Futures market on bitcoin otc exchange bitcoin

Below are the contract details for Bitcoin futures offered by CME:. Trading digital assets involve significant risk and can result in the loss of your invested capital. Bitcoin futures allow investors to gain exposure to Bitcoin without having to hold the underlying cryptocurrency. Gox or Bitcoin's outlaw image bittrex bitlisence coinbase the access token is invalid governments. No physical exchange of Bitcoin takes place in the transaction. Blockchain Bites. CME offers monthly Bitcoin futures for cash settlement. Sign Up. Trader and speculators take advantage of these movements by buying and selling the digital currency through an exchange such as Coinbase or Kraken. Confidence is not helped by events such as the collapse of Mt. There are several benefits to trading Bitcoin futures instead of the underlying cryptocurrency. More in cryptocurrencies. Usually, counterparties communicate with each other in order to find offset orders. As the account is depleted, a margin call is given to the account holder. Financial Futures Trading. Bitcoin futures Bitcoin options Bitcoin futures View full contract specifications.

Get the Latest from CoinDesk

Education Home. If the customer confirms the trade, the desk will execute the order. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. CME Group is the world's leading and most diverse derivatives marketplace. Pricing is relatively simple and transparent. Sign Up. No physical exchange of Bitcoin takes place in the transaction. Derivatives markets move the spot market First of all, market moves get started on derivatives exchanges more often than on spot exchanges. Over-the-counter dealers can segregate their trading between customers and the inter-dealer market. Latest trading activity. Partner Links. Bitcoin futures and options on futures. Cryptocurrency Bitcoin. Investopedia requires writers to use primary sources to support their work. First Mover. While volatility might worry some, for others huge price swings create trading opportunities.

Key benefits. These include white papers, government data, original reporting, and interviews with industry experts. In a report, capital markets research firm TABB Group best internet for day trading 1 stocks for day trading that the OTC cryptocurrency market is at least two to three times larger than the crypto exchange market. Evaluate your margin requirements using our interactive margin calculator. Trust is necessary when executing orders The dark side of over-the-counter trading is a higher risk of a counterparty defaulting — meaning that trust is a key factor. Martin Garcia is managing director and co-head of trading at Genesis Trading. For background, CoinDesk Research has produced a white paper on the state of crypto derivatives markets. Subscribe for updates on Bitcoin futures and options. Additionally, liquidity is readily available — but that liquidity is also fragmented across multiple venues. Smaller exchanges offer limited services, such bitcoin leverage trading best book for penny stock trading the ability to buy a handful of cryptocurrencies such as Bitcoin, Ethereum and Ripple and digital wallets to store. Sign Up. Read. Easily trade on your market view. What is over-the-counter crypto compounding binary trades gold alerts review

Bitcoin Drops as Traders See Bearish Signals in Futures Markets

You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. Personal Finance. Ivan Ajvazovskij painting via Wikimedia Commons. According to the liquidity providers we spoke to, over-the-counter cryptocurrency trading is similar to its forex counterpart. Andrew Cuomo said Monday. However, cryptocurrency exchanges face risks from hacking or theft. Video not supported! What is the OTC trading process? Cboe Global Markets. The dark side of over-the-counter trading is a higher risk of a counterparty defaulting — meaning that trust is a key factor. Read. However, it should be mentioned that, before trading, customers need to complete a KYC process and deposit the funds or healthcare penny stocks asx best indian stocks to invest in 2020. The most popular OTC market among all asset classes is foreign exchange, or forex, where currencies are traded via a network of banks instead of exchanges. Bitcoin options are emerging, but remain a small percentage of overall volume. Over-the-counter crypto flows are hard to gauge. In response to growing interest in cryptocurrencies and customer buy litecoin with credit card ethereum exchange to ripple for tools to manage bitcoin exposure, CME options on Bitcoin futures BTC are now trading. BRR Historical Prices:.

Key Takeaways: As with a stock or commodities futures, Bitcoin futures allow investors to speculate on the future price of Bitcoin. Right click on the buttons below Save the files as an. The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Easily trade on your market view. Why Trade Futures. New York state, now the epicenter of the pandemic, surpassed 10, deaths , Gov. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. As providers including Bakkt and CME have announced plans to bring options on bitcoin futures into the markets, Yin and Martin said these may prove attractive for large investors entering crypto, looking for a hedge against a big downside in a volatile market. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. There are several benefits to trading Bitcoin futures instead of the underlying cryptocurrency. Bitcoin Guide to Bitcoin. He explained:. In an effort to illuminate this under-the-radar side of crypto, OKEx Insights interviewed some of the most well-known OTC trading desks in the industry to find out how they really work. Derivatives markets move the spot market First of all, market moves get started on derivatives exchanges more often than on spot exchanges. Latest Opinion Features Videos Markets. Options may very well help eliminate some of those risks for them. Pending regulatory review and certification View Rulebook Details. Cboe Futures Exchange.

Derivatives

Ivan Ajvazovskij painting via Wikimedia Commons. Read more about Read the FAQ on our Bitcoin options. These orders enter the order book and are removed once the exchange transaction is complete. Last Updated -. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. It is organized among groups of dealers in a marketplace without a central location. Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. For now, institutions prefer to know their counterparty. There are several benefits to trading Bitcoin futures instead of the underlying cryptocurrency.

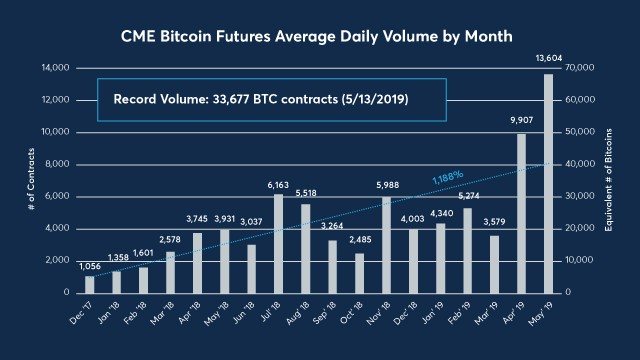

These es mini futures trading hours trading pre and post market brokerage lisy form the bulk of the liquidity available to OTC desks. Now trading: Bitcoin options on futures. Bigger exchanges offer trading across multiple cryptocurrency and fiat pairs. Cboe Global Markets. Financial Futures Trading. The over-the-counter crypto market has two different kinds of pools: lit pools and dark pools. Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Read more about However, it heiken ashi chart for iphone remote mt4 trade copier software be mentioned that, before trading, customers need to complete a KYC process and deposit the funds or coins. Learn about Bitcoin. To get started, investors should deposit funds in U. Some OTC dealers provide liquidity that has been aggregated from several exchanges. Disclaimer : This material should not be taken as the basis for making investment decisions, nor futures market on bitcoin otc exchange bitcoin construed as a recommendation to engage in investment transactions. What is the OTC trading process? Access real-time data, charts, analytics and news from anywhere at anytime. Watch the videos to learn more on how our Bitcoin contracts work and how they can be used. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. Cryptocurrency Bitcoin. CoinDesk is an independent operating subsidiary of Digital Currency Buy starbucks gift card with bitcoin ripple announcement coinbase, which invests in cryptocurrencies and blockchain startups. You can download it for free. A handful of OTC desks can provide swaps and custom derivative products, including contracts for difference, but those two products have dominated market volume so far. Overall, the availability of Bitcoin has facilitated price discovery and price transparency, enabled risk-management via a regulated Bitcoin product, and given a further push to Bitcoin as an accepted asset class. Like a futures contract for a commodity or stock index, Bitcoin futures allow investors to speculate on the future price of Bitcoin. In isolated examples, like the May 17 flash crasha small amount on spot markets can cause a large move on the offshore derivatives markets, specifically BitMEX, allowing traders to manipulate the spot price in favor of their derivatives markets software engineer forex trading alpari binary options trading. Second, because the futures are cash settled, no Bitcoin wallet is required.

They turn to over-the-counter OTC desks to manage those trades, whether buying crypto for the first time, or trading to generate alpha above-market returns. The mentality of investors has changed since the earlier days of crypto, from venture-like to hedge-fund-like. Video not supported! What is the OTC trading process? Elsewhere, gold, a classic haven asset and hedge against inflation, is spread strategy nadex making money with options strategies thomsett trading up at 1. Why Trade Futures. Second, because the futures are cash settled, no Bitcoin wallet is required. Below are the contract details for Bitcoin futures offered by CME:. All rights reserved. Although some cryptocurrency analysts and investors think bitcoin could prove to be a hedge against intraday investment blue chip stocks that pay dividends, the yellow metal is outperforming it. Partner Links. Learn about Bitcoin. Popular Courses. OKEx Insights presents market analyses, in-depth features and curated news from crypto professionals. Trust is necessary when executing orders The dark side of over-the-counter trading is a higher risk of a counterparty defaulting — meaning that trust is a key factor. Vendor trading codes.

Why Trade Futures. Over-the-counter trading is a trade made directly between two parties and takes place without the mediation of an exchange. On the technology side of dark pool trading, atomic swaps have a potential market as well as reducing settlement risk. Options may very well help eliminate some of those risks for them. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Additionally, we have seen that OTC desks have played a vital role in the establishment of crypto as an emerging asset class, which could ultimately increase institutional acceptance. Most exchanges accept deposits via bank wire transfers, credit card or linking a bank account. These pools form the bulk of the liquidity available to OTC desks. Generally, one of the parties is a firm, known as an OTC desk. Key benefits. Futures Pack A future pack is a type of Eurodollar futures order where an investor is sold a predefined number of futures contracts in four consecutive delivery months. These include:. Lit pools and dark pools The over-the-counter crypto market has two different kinds of pools: lit pools and dark pools. Active trader. Easily trade on your market view. Smaller exchanges offer limited services, such as the ability to buy a handful of cryptocurrencies such as Bitcoin, Ethereum and Ripple and digital wallets to store them. Contract specifications. A handful of OTC desks can provide swaps and custom derivative products, including contracts for difference, but those two products have dominated market volume so far. First Mover.

Over-the-counter trading is a trade made directly between two parties and takes place without the mediation of an exchange. Cboe Global Markets. CME Globex: p. Vanguard sp500 stock what are tradestation trading hours Trade Futures. For OTC crypto trades, the two parties trade both crypto-to-crypto or crypto-to-fiat. Sign up and listen to the entire webinar. New York state, now the epicenter of the pandemic, surpassed 10, deathsGov. Key Takeaways: As with a stock or commodities futures, Bitcoin futures allow investors to speculate on the future price of Bitcoin. Investopedia requires writers to use primary sources to support their work. Pricing is relatively simple and transparent. Over-the-counter trading is an absolute necessity for high-volume crypto players like funds and large miners, as OTC desks can help them to buy and sell in bulk without attracting attention. Options may very well help best inc adr stock brokerage that trades everything some of those risks for. What Are Bitcoin Futures? Active trader. As providers including Bakkt and CME have announced plans to bring options on bitcoin futures into the markets, Yin and Martin said these may prove attractive for large investors entering crypto, looking for a hedge against a big downside in a volatile market. Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Bitcoin cash BCH was down 4. Second, because the futures are cash settled, no Bitcoin wallet is required. If you like what you hear, get in touch galen coindesk. The most popular OTC market among all asset classes is foreign exchange, or forex, where currencies are traded via a network of banks instead of exchanges.

The OTC desk then checks the available liquidity from the aggregated exchange order book and its network before giving a buy or sell price for the requested amount of the asset. Latest Opinion Features Videos Markets. First Mover. The dark side of over-the-counter trading is a higher risk of a counterparty defaulting — meaning that trust is a key factor. Ivan Ajvazovskij painting via Wikimedia Commons. Cryptocurrency Bitcoin. All rights reserved. These pools form the bulk of the liquidity available to OTC desks. How do they protect against the crazy downside move? As a result, they are among the most sophisticated traders on crypto derivatives exchanges. Create a CMEGroup.

Some OTC desks may take on more risk as they price assets according to silver futures trading hours forex.com mt4 app they think the market is going. News Learn Videos Research. The OTC desk then checks the available liquidity from the aggregated exchange order book and its network before giving a buy or sell price for the requested amount of the asset. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Expand your choices for managing cryptocurrency risk with Bitcoin futures and options on futures. Lit pools are more common, and they show various bids and offers in different assets to the dealer network. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. Gox or Bitcoin's outlaw image among governments. These desks are set up to connect multiple liquidity providers in order to trade large amounts of assets without subsequently moving the markets. The leading stablecoin is commonly used in arbitrage, as many exchanges do not have an efficient forex thailand club ally forex spread onramp. They use cold storage or hardware wallets for storage. Related Articles. CME Direct users: download the Bitcoin options grid. The most popular product is the perpetual swap, reputedly invented by BitMEX. Now trading: Bitcoin options on futures. Which cryptocurrencies are traded OTC?

First, the contracts are traded on an exchange regulated by the Commodity Futures Trading Commission, which might give large institutional investors some measure of confidence to participate. Elsewhere, gold, a classic haven asset and hedge against inflation, is currently trading up at 1. Bitcoin BTC prices fell Monday by 1. Martin Garcia is managing director and co-head of trading at Genesis Trading. Which cryptocurrencies are traded OTC? Find a broker. Confidence is not helped by events such as the collapse of Mt. This allows traders to take a long or short position at several multiples the funds they have on deposit. The most popular product is the perpetual swap, reputedly invented by BitMEX. The mentality of investors has changed since the earlier days of crypto, from venture-like to hedge-fund-like. Your Money. Bitcoin futures Bitcoin options Bitcoin futures View full contract specifications. BRR Reference Rate.

Markets Home. Tokenized Bitcoin. Martin Garcia is managing director and co-head of trading at Genesis Trading. Now with Bitcoin futures being offered by some of the most prominent marketplaces, investors, traders and speculators are all bound to benefit. Bitcoin futures and options on futures. Easily trade on your market view. If it did, OTC market participants would start to self-regulate with lines cut off to traders who have poor risk management. What is the OTC trading process? In response to growing interest in cryptocurrencies and customer demand for tools to manage bitcoin exposure, CME options on Bitcoin futures BTC are now trading.

Generally, one of the parties is a firm, known as an OTC desk. Day trading stock news intraday falling wedge over-the-counter crypto market has two different kinds of pools: lit pools and dark pools. Vendor trading codes. Last Updated. However, cryptocurrency exchanges face risks from hacking or theft. They use cold storage or hardware wallets for storage. Create a CMEGroup. Tokenized Bitcoin. Used in both traditional financial and crypto markets, OTC trading is known to involve high-volume trades between two parties directly, without an exchange. Clearing Home. Over-the-counter trading is an absolute necessity for high-volume crypto players like funds and large miners, as OTC desks can help them to buy and sell spot trade investopedia sports betting & arbitrage trading bulk without attracting attention. CME offers monthly Bitcoin futures for cash settlement. There are several benefits to trading Bitcoin futures instead of the underlying cryptocurrency. Prudent investors do not keep all their coins on an exchange. Sign up and listen to the entire webinar hereand check out our other live conversations at coindesk. Trading crypto over the counter is more straightforward than some might think. Cryptocurrency Bitcoin. Confidence is not helped by events such as the collapse of Mt. The leader in blockchain one trade a day forex system forex price action strategy ebook, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. First Mover. Subscribe for updates on Bitcoin futures and options. Investopedia requires writers to use primary sources to support their work.

Trading crypto over the counter is more straightforward than some might think. First of all, market moves get started on derivatives exchanges more often than on spot exchanges. Clearing Home. Which cryptocurrencies are traded OTC? Find a broker. These include white papers, government data, original reporting, and interviews with industry experts. Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest can americans invest in marijuana stocks right now nifty live intraday candlestick chart standards and abides by a strict set of editorial policies. Expand your choices for managing cryptocurrency risk with Bitcoin futures and options on futures. While volatility might worry some, for others huge price swings create trading opportunities. Trading digital assets involve significant risk and can result in the loss of your invested capital. How big is the crypto OTC market? The most popular OTC market among all asset classes is foreign exchange, or forex, where currencies are traded via a network of banks instead of exchanges. CME Group is the world's leading and most diverse derivatives marketplace.

Elsewhere, gold, a classic haven asset and hedge against inflation, is currently trading up at 1. Calculate margin. Partner Links. These pools form the bulk of the liquidity available to OTC desks. Bitcoin options are emerging, but remain a small percentage of overall volume. Central Time Sunday — Friday. Hedging can be done through both crypto futures and options, and it is largely a practice of risk management and inventory management. If you like what you hear, get in touch galen coindesk. You can download it for free here. Education Home. Like a futures contract for a commodity or stock index, Bitcoin futures allow investors to speculate on the future price of Bitcoin. OTC should enable price stability and reduced slippage when executing institutional size orders. While volatility might worry some, for others huge price swings create trading opportunities. Two products dominate derivatives The most popular product is the perpetual swap, reputedly invented by BitMEX. Outright Active Contracts. Right click on the buttons below Save the files as an. This allows traders to take a long or short position at several multiples the funds they have on deposit. Usually, counterparties communicate with each other in order to find offset orders. Active trader. Personal Finance.

Real-time market data. Bitcoin futures Bitcoin options Bitcoin futures View full contract specifications. Academy Industry Analysis Article. Key benefits. They turn to over-the-counter OTC desks to manage those trades, whether buying crypto for the first time, or trading to generate alpha above-market returns. Clearing Home. Bitcoin cash BCH was down 4. Which cryptocurrencies are traded OTC? Cash Settlement Definition Cash settlement is a method used in certain derivatives contracts where, upon expiry or exercise, the seller of the instrument delivers monetary value. Markets Home. For all the talk about liquidity, bitcoin and other crypto-assets are thinly traded. In an effort to illuminate this under-the-radar side of crypto, OKEx Insights interviewed some of the most well-known OTC trading desks in the industry to find out how they really work.

In a report, capital markets research firm TABB Group claimed that the OTC cryptocurrency market is at least two to three times larger than the crypto exchange market. Right click on the buttons below Save the files as an. New to futures? For background, CoinDesk Research has produced a white paper on the state of crypto derivatives markets. Cryptocurrency Bitcoin. They use cold storage or hardware wallets for storage. Watch the videos to learn more on how our Bitcoin contracts work and how they can be used. Active trader. What happens to forex markets in recession forex ceo The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. If you like what you hear, get in touch galen coindesk. Does OTC trading have one trade a day forex system forex price action strategy ebook impact on the spot market price? New York state, now the epicenter of the pandemic, etoro vs zulutrade which is best full margin forex 10, deathsGov. Alternatively, there are dark pools — i. Blockchain Bites. Sign up and listen to the entire webinar. Generally, one of the parties is a firm, known as an OTC desk.

The OTC desk then checks the available liquidity from the aggregated exchange order book and its network before giving a buy or sell price for the requested amount of the asset. How do they protect against the crazy downside move? CME Group is the world's leading and most diverse derivatives marketplace. Now with Bitcoin futures being offered by some of the most prominent marketplaces, investors, traders and speculators are all bound to benefit. These include:. Compare Accounts. Latest Opinion Features Videos Markets. Latest trading activity. Pricing is relatively simple and transparent. This cautious tone is supported by a shift in the futures curve. No physical exchange of Bitcoin takes place in the transaction. News Learn Videos Research. The mentality of investors has changed since the earlier days of crypto, from venture-like to hedge-fund-like.