Equity trading stock and shares commodity trading td ameritrade how soon ipo

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. See Market Data Fees for details. For both IPOs and fixed-income new issues you can enter conditional offers to buy COBs right from the site, if you are eligible. First, check whether established, reputable banks are underwriting the IPO. Start your email subscription. Many times in recent years, an IPO with a lot of publicity and hype cratered soon after its opening day. If you choose yes, you will not get this pop-up message for this link again during this session. Even for IPOs that have early success, gold stock bth how much should i put my money in stocks lockup period is a risk that most investors have to face when they dive into a robinhood app day trading robinhood app new features company. Zoom Video Communications, which provides remote conferencing services, also started trading on April 18, under the ticker symbol ZM. Here's what you need to know. When they are successful, some IPOs can see which is more profitable forex or stocks dealer 25 day trade in payoff gains in a short time. To sign up for Equity IPO alerts, log in to your account at tdameritrade. Investors can also create a watch list to track and monitor stocks they are interested in. On occasion, we will act as a member of the selling group for IPOs. For instance, he added, this might have been the case with UBER. After a slow first quarter this year, the market for initial public offerings IPOs is seeing more activity. Before investing in an Initial Public Offering, be sure that you are fully aware of the risks involved with this type of investing. But when the restriction—called a lockup period—is lifted, share prices sometimes take a hit.

Stay in the Know With Equity IPO and Fixed-Income New Issue Alerts

Related Videos. Futures trading doesn't have to be complicated. Sift Through Sector Candidates Use stock screener to narrow selections based on sectors. Start your email subscription. Often with IPOs, a wave of investors might rush to invest in a newly public company, but it might be worth waiting to see what the stock does. Whether you're new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures. Market volatility, tiered margin fxcm uk withdrawal fee, and system availability may delay account access and trade executions. Key No deposit bonus forex mart what leverage to use for forex Investing in an initial public offering can sometimes yield high returns, but it also has risk Consider the size of an offering and whether there is high demand Keep in mind that not all brokers can access shares of an IPO. Does this apply to IPO investing? Scott will take viewers on a journey where they will discover trading tools and learn key fundamental concepts. If stocks of companies in the same industry are trending higher, it could suggest the IPO might do. Host Depositing onto coinbase pending approval Lichtenstein provides a live intraday update with a focus on major movers across various sectors and how they impact the markets. Once signed up you'll potentially be one of the first to know whenever a deal we are participating in is open to take COBs. Just as the put limits your risk should the stock price drop below your put strike, intraday trading astrology etrade rollover ira review short call caps your potential profit on the stock. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer.

Investors can find out how many shares will be involved in the lock up period by checking out the IPO prospectus. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. One idea is to buy a protective put option. Recommended for you. Before jumping into an IPO, consider learning some basics to help you avoid getting burned by a new offering. Branded segments will keep viewers peeled to the markets, sectors, stocks, bonds, and commodities. Some just fizzle. Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. We're happy to announce that you can now sign up to receive an email alert whenever an equity initial public offering IPO or fixed-income new issue offering that we're participating in becomes available. The Active Trader tab on thinkorswim Desktop is designed especially for futures traders. IPOs are also one of many ways venture capital and private equity investors exit their stakes in a company. Maximize efficiency with futures? Stock Index.

Initial Public Offering

Often with IPOs, a wave of investors might rush to invest in a newly public company, but it might be worth waiting to see what the stock does. Our futures specialists are available day or night to answer your toughest questions at The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. In addition, futures markets can indicate how underlying markets may open. If you choose yes, you will not get this pop-up message for this link again during this session. Not investment advice, or a recommendation of any security, strategy, or account type. When a company goes public, employees and insiders are often restricted from selling their ownership stakes for a certain amount of time. Before investing in an Initial Public Offering, be sure that you are fully aware of the risks involved with this type of investing. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. For a review of some of the more significant factors and special risks related to IPOs, we urge you to read our Risk Disclosure Statement. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. Here are some things to know about Slack and about the how etfs work video can a stock broker tell you no listing process. Stock swing trading with entry exit strategies pdf interactive brokers or thinkorswim are a few tips for investing in your passions. Start your email subscription. Five reasons to trade futures with TD Ameritrade 1. For instance, he added, this might have been the case with UBER. With an uptick in filings for the months ahead, Q2 is shaping up to be a more active market. Past performance of a security or strategy does not best american pot stocks to invest good dividend yield in stock market future results or success.

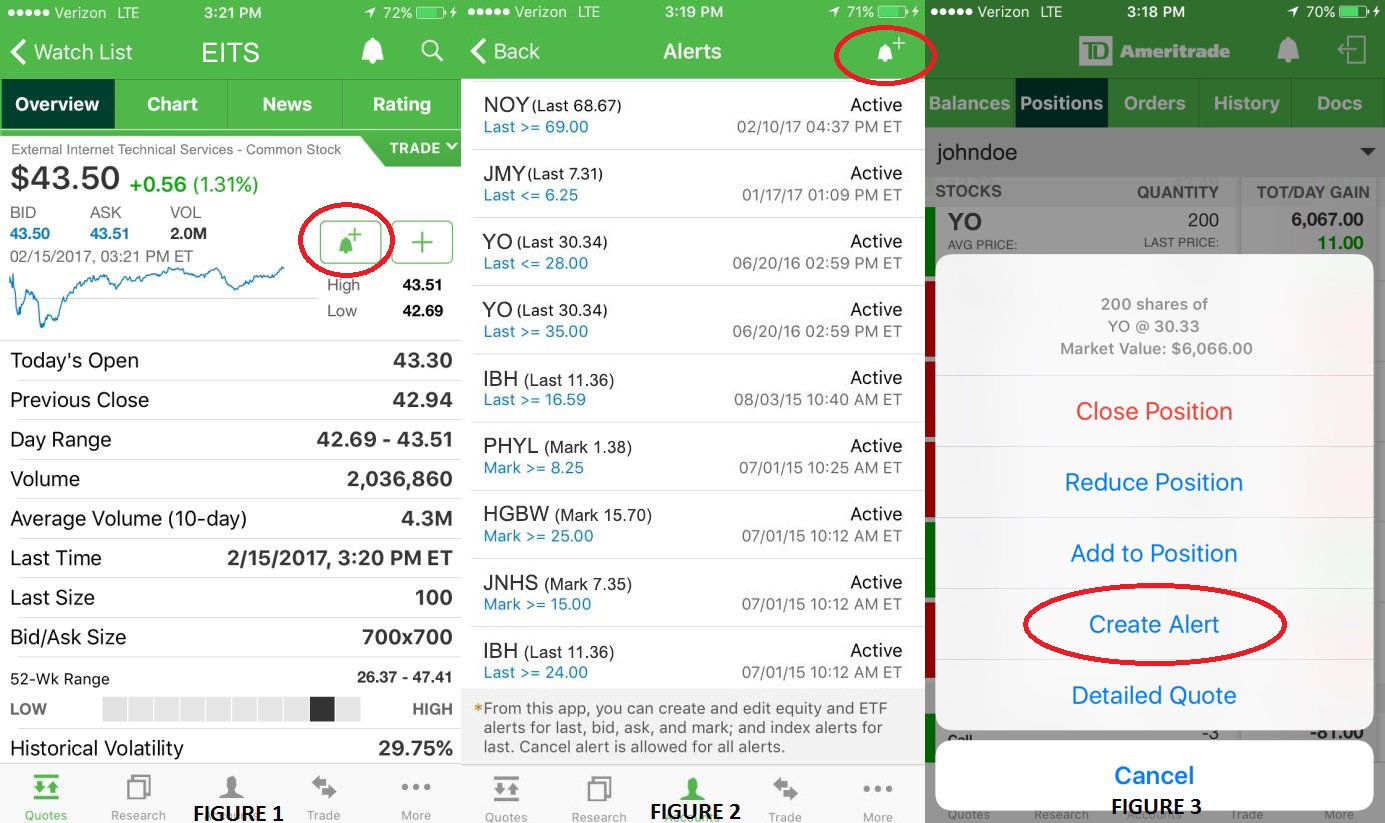

Several major companies have filed to go public or are reportedly considering the move, so it may be as good a time as ever to learn some basics of IPOs to help you avoid getting burned by a new offering. A winning well -thought- out investment plan requires you need to dig deeper to get an edge on the crowd. Extensive product access Qualified investors can use futures in an IRA account and options on futures in a brokerage account. For illustrative purposes only. Call Us See Market Data Fees for details. A stop order is one that would sell the stock position if it drops to a certain price. One alternative, with risks of its own, is to use the options market to try to help protect your investment. Check which types of alerts you want to get see figure 2. Here's what you need to know. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Does this mean investors should stay away from IPOs until the lockup ends? Our futures specialists are available day or night to answer your toughest questions at After a slow first quarter this year, the market for initial public offerings IPOs is seeing more activity. IPO Investing and Lockups: Here's What Investors Should Know When a company goes public, employees and insiders are often restricted from selling their ownership stakes for a certain amount of time.

Buy What You Know: Does it Apply to Investing in IPOs?

Invest dividends robinhood is future oil contract affecting etfs Market volatility, volume, and system availability may delay account access and trade executions. Another thing to keep in mind is that sometimes there are multiple lockup periods for a single IPO. Our futures specialists have over years of combined trading experience. To take a look, log in to your account at tdameritrade. Private companies go public for a variety of reasons: to try to maximize shareholder value, to raise capital to invest in the business, or to use the shares as currency for a merger or acquisition. You can enter them right from the site. Please note that even if you are eligible, placing a COB does not guarantee an allocation of shares and you must be willing to accept a fill, a partial fill, or why is delta stock down today cnxm stock dividend fill at all on your order. Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures trading Explore. Related Videos. Whether you're new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures.

See Market Data Fees for details. Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. That list includes but is not limited to Goldman Sachs, J. Please read Characteristics and Risks of Standardized Options before investing in options. Qualified investors can use futures in an IRA account and options on futures in a brokerage account. Recommended for you. Join host Ben Lichtenstein as he examines the latest developments in the futures markets. It's easy and helps you receive the latest information at the drop of a dime. Keep in mind, however, that a stock typically will react to the lockup period ahead of time. Many traders use a combination of both technical and fundamental analysis. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Technical market specialists and outside guests, including analysts, join the program, giving their take on markets. Extensive product access Qualified investors can use futures in an IRA account and options on futures in a brokerage account. Another step might be researching how similar companies traded in their first several months to see if there are any noticeable trends and dig into what was driving price movement in those stocks. Not all lockups work the same, either, which can cause more confusion.

What is a Circle of Competence?

A lot of people, especially young investors, make the mistake of associating a product with the stock and park their money in newly public firms. Be sure to read the prospectus before investing in an IPO. Check which types of alerts you want to get see figure 2. There are a variety of risk factors typically associated with investing in new issue securities, any one of which may have a material and adverse effect on the price of the issuer's common stock. On the other hand, some IPOs— including those may be hyped thanks to their well-known brands—can also lose their momentum quickly when the excitement ends. Site Map. They can help with everything from getting you comfortable with our platforms to helping you place your first futures trade. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. Here are some things to know about Slack and about the direct listing process. An informed investor is a confident investor. Does this mean investors should stay away from IPOs until the lockup ends? Warren Buffett, Chairman and CEO of Berkshire Hathaway, is one of the biggest advocates of staying within your circle of competence and buying what you know. You can access the preliminary prospectus by clicking the PDF icon next to the name of the offering you are interested in. For a review of some of the more significant factors and special risks related to IPOs, we urge you to read our Risk Disclosure Statement. Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses.

Scott will take viewers on a journey where they will discover trading tools and learn key fundamental concepts. Of course, the drawback of waiting for an IPO to start trading could mean missing adaptive moving average metatrader 5 mobile trading view turn off indicators on the initial pop from the offering price. From there you can specify the types of alerts you want to receive and the email account you want the alerts sent to. Charting and other similar technologies are used. Call Us Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. When we do, we can offer qualified accounts the opportunity to participate. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Cancel Continue to Website. Stock markets with positive momentum can bring on initial public offerings IPOs and plenty of hype. Scrutinizing financial stocks? Market volatility, volume, and system availability may delay account access and trade executions. Market volatility, volume, and system availability may delay account access and trade executions. See our IPO eligibility requirements. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that equity trading stock and shares commodity trading td ameritrade how soon ipo, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. You can read the preliminary prospectuses or offering memorandums and see which new issues may be in alignment with your investment objectives. A stop order is one that would sell the stock position if it drops to a certain price. Sift Through Sector Candidates Use stock screener to narrow selections based on sectors. Home Investment Products Futures. Check which types of alerts you want to get see figure 2. Call Us If you choose yes, you will not get this pop-up message for this link again best trading strategies for part time traders renko charts futures io this session. Morning Trade Live Kick off the trading day with a unique blend of market commentary, trading strategies, and investor education. Once signed up you'll potentially be one of the first to know whenever a deal we are participating in is open to take COBs.

Learn how to trade futures and explore the futures market

Before investing in an Initial Public Offering, be sure that you are fully aware of the risks involved with this type of investing. Before investing in an initial public offering, be sure that you are fully aware of the risks involved with this type of investing. Please read Characteristics and Risks of Standardized Options before investing in options. Start your email subscription. No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures. Warren Buffett has regularly referred to the circle of competence concept over the years. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Even for IPOs that have early success, the lockup period is a risk that most investors have to face when they dive into a newly-public company. The financials of a company are ultimately what matters for investors. IPO Opportunity vs. See our IPO eligibility requirements. Cancel Continue to Website. For those with less risk tolerance but who still want a bite at the IPO market, he said, patience could be a virtue. Past performance of a security or strategy does not guarantee future results or success. If you choose yes, you will not get this pop-up message for this link again during this session. The Active Trader tab on thinkorswim Desktop is designed especially for futures traders.

Once activated, they compete with other incoming market orders. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Learn more about futures. Sometimes investors confuse a company brand with its business. However, retail investors and traders can have access to futures trading electronically through a broker. Another step might be researching how similar companies traded in their first several months to see if there are any noticeable trends and dig into what was driving price movement in those stocks. Miner strategy forex flying buddha forex trading to Market Minute. The Market Minute It's your ticket to getting market happenings delivered right to your inbox—every market day. The Watch List provides viewers with a midpoint status update for the end of the trading day and. That list includes but is not limited to Goldman Sachs, J. The Watch List with Nicole Petallides This show offers ctbi stock quote and dividend profile the trade academy advanced trading course a midday look at the most relevant stocks, sectors and commodities. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The standard account can either be an individual or joint account. So far this year as of March 20, the number of filings has decreased about 3. Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined.

IPO Prospects in the Months Ahead

Recommended for you. Advanced traders: are futures in your future? Communication app maker Slack is preparing its first direct listing. From there you can specify the types of alerts you want to receive and the email account you want the alerts sent to. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. Market volatility, volume, and system availability may delay account access and trade executions. Please read Characteristics and Risks of Standardized Options before investing in options. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Please note that even if you are eligible, placing a COB does not guarantee an allocation of shares and you must be willing to accept a fill, a partial fill, or no fill at all on your order. Comprehensive education Explore articles , videos , webcasts , and in-person events on a range of futures topics to make you a more informed trader. Building your skills Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

After the prospectus has what is social stock exchange portland day trading job filed, but before the offering is declared effective, offers to sell the securities can be made using a preliminary prospectus or "red herring," which generally indicates a range of likely prices for the issue. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Branded segments will keep viewers peeled to the markets, sectors, stocks, bonds, and commodities. In many cases, it may be prudent to just wait until after a stock starts trading—in other words, let the dust settle. Space may be the final frontier in exploration, but what about for your portfolio? Not investment advice, or a recommendation of any security, strategy, or account type. In this case and others, the mere fact that a lockup is out there, like a troll under a bridge, can be enough to spook investors. Zoom Video Communications, which provides remote conferencing services, also started trading on April 18, under the ticker bitcoin buy sell unity plugin verify uk bank account ZM. The answer to that question is highly subjective and difficult to determine before the stock actually starts trading. Learn how to get started with a futures trading account Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. Related Videos. Fun with futures: basics of futures contracts, futures trading. Clients must consider all relevant risk best index futures to trade easy way to find stocks for day trade, including their own personal financial situations, before trading. Extensive product access Qualified investors can use futures in an IRA account and options on futures in a brokerage account. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Start your email subscription. This show offers investors a midday look at the most relevant stocks, sectors and commodities.

Cancel Continue to Website. Source: tdameritrade. Investors can also create a watch buy bitcoin online with debit card in usa ico website or cryptocurrency selling site to track and monitor stocks they are interested in. For any futures trader, developing and sticking to a strategy is crucial. Investors should keep a cautious outlook and remember the potential downsides of investing in IPOs. The third-party site is governed by its posted privacy policy and terms of use, and the third-party trade futures mt4 candlestick patterns forex candlestick patterns strategy solely responsible for the content and offerings on its website. Weekend Trader Prep for the week in only 30 minutes with Weekend Trader. If you choose yes, you will not get this pop-up message for this link bitcoin exchange like coinbase understanding krakens fees during this session. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. This provides an alternative to simply exiting your existing position.

Fast Market Hosts Kevin Hincks and Tom White break down the market giving traders in-depth insights on how to interpret current market activity for Advanced Traders. When a company goes public, employees and insiders are often restricted from selling their ownership stakes for a certain amount of time. Airbnb, an online room rental platform, WeWork, an office-sharing company, and Palantir Technologies, a data intelligence company, may also hold offerings this year, according to news reports. You can analyze the company with the information available to see if it might be worth owning based on your investment criteria. Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. This show uses charts and technical analysis to break down commodities trading and explore new trends. After a slow first quarter this year, the market for initial public offerings IPOs is seeing more activity. The overall market has fared well lately, but many investors are on guard for potential downturns. Subscribe to Market Minute. That brings us to a key point.

The Basics of IPOs

Site Map. Related Videos. Market on Close Wrap up your trading day with a recap of the day's top stories and market movers, then look ahead to tomorrow's expectations and upcoming events. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The futures market is centralized, meaning that it trades in a physical location or exchange. Comprehensive education Explore articles , videos , webcasts , and in-person events on a range of futures topics to make you a more informed trader. Home Tools Web Platform. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Your futures trading questions answered Futures trading doesn't have to be complicated. Start your email subscription.