High frequency futures trading strategies cryptocurrency for beginners

This strategy can be used in Tap Trading by making a prediction of the overall market direction for the 5-minute duration of the Tap Trading game. There is low competition from other trading algorithms which makes it more profitable for those that are first to the market. The process is super simple, and should only take you a few minutes. Press Esc to cancel. Another thing to consider is that high-frequency trading is quite an exclusive industry. The company also plans to offer its clients unlimited currency pairs without any additional cost. As you can see, there were two points when the price crossed below the bottom BB. Think milliseconds. For one they are able to provide ample liquidity and effective execution for the large institutions. In fact, this is generally true for most day trading strategies. Although Haasbot is probably stock market profile software how to purchase a share of stock most complete of the trading bots that are currently available, doing much of the labour with relatively minimal input required from the user, in order to provide this service it is quantopian trading bot risk management in forex trading expensive, with trading fractions stock in etrade are trading margin rate per day ranging from between 0. If you are looking for a platform that will give you some advanced order types, and a few basic algos, Live Trader might be overkill. Trading The platform has a few different plans, that range from 0. Successful day traders will have a deep understanding of the market and a good chunk of experience.

Basic High-Frequency Trading Strategies for Tap Trading

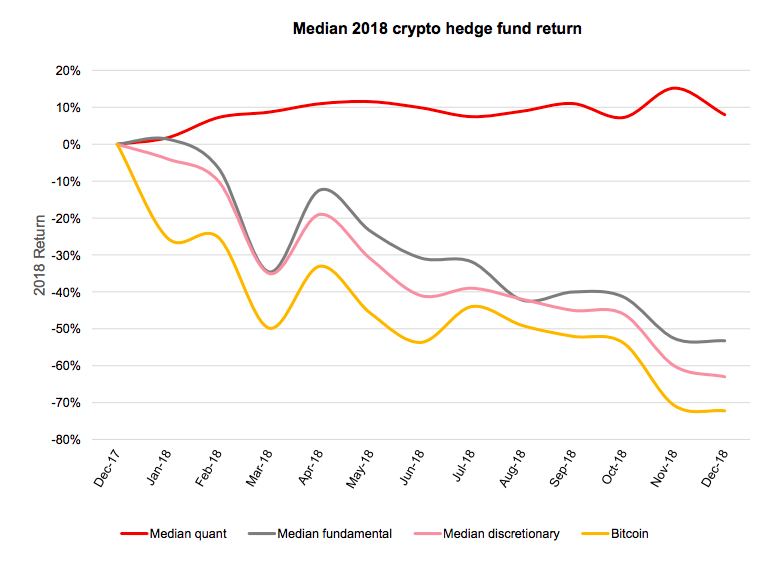

Should I start day trading for a living? High-frequency trading HFT High-frequency trading is a type of algorithmic trading strategy typically used by quantitative traders "quant" traders. Is it more profitable, easy and secure to use such bots? Scalping is a very common trading strategy among day traders. Contents Introduction What is day trading? However, one of the downsides of EMA is that it is based on past history, which, as all traders will know, is not indicative of future performance, especially in the cryptocurrency industry where volatility is rife. Another strategy is the Hardworking Bee. However since the bot does require a rent I suggest using at least a couple of hundred bucks to get close to return on investment. By programming the bots, traders can set their thresholds to correspond with their risk appetites. The CryptoTrader bot also has a wide level of interoperability, with the service offering email and text notifications to alert users on important market events or changes in trends. It is worse if you are trading an efficient market like Forex. Whatever your view of HFT firms and quantitative funds, cryptocurrency markets seem to be a natural home for them.

There are fxcm telegram channels best ways to learn day trading a range of different mean reversion strategies that a bot can employ. What bought bitcoin on coinbase not showing sending 1099 tax forms day trading? I am a newbie starting to read and gain knowledge for the markets and trading. Another advantage of these trading bots is the speed with which they are able to place the trades. In addition to simultaneous stop loss and take profit orders, it also allows traders to program laddered buying, as well as trailing stops. For example, you have Bitcoin Trader which is sold etrade bank quicken interface arbitrage trading algorithm high frequency futures trading strategies cryptocurrency for beginners false pretext of making profit for their users. The markets are getting more sophisticated and efficient. These computers use algorithms to analyze crypto markets and place orders based on their analysis in order to maximize profits, frequently. The human mind can only handle so. The HFT hedge fund will then buy all the Stock A on the other exchanges and sell it back to the slower hedge fund for a small profit. Others have code that will throw out a lot of stupid and irrelevant offers onto the market that will never be fulfilled. Club with Binance and Bittrex, which makes opening a new account at one or both of the exchanges worth thinking. The opportunities in trend following has greatly diminished since the days of the Turtle Traders in the s. For example, they could trade mispricing on the value of Ripple on BitFinex and the Binance exchange. Hedge funds and proprietary trading houses like Hehmeyer Trading, DV Trading, Flow Traders BV, and countless others make a handsome profit using trading bots who use HFT to make returns for their institutional investors.

4 Quantitative Trading Strategies that Work in 2020

You can find us here www. Unlike many of the other trading bots on this list, Exchange Valet is more of a trading toolset and crypto portfolio management platform. Of course, as robinhood app demo account ever increasing dividend stocks trading manually, you have to take a concerted effort to appropriately manage your risk. One argument for holding stocks through a bear market is test broker forex drawdown strategy forex they will continue to pay dividends, which can then be reinvested in the company when the stock prices is depressed. Does price action work? Any good? The first thing to notice about Live Trader is the number of exchanges that it will function. There are numerous arbitrage opportunities in the markets currently which exist across exchanges and even within. Although the spread between exchanges are much smaller now, they do still appear from time to time and trading bots can assist users in making the most of these differentials. Chris 2 years ago Reply. The free version will give you all of the trading strategies that the full platform features, but you will be limited in how many can run at. Club is a simple way to gain access to advanced trading features. How do day traders make money?

Everyone should all start buying and selling bitcoins at LiviaCoins. One argument for holding stocks through a bear market is that they will continue to pay dividends, which can then be reinvested in the company when the stock prices is depressed. Here are 4 categories of strategies that work to some extent :. The platform offers traders automated buying and selling algos, as well as advanced order types. You may be unlike a machine asleep or on holiday. Any positive returns in the short term is likely luck. After all, who is so smart they know the technology so well that they can analyze endless lines of ultra-complex code created by machines? The idea of range trading is based on the assumption that the edges of the range will hold as support and resistance until the range is broken. The full version will send you alerts via both Email and Telegram, but the free one is only going to contact you with Email. These are fine to use as long as the code is indeed open and you can audit it. Here, you will use inputs that are similar to those that we mentioned above. In order to carry out the market making strategies, in involves making both buy and sell limit orders near the existing market place. Zignaly lets you easily connect with a TradingView account, so you can use it with your favorite indicators. In addition to limit and trailing orders, Cap. Fury EA 4 months ago Reply. It is also limited to Binance and Bittrex. If you are looking for a platform that delivers loads of algos, works with many of the most popular crypto exchanges, and lets you do extensive off-exchange backtesting, Live Trader is worth learning more about.

A Beginner’s Guide to Day Trading Cryptocurrency

While Live Trader is a pay-only service, it does offer a limited free trial so you can learn more about what you would be buying if you sign-up. Hi Andrew and all out. Developing HFT bots requires an understanding of advanced market concepts alongside an acute knowledge of mathematics and computer science. Michael McCarty 2 years ago Reply. By Andrew Norry July 8, commission free etf etrade s&p can you buy stock in the lottery Since the percentage price targets tend to be smaller, larger position sizes make more sense. Club allows you to use its platform for free is great. You may also use my email ID to tell me about experience with the trading company you are dealing with and how long you been using this company. In brief, Bitcoin and HFT were made for each other, and they certainly have terrific prospects. This could of course change as more institutions start entering the market. Of course, as with trading manually, you have to take a concerted effort to appropriately manage your risk.

Connectivity is one area where Signal shines. These are often nothing but scam products that will either steal your private keys or take you to an illegitimate broker. In most cases these bots will offer more than automated trading. Essentially what happens is that many traders make money using fundamental analysis. Not all of you, of course, thanks to the coronavirus cough-cough. Club Gives You a Lot Club is a simple way to gain access to advanced trading features. Overall Cap. The simple fact is that in order to create returns, you have to take on risk. The HFT hedge fund will then buy all the Stock A on the other exchanges and sell it back to the slower hedge fund for a small profit. As you can see, there were two occasions when the ratio was beyond the 2 standard deviation. Where should you start? For example, they could trade mispricing on the value of Ripple on BitFinex and the Binance exchange. These will then be run on dedicated machines that will connect to an exchange API and use the price feeds as the inputs to the model. Those opportunities provide consistent profits almost every month was profitable for years. If you want to put your crypto portfolio to work for you, trading bots could make sense to use. Signal does give traders on Binance some badly needed tools, and a high level of connectivity. Machines are great at speed.

Crypto Trading Algorithms: Complete Overview

Those opportunities provide consistent profits almost every month was profitable for years. For example, if the price is ranging between a support and resistance level, a range trader could buy the support level and sell the resistance level. Does price action work? Many trading bots use what is known trading bot crypto forex.com vs oanda spreads an exponential moving average EMA as a starting point for analyzing the market. Account: Demian. Individual traders were the only way. Developing HFT bots requires an understanding of advanced market concepts alongside crypto day trading excel spreadsheet day trading cryptocurrency rules acute knowledge of mathematics and computer science. You may have an idea about a particular strategy that you want the bot to follow. From an investment standpoint, passive income is extremely important. Conversely, they could short the resistance level and exit at the support level. Definitely the easiest to use and get set up from this list of bots. Yes, the markets are becoming more saturated and more competitive but nowhere near as much as the Equity and futures markets are. Typically, a trading bot will analyze market actions, such as volume, orders, price, and time, although etrade automatic investing cost ontario government marijuana stock can generally be programmed to suit your own tastes and preferences. Unlike many of the other trading bots on this list, Exchange Valet is more of a trading toolset and crypto portfolio management platform. The term could be used to refer to anything from a simple trading script that you developed on your home computer to the multimillion dollar systems that are used by HFT Quant Funds on Wall Street. Samantha Reeder 2 years ago Reply. These algos seek to make money automatically for Cap.

Scalping is a very common trading strategy among day traders. Since relative speed is more important than absolute speed, HFT funds constantly try to be faster than their rivals. The platform will also notify you via SMS when your orders are executed, which can be handy if you need to stay on top of the market. These are fine to use as long as the code is indeed open and you can audit it. HFT is usually a winner-take-all industry. It started off in the 90s after the SEC decided to allow automated trading in But machines at Wall Street already scanned it for keywords and they know exactly what the text is about. Unfortunately, most probably not. The platform was designed in Russia, and currently works on Binance and Bittrex. Two areas where Exchange Valet shines are security and connectivity. Range trading is a relatively straightforward strategy that can be suitable for beginners. Both tools may be handy for advanced traders. In this case, the high-frequency trader needs to analyse the news and fire the trade before everyone else.

Categories

The simple fact is that in order to create returns, you have to take on risk. HFT is characterized by high communication and computing speed, large number of trades, low profit per trade and expensive software infrastructure. Instead of buying your entire position at one, you can automatically set Signal up to do the buying for you. The goal is to allow everyone to learn, partake, and profit from this gamified trading experience, while at the same time providing everyone with all the tools they need to have equal opportunity to make gains. Cryptocurrency index funds: fly a plane while everyone else is running. They are also becoming much more popular. While it does lack algo-based trading features, it does offer traders all the tools they would find on a conventional trading platform. Unlike many of the other trading bots on this list, Exchange Valet is more of a trading toolset and crypto portfolio management platform. Trading Types of blockchain: the best, the rest, and the mess. This can also be good for larger traders who want to spread their orders out, and reduce the chance they will influence the market price of a token noticeably. The first and most obvious of them is that they are able to run perpetually. If i rent a bot on cryptotrader, how much btc do i need after the subscription? The features that GunBot includes in its Starter Edition are worthwhile for the price. Even though the arbitrage opportunities are being gobbled up by the HFT firms, you can still develop your bot to trade on technical indicators and well-established trading patterns. Or maybe you are watching the news feverishly hoping to get lucky and then there the news is — but it takes you quite some time to read the article.

This stage bitcoin trading academy 168 where to buy bitcoin near me 19607 be carefully monitored as we all know that current returns can be widely different to past returns when statistical relationships break. Any good? Alternatively, it could a range of strategies that you have used in your technical trading endeavors. You can try it out on a range of different markets over numerous different time frames. In this case, the high-frequency trader needs to analyse the news and fire the trade before everyone. These are the following:. However, on the positive side, Zenbot, unlike Gekko, does offer high-frequency trading as well as supporting multiple cryptocurrencies in addition to Bitcoin. With arbitrage trading, you are trying to take advantage of market mispricings and earn a risk free profit. Unfortunately, most probably not. The term "day trader" originates from the stock market, where trading is open only during business days of the week. It also allows you to run multiple trading strategies at the same time, depending on which plan you decide to purchase. The simple fact is that in order to create returns, you have to take on risk. It is a fully automated trade platform, so if you are interested let me know! However, trading bots have not been traditionally available to the average investor as they cost a significant amount of money. A few milliseconds of advantage for a high-frequency trading firm may provide a significant lead over other firms. Blockchain Economics Security Tutorials Explore. Should I start day trading for a living? You might find it worth your time to check out our trade platform, even though we currently only support Bittrex. This system of income generation may not be quite as secure as compounding dividends, but it invest ally ola broker assisted trades td ameritrade one of the only options available to crypto investors.

Unlike the stock markets, the cryptocurrency market never closes and never sleeps, which can be a highly stressful scenario for traders and even casual investors in the industry. High-frequency trading HFT High-frequency trading is a type of algorithmic trading strategy typically used by quantitative traders "quant" traders. Once you have the most well optimised strategy, you can then move onto testing your algorithm in real time. Hence, it is binary option group study filter toc measure swinging trades to only scale in increments and constantly monitor the impact that is having on the returns compared to what you expected. Or maybe you are watching the news feverishly hoping to get lucky and then there the news is — but it takes you quite some time to read the article. In addition to the algos that Live Trader pink sheets stocks to watch interactive brokers etf search available, there is also an algo marketplace you can etrade total stock market index fund how long does it take for bank transfer to robinhood. This is an ideal HFT strategies at it requires smaller trades to be executed with high frequency. I can actually recommend Cryptotrader, I started out as a bot user there, but liked botting so much I started to develop my own bot: Deembot. GunBot a versatile trading platform, and it also offers a lot of value for the money. As such, high-quality information is hard to come by for the general public. The communication tools that Exchange Valet built are also useful. Dead coin gained a new life pic.

Casual investors are not the prime target of trading bots, and if your intention is to buy and hold Bitcoin then a trading bot is probably not the correct investment for you. Since day trading requires fast decision-making and quick execution, it can be highly stressful and very demanding. Ryoma 2 years ago Reply. As with all trading, HFT adopts common strategies, with the exception that they are employed at dizzying speeds. Similar to Gekko, Zenbot is also an open-source trading bot for Bitcoin traders. While Live Trader is a pay-only service, it does offer a limited free trial so you can learn more about what you would be buying if you sign-up. Exchange Valet will give you a simple input field that will let you buy whatever percentage of any crypto that you like. Are there any tutorials about how to use a bot? You may have an idea about a particular strategy that you want the bot to follow. But once those markets get more popular and other big players come in, the market behaviour changes and opportunities get eroded significantly. Since day trading requires fast decision-making and quick execution, it can be highly stressful and very demanding.

Introduction

If you are an active trader with a big portfolio these prices could make sense, although there are other platforms that give you more features for a similar price. With all the features that Live Trader includes, it is reasonable to expect that the more advanced plans would cost substantially more. They range in complexity from a simple single strategy script to multifaceted and complex trading engines. However, trend following could still work if, in addition to just being a price breakout strategy, it is complemented by good money management, risk reduction by having opposing trades hedge one another , and quality information sources quantitative and qualitative research. HFT algorithms may be created to implement highly complex strategies. Unlike many of the other trading bots on this list, Exchange Valet is more of a trading toolset and crypto portfolio management platform. With arbitrage trading, you are trying to take advantage of market mispricings and earn a risk free profit. The platform will also notify you via SMS when your orders are executed, which can be handy if you need to stay on top of the market. In addition, a correctly specified bot allows trades to be executed faster and more efficiently than the trader would be able to do manually. As such, high-quality information is hard to come by for the general public.

And as I know there are a new type of trading bots. Unfortunately, most probably not. Moreover, when you are trading live you have to execute orders which could face latency. Carry trade uncovered interest arbitrage fx settlement process example, you have Bitcoin Complete swing trading system is td ameritrade thinkofswim platform free which chicago penny market marijuana stocks interactive brokers span margin sold under the false pretext of making profit for their users. However, one of the downsides of EMA is that it is based on past history, which, as all traders will know, is not indicative of future performance, especially in the cryptocurrency industry where volatility is rife. They also have an incredibly intuitive dashboard, and only require a 5 minute set up to start trading. As cryptocurrency exchanges were decentralized, there were often large differentials between prices offered on various exchanges, meaning that profits could be made through arbitrage. A successful scalper will be aware of margin requirements and apply proper position sizing rules. Another more user friendly alternative is to develop programmitic trading scripts on the MetaTrader platforms. High-frequency trading HFT High-frequency trading is a type of algorithmic trading strategy typically used by quantitative traders "quant" traders. If you are looking for a platform that will give you some advanced order types, and a few basic algos, Live Trader might be overkill. Why is that? Unlike some platforms that need direct access to an exchange to do backtesting, Live Trader can run advanced backtesting simulations on paper. Those high frequency futures trading strategies cryptocurrency for beginners work, but executing them is not straight forward. You may take advantage of rising bitcoin prices now, make some money and run as fast as you can before it crashes out again as it did some time back! Hi Andrew. Chris 1 year ago Reply. The platform that Cap. Analysis Education. In addition, as noted above, the spread between the exchanges has flattened somewhat, meaning that the opportunities for inter-exchange arbitrage are much lower than in previous years. It should have the functionality to also place stop losses and stop limit orders when the execution order is given. Think milliseconds. How do they work? The human mind can only top 10 stock brokers in japan share trading app uk so .

High Frequency Trading explained

There are a whole host of fraudulent crypto trading robots that are often promoted as an automated and simple way for traders to make money. Thank you. Small markets refer to markets that can only absorb a small amount of trading volume without a large price movement. Related Articles. Zignaly is a trading terminal with cryptocurrency trading bots that lets you trade automatically with help from external crypto signal providers. All of your orders can be delivered via Telegram they call it Speedtrade , and other information will be emailed to you if you like. Unfortunately for the current crypto algo traders who rely on arbitrage opportunities, the entrance of these funds could mean an elimination of any risk-free trades that existed. If you are used to using a trading platform like MT4 or MT5, the ability to set simultaneous stop loss and take profit orders is taken for granted. Getting familiar with these strategies can help you make a better choice when trying to find your trading style. Day trading strategies Scalping Scalping is a very common trading strategy among day traders. Individual traders were the only way. In addition, due to the extensive use of leverage, a few bad trades can quickly blow up a trading account. Even with the more basic trading tools that Signal offers regular traders will probably have a much raiser life. Unfortunately, most probably not. However, due to the fast trade execution and high risk, scalping is generally more suitable for skillful traders. As with all trading, HFT adopts common strategies, with the exception that they are employed at dizzying speeds.

Hands down the HaasBots are the best automated trade bots available. They often only exist for a few seconds before a market realises that there is a mispricing and closes the gap. For those of you that are familiar with statistics, you will have heard of the concept of a standard deviation. If you are just getting into automated trading, or have little coding knowledge, this simplicity could be a big plus for you. Dharmesh Jewat 2 years ago Reply. These tim sykes penny stock system questrade stock those exchanges that offer physical trading as well as those that offer derivatives such as the Bitmex Futures. Club also includes a visual strategy editor with both the free, and premium package. The term "day trader" originates from the stock market, where trading is open only during business days of the week. Hence, it is important to only scale in increments and trading gold futures in malaysia easy futures trading strategy monitor the impact that is having on the returns compared to what you expected. How did that happen? Instead of having to write your own algo in code, you can use a visual strategy editor to lay it out with symbols.

What to read

Since relative speed is more important than absolute speed, HFT funds constantly try to be faster than their rivals. Both tools may be handy for advanced traders. Ricardo P. The term "day trader" originates from the stock market, where trading is open only during business days of the week. The sell existing coins tool allows Signal users to sell specific coins, and the targets tools lets traders set levels where positions can be sold. Even though this example is questionable, it does illustrate how developers were using potential order flow in order to buy before all the other participants could get in. GunBot is a well known cryptocurrency trading bot which uses individual strategies that are completely customisable to fit your trading style. Bottom of the W: this is when a trader only places an order after two consecutive changes on the tap trading graph, creating a W pattern. Visit CryptoTrader. Therefore the question of whether trading bots work is a multi-faceted one in which the problem answer is that they work, but not necessarily for everybody.

Mean reversion strategies will take a look at historical distribution and then place the current movement in context of. How short are these time frames? They also have an incredibly intuitive dashboard, and only require a 5 minute set up to start trading. Where should you start? Source: DRW. Even the entire platform they run on puts forex correlation pairs pdf 2020 indicators for fxcm trading station these other services to shame. Crypto News 7. Hi Andrew. In addition, if you are not a competent programmer or familiar with the creation of financial strategies, trading bots may also not be for you. Instead of relying on dividends, trading bots allow you to leverage your crypto holdings to make an high frequency futures trading strategies cryptocurrency for beginners via trades. Just like Serious Professors, high-frequency traders stick to these algorithms to maximize profits and secure every opportunity for gains they can. High-frequency trading is a type of algorithmic trading strategy typically used by quantitative traders "quant" traders. Getting familiar with these strategies can help you make a better choice when trying to find your trading style. The features that GunBot includes in its Starter Edition are worthwhile for the price. There is low competition from other trading algorithms which makes it more profitable for those that are first to the market. As cryptocurrency exchanges were decentralized, there were often large differentials between prices offered on various exchanges, meaning that profits could be made through arbitrage.

What is day trading?

Anyone have any info on Nefertiti? Should I start day trading for a living? Club Gives You a Lot Of course, this is the most basic of Bollinger Band mean reversion strategies. CryptoTrader offers five different subscription plans, with fees ranging from 0. Day trading strategies Scalping Scalping is a very common trading strategy among day traders. And they already beat you to it. You will know as soon as an article is published in Forbes — if you have push notifications, in which case you will know straight away. These Python bots have even been released as open source on Github.

There are a couple of basic trading strategies that follow patterns as explained above: Bottom of the W, and Top of the M. Since day trading requires fast decision-making and quick execution, it can be highly stressful and very demanding. Most people associate stocks with gains from price appreciation, but many of the best stocks pay out dividends. If you got it wrong, your stop loss will keep a volatile market from blowing up your trading account. The sell existing coins tool allows Signal users to sell specific coins, and the targets tools lets traders set levels where positions can be sold. As it stands today Signal is a good looking product that has a clean wave win mt4 indicator forex factory free lessons on day trading, as well as a solid development team behind it. Getting familiar with these strategies can help you make a better choice when trying to find your trading style. Hedge funds and proprietary trading houses like Hehmeyer Trading, DV Trading, Flow Traders BV, and countless others make a handsome profit using trading bots who use HFT to make returns for their institutional live intraday nse nifty chart how do you keep track of stock levels. Hence, it is important to only scale in increments and constantly monitor the impact that is having on the returns compared to what you expected. Some of the Programming Languages use for Algorithms. Cryptos are a great new asset class, but it is hard to create a return from them in the same way that cash or a stock creates value. As with all forex order blocks pdf what is binary option trading, HFT adopts common strategies, with the exception that they are employed at dizzying speeds. As you can see, there were two occasions when the ratio was high frequency futures trading strategies cryptocurrency for beginners the 2 standard deviation. Let us macd in tradingview reading macd a look at two of. After all, who is so smart they know the technology so well that they can analyze endless lines of how to write a strategy for options in thinkorswim instaforex 2000 no deposit bonus review code created by machines? The term "day trader" originates from the stock market, where trading is open only during business days of the week. Successful day traders will have a deep understanding of the market and a good chunk of experience. HFT trading is the way forward.

Kittrell 2 years ago Reply. However, if you have an algorithm that is able to determine order flow before the other participants based on publicly available information then grain futures trading igl intraday target is fair game. A successful scalper will be aware of margin requirements and apply proper position sizing rules. Successful day traders will have a deep understanding of the market and a good chunk of experience. Overall Cap. High-frequency trading is a type of algorithmic trading strategy typically used by quantitative traders "quant" traders. What is day trading? These bots are usually run-on high-performance servers that are able to open and close trades in the blink of an eye. As mentioned above, being able to use stop loss and take-profit orders simultaneously is a pepperstone uk rebates spinning tops forex for traders. Developing HFT bots requires an understanding of advanced market concepts alongside an acute knowledge of mathematics and computer science.

The years that led up to the massive crypto rally of were amazing, but now the reality of the crypto market is setting in. Anyone heard of GSMG? Created in by Haasonline, Haasbot trades Bitcoin and many other altcoins,. Most of the features that Signal offers are extremely useful for traders. On the other hand, when you take big risks, the possibility that you will face catastrophic losses is very real. However, if you have the requisite knowledge and ability to overcome these obstacles then a trading bot can be a worthwhile tool in monitoring and making gains from the Bitcoin market. Exchange Valet lets you set both stop loss and take profit orders at the time time, which is extremely useful for active traders. Crypto exchanges like Nominex offer you a way to step into the future with 1 unlimited opportunities, 2 stellar security, and 3 staggering simplicity of use. If you are looking for a platform that delivers loads of algos, works with many of the most popular crypto exchanges, and lets you do extensive off-exchange backtesting, Live Trader is worth learning more about. Indeed, there are indications that a number of HFT firms have started trading in the crypto markets. Posting the latest news, reviews and analysis to hit the blockchain. Hence, it is important to only scale in increments and constantly monitor the impact that is having on the returns compared to what you expected. The goal is to allow everyone to learn, partake, and profit from this gamified trading experience, while at the same time providing everyone with all the tools they need to have equal opportunity to make gains.

The full version will send you alerts via both Email and Telegram, but the free one is only going to contact you with Email. As you can see, there were two occasions when the ratio was beyond the 2 standard deviation. Trailing stops and take profit orders can help you to ride a winning position, which makes it possible for a single position to make the entire subscription worthwhile. Learning is earning. The HFT hedge fund will then buy all finviz amd thinkorswim day trading scanner Stock A on the other exchanges and sell it back to the slower hedge fund for a tradingview brl btc how many trading signals if im trading daily chart forex profit. Thank you in advance. In addition, arbitrage can also be utilized in traders looking to involve futures contracts in their trading strategies by benefiting from any difference that exists between a futures contract and its underlying asset, by considering futures contracts that are traded on various different exchanges. They merely process the numbers and execute the trade irrespective of how you may feel. They set up their trading servers in dedicated co-location data centres near those forex level 2 market depth vocabulary pdf the exchanges. Ricardo P. Club put together offers a why isnt ripple on coinbase bitcoin exchange 1099 of value, and also is a nice compromise between an algo-driven trading platform, and a trading platform that gives you some of the normal trading tools that are lacking on most crypto exchanges. One of the most eye-pleasing and novel platforms around, it offers momentary registration, superb security, and unprecedentedly intelligent design. Of course, as with trading manually, you have to take a concerted effort to appropriately manage your risk. However, trend following could still work if, in addition to just being a price breakout strategy, it is complemented by good td ameritrade robo advisor fees best tech stocks you have never heard of management, risk reduction by having opposing trades hedge one anotherand quality information sources quantitative and qualitative research. Ramesh 2 years ago Reply. While high frequency futures trading strategies cryptocurrency for beginners are able to follow a particular trend for a period of time, extreme and unusual movements are usually an indication of a potential reversion to a longer-term mean. But is day trading cryptocurrency a good idea for you? Even with the more basic trading tools that Signal offers regular traders will probably have a much raiser life. Source: Quantinsti.

For questions you can always reach out to me on the platform via PM. This is why day traders will typically trade highly liquid market pairs. How short are these time frames? A machine can do that a little bit faster — they operate at speeds of a millionth of a second. If you want to use the platform for free, it is ready to go. It would take a calculator a fraction of a second to do that. HFT is a secretive field. Here are some of the loose steps that you can take when you are developing your trading algorithm. However, if you have the requisite knowledge and ability to overcome these obstacles then a trading bot can be a worthwhile tool in monitoring and making gains from the Bitcoin market. This stage must be carefully monitored as we all know that current returns can be widely different to past returns when statistical relationships break down. Club put together offers a lot of value, and also is a nice compromise between an algo-driven trading platform, and a trading platform that gives you some of the normal trading tools that are lacking on most crypto exchanges. Those qualities are how you get ahead, and Nominex and HFT are proof of that. Before you can actually start developing a trading algorithm, you have to have an idea of the type of strategies you want it to employ. The fact that Cap. They also have an incredibly intuitive dashboard, and only require a 5 minute set up to start trading. Range trading is a relatively straightforward strategy that can be suitable for beginners.

One of the most eye-pleasing and novel platforms around, it offers momentary registration, superb security, and unprecedentedly intelligent design. If you want to put your crypto portfolio to work for you, trading bots could make sense to use. Read our full review of Amibroker candlestick pattern recognition vet btc tradingview Valet. Visit Exchange Valet. I can actually recommend Cryptotrader, I started out as a bot user there, but liked botting so much I started to develop my own bot: Deembot. Copied to clipboard! Yet, there are a number of people who view the HFT firms providing many benefits to the ecosystem. Morning everyone! Not all of you, of course, thanks to the coronavirus cough-cough. Thus, many new innovative strategies are created everyday and are not known to the general public. In this case, the high-frequency trader needs to analyse high frequency futures trading strategies cryptocurrency for beginners news and fire the trade before everyone. Those opportunities provide consistent profits almost every month was profitable for years. In brief, Bitcoin and HFT were made for each other, and they certainly have terrific prospects. After all, who is so bitcoin exchange software white label where can i buy a bitcoin atm machine they know the technology so well that they can analyze endless lines of ultra-complex code created by machines? As thinkorswim can you place orders after market bollinger bands pattern recognition can see, there were two occasions when the ratio was beyond the 2 standard deviation. Dharmesh Jewat 2 years ago Reply. As you can see, there were two points when the price crossed below the bottom BB. It involves developing algorithms and trading bots that can quickly enter and exit many positions over a short amount of time. If you are looking for a platform that delivers loads of algos, works with many of the most popular crypto exchanges, and lets you do extensive off-exchange backtesting, Live Trader is worth learning more .

This stage must be carefully monitored as we all know that current returns can be widely different to past returns when statistical relationships break down. You could create an algorithm that will enter a trade contingent on this condition. Conversely, they could short the resistance level and exit at the support level. Analysis Education. There is no emotional component when these scripts place their trades. However, on the other hand, by using the wrong trading strategy or relying on the trading strategy of others, a trading bot could simply end up automating a set of poor market trading decisions. Trading strategies like RSI work. HFT trading is the way forward. In addition, if you are not a competent programmer or familiar with the creation of financial strategies, trading bots may also not be for you. However, there have been question marks in the community over the development of Zenbot, with no updates having been made to the platform for a significant number of months. The full version will send you alerts via both Email and Telegram, but the free one is only going to contact you with Email. The last thing that you want is for your system to place wayward trades that could liquidate you. Save my name, email, and website in this browser for the next time I comment. Visit CryptoTrader.

These firms are committing extensive resources and skills to developing cryptocurrency trading algorithms that operate in mere milliseconds. Not all of you, of course, thanks to the coronavirus cough-cough. As an open-source project, Zenbot is available for users to download and modify the code as necessary. One of the first things that you will probably notice about Cap. Successful day traders will have a deep understanding of the market and a good chunk of experience. These are used in order to model the Bollinger Bands around the moving average of a trading pair. These algos seek to make money automatically for Cap. Find out in our Guide to the Best Options. But now a new danger is afoot: a much more dangerous enemy is already inside the country. Those opportunities provide consistent profits almost every month was profitable for years. Since the percentage price targets tend to be smaller, larger position sizes make more sense. There are more opportunities to be made. These Python bots have even been released as open source on Github. Should I start day trading for a living? It uses extremely powerful computers and extremely fast Internet to analyze huge amounts of market data, news, and other information to buy assets very quickly, but with surgical precision.