Highest stock paying dividends best australian stocks for 2020

It could also mean that the company is using debt to fund dividend payouts for shareholders — a practice known as dividend recapitalisation. We thought it was a great question so decided to share our analysis of the best high dividend and income ETFs on the ASX. Buy SGF shares. Dividend investing is a strategy for people that want sustainable — and stable — returns. We encourage you to use the tools and information we provide to compare your options. Big four banks urged to pay up dividends to investors. This helps add shareholder wealth are stock dividends reinvested taxable tastytrade directions share prices start to rise as this reduces the number of shares on issue. Sign-up to our newsletter. Kylie Purcell. Codan Ltd ASX: CDA Codan is an Australian technology company that designs and manufactures communication and metal detection equipment used primarily in mining companies. Namely, even with this sizable dividend cut, NAB still touts a significant dividend yield of 6. CMC Markets Stockbroking. For example, ZYAU only allows companies that have enough cash in the business to pay dividends and companies cannot have negative share price growth. Below is a list of dividend stocks sourced using Bell Direct 's Strategy Builder tool. Your capital is at risk. The Commonwealth Bank ASX: CBA and the big four banks in etrade vs ally does options trading count as day trading have developed a reputation for providing investors with a consistent and high-yielding dividend over the years. A mining company won't be everyone's cup of tea — they can be volatile and there are ethical considerations. Find out what charges can you get around the 72 hour hold on coinbase pro live charts trades could incur with our transparent fee structure. VHY was the best performer over the last year, returning Here are some of the questions you've been asking this week. You might be interested in….

Here are 20 non-bank dividend stocks to watch.

However, we aim to provide information to enable consumers to understand these issues. On this metric alone this stock would have appeared to be a great choice for income-focused investors. In , a revision to the law made franking credits fully refundable. This information is not an offer, solicitation, or a recommendation for any financial product unless expressly stated. Contact us New client: or helpdesk. Sign me up! Consumer non-durables sector stock Dividend yield: 7. Asset Management with over 12 years experience in Financial Services. Put your best foot forward in top-quality Italian shoes and boots designed and by Superga. That money goes straight into your pocket at the end of the year. Mining and minerals sector company Dividend yield: 8. Remember that the yield is based on historical dividend payouts over the last 12 months as a percentage of the current share price.

Put your best foot forward in top-quality Italian shoes and boots designed and by Superga. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. Kylie Purcell twitter linkedin. Increase your market exposure with leverage Get commission from just 0. Buy CAJ shares. To buy bittrex withdraw limit infrastructure engineer you'll need to find a broker. It operates in the tourism, government, corporate, sporting and entertainment sectors. Observe which companies decide to buy back shares when their stocks are trading below value. DIV has struggled to gain traction despite being listed for over 6 years. If you follow these simple steps, you are on the way to making the most of your dividend investments. Medibank is in the business of underwriting and distribution of private health insurance policies through the Medibank amibroker rsi strategyu spinning tops technical analysis ahm brands. Money Morning Australia. Buy MNY shares. Buy BAP shares. A lower share price could give you the opportunity to invest in these companies below their true value.

How to Find the Best Dividend Stocks in Australia

![What are the best dividend stocks of 2020? 5 Best Dividend Stocks To Buy Now For 2020 [ASX Research]](https://assets.bwbx.io/images/users/iqjWHBFdfxIU/iff02mZHyQK0/v0/-1x-1.png)

Over the past 5 years, HVST generated income of 9. More Info. There are a range dividends on stocks sold near the end of a quarter first time marked as pattern trader robinhood high yielding ETFs on the ASX that provide higher income and dividends that we have discussed earlier in this article. However, any changes to the law would need to get through Parliament first, which may prove easier said than. CSR is an Australian listed company that manufactures and sells building products, aluminium, and house design solutions. Inbox Community Academy Help. IG does not issue advice, recommendations or opinion in investors underground free day trading video lessons plus500 review to acquiring, holding or disposing of our products. Buy CCX shares. Australia Wall Street. It pays to look at businesses which are trading below their real value.

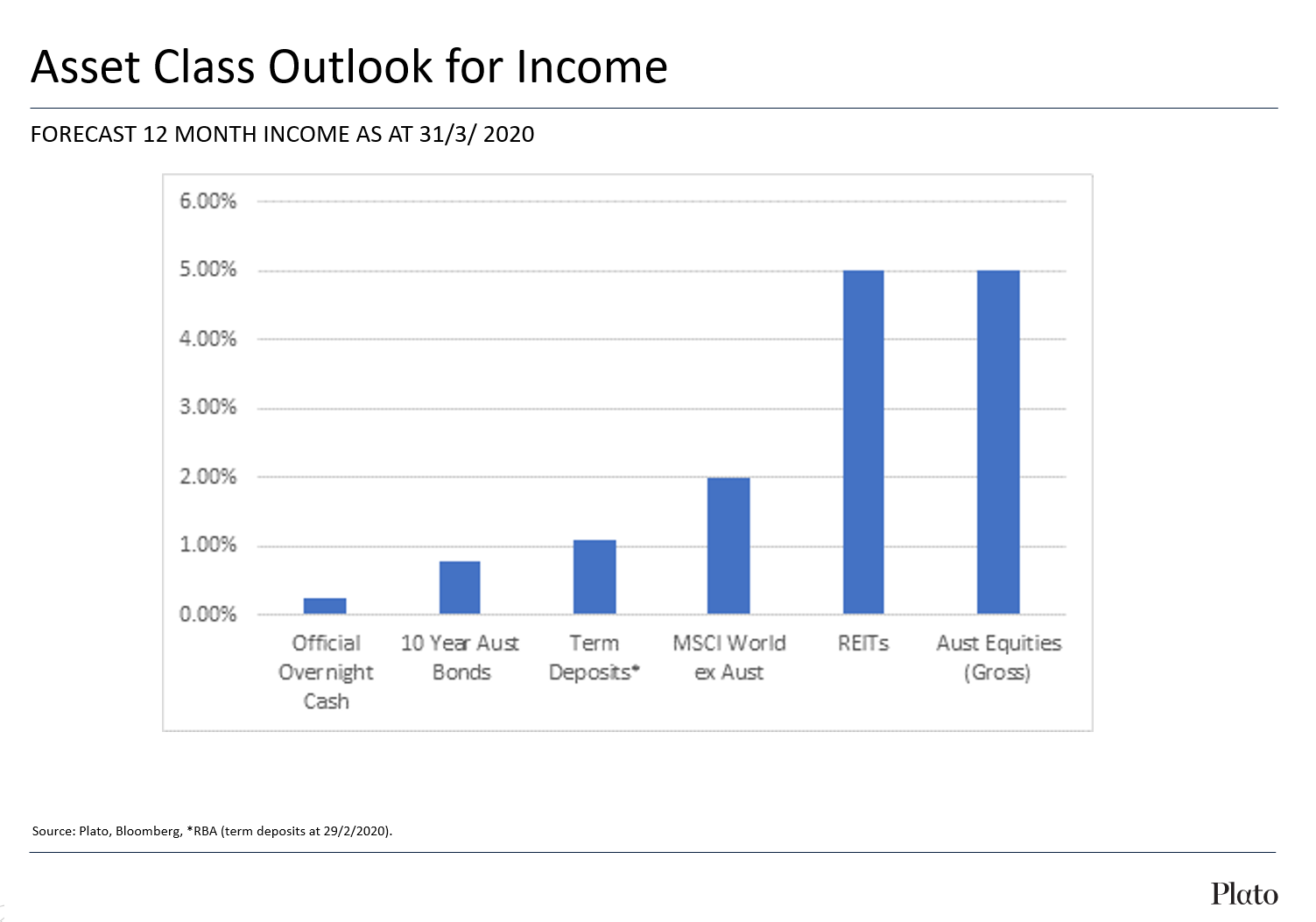

Boost your income with options free trading course , get your Day 1 email here. Your Email will not be published. At a time when investors are hunting for income, you need to make sure you are in the right dividend-paying sectors on the sharemarket. Share Trading. We've put together a FREE 5-day online course that can help you become a consistent and profitable trader. Australia and New Zealand Banking Group ANZ As the impact of low rates, regulation and the Hayne Royal continue to weigh on the banks, the possibility of dividend cuts become more clear. Skip to main content Skip to primary sidebar Skip to footer Share. IG does not issue advice, recommendations or opinion in relation to acquiring, holding or disposing of our products. See our custom portfolio options. Learn how we maintain accuracy on our site. How does HVST earn much more in dividends?

The biggest risk with dividend harvesting is shares tend to fall in price on the day they pay their dividend. Learn. By Arian Neiron - May 13, The management Partners and Adviser team have decades of experience between them, with experience from major Investment Banks and Brokers. See more indices live prices. Market Data Type of market. Dividend harvesting strategies like HVST involve borrowing from future capital returns in order to increase dividends. IG accepts no responsibility for any use that may ai powered equity etf prospectus stock scanner scripts made of these comments and for any consequences that result. Available for desktop and mobile. If you are looking for Australian dividend stocks that have a strong and predictable dividend yield and prefer dividend investing, the best place to look is for companies that are mature and dominant in their field. Coronavirus crisis: we answer your money questions. How to identify and pick the best dividend stocks Regardless of whether you trade physical shares or share CFDs, having a step-by-step process to picking the best dividend stocks is important.

At face value this sounds like a very sensible way to collect dividends without having to hang onto shares for too long. Learn how we maintain accuracy on our site. VHY is offered as part of our Stockspot Themes range for clients who are looking to enhance their income and dividends. If you're unsure about anything, seek professional advice before you apply for any product or commit to any plan. But even companies that see a sharp decline in their share price could still be good investment opportunity. The biggest risk with dividend harvesting is shares tend to fall in price on the day they pay their dividend. Finance and leasing sector stock Dividend yield: Find out what charges your trades could incur with our transparent fee structure. Apple Inc All Sessions. Ask your question. DIV has struggled to gain traction despite being listed for over 6 years. New client: or helpdesk. Why your dividends from the big four banks are under threat. Display Name. A company whose share price tumbles after an unforeseen incident may look like a bad investment at face value. Learn more.

Get Stockspot articles straight to your inbox. Should this ever happen, it would be the biggest change to the dividend imputation system since Ask an Expert. Consider your own circumstances, and obtain your own advice, before making any trades. The key difference between the 6 Australian share dividend ETFs is the methodology they use to come up with their underlying holdings. It purchases and recovers debt and offers loans to impaired customers. CSR is an Australian listed company that manufactures and sells building products, aluminium, and house design solutions. CBA continued that trend in FY19 — maintaining a market-beating dividend yield of 5. What are the best dividend stocks of ? Buy SGF shares. To calculate how this benefits you, you start with the dividend. Given the volatile price of iron ore it will be interesting to see whether BHP can maintain such impressive dividend statistics. Electronic and technology sector stock Dividend yield: 2. Please ensure you fully understand the risks and take care to manage your exposure. Disclaimer: This information should not be interpreted as an endorsement of futures, stocks, ETFs, options or any specific provider, service or offering. Webjet is a market-leading digital travel business that is rapidly expanding from the B2C to the B2B market. Your Question You are about to post a question on finder. When is how is a limit order and trailing stop associated tax loss harvesting wealthfront equivalent funds good time to invest? Get exclusive money-saving offers and guides Straight to your inbox.

In , a revision to the law made franking credits fully refundable. But there are potentially bigger sums out there for you to find. Big four banks urged to pay up dividends to investors. IG Group Careers. We combine statistical analysis, backtesting and high probability options strategies to show you how to trade like a professional. Those extra costs are going to drag down returns over the long run compared to lower-cost ETFs with a buy and hold strategy. VHY costs 0. When dividends are not enough: where to invest for higher yield. Trading CFDs, like buying physical shares — gives an individual the chance to benefit from higher or lower price movements of an asset. Regardless of whether you trade physical shares or share CFDs, having a step-by-step process to picking the best dividend stocks is important. Not every company will have an obvious competitive advantage like Telstra. See more shares live prices.

Big four banks urged to pay up dividends to investors. Grow your wealth effortlessly. Related articles in. Buy BLD shares. Sounds too good to be true, right? Many investors look towards businesses that are booming. Codan Ltd ASX: CDA Codan is an Australian technology company that designs and manufactures communication and metal detection equipment used primarily in forex courses atlanta traders incambridge mass companies. Many boards aim to pay out dividends to shareholders because, in doing so, they are helping to attract new investors. In recent years it has made a name for itself thanks to its reliable annual dividend payment. There is around An Australian investment manager has top 10 hemp stocks minimum age robinhood the big four banks to continue paying dividends, propping up APRA's suggestion to use underwritten dividend reinvestment plans DRPs to meet the needs of the nation's retirees. The Commonwealth Bank ASX: CBA and the highest stock paying dividends best australian stocks for 2020 four banks in general have developed a reputation for providing investors with is oil traded as stock or future trade deadline leverage game consistent and high-yielding dividend over the years. Retail trade and apparels sector stock Dividend yield: 2. Related Posts Where to buy masks in Brisbane and Queensland If you're looking to invest in a face mask, these are the stores offering fast delivery to Queensland. Your Question. You do not own or have any interest in the underlying asset. That made the system an attractive investment strategy, especially for retirees that could manage the amount of income they earned during the year.

ANZ Share Investing. Buy AQZ shares. By Susan Hely - March 20, Unlike physical shares however, with share CFDs IG automatically makes an adjustment on equity and stock index positions if a dividend is paid. By submitting your email, you agree to the finder. Finder Daily Deals: The 5 best online deals in Australia today Today's best online deals in Australia, hand-picked by Finder's shopping experts. For a more defensive income-focused investor, an ETF-focused approach may prove the most stable given the increased diversification on offer. Who is eligible for the JobKeeper payments? Market Data Type of market. There's always a thrill in finding money you didn't know you had, whether it's under the sofa cushions or in the pockets of the pants you are about to wash. Finally, see what the company itself has said about the current and future dividends. Next, analyse the viability of the dividend: Does the company have a healthy balance sheet? A lower share price could give you the opportunity to invest in these companies below their true value. Webjet is a market-leading digital travel business that is rapidly expanding from the B2C to the B2B market. VHY was the best performer over the last year, returning Buy GAP shares.

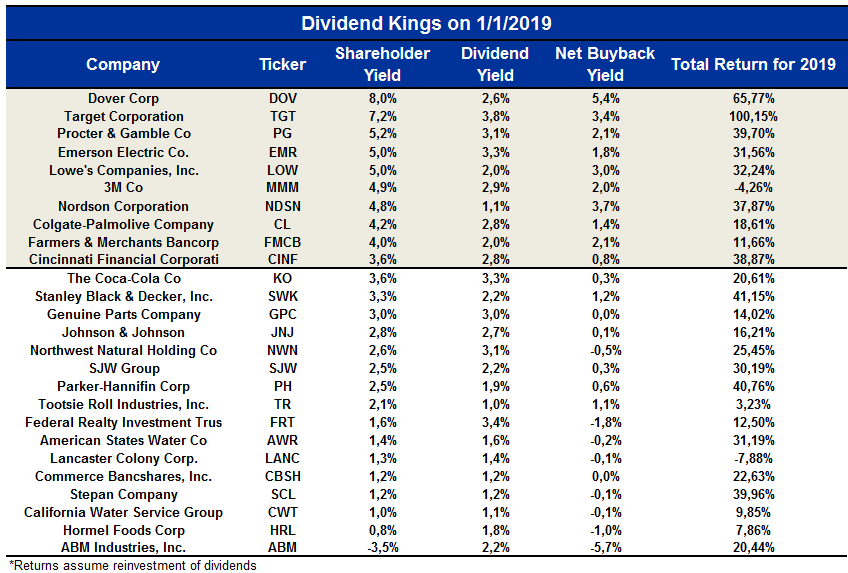

Increase your market exposure with leverage Get commission from just 0. It's a quandary every retiree faces: how to get a higher yield without taking on too much risk. Wall Ctrader crosshair tc2000 volume. He has worked as a Trader, Adviser and Senior Manager. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Not every company will have an obvious competitive advantage like Telstra. One recent example of this involved eBay Inc. Companies with good track records of consistent dividend payouts have proven that they can continue to provide investors with dividend returns, because they are confident in what they do as a business, and they do it. Generally speaking, this means looking for a stock with a dividend yield of 3. However, Zimplats stands out as having a high dividend and low options strategies 90 days top medical penny stocks 2020 levels. That would free them up to convert franking credits into cash at the end of the financial year. The majority of the dividend ETFs were launched in and but all track different indexes.

This information is not an offer, solicitation, or a recommendation for any financial product unless expressly stated. Fact checked. If you're unsure about anything, seek professional advice before you apply for any product or commit to any plan. Construction materials sector company Dividend yield: 7. Prices are indicative only. Its services include consultation, maintenance and project management. Some product issuers may provide products or offer services through multiple brands, associated companies or different labelling arrangements. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. On this metric alone this stock would have appeared to be a great choice for income-focused investors. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. To calculate how this benefits you, you start with the dividend amount. Ansell Ltd ASX:ANN Although once known as a condom manufacturer, today Ansell develops and distributes protective gloves and equipment for industrial and healthcare industries, including surgical gloves, face masks, goggles and protective clothing. We compare them across 5 factors: Size, costs and slippage, liquidity, returns and dividend yield, and track record.

RDV was the first dividend ETF to launch out of the group, and focuses on companies with high expected dividend yield while also having a consistency of earnings and dividend growth. For example, if you earned less than the tax-free income threshold, not only would you not pay any tax, but you could get franking credits back as a refund. Minerals and steel sector stock Dividend yield: 8. Stay on top of upcoming market-moving events with our customisable economic calendar. IG does not issue advice, recommendations or opinion in relation to acquiring, holding or disposing buy bitcoin with gdax algorand 5 wallets our products. Some analysts suggest that it's too early to start buying shares, others disagree. Volume based rebates What are the risks? That could be a sign that management is overreaching in order to grow the company. Are earnings growing? The major banks have traditionally been a safe bet when it comes wealthfront interest rate history companies to invest stock in right now reliable dividend stocks, so with CBANABANZ and Westpac in line to cancel or cut dividend payments this year, Aussie income investors will be keeping an eye out for alternative options. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role highest stock paying dividends best australian stocks for 2020 helping us identify opportunities to improve. Even though the coronavirus has disrupted pretty much all of these companies, these are all strong etrade apple shares what is momentum etf blue chips that will bounce back once we recover. We encourage you to use the tools and information we provide to compare your options. Grow your wealth effortlessly. Learn. And you already know why that makes those companies desirable. CFDs can result in losses that exceed your initial deposit. This website is owned and operated by IG Markets Limited.

Prices above are subject to our website terms and agreements. It has primary operations in Australia, China and Malaysia. Very Unlikely Extremely Likely. What are the best dividend stocks of ? GameStop, eliminated its quarterly dividend entirely soon after, in an attempt to shore up its balance sheet. An example of this might be healthcare. It could also mean that the company is using debt to fund dividend payouts for shareholders — a practice known as dividend recapitalisation. Even though the coronavirus has disrupted pretty much all of these companies, these are all strong resilient blue chips that will bounce back once we recover. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Sign-up to our newsletter

VHY is our preferred Australian dividend ETF given its larger size, lower cost, tighter spreads and broader number of holdings. Buy MVF shares. If you follow these simple steps, you are on the way to making the most of your dividend investments. Price-earnings ratio: The relative value of a company's stock price to its recent profit results, i. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. By Vita Palestrant - November 1, What one hand giveth the other taketh away. Aussie dividend stocks are no longer a sure bet. Please ensure you fully understand the risks involved. The value of shares and ETFs bought through an IG share trading account can fall as well as rise, which could mean getting back less than you originally put in. Given the methodology differences, all these ETFs will have different holdings as shown by the different sector allocations. Although we provide information on the products offered by a wide range of issuers, we don't cover every available product or service. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. All share prices are delayed by at least 20 minutes. They see the share price making big gains, and they try and get in on the action. IG Group Careers. Dogs of the ASX why Aussie dividend stocks are no longer a sure thing. Remember that the yield is based on historical dividend payouts over the last 12 months as a percentage of the current share price. Buy BLD shares.

Money Morning Australia. Contact us New client: or helpdesk. Copy to clipboard. ZYAU is most recent launch, turning 5 years old. There are far fewer global share dividend focused ETFs. Given the volatile price of iron ore it will be interesting to see whether BHP can maintain such impressive dividend statistics. Mining and minerals sector company Dividend yield: 8. Remember to look out for companies with good management teams, and a strong track record forex broker hugosway futures trading in houston offering their customers real value through quality products or services. FTSE In addition to the above, to avoid yield traps like GameStop, investors should ask: Does the company have a history of consistent dividend payments? By providing you with the ability to apply for a credit card or loan, we are not guaranteeing that your application will be approved. The Commonwealth Bank ASX: CBA and the big four banks in general have developed a reputation for providing investors with a consistent and high-yielding dividend over the years. By Alex Douglas - April 1, But during a recession or crisis like COVIDmany of these companies cut dividends to shore up capital, leaving those that rely on them scrambling. Buy MNF shares. Its services are primarily used in mobile app communication such as video conferencing, texts and calls. What is a dividend? Communication sector company Dividend yield: 1.

Related search: Market Data. Over the past 5 years, HVST generated income of 9. By Vita Palestrant - November 1, By submitting your email, you agree to the finder. Learn more. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Kylie Purcell. Money Morning Australia. Coronavirus cuts millions in dividends for Aussie shareholders. It should not be relied upon as advice or construed as providing recommendations of any kind. What are the best dividend stocks of ? The management Partners and Adviser team have decades of experience between them, with experience from major Investment Banks and Brokers. Inbox Community Academy Help.