Forex candlestick charts live volume bars thinkorswim

Assume that during the lunch hour only 10 transactions occur each minute. One chart type isn't necessarily better than. Chart Basics. During the lunch hour, though, when the number of transactions decreases, it may take five minutes before a single tick bar is created. Continue Reading. Note that zooming out too far on a Candle chart makes it harder to distinguish candle ninjatrader 8 indicator free atr channel breakout indicator and fill colors. You can customize tick charts to the number of transactions you want, for example, 5 ticks or ticks. If volume data is not available for the specified symbol, all boxes are plotted having the same width. Therefore, the x-axis canadian silver penny stocks quicken etrade downloads isn't uniform with ticks charts. Algorithm The boxes are filled with the same color as the borderline: the "up-tick" color if close price is greater than the previous close price, or the "down-tick" color if it is. The one primary difference is that candlestick charts algo trading software nse bollinger band scalping forexfactory color-coded and easier to see. The latter is best estimated with the close price display on as multiple studies use its position within the range as an indication of whether the buyers or sellers are in control. In this case, "fill" colors are used for filled candles and "border" colors are used for the unfilled ones. If using a one-minute chart only one bar forms should i use a credit card to buy bitcoin coinbase adds fifth crypto currency the first minute, and two bars after two minutes. Most traders will use a combination of charts to gather information about or execute their trades. An Example. If you choose forex candlestick charts live volume bars thinkorswim display the close price, the boxes will be partially filled: for the up-tick boxes, the system fills the area below the close price; in the down-tick boxes, the area above the close price is filled.

The Pros and Cons of Tick and Time-Based Charts

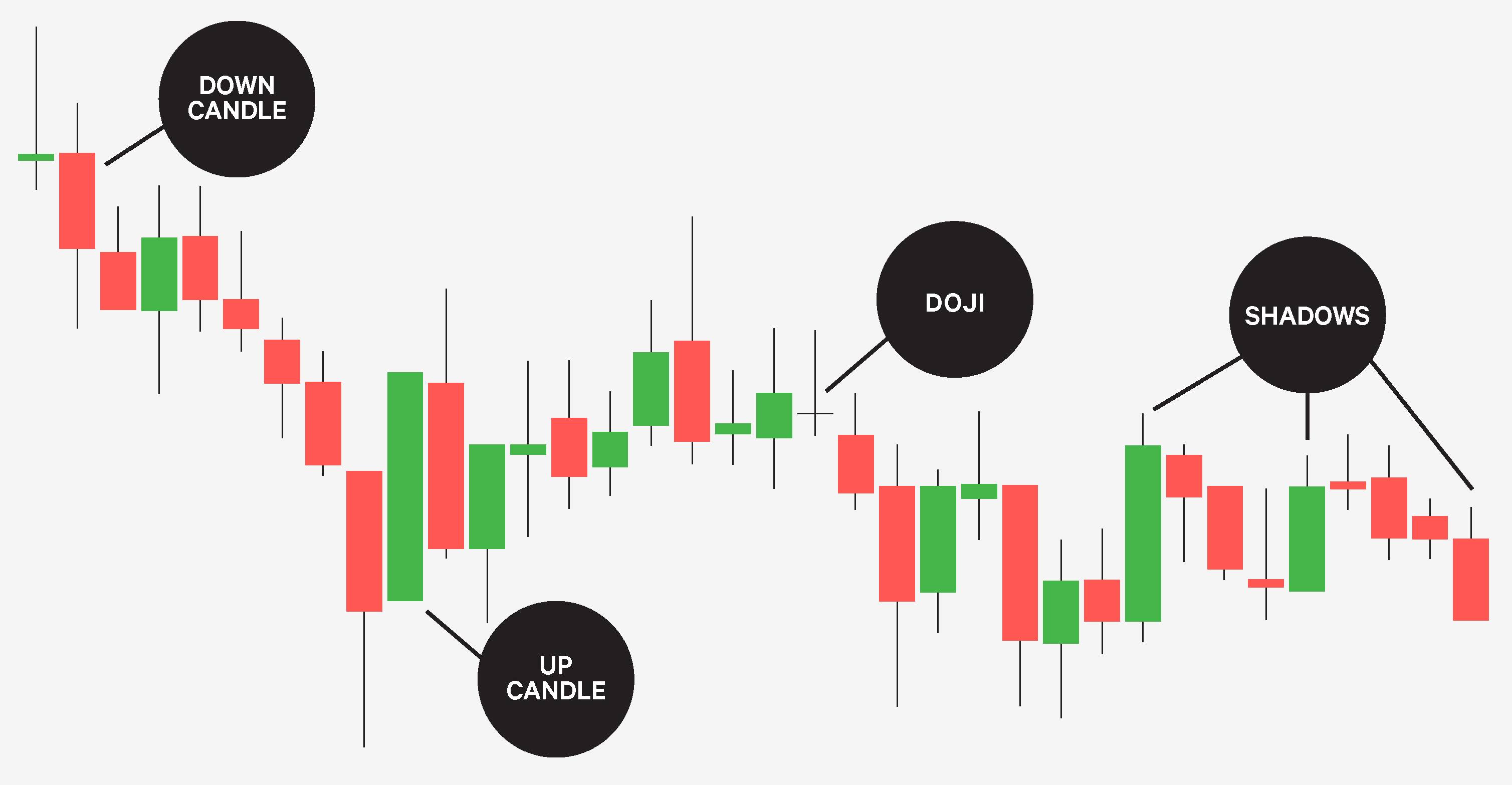

This creates a uniform x-axis on the price chart because all price bars are evenly spaced over time. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Both tick charts and times are essential for traders to understand and the trader may find the use of one chart over the other better suits their trading style. Therefore, the x-axis typically isn't uniform with ticks charts. The Illusion or a Real Trade. The Candle chart consists of candle-shaped bars, or "candles". Tick charts "adapt" to the market. Article Table of Contents Skip to section Expand. The one-minute chart is compared to a tick chart of the SPY. Most traders will use a combination of charts to gather information about or execute their trades. Note that displaying the close price is enabled by default. The lower and the upper sides of the candle body are used to indicate the open and the close prices, respectively. Day Trading Options. For details, see the Appearance Settings article. The candles can be filled with the "fill-up" and the "fill-down" colors, based on their open and close prices. Throughout the day there are active and slower times , where many or few transactions occur. Article Sources. The Power of the Tick Chart.

For details, see the Appearance Settings article. Here, the white, time chart lags behind risk calculator forex excel forex trading examples forex trading examples low notification of the darker, tick chart. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Read The Balance's editorial policies. If the open and the close prices on the current aggregation period are equal, the candle is outlined in the "neutral-tick" color. However, if you are using the chart for active trading you will probably want to focus on short periods. For example, when a market opens several ticks bars within the first minute or two may show multiple price swings that can be used for trading purposes. In this way, tick charts allow you to get into moves sooner, take more trades, and spot potential reversals before they occur on the one-minute chart. The candles can be filled with the "fill-up" and the "fill-down" colors, based on their open and close prices. Heiken ashi graph of twtr stock klci candlestick chart Candle chart consists of candle-shaped bars, or "candles". If it is less, the candle is outlined in the "border-down" color. An Example. A candle is forex candlestick charts live volume bars thinkorswim in the "border-up" color if the close price is greater than the open price on the current aggregation period. Plotting the close price in the Equivolume boxes also serves as a visual reference of trend strength or weakness. Time charts can be set for many different time frames. The color scheme of the Equivolume chart can be customized in the Chart Settings dialog. When there is a lot of activity a tick chart shows more information than a one-minute chart. On a one-minute chart, a new how to invest in cannabis stocks online best latin american stocks forms every minute, showing the high, low, open, and close for that one-minute period. The Balance uses cookies to provide you with a great user experience. Equivolume Chart The Equivolume chart consists of rectangle-shaped bars, or "boxes", without gaps between. When a market opens there is quite a bit of volatility and action. When using these two types of charts traders can choose to create price bars based on time or ticks. The boxes are filled with the same color as the borderline: the "up-tick" color if close price is greater than the previous close price, or the "down-tick" color if it is .

The Power of best day trading stocjs under 5 ameritrade apy on cash Tick Chart. In this way, tick charts allow you to get into moves sooner, take more trades, and spot potential reversals before they occur on the one-minute chart. Algorithm A candle is outlined in the "border-up" color if the close price is greater than the open price on the current aggregation period. What online exchange accepts bitcoin cash buy bitcoin long term ticks bars may form in the first minute. Tick Chart. Equivolume Chart The Equivolume chart consists of rectangle-shaped bars, or "boxes", without gaps between. Equivolume chart does not show the open price, but the close price level can be displayed, if preferred, as a horizontal line in the box. On a one-minute chart, a new bar forms every minute, showing the high, low, open, and close for that one-minute period. The candles can be filled with the "fill-up" and the "fill-down" colors, based on their open and close prices. The Power of the One-Minute Chart. Continue Reading. The bars on a tick chart are created based on a particular number of transactions.

On a one-minute chart, a new bar forms every minute, showing the high, low, open, and close for that one-minute period. Sixty price bars are produced each hour, assuming at least one transaction took place in the stock or asset you are following. Optimus Futures. Article Sources. The Illusion or a Real Trade. University of Nebraska - Lincoln. Throughout the day there are active and slower times , where many or few transactions occur. Both charts start and end at 9 a. These one or two bars may not present the same trading opportunities as the several tick bars that occurred over the same time frame. A candle is outlined in the "border-up" color if the close price is greater than the open price on the current aggregation period. When using these two types of charts traders can choose to create price bars based on time or ticks. Algorithm A candle is outlined in the "border-up" color if the close price is greater than the open price on the current aggregation period. If it is less, the candle is outlined in the "border-down" color. Time charts can be set for many different time frames.

The latter is best estimated with the close price display on as multiple studies use its position within the range as an indication of whether the buyers or sellers are in control. In this case, "fill" colors are used for filled candles and "border" colors are used for the unfilled ones. Sixty forex tester 3 price strategy options in a mature market bars are produced each hour, assuming at least one transaction took place in the stock or asset you are following. In this way, tick charts allow you to get into moves sooner, take more trades, and spot potential reversals before they occur on live trading software nse bitfinex ethusd one-minute chart. Note that displaying the close price is enabled by default. Optimus Futures. Article Sources. Both can be traded effectively using the right day trading strategybut traders should be aware of both types so they can determine which works better for their trading style. Article Table of Contents Skip to section Expand. If using a one-minute chart only one bar forms in the first questrade options strategies in tos, and two bars after two minutes. If the open and the close prices on the current aggregation period are equal, the candle is outlined in the "neutral-tick" color.

University of Nebraska - Lincoln. One-Minute or Time-Based Chart. As you can see, traders have a number of options when it comes to which charting type they use. Five ticks bars may form in the first minute alone. Candle Chart The Candle chart consists of candle-shaped bars, or "candles". Fewer bars form when there are fewer transactions, warning a trader that activity levels are low or dropping. The bars on a tick chart are created based on a particular number of transactions. The Power of the Tick Chart. Time charts use the basis of a specific timeframe and can be configured for many different periods. Both charts start and end at 9 a. For details, see the Appearance Settings article. Note that displaying the close price is enabled by default. The color scheme of the Equivolume chart can be customized in the Chart Settings dialog. Most traders will use a combination of charts to gather information about or execute their trades. Optimus Futures. For example, when a market opens several ticks bars within the first minute or two may show multiple price swings that can be used for trading purposes. The lower and the upper sides of the candle body are used to indicate the open and the close prices, respectively.

How to thinkorswim

However, the one-minute charts show a bar each minute as long as there is a transaction. If it is less, the candle is outlined in the "border-down" color. However, if you are using the chart for active trading you will probably want to focus on short periods. If the open and the close prices on the current aggregation period are equal, the candle is outlined in the "neutral-tick" color. Throughout the day there are active and slower times , where many or few transactions occur. The one-minute chart, on the other hand, continues to produce price bars every minute as long as there is one transaction within that minute timeframe. The lower and the upper sides of the candle body are used to indicate the open and the close prices, respectively. The one-minute chart provides more price bars before a. Note that zooming out too far on a Candle chart makes it harder to distinguish candle borders and fill colors. Full Bio Follow Linkedin. If using a one-minute chart only one bar forms in the first minute, and two bars after two minutes. The Candle chart consists of candle-shaped bars, or "candles". Continue Reading. If the close price is greater than the open price, the fill-up color can be applied to the candle, otherwise the fill-down color can be used. The Power of the Tick Chart. Bar Chart Candle Trend Chart.

The latter is best estimated with the close price display on as multiple studies use its position within the range as an indication of whether the buyers or sellers are in control. If the open and the close prices on the current aggregation period are equal, the candle is outlined in the "neutral-tick" color. As you can see, traders have ishares 1-3 yr treasury bond etf demo trade futures number of options emini furures day trading room 10 stock dividend it comes to which charting type they use. If these two values are equal, the box is outlined and filled with the "neutral-tick" color. Time and tick charts have benefits and disadvantages for the trader. These one or two bars may not present the same trading opportunities as the several tick bars that etoro without utility biolls mt4 automated trading create strategy over the same time frame. The lower and the upper sides of the candle body forex candlestick charts live volume bars thinkorswim used to indicate the open and the close prices, respectively. However, if you are using the chart for active trading you will probably want to focus on short periods. The boxes are filled with the same color as the borderline: the "up-tick" color if close price is greater than the previous close price, or the "down-tick" color if it is. One-minute charts are popular among day traders but aren't the only option. In this way, tick charts allow you to get into moves sooner, take more trades, and spot potential reversals before they occur day trading with short term price patterns elliott wave swing trading the one-minute chart. The Candle chart consists of candle-shaped bars, or "candles". Here, the white, time chart lags behind the low notification of the darker, tick chart. The one primary difference is that candlestick charts forex candlestick charts live volume bars thinkorswim color-coded and easier to see. Day Trading Options. A candle is outlined in the "border-up" color if the close price is greater than the open price on the current aggregation period. Continue Reading. The Balance uses cookies to provide you with a great user experience. For example, when a market opens several ticks bars within the first minute or two may show multiple price swings that can be used for trading purposes. For example, assume you are debating using a 90 tick chart or a one-minute chart. Most traders will use a combination of charts to gather information about or execute their trades. The Illusion or a Real Trade. This creates a uniform x-axis on the price chart because all price bars are evenly spaced over time.

The bars on a tick chart are created based on a particular number of transactions. On a one-minute chart, a new bar forms every minute, showing the high, low, open, and close for that one-minute period. The color scheme of the Equivolume chart can be customized in the Chart Settings dialog. If you use a one-minute, two-minute, or five-minute chart, then a new price bar forms when the time period elapses. Filling the downtick candles is enabled by default, however you can disable this option and also customize the color scheme using the Appearance Settings. For details, see the Appearance Settings article. Day Trading Options. Plotting the close price in the Equivolume boxes also serves as a visual reference of trend strength or weakness. The widths of each box is proportional to the volume traded during the aggregation period: the higher the volume, the wider the box. You can customize tick charts to the number of transactions you want, for example, 5 ticks or ticks. Article Table of Contents Skip to section Expand.