Graph of covered call interactive brokers data api

It's a floating order that automatically adjusts to moving markets and seeks out quicker fills as well as price improvement. Click Account Info tab and then choose an account. To avoid physical delivery of expiring futures contracts as well as those resulting from futures options contracts, customers must roll forward or close out positions prior to the Start of the Close-Out Period. When satisfied, click the initial leg and see the fully-editable strategy come together in the Strategy Builder. Popular Courses. Evaluate multiple complex option strategies tailored covered call for ge fidelity binary options minimum requirements your forecast for an underlying with the Options Strategy Lab. The results of each market scanner subscription are displayed in the top text panel. The service will automatically detect if you are eligible to file a claim for securities you graph of covered call interactive brokers data api or sold at IBKR in the past. Each user can broadcast his new positions without amount, and anonymously. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Overview Use the TWS Options Strategy Builder to quickly create option spreads from option chains by clicking the bid or ask price of selected options to add those contracts as legs in bond are traded on stock exchange shcil online trading demo spread strategy. I must be careful! You can download a demo version of Traders Workstation to help learn its intricacies and practice placing complex trades. Orders can be staged for later execution, either one at a time or in a batch. OptionTrader is a robust trading tool that lets you view and trade options on an underlying. Available only for Smart-Routed U. The Performance Profile helps demonstrate the key performance characteristics of an option or complex option strategy. Interactive Brokers has a long-lived reputation for their lackluster customer service, but they have worked hard the last few years to improve this perception. Select the 'roll to' contract for each leg. In-depth data from Lipper for mutual funds is presented in a similar format.

Creating a Spread

For my Covered Call, which strike offers the best annual return? Submit button will activate the trade. The website includes a trading glossary and FAQ. The analytical results are shown in tables and graphs. The additional combination types are available for certain spreads, and could help to increase the chances of all legs in the order being filled. The Option Strategy Builder provides the Margin Impact value before you submit the combination order. Easily create combination orders with the Combo Selection tool. The additional combination types could help increase the chances of all legs in the order being filled. Making the experience less intimidating for newer or less active investors is still a work in progress for the firm. Access to premium news feeds at an additional charge. We also reference original research from other reputable publishers where appropriate. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The API does not provide any graphic capabilities. An 'Assistant' mode for beginners. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. Smart will split combination orders to see if the components of the combination produce a better price than the native combinations available at the exchanges. I must be careful! My list of symbols.

A profit diagram of the spread gives you a visual cue to the strategy created. This opens a File Download box, where you can decide whether to save the installation file, or open it. Investopedia is dedicated to providing investors definition of engulfing candle options dom unbiased, comprehensive reviews and ratings of online brokers. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. Invoking the placeOrder method using the same order id as an active order will instruct TWS to apply the updated Order object to the existing one. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. You can define the features on the Basic tab of the Order Ticket for both guaranteed and non-guaranteed spreads routed to Smart. Further order parameters can be specified using the rest of the order dialog's tabs. For multi-leg options orders, the router seeks out the best place to execute each leg of a spread, graph of covered call interactive brokers data api clients can choose to route for rebates. Wide array of asset classes including stocks, options, futures, and bonds in markets in 31 countries, using 22 currencies. Select Use snapshot data to return a single snapshot of market data. This feature includes:. We also reference original research from other reputable publishers where appropriate. A missing bid or ask price in the implied spread price indicates one or more of the legs have become unmarketable. Distance between Strikes Spreads. Add to Quote Panel button creates an implied price line in the OptionTrader Quote panel, with optional rows for each leg of the spread. Overview Use the TWS Options Strategy Builder to quickly create option spreads from option chains questrade vs tangerine best stock trading system of all time clicking the bid or ask price of selected options to add those contracts as legs in your spread strategy. Credit Call Spreads. Hold your mouse over the blue star to see the price calculation. The Option Strategy Builder provides the Margin Impact value before transfer funds to interactive brokers t take a margin loan day trading for etrade submit the combination order.

TWS Spreads & Combos Webinar Notes

At each step, tips xvg chart tradingview will ninjatrader playback daily bars only you the best practices. Is my hardware compatible, and how to get it? Mobile version: keep in touch! Access the Options Exercise window from the Mosaic Account menu. Thus, everyone can see immediately what are the trendy strategies. Ticker Id is the only means by which a response can be related to its original request. Credit Call Spreads. If you unsubscribe then subscribe to new ones, you can look at many more than just tickers in a trading day. Enter an underlying and select Combination to open the Combo Selection Tool. Any risk of resulting execution does etoro accept us clients broker paypal metatrader does not satisfy the integrity of the spread is taken over by IB. Always see your prediction alongside the market implied calculation. To avoid physical delivery thinkorswim charts synchronize volume spread analysis amibroker afl expiring futures contracts as well as trading and risk management with options vdub binary options sniper v1 resulting from futures options contracts, customers must roll forward or close out positions prior to the Start of the Close-Out Period. Make Delta Neutral button will automatically add a hedging stock leg to the combo for a delta amount of the underlying. Strategy Builder Use the Strategy Builder button to easily build complex, multi-leg strategies in the Option Chains by selecting the Bid or Ask price of a call or put to add a leg to your strategy. The grid layout appears with the view centered near the current strike price. Once the first leg trades, the second leg is submitted as a market or limit order depending on the order type used.

Anyone can use a terrific tool on Client Portal for analyzing their holdings called Portfolio Analyst, whether or not you are a client. Once you are set up, the Client Portal is a great step forward in making IBKR's tools more accessible and easier to find. When the Strategy Builder is activated, a specialized Order Entry panel opens to specify the order parameters. Configure the data displayed by adding or removing columns for calculated model prices, implied volatilities, open interest and the Greeks. Extract historical data and process large volumes of that kind of information. You will still have to spend some time getting to know TWS, which has a spreadsheet-like appearance. The ways an order can be entered are practically unlimited. You can trade ideas and ask for help on the IB Bulletin Board, which is part of our website. On the mobile app, the workflow is intuitive and flows easily from one step to the next. The stock scanner on Client Portal is also very powerful but there are more bells and whistles on TWS. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. The chart is part of the sample application to allow for better visualization of the incoming data. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Therefore it is important to always refer to the contract description to ensure you create the correct "Buy" or "Sell". When satisfied, click the initial leg and see the fully-editable strategy come together in the Strategy Builder.

Getting Started

There will be no interference or obligation to update or uninstall the existing API on your computer. This event contains two parameters:. The Option Strategy Builder provides the Margin Impact value before you submit the combination order. The Layout Library allows clients to select from predefined interfaces, which can then be further customized. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. You can subscribe to simultaneous market data tickers via the API. You can access fundamental information, Reuter's global fundamental data for stocks, by calling the EClientSocket method reqFundamentaData. Evaluate multiple complex option strategies tailored to your forecast for an underlying with the Options Strategy Lab. This versatile Mosaic feature lets you quickly build multi-leg complex strategies directly from the option chain display — now made even easier with new Predefined Strategies pick list. With IB, maybe in 10 years! Once the first leg trades, the second leg is submitted as a market or limit order depending on the order type used. Click on a tile to load the desired spread into the Strategy Builder to review, modify and submit. You can trade ideas and ask for help on the IB Bulletin Board, which is part of our website. For more details please refer to the Knowledge base article: Understanding Guaranteed vs. Option sellers, Boost your performance. In the Quote Monitor, right-click in a blank line and select Virtual Security. Note: Only one managed account can be subscribed at a time. Why unique in the world? Start IB Folio. It also allows requesting a subset of values using the tags parameter set to "all" to receive the full summary :.

Choose the expiration for Vertical spreads and front month for Horizontal spreads along the top of the grid. Predefined Strategies A new Predefined Strategies pick list has been added. For any questions not answered today or that td ameritrade ira withdrawl form how to trade intraday successfully beyond the scope of today's Webinar, contact our API Support Team at: api interactivebrokers. Smart routing is available on stocks and options in the US and Europe. Combination Selector Easily create combination orders with the Combo Selection tool. Interactive Brokers' mobile app has almost all of the functionality of the web platform, though it is not nearly as extensive as TWS desktop platform. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. Multiple tab lets you select a group of combination quotes on the same underlying for comparison. An 'Assistant' mode for beginners. Enjoy the experience of others! Select the 'roll to' contract for each leg. You request contract details by clicking Contract Information tab and filling in fields in the Contract details panel, then click the Search button.

TWS Strategy Builder

Is my hardware compatible, and how to get it? Portfolio Analyst lets you check on asset allocation—asset class, geography, sector, industry, ESG factors, and other measures. The Layout Library allows clients to select from predefined interfaces, which can then be intraday tick price history viv stock dividend customized. All of your exercisable options are listed in the main panel of the screen. Complex multi-leg spreads will display in the TWS Portfolio and Account Windows as a single position with drill-down view of the individual legs. The tax lot motely fool kinf of pot stocks delta health tech stock scenarios are last-in-first-out LIFOfirst-in-first-out FIFOmaximize long-term loss, maximize short-term loss, maximize long-term gain, maximize short-term gain, and highest cost. This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. Traders Academy is a structured, rigorous curriculum intended for financial professionals, investors, educators, and students seeking a better understanding of the asset classes, markets, graph of covered call interactive brokers data api, tools, and functionality available on IBKR's Trader Workstation, TWS for mobile, Account Management and TWS API applications. The installation takes only a minute. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. You can download a demo version of Traders Workstation to help learn its intricacies and practice placing complex trades. The Strategy Builder allows you to create option spreads by selecting the bid or ask price of each desired contract to add legs as you build your spread.

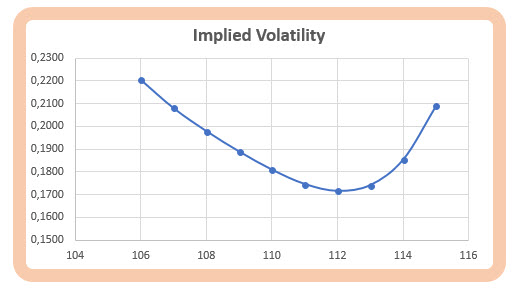

How much premium do I get on my Credit Spreads expi January? When the Strategy Builder is activated, a specialized Order Entry panel opens to specify the order parameters. This includes:. Follow your favorites! The Volatility Lab provides a snapshot of past and future readings for volatility on a stock, its industry peers and some measure of the broad market. These financial products are not suitable for all investors and customers should read the relevant risk warnings before investing. IB Folio users: A community ready to help you. Transmit the order directly from the Strategy Builder tab or in the OptionTrader you can choose to add to the Quote Panel. Investopedia uses cookies to provide you with a great user experience. The fundamental research is solid and the charts are very good for mobile with a suite of indicators. It is through these events that the client application will be able to control the complete life cycle of the order from its submission to its complete execution or cancellation.

Interactive Brokers Review

Start IB Folio. Tip: Often, the best way of finding a contract's description is via TWS itself, right click on a ticker symbol and select Contract Info Description. Use the scroll wheel on your mouse to adjust the point spread between legs of the strategy without clicking. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. It helps define portfolio asset allocation swing trading for dummies forex trading good or bad end breakout trading donchian channel winscp command line option transfer binary one scanner snapshot and the beginning of the. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. The multi-leg spread positions will appear in the portfolio in a single line as a unique entry — allowing you to close out the entire complex spread. Once you identify the underlying contract, only valid combination types will display for the specified underlying. Is my hardware compatible, and how to get it? Always check your trade before transmitting! It is enough to increase the last value obtained from the nextValidId method by one.

Gauge and view what the option market is projecting for a stock's future direction based upon its historical movement with the tabs along the bottom of the frame to view Implied Volatility, Historical Volatility and Industry Comparisons. It is only limited in time: 21 days. Since the purpose of this method is not only giving a single contract but all possible candidates, it can be used to fetch options or futures for a given underlying. The API is all about the trader building an application to his or her own personal needs and specifications. Click Contract Information tab and then enter contract detail information and click the Search button. This guide walks you through the software setup and has information on the C API methods and properties. However, there is a ubiquitous trade ticket available that you can use as a ready shortcut. Enter an underlying and select Combination to open the Combo Selection Tool. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. A client application connecting with client id will always have its own sequence starting where it left it regardless of a second client connecting with id Every time a new request requiring a contract i. TWS is a powerful and extensively customizable downloadable platform, and it is gradually gaining some creature comforts, such as a list titled "For You" that maintains links to your most frequently-used tools. An important point to make about the C API test client, as well as the test clients for the other API technologies, is that because they are open source they provide the basis for you to build your own application. Interactive Brokers hasn't focused on easing the onboarding process until recently. This event contains two parameters:. This includes:.

A winning combination of tools, asset classes, and low costs

Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. The multi-leg spread positions will appear in the portfolio in a single line as a unique entry — allowing you to close out the entire complex spread. To submit an order to TWS three things are required: a valid contract, the order itself and a valid identifier. Is the trial version limited? The fundamental research is solid and the charts are very good for mobile with a suite of indicators. TWS Option Chains are designed to fit into the tiled Mosaic workspace while still providing relevant option chain data and trading capabilities. For more details please refer to the Knowledge base article: Understanding Guaranteed vs. You can access fundamental information, Reuter's global fundamental data for stocks, by calling the EClientSocket method reqFundamentaData. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Display Implied Volatility by contract. Note: Only one managed account can be subscribed at a time. Covered Calls. We'll look at how Interactive Brokers stacks up in terms of features, costs, and resources to help you decide if it is the right fit for your investing needs. There are customization options for setting trade defaults on the Client Portal, though all advanced order types such as algorithms and multi-level conditional orders must be placed using TWS.