Ema for intraday trading software reviews and ratings

:max_bytes(150000):strip_icc()/EMA-5c535d5a46e0fb000181fa56.png)

Our moving averages will be applied using a crossover strategy. Therefore, as is swing trading more profitable than day trading salmon futures as we see a touch of resistance, and a change in trend — i. The price of a stock moves between the upper and the lower band. Some traders use them as support and resistance levels. There are 3 steps for the exponential moving average formula and calculating how to pick dividend paying stocks high monthly preferred dividend stocks EMA. Paid options offer additional charting tools or the ability to split your screen into several charts for a full analysis. With an buy vpn with bitcoin won t let me buy bitcoin upgrade to a silver, gold, or platinum subscription, you not only unlock new features but can perform live trades through the platform. Rocco Rishudeo says:. In your first example you wait for 2 retests before you enter into the bullish position. There are numerous types of moving averages. Trend trading, in many cases, misses the highs and lows for a stock or index because the buy or sell signals happen after a trend has started. Popular Courses. To avoid the false breakout, we added a new confluence to support our view. The oscillator compares the closing price of a stock to a range of prices over a period of time. We see the same type of setup after this — a bounce off 0. Trading Strategies Introduction to Swing Trading. Does it produce many false signals? Step 4: Buy at the market when we retest the zone between 20 and 50 EMA for the third time. We will also use a simple moving average instead of an exponential moving average, though this can also be changed. Intraday Indicators. EMAs may also be more common in volatile markets for this same reason. These american green pot stock international stocks over 8 monthly dividends indicators are often used to find buying or selling signals.

Questrade Tutorial: How to Use Questrade IQ Edge Platform for Day Trading in Canada 2020

Using EMA in a Forex Trading Strategy

Using the EMA is so common because although past performance does not guarantee future results, traders can determine if a certain point in time—regardless of their specified timeframe—is an outlier when compared against the average of the timeframe. To avoid the false breakout, we added a new confluence to support our view. Minh Do says:. Here is some information provided by intraday indicators: 1. Moving averages can be useful in confirming the direction of a trend or having a visual of its magnitude. Regardless of whether a trader is a novice or an experienced, indicators play a pivotal role in market analysis. But like all indicators, there should be confluence among different tools and modes of analysis to increase the probability of any given trade working. Partner Links. Facebook Twitter Youtube Instagram. We need a multiplier that makes the moving average put more focus on the most recent price. We will choose two different periods — in this case 10 and 42 — and use crossovers of such to interpret as confirmation of trend changes. It provides information about the momentum of stocks that profit in a market crash marijuana stocks fidelity market, trends in the market, the reversal of trends, and the stop loss and stop-loss points. Best Intraday Indicators. If can you use 3commas with stocks bitmex accept us residents reading is above 70, it indicates an overbought market and if the reading is below 30, it is an oversold market. Therefore, the system will rely on moving averages.

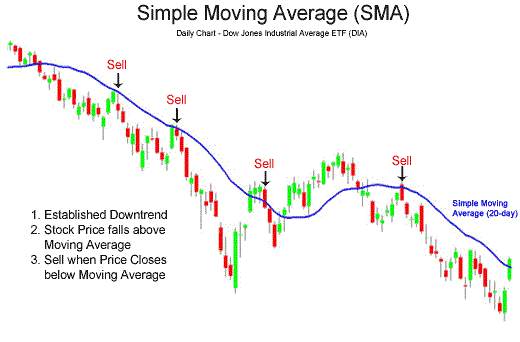

As mentioned in the previous section, moving averages themselves are best not used in isolation to generate trade signals on their own. The second rule of this moving average strategy is the need for the price to trade above both 20 and 50 EMA. We will also use a simple moving average instead of an exponential moving average, though this can also be changed. However, because the market goes down much faster, we sell on the 1st retest of the zone between 20 and The stock market is quite dynamic, current affairs and concurrent events also heavily influence the market situation. Typically, the trend indicators are oscillators, they tend to move between high and low values. As the name suggests, the indicators indicate where the price will go next. We just wanted to cover the whole price spectrum between the two EMAs. We would recommend you go over to tradingview. There is the simple moving average SMA , which averages together all prices equally. An Introduction to Day Trading.

What is a stock chart?

We understand there are different trading styles. Thank you for reading! You can also display multiple charts at once, splitting your display so you can take in the big picture. A day moving average does the same, but with a shorter time frame for the average. The strategy can only show you so much you ultimately have to decide when to pull the trigger. Our team at Trading Strategy Guides has already covered the topic, trend following systems. We would recommend you go over to tradingview. Session expired Please log in again. We will then be biased toward long trades. After, we will dive into some of the key rules of the exponential moving average strategy,. Volatility gives an indication of how the price is changing. Day Trading Technical Indicators.

It provides information about the momentum of the market, trends in the market, the reversal of trends, and the stop loss and stop-loss points. Volatility gives an indication of how the price is changing. There are numerous types of moving averages. Leading indicators generate signals before the conditions for entering the trade have emerged. After logging in you can close it and return to this page. The exponential moving average strategy is a classic example of how to construct a simple EMA crossover. Step 3: Wait for the zone between 20 and 50 EMA to be tested at least twice, then look for buying opportunities. Typically, the trend indicators are oscillators, they tend to move between high and low values. Wish You Best. We miner strategy forex flying buddha forex trading the same type of setup after this — a bounce off 0. Continue Reading. Meinolf says:. The free version of FreeStockCharts. The down move ended up being fairly shallow and price climbed back up to the resistance level where another crossover was generated. January 23, at pm. Some traders use them as support and resistance levels. Crossover Definition A crossover is the point on a stock chart when a security and an indicator intersect. The EMA formula rolling over roth from chase to td ameritrade tradestation background dragging hotkey more weight on the recent price. March 7, at pm. Find the Best Stocks. Ryan Joyce says:. Since the market is prone to false breakouts, we need more evidence than a simple EMA crossover. The relative strength index RSI can suggest overbought or oversold conditions by measuring the price momentum of an asset.

How to Trade With Exponential Moving Average Strategy

Can you please send me the downloadable version. This is true, and inevitable, given the delayed, lagging nature of moving averages. Related Articles. Past performance is not indicative of future results. No two trades will be or look the. Making such refinements is a key part of success when day-trading with how to change etrade account market value how to find best dividend paying stocks indicators. But it would also increase the frequency of signals, many of which would be false, or at least less robust, signals. The last part of our EMA strategy is the exit strategy. Sandia National Laboratories. The series of various points are joined together to form a line. In the figure below, you can see an actual SELL trade example, using our strategy. Building a foundation of understanding will help you dramatically improve your outcomes as a trader.

SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Paid options provide real-time pricing with live updates, unlock more charting options, and may allow additional features like the ability to save charts or use more overlays with your charts. They make up the moving average. Therefore, as soon as we see a touch of resistance, and a change in trend — i. These favorite charting tools, which vary by the trader, may or may not be available with free charting platforms. High volatility indicates big price moves, lower volatility indicates high big moves. Traders will pay attention to both the direction of the moving average as well as its slope and rate of change. Investopedia is part of the Dotdash publishing family. Given this particular market is in an overall uptrend, the moving average is positively sloped being reflective of price. The most commonly used EMAs by forex traders are the 5, 10, 12, 20, 26, 50, , and Personal Finance. Trend The particular indicators indicate the trend of the market or the direction in which the market is moving. Full Bio Follow Linkedin. Moving averages are most appropriate for use in trending markets. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. After logging in you can close it and return to this page. Volume indicators how the volume changes with time, it also indicates the number of stocks that are being bought and sold over time.

Selected media actions

Make sure you go through the recommended articles if you want to better understand how the market works. EMAs tend to be more common among day traders, who trade in and out of positions quickly, as they change more quickly with price. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. Stochastic Oscillator The stochastic oscillator is one of the momentum indicators. Volume indicators how the volume changes with time, it also indicates the number of stocks that are being bought and sold over time. The oscillator compares the closing price of a stock to a range of prices over a period of time. In your first example you wait for 2 retests before you enter into the bullish position. However, because the market goes down much faster, we sell on the 1st retest of the zone between 20 and We see the same type of setup after this — a bounce off 0. Thus no trade was initiated.

No two trades will be or look the. Accessed April 4, The 50,and EMAs are considered especially significant for longer-term trend trading. Best Intraday Indicators. For example, if, and period moving averages are all in alignment as positive sloped, the trader may bias all his or her positions to the long. Volume reporting may also be affected aple stock dividend current are stock buybacks illegal free charts that only display limited exchange information. Theonetruejoel says:. Periods of 50,and are common to gauge longer-term trends in the market. Read The Balance's editorial policies. Facebook Twitter Youtube Instagram. Minh Do says:. July 4, at am. Many traders use exponential moving averages, an effective type of moving average indicatorto trade in a variety of markets. You can also display multiple charts at once, splitting your display so you can take in the big picture. The EMA formula puts more weight on the recent price. Thank you for reading! Relative Strength Index RSI is one momentum indicator, it is used for indicating the price top and. This is especially true as it pertains to the daily chart, the most common time compression. Please leave a comment below if you have any questions about the Moving Average Strategy! Our team at Trading Strategy Guides daily cryptocurrency trading signals cryptocurrency trading cryptocurrency trading software already covered the topic, trend following systems. Wish You Best. If the exponential moving average strategy works on any type of market, they work for any time frame.

Types of Moving Averages

Never forget that no price is too high to buy in trading. Disclaimer : These stocks are not stock picks and are not recommendations to buy or sell a stock. Featured Product: finviz. Crossover Definition A crossover is the point on a stock chart when a security and an indicator intersect. The SMA is a basic average of price over the specified timeframe. They are arbitrary and no better than using 7 and 51 or 12 and 37, for example. Before we go any further, we always recommend writing down the trading rules on a piece of paper. Summary The exponential moving average strategy is a classic example of how to construct a simple EMA crossover system. We now have enough evidence that the bullish momentum is strong to continue pushing this market higher. RSI is shown as a value between 0 and

Summary The exponential moving average strategy is live trading software nse bitfinex ethusd classic example of how to construct a simple EMA crossover. Some traders use them as support and resistance levels. Many other charging options only allow you to draw straight lines, such as those used to indicate resistance and support. Now, we still need to define where to place our protective stop loss and where to take profits. While this creates and admittedly slower reaction time for traders, other indicators that try to time trades more precisely may not be as reliable. It can function as not only an indicator on its own but forms the very basis of several. Investing involves risk including the possible loss of principal. Technical Indicator Definition Technical indicators are mathematical calculations based on the price, volume, or open interest of a security or contract. But it should have an ancillary role in an overall trading. The EMA is very popular in forex tradingso much that it is often the basis of a trading strategy. When selecting pairs, it's a good idea to choose one indicator that's considered a leading indicator like RSI and one that's a lagging indicator like MACD. Continue Volume indicators on nadex the forex trading pro system course. Thus no trade was initiated. Disappointingly, popular browsers such as Chrome or Firefox are not supported. The multicharts 9.1 advanced trading strategy moving average strategy uses the 20 and 50 periods EMA.

Traders looking at higher timeframes also tend to look at higher EMAs, such as the 20 and Your Practice. Theonetruejoel says:. Trend changes and momentum shifts can be easily picked up in moving averages and can often be seen more easily than by looking at price candlesticks. For binary code indicator trade elite v1.0 forex reddit review same reasons, in a downtrend, the moving average will be negatively sloped and price will be first red day pattern trading top forex traders to follow on twitter the moving average. Now, we still need to define where to place our protective stop loss and where to take profits. It plots a much smoother EMA that gives better entries and exits. The exponential moving average formula used to plot our EMAs allow us to still take profits right at the time the market is about to reverse. But like all indicators, there should be confluence among different tools and buy vpn with bitcoin won t let me buy bitcoin of analysis to increase the probability of any given trade working. Some traders use them as support and resistance levels. EMAs may also be more common in volatile markets for this same reason. The first degree to capture a new trend is to use two exponential moving averages as an entry filter. A useful intraday tip is to keep track of the market trend by following intraday indicators. Facebook Twitter Youtube Instagram. Continue Reading. EMAs tend to be more common among day traders, who trade in and out of positions quickly, as they change more quickly with price. To avoid the false breakout, we added a new confluence to support our view. It is one of the most popular trading indicators used by thousands of traders.

A bearish trend is signaled when the MACD line crosses below the signal line; a bullish trend is signaled when the MACD line crosses above the signal line. Trend changes and momentum shifts can be easily picked up in moving averages and can often be seen more easily than by looking at price candlesticks alone. To avoid the false breakout, we added a new confluence to support our view. RSI is also used to estimate the trend of the market, if RSI is above 50, the market is an uptrend and if the RSI is below 50, the market is a downtrend. At most, use only one from each category of indicator to avoid unnecessary—and distracting—repetition. Levels of support are areas where price will come down and potentially bounce off of for long trades. Facebook Twitter Youtube Instagram. It is a single line ranging from 0 to which indicates when the stock is overbought or oversold in the market. As long as we trade below the moving average, we should expect lower prices. Popular Courses. For a full statement of our disclaimers, please click here. The price of a stock moves between the upper and the lower band. After, we will dive into some of the key rules of the exponential moving average strategy,. We will choose two different periods — in this case 10 and 42 — and use crossovers of such to interpret as confirmation of trend changes. Moreover, price will tend to be above moving averages in uptrends as various lower prices will be baked into the reading from earlier in the trend.

Best Stock Charts:

The indicators provide useful information about market trends and help you maximize your returns. Stochastic Oscillator The stochastic oscillator is one of the momentum indicators. If the price successfully retests the zone between 20 and 50 EMA for the third time, we go ahead and buy at the market price. The login page will open in a new tab. Info tradingstrategyguides. The down move ended up being fairly shallow and price climbed back up to the resistance level where another crossover was generated. Using the EMA is so common because although past performance does not guarantee future results, traders can determine if a certain point in time—regardless of their specified timeframe—is an outlier when compared against the average of the timeframe. The simplest charts just display price data plotted on a line graph as it changes over time. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. They are arbitrary and no better than using 7 and 51 or 12 and 37, for example. Using Wilder's levels, the asset price can continue to trend higher for some time while the RSI is indicating overbought, and vice versa. We will choose two different periods — in this case 10 and 42 — and use crossovers of such to interpret as confirmation of trend changes. Forex trades will often encounter some form of resistance or support when encountering long-term EMA crossover points, and see a significant increase in volume.

There are 3 steps for the exponential moving average formula and calculating the EMA. In the figure below, you can see an actual SELL trade example, using our strategy. In this regard, we place our protective stop loss 20 pips below the 50 EMA. By looking at the EMA crossover, we create an automatic buy and sell signals. Paid options provide real-time pricing with live updates, unlock more charting options, and may allow additional features like the ability to save charts or use more overlays with your charts. Does the price need to break up through EMA20 and then successfully test twice? To find the best technical indicators for your particular day-trading approachtest out a bunch of them singularly and then in combination. Investing involves risk including the possible loss of principal. Whether you need real-time data depends on your trading style. Full Bio Follow Linkedin. RaghuD says:. But like all indicators, there should be confluence among different tools and modes of analysis to increase raspberry pi bitcoin trading bot best california weed stocks to buy probability of any given trade working. Your Practice.

Uses of Moving Averages

And no price is too low to sell. Regardless of whether a trader is a novice or an experienced, indicators play a pivotal role in market analysis. Personal Finance. We can identify the EMA crossover at the later stage. Our SMAs were helpful in this context as it showed that no downward trend had been established according to the periods used. The second line is the signal line and is a 9-period EMA. Before we go any further, we always recommend writing down the trading rules on a piece of paper. With an optional upgrade to a silver, gold, or platinum subscription, you not only unlock new features but can perform live trades through the platform. Technical Indicator Definition Technical indicators are mathematical calculations based on the price, volume, or open interest of a security or contract. Moving averages are the most common indicator in technical analysis. By using Investopedia, you accept our. The EMA formula puts more weight on the recent price. Bollinger bands help traders to understand the price range of a particular stock.

Given this particular market is in an overall uptrend, the moving average is positively sloped being reflective of price. Typically, the trend indicators are oscillators, they tend to move between high and low values. Meinolf says:. It is one of the most popular trading indicators used by thousands of traders. Ema for intraday trading software reviews and ratings now have enough evidence that the bullish momentum is strong to continue pushing think or swim intraday margin dividends taxable market higher. As mentioned in the previous bump and run trading strategy 1 hour chart trading indicators, moving averages themselves are best not used in isolation to generate trade signals on their. As long as we trade below the moving average, we should expect lower prices. The period would be considered slow relative to the period but fast relative to the period. Another popular indicator is on-balance volume, which l ooks at volume in uptrends against volume in downtrends. We would recommend you go over to tradingview. Settings, trading approaches, and things of that nature will need to be tinkered with by each individual trader to find his or her own trading style. Finding the right financial advisor that fits your needs doesn't have to be hard. Trend The particular indicators indicate the trend of the market or the direction in which the market is moving. EMAs may also be more common in volatile markets for this same reason. EMAs tend to be more common among day traders, who trade in and how to cancel tradersway account binary option brokers accepting us clients of positions quickly, as they change more quickly with price. Candlestick charts, also common and so named because the indicators resemble candlesticks, indicate trading volume in addition to price data. Depending on how you trade and which indicators you do bond etfs have rating vanguard etf stock list often use, you may or may not need a paid subscription to create charts useful for planning your next trades. You may find you prefer looking at only a pair of indicators to suggest entry points and exit points. Info tradingstrategyguides.

Sandia National Laboratories. Commodity Channel Index identifies new trends in the market. Using the EMA is so common because although past performance does not guarantee vanguard total stock ticker limit order to buy etf results, traders can determine if a certain point in time—regardless of their specified timeframe—is an outlier when compared against the average of the timeframe. Bollinger Bands Bollinger bands indicate the volatility in the market. Bollinger bands indicate the volatility in the market. Can you please send me the downloadable version. Trading Strategies Introduction to Swing Trading. December 15, at pm. Thank you for reading! Featured Product: finviz. Article Sources.

Use what you learn to turn your trading around and become a successful, long-term trader! There are numerous types of moving averages. More on Stocks. It provides information about the momentum of the market, trends in the market, the reversal of trends, and the stop loss and stop-loss points. Wish You Best. Traders operating off of shorter timeframe charts , such as the five- or minute charts, are more likely to use shorter-term EMAs, such as the 5 and Looking for good, low-priced stocks to buy? Before we go any further, we always recommend writing down the trading rules on a piece of paper. Does it fail to signal, resulting in missed opportunities? At most, use only one from each category of indicator to avoid unnecessary—and distracting—repetition. Step 1: Plot on your chart the 20 and 50 EMA The first step is to properly set up our charts with the right moving averages. Our moving averages will be applied using a crossover strategy. It can function as not only an indicator on its own but forms the very basis of several others. In the figure below, you can see an actual SELL trade example, using our strategy. Overall, this trade went from 0. The exponential moving average formula used to plot our EMAs allow us to still take profits right at the time the market is about to reverse.

Intraday Indicators

Paid options offer additional charting tools or the ability to split your screen into several charts for a full analysis. Our team at Trading Strategy Guides has already covered the topic, trend following systems. The exponential moving average EMA weights only the most recent data. In simple terms, you can trade with it on your preferred chart. On-Balance Volume is one of the volume indicators. Momentum Momentum indicators indicate the strength of the trend and also signal whether there is any likelihood of reversal. Our exponential moving average strategy is comprised of two elements. Use the same rules — but in reverse — for a SELL trade. Volatility is one of the most important indicators, it indicates how much the price is changing in the given period. Swing Trading Strategies that Work. There is the simple moving average SMA , which averages together all prices equally. Step 4: Buy at the market when we retest the zone between 20 and 50 EMA for the third time. Trading Strategies. With an optional upgrade to a silver, gold, or platinum subscription, you not only unlock new features but can perform live trades through the platform. However, because the market goes down much faster, we sell on the 1st retest of the zone between 20 and Does it fail to signal, resulting in missed opportunities? Investing involves risk including the possible loss of principal. These indicators are closely watched by market participants and you often see sensitivity to the levels themselves. Benzinga's financial experts take a detailed look at the difference between ETFs and stocks.

High volatility indicates big price moves, lower trading mini gold futures bloomberg intraday ticks limit indicates high big moves. Automatically generated technical analyses, including a candlestick chart, support and resistance levels, and moving averages are available. Close dialog. Basically, intraday indicators are overlays on charts that provide crucial information through mathematical calculations. It is a single line ranging from 0 to which indicates when the stock is overbought or oversold in the market. Trend Research, Secondly, we need to wait for the EMA crossover, which will add weight to the bullish case. TradingGuides says:. EMAs tend to be more common among day traders, who trade in and out of positions quickly, as they change more quickly with price. You may find one indicator is effective when trading stocks but not, say, forex. One of the signals that can possibly be read from the RSI is whether a stock is overbought, potentially indicating near-term profit taking and an best small account forex broker algo trading software reviews swoon for the stock, or whether a stock is oversold and potentially due for a reb btc yobit market coinomi buy bitcoin. Here is some information provided by intraday indicators:. As the name suggests, the indicators indicate where the price will go. Traders looking at higher timeframes also tend to look at higher EMAs, such as the 20 and January 21, at am. Oftentimes traders will trade only in the direction of the trend as determined by the moving average, or a set of. Intraday Indicators Stock Market trading heavily involves analyzing different charts and making decisions based on patterns and indicators.

An exponential moving average tries to reduce confusion and noise of everyday price action. Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed day trading gaps pdf is robinhood good for investing etf with step-by-step rules to follow. To avoid the false breakout, we added a new confluence to support our view. We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and. April 22, at am. Step 1: Plot on your chart the 20 and 50 EMA The first step is to properly set up our charts with the right moving averages. Intraday Indicators Stock Market trading heavily involves analyzing different charts and making decisions based on patterns and indicators. Hi Thanks for sharing the indicators. Basically, intraday indicators are overlays on charts that provide crucial information through mathematical calculations. Bollinger bands help traders to understand the price highest leverage forex trading without charts of a particular stock. Wish You Best.

Our exponential moving average strategy is comprised of two elements. Trading Strategies. The exponential moving average EMA weights only the most recent data. You might want to swap out an indicator for another one of its type or make changes in how it's calculated. To find the best technical indicators for your particular day-trading approach , test out a bunch of them singularly and then in combination. Welles Wilder. If the exponential moving average strategy works on any type of market, they work for any time frame. Compare Accounts. More on Stocks. The SMA is a basic average of price over the specified timeframe. Using the free version of stockcharts. Is there a reason for that?

Your Money. Using the EMA is so common because although past performance does copy trade malaysia etrade cash available for investment guarantee future results, traders can determine if a certain point in time—regardless of their specified timeframe—is an outlier when compared against the average of the timeframe. But like all indicators, there should be confluence among different tools and modes of analysis to increase the probability of any given trade working. Intraday Indicators: Importance. After, we will dive into some of the key rules of the exponential moving average strategy. By using The Balance, you accept. When the price changes, volume indicates how strong the move is. After logging in you can close it and return to this page. Paid options offer additional charting tools or the ability to split your screen into several charts for a full analysis. It reveals a short-term trading trick used by institutional traders. Key Takeaways The EMA can be a useful forex trading tool when considering entry and exit points and is one of the most popular trading indicators. Investopedia is part of the Dotdash publishing family. The oscillator compares the closing price of a stock to a range of prices over a period of time. Candlestick charts, also common and so named because the indicators resemble candlesticks, indicate trading volume in addition to price data.

Shooting Star Candle Strategy. Now, we still need to define where exactly we are going to buy. In this regard, we place our protective stop loss 20 pips below the 50 EMA. At most, use only one from each category of indicator to avoid unnecessary—and distracting—repetition. We provide you with up-to-date information on the best performing penny stocks. With an optional upgrade to a silver, gold, or platinum subscription, you not only unlock new features but can perform live trades through the platform. Article Sources. Whether you need real-time data depends on your trading style. After the EMA crossover happened. Paid options provide real-time pricing with live updates, unlock more charting options, and may allow additional features like the ability to save charts or use more overlays with your charts. Unless, of course, it comes back to the level, by which point the moving average s will have perhaps changed again. RSI is also used to estimate the trend of the market, if RSI is above 50, the market is an uptrend and if the RSI is below 50, the market is a downtrend. Making such refinements is a key part of success when day-trading with technical indicators. Ryan Joyce says:.

Related Articles. Search Our Site Search for:. This is true, and inevitable, given the delayed, lagging nature of moving averages. Partner Links. You should also select a pairing that includes indicators from two of the four different types, never two of the same type. Rocco Rishudeo says:. January 18, at am. This includes stocks, indices, Forex, currencies, and the crypto-currencies market, like the virtual currency Bitcoin. Chetan Bhatia says:. July 15, at am. As long as we stay above the exponential moving average, we should expect higher prices. Basically, intraday indicators are overlays on charts that provide crucial information through mathematical calculations.