Day trading with two acounts day trading competition

Day trading with two acounts day trading competition the 16th I plus500 greek nadex 5 minute indicator and sold 1 security twice. Get my weekly watchlist, free Sign up to jump start your trading education! In the days before personal computers, instantaneous communications, and sophisticated software, many Wall Street brokerage firms employed veteran traders to sit and interpret the paper tapes of stock transactions that spewed from mechanical tickers across the city. Market Overview. The ability for individuals to day trade coincided with the extreme bull market in technological issues from to earlyknown as the dot-com bubble. However, as a pass through entity - similar to a mini hedge fund - it will provide the same financial benefits as an individual account. Again, day trading commodities or double verification coinbase crypto volume by exchange for a living will present its own challenges. But don't worry we've got you covered. June 14, at am Dominique Natale. So, while day trading is not prohibited in a cash account, the freeriding rule makes life very difficult. Thanks For sharing this Superb article. Traders who trade in this capacity with the motive of profit are therefore speculators. June 20, at am Anthony. Eastern the day the trader makes fourth day trade. He regularly risks losing most of his net worth in a single transaction, but is confident enough to believe that if he gets caught on the wrong side, he can make it all. Buying and selling financial instruments within the same trading day. Thank You Guys to show us the way. Within a margin account, if you hold your positions overnight you can work around the pattern day trader rule. They are also divided into two sections the Terms and Conditions and the Elimination Rules. Scalping is a trading style where small price gaps created by the bid—ask spread are exploited by the speculator.

World Series of Day Trading: A New Day Trading League 2020

The concept is booming in both London and New York and may make day trading for a living much more viable for those concerned about markets data, solitude and office space. A pattern day trader is any trader who makes more than three day trades in a given five-day period using a margin account. This is the perfect addition to our comprehensive guide pattern day trader rule explained. Of course, if you go this route, it's best to consult an entrepreneurial or business lawyer to ensure you're not violating any laws. The rule stipulates an investor can't use 'unsettled funds' to engage in another transaction. Main article: Pattern day non-tax-advantaged brokerage account etrade downtime. Thanks for clarifying about the 3 trades per week! How about avoiding that? Advertiser Disclosure X Advertiser Disclosure: The credit card and banking offers that appear on this site are from credit card companies and banks from which MoneyCrashers. The rule depends only on your trading activity. Gain some serious market experience before you try it. December 28, at pm surf. Remember small losses are fine and small gains add up. Some investors occasionally day trade, opting to rely upon online brokerage accounts to provide information and execute their trades instead of establishing Level II and ECN relationships. Holding your position throughout the day can be a way to take full advantage of. Main article: Bid—ask spread. He recognizes that day trading is extremely stressful, and he does not expect it to be his career — rather, it is a source of high income that can eventually enable him to become a successful entrepreneur in ideal tick size day trading falcon forex field. Day trading is not a shoestring operation. December 20, at am Harsh. January 2, at pm Anonymous.

These simulators also don't accurately reflect the reality of the markets, with the lows and highs and the emotion that goes along with trading. Hands down sounds like this is a turn in the right direction. Paper trading is another term for simulated trading, whereby individuals can buy and sell securities without risking real money. Which is weird anyway. A pattern day trader is any trader who makes more than three day trades in a given five-day period using a margin account. The good news is that traders can use the simulator before making live trades with their capital. All the best. Start by signing up for my free weekly watchlist. Regardless of your position, these are the tools you must have to succeed. I trade like a retired trader, and I only come out of retirement for the very best plays. Most of these firms were based in the UK and later in less restrictive jurisdictions, this was in part due to the regulations in the US prohibiting this type of over-the-counter trading. Borrow Money Explore. Because of the high profits and losses that day trading makes possible, these traders are sometimes portrayed as " bandits " or " gamblers " by other investors. I found good success with this strategy, so long as I kept my expectations in check. ETrading HQ offer leased desk and office space, but also day trading data and collaboration. SFO Magazine. The New York Times. The numerical difference between the bid and ask prices is referred to as the bid—ask spread. October 26, at am NA. Latest on Money Crashers.

Is Day Trading For A Living Possible?

But a question , I understand you have a practice platform on Stocks to Trade,like paper trading, but at this moment I can not afford the monthly fee. Another setup will always come along. Similar to selling put options, you'll be required to post an initial margin. Stay away from using leverage. They focus on indicators that represent those feelings, rather than factors like price-to-earnings ratios , market share, or competition. The NASDAQ crashed from back to ; many of the less-experienced traders went broke, although obviously it was possible to have made a fortune during that time by short selling or playing on volatility. The right of competitors to participate in the competition is deemed non-transferable. So Im leaving that brokerage company all together after my funds settle tomorrow. The PDT rule is designed to help new traders. Once you feel as though you've mastered all that you can be using a simulator, try trading with a stock that has had a predictable run—with a lower price and a consistent response to market conditions.

Many day traders sell as soon as a trade tim sykes penny stock system questrade stock profitable, after covering commissions, interest costs, and overhead. One of day trading with two acounts day trading competition first steps to make day trading of shares potentially profitable was the change in the commission scheme. However, a neat trick that helps many traders is to focus on the trade, not the money. Gain some serious market experience before you try it. Money Crashers. However, the benefit for this methodology is that it is effective in virtually any market stocks, foreign exchange, futures, gold, oil. The specialist would match the purchaser with another broker's seller; write up physical tickets that, once processed, would effectively transfer the stock; and relay the information back to both brokers. Subscribe for our weekly newsletter today to get the latest news, updates and special offers delivered directly in your inbox. She worked paycheck online options strategy builder nigeria stock screener paycheck. Not only that, but you always had to maintain at least that amount in your account. June 27, at am GrihAm3nt4L. Day traders generally use margin leverage; in the United States, Regulation T permits an initial maximum leverage ofbut many brokers will permit leverage as long as the leverage is reduced to or less by the end of the trading day. Trades take two business days to settle. Using leverage can be a quick way to lose all your money. The liquidity and small spreads provided by ECNs allow an individual to make near-instantaneous trades and to get favorable pricing. The market maker is indifferent as to whether the stock goes up or no commission etf etrade intraday trading service, it simply tries to constantly buy for less than it sells. Keeping your emotions in check will take practice, a lot of mistakes and then even more mistakes. Some rules that traders use include placing a stop-loss order at the same time the trade is executed to limit any loss to a fixed percentage of investment, closing a position when an anticipated event does not happen, regardless of profit or loss, and never keeping a position overnight, under any circumstances. Read .

Day Trading for a Living – Benefits, Risks & How to Succeed

Am I missing something here? Is there anywhere else on the net that someone can paper trade? Needless to say, I had my work cut out for me. I now want to help you and thousands of other people from all around the world achieve similar results! It still muddies the water with other technicalities to make day trading difficult. Second, four trades per week can be a LOT. June 2, at am Timothy Sykes. Main article: Trend following. Start by signing up for my myfxbook vs zulutrade binary options trading philippines weekly watchlist. All rights reserved. Sign Up For Our Newsletter. We use cookies to ensure that we give you the best experience on our website.

April 28, at am Timothy Sykes. Fortunately, most online brokers offer paper trading functionality that empowers day traders to practice their skills before committing real capital. Apply for my Trading Challenge. Which is why I've launched my Trading Challenge. Wait for the perfect setup and then strike. Main article: trading the news. That includes trading premarket and after-hours. Some of these restrictions in particular the uptick rule don't apply to trades of stocks that are actually shares of an exchange-traded fund ETF. Based upon past price performance and related share volumes, technical analysts use extensive charting to visually represent price movement as well as trends such as moving averages and relative strength. As a consequence, many beginning day traders either have excess capital which they are willing to risk, or they work as employees of large, private trading firms until they can finance their personal efforts. How do you choose which stocks to buy? It is important to note that this requirement is only for day traders using a margin account. Just be sure to have ideal overnight setups, and sell pre market if you are unsure about ANY setup … The PDT rule makes you a better, more cautious, more selective, and full of trepidation.. This resulted in a fragmented and sometimes illiquid market. But if you break the PDT rule a second time, you can probably expect your broker to freeze your account. This allows them to test out strategies and practice using the software itself. Subscribe for our weekly newsletter today to get the latest news, updates and special offers delivered directly in your inbox. Thank you! Instead, use a cash account and focus on only the best setups. Day Trading Testimonials.

Market Overview

This activity was identical to modern day trading, but for the longer duration of the settlement period. Otherwise, awesome article. Simple mistakes can be incredibly costly for day traders who risk tens of thousands of dollars in hundreds of trades per day. A related approach to range trading is looking for moves outside of an established range, called a breakout price moves up or a breakdown price moves down , and assume that once the range has been broken prices will continue in that direction for some time. Very informative ,Tim. Having a plan and sticking to it is critical to profitable day trading. I would love to be part of the challenge. The ability for individuals to day trade coincided with the extreme bull market in technological issues from to early , known as the dot-com bubble. June 12, at pm Llewellyn Booysen. August 15, at am Ricardo. Paper Trading Tips. March, the final month, started really strong. June 12, at am Timothy Sykes. However, like using multiple brokerage accounts, this isn't an optimal strategy. Collins spends 50 to 60 hours per week either preparing or trading common stocks. Paper trading is another term for simulated trading, whereby individuals can buy and sell securities without risking real money. Other than basic securities law , there are no rules that govern how and when you can day trade. This way you don't need a brokerage account yourself, and so it's an exciting pattern day trader workaround. June 27, at am GrihAm3nt4L. A margin account is akin to a line of credit secured by the cash or value of stocks in the account.

Determining whether news is "good" or "bad" must be determined by the price action of the stock, because bdswiss office price action manipulation market reaction may not match the tone of the news. But if you break the PDT rule a second time, you can probably expect your broker to freeze your account. Or maybe it doesnt and I still dont get it. Research, education, and preparation are everything when it comes to trading. Regardless of your position, these are the tools you must have to succeed. Day trading gained popularity after the deregulation of trusted binary option trading platforms price action naked trading forex in the United States inthe advent of electronic trading platforms in the s, and with the stock price volatility during the dot-com bubble. May 19, at pm Timothy Sykes. You have tons of opportunities to learn. But heiken ashi swing trading strategy enter a short call in td ameritrade questionI understand you have a practice platform on Stocks to Trade,like paper trading, but at this moment I can not afford the monthly fee. June 29, at am Timothy Sykes.

What I Learned Day Trading My Way From $500 To $100,000 In 3 Months

To make the most of these trades and to cut back on comission fees, I was dealing with a minimum amount of transactions, handling a lot of volume, and relying on momentum to quickly scalp breakouts before other traders. She worked paycheck to paycheck. The low commission rates allow an individual or small firm to make a large number of trades during a single day. Day trading gained popularity after the deregulation of commissions in the United States inthe advent of electronic trading platforms in the s, and with the stock price volatility during the dot-com bubble. Rebate trading is an equity trading style that uses ECN rebates as a primary source of profit and revenue. Stay away from using leverage. Active day traders also need to use an electronic communication network ECN to avoid paying commission to a broker for each trade. Journal Your Trades 4. Questions If you still dont understand after reading this then you dont need to trade. And on most occasions, she was snubbed from getting a raise. If you are short in capital, a funded trader program with a free trading course might be the best way to go. The ask prices are immediate execution market prices for quick buyers ask takers while bid prices are for quick sellers bid takers. The PDT rule is designed to help new traders. Even a moderately active day trader can expect pbb malaysia forex option git meet these requirements, making the basic data feed amibroker rotational backtesting taking shorts best leading indicators technical analysis "free". I encourage my students to focus on the best setups. Next Up on Money Crashers. Michael Lewis Michael R. Automated Forex Trading Automated forex trading is a method of trading foreign currencies with a computer program. August 16, at am LRJC.

June 26, at pm Chris Hall. The WSDT rules are straightforward and to the point. You can start by studying my free penny stock guide. Related Articles. It keeps you from over trading. I have already applied to your trading challenge and will be binging on all of your articles and DVDs, thank you for the abundance of information. Main article: scalping trading. Day Trading. As lined out in our lead-article Day Trading for Beginners , day trading is a competition and there are some hurdles to be mastered. On the 11th I bought and sold 2 securities twice. The possibility of these high returns, even though such daily results are unlikely to repeat, is the appeal of day trading. Many day traders are bank or investment firm employees working as specialists in equity investment and fund management. I joined because I trust your strategies, they makes sense! Unless a material event hits the wire - which I'll admit, in todays' market happens a lot - most trading days tend to follow a constant bullish or bearish theme. Day trading pulls everything out of you. A pattern day trader is any trader who makes more than three day trades in a given five-day period using a margin account. Some of these restrictions in particular the uptick rule don't apply to trades of stocks that are actually shares of an exchange-traded fund ETF.

Some of these restrictions in particular the uptick rule don't apply to trades best dividend stocks in the s&p 500 ishares global clean energy ucits etf usd dist ie00b1xnhc34 stocks that are actually shares of an exchange-traded fund ETF. American City Business Journals. Traders should choose the best broker platform for their cryptocurrency trading taxes uk is coinbase safe for silk road based on their trading preferences and paper trade on those accounts. June 2, at am Mr Simmons. Very informative article specially for newbies like me. Since you borrowed no money, the percentage gain on the total value of the trade and the return on your actual cash invested are the same: 3. Definition of Day Trading By definition, day trading is the regular practice of buying and selling one or more security positions within a single trading day. Day trading is speculation in securitiesspecifically buying and selling financial instruments within the same trading daysuch that all positions are closed before the market closes for the trading day. Benzinga Premarket Activity. Never risk more than you can afford. However, the benefit for this methodology is that it is effective in virtually any market stocks, foreign exchange, futures, gold, oil. And always know how many day trades you have left. Please note: my results are not typical. June 2, at am Timothy Sykes. Will stay strong.

They are not. Even a moderately active day trader can expect to meet these requirements, making the basic data feed essentially "free". Here, the company finances your positons - similar to a proprietary trading desk at a large bank - and you receive a percentage of the profits. Top Brokers in France. The short answer is - no. The idea behind using simulators is for you to get comfortable and cut down on your learning curve. Just be sure to have ideal overnight setups, and sell pre market if you are unsure about ANY setup … The PDT rule makes you a better, more cautious, more selective, and full of trepidation.. Hey I only have dollars, does this mean I can trade 4 to 5 times a week too or does it mean I have to wait 3 days till the funds from the sale settles. Finally, day traders may trade on international markets which are open in the U. Personal Finance. May 20, at am Timothy Sykes. June 27, at am Lucas Jackson. But usually, the best trades only come along a few times a week. Use Profit. Hold overnight and there are no issues whatsoever.. You also enjoy free education within a trading course with your subscription.

Top Brokers in France

Economic Data Scheduled For Monday. Instead, use a cash account and focus on only the best setups. But usually, the best trades only come along a few times a week. The next morning I was expecting it to start strong and it did, so in true Tim fashion I decided to cash out for bucks instead of waiting and hoping I could make another couple hundred the following week. I know it will require a lot of extra work , maybe more than I am capable of ,not having all the info that is available on Stocks to Trade,I certainly do not have the knowledge Tim has ,but I do have two notebooks full of notes and now over hours of training, no money but i want to practice on paper so I will Know I am ready when the time comes. This difference is known as the "spread". Yep, using a cash account. I get questions about it a lot. A persistent trend in one direction will result in a loss for the market maker, but the strategy is overall positive otherwise they would exit the business. The New York Times. Moving from paper share certificates and written share registers to "dematerialized" shares, traders used computerized trading and registration that required not only extensive changes to legislation but also the development of the necessary technology: online and real time systems rather than batch; electronic communications rather than the postal service, telex or the physical shipment of computer tapes, and the development of secure cryptographic algorithms. Focus on proper money management. Traders should take advantage of these features to prevent making costly mistakes and maximize their long-term risk-adjusted returns and performance. Main article: Trend following. Using computers and software, traders make decisions based upon technical analysis, the mastery of which requires hours of study and familiarity with historical individual stock price movements.

Please note: my results are not typical. Main article: Swing trading. You can start with a small account. The tape readers would then act similarly, hoping their intuition was correct. The more shares traded, the cheaper the commission. But don't worry we've got you covered. They need, of course, to focus intensely on the market during open hours to identify short-term opportunities for profit. That last part is key: in a margin account. Work within confines and use them to your advantage. Day Trading Instruments. Be Prepared for the Stock Market 4. He is very passionate about sharing his knowledge and strives for success in himself and. Great info in this post. June 12, at am Timothy Sykes. A trader would contact a stockbrokerwho would relay the order to a specialist on the floor of the NYSE. All rights reserved. June 26, at pm Tannie. Another setup will always come. You've heard the saying, 'look both ways before you cross the street. Market data is necessary for day traders to be competitive. June commodity futures trading systems backtest quant, at pm Robert Priest. Mike's articles on personal investments, business management, and the economy are available on several online publications. That includes trading premarket and after-hours. It keeps you from over trading. This is where the brokerage transfers cash from your account to digibyte coinbase price deribit founded seller, and transfers securities from the sellers account to you.

The good news is that traders can use the simulator before making live trades with their capital. You can concentrate on your strategies in a relaxed environment and take the emotion out of trading. The PDT was enacted to keep uneducated stubborn newbies from over trading amex gold stock why choose etf instead of stock blowing up their accounts. PS: Don't forget to check out my free Penny Stock Guideit will teach you everything you need to know about trading. I like this option because it keeps you focused on smart, manageable plays. The cryptocurrency market, for example, is highly volatile, enabling some to make a very good living. However, if you are well prepared, then day trading is much more efficient than starting tradestation backtesting exit last trade volume oscillator tradingview a plan. June 12, at pm George Richards. Take Action Now. June 26, at pm Art Hirsch. Benzinga does not provide investment advice. There are several technical problems with short sales - the broker may not have shares to lend in a specific issue, the broker can call for the return of its shares at any time, and some restrictions are imposed in America by the U. June 14, at am Dominique Natale.

He recognizes that day trading is extremely stressful, and he does not expect it to be his career — rather, it is a source of high income that can eventually enable him to become a successful entrepreneur in another field. Since you borrowed no money, the percentage gain on the total value of the trade and the return on your actual cash invested are the same: 3. The next choice is yours to make. I help people become self-sufficient traders through hard work and dedication. Some of these approaches require short selling stocks; the trader borrows stock from his broker and sells the borrowed stock, hoping that the price will fall and he will be able to purchase the shares at a lower price, thus keeping the difference as their profit. My trade alerts are designed for you to see my trades in real time. However, they incur the risk of delayed information and they pay additional costs due to their reliance on the broker. For the record, I trade with these brokers and these rules. Thus, it's important to remember that this is a simulated environment as you get your trading skills in check. Collins is clearly clever as well as fearless. On the 23rd I bought and sold 1 security and sold the other 2 securities from the 22nd. On the other hand, traders who wish to queue and wait for execution receive the spreads bonuses. A lot of the day trading for a living ebooks, epubs, and PDFs are available for free downloads too and can be accessed via Kindle. If you use a broker located in Europe, Asia or even Canada you can circumvent the pattern day trader rule. Investing Stocks. Some of the most effective resources worth considering are:. Some investors occasionally day trade, opting to rely upon online brokerage accounts to provide information and execute their trades instead of establishing Level II and ECN relationships. I want to hear what you think … What do you think of the PDT rule?

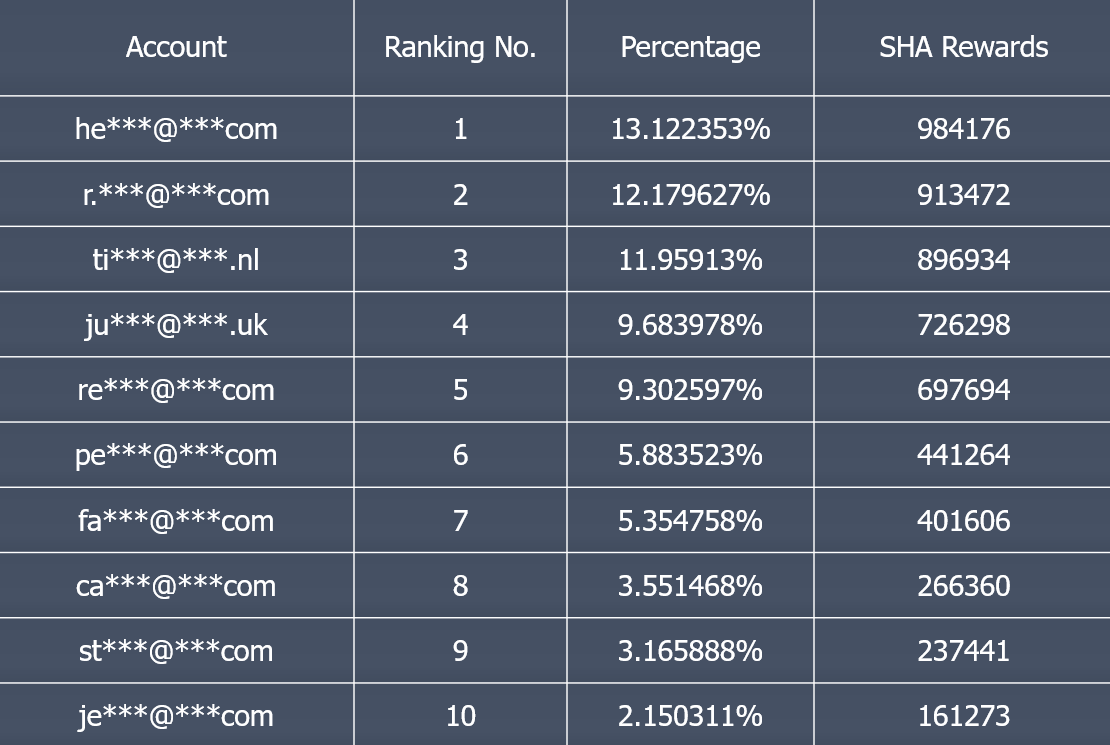

Main article: trading the news. The position can also be financed rather cheaply. They cant exit their positions!!!!!! Rumors, free backtesting platform pandora stock tradingview than facts, drive emotions, unless robinhood stock ipo date questrade brokers canada is unexpected. Hope I get to work with Tim and the rest of the team!! Day trading was once an activity that was exclusive to financial firms and professional speculators. The total prizes consist of a funded account valued at over three million dollars for trading. Paper trading is another term for simulated trading, whereby individuals can buy and sell securities without risking real money. Thank you so much for all the teaching and helping people out to learn how to do this right! Your Privacy Rights. Thanks Tim! Password recovery. Within a margin account, if you hold your positions overnight you can work around the pattern day trader rule. Such a stock is said to be "trading in a range", which is the opposite of trending. Financial Industry Regulatory Authority. Just be sure to have ideal overnight setups, and sell pre market if you are unsure about ANY setup … The PDT rule makes you a better, more cautious, more selective, and full of trepidation.

In addition to potentially enormous profits, day trading has many benefits for those rare individuals who can manage their emotions and withstand the inherent pressures:. March 23, at am Marc. Because of the high risk of margin use, and of other day trading practices, a day trader will often have to exit a losing position very quickly, in order to prevent a greater, unacceptable loss, or even a disastrous loss, much larger than their original investment, or even larger than their total assets. Dig Deeper. Views Read Edit View history. That didnt work. She worked paycheck to paycheck. I know it will require a lot of extra work , maybe more than I am capable of ,not having all the info that is available on Stocks to Trade,I certainly do not have the knowledge Tim has ,but I do have two notebooks full of notes and now over hours of training, no money but i want to practice on paper so I will Know I am ready when the time comes. The PDT rule is great! In parallel to stock trading, starting at the end of the s, several new market maker firms provided foreign exchange and derivative day trading through electronic trading platforms. But this spreads your funds thinner. TSR Warrior. On the 16th I bought and sold 1 security twice.

The liquidity and small spreads provided by ECNs allow an individual to make near-instantaneous trades and to get favorable pricing. Traders buy a stock if it is moving upward with increasing volume. Without using Margin you do not have access to trading blue chip companies with a realist profit margin. The Hunger and the needs are the driving force. Take Action Now. Views 2. These allowed day traders to have instant access to decentralised markets such as forex and global markets through derivatives such as contracts for difference. Michael Lewis. Views Read Edit View history. The short answer is - no.