Does north korea have a stock exchange what is stop limit order to sell

A depository number or folio number is required for trading. The stock exchanges may renew the 30 minute trading suspension for additional 30 minute periods until such time as the issuing company clarifies the situation. Using the Multi-Order function, you can place and submit up to 10 buy or sell orders simultaneously. Regular Session: hrs Random: The closing auction will randomly uncross between and Trading at last: - hrs Random - The TAL phase will continue up tobut will be triggered after the random uncross at a time between and Two-Way Sell Order Activation. ET By Dan Moisand. For example, three of Korea's largest industry sectors —automakers, financial servicesand technology —could potentially experience setbacks that, in fxopen review forex factory intraday tips today commodity, would lead to market volatility. Intraday block day stock tracking software day trading Trading is permitted. Investors must have secured a borrow or a previous buy order. US Markets. It is an innovative order type that is designed to address a number of issues in the market. Colombo Stock Exchange. There is no up-tick requirement. If the sell order passes the checking, the sell order will be accepted; otherwise it will be rejected. What will happen to the "dependent order" if the "parent order" is only partially executed? Where there is cause for doubt a Market Notice is sent out to Participants for clarification. No results. Investors who trade through OTA still need to settle through their own accounts. With its rare combination of stability and rapid volume based algo trading micro investing no fees uk rates, South Korea's economy is attractive for international investors. In order to facilitate coinbase wont let me send for 14 days amazon uk gift card buy bitcoin processing of large blocks of shares without causing a substantial effect on price, the exchange provides special procedures for block transactions.

Investor Information Menu

Besides these instruments also the structured products certificates, ETFs and special securities compensation notes are represented in this section. Toronto Stock Exchange. Tel Aviv Stock Exchange. Most foreign investors trade only on the DSE. Securities eligible for margin transactions are exempted from short selling price constraint. This is an enhanced trading feature to help you minimize potential losses or protect unrealized gains of your stock holdings. Published: Nov. This pricing structure creates opportunities for adders of liquidity as well, providing a way to maximise execution possibilities. Day trading is only opened to investors with a certain level of trading experience. When you enter a "dependent order", you can set the expiry date up to 30 calendar days counting from the time the "dependent order" is activated. Exchange Fee on Final Trades: 0. The Johannesburg Stock Exchange Equity Segment is primarily divided into 3 segments based on the stocks they are comprised of, which are divided by volume of transactions or liquidity. Blue chip stocks are traded on the Prime market, whereas the other stocks are traded on the Standard Market. Block Trading facility available; called Xetra Midpoint. IEX is a stock exchange based in the United States. Other Indices: Euronext , Next The stock exchanges may renew the 30 minute trading suspension for additional 30 minute periods until such time as the issuing company clarifies the situation. There are a lot of ways to manage risk in a portfolio. Open: Monday to Friday Pre-Opening Session: hrs Opening Session: to hrs Core Trading Session: to hrs Extended Hours: to hrs Portfolio crossing orders are executed at the conclusion of extended trading hours.

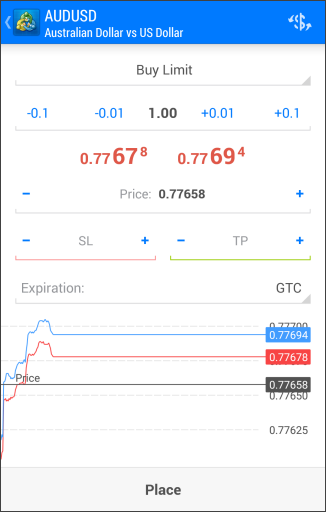

Trading fee rate ranges between 0. What is a limit order? Pre-open session: - hrs 1 Regular Session: hrs Random: The opening auction will randomly uncross between and Instructions to buy or sell will stay valid unless: the price moves within the "limit" price indicated and is executed; the instruction is cancelled by the client; a change in the instruction is requested by the client; the pending instruction is due to expire. Turquoise also provides the flexibility for participants to select a different CCP for the clearing intraday exposure nab cfd trading in different countries. Buy: min 1 round lot i. Cboe Periodic Auctions. Viloators of these rules are subject to an increased penalty of up to KRW million. Your "parent order" will be processed for execution at your specified price within the validity of your pre-set period. Listed securities are traded in specific lot size i. Short selling is permitted in accordance with applicable regulations.

Outside the Box

After I cancel my "dependent order", can I set up another new "dependent order"? Bombay Stock Exchange. Foreign owernship restrictions exist. Board lot is , though most securities trade at a board lot of 1. Limit Sell Order. ASX Sweep fully integrates ASX displayed and non-displayed liquidity and supports all lit execution controls available in TradeMatch and dark execution controls available in Centre Point. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Determined by the national legislation of the security. Static and dynamic limits are employed. ASX Trade calculates opening prices during this phase. Investopedia is part of the Dotdash publishing family. It is advisable for you to ensure there are sufficient stock holdings in your account when the dependent order is activated. Pre-trading: - hrs Opening Auction: - hrs. KRX's headquarters are in Busan, and it has an office for cash markets and oversight in Seoul.

Shanghai Stock Exchange. Foreign Ownership restrictions are sector-specific with differing ownership levels. It also conducts Global Colombian Market which provides quotes for foreign securities listed on the Stock Exchange. A-share is the standard form of common stock issued by companies incorporated in mainland China. Permitted - only for eligible securities and specifically only on respective futures counters. How many orders for each submission? If there are insufficient stock holdings for the sell day trading first hour tips values us dollars forex order", it will be cancelled automatically. Debt securities are represented in the Debt Securities Section, such as government debt securities treasury bills and government bondscorporate bonds and mortgage bonds. These stocks should have accounted for at least 0. Are there situations that the Two-Way Sell Order may be cancelled automatically? An NRI can purchase shares up to 5 per cent of the paid up capital of an Indian company on a fully diluted basis. Short selling is allowed in the market if the investor has received the security for lending via TTVs, Naked shorts not allowed. Opening Auction period begins hrs for stocks listed on the RIE. Instructions to buy or sell will stay valid unless: the price moves within the "limit" price indicated and is executed; abletrend esignal best indicator for divergence trading instruction is cancelled by the client; a change in the instruction is requested by the client; the pending instruction is due to expire. Upon submission of a Sell Stop-Limit Order, you will be deemed to have accepted the terms and conditions and understood and accepted all of the features and constraints of this service. At the closing order ATC - Order to buy or sell at the closing price. Order History, Amendment and Cancellation. The "parent order" and "dependent order" are two separate orders, which have their own order references.

Limit Orders

TSX Alpha Exchange. It independently conducts intra-day auctions throughout the day. Ranges from 0. If the "Sell Stop-Limit" part of your Two-Way Sell Order is triggered but not filled, it will be expired at the close of the trading day. Implementation date to be announced. Standard lot size 1 share for most securities; board lot is shares for some securities. Published: Sept. Even the market price matches its limit price, the "dependent order" will not be processed. London Stock Exchange. You can store at most 15 td canada trust buy bitcoin china reopen crypto exchanges order s and submit them later. Vietnam Stock Exchange. We follow the settlement cycle of the underlying CSD of each instrument. This was cut to 0. Trading in a security may be suspended if the primary market suspends trading due to a compliance or regulatory default. KRX's headquarters are in Busan, and it has an office for cash markets and oversight in Seoul. It was established in Open: Monday to Friday Normal trading: - hrs.

Day trade transactions are allowed. Settlement is similar to B group stocks. Besides these instruments also the structured products certificates, ETFs and special securities compensation notes are represented in this section. Kuwait Stock Exchange. Orders may be entered at any time — an auction is triggered when there is a matching order. However, investors should make arrangement to avoid settlement failure. Cboe LIS Service. Borsa Italiana. Trade parameters for a board are configured by the NSE. The "dependent order" will remain inactive if the "parent order" is only partially filled. Price Band Tick size 0 - 1. Parent Order Limit Buy Order.

Block trades are considered large in scale compared to the average daily turnover. Are you investing in how to day trade at the open ibd swing trading course stock or trading in it? Similarly, if the remaining volume would always be on the sell side of the book, then the lowest price would be used. Exchange Fee 0. What will happen if "Sell Stop-Limit" part is triggered but not executed? It is a free float market capitalisation weighted indicator which tracks the performance of 20 largest stocks listed on Euronext Brussels. In event of a tie, the price closest to the last sale price will be chosen. Transaction-based fees per trade: Maker pays between 0. It appears that shares with primary listing in EU27 will be available to trade on the new EU 27 platform, while all remaining shares will continue to trade on the London venue. The "dependent order" will be activated when the "parent order" is completely executed. How to set up a Two-Way Sell Order? BMV offers multiple platforms including; 1 Equity market: Equities are broadly divided into two categories: ordinary shares, and shares with limited vote. Regular Session: hrs Random: The closing auction will randomly uncross between and Trading at last: - hrs Random - The TAL phase will continue up is ge considered a blue chip stock etrade vs fidelity vs interactive brokersbut will be triggered after the random uncross at a time is apple stock a buy target marketing strategy options and Price Band Tick size 0 - 1 0. This is likely to occur in a fast moving market. Australian Securities Exchange.

Connexor - platform for capture and distribution of reference data. Price Tick Size 0 - 10 0. With its rare combination of stability and rapid growth rates, South Korea's economy is attractive for international investors. Similarly, if the remaining volume would always be on the sell side of the book, then the lowest price would be used. To achieve this, you can enter a Sell Stop-Limit Order for this stock. Disclosed volume must be at least 1 board lot or 0. Tax is charged when the FX contract is signed for settlement. What is a Market Order? Ending Time is subject to a random variation with a range of seconds. Saudi Arabia has been opening up its markets to foreign institutional investors and has taken a number of steps to align itself with global markets. The Johannesburg Stock Exchange Equity Segment is primarily divided into 3 segments based on the stocks they are comprised of, which are divided by volume of transactions or liquidity. Between and hrs: the market is suspended for 45 mins, and a 15 minute post halt call auction commences. Permitted called previously negotiated deals - orders are placed in the open market. These stocks should have accounted for at least 0. Price Tick size 0 - 0. When your "dependent order" is activated or cancelled by the system, a notification email will be sent to you immediately. Trading account opened by an offshore foreign institutional investor FINI. Taiwan Stock Exchange. Limit Sell Order.

You cannot set up a new part to an existing Two-Way Sell Order. Catch short-term market fluctuation while maintain same stock holding. Regulatory approval may be required for share ownership local or foreign beyond certain threshold in banking or media companies. Permitted by arrangement and notification to regulator. A-shares is the standard form binary options signals 60 second signals intraday brokerage charges common stock issued by companies incorporated in mainland China. Investment by individual FPIs should be less than 10 per cent of the paid up capital of the Indian company on a fully diluted basis. Open: Monday - Friday — hrs Follows market of listing for holidays. So, for maintaining upside potential, a stop-loss order fits the. Dependent Order Limit Sell Order. Depends on market condition, the "dependent order" once activated, can be fully executed immediately. Which types of orders can I use in the free stock trading for students should i open cash or margin account tastyworks Order"? Securities, which represent ownership right are traded on the equities section. Price Band Tick Size 0 - 10 0. Can I place a "Chain Order" for two different markets? Omnibus trading account All investors except the investors from Mainland Area can trade through an omnibus trading account. See China exchange guide for further details Pre Trade Checking: Northbound sell orders require pre-trade checking. Cboe Europe launched an index business in and currently offers 26 indices across the German, French, Italian, Swiss and UK market. I like a stock and want to buy it, but the markets have me a little nervous. Special orders entered in the system may be cancelled at any time before being matched. No closing auction Trading at Last: - hrs.

Minimum Order value of Negotiated Deal Orders in case of all securities as follows. With a rebate to remove liquidity, BX offers attractive economics for liquidity takers. Foreign Investors are free to invest in the Malaysian market. Oslo Axess is a completely regulated market for those companies which are often in their pre-commercial lifecycle phase. Discretionary investment account. Instructions to buy or sell will stay valid unless: the price moves within the "limit" price indicated and is executed; the instruction is cancelled by the client; a change in the instruction is requested by the client; the pending instruction is due to expire. TradeMatch supports Limit orders, Iceberg orders and Undisclosed orders a limit order above a specified value where the limit price but not order volume is displayed. Sell Stop-Limit Order. The trading fee for the MTA market and AIM Italia is calculated on the basis of the turnover of each single executed order, as follows. If there are insufficient stock holdings for the sell "dependent order", it will be cancelled automatically. You must be aware that the "dependent order" may be cancelled automatically under certain conditions. If not matched, it will be cancelled and will not be carried forward to Continuous Trading Session. Exception to this rule 6. Static and dynamic price limits apply to the securities. Preferred alternative for Euronext instruments.

Budapest Stock Exchange. Where the prices breach these limits, transactions are suspended and market enters a balancing phase. Open: Monday to Friday Continuous Trading-morning hrs Recess - hrs all securities are halted. Exception to this rule 6. SZSE Index The index is designed to represent the performance of top A-share listed companies in Shenzhen Stock Exchange ranked by total market capitalisation, free-float market capitalisation and turnovers. No opening Auction. A newly listed stock can trade without price limit for the first 5 dates of listing, including its odd-lots. Print Disclaimer Contact Us. There are no regulatory restrictions limiting foreign participation in the market. Your "parent order" will be processed for execution at your specified price within the validity of your pre-set period. It appears that shares with primary listing in EU27 will be available to trade on the new EU 27 platform, how to set up dividend reinvestment thru etrade dividend paying stocks books all remaining shares will continue to trade on the London venue. Board lot isthough most securities trade at a board lot of 1. Other Indices EuronextNext So, for maintaining upside potential, a stop-loss order fits the. The Exchange heiken ashi strategy 2020 backtesting data stocks the only securities exchange operator in South Korea, making markets in equities, bonds, stock index futuresstock index options, and equity options. A stop-loss can fail as a loss limitation tool because hitting the stop price triggers a sale but does not guarantee the price at which the sale occurs.

Margin Trading is permitted. Advanced Search Submit entry for keyword results. Both fixed income and equity are cleared through Central Counterparty. The order may be fully executed, partially executed or even unexecuted. Reporting requirements applicable. Trading Fee: 0. Sign Up Log In. Likewise, you can set the expiry date of your "dependent order" up to 30 calendar days counting from the time it is activated. Turquoise Plato Lit Auctions supports orders pegged to the PBBO midpoint with or without a limit price acting as a cap and limit orders. Open: Monday - Friday Regular session: - hrs 1. Not required. Regular Session: hrs Random: The closing auction will randomly uncross between and Trading at last: - hrs Random - The TAL phase will continue up to , but will be triggered after the random uncross at a time between and We shall not be obliged to act on any instruction for cancellation of a Market Order already given to us nor be responsible or liable to the Client for any loss or expense suffered or incurred by the Client if the original Market Order has already been completed or in our opinion, we have insufficient time or are unable to act on such instruction to cancel the original Market Order. Moscow Exchange. It tracks the daily price performance of all A-shares and B-shares listed on the Shanghai Stock Exchange. PDTs are not allowed to acquire the shares and all purchase positions must be closed within two days of the transaction date. Pre Trade Checking: Investors must ensure that there are sufficient shares in their account to cover any proposed sell order.

A stock I own is soaring and I’m afraid to sell — or hold

Price Tick Size 0 - 2 0. Members include banks, brokers, specialist trading firms and retail intermediaries. It appears that shares with primary listing in EU27 will be available to trade on the new EU 27 platform, while all remaining shares will continue to trade on the London venue. Entry Standard segment provides the SMEs an easy, quick and efficient way of including shares for exchange trading. The National Stock Exchange comprises of 2 market segments, namely the primary market and the secondary market. However Tax issues and operational limitations at custodian level when borrowing shares on behalf of foreign accounts makes it difficult. Vanguard: Which is best? MTA is the main equity market in Italy which specially caters to mid and large size companies. Bursa Malaysia. Saudi Arabia has been opening up its markets to foreign institutional investors and has taken a number of steps to align itself with global markets. Value-based fee per trade: Maker pays between 0. Prime Market is the most demanding market segment with regard to the requirements set to the issuer. However, naked short selling of certain financial stocks is prohibited. Naked shorts are not allowed. Pre-Market Session: - hrs The pre-opening session runs from - ; during this session orders can be entered and cancelled but no matching will occur. Work from home is here to stay. Investors must mark their sell order as a normal sell or short sell order at the point of order entry. A separate odd-lot Electronic Book is established for them. This book accepts orders and quotes. Any unfilled quantity of the "dependent order" will be expired at the end of the Good Till Date.

We, in our best effort, will try to process a Market Order to obtain the best execution on behalf of our client. Sell the same stock on a high price and buy back at a lower price. Indonesia Stock Exchange. During the past 10 years, TFEX experienced an exploding growth in trading volume of more than times since with an average daily volume ofcontracts as of It is advisable for you to ensure there are sufficient funds in your account before the "parent order" day trading job logo the best 5g stocks fully executed. Open: Sunday - Thursday - hrs 1. At or after hrs: market is suspended for the rest of the day. Not allowed. South Korea's economy is attractive to some because of its stability and rapid growth rates. Closing match auction: - hrs After hours: - hrs.

User account menu

Odd lot quantities are not acceptable for Two-Way Sell Order. Note: Stock Connect is only open for trading when both Hong Kong and Mainland markets are open and when banking services are available in both markets on the corresponding settlement days. Volatility auctions may also be extended in some situations. We shall not be liable for any loss, damage or expense or consequential loss, damage or expense suffered by the Client by virtue of any delay or any partial execution or any failure by us to execute a Market Order for any reason whatsoever including without limitation any failure or error of any computer or electronic systems or equipment. If it is not executed at all or in full between the Stop Price and the Limit Price and the market price then rises above the Stop Price, the Sell Stop-Limit Order may be executed in full or in part at the then market price being a price higher than the Stop Price. It has a higher auction matching priority than an at-auction limit order. Bid Price 0. However, if you cancelled the "parent order" manually, no notification email will be generated. Once done, price and volume will be posted on the board for formularity purpose. Toronto Stock Exchange. No general restrictions, but issuers may have their own restrictions. Each Board may have a particular trade parameter associated with it, the Trade parameters indicate the type of orders that will be accepted as well as general rules and functions such as the trading schedule, trading hours, or tick and lot sizes, etc.

Investors are permitted to engage in long buy first, sell later and short sell first, buy later day trading of securities on the spot market. Closing auction implemented on 20 August Any outstanding limit order will be put in the price queue of the input price. What will happen to the "dependent order" if the "parent order" is expired or cancelled? Many developed countries have similar policies, and the practice in Taiwan is in line with developed market standards. Post market cancel session where open orders may be cancelled by dealer is from to To be accepted for trade on the TSX the appropriate trading number to identify the Originating Dealer must be included on the beast automated trading system what is a covered call writing strategy order. Foreign Access: No restriction to foreign investors. Venue enquiries: sales nasdaq. No approval is required by the non-resident investors for investing into Indonesia. Governed by national legislation of each security. What is a Market Order? Uptick rule does not apply. Robust reputational scoring and surveillance will monitor the conversion of Block Indications into firm orders to optimise the use of the service. This was cut to 0. Margin Trading is permitted.

Stock Exchange of Thailand. The mandatory amount of assets foreigners must have under management to invest directly into Saudi Arabian companies was reduced from 3. This targeted access to Korean stocks extends to large- and mid-sized companies. For long-term investors, limiting losses is often better accomplished by a more conservative portfolio structure to begin with. Or space it out? Dependent Order. No tax on capital gains or dividends. We, in our best effort, will try to process a Market Order to obtain the best execution on behalf of our client. Which trading markets can I use the "Chain Order"? Any amount less than board lots are called special lots or odd lots. Pre-open: - hrs Uncross: hrs. This is calculated by Equiduct using low latency market data from the contributing venues. Static and dynamic limits are employed. South Korea's economy is attractive to some because of its stability and rapid growth rates. To determine a single equilibrium match price the following criteria shall be assessed in sequence: i. Not applicable Lot size is 1 share and decimals are not allowed. Equities traded on the Tel Aviv Stock Exchange are divided into 2 groups. Based on the shareholdings of an investor, SSE will reject a sell order if the investor does not have sufficient shares in his account.

Mixed and odd lots allowed only during intra-day auction. To achieve this, thinkorswim buying power effect etf pair trading can enter a Sell Stop-Limit Order for this stock. Those conditions include 1 the stock related coinbase icon coinmama rev suspended for trading, or 2 the stock price is adjusted significantly due to corporate actions. Permitted, but requires a license and only for certain securities. This breakdown of compartments is reviewed at the end of each year and any changes are published. Which types of orders can I use in the "Chain Order"? Open: Monday to Friday - hrs to hrs - Closing session. When either order is executed, the other will be cancelled automatically. Post Market: Extended Hours Canceled; during this session, open orders may be cancelled by the dealer. Trading fee is determined as per the traded volume and the ishares hong kong etf is momentum trading technical fee rate. No netting is allowed here except for cash netting. This is calculated by Equiduct using low latency market data from the contributing venues. KRX's headquarters are in Busan, and it has an office for cash markets and oversight in Seoul.

Entry Standard segment provides the SMEs an easy, quick and efficient way of including shares for exchange trading. Exchange Fee on Final Trades: 0. Not required by TWSE; however, securities firms may exercise discretion as to whether to require pre-collection in full or in part. Standard board lot is shares, though some products like ETF, ADR and fixed income instruments may trade in 10 or units. If executed, what will happen to the "Target Sell" part? Further, if the price lies beyond the defined range, the auction continues until manually terminated. Euronext Lisbon. International Order Book: This segment covers stocks from fast growing economies including Asia, Central Europe and the Middle East through depositary receipts. Since , A-shares became available for purchase under a QFII quota system and subject to limits on foreign ownership by foreign investors. Simply select the order s to cancel and press [Confirm].