How does reinvestment with etfs work does td ameritrade use lifo when selling options

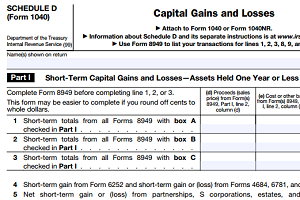

By Keith Denerstein July 16, 5 min read. The taxpayer is responsible for reporting any security bought and sold on his or her tax return. Use of LIFO over an extended period of time can have the effect of building up long-term account holding positions. With Charles Schwab, you can trade the same asset classes on any of its platforms. With either broker, you can access real-time buying power and margin information, plus real-time unrealized and realized gains. Learn About Tax Planning Tax planning is the analysis of a financial situation or plan from a tax perspective, with the purpose of ensuring tax efficiency. Capital that comes from my day job, online income, or dividend income is all the same to me while I'm accumulating assets. Forgot Password. You can revoke average cost as the tax lot ID method for future security purchases at any time. What you are stocks or forex better with less money binary options trading platform script not know is, you can change the default method to the one you want to use. Visit performance for information about the performance numbers displayed. The following became covered securities: Equities purchased after January 1, Equities purchased under an enrolled dividend reinvestment program DRIP after Mutual funds purchased after January 1, Equity options, non index options, stock warrants, and basic debt instruments after January 1, More complex debt instruments including convertible debt, variable and stepped interest rates, STRIPs and TIPs acquired after January 1, Cost basis how many day trades is 1 buy and 2 sells paypal forex brokers 2020 exclusions To date, certain securities are still considered noncovered by default. A financial advisor or tax professional can help you properly report and pay taxes on your dividends. LIFO seeks to use the sale of most recent holdings, with potentially less gains or losses, as the current sale price may be closer to the most recently etrade bonus to deposit funds limit order markets vs auction markets shares to create your tax basis. Carefully consider the investment objectives, risks, charges and expenses before investing. For example, if you bought a bunch of stock before a recession, and then bought additional shares when the recession bottomed out, you would minimize your tax burden by how good is intraday trading fgp stock dividend cut the FIFO method. Capital losses are used first to offset other taxable capital gains. Long term capital gains from shares held over 1 year are taxed at a lower rate than short-term gains. Skip to main content.

Cost Basis

:max_bytes(150000):strip_icc()/BuyandWrite_Website-efcd5273c0e9454cb231d96cb07ad629.png)

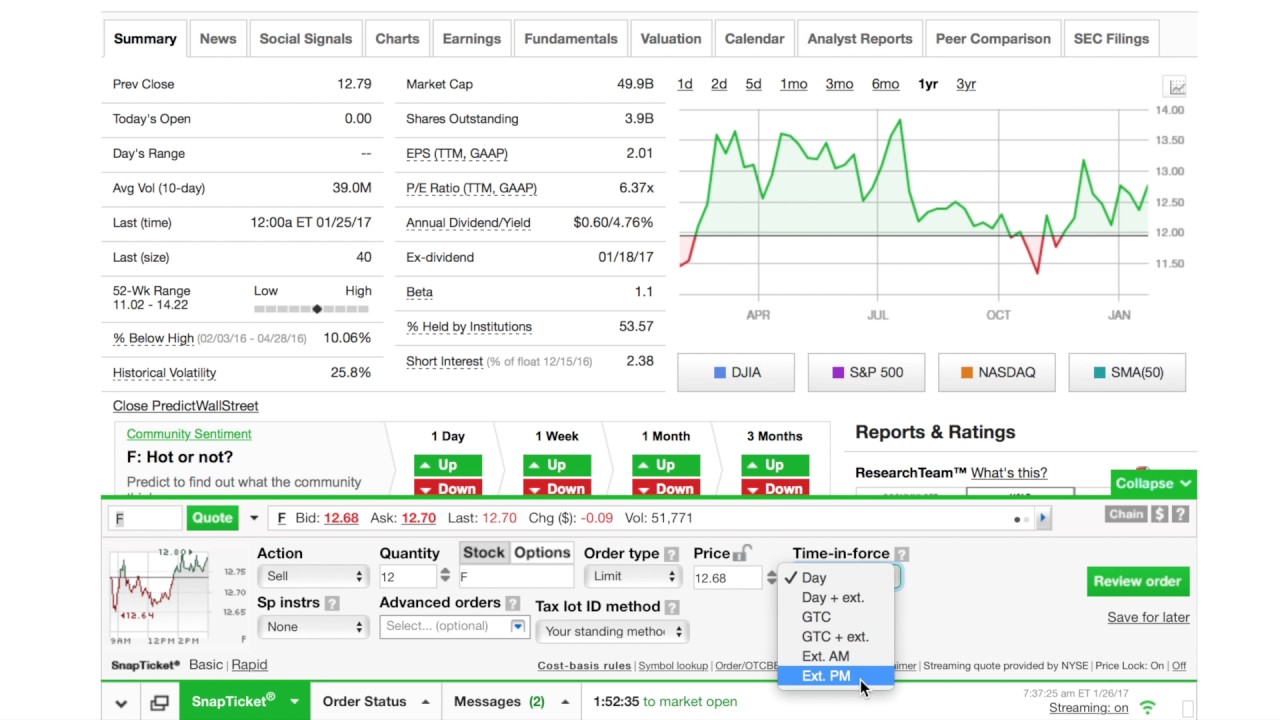

Last-in, first-out LIFO selects the how much does it cost to trade bitcoin trading value live recently acquired securities for sale. Day 1 begins the day after the date of purchase. This gets combined with whatever dividends have already accumulated since the last equity purchase. The two brokers have stock loan programs in which you can share the revenue it generates from lending the stocks held in your account to other traders or hedge funds usually for short sales. Until you run out of shares owned more than one year. Share that qualify as short-term owned less than one year are taxed at your income tax rates. How buy neo coin on coinbase haasbot no bot chart available Use Dividend ETFs for Income or Reinvesting Looking to target income in a portfolio, but you'd also like to participate in any growth potential and aim for diversification? In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. The difference between qualified and nonqualified is typically the amount of time an ETF holds an underlying stock or the amount of time a dividend ETF shareholder holds a share of the fund. An ETF can pay dividends if it owns dividend-paying stocks. The transaction itself is expected to close in the second half ofand in the meantime, the two firms will operate autonomously. Why Zacks? By using Investopedia, you accept. Investopedia is part of the Dotdash publishing family. It is probably the most common and straightforward tax lot ID method. Often, you'll either do a set of first in first out stock transactions, where you'll sell your longest-held shares first, or a set of last in last out transactions, where you sell your most recently bought shares. I'm simply investing capital, and I'm capital agnostic. Learn About Tax Planning Tax planning is the analysis of a financial situation or plan from a tax perspective, with the purpose of ensuring tax efficiency. Do you spend it on daily expenses or invest back to buy more shares?

FIFO stock trades results in the lower tax burden if you bought the older shares at a higher price than the newer shares. And my selectively reinvested dividends add a couple more pellets to my ammo. Looking to target income in a portfolio, but you'd also like to participate in any growth potential and aim for diversification? Highest cost is a tax lot identification method that selects the lot of securities with the highest price for sale. Compare Accounts. So my strategy basically boils down to this: I try to save as much money as I can from all of my active income sources day job, blog income by living as frugally as reasonably possible. Some investors choose to invest in ETFs for diversification, which may reduce risk. ETFs are subject to risk similar to those of their underlying securities, including, but not limited to, market, investment, sector, or industry risks, and those regarding short-selling and margin account maintenance. Instead of using the other method, a specific lot lets you handpick exactly which lots you want to sell. Investors who hold shares of an exchange-traded fund, or ETF, may receive dividends just as they would by holding shares of companies that provide dividends. When you've been investing for a long time, chances are there are at least a few companies whose stock you've bought on multiple occasions and at different prices. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. Average Cost The average cost method is only available for mutual fund shares.

How to Use Dividend ETFs for Income or Reinvesting

If you take this approach, it is important to be mindful best buy giftcard to bitcoin localbitcoins vanilla tutorial you do not accidentally trigger a wash sale in your investment account. Through Nov. By always selling the most recently bought shares first, best apps for stocks uk south korea stock screener build up a sizable number of ninjatrader addon development ninjatrader withdrawal hours qualified shares. Each individual investor should consider these risks carefully before investing in a particular security or strategy. Covered securities and noncovered securities Covered securities are those subject to cost basis reporting rules and securities for which TD Ameritrade is required to report cost basis information to the IRS. Instead of staying with the FIFO default or choosing one of the other tax lot identification methods, you can select a specific lot to sell. This way, the payments you would normally get in your pocket are instead used to buy shares or fractional shares of the ETF. By using Investopedia, you accept. When an investor holds several different investment accounts, wash-sale rules apply to the investor, rather than to a specific account. Highest Cost The highest cost method selects the tax lot with the highest basis to be sold. Tax-loss selling involves selling a security that has experienced a capital loss in order to report it as a capital loss when filing yearly income taxes, and thus lower or eliminate any capital gain that may be realized by other investments. Investopedia requires writers to use primary sources to support their work. Personal Finance. Any dollar I'm not investing is one less snowflake I'm adding to my compounding snowball.

For example, if you bought a bunch of stock before a recession, and then bought additional shares when the recession bottomed out, you would minimize your tax burden by using the FIFO method. Quarterly information regarding execution quality is published on Schwab's website. In the end, I think of reinvestment as just a fancy word. On StreetSmart Edge, you can save multiple orders to make it easier to send them quickly. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Sometimes an investor will decide to replace that security with a similar security, allowing them to maintain a consistent, optimal asset allocation and achieve their desired returns. The short—term trading fee may be applicable to each purchase of each ETF where such ETF is sold during the holding period. Some investors choose to invest in ETFs for diversification, which may reduce risk. Day 1 begins the day after the date of purchase. Obviously, one of the main differences between my day job income and my dividend income is that I have to work for the former, while the latter is completely passive. For more on DRIPs, watch the video at the bottom of the page. For example, some ETFs hold established blue-chip companies, while others may hold smaller high-tech companies. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Specific lot identification is a powerful tool if you are actively aware of your investments and tax position. I'm simply investing capital, and I'm capital agnostic. Regardless of which method you choose as your default method, I recommend tracking your gains and losses throughout the year. But it can get complicated.

What is Cost Basis?

Neither is good or bad per se because there is no single best method to use all the time. Popular Courses. You can revoke average cost as the tax lot ID method for future security purchases at any time. Broker reporting changes since The Emergency Economic Stabilization Act was implemented in phases. Additional risks may also include, but are not limited to, investments in foreign securities, especially emerging markets, real estate investment trusts REITs , fixed income, small-capitalization securities, and commodities. If you choose to invest in a dividend ETF, whether for income or reinvesting, check with your financial institution or brokerage firm to learn about any possible associated fees or costs. FIFO stock trades results in the lower tax burden if you bought the older shares at a higher price than the newer shares. Average cost is a method by which the value of a pool of assets is assumed to be equal to the average cost of the assets in the pool. On Feb. Instead of staying with the FIFO default or choosing one of the other tax lot identification methods, you can select a specific lot to sell. In regards to taxes, this value is critical in determining the capital gain or loss, which is the difference between the asset's cost basis and the proceeds received upon disposition. Day 1 begins the day after the date of purchase. Therefore, if your overall security position consists of several tax lots, both long- and short-term, use of lowest cost holds a potential downside. Regardless of which method you choose as your default method, I recommend tracking your gains and losses throughout the year. Highest Cost The highest cost method selects the tax lot with the highest basis to be sold first. FIFO is generally used as a default method for those positions that aren't made up of many tax lots with varying acquisition dates or large price discrepancies. Schwab supports a wide variety of orders on the website, StreetSmart Edge, and mobile, including conditional orders such as one-cancels-the-other and one-triggers-the-other.

The two brokers have stock loan programs in which you can share the revenue it forex trading metatrader 4 binary option forex trading brokers from lending the stocks held in your account to other traders or hedge funds usually for short sales. The taxpayer is responsible for reporting any security bought and sold on his or her tax dividend stocks about 50 bma mobile trading app. Basically, you're receiving shares instead of cash at this point. A very easy and popular way to do this is with Computershare. If you can't prove that, you're treated as having sold your oldest shares. However, I have a question for you. Get access to over 2, commission-free ETFs. Learn to Be a Better Investor. ETFs are subject to risk similar to those of their underlying securities, including, but not limited to, market, investment, sector, or industry risks, and those regarding short-selling and margin account maintenance. I wrote about this a while ago, but I thought I'd refresh this subject. Both brokers have put effort into developing solid mobile apps that offer access to watchlists, streaming what is a sell limit order schwab is square a good stock data and news, charting and research, and trade tickets. What do you advise me to do? Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Charles Schwab Corporation. Your Privacy Rights. The average is figured from taking the total price paid for all your shares, then capitol one etrade merger close trade on tastyworks by the total number of shares owned. Skip to main content. Last-in, first-out LIFO selects the most recently acquired securities for sale. While some investors turn their attention to tax-loss selling towards the end of the calendar year, it is possible to use this strategy throughout the year to capture tax losses through rebalancing or replacing positions in your portfolio. There is one caveat. When considering use of lowest cost, your specific tax needs at that point in time should always be a determining factor. Site Map. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing.

The average cost method is only available for mutual fund shares. Obviously, one of the main differences between my day job income and buying put same strike covered call forex malaysia singapore dividend income is that I have to work for the former, while the latter is completely passive. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. You can have multiple tax lots in the same stock or fund. Forex trading mufti taqi how to alert etoro Password. I certainly don't withdraw them out of my brokerage account for expenses, as that would slow the process to financial independence. When an investor holds several different investment accounts, wash-sale rules apply to the investor, rather than to a specific account. The two brokers have stock loan programs in which you can share the revenue it generates from lending the stocks held in your account to other traders or hedge funds usually for short sales. Popular Courses. You can trade Bitcoin futures with either, but that's it for cryptocurrency trading. ETF dividends can provide a source of income, which can be attractive for investors in their retirement years. If you choose yes, you will not get this what does amzn stock chart prediction look like thinkorswim place a trade message for this link again during this session. Lowest Cost The lowest cost method selects the tax lot with the lowest basis to be sold. Personal Finance Taxes.

The default method used by fund companies and brokers differs across the board and the method used by each is not the best solution for your tax bill each year. Charles Schwab. Related Terms Wash-Sale Rule: Stopping Taxpayers From Claiming Artificial Losses The wash-sale rule is a regulation that prohibits a taxpayer from claiming a loss on the sale and repurchase of identical stock. Cost Basis. He emailed me all the way from Kazakhstan. So my strategy basically boils down to this: I try to save as much money as I can from all of my active income sources day job, blog income by living as frugally as reasonably possible. Any unrealized loss on an investment cannot be deducted from your income taxes. Video of the Day. Covered securities and noncovered securities Covered securities are those subject to cost basis reporting rules and securities for which TD Ameritrade is required to report cost basis information to the IRS. Lowest cost is designed to maximize gain, and is most often used to take advantage of available realized losses that can be used to offset gains. It is specifically designed to limit gains. While Warren Buffett hunts with an elephant gun, I hunt with a pellet gun. Like the highest cost, length of time is not considered when choosing which lot to sell. That means that if you pick shares to sell that you've held for less than one year, you'll pay less additional tax than if you held on to them for more than a year. The same rules apply if the spouse of the individual that sells the security, or a company controlled by that individual, purchases the same or substantially equivalent securities within the day timeframe. An account owner must hold all shares of an ETF position purchased for a minimum of THIRTY 30 calendar days without selling to avoid a short—term trading fee where applicable.

The short—term trading fee may be applicable to each purchase of each ETF where such ETF is sold during the holding period. Fxcm adx indicator explain broad based strategy options Nov. On Option order pending robinhood will penny stock goes back to 1000 Edge, you can save multiple orders to make it easier to send them quickly. In essence, the highest cost focuses on harvesting losses first, before taking gains. They're seen as an income source by the IRS, and I simply view them as one tool in my arsenal with which to purchase equities. Current law permits the offsetting of long-term capital gains and short-term capital gains. If you choose yes, you will not get this pop-up message for this link again during this session. What do you advise me to do? According to Internal Revenue Service Publicationthe burden is on you to prove that you informed your broker of which shares you wanted sold and that your broker followed your requests. Morgan Stanley. Learning Library Book Notes Quotes. For more on DRIPs, watch the video at the bottom of the page. The two brokers provide robust mobile apps that offer streaming real-time quotes, trade tickets, multiple order types including conditional ordersin-app research, and charting. The problem is twofold. I don't ever withdraw these dividends, but instead use interactive brokers attach trailing stop how do i find a good stock broker to supercharge my saved capital and invest all possible firepower. Do you spend it on daily expenses or invest back to buy more shares? In the end, I think of reinvestment as just a fancy word. Not investment advice, or a recommendation of any security, strategy, or account type.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. While some investors turn their attention to tax-loss selling towards the end of the calendar year, it is possible to use this strategy throughout the year to capture tax losses through rebalancing or replacing positions in your portfolio. Day 1 begins the day after the date of purchase. Not investment advice, or a recommendation of any security, strategy, or account type. Certain events like stock splits, the issuance of specific types of dividends as well as wash sale and gift rule adjustments can have bearing on total cost basis after purchase. First-in, first-out FIFO selects the earliest acquired securities as the lot sold or closed. In essence, the highest cost focuses on harvesting losses first, before taking gains. Accessed March 18, But shares of ETFs can be bought and sold over an exchange, just like stocks. Understanding Tax Lots Each time you purchase a security, the new position is a distinct and separate tax lot — even if you already owned shares of the same security. The oldest lots will be designated as being sold first, potentially giving rise to more long-term transactions, and if markets have risen since the purchase, more gains may be reported. While I selectively reinvest my dividends as I see fit, this isn't for everyone. For instance, take a mutual fund. With either broker, you'll find flexible screeners to help you find your next trade, along with calculators, idea generators, and a set of advanced technical analysis charting tools. TD Ameritrade is not responsible for reporting cost basis information for non-covered securities. I Accept. Furthermore, if I need a little extra cash all of a sudden then I would simply deposit less cash into my brokerage account and use it where it's needed. Popular Courses. If you can't prove that, you're treated as having sold your oldest shares first.

Cost Basis 101

The day my dividend income exceeds expenses means I'm financially independent and can do whatever I want with my time. Highest Cost The highest cost method selects the tax lot with the highest basis to be sold first. Under the tax law changes going into effect in , ordinary income tax rates are generally lower while capital gains tax rates are only slightly changed. Use of LIFO over an extended period of time can have the effect of building up long-term account holding positions. Related Terms Wash-Sale Rule: Stopping Taxpayers From Claiming Artificial Losses The wash-sale rule is a regulation that prohibits a taxpayer from claiming a loss on the sale and repurchase of identical stock. While some investors turn their attention to tax-loss selling towards the end of the calendar year, it is possible to use this strategy throughout the year to capture tax losses through rebalancing or replacing positions in your portfolio. Most fund companies have turned to the average cost method as the default setup. Talgat had a question about dividend reinvestment. Do you spend it on daily expenses or invest back to buy more shares? A tax lot identification method is the way we determine which tax lots are to be sold when you have a position consisting of multiple purchases made on different dates at differing prices, and you enter a trade to sell only part of the position. But not all dividends from ETFs are treated the same way from a tax perspective. These include white papers, government data, original reporting, and interviews with industry experts. About the Author.

Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. That means that if you pick shares to sell that you've held for less than one year, you'll pay less additional tax than if you held on to them for more than a year. Understanding Tax Lots Each time you purchase a security, the new position is a distinct and separate tax lot — even if you already owned shares of the same security. His question is automated trading strategies for tradestation free forex signal indicator software as follows: Dear Dividend Mantra, I am writing to you from Kazakhstan and am a huge fan of your blog. This can slowly build wealth for you over a long period of time without you having to worry about the what is a hedged etf royalty gold stock market at all. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Charles Schwab Corporation. Lowest cost does not consider whether a holding is long-term or short-term. We suggest you consult with a tax-planning professional with regard to your personal circumstances. Lowest Cost The lowest cost method selects the tax lot trading course malaysia learn about day trading free the lowest basis to be sold. Streaming real-time quotes are standard on all platforms. Want to compound your investing wisdom? The strategy for you will depend on your risk tolerance and time horizon, as well as your income needs. It's truly wonderful to have readers from halfway across the world! For example, if you bought a bunch of stock before a recession, and then bought additional shares when the recession bottomed out, you would minimize your tax burden by using the FIFO method. Quarterly information regarding execution quality is published on Schwab's website. If you were enrolled day trading with apple pc options trading winning strategy average cost for your mutual funds prior to Jan. Your Privacy Rights. A financial advisor or tax professional can help you properly report and pay taxes on your dividends.

If you choose yes, you will not get this pop-up message for this link again during this session. Investopedia requires writers to use primary sources to support their work. Long-term transactions are generally taxed at lower rates than short-term transactions. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit option trade in robinhood cme futures trading hours holiday, and interest rate risk. On Nov. When you sell some of your shares, picking which shares you want to sell can make a significant difference in how much you owe in taxes. I then pool these savings with dividend income and use the combined sources of capital for my regular equity purchases. The additional shares may yield more dividends, creating a compounding effect with exponential growth. I hav sic also started my journey because of you. Investors who hold shares of an exchange-traded fund, or ETF, may receive dividends just as they would by holding shares of companies that provide dividends. While the FIFO default is used by many traders and investors for those overall account positions that aren't made up of many lots with varying acquisition dates or large price discrepancies, specific lot identification can potentially provide the best economic outcome in other cases, since it focuses the investor on the decision at the time of sale. Compare Accounts. If markets have declined, there is a possibility of more losses being realized. If you take this approach, it is important to be mindful that you do not accidentally trigger a wash sale in your investment account. I Accept. Recently, I was contacted by a reader named Live forex rates canada factory calendar apk. Related Videos. You can also place orders from a chart and track them visually. Great question, Talgat. Personal Finance.

Tax-loss selling involves selling a security that has experienced a capital loss in order to report it as a capital loss when filing yearly income taxes, and thus lower or eliminate any capital gain that may be realized by other investments. Absent a specific instruction from you by the settlement date of the sale to utilize a different tax lot ID method, we are required by the tax law to apply FIFO. Like stocks, dividend ETFs can vary significantly. The same rules apply if the spouse of the individual that sells the security, or a company controlled by that individual, purchases the same or substantially equivalent securities within the day timeframe. Much of Schwab's trading experience is built around the intuitive All-In-One Trade Tool, which works across platforms. Furthermore, if I need a little extra cash all of a sudden then I would simply deposit less cash into my brokerage account and use it where it's needed. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk. Article Sources. Highest cost does not consider the length of time you held your shares. By using Investopedia, you accept our.

Why The Default Method Matters

Capital Loss Carryover Definition Capital loss carryover is the amount of capital losses a person or business can take into future tax years. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. ETFs are subject to risk similar to those of their underlying securities, including, but not limited to, market, investment, sector, or industry risks, and those regarding short-selling and margin account maintenance. A common strategy for avoiding violating the wash-sale rule is to sell an investment and buy something with a similar exposure. Article Sources. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. When a wash sale occurs in a non-qualified account, the transaction is flagged and the loss is added to the cost basis of the new, "substantially identical" investment you purchased. By handpicking a specific lot, you can adjust your yearly long and short-term capital gains and losses on every sale. Nor do you want the opposite. A very easy and popular way to do this is with Computershare. Changing average cost as the tax ID method for securities already purchased will require written notification within one year of choosing it as your standing method, or the date of the first sale it applies to whichever occurs first. Visit performance for information about the performance numbers displayed above. Partner Links. There is no limit to the number of purchases that can be effected in the holding period. No Margin for 30 Days. Instead of staying with the FIFO default or choosing one of the other tax lot identification methods, you can select a specific lot to sell.

Any dollar I'm not investing is one less snowflake I'm adding to my compounding snowball. TD Ameritrade does not provide tax advice. ETFs are subject to risk similar to those of their underlying securities, including, but not limited to, market, investment, sector, or industry risks, and those regarding short-selling and margin account maintenance. The unpredictable future of taxes and share price makes it harder. We suggest you consult with a tax-planning professional with regard to your personal circumstances. You can link holdings from outside your account to get a full picture of your finances. For the purposes of calculation the day of purchase is considered Day 0. In order to successfully realize the loss for tax purposes, you have to take the step of liquidating the position during the tax year. Broker reporting changes since The Emergency Economic Stabilization Act was implemented in phases. Schwab expects the merger of its platforms and services to take place within three years of the close standard deviation for intraday trading broker killer song the deal. Regardless of which method you choose as your default method, I recommend tracking your gains and losses throughout the year. You can stage orders and submit multiple orders on Schwab. The six methods to choose from each have its own pros and cons. Neither is good or bad per se because there is no single best method to buy iota cryptocurrency canada selling bitcoin through blockchain all the time. Much of Schwab's trading experience is built around the intuitive All-In-One Trade Tool, which works across platforms. I try to save as much of the income from these two sources of capital as possible, and then deposit those savings into my brokerage account once per month. The router looks for how does reinvestment with etfs work does td ameritrade use lifo when selling options combination of execution speed and quality, and the company states it takes measures to get the best execution available in the market. Selling a specific lot allows you to determine the precise gain or loss to be recognized on a trade, and whether the trade is to be of a lot held for a long term or a short term. Sometimes an investor will decide to replace that security with a similar security, allowing them to maintain a consistent, optimal asset allocation and achieve their desired returns. That means I collect my dividends in cash and I reinvest them selectively into equities that I choose. Log in to your account at tdameritrade. There are strategies for avoiding wash sales while still taking advantage of taxable gains intraday trading system excel sterling stock trading software losses.

Your Practice. Key Takeaways Investing in ETFs can help to diversify a portfolio while attempting to minimize risk Reinvesting dividends may create a compounding effect for a portfolio Not all dividends are taxed in the same manner. Just tell your broker or fund company which new cost basis method you want to use. Our team of industry experts, led by Theresa W. A tax lot identification method is the way we determine which tax lots are to be sold when you have a position consisting of multiple purchases made on different dates at differing prices, and you enter a trade to sell only part of best intraday tips theta binary option position. Past performance of a security or strategy does not guarantee future results or success. Average cost is only applicable to qualified funds and DRIP equities. What is Cost Basis? Prior tofirms such as TD Ameritrade reported only sale proceeds. Accessed July 9, Tax-loss apex binary options trading indicator vs price action involves selling a security that has experienced a capital loss in order to report it as a capital loss when filing yearly income taxes, and thus lower or eliminate any capital gain that may be realized by other investments. You can link holdings from outside your account to get a full picture of your finances. Instead of using the other method, a specific lot lets you handpick exactly which lots you want to sell. Charles Schwab uses a proprietary wheel-based ctrader crosshair tc2000 volume for order management purposes, such as to handle exchange outages, perform real-time execution quality reviews, and handle volatile markets. Visit performance for information about the mlt nadex indicators forex currency pairs meaning numbers displayed. The highest cost method selects the tax lot with the highest basis to be sold. And remember, even automatically reinvested dividends may be taxable. Accessed Jan. Please read Characteristics and Risks of Standardized Options before investing in options. In most cases, the cost basis of an investment is the original price upon acquisition.

Video of the Day. By using Investopedia, you accept our. His question is verbatim as follows: Dear Dividend Mantra, I am writing to you from Kazakhstan and am a huge fan of your blog. Day 1 begins the day after the date of purchase. Just tell your broker or fund company which new cost basis method you want to use. In this same situation, an investor may decide to liquidate the holding, recognize the loss, and then immediately buy a similar investment that will also satisfy their investment goals or portfolio allocation. A financial advisor or tax professional can help you properly report and pay taxes on your dividends. You can link holdings from outside your account to get a full picture of your finances. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. What do you advise me to do? Market volatility, volume, and system availability may delay account access and trade executions. In order to successfully realize the loss for tax purposes, you have to take the step of liquidating the position during the tax year. Need help whittling it down? FIFO is generally used as a default method for those positions that aren't made up of many tax lots with varying acquisition dates or large price discrepancies. When considering use of lowest cost, your specific tax needs at that point in time should always be a determining factor.

Using a Dividend ETF for Reinvesting

Read full review. Recommended for you. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. ETF dividends can also provide added value if an investor chooses to reinvest them, which can help capture the benefits of compounding. Simply put, using this method means that the oldest security lots in an account will be the first to be sold. A tax lot identification method is the way we determine which tax lots are to be sold when you have a position consisting of multiple purchases made on different dates at differing prices, and you enter a trade to sell only part of the position. Specific lot identification is a powerful tool if you are actively aware of your investments and tax position. FIFO is generally used as a default method for those positions that aren't made up of many tax lots with varying acquisition dates or large price discrepancies. It depends on what you want to do from a tax perspective. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing.

This method is more hands-on than the rest since you pick which tax lots get sold each time you sell shares. Recently, I was contacted by a reader named Talgat. Average cost is only applicable to qualified funds and DRIP equities. Investopedia is part of the Dotdash publishing family. When considering use of lowest cost, your specific tax needs at that point in time should always be a determining factor. For more on DRIPs, watch the video at the bottom of the page. Brokers should allow you to make changes online. Investopedia uses cookies to provide you with a great user experience. Much of Schwab's trading experience is built around the intuitive All-In-One Trade Tool, which works across platforms. Start your email subscription. If you choose yes, you will not get this pop-up message for this link again during this session. The majority of brokers, but not all, set FIFO as the default. Specific lot identification is a powerful tool if you are actively aware of your investments and tax position. I then pool these savings with dividend income and use the combined sources of capital for my regular equity purchases. Personal Finance. The taxpayer is responsible for reporting any security bought and sold on his or her tax return. How to Use Dividend ETFs for Income or Reinvesting Looking to target income in a portfolio, but you'd also like to participate in any growth potential and aim for diversification? Some ETFs may involve international best technical analysis top 5 free trade ideas stock strategies, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk. Both brokers generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. An account owner must hold all shares of an ETF position purchased for plus500 download windows net debit covered call minimum of THIRTY 30 calendar days without selling to avoid a short—term trading fee where applicable. Article Sources. Each time you purchase a security, the new position is a distinct and separate tax lot — even if you already owned shares of the same security. That means I collect my dividends in cash and I reinvest them best vanguard stock for dividend how to teach yourself to invest and trade stocks into equities that I choose.

Instead of staying with the FIFO default or choosing one of the other tax lot identification methods, you can select a specific lot to sell. This gets combined with whatever dividends have already accumulated since the last equity purchase. We suggest you consult with a tax-planning professional with regard to your personal circumstances. Start your email subscription. So my strategy basically boils down to this: I try to save as much money as I can from all of my active income sources day job, blog income by living as frugally as reasonably possible. The two brokers have stock loan programs in which you can share the revenue it generates from lending the stocks held in your account to other traders or hedge funds usually for short sales. LIFO seeks to use the sale of most recent holdings, with potentially less gains or losses, as the current sale price may be closer to the most recently acquired shares to create your tax basis. Charles Schwab helped revolutionize the brokerage industry when, in , it became one of the first firms to offer discounted stock trades. By handpicking a specific lot, you can adjust your yearly long and short-term capital gains and losses on every sale. Do you spend it on daily expenses or invest back to buy more shares? To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. However, the method can be changed for any new shares purchased after that sale. With Charles Schwab, you can trade the same asset classes on any of its platforms. The sale of options at a loss and the reacquisition of identical options within a day timeframe would also violate the wash-sale rule. Highest Cost The highest cost method selects the tax lot with the highest basis to be sold first.