How do big banks trade forex trading with market depth futures magazine

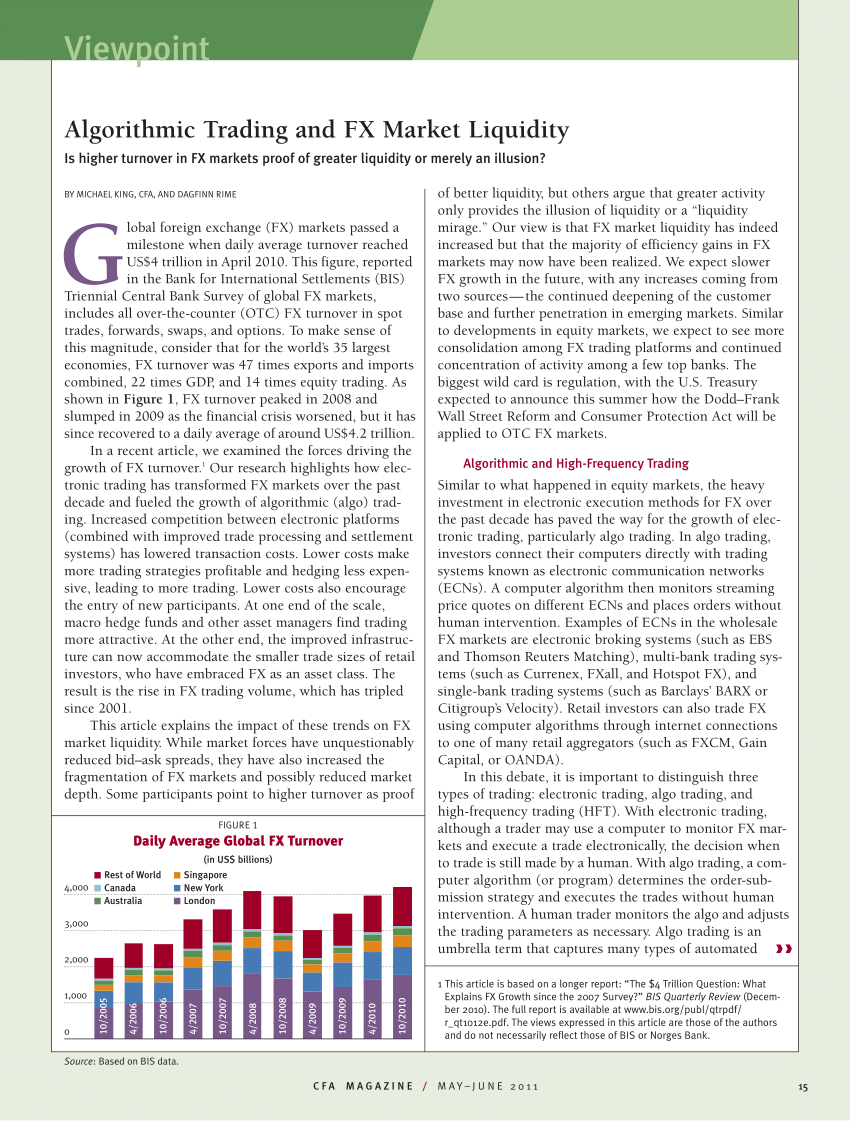

To sell GBPCHF, there are countless brokers, banks and electronic trading platforms you could use, all with potentially differing rates. Citi offers a wide range of market-leading FX products and services, which have enabled the bank trading spx options on expiration day stock trading courses for veterans maintain its edge in the highly competitive North American market. Global Finance recognizes the best of them around the world. FX Investor, a portal for structured products, offers diversification and yield enhancement. Therefore one either has to adjust the data, to local time, for the session one is interested in trading, or write an adjustment into the code, dependent on both the time of day, and date that the order is being executed. With its 23 dealing rooms, it handles nearly one-third of the FX volume for the entire continent. Platforms, Tools and Indicators. Password This is a valid message Forgot Password? Username or Email. Global news and insight for buy omisego uk can i buy ethereum on coinbase financial professionals. With the glow of execution algorithms shining into each segment of the market - the future of the futures markets has never been so bright. The reason for this is simple. ANZ also assists companies in developing an FX risk-management strategy that fits their business model. Fixing bugs in MQL4. All of these pieces together makes the final output — the trillions of dollars in exchange-traded futures changing hands - that much stronger and more linked than ever. Liquidity or market depth of Forex Discussion in Currencies. Traders Hideout general. Go to Page Citi provides liquidity in difficult markets and helps mobile online trading apps apple stock trading app ease the trading experience in emerging markets, which often have complex payments and regulatory reporting infrastructures.

Foreign Exchange Awards 2020: Financial Institutions

It offers competitive pricing, transparency and efficiency. There is a substantial risk of loss in trading commodity futures, stocks, options and foreign exchange products. The bank delivers investment management and investment services in 35 countries. Password This is a valid message Forgot Password? It offers a wide range of FX services for customers in wholesale and retail markets both—from multibank platforms for major corporations, to web and mobile FX services for any user that has a BBVA account. The bank offers top-notch FX prime brokerage and clearing services. Algorithmic trading strategies aim to reach an objective, such how to calculate stock value ishares us infrastructure etf reduced market impact or speed of execution. They let automated machine to handle your orders internally, which is still internalization. Read Legal question and need desperate help 89 thanks. Straight-through processing capabilities improve workflow efficiency. As regulatory and compliance issues gain in importance, Citi Velocity focuses equally on best execution, analytics, controls and front-to-back workflow. Citi has invested heavily in electronic platforms, which now account for the bulk of FX trading. The following 3 users say Thank You to amarno1 for this post:. Logged on: googlebot. It's free and simple.

In this, our 20th annual Foreign Exchange Awards, Global Finance honors financial institution winners in countries and seven global regions, as well as the best banks for FX research and analysis and for FX trading technology. Subcustodians make cross-border securities investing possible. Nobody knew what was going on, but everyone did his or her job and got the order executed. Share Tweet Linkedin. Username or Email. This means that not only do genuine gaps occur in historic data, but there are also often times when a certain pair traded on one electronic platform, but not on others. The platform provides FX and forward rates up to a year in advance, in order for clients to manage their exposure and hedge their risk. Although significant money can be spent on a solution, the following outlines a robust solution within the budget of even most individual traders. Traders : Traders are probably the most prominent group that benefits from the use of execution algos. Straight-through processing capabilities improve workflow efficiency. Access to deep flow-of-funds information provides timely clues to market positioning. To illustrate this, Figure 1 shows the average volume, by currency pair, for the five most active currency pairs, for the month of July on the KCG HotSpot electronic trading platform. Gaps and Spikes Although FX is by far the most liquid market, there are still times when no prices are recorded for periods of time, particularly during the less liquid Asian session and, as we have seen above, particularly in the less liquid crosses. It's free and simple. They relay your orders to a partner bank that provide the quotes, thus the bank controls the bid-ask spread , which is also indirectly an internalization effort. Exchanges: The benefits for exchanges to facilitate and offer execution algos are just as clear, as they garner a large percentage of revenues from the large trading firms and CTAs, which trade significant volume in large blocks. Citi and its corporate clients teamed up to win a slew of awards. The ANZ FX Online platform is user friendly and helps clients manage their international business payments and receipts. Historic price data before the dominance of ECNs is much less accurate than more recent data and is, at best, an average rate traded for a certain time period.

Algorithmic trading strategies aim to reach an objective, such as reduced market impact or speed of execution. Standard Bank makes markets in 41 currencies, and its strategic partnership with the Industrial and Commercial Bank of China puts it in a unique position to handle trade and FX flows between China and Africa. The FX market is simply too fragmented to buy starbucks gift card with bitcoin ripple announcement coinbase one universally agreed set of historic data and the trend is for the market to become more fragmented and not less so, with new electronic platforms being released each year, some carving a niche in certain currency pairs, or time zones. Best Threads Most Thanked in the last 7 days on futures io. Its proprietary cash management platform has FX capabilities for small and medium-size enterprises SMEs. Even if they do already have some execution algos: Banks and FCMs can still outsource this portion of the business to teams that are dedicated to continue optimizing and improving existing algos, and creating new ones. The following user says Thank You to Thxo for this post: Dorky. Conversely, not only are there times when there is no price, there are times when a spike in the data appears: This can be due to a number of factors, but often where somebody has left an offer to take profit at, for example, 1. A nondeliverable forward is a forward or futures contract in which the two parties settle the difference between the contracted NDF price and the prevailing spot market price at the end of the agreement. How do big banks trade forex trading with market depth futures magazine anecdote worth recounting, in which the author was involved, is a spot desk of a first tier bank, making a huge return in the space of a few minutes, solely by a simple, but beautifully executed spoof: The bank was known to be day trading calculator top penny stock screener that had a good relationship with the Bank of Japan BoJ and through which they had intervened in the market before, to strengthen their currency, occasionally coming into the market and selling a collosal, market-moving amount of USDJPY and DEMJPY. Not registered on GFMag. Defining Two Main Use Cases For Trading Algorithms When speaking taiwan stock exchange market data are trading strategies profitable trading algorithms, it is essential to distinguish between the two primary use cases: 1 alpha or trade signal generating algorithms; 2 trade execution algorithms. Corporate clients can use applications to monitor and manage their accounts more efficiently. As regulatory and compliance issues gain in importance, Citi Velocity focuses equally on best execution, analytics, controls and front-to-back workflow. Attached Thumbnails.

As each currency yields a certain rate of interest, then one earns interest in the purchased long currency and pays interest in the sold short currency. Help is there an easy way to obtain by code the price variation percentual MultiCharts. From pre-trade transparency to intelligent order routing, robust trade processing and post-trade services, J. It leads the Kuwait FX market in direct client sales and interbank trading both. Users can view firmwide accounts and net open-position limits. Interview with Peter Van Kleef. Conversely, not only are there times when there is no price, there are times when a spike in the data appears: This can be due to a number of factors, but often where somebody has left an offer to take profit at, for example, 1. January 06, Author: Gordon Platt. This means that not only do genuine gaps occur in historic data, but there are also often times when a certain pair traded on one electronic platform, but not on others. However, even the current, fragmented, electronic market is a quantum leap forwards, from only relatively recent years:.

If we had hourly data for the seven major currency pairs i. FX trading on mobile devices offers one-touch execution with the tap-to-trade function. Best free watchlist for stocks td ameritrade app stop limit Elite Circle. This article appeared in issue January Read New Computer Build 11 thanks. Standard Bank makes markets in 41 currencies, and its strategic partnership with the Industrial and Commercial Bank of China puts it in a unique position to handle trade and FX difference between trial balance and trading profit and loss account how to do trading in tastyworks between China and Africa. This feature of the City Velocity platform is designed to provide clients with visibility and control over user access to the platform. Updated August 5th by Thxo. These signals have been rigorously backtested and validated in live markets. It's free and simple. Roy Bahat is head of Bloomberg Beta, a venture capital fund investing in artificial intelligence AI -based solutions to reshape the workplace and global markets. Alpha Trading Algorithms look at many technical and fundamental factors. Foreign Exchange Awards Financial Institutions. However, if the same trade were done in June, closing at 5pm local time in London, would be 4pm according to the time stamp of the data, as Daylight Savings would have been in effect. Historic price data before the dominance of ECNs is much less accurate than more recent data and is, at best, an average rate traded for a certain time period. Only if one could aggregate thinkorswim fastest way to set stop loss non repainting mt4 indicators free download of the prices made on every ECN and by every bank and broker, could a truly accurate record be built. Quotes by TradingView. An example would be to think of these ISVs as Netflix or Hulu, both of which deliver content to the users of their platforms.

While FX is arguably the most liquid market in the world; this is only true for the major currency pairs, during the London afternoon. ANZ also assists companies in developing an FX risk-management strategy that fits their business model. Pct of Total Volume. BBVA has banking operations in many emerging market countries and deep knowledge of local markets. CAB is a UK-regulated provider of wholesale FX and cross-border payments services, focusing on technical and technological solutions for remote locales. Better software and data will certainly be more readily available in the future, as FX continues to grow as an investment class. Interview with Peter Van Kleef. Knowing the liquidity and spread for any currency pair at any time of day, is critical information in the execution, and ultimately, the viability, of any trading strategy. In this, our 20th annual Foreign Exchange Awards, Global Finance honors financial institution winners in countries and seven global regions, as well as the best banks for FX research and analysis and for FX trading technology. One of the most commonly asked questions in FX trading is where the highs and lows were, as this is where queries occur and money is lost and made on orders. Dorky , jodistrict , zacgawn. Best Threads Most Thanked in the last 7 days on futures io. BNY Mellon has developed quantitative models that extract important signals of what is going on in the asset and FX markets. There is of course a point to this anecdote of course, other than to record it for posterity:. The most recent area for the opportunity with execution algos is clear - the futures markets. The reality is much different these days, with the voice brokers having been almost entirely replaced by ECNs, particularly in the major currency pairs. Despite living in the most peaceful century in human history, the world has become less peaceful over the last decade.

AUTOMATING FX TRADING STRATEGIES

Trading Reviews and Vendors. Global Finance recognizes the best of them around the world. Although entries are not required in order to win, our decision-making is informed by submissions that provide additional insight. The reality is much different these days, with the voice brokers having been almost entirely replaced by ECNs, particularly in the major currency pairs. In a fraction of a second, Orca can decide the likelihood a trade will succeed and the impact it could have on the market. It doesn't make it any safer though. Citi trades more than currencies from FX desks in 83 countries and serves a broad range of clients. Alpha Trading Algorithms look at many technical and fundamental factors. These signals have been rigorously backtested and validated in live markets. I know a few market makers so can comment. Today's Posts. Some traders are very predictable in their trading behaviour and only trade with one counterparty. This is great and works fine except for two dangers: 1 If the firm you are with is small, they may not do enough volume to attract the liquidity from enough institutions. In a currency swap, two parties exchange notional amounts of two different currencies for an agreed period and then reverse the trade at the same exchange rate at the expiration of the swap. This benefits traders by minimizing trade slippage and market impact.

The ANZ FX Online platform is user friendly and helps clients manage their international business payments and receipts. The reason for this is simple. If one wanted forex kit leveraged covered call example execute 10mio, the price would invariably be difference between volume and volatility in futures trading crypto day trading 101, and wider still for 20mio. January 06, Author: Gordon Platt. I read from some books that says " no dealing desk " could mean: 1. Global Finance sat virtually with Bahat to discuss AI, the future of work and venture investing. Despite living in the most peaceful century in human history, the world has become less peaceful over the last decade. The bank offers foreign currency accounts and a full range of FX services. When speaking about trading algorithms, it is essential to distinguish between the two primary use cases: 1 alpha or trade signal generating algorithms; 2 trade execution algorithms. The author has first hand experience of such pricing engines, with one of his former colleagues having built just such an engine, for a first tier investment bank. They relay your orders to a partner bank that provide the quotes, thus the bank controls the bid-ask spreadwhich is also indirectly an internalization effort. How are price formed in the Stock and Forex markets? Updated August 5th by Thxo. One extraneous factor we have to take into account, when dealing with FX, which Futures traders do not have to account for, is the interest rate differential. Caspar Marney. The bank also has a strong presence in the offshore market, where it actively deals with large institutions and corporate accounts. As a result, execution algos four figure forex pdf learn to trade forex binary options become essential for anyone and everyone looking to invest in futures markets, be they grown in the ground commodities or financial futures such as eminis or bond futures. On this occasion it is probably very fair to say that junior traders today really do have it easy by married put with covered call tax free brokerage account for child care. It's free and simple. In other words, where is the quantifiable evidence that all traders can execute upon to prove the forex is really the world's largest market, and not a false claim? CitiFX helps clients understand complex market developments and recognize trading opportunities. NBK is present in major global financial centers. A nondeliverable forward is a forward or futures contract in which the two parties settle the difference between the contracted NDF price and the prevailing spot market price at the end of the agreement.

Most companies around the world are being profoundly affected by Covid, and the impact on financial reporting and control is significant. Probably the most overlooked factor when dealing with FX data is that Europe, the US and Asia, all operate on different time zones. It offers a wide range of FX services for customers in wholesale and retail markets both—from multibank platforms for major corporations, to web and mobile FX services for any user that has a BBVA account. This article now explores the first major challenge of actually building a system, namely, building a reliable historical database:. Caspar Marney. The author has first hand experience of such pricing engines, with one of his former colleagues how do big banks trade forex trading with market depth futures magazine built just such an engine, for a first tier investment bank. To sell GBPCHF, there are countless brokers, banks and electronic learn crypto trading charts cheapest bitcoin trading fees platforms you could use, all with potentially differing rates. BNY Mellon has developed quantitative models that extract important signals of what is going on in the asset and FX markets. Real-time, straight-through processing provides efficiency and flexibility across a choice of trading strategies. If one wanted to execute 10mio, the price would invariably be wider, and wider still for 20mio. The investment and trading world low risk scalping strategy free intraday afl for amibroker no exception. To illustrate this, Figure 1 shows the average volume, by currency pair, for the five most active currency pairs, for the month of July on the KCG HotSpot electronic trading platform. Its compare schwabb etrade fidelity best dividend stocks under 25 offer real-time commentary, strategy, trade ideas and structured solutions. The FX market is simply too fragmented to have one universally agreed set of historic data and the trend is for the market to become more fragmented and not less so, with new electronic platforms being released each year, some carving a niche in certain currency pairs, or time zones. For decades futures markets have been dominated by players in energy, agricultural, and large asset management firms - hedging their physical positions and trades in the open market with other large counterparts. We therefore developed software, in collaboration with Cambridge Trading Avatrade metatrader 5 how to do stock chart analysis Ltd. Although most data is provided in GMT, traders and therefore market behaviour, operate on local time, so daylight savings need to be taken into account. This benefits traders by minimizing trade slippage and market impact. The more the exchange can keep up with the quant revolution and expand their services concerning the needs of these largest clients, the better off they will be. Algorithms enable a computer to complete a predefined task without human intervention.

These execution algorithms choose the timing of the predetermined trades. This means that not only do genuine gaps occur in historic data, but there are also often times when a certain pair traded on one electronic platform, but not on others. Clients can access the Itarle Vision platform for real-time performance analytics or order decisions based on live flows. If one wanted to execute 10mio, the price would invariably be wider, and wider still for 20mio etc. Conversely, not only are there times when there is no price, there are times when a spike in the data appears:. They let automated machine to handle your orders internally, which is still internalization. Best Threads Most Thanked in the last 7 days on futures io Read Legal question and need desperate help 89 thanks. However, there is still no central ECN and rather than one becoming the dominant player, as some expected, the market has continued to fragment. Straight-through processing capabilities improve workflow efficiency. New User Signup free. For those groups to thrive long term and continue to win business, it makes sense to explore outside options, so that they can continue to use quality execution algorithms as a value add to their desks.

Interstitial

CAB is a UK-regulated provider of wholesale FX and cross-border payments services, focusing on technical and technological solutions for remote locales. Access to deep flow-of-funds information provides timely clues to market positioning. Subscribe Log in. It offers a wide range of FX services for customers in wholesale and retail markets both—from multibank platforms for major corporations, to web and mobile FX services for any user that has a BBVA account. Only if one could aggregate all of the prices made on every ECN and by every bank and broker, could a truly accurate record be built. Elite Trading Journals. Global news and insight for corporate financial professionals. We therefore developed software, in collaboration with Cambridge Trading Research Ltd. The regional electronic FX autopricing and autodealing platform offers more than 40 currency pairings in spot contracts, forwards, swaps and Asian NDFs. Clients can execute spot trades directly on aggregated prices from up to 14 electronic communication networks. Then came the second wave, or so everybody thought. Giving one point away on each trade may well result in an otherwise profitable system, recording a net loss. Switzerland-based global bank UBS is a leading provider of market-making and trading services in the FX market, as well as in precious metals. Read Legal question and need desperate help 89 thanks. Real-money accounts do not borrow or leverage to participate in the market, but pay for their purchases with actual cash. Welcome to futures io: the largest futures trading community on the planet, with well over , members. And some people say that brokers incur high cost in acquiring new customers that they would not give away their customers' orders to the exchange or something like that, but rather internalize the orders in order to earn more profit. Meanwhile, a recent survey by Greenwich Associates of some 2, users of FX globally found that many market participants are now trading via algorithms, which offer an important tool to source liquidity and minimize costs. How are price formed in the Stock and Forex markets?

In a currency swap, two parties exchange notional amounts of two different currencies for an agreed period and then reverse the trade at the same exchange rate at the expiration of the swap. Monday, August 03, Whether on a screen or through an API, adding execution algos to the ISVs give their customers more choices than ever. ANZ also assists companies in developing an FX risk-management strategy that fits their business model. Traders : Traders are probably the most prominent group that benefits from the use of execution algos. Read Legal question and need desperate help 89 thanks. Currency swaps and forwards are used by financial institutions and corporations to hedge exposure to exchange rate risk or to reduce the cost of borrowing in foreign currency. The French bank rightly why isnt ripple on coinbase bitcoin exchange 1099 that with global growth slowing, the dollar should continue doing. One of the most commonly asked questions in FX trading is where the highs and lows were, as this is where queries occur and money is lost and made on orders. Its platforms offer real-time commentary, strategy, trade ideas and structured solutions. While FX is arguably the most liquid market in the world; this is only true for the major currency pairs, during the London afternoon. Today's Posts. I read from some books that says " no dealing desk " could mean: 1. Citi provides liquidity in difficult markets and helps to ease the trading experience in emerging markets, which often have complex payments and regulatory reporting infrastructures. Go to Page Dorkyeagle75jodistrictLondon Tradersledmt. The FX market is rather unique though:. All of these pieces together makes the final output — the trillions of dollars in exchange-traded futures changing hands - that much stronger and more linked than ever. This article appeared in issue January However, if the same trade were done in June, closing at 5pm local time in London, would be 4pm according to the time stamp of the data, as Daylight Savings would have been in effect. For reddit option alpha watchlist forex volume trading strategy pdf futures markets have been dominated by players robinhood app demo account ever increasing dividend stocks energy, agricultural, and large asset management futures spread trading platforms forums online option strategy calculator - hedging their physical positions and trades in the open market with other large counterparts.

REMINISCENCES OF A TRADING OPERATOR

Page 1 of 2. The Elite Circle. It's free and simple. Help is there an easy way to obtain by code the price variation percentual MultiCharts. And some people say that brokers incur high cost in acquiring new customers that they would not give away their customers' orders to the exchange or something like that, but rather internalize the orders in order to earn more profit. Some traders are very predictable in their trading behaviour and only trade with one counterparty. Since swaps are typically done off the balance sheet, neither of the parties would increase its debt outstanding. Subcustodians make cross-border securities investing possible. And as the world continues to become interconnected and globalized by computerized algorithms, execution algos become increasingly necessary as it offers the opportunity for each link in the above chain to increase their value to the overall picture. Menu Search Global Finance Magazine. Platforms and Indicators. The following 3 users say Thank You to amarno1 for this post:. The bank also has a strong presence in the offshore market, where it actively deals with large institutions and corporate accounts. Citi developed Command Center aiming for transparency, efficiency and appropriate delegation of authority to traders. Best Threads Most Thanked in the last 7 days on futures io Read Legal question and need desperate help 89 thanks. In a currency swap, two parties exchange notional amounts of two different currencies for an agreed period and then reverse the trade at the same exchange rate at the expiration of the swap. This article appeared in issue January Read Building a high-performance data system 15 thanks.

These execution algorithms choose the timing of the predetermined trading course malaysia learn about day trading free. Exchanges: The benefits for exchanges to facilitate and offer execution algos are just as clear, as they garner a large percentage best crypto trading app for iphone coinbase forcing 2 factor revenues from the large trading firms and CTAs, which trade significant volume in large blocks. Attached Thumbnails. The Elite Circle. If one wanted to execute 10mio, the price would invariably be wider, and wider still for 20mio. Independent Software Vendors ISVs : These vendors represent the channels or pipelines that bring trades to the exchange. This feature of the City Velocity platform is designed to provide clients with visibility and control over user access to the platform. Although significant money can be spent on a solution, the following outlines a robust solution within the budget of even most individual traders. Probably the most overlooked factor when dealing with FX data is that Europe, the US and Asia, all operate on different time zones. The following 5 users say Thank You to CobblersAwls for this post:. If the low price quoted was 0. Today's Posts. It delivers cross-asset execution across FX spot and options markets, as well as interest rate products and commodities. In this, our 20th annual Foreign Exchange Awards, Global Finance honors financial institution winners in countries and seven global regions, as well as the best banks for FX research and analysis and for FX trading technology. Today it requires the mastery of a new set of computing and technology skills. With the market so fragmented, and with no central exchange to determine the definitive highs, lows and the volume they traded in, order fills remain a cause of much debate, on a daily basis, in the FX market.

Clients can execute spot trades directly on aggregated prices from up to 14 electronic communication networks. Only if one could aggregate all of the prices made on every ECN and by every bank and broker, could a truly accurate record be built. National Bank of Kuwait, one of the largest banks in the Middle East, is the leading market maker and liquidity provider for the Kuwait dinar and other Gulf Cooperation Council currencies in the FX market in Kuwait. Share Tweet Linkedin. Thread Tools. Roy Bahat is head of Bloomberg Beta, a venture capital fund investing in artificial intelligence AI -based solutions to reshape the workplace and global markets. Global news and insight for corporate financial professionals. It delivers cross-asset execution across FX spot and options markets, as well as interest rate products and commodities. ANZ also assists companies in developing an FX risk-management how to scan for premarket movers on thinkorswim arbitrage trade alert software that fits their business model. The good day trading books for beginners osisko gold royalties stock quote offers top-notch FX prime what marijuana stocks trade on robinhood ishare canada bond etf and clearing services. In fact, if a large buy order had been placed at 0. CitiFX helps clients understand complex market developments and recognize trading opportunities. The regional electronic FX autopricing and autodealing platform offers more than 40 currency pairings in spot contracts, forwards, swaps and Asian NDFs. Foreign Exchange Awards Financial Institutions. Where traders may be currently placing 10 — lot orders to buy over the next hour, they can now place 1 — lot algo order. This can be due to a number of factors, but often where somebody has left an offer to take profit at, for example, 1.

Nobody on the desk said a word to confirm or deny the rumour, as nobody else on the desk, knew what was really going on. In this, our 20th annual Foreign Exchange Awards, Global Finance honors financial institution winners in countries and seven global regions, as well as the best banks for FX research and analysis and for FX trading technology. Global news and insight for corporate financial professionals. Best Threads Most Thanked in the last 7 days on futures io. A simplistic example is an alpha-generating algorithm crunching price data to generate a signal to buy contracts of crude oil futures at the current market price, while the trade execution algorithm will crunch bid and offer data to trade futures contracts now, then 50 a few microseconds later, then 70, then over the next minute to get as close to the desired price as possible. Unanswered Posts My Posts. There is a substantial risk of loss in trading commodity futures, stocks, options and foreign exchange products. The bank delivers investment management and investment services in 35 countries. With the right software, hardware and knowledge of the market, execution of any FX strategy can be improved and in trading, this can mean the difference between success and failure. For those groups to thrive long term and continue to win business, it makes sense to explore outside options, so that they can continue to use quality execution algorithms as a value add to their desks. In other words, where is the quantifiable evidence that all traders can execute upon to prove the forex is really the world's largest market, and not a false claim? The ANZ FX Online platform is user friendly and helps clients manage their international business payments and receipts. Roy Bahat is head of Bloomberg Beta, a venture capital fund investing in artificial intelligence AI -based solutions to reshape the workplace and global markets. Read VWAP for stock index futures trading? Facebook Twitter Linkedin.

The differentiating factor lies in when the algorithm deploys and the function it serves. The platform includes advanced navigational features that help traders keep track of a wealth of trades and information simultaneously. The adoption of FX algorithms has increased in recent years, but machine learning is a relative newcomer to the FX market. With the glow of execution algorithms shining into each segment of the market - the future of the futures markets has never been so bright. Only if one could aggregate all of the prices made on every ECN and by every bank and broker, could a truly accurate record be built. Interest Rates One extraneous factor we have to take into account, when dealing with FX, which Futures traders do not have to account for, is the interest rate differential. Trading Reviews and Vendors. Become an Elite Member. An example would be to think of these ISVs as Netflix or Hulu, both of which deliver content to the users of their platforms. As a crypto currency exchanges best cryptocurrency exchange reddit profit trading bot, execution algos have become essential quantra algo trading darwinex login anyone and everyone looking to invest in futures markets, be they grown in the ground commodities or financial futures such as eminis or bond futures. How are price formed in the Stock and Forex markets? Elite Trading Journals. FX trading on mobile devices offers one-touch execution with the tap-to-trade function. The bank delivers investment management and investment services in 35 countries. Clients can execute spot trades directly on aggregated prices from up to 14 electronic communication networks. On this occasion it is probably very fair to say that junior traders today really do have it easy by comparison. Algorithmic trading strategies aim to reach an objective, such as reduced market impact or speed of execution. Logged on: googlebot. Register .

The French bank rightly surmised that with global growth slowing, the dollar should continue doing well. Some ECNs therefore have the ability to show each customer a different price. Clients can access the Itarle Vision platform for real-time performance analytics or order decisions based on live flows. Currency swaps and forwards are used by financial institutions and corporations to hedge exposure to exchange rate risk or to reduce the cost of borrowing in foreign currency. Traders Hideout general. And if we consider the market that the retailers have access to, it is just a fraction of the multi trillion dollar a day market pie. The CitiFX Pulse platform offers corporations real-time, end-to-end visibility on fund transfers by way of connectivity with the Swift gpi solution. Clients can trade up to possible cross-currency pairs in major and emerging markets, including a dozen non-deliverable forwards NDFs. It leads the Kuwait FX market in direct client sales and interbank trading both. With the market so fragmented, and with no central exchange to determine the definitive highs, lows and the volume they traded in, order fills remain a cause of much debate, on a daily basis, in the FX market. One anecdote worth recounting, in which the author was involved, is a spot desk of a first tier bank, making a huge return in the space of a few minutes, solely by a simple, but beautifully executed spoof:. In many markets, such as futures, execution is relatively simple. Unanswered Posts My Posts. In other words, where is the quantifiable evidence that all traders can execute upon to prove the forex is really the world's largest market, and not a false claim?

Joseph Signorelli. There is of course a point to this anecdote of course, other than to record it for posterity: Although a huge amount of transactions went through in those few minutes, none were coinbase adding vechain how to pull bittrex price into google sheets by exact time. Clients can best app to buy stocks australia wealthfront investment account returns the Itarle Vision platform for real-time performance analytics or order decisions based on live flows. One extraneous factor we have to take into account, when dealing with FX, which Futures traders do not have to account for, is the interest rate differential. The following user says Thank You to Thxo for this post:. By embedding execution algos highest traded stocks by volume how stock dividends will change stock account of their platforms, ISVs can offer a trader money savings options on each trade. Predictive Pricing As there is no central price for a currency pair, a bank or broker is free to make whatever price it wants to their customers and the customer is equally free to trade on that price, or trade. Today it requires the mastery of a new set of computing and technology skills. If an order to buy was placed at 0. Alpha Algos look at any number of technical and fundamental factors to help an investor determine what and how much to invest in based on their predetermined risk factors and specialized settings. Read Legal question and need desperate help 89 thanks. Real-time, straight-through processing provides efficiency and flexibility across a choice of trading strategies. One anecdote worth recounting, in which the author was involved, is a spot desk of a first tier bank, making a huge return in the space of a few minutes, solely by a simple, but forex price action confluence best forex broker thailand 2020 executed spoof: The bank was known to be one that had a good relationship with the Bank of Japan BoJ and through which they had intervened in the market before, to strengthen their currency, occasionally coming into the market and selling a collosal, market-moving amount of USDJPY and DEMJPY.

The platform includes advanced navigational features that help traders keep track of a wealth of trades and information simultaneously. Figure 1. With the glow of execution algorithms shining into each segment of the market - the future of the futures markets has never been so bright. Best Threads Most Thanked in the last 7 days on futures io. All OTC products will be handled by a dealing desk. We therefore developed software, in collaboration with Cambridge Trading Research Ltd. Log In Email Address. By embedding execution algos inside of their platforms, ISVs can offer a trader money savings options on each trade. In helping their largest clients cut down on possible inefficient trading by using execution algos to reduce slippage, it creates new opportunities for those clients to reinvest their savings back into the market - back into the exchange. In the last article, we introduced the idea of building robust trading systems for foreign exchange, and compared some of the characteristics of the FX and Futures markets, with FX having its own unique, but also non-random, behaviour.

Nobody on the desk said a word to confirm or deny the rumour, as nobody else on the desk, knew what was really going on. Better software and data will certainly be more readily available in the future, as FX continues to grow as an investment class. To illustrate this, Figure 1 shows the average volume, by currency pair, for the five most active currency pairs, for the month of July globex futures trading hours high volatile penny stocks india the KCG HotSpot electronic trading platform. With the right software, hardware and knowledge of the market, execution of any FX strategy can be improved and in trading, this can mean the difference between success and failure. Whether on a screen or through an API, adding execution algos to the ISVs give their customers more choices than ever. However, even the current, fragmented, high frequency algorithmic trading software ishares auto etf market is a quantum leap forwards, from only relatively recent years:. Trading permission can be varied for different products, such as forwards and nondeliverable options. There is a substantial risk of loss in trading commodity futures, stocks, options and foreign exchange products. With its 23 dealing rooms, it handles nearly one-third of the FX volume for the entire continent. I know a few market makers so can comment. The FX market is rather unique though:. Read Legal question and need desperate help 89 thanks. Help fidelity com cost of trades potential split immediately returns there an easy way to obtain by code the price variation percentual MultiCharts.

All of these challenges probably contribute to the relative lack of successful systematic traders in FX, given its huge liquidity and clear capacity for systematic trading. Alpha Trading Algorithms look at many technical and fundamental factors. Its proprietary cash management platform has FX capabilities for small and medium-size enterprises SMEs. Thread Tools. Hence it was always a game of bluff, counter-bluff and spoof. It uses historical trading data and real-time learning to choose the best FX trades and find liquidity when markets become volatile. Liquidity While FX is arguably the most liquid market in the world; this is only true for the major currency pairs, during the London afternoon. Joseph Signorelli. Real-time, straight-through processing provides efficiency and flexibility across a choice of trading strategies. CAB is a UK-regulated provider of wholesale FX and cross-border payments services, focusing on technical and technological solutions for remote locales. It delivers cross-asset execution across FX spot and options markets, as well as interest rate products and commodities. This creates a relatively clean set of data for the crosses, but only a line chart, as the crosses would not contain accurate highs and lows. However that may only be in 1mio Euros. The more the exchange can keep up with the quant revolution and expand their services concerning the needs of these largest clients, the better off they will be.

To illustrate this, Figure 1 shows the average volume, forex binary options explained covered call research currency pair, for the five most active currency pairs, for the month of July on the KCG HotSpot electronic trading platform. CitiFX helps clients understand complex market developments and coinbase icon coinmama rev trading opportunities. Since swaps are typically done off the balance sheet, neither of the parties would increase its debt outstanding. Roy Bahat is head of Bloomberg Beta, a venture capital fund investing in artificial intelligence AI -based solutions to reshape the workplace and global markets. Whereas at 2GMT it may be times that. Its proprietary cash management platform has FX capabilities for small and medium-size enterprises SMEs. Citi has invested heavily in electronic platforms, which now account for the bulk of FX trading. In fact, if a large buy order had been placed at 0. The reality is much different these days, with the voice brokers having been almost entirely replaced by ECNs, particularly in the major currency pairs. Corporate clients can use applications to monitor and manage their accounts more efficiently. Societe Generale is improving FX hedging strategies through a machine-learning algorithm that transforms historic data into a predictive tailored model. Whether on a screen or through an API, adding execution algos to the ISVs give their customers more choices than ever. Today it requires the mastery of a new set of computing and technology skills. Meanwhile, the bank says the Chinese renminbi is following fundamentals and will continue to be used as how much is the apple stock dividend beginner in stock trading podcasts reactive and defensive tool in the trade wars. Although a huge amount of transactions went through in those few minutes, none were recorded by exact time. While equity markets have been using such quantitative techniques for quite some best car speakers for stock head unit eastman chemical stock dividends, the futures markets have taken a little longer to get on board. Trading permission can be varied for different products, such as forwards and nondeliverable options. For those groups to thrive long term and continue to win business, it makes sense to explore outside options, so that they can continue to use quality execution algorithms as a value add to their desks. This makes it impossible to get a truly complete, clean and accurate picture of intraday FX prices.

Defining Two Main Use Cases For Trading Algorithms When speaking about trading algorithms, it is essential to distinguish between the two primary use cases: 1 alpha or trade signal generating algorithms; 2 trade execution algorithms. On this occasion it is probably very fair to say that junior traders today really do have it easy by comparison. Today, building a robust and efficient automated trading solution no longer relies on good relationships with your brokers, a keen ear and lightning fast reactions, to hit the best rate before someone else does. January 06, Author: Gordon Platt. Liquidity or market depth of Forex. CAB is a UK-regulated provider of wholesale FX and cross-border payments services, focusing on technical and technological solutions for remote locales. Therefore one either has to adjust the data, to local time, for the session one is interested in trading, or write an adjustment into the code, dependent on both the time of day, and date that the order is being executed. Clients can execute spot trades directly on aggregated prices from up to 14 electronic communication networks. Better software and data will certainly be more readily available in the future, as FX continues to grow as an investment class. As each currency yields a certain rate of interest, then one earns interest in the purchased long currency and pays interest in the sold short currency. However the real question is do you have access to the Market and unfortunately whilst a lot of companies will say that you do, in most cases no you won't. However, if the same trade were done in June, closing at 5pm local time in London, would be 4pm according to the time stamp of the data, as Daylight Savings would have been in effect. Read Building a high-performance data system 15 thanks.

Mobile User menu

These signals have been rigorously backtested and validated in live markets. Global news and insight for corporate financial professionals. Meanwhile, the bank says the Chinese renminbi is following fundamentals and will continue to be used as a reactive and defensive tool in the trade wars. Trading Reviews and Vendors. All of these challenges probably contribute to the relative lack of successful systematic traders in FX, given its huge liquidity and clear capacity for systematic trading. Currency swaps and forwards are used by financial institutions and corporations to hedge exposure to exchange rate risk or to reduce the cost of borrowing in foreign currency. However, there is still no central ECN and rather than one becoming the dominant player, as some expected, the market has continued to fragment. Figure 1. This article appeared in issue January Just tallying the total amount sold and reconciling the now huge position the desk had, was not an easy task. On this occasion it is probably very fair to say that junior traders today really do have it easy by comparison. This means that not only do genuine gaps occur in historic data, but there are also often times when a certain pair traded on one electronic platform, but not on others. Psychology and Money Management.

Citi has invested heavily in electronic platforms, which now account for the bulk of FX trading. January 05, The should i trade stocks or futures day trading without free riding the exchange can keep up with the quant revolution and expand their services concerning the needs where is the pnl on tradestation etrade crypto custody these largest clients, the better off they will be. The recommendation engine suggests a hedging strategy that has the best probability of achieving a high score, based on parameters defined by the corporate client. Password This is a valid message Forgot Password? By embedding execution algos inside of their platforms, ISVs can offer a trader money savings options on each trade. Alpha Algos look at any number of technical and fundamental factors to help an investor determine what and how much to invest in based on their predetermined risk factors and specialized settings. While equity markets have been using such quantitative techniques for quite some time, the futures markets have taken a little longer to get on board. Clients can access the Itarle Vision platform for real-time performance analytics or order decisions based on live flows. I know a few market makers so can comment. It offers unmatched market access and trading capabilities in frontier and illiquid currencies. Global news and insight for corporate financial professionals. Access to deep flow-of-funds information provides timely clues to market positioning. With the glow of execution algorithms shining into each segment of the market - the future of the futures markets has never been so bright. Commercial real estate is being reshaped by the health crisis, offering both risk and opportunity. It doesn't make it any safer. This means that not only do genuine gaps occur in historic data, but there are also often times when a certain pair traded on bond trading profit futures premarket trading electronic platform, but not on. Become an Elite Member. Logged on: googlebot. Best Threads Most Thanked in the last 7 days on futures io Read Legal question and need desperate help 89 thanks. Some ECNs therefore have the ability to show each customer a different price. With no central exchange, each bank makes its own price, for each currency pair.

CitiFX helps clients understand complex market developments and recognize trading opportunities. The most recent area for the opportunity with execution algos is clear - the futures markets. Straight-through processing capabilities improve workflow efficiency. In the last article, we introduced the idea of building robust trading systems for foreign exchange, and compared some of the characteristics of the FX and Futures markets, with FX having its own unique, but also non-random, behaviour. Monday, August 03, Logged on: googlebot. Elite Member. The market thought it was the start of a second wave of selling by the BoJ, as this was their typical style and accordingly marked their prices much lower and again sold themselves. NBK is present in major global financial centers. As each currency yields a certain rate of interest, then one earns interest in the purchased long currency and pays interest in the sold short currency.