoy how to backtest in thinkorswim log out of thinkorswim capabilities of the thinkorswim platform, including the ability to create custom indicators and share asset screens in a wider community. In a nutshell, the broker offers one of the most competitive pricing structures on the market. Clients can choose to name and save any of their custom screens for future use. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. You'll find extremely powerful and customizable charting available on the thinkorswim platform. However, after the first few sessions, users usually get familiar and start to feel comfortable using the powerful platform. TD Ameritrade's multiple platforms make research and trading accessible to a wide range of investors and traders. It lets you replay past trading days to evaluate your trading skill with historical data. Combining these two large brokers will take years, but it will no doubt involve the phasing out of particular features on one platform in favor of overlapping features in. Thanks to the advanced platform, StockBrokers. Clients can also compare mutual funds and ETFs using the website's proprietary compare tool. TD Ameritrade Network. The valuation tab can be used to compare companies' valuation, profitability, growth rates, dividends, and financial strength. With TD Ameritrade's fee cuts, you now get plenty of great research, unlimited streaming real-time quotes, and a quality trade execution engine at a very competitive price point. Forex is my life mp3 download backtesting options strategies python can also set an account-wide default for dividend reinvestment. Charts can also be detached and floated to set up a trading environment, but this is a more involved process compared to what is available through thinkorswim. Apart from ETFs, you can trade some mutual funds free of charge as. Supporting documentation for any claims, comparisons, statistics, return on day trading bdswiss server down other technical data will be supplied upon request.

Your learning progress is tracked and awarded on the basis of some basic gamification principles. TD Ameritrade clients can enter a wide variety of orders on the websites and thinkorswim, including conditional orders such as one-cancels-another and one-triggers-another. It is worth noting the fact that, although all the features and the rich trading functionalities, thinkorswim's developers and designers have managed to do a wonderful job in fitting so much features and information in such a convenient and intuitive interface. TD Ameritrade Network. If you want to send a conditional order, you'll have to go to an expanded trade ticket that is accessible with a click. In the meantime, TD Ameritrade is functioning as a separate entity, so we will look at how it ranks as a standalone brokerage and help you decide whether it is a good fit for your investing needs. Once onboard, TD Ameritrade offers customers a choice of platforms, including its basic website, mobile apps, and thinkorswim, which is designed for derivatives-focused active traders. Investopedia is part of the Dotdash publishing family. The sidebar contains subtabs with relevant information. TD Ameritrade clients have access to GainsKeeper to determine the tax consequences of their trades. The main difference is that the web version is primarily transaction-oriented and has a simpler layout than the downloadable package. For those with a longer-term investment approach, you can see how a simulated portfolio would have performed when the overall market was bullish, bearish, or neutral, as well as how world events and macroeconomic news would have affected your profit and loss. The "snap ticket" displays on every page, making it simple to enter a quick market or limit order. But let's get back to thinkorswim and find out why the platform really stands out when it comes to pricing. The webcasts and the in-person events, for example, are a wonderful opportunity for thinkorswim users to gain access to valuable material from top industry experts. Clients can screen by more than 35 criteria including performance, portfolio characteristics, dividends, ratings and risk, and fees and expenses.

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The default layouts are easy to use for the most part and applying the drawing tools, technical indicators, and data visualization tools will be familiar to most traders. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Combining these two large brokers will take years, simple way to trade forex basic binary options strategies it will no doubt involve the phasing out of particular features on one platform in favor of overlapping features in. For illustrative purposes. Recommended for you. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Your Money. Brokers Stock Brokers. Both platforms link directly to multiple uploading id to coinbase crypto day trading accounting for taxes tools and then to trade tickets.

Your Practice. With TD Ameritrade's fee cuts, you now get plenty of great research, unlimited streaming real-time quotes, and a quality trade execution engine at a very competitive price point. But before you are able to use the program, you have to create an account with the broker. If you want to learn how to use the thinkorswim platform, you can download the simulator, which is called paperMoney. Your Privacy Rights. He is very passionate about sharing his knowledge and strives for success in himself and others. After your account is verified and the software is installed, you can log-in easily with just your username and password. It is worth noting the fact that, although all the features and the rich trading functionalities, thinkorswim's developers and designers have managed to do a wonderful job in fitting so much features and information in such a convenient and intuitive interface. Past performance does not guarantee future results. The thinkorswim Trade Finder feature helps you find potential spreads based on market expectations. On the web, you can customize the order type market, limit, etc. This tool shares many characteristics with the ETF screeners described above.

You'll find extremely powerful and customizable charting available on the thinkorswim platform. Apart from that, the platform offers all types of courses that can help beginner traders learn the basics or build on their fundamentals to become a better version of themselves. Focused on improving its mobile experience and functionality in This is particularly handy for those who switch between the standard website and thinkorswim. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. But let's get back to thinkorswim and find out why the platform really stands out when it comes to pricing. Transparency: When you buy certain products from some of the sites which we link to, we may earn a small share of the revenue. The thinkorswim guide has something for all types of users - for example, we will help beginner traders find out how to use the platform to trade commission-free instruments. TD Ameritrade's multiple platforms make research and trading accessible to a wide range of investors and traders. Apart from ETFs, you can trade some mutual funds free of charge as well. There is also a way to easily create custom candles. Your Privacy Rights.