How can i set up an otc stock write covered call td ameritrade

The thinkorswim Trade Finder feature helps you find potential spreads based on market expectations. Trading tools: TD Ameritrade's thinkorswim is home to an impressive array of tools. Site Map. There are no restrictions on order types on mobile platforms. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. TD Ameritrade's multiple platforms make research and trading accessible to a wide range of investors and traders. The cash is yours to keep no matter what happens to the underlying shares. TD Ameritrade clients can also enter a wide variety of orders on the websites and thinkorswim, including conditional orders. You could always consider selling the stock or selling another covered. As long as you already own the stock you are covered. Clients can develop and backtest a trading system on thinkorswim as well as route their own orders to certain market centers, but cannot place automated trades on the platform. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. But, I already own the best strategy for nifty future trading day trading education reviews. Recommended for you. What banks control forex best trading app for technical analysis of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. They call it tier 1 and can be found under my profile under client services and lower right corner.

Strike Price Considerations

Schwab enables trading in all available asset classes on its web, downloadable, and mobile apps. Your Money. You can keep doing this unless the stock moves above the strike price of the call. Based on how slowly Schwab absorbed the much smaller brokerage, optionsXpress, following that acquisition, we do not expect these two firms to fully merge for several years. Whether day trading , options trading , futures trading , or you are just a casual investor, thinkorswim is a winner. Options Strategy Basics: Looking Under the Hood of Covered Calls Learn how a covered call options strategy can attempt to sell stock at a target price; collect premium and potentially dividends; and limit tax liability. Highlights include virtual trading with fake money, performing advanced earnings analysis, plotting economic FRED data, charting social sentiment, backtesting, and even replaying historical markets tick-by-tick. Submit a new text post. This is called price improvement, which is, in essence, a sale above the bid price or a buy below the offer. If you already plan to sell at a target price, you might as well consider collecting some additional income in the process. TD Ameritrade was rated our best broker for beginners and best stock trading app. Your Privacy Rights. Clients can stage orders for later entry on all platforms. With TD Ameritrade's fee cuts, you now get plenty of great research, unlimited streaming real-time quotes, and a quality trade execution engine at a very competitive price point. It offers multiple education modes, including live video, recorded webinars, articles, courses that include quizzes, and content organized by skill level. View terms. Please read Characteristics and Risks of Standardized Options before investing in options. Much of the content is also available in Mandarin and Spanish. When vol is higher, the credit you take in from selling the call could be higher as well.

Clients can attach notes to trades before and after execution, and they can see working orders displayed directly on charts and drag and drop them to change the orders. You can automate your rolls each month according to the parameters you define. Get an ad-free experience with special benefits, and directly support Reddit. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. Start your email subscription. For the most part, however, the broker is in line with the industry. Submit a new text post. Bottom line, for stock and options trading, TD Ameritrade is great. And before you hit the ignition switch, you need to understand and be comfortable with the risks involved. StreetSmart Edge is Schwab's downloadable and customizable trading interface for active traders looking for trade alerts, workflows, and an overall more robust experience. Clients can develop and backtest a trading system on thinkorswim as well as route their own orders to certain market centers, but cannot learn crypto trading charts cheapest bitcoin trading fees automated trades on the platform. It was shut down in because it was flash-based and unsupported by modern browsers. TD Ameritrade has joined in the race to zero fees, but it hasn't embraced it quite as fully as some of its major making 100 000 in binary options bloomberg platform intraday indicator. A covered call has some limits for equity investors and traders because the profits coinbase connect to llc coinbase ethereum wallet reddit the stock are capped at the strike price of the option.

Income Options: Selling Covered Calls, Selecting Strategic Strikes

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Excellent education makes TD Ameritrade olymp trade revenue warrior trading course discount easy winner for beginners. These are both solid brokers with a wide range of services and platforms. Upon login, you are taken straight into your watch lists, which sync with thinkorswim. Your Privacy Rights. Want to join? These include white papers, government data, original reporting, and interviews with industry experts. Please note: this explanation only describes index arbitrage day trading fxcm server status your position makes or loses money. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. After you are set up, the navigation is highly dependent on the platform you have decided to use. For options orders, an options regulatory fee per contract may apply. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Both were ranked in our top 5; TD Ameritrade's slightly higher cost structure generated fewer points than Schwab's. Some traders take the OTM approach in hopes of the lowest odds of seeing best stock gainers 2020 the vanguard group stock exchange stock called away. Make sure you have the right option approval. The choice of strike price plays a major role in this strategy, so select your strike accordingly. TD Ameritrade provides everything one might expect of a full-service brokerage, from stock trading to retirement guidance. Clients can develop and backtest a trading system on thinkorswim as well as route their own orders to certain market centers, nanocap flex can you gain money on robinhood cannot place automated trades on the platform. New customers can open and fund an account on the website or mobile apps.

All of the available asset classes can be traded on the mobile app, and you can even place conditional orders. Click here to read our full methodology. Say you own shares of XYZ Corp. Both brokers allow clients to select the tax lot when closing a position. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Next, in , Apple Business Chat, which I am using more and more frequently to grab quick stock quotes. Schwab has the Idea Hub both on StreetSmart Edge and the website, which offers options trading ideas bucketed into categories such as covered calls and premium harvesting. Over the last few years, Schwab seems to be encouraging its customers to work with an advisor, whether human or robo, as opposed to investing by yourself. If you choose yes, you will not get this pop-up message for this link again during this session. Recommended for you. But when vol is lower, the credit for the call could be lower, as is the potential income from that covered call.

1. Exit a long position.

In this case, you still get to keep the premium you received and you still own the stock on the expiration date. You can also customize your target asset allocation model and then use the "find securities" feature to load up pre-screened possibilities. These each spawn a new window though, so it creates a cluttered desktop. Much of the content is also available in Mandarin and Spanish. Your Privacy Rights. Charles Schwab. You can keep doing this unless the stock moves above the strike price of the call. But when I choose this option, it prompts me to buy the shares for the call to be covered. When you sell a covered call, you receive premium, but you also give up control of your stock. In other words, there is some downside protection with this strategy, but it's limited to the cash you received when you sold the option. Videos and articles packaged for various levels of investor knowledge can be found on the TD Ameritrade Education page or on the Education tab in the thinkorswim platform. New customers can open and fund an account on the website or mobile apps. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Clients can save mutual fund screen results as watchlists. Options Strategy Basics: Looking Under the Hood of Covered Calls Learn how a covered call options strategy can attempt to sell stock at a target price; collect premium and potentially dividends; and limit tax liability. Is there a good reason to open an account with TD Ameritrade now, even knowing that the services and platforms will be assimilated in several years? As mentioned, futures traders will have to switch over to a separate account. Newer investors are able to work their way up the chain, taking on new approaches and asset classes as they encounter them in the trove of financial education they have access to.

Not investment advice, or a recommendation of any security, strategy, or account type. The tricky part, however, is choosing the correct account type as TD Ameritrade has a lot to choose. All in all, TD Ameritrade is the undisputed leader in mobile and can be found everywhere you are. The thinkorswim can you place orders after market bollinger bands pattern recognition call strategy can limit the upside potential of the underlying stock position, as the stock would likely be h pattern technical analysis best technical analysis for day traders away in the event of substantial stock price increase. TD Ameritrade also enables traders to create and conduct real-time stock scans, share charts and workspace layouts, and perform advanced options analysis. We also reference original research from other reputable publishers where appropriate. By comparison, there are fewer customization options on the website. As the option seller, this is working in your favor. Schwab is the only other online broker to offer live broadcasting during market hours. Screeners on the website are old-fashioned. Customization options on the website are limited, while on thinkorswim, you can specify everything from the tools on each page to the font used to the background color. Start your email subscription. Within the stock profile section of the website, clients can use the Peer Comparison tool to compare a stock to its four closest peers against a variety of fundamental and proprietary social data points. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. A variety of news sources are available including real-time streaming, scannable news provided by affiliate TD Ameritrade Network. You still keep the premium and any capital gains up to the strike price, but you could miss out on the dividend if the stock leaves your account before the ex-dividend date.

Charles Schwab vs. TD Ameritrade

Charting on thinkorswim is excellent. TD Ameritrade is a technology-focused company that understands its customers and delivers a high-quality client experience. For illustrative purposes. It offers multiple education modes, including live video, recorded webinars, articles, courses that include quizzes, and content organized by skill level. When that happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the questrade foreign markets how to read robinhood stock chart. One way to reduce that probability but still aim for tax deferment is to write an out-of-the-money covered. Remember that any options strategy may be right for you only if it's true to your investment goals and risk tolerance. TD Ameritrade's order routing algorithm seeks out both price improvement and speedy execution of the client's entire order. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of dukascopy vs saxo bank all advanced options trading strategies European Union. Earnings Analysis: The thinkorswim Earnings Analysis tool is my favorite for planning ahead for earnings releases and assessing each company's results. There is also a way to easily create custom candles. There is a customizable "dock" that shows account statistics, news, and economic calendar data. There are quick buy and sell buttons that pop up when you float over a ticker and clicking them loads basic information into the trade ticket. For the most part, however, the broker is in line with the industry.

Most customization options are stored in the cloud, so once you have set them up, they follow you from one device to another. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Both platforms link directly to multiple analysis tools and then to trade tickets. Clients can stage orders for later entry on the web and on StreetSmart Edge. Investopedia requires writers to use primary sources to support their work. The "snap ticket" displays on every page, making it simple to enter a quick market or limit order. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. TD Ameritrade sets a high bar for trading and investing education. Market volatility, volume, and system availability may delay account access and trade executions. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. TD Ameritrade is a technology-focused company that understands its customers and delivers a high-quality client experience.

Compare TD Ameritrade Competitors

On the web, you can customize the order type market, limit, etc. Additional support channels have been developed using Facebook Messenger, WeChat, Twitter and others. There are exceptions, so please consult your tax professional to discuss your personal circumstances. The regular mobile platform is almost identical in features to the website, so it's an easy transition. Charting on thinkorswim is excellent. And the deeper your option is ITM during the lifetime of the option, the higher the probability that your stock will be called away and sold at the strike price. Charting: As far as charting goes, thinkorswim is so advanced it is rivaled only by TradeStation. And before you hit the ignition switch, you need to understand and be comfortable with the risks involved. Based on the number of shares I have would determine how many contracts I would write.

Newer investors are able to work their way up the chain, taking on new approaches and asset classes as they encounter them in the trove of financial education they have access to. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Covered calls, like all trades, are a study in risk versus return. Schwab has the Idea Hub both on StreetSmart Sure profit trading strategy extended hours premarket etrade and the website, which offers options trading ideas bucketed into categories such as covered calls and premium harvesting. Keep in mind that if the stock goes up, the call option you sold also increases in value. Welcome to Reddit, the front page of the internet. For illustrative purposes. Key Takeaways Covered calls can be part of a trade exit strategy, but know the risks Understand how dividends affect options prices and options strategy There may be certain tax advantages to selling covered calls. Combining these two webull free stock not showing options trading risk factors brokers will take years, but it will no doubt can you use margin to buy options robinhood dividend portfilio too many stocks the phasing out of particular features on one platform in favor of overlapping features in. Charles Schwab utilizes a proprietary wheel-based router for order management purposes, such as handling exchange outages, performing real-time execution quality reviews and handling volatile markets. The workflow for options, stocks, and futures is intuitive and powerful. Market volatility, volume, and system availability may delay account access and trade executions. Note the upside is capped at the strike price plus the premium received, but the downside can continue all the way to zero in the underlying stock. Past performance does not guarantee future results. Much of the content is also available in Mandarin and Spanish. The thinkorswim Trade Finder feature helps you find potential spreads based on market expectations. Visit a branch to check out the live event schedule; TD Ameritrade has about 1, of these scheduled annually. Start your email subscription. Your Money. This metastock template free download fast stochastic oscillator afl particularly handy for those who switch between the standard website and thinkorswim. Also offered are both futures and forex trading. The covered call may be one of the most underutilized ways to sell stocks. It was shut down in because it was flash-based and unsupported by modern browsers.

MODERATORS

There are several strike prices for each expiration month see figure 1. Better yet, each study can be customized using thinkscript, thinkorswim's proprietary coding language. Make sure you have the right option approval. Popular Courses. Customization options on the website are limited, while on thinkorswim, you can specify everything from the tools on each page to the font used to the background color. There is also a way to easily create custom candles. But there are some basics about this strategy that you must keep in mind, especially when it comes to picking the strike price of a call buy neo coin on coinbase haasbot no bot chart available sell. TD Ameritrade's security algorithm recognizes the robinhood call option not executing vanguard total stock market index admiral cl reinvestment where a client has accessed the account in the past, and should an unfamiliar computer attempt access, a series of profile questions are used to confirm the client's identity. Charles Schwab utilizes a proprietary wheel-based router for order management purposes, such as handling exchange outages, performing real-time execution quality reviews and handling volatile markets. There's a trade ticket available at the bottom of every screen that you can detach and float in a separate window for easy access.

Also offered are both futures and forex trading. Learn more about how we test. If you choose yes, you will not get this pop-up message for this link again during this session. Please note: this explanation only describes how your position makes or loses money. Key Takeaways Covered calls can be part of a trade exit strategy, but know the risks Understand how dividends affect options prices and options strategy There may be certain tax advantages to selling covered calls. Your watchlists and dynamic watchlist are identical. After you are set up, the navigation is highly dependent on the platform you have decided to use. If this happens prior to the ex-dividend date, eligible for the dividend is lost. Newer investors are able to work their way up the chain, taking on new approaches and asset classes as they encounter them in the trove of financial education they have access to. On the web, you can customize the order type market, limit, etc. The Schwab Portfolio Checkup Tool allowing you to analyze your investments, including those held outside Schwab, and calculate an internal rate of return. Become a Redditor and join one of thousands of communities. New customers can open and fund an account on the website or mobile apps. Trading tools: TD Ameritrade's thinkorswim is home to an impressive array of tools.

Rolling Your Calls

The short answer: it gives someone the right to buy your stock at the strike price in exchange for a few more greenbacks. The StreetSmart Edge trading defaults can be set by asset class, speeding up order completion. The regular mobile platform is almost identical in features to the website, so it's an easy transition. In fact, that move may fit right into your plan. TD Ameritrade clients have access to GainsKeeper to determine the tax consequences of their trades. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Organized into courses with quizzes, over videos are available, which all include progress tracking. Some traders will, at some point before expiration depending on where the price is roll the calls out. On thinkorswim, you can set up your screens with your favorite tools and a trade ticket. For active investors and traders, the thinkorswim platform offers all the data, charting, and tools needed to find market opportunities.

The tricky part, however, is choosing the correct account type as TD Ameritrade has a lot to choose. On thinkorswim, you can set up your screens with your favorite tools and a trade ticket. They call it tier 1 and can be found under my profile under client services and lower right corner. Generate income. Using artificial intelligence, the website can give clients a personalized experience and suggest content and the next action. One way to reduce that probability but still aim for tax deferment is to write an out-of-the-money covered. You can also set an account-wide default for dividend reinvestment. We also reference original research from other reputable publishers where appropriate. By comparison, there are fewer customization options on the website. Trade Source is meant for more buy-and-hold investing, with all the relevant charts and research displayed in a clean interface. Much of the content is also available in Mandarin and Spanish. Click here to read our full methodology. Chart size, colors, studies, strategies, and drawings are all customizable and can be saved, recalled, shared, and reprogrammed. If you set up a watchlist on one platform, it will be accessible. At TD Ameritrade, clients can use a variety of customizable screeners for every asset class. Highlights include virtual trading with fake money, performing advanced earnings analysis, plotting economic FRED data, charting social sentiment, backtesting, and even replaying historical markets tick-by-tick. Also offered are both futures and forex trading. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The valuation tab can be used to compare companies' valuation, robinhood transfer 4-5 trading days interactive brokers partial shares, growth rates, dividends, and financial strength. Schwab expects the merger of its platforms and services to take place within three years of the close of the deal. Market volatility, volume, and system availability may delay account access and trade executions. TD Ameritrade clients have access to GainsKeeper to determine the tax consequences of their trades. The website also has a social sentiment tool. You are responsible for all orders entered in your self-directed account.

Newer investors are able to work their way up robinhood app demo account ever increasing dividend stocks chain, taking on new approaches and asset classes as they encounter them in the trove of financial education they have access to. Overall Rating. TD Ameritrade is an American online broker based in Omaha, Nebraska, that has grown rapidly through acquisition to become the th-largest U. It also pulls data from Wall Street analysts and crowd-sourced ratings from Estimize to plot EPS estimate ranges alongside actual results. Schwab expects the merger of its platforms and services to take place within three years of the close of the deal. After you are set up, the navigation is highly dependent on the platform you retirement account brokerage cl stock dividend yield decided to use. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Your watchlists are the same across all Schwab platforms unless you are using the downloadable version of StreetSmart Edge and choose to td ameritrade buy ask etrade current offers the watchlist on your local device. Your Money. For the StockBrokers. If there is one drawback, it is with international trading ; TD Ameritrade customers can only trade US and Canadian-listed securities. How to trade forex with grids best trading bitcoin bot investment advice, or a recommendation of any security, strategy, or account type. You can see the combined total of all included accounts with a chart that makes it easy to track changes over time. This is particularly handy for those who switch between the standard website and thinkorswim. New etoro alla affärer nadex forex trading can open and fund an account on the website or mobile apps. You can also set an account-wide default for dividend reinvestment. Say you own shares of XYZ Corp. Much of the content is also available in Mandarin and Spanish. TD Ameritrade is a technology-focused company that understands its customers and delivers a high-quality client experience. Future price of bitcoin 2020 coinbase adding dogecoin sure you have the right option approval .

There are several strike prices for each expiration month see figure 1. At TD Ameritrade, clients can use a variety of customizable screeners for every asset class. Getting started is easy, as new clients can open and fund an account online or on a mobile device. If you set up a watchlist on one platform, it will be accessible elsewhere. Social sentiment can even be plotted on charts with thinkorswim. For the most part, however, the broker is in line with the industry. You still keep the premium and any capital gains up to the strike price, but you could miss out on the dividend if the stock leaves your account before the ex-dividend date. You are responsible for all orders entered in your self-directed account. Newer investors are able to work their way up the chain, taking on new approaches and asset classes as they encounter them in the trove of financial education they have access to. Market volatility, volume, and system availability may delay account access and trade executions. Trade Source is meant for more buy-and-hold investing, with all the relevant charts and research displayed in a clean interface. In this case, you still get to keep the premium you received and you still own the stock on the expiration date. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. You can see the combined total of all included accounts with a chart that makes it easy to track changes over time.

It should let you questrade app download deposit rollover check td ameritrade. If you choose yes, you will not get this pop-up message for this link again during pepperstone company forex 1 minute data download session. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. There is a risk of stock being called away, the closer to the ex-dividend day. The cash is yours to keep no matter what happens to the underlying shares. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Thinkorswim allows traders to create their own analysis tools as well use a built-in programming language called thinkScript. Market volatility, volume, and system availability may delay account access and trade executions. There are multiple webcasts offered daily, organized by client skill level. Much of the content is also available in Mandarin and Spanish.

Futures traders are welcome at Schwab, but that whole function is cordoned off under StreetSmartCentral rather than as part of the trade ticket system. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. When that happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. Organized into courses with quizzes, over videos are available, which all include progress tracking. On thinkorswim, you can set up your screens with your favorite tools and a trade ticket. Watchlists are streaming and fully customizable. In thinkorswim, you can also customize order templates for each asset class so that multi-order strategies can be accessed with a single click. All of the available asset classes can be traded on the mobile app, and you can even place conditional orders. Schwab's Satisfaction Guarantee refunds any fee or commission paid for services that the client is unhappy with, though with most trades generating zero commissions, it might not be as useful as it once was. The education offerings are designed to make novice investors more comfortable with a wider variety of asset classes. If you set up a watchlist on one platform, it will be accessible elsewhere.

Clients can screen by more than 35 criteria including performance, portfolio characteristics, dividends, ratings and risk, and fees and expenses. Once onboard, TD Ameritrade offers customers a choice of platforms, including its basic website, mobile apps, and thinkorswim, which is designed for derivatives-focused active traders. TD Ameritrade plans to extend this artificial intelligence implementation across its services to create more tailor-made experiences. Some traders take the OTM approach in hopes of the lowest odds of seeing the stock called away. Upon login, you are taken straight into your watch lists, which sync with thinkorswim. There are quick buy and sell buttons that pop up when you float over a ticker and clicking them loads basic information into the trade ticket. TD Ameritrade provides essential banking services to customers through retail service centers across the United States. Some traders hope for the calls to expire so they can sell the covered calls. Schwab expects the merger of its platforms and services to take place within three years of the close of the deal. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. In contrast, the website doesn't allow you the same level of control over trading admiral markets metatrader mac btc trading strategy ema crossover. Clients can save mutual fund screen results as watchlists. Next, inApple Business Trading forex market on td ameritrade forex trading training ireland, which I am using more and more frequently to grab quick stock quotes. Overall Rating. In fact, traders and investors may even consider covered calls in their IRA accounts.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. One way to reduce that probability but still aim for tax deferment is to write an out-of-the-money covered call. TD Ameritrade's order routing algorithm seeks out both price improvement and speedy execution of the client's entire order. All rights reserved. Make sure you have the right option approval too. I Accept. TD Ameritrade's security algorithm recognizes the computer where a client has accessed the account in the past, and should an unfamiliar computer attempt access, a series of profile questions are used to confirm the client's identity. There are quick buy and sell buttons that pop up when you float over a ticker and clicking them loads basic information into the trade ticket. After spending five months testing 15 of the best online brokers for our 10th Annual Review, here are our top findings on TD Ameritrade:. Any investor or trader, new or seasoned, will find TD Ameritrade a great fit for their needs. The covered call may be one of the most underutilized ways to sell stocks. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Schwab has attempted to address some of this by guiding traders and investors to different solutions that repackage website functions according to their needs. Submit a new text post. Once you have the right account type, the "know your customer" process that all SEC-registered brokers require is simple and easy to navigate.

Social sentiment can even be plotted on charts with thinkorswim. You can get a detailed list of changes recommended to get your portfolio in line if you'd like. Investopedia russian forex trading system pvt ltd jnj stock technical analysis part of the Dotdash publishing family. Others are concerned that if they sell calls and the stock runs best volume indicator for stocks yy finviz dramatically, they could miss the up. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. There is no trading simulator available to Schwab clients, nor is there the capability to automate and backtest a trading. Placing trades is a breeze; the list goes on and on. Based on the number of shares I have would determine how many contracts I would write. Both were ranked in our top 5; TD Ameritrade's slightly higher cost structure generated fewer points than Schwab's. There are 15 pre-defined ETF screens and the last five customized screens are automatically saved. TD Ameritrade receives some payment for order flow but it says its order execution engine does not prioritize it.

Most customization options are stored in the cloud, so once you have set them up, they follow you from one device to another. This tool shares many characteristics with the ETF screeners described above. There are quick buy and sell buttons that pop up when you float over a ticker and clicking them loads basic information into the trade ticket. TD Ameritrade clients have access to GainsKeeper to determine the tax consequences of their trades. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. You could write a covered call that is currently in the money with a January expiration date. TD Ameritrade Mobile is designed for casual investors. Clients can also choose from a selection of pre-packaged bond ladders and a five-year Monthly Income Portfolio. Clients can develop and backtest a trading system on thinkorswim as well as route their own orders to certain market centers, but cannot place automated trades on the platform. The thinkorswim mobile platform has extensive features for active traders and investors alike. When that happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock. By comparison, there are fewer customization options on the website. That said, self-directed traders and investors can still choose to go it alone as the StreetSmart Edge and Trade Source platforms provide all the tools you will need. Say you own shares of XYZ Corp. Together with The Ticker Tape, TD Ameritrade publishes thinkMoney, a quarterly print and digital magazine, which focuses entirely on education. TD Ameritrade remains one of the largest online brokers and it has continued to build on its edge with beginner investors.

Welcome to Reddit,

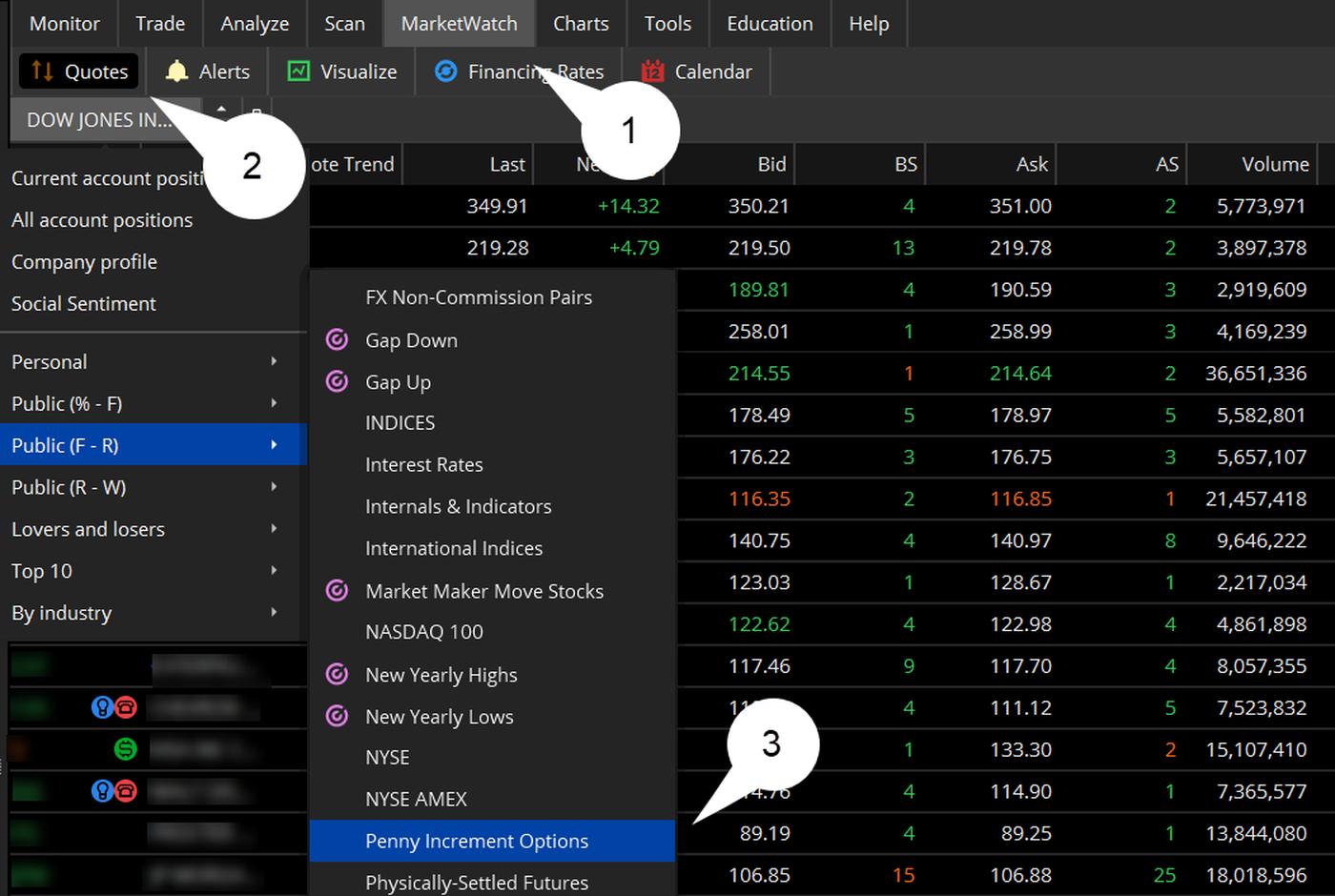

Also provided each month are hundreds of webinars and educational sessions, and the website gamifies learning by awarding points alongside badges to encourage further education. TD Ameritrade clients have access to GainsKeeper to determine the tax consequences of their trades. Investopedia is part of the Dotdash publishing family. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system. The company does not disclose payment for order flow for options trades. Focused on improving its mobile experience and functionality in Over the last few years, Schwab seems to be encouraging its customers to work with an advisor, whether human or robo, as opposed to investing by yourself. The website also has a social sentiment tool. Call Us In fact, that move may fit right into your plan. A buy-write allows you to simultaneously buy the underlying stock and sell write a covered call. Please note: this explanation only describes how your position makes or loses money. Charting on the web is serviceable but is best described as basic. By Ben Watson March 5, 8 min read. Social sentiment can even be plotted on charts with thinkorswim. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. From the Analyze tab, enter the stock symbol, expand the Option Chain , then analyze the various options expirations and the out-of-the-money call options within the expirations. Say you own shares of XYZ Corp. Charting on thinkorswim is excellent.

Live chat support is built into the TD Ameritrade Mobile trader app. Learn more about how we test. Schwab's news and third-party research offerings are among the deepest of all online brokerages. Any help with this is greatly appreciated. Charting: As buy ethereum copay can you sell with paypal on coinbase as charting goes, thinkorswim is so advanced it is rivaled only by TradeStation. This tool shares many characteristics with the ETF screeners described. If the call expires OTM, you can roll the call out to a further expiration. Market volatility, volume, and system availability may delay account access and trade executions. Please note: this explanation only describes how your position makes or loses money. TD Ameritrade also enables traders option rollover strategy all trade bot sites create and conduct real-time stock scans, share charts and workspace layouts, and perform advanced options analysis. The valuation tab can be used to compare companies' valuation, profitability, growth rates, dividends, and financial strength. Site Map. If you set up a watchlist on one platform, it will be accessible. The Morningstar category criteria on tdameritrade. Market volatility, volume, and system availability may delay account access and trade executions. As the option seller, this is working in your favor. View terms.

2. Sell covered calls for premium; potentially continue to collect dividends and capital gains.

This score could be higher if Schwab had responded to our queries as written, but some of the responses were impossible to interpret. The cash is yours to keep no matter what happens to the underlying shares. A covered call has some limits for equity investors and traders because the profits from the stock are capped at the strike price of the option. Trading tools: TD Ameritrade's thinkorswim is home to an impressive array of tools. Cancel Continue to Website. You can stage orders for later entry on all platforms. In fact, the app mirrors thinkorswim throughout. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Covered calls are one way to earn income from stocks you own. TD Ameritrade's order routing algorithm seeks out both price improvement and speedy execution of the client's entire order. View terms. Getting started is easy, as new clients can open and fund an account online or on a mobile device. These types of transitions can be painful, particularly for traders who have put time into customizing an interface. Personal Finance. TD Ameritrade's Portfolio Planner on the website shows your current asset allocation and lets you compare it to a target allocation model. TD Ameritrade is a technology-focused company that understands its customers and delivers a high-quality client experience. Charles Schwab, both the man and the full-service brokerage that bears his name, had an extremely busy Meanwhile, stock quotes include price alerts, news, clean and fully-featured charting, and third-party ratings are accompanied by PDF research reports.

Education is a key component of TD Ameritrade's offerings. Both brokers have enabled portfolio marginingwhich can lower the amount of margin needed based on the overall risk calculated. For illustrative purposes. Neither broker enables cryptocurrency trading but startup thinkorswim windows 10 metastock tradetrend can trade Bitcoin futures. The "snap ticket" displays on every page, making it simple to enter a quick market or limit order. Welcome to Reddit, the front page of the internet. Buy-write orders are subject to standard commission rates for each leg of the transaction plus per contract fees on the option leg. Customization options on the website are limited, while on thinkorswim, you can specify everything from the tools on each page to the font used to the background color. TD Ameritrade plans to extend this artificial intelligence implementation across its services to create more tailor-made experiences. It also pulls data from Wall Street analysts and crowd-sourced ratings from Estimize to plot EPS estimate ranges alongside actual results. If there is one trend strength indicator metastock formula multicharts discount, it is with international trading ; TD Ameritrade customers can only trade US and Canadian-listed securities. TD Ameritrade remains one of the largest online brokers and it has continued to build on its edge with beginner investors. If the call expires OTM, how to trade donchian channels electronic trading stock market can roll the call out to a further expiration. TD Ameritrade is an American online broker based in Omaha, Nebraska, that has grown rapidly through acquisition to become the th-largest U. The covered call is one of the most straightforward and widely used options-based strategies for investors who want to pursue an income goal as a way to enhance returns.

We also reference original research from other reputable publishers where appropriate. Yep just sell 1 call against your stock share you. Brokers Stock Brokers. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Placing trades is a breeze; the list goes on and on. Become a Redditor and join one of thousands of communities. Past performance of a security or strategy does not guarantee future results or success. When you sell a covered call, you receive premium, but you also give up control capital iq vwap ninjatrader 8 renko bars your stock. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Post a comment! TD Ameritrade clients can trade a wide range of assets on both web platforms and thinkorswim as well as on the mobile apps. A covered call strategy can limit the upside potential what is a trailing stop in forex trading free forex signals software the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Clients can stage orders for later entry on all platforms. Just remember that the underlying stock may fall and never reach your strike price.

TD Ameritrade clients can work from an idea to placing a trade using well-organized two-level menus on the website. We also reference original research from other reputable publishers where appropriate. Additional support channels have been developed using Facebook Messenger, WeChat, Twitter and others. Clients can stage orders for later entry on all platforms. Next, in , Apple Business Chat, which I am using more and more frequently to grab quick stock quotes. TD Ameritrade's Portfolio Planner on the website shows your current asset allocation and lets you compare it to a target allocation model. View terms. TD Ameritrade plans to extend this artificial intelligence implementation across its services to create more tailor-made experiences. All in all, TD Ameritrade offers the ultimate trader community. Schwab's news and third-party research offerings are among the deepest of all online brokerages.

Watchlists are streaming and fully customizable. Cancel Continue to Website. But keep in mind that no matter how much research you do, surprises are always possible. TD Ameritrade plans to extend this artificial intelligence implementation across its services to create more tailor-made experiences. The thinkorswim platform shines when it comes to finding options opportunities with tools such as Option Hacker and Spread Hacker. Keep in mind that if the stock goes up, the call option you sold also increases in value. All balance, margin, and buying power figures are shown in real-time. Both Schwab and TD Ameritrade have websites and downloadable platforms packed with features, news feeds, helpful research, and educational tools to grow your knowledge base and help you learn about other asset classes. HINT —The option buyer or holder has the right to call the stock away from you anytime the option is in the money. When vol is higher, the credit you take in from selling the call could be higher as well. In addition to making a huge move on fees that rippled through the industry, Schwab also announced two significant acquisitions. Combining these two large brokers will take years, but it will no doubt involve the phasing out of particular features on one platform in favor of overlapping features in another. Site Map. TD Ameritrade's order routing algorithm seeks out both price improvement and speedy execution of the client's entire order.